An Agreement for Purchase of Assets is a legal contract outlining the terms and conditions under which one party agrees to buy specific assets from another. This agreement details the assets involved, purchase price, and any representations or warranties made by the seller. It serves to protect both parties by clearly defining the scope of the transaction and the responsibilities of each side.

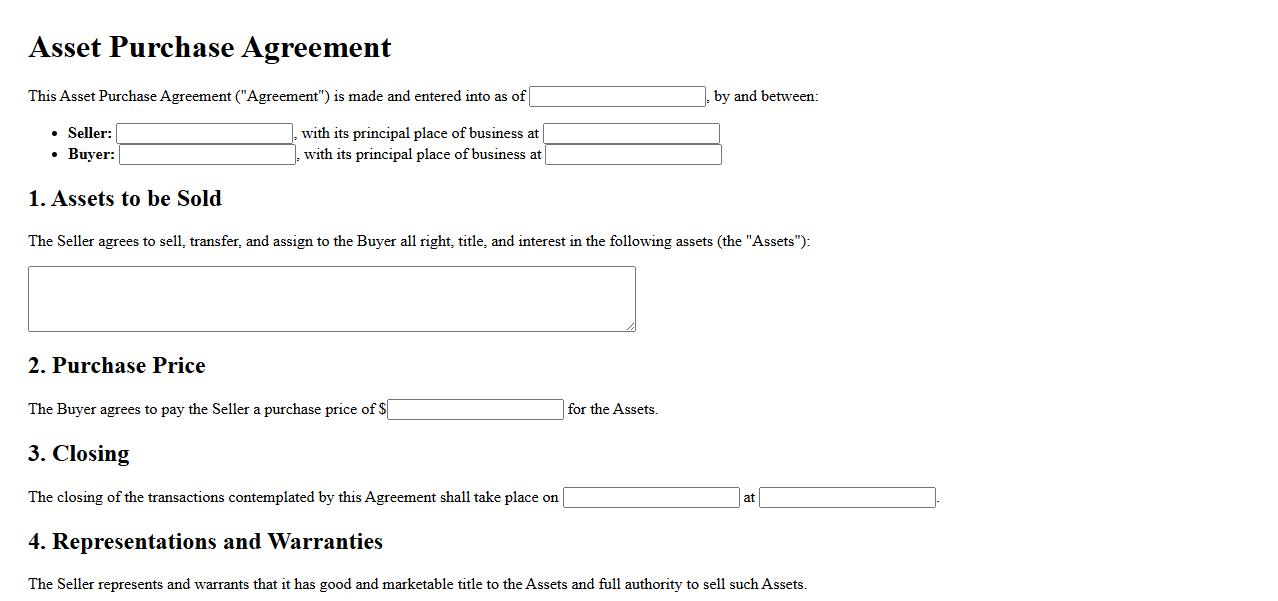

Asset Purchase Agreement

An Asset Purchase Agreement is a legal contract outlining the terms and conditions for the sale of specific assets between a buyer and seller. It clearly defines which assets are being transferred, the purchase price, and any warranties or representations. This agreement protects both parties by establishing responsibilities and minimizing disputes during the transaction.

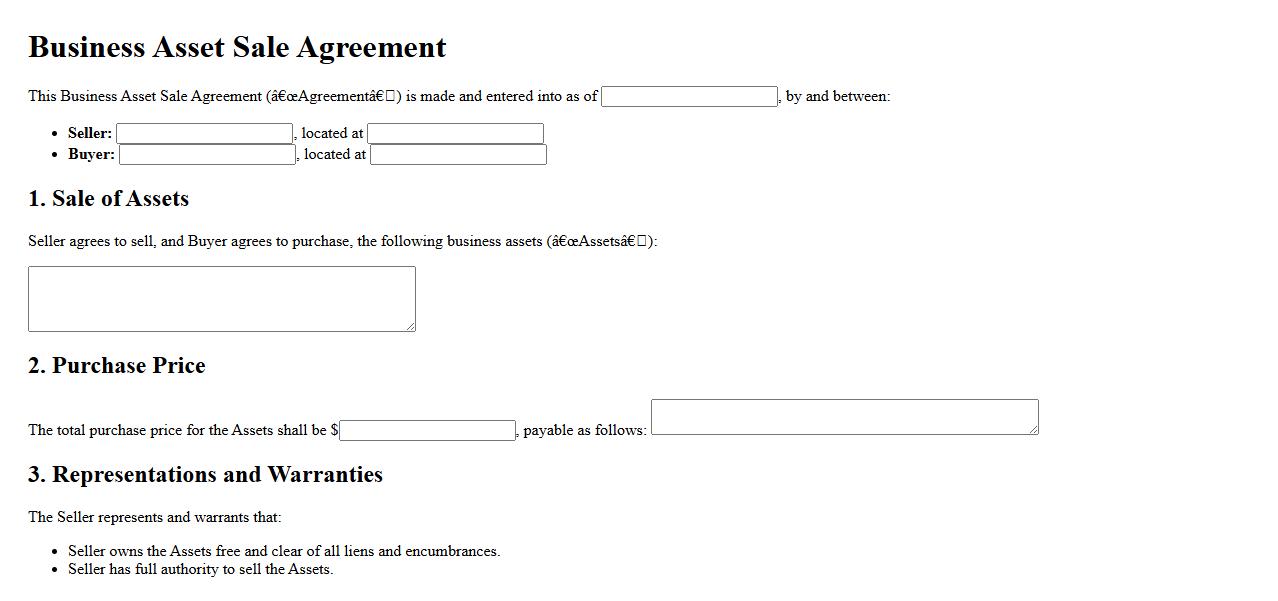

Business Asset Sale Agreement

A Business Asset Sale Agreement is a legal contract outlining the terms for the sale of specific assets of a business rather than the entire company. It details the assets being sold, the purchase price, and the responsibilities of both buyer and seller. This agreement helps protect both parties by clearly defining the transaction's scope and conditions.

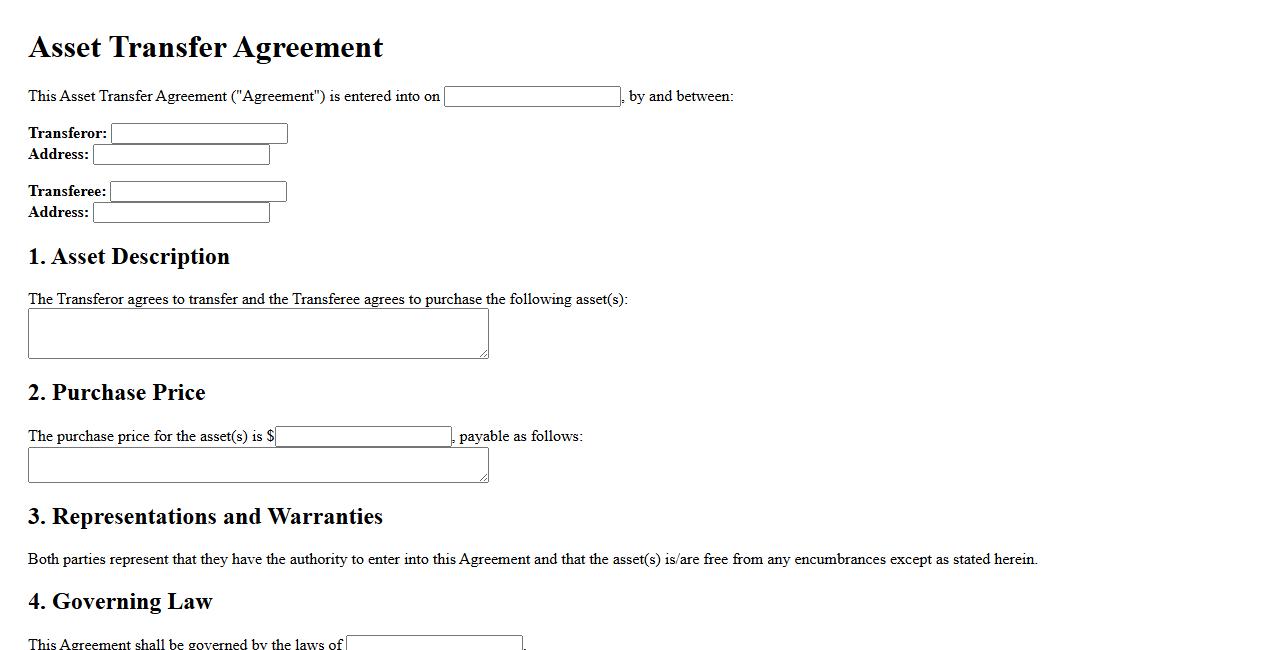

Asset Transfer Agreement

An Asset Transfer Agreement is a legal document outlining the terms and conditions under which ownership of assets is transferred from one party to another. It ensures clear communication and protection for both the buyer and seller by specifying details such as asset descriptions, transfer dates, and payment terms. This agreement helps prevent disputes and provides a framework for smooth asset transactions.

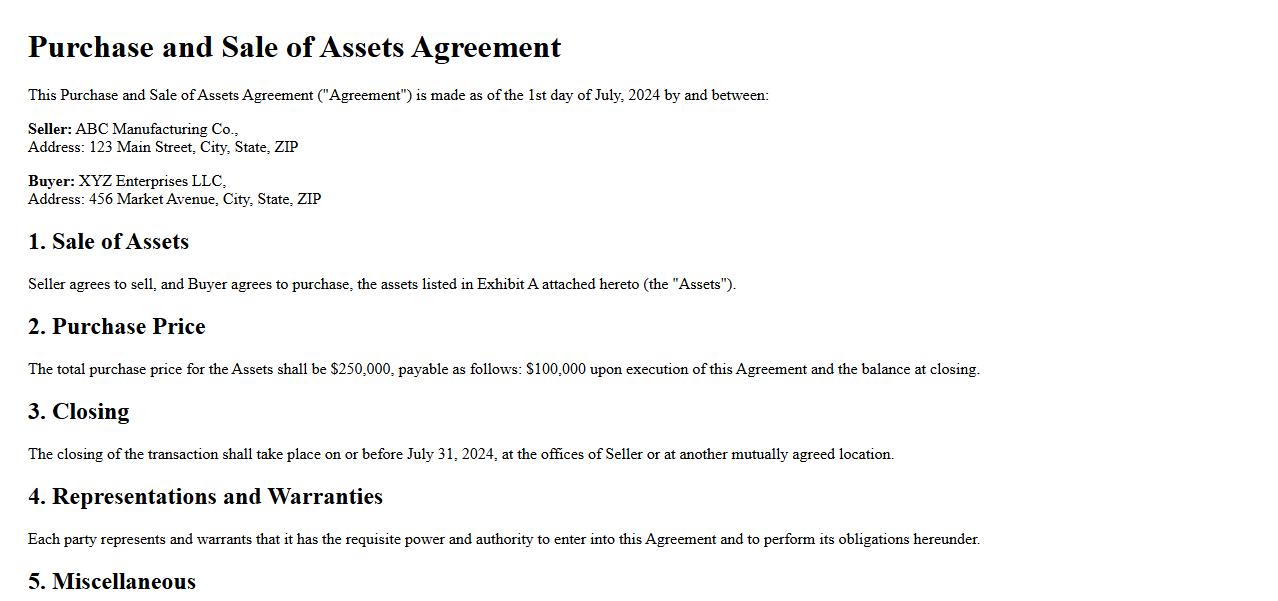

Purchase and Sale of Assets Agreement

The Purchase and Sale of Assets Agreement is a legal contract used to transfer ownership of specific assets from a seller to a buyer. This agreement clearly outlines the terms, conditions, and details of the transaction to protect both parties. It ensures a smooth and transparent transfer of assets, minimizing potential disputes.

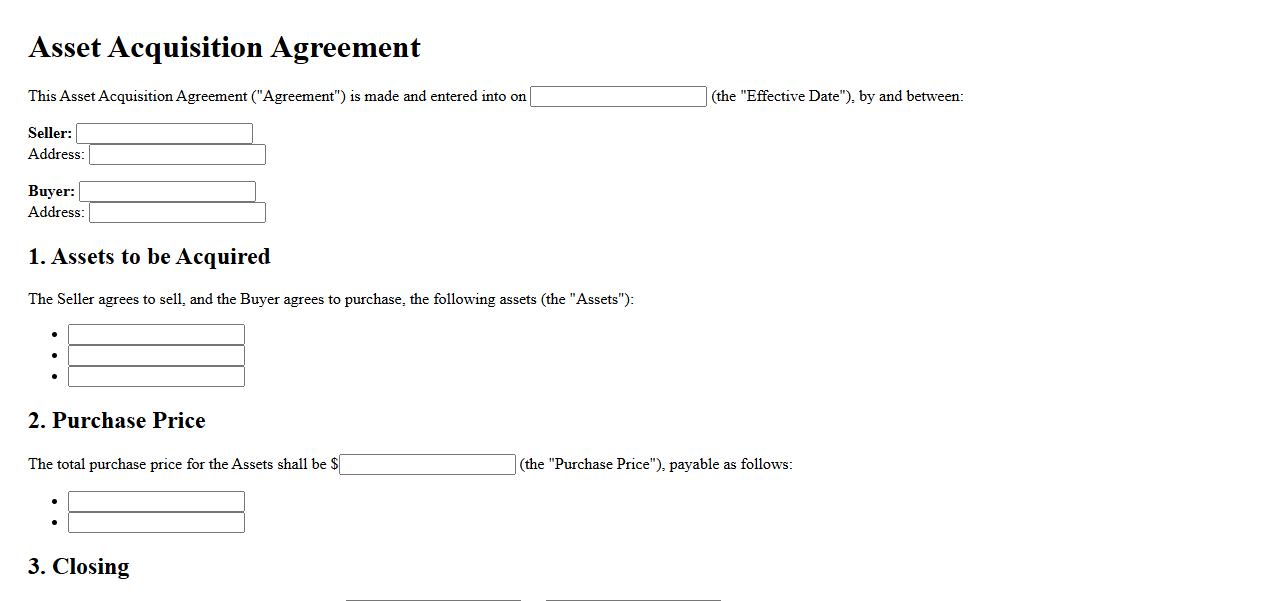

Asset Acquisition Agreement

An Asset Acquisition Agreement is a legal contract used when one party purchases specific assets from another. It outlines the terms and conditions related to the transfer of ownership, including the description of assets, purchase price, and liabilities. This agreement ensures clarity and protection for both buyer and seller during the transaction.

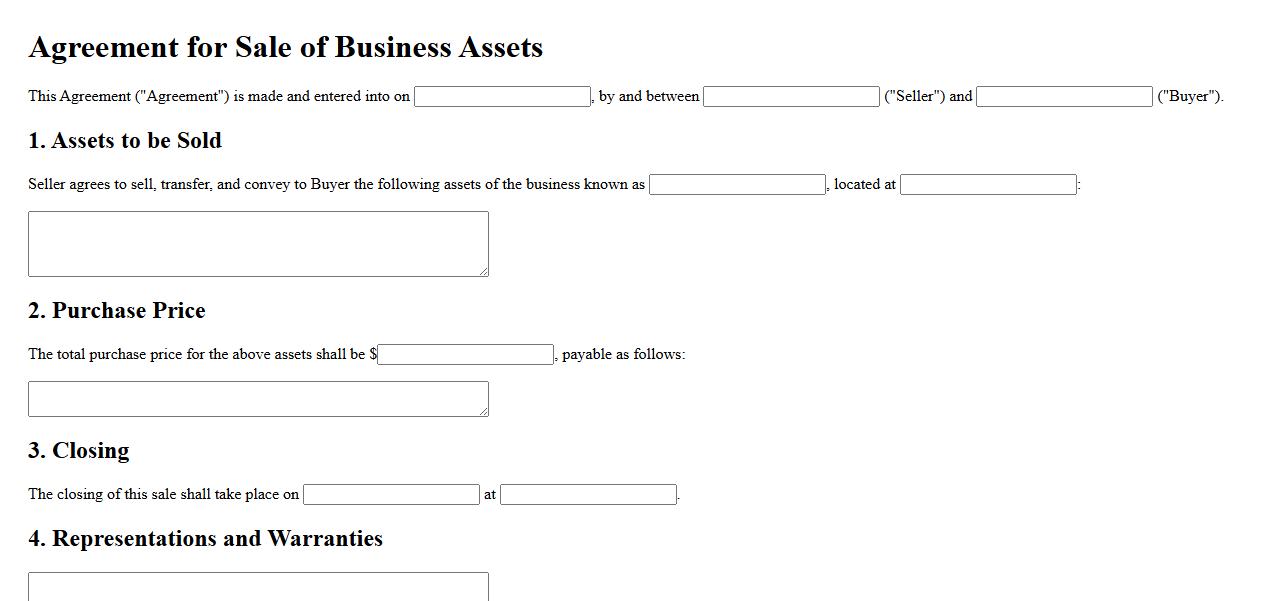

Agreement for Sale of Business Assets

An Agreement for Sale of Business Assets is a legal document outlining the terms and conditions under which a business sells its assets to another party. It specifies details such as the assets included, purchase price, and responsibilities of both buyer and seller. This agreement ensures a clear understanding and protects the interests of both parties involved in the transaction.

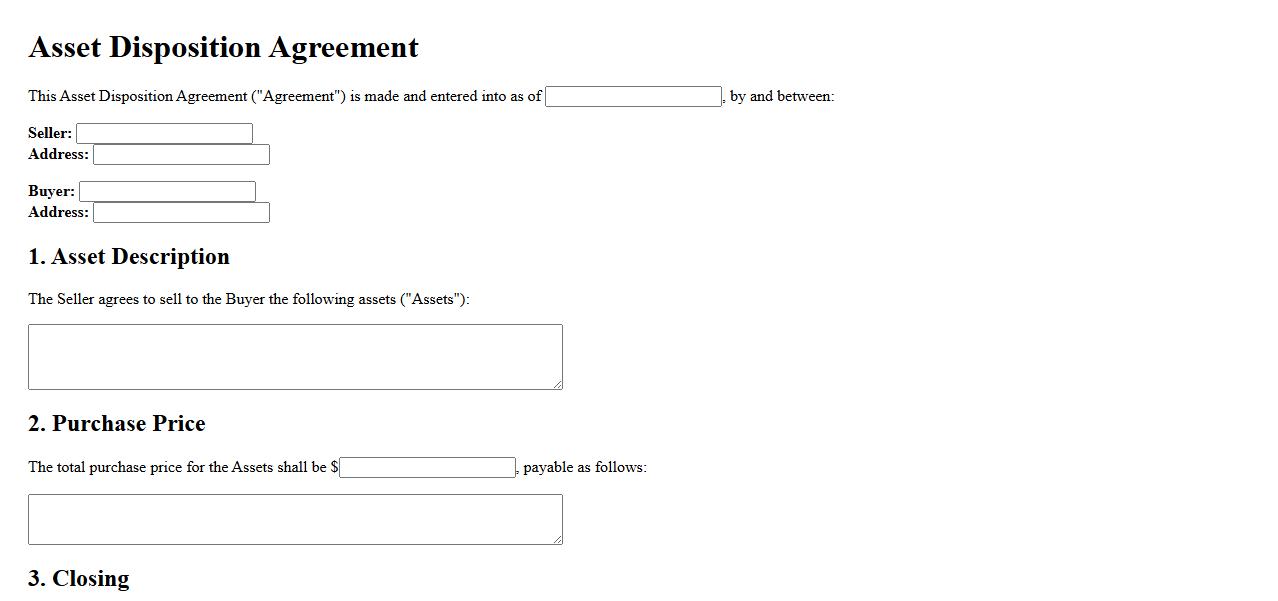

Asset Disposition Agreement

An Asset Disposition Agreement is a legal contract outlining the terms and conditions for the sale, transfer, or disposal of assets between parties. It ensures clear understanding and protection of rights related to the ownership and value of the assets involved. This agreement is essential for businesses to manage asset liquidation efficiently and transparently.

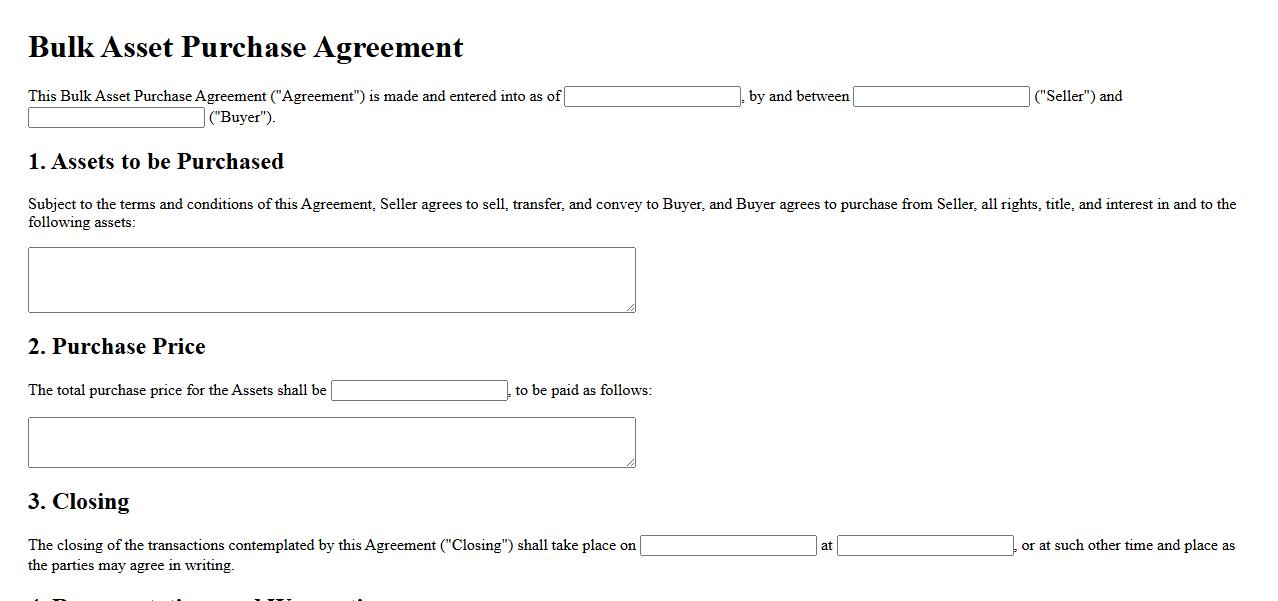

Bulk Asset Purchase Agreement

A Bulk Asset Purchase Agreement is a legal contract used when a buyer acquires multiple assets from a seller in a single transaction. This agreement outlines the terms, conditions, and price for the bulk transfer of assets, ensuring clarity and protection for both parties. It is commonly used in business sales and mergers to streamline asset acquisition.

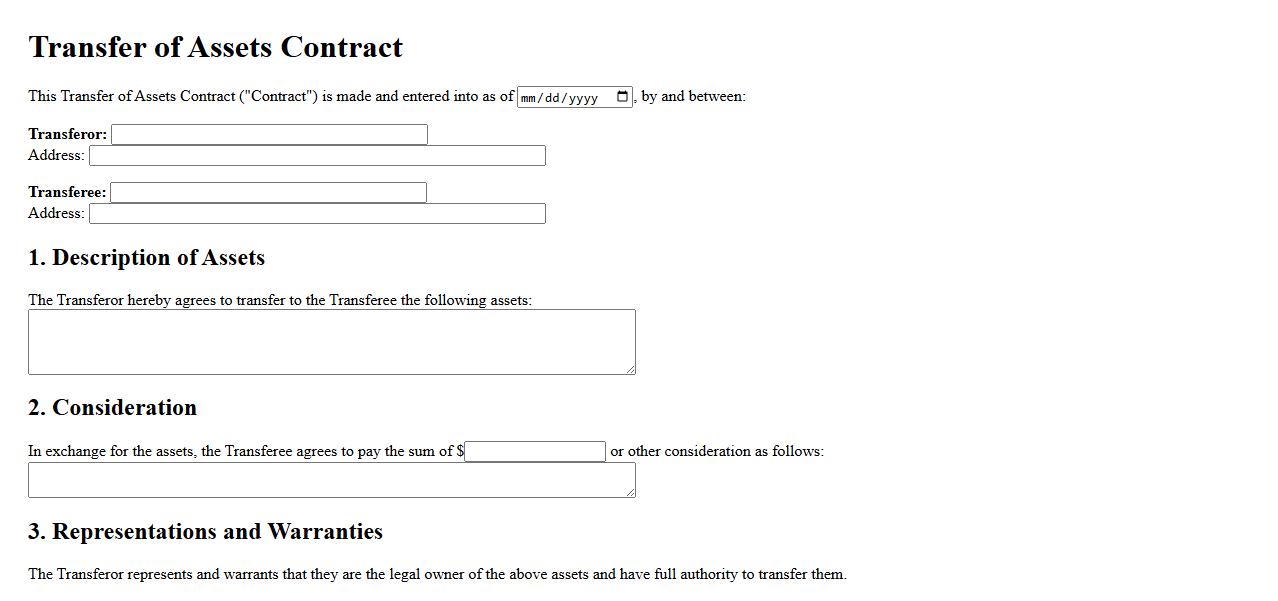

Transfer of Assets Contract

The Transfer of Assets Contract is a legal agreement used to formally transfer ownership of assets from one party to another. This contract outlines the terms, conditions, and responsibilities involved in the transfer to ensure clarity and protect both parties. It is essential for accurately documenting the transaction and preventing future disputes.

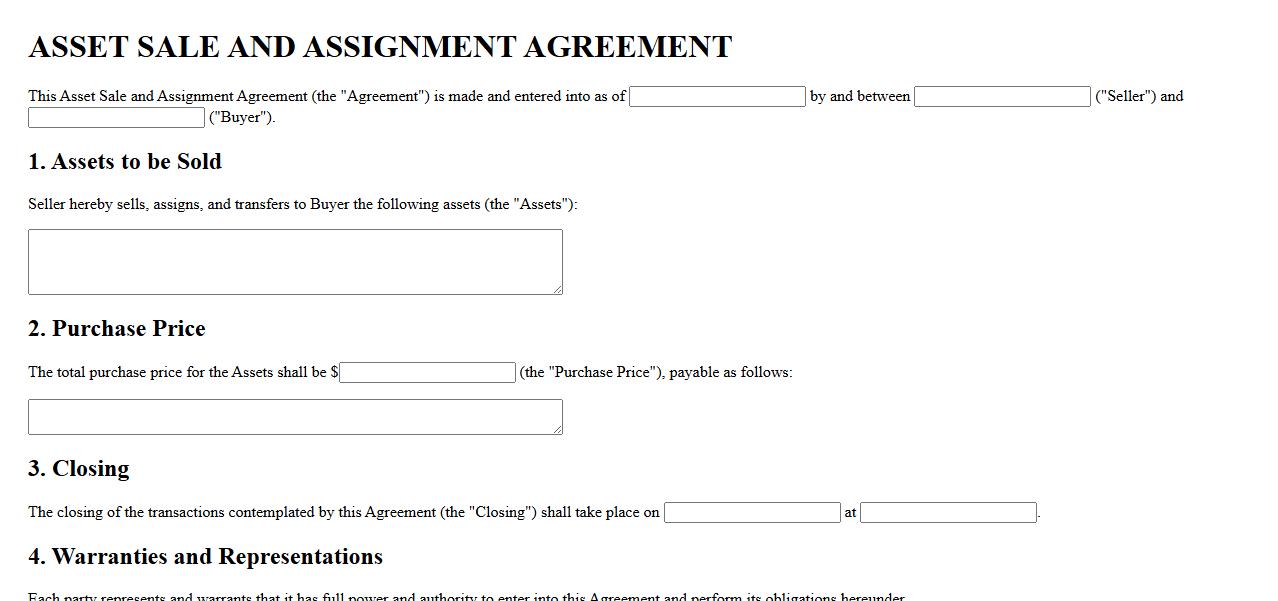

Asset Sale and Assignment Agreement

An Asset Sale and Assignment Agreement is a legal document that outlines the terms for transferring ownership of assets from one party to another. It details the specific assets involved, purchase price, and any liabilities included. This agreement ensures a clear and binding transaction between the buyer and seller.

What specific assets are being transferred under this Agreement for Purchase of Assets?

The assets being transferred typically include tangible property like equipment, inventory, and real estate, as well as intangible assets such as intellectual property and contracts. The agreement clearly defines the list of specific assets that are part of the sale, ensuring both parties have a mutual understanding. This detailed enumeration helps avoid disputes post-closing.

What are the payment terms and purchase price stipulated in the agreement?

The purchase price is outlined explicitly to reflect the total amount payable by the buyer to the seller. Payment terms often specify the schedule, method of payment, and any adjustments such as prorations or escrow holdbacks. Clear payment provisions protect both parties by establishing when and how funds will be transferred.

Which warranties and representations are made by the seller regarding the assets?

The seller provides warranties and representations to assure the buyer of the legal status and condition of the assets. These include assurances that the assets are free from liens, owned outright by the seller, and comply with all relevant laws. Such declarations reduce the buyer's risk by confirming the assets' value and legitimacy.

What are the conditions precedent to closing outlined in the agreement?

The agreement lists the conditions precedent that must be fulfilled before the transaction can close. These may include obtaining necessary approvals, completion of due diligence, and fulfillment of regulatory requirements. Meeting these conditions ensures that the closing proceeds smoothly without unexpected legal or financial issues.

How are liabilities and obligations associated with the assets allocated between buyer and seller?

The agreement specifies the allocation of liabilities and obligations tied to the transferred assets, clearly distinguishing which are assumed by the buyer and which remain with the seller. This allocation protects each party from unwanted risks arising from past or future obligations. Properly defining these responsibilities is crucial for a successful asset transfer.