Filing a claim for rental insurance involves notifying your insurance provider about damages or losses to your rented property due to covered events such as fire, theft, or water damage. It requires submitting documented proof, including photos and receipts, to support your claim and expedite the compensation process. Understanding policy limits and exclusions is crucial to ensure a successful claim for rental insurance.

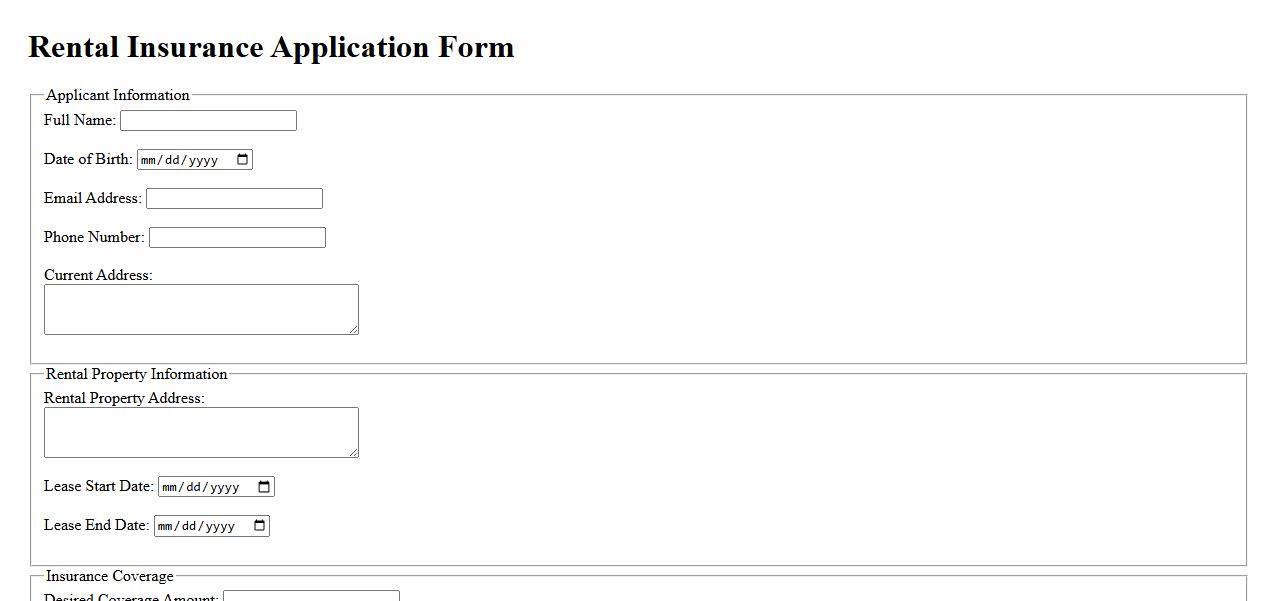

Rental Insurance Application Form

The Rental Insurance Application Form is a crucial document that helps tenants secure protection for their belongings and liability. This form collects essential information about the applicant and the rental property to provide appropriate coverage. Completing the application accurately ensures a smooth approval process for rental insurance.

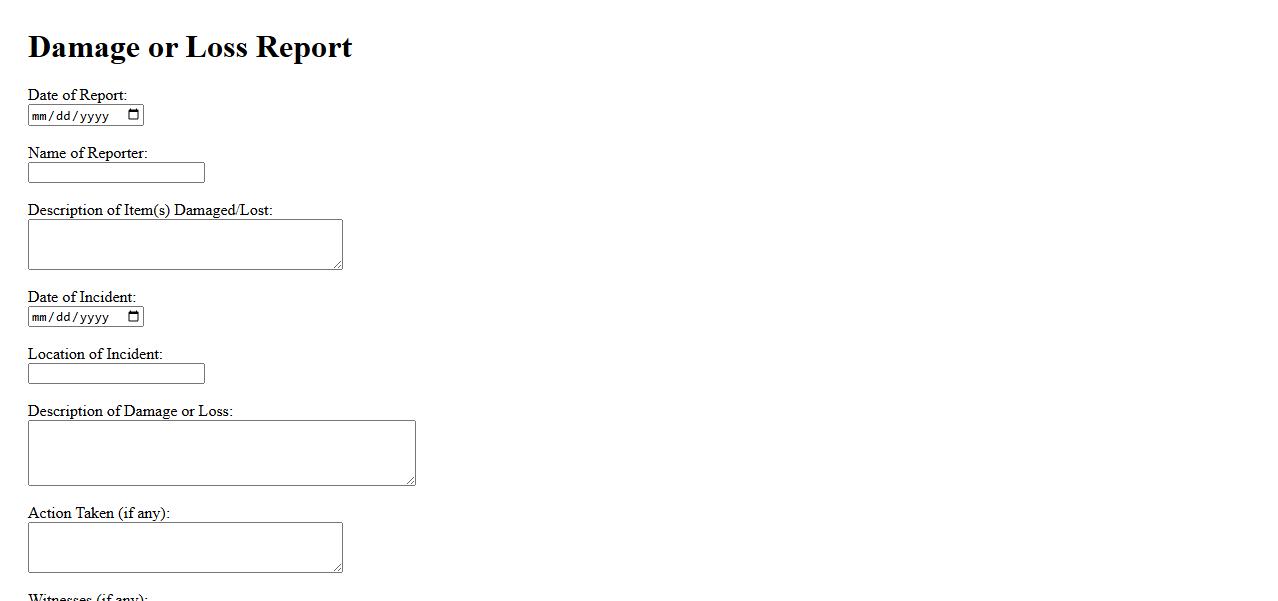

Damage or Loss Report

A Damage or Loss Report is a detailed document used to record any harm or missing items related to a product, property, or shipment. It helps in assessing the extent of damage or loss and initiates the claim or repair process. Timely and accurate reporting is essential for resolving disputes and ensuring accountability.

Proof of Rental Agreement

Proof of Rental Agreement is a crucial document that verifies the terms and conditions agreed upon between a landlord and tenant. It serves as legal evidence of the rental arrangement, including payment details and duration. This proof ensures clarity and protection for both parties involved in the rental process.

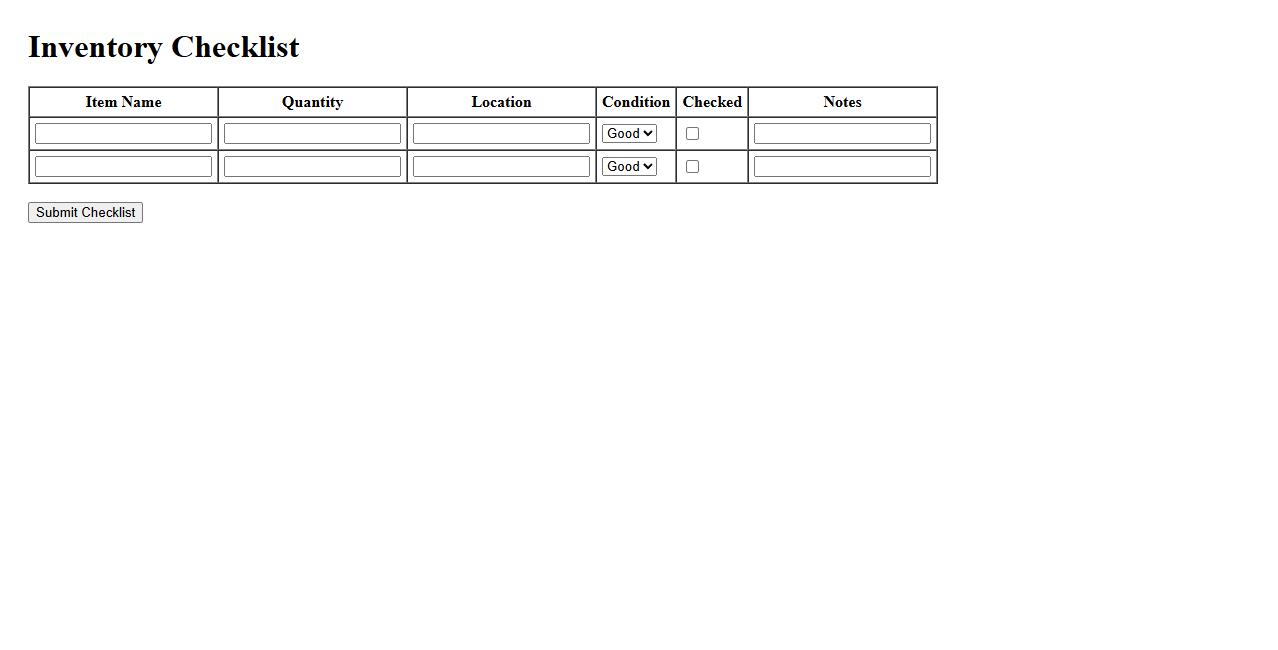

Inventory Checklist

An Inventory Checklist is a crucial tool for maintaining accurate records of stock and supplies. It helps businesses track quantities, identify shortages, and manage reordering efficiently. Regular use ensures streamlined operations and minimizes the risk of inventory errors.

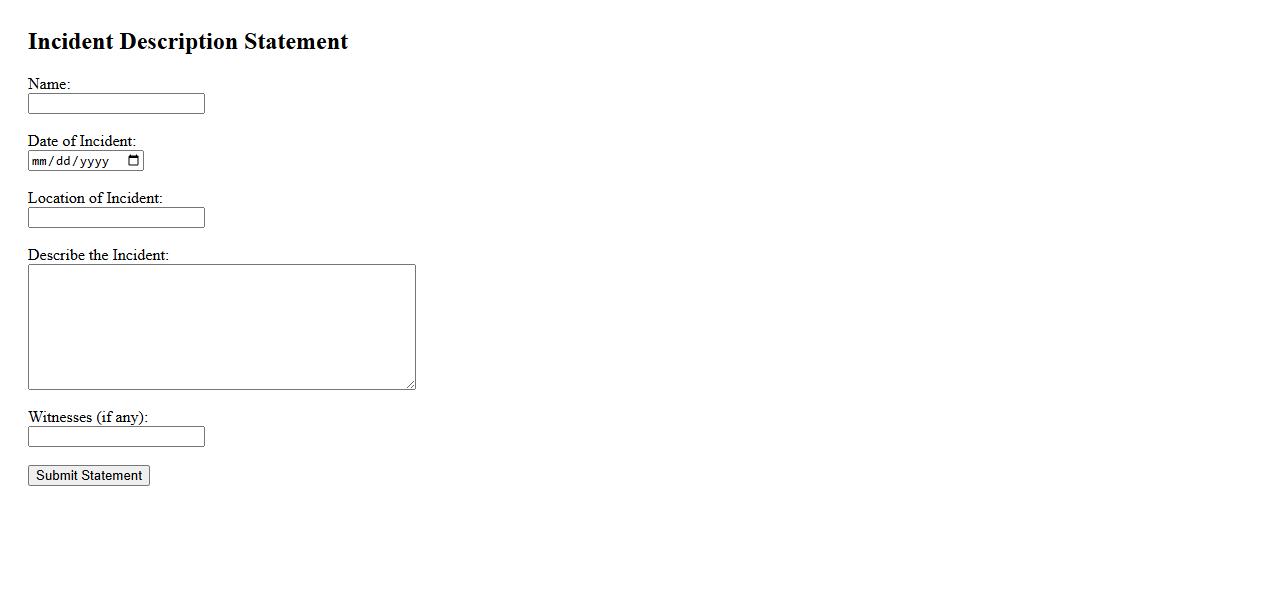

Incident Description Statement

An Incident Description Statement provides a clear and concise summary of an event or situation that occurred, detailing key facts and circumstances. It is essential for accurately documenting incidents for investigations or reports. This statement helps ensure that all relevant information is communicated effectively.

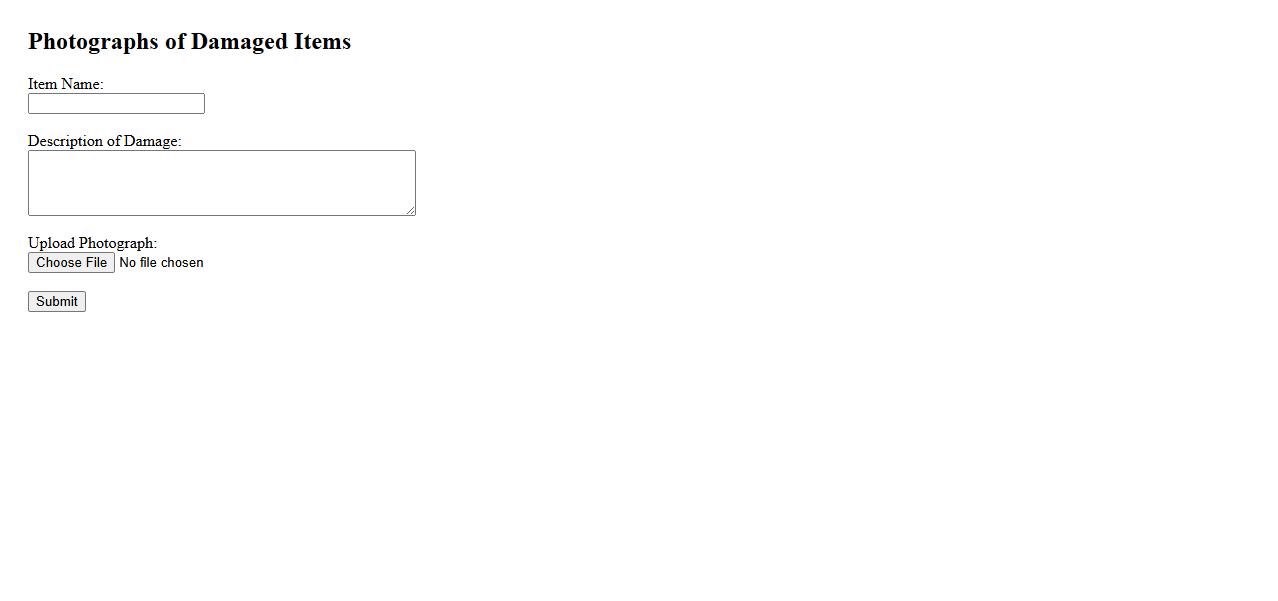

Photographs of Damaged Items

Photographs of damaged items provide clear visual evidence essential for insurance claims or repair assessments. These images help document the extent and nature of the damage accurately. Properly captured photographs ensure a smooth evaluation process and support accountability.

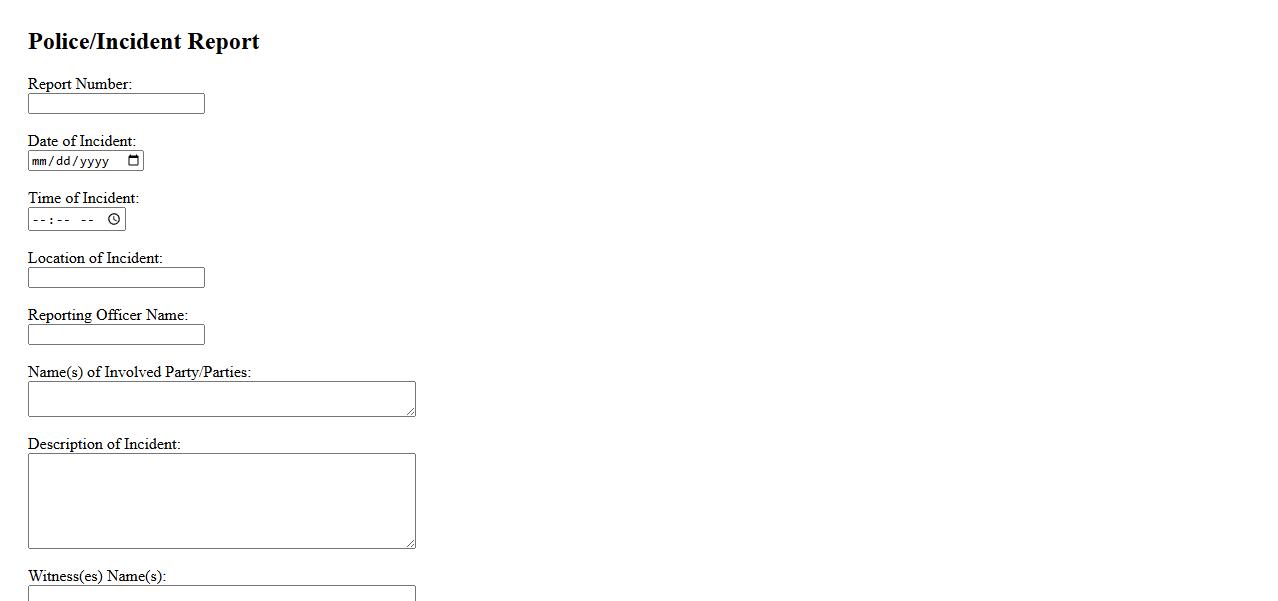

Police or Incident Report

A Police Report is an official document detailing the facts and circumstances of a crime or incident. It serves as a critical record for investigations and legal proceedings. Accurate incident reports ensure proper documentation and help maintain public safety.

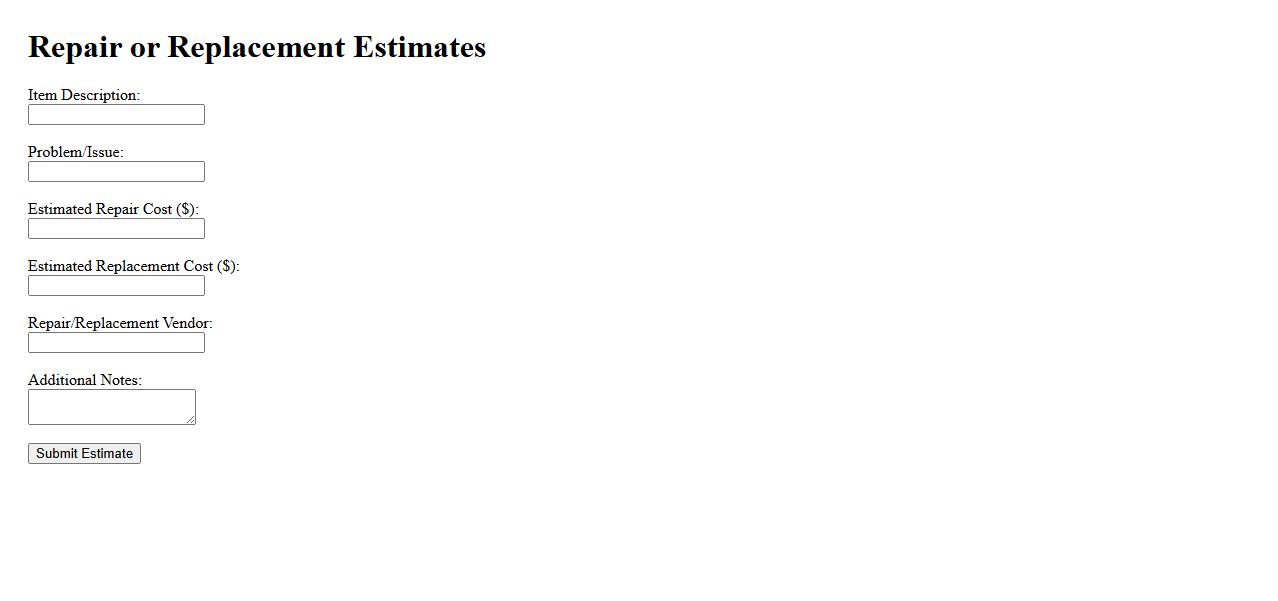

Repair or Replacement Estimates

Our service provides accurate repair or replacement estimates to help you make informed decisions. We evaluate the condition and cost-effectiveness of fixing versus replacing your item. Trust us for transparent and detailed assessments tailored to your needs.

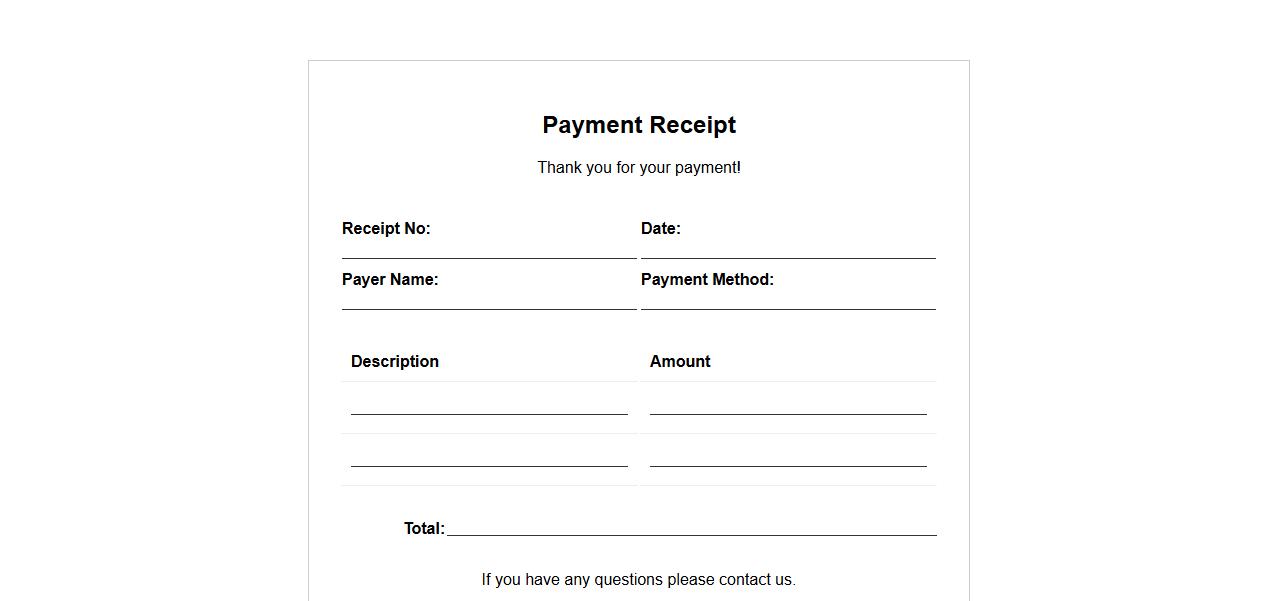

Payment Receipts

Payment receipts serve as official proof of transaction between a buyer and a seller. They detail the amount paid, date, and payment method, ensuring transparency and record-keeping. These documents are essential for financial tracking and resolving disputes.

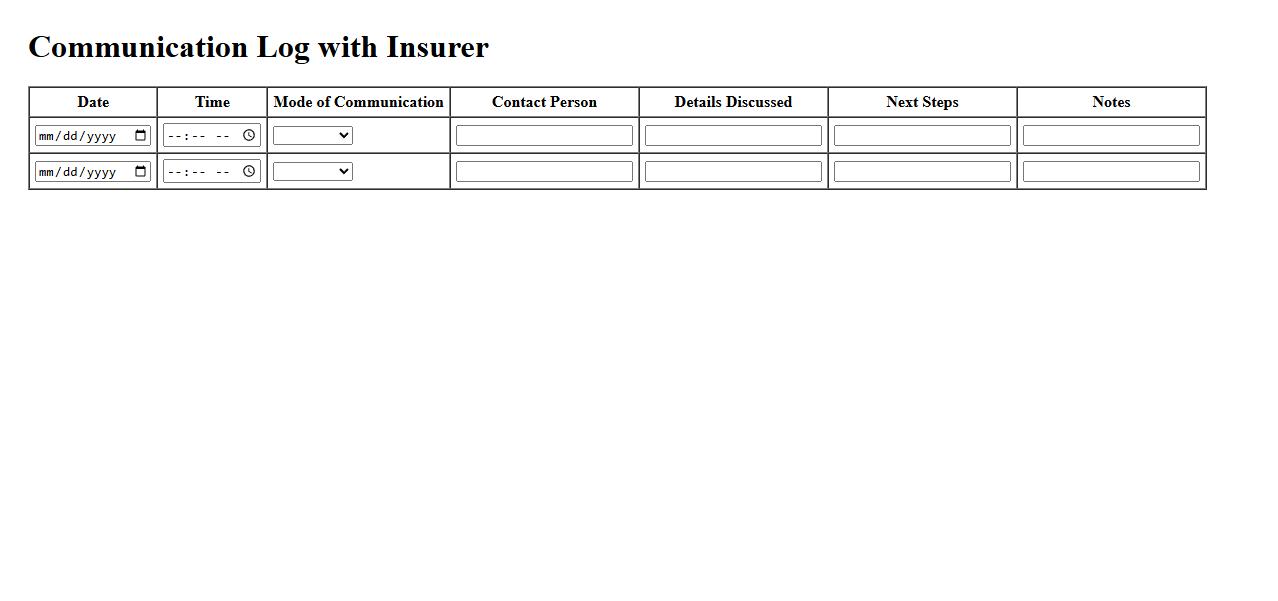

Communication Log with Insurer

A Communication Log with Insurer is essential for tracking all interactions and correspondence with your insurance company. It helps ensure accurate records of claims, policy updates, and important conversations. Maintaining this log can prevent misunderstandings and support efficient resolution of issues.

What specific type of loss or damage is being reported in this rental insurance claim?

The claim reports water damage caused by a burst pipe in the rental property. This damage has affected several rooms, including the living area and kitchen. The insured is seeking compensation for repairs and damaged personal belongings.

When and where did the incident leading to the claim occur?

The incident took place on March 15, 2024, at the rental property located at 123 Elm Street, Springfield. The burst pipe caused flooding primarily during the early morning hours. Immediate action was taken to stop the leak and minimize further damage.

Who is listed as the primary policyholder for this rental insurance?

The primary policyholder listed on the insurance policy is John Doe. He is officially responsible for maintaining the rental insurance coverage on the property. All communications and claims are directed to him by the insurance company.

What supporting documents or evidence are included with this claim (e.g., photos, police reports)?

The claim is supported by several photographs of the damaged areas and a plumber's report detailing the burst pipe. Additionally, repair estimates from licensed contractors are included. No police report was necessary as this is a property damage claim without criminal involvement.

Are there any previous claims filed under this policy for similar incidents?

There are no previous claims filed under this rental insurance policy for water damage or other similar incidents. The current claim is the first reported loss event during the policy term. This clean claims history may benefit the policyholder during the review process.