An Agreement to Co-Sign Lease is a legal document where a co-signer agrees to take responsibility for the lease obligations if the primary tenant defaults. This agreement ensures that the landlord has an additional layer of security for rent payments and property maintenance. Co-signers typically must meet credit and income requirements to qualify.

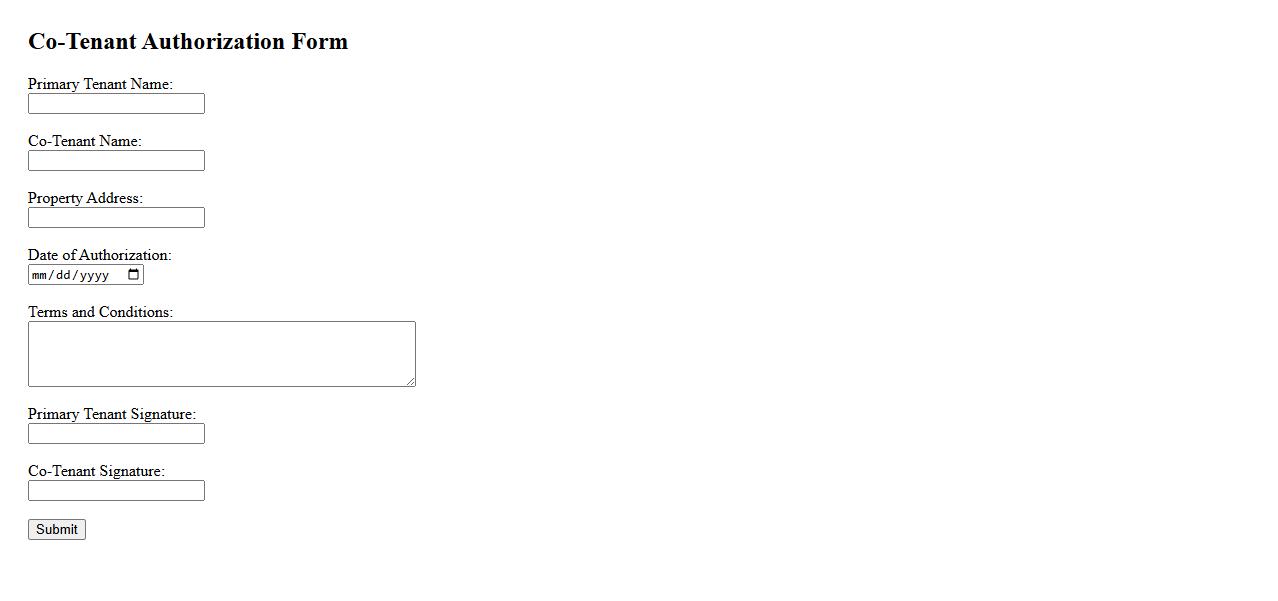

Co-Tenant Authorization Form

The Co-Tenant Authorization Form is a crucial document that grants permission for multiple tenants to share responsibility for a rental property. This form ensures all parties acknowledge their obligations and rights, helping to prevent disputes. It also facilitates communication and legal clarity between landlords and co-tenants.

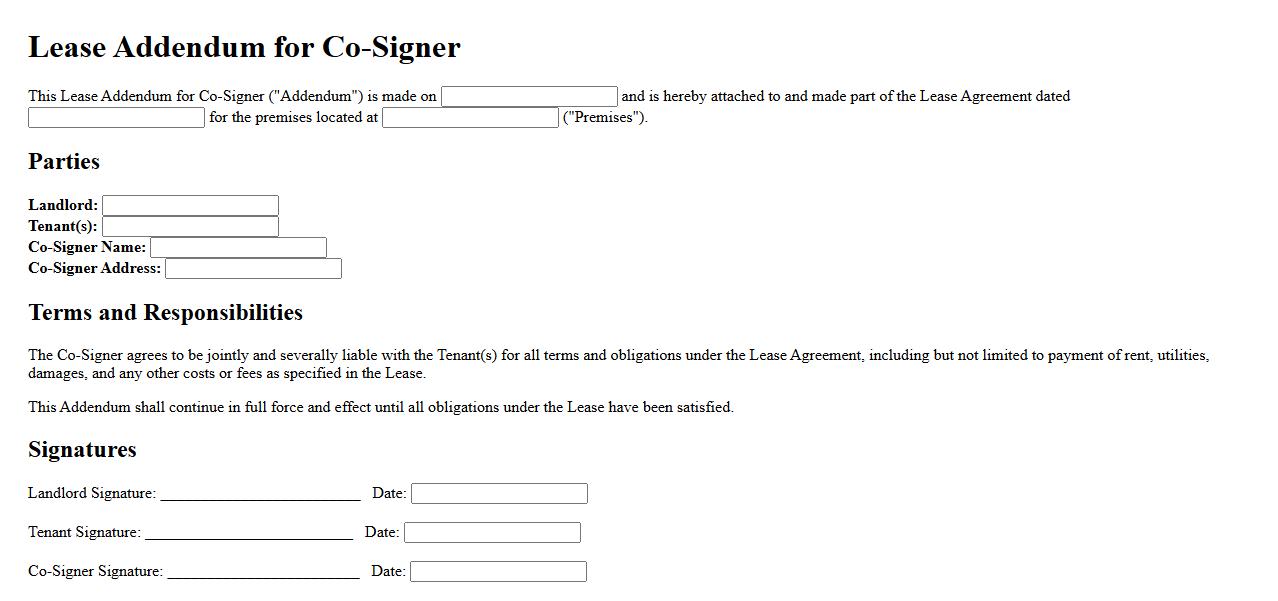

Lease Addendum for Co-Signer

A Lease Addendum for Co-Signer is a legal document that outlines the responsibilities and obligations of a co-signer in a rental agreement. It ensures that the co-signer agrees to be financially liable if the primary tenant fails to meet the lease terms. This addendum protects landlords by providing an additional layer of security for rent payments and lease compliance.

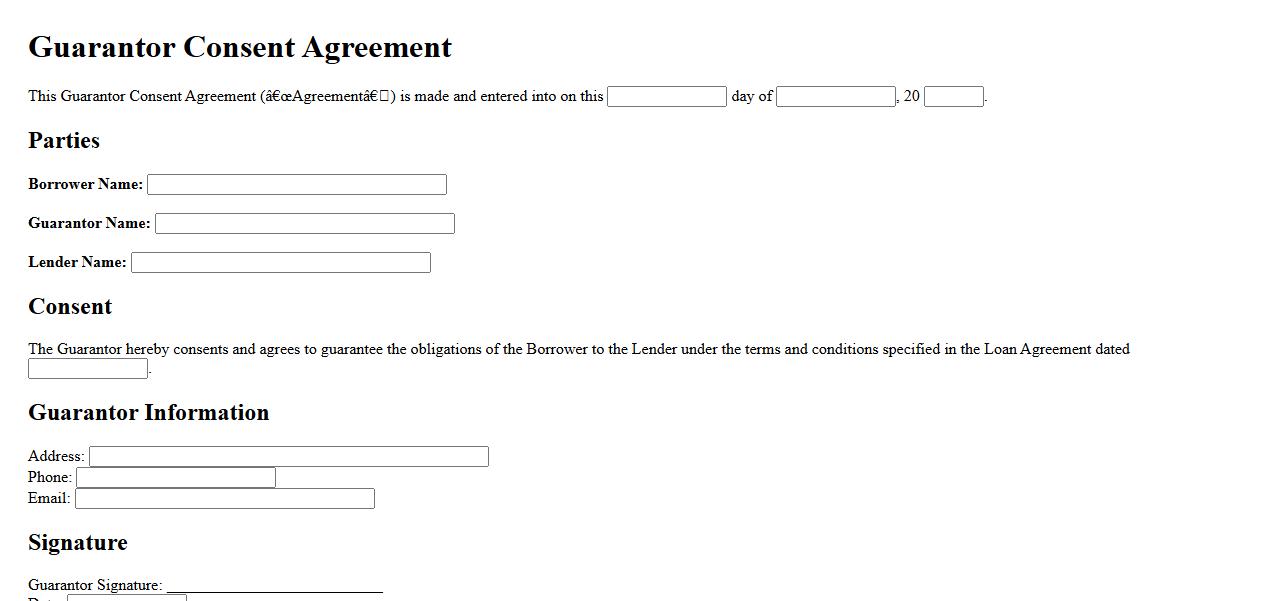

Guarantor Consent Agreement

The Guarantor Consent Agreement is a legal document in which a guarantor formally agrees to take responsibility for a debt or obligation if the primary party defaults. This agreement ensures that lenders or creditors have an additional layer of security. It clearly outlines the terms and conditions under which the guarantor consents to the obligations.

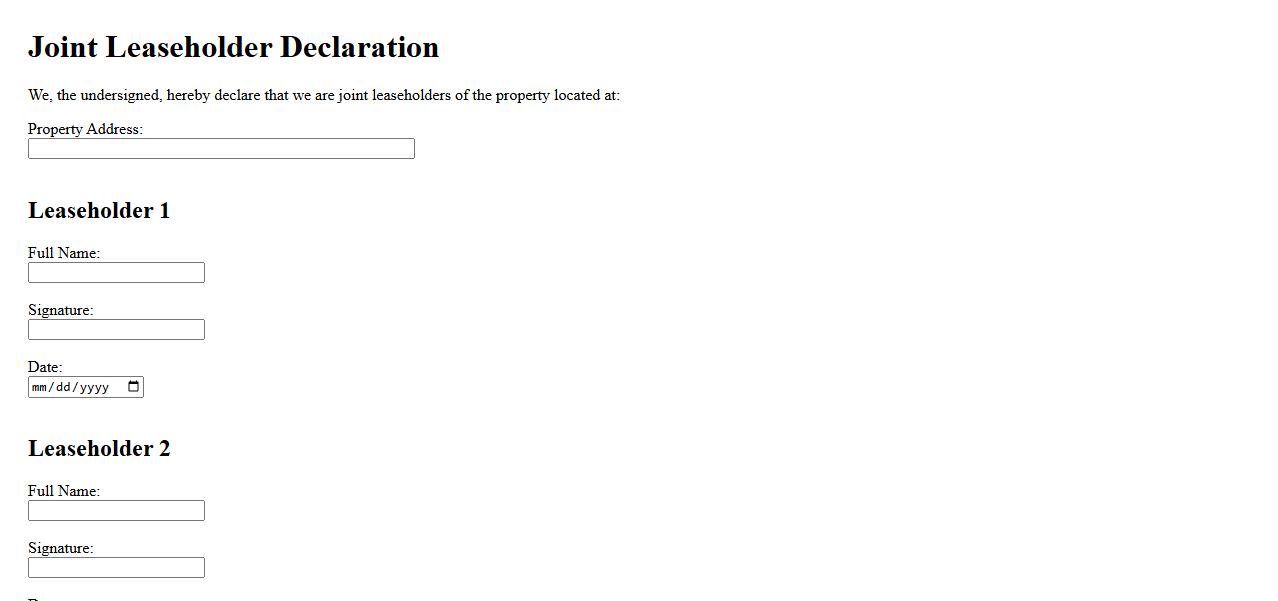

Joint Leaseholder Declaration

The Joint Leaseholder Declaration is a legal document confirming the shared responsibilities and rights of multiple leaseholders on a property. It ensures clarity and agreement between all parties regarding lease terms and obligations. This declaration helps prevent disputes and facilitates smooth property management.

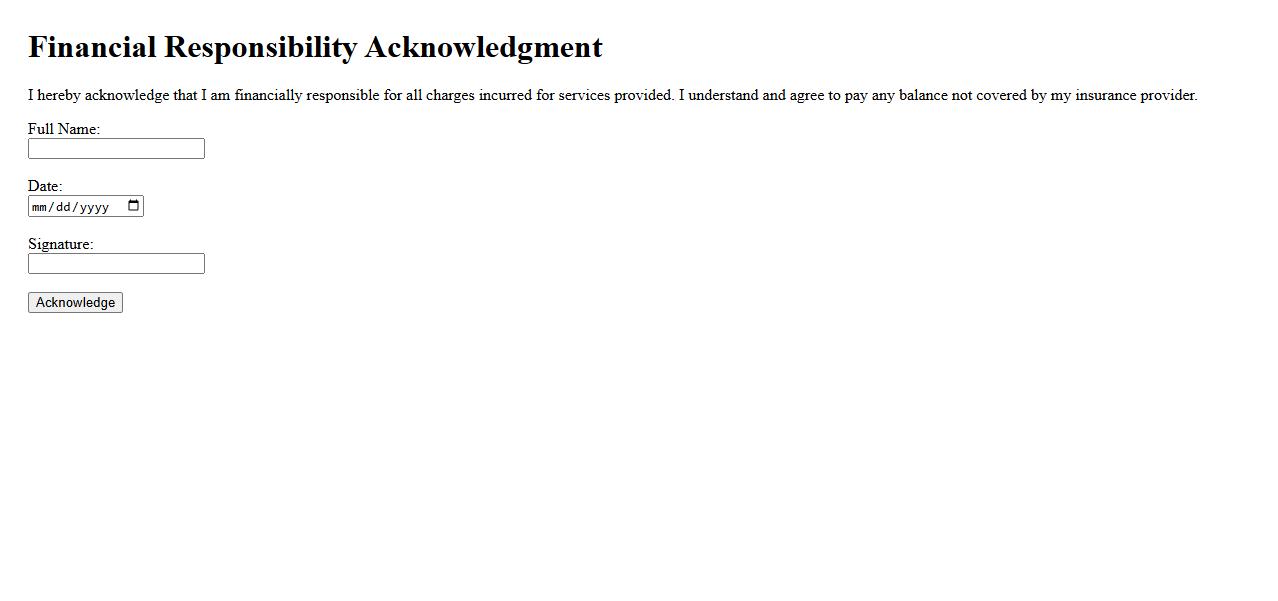

Financial Responsibility Acknowledgment

The Financial Responsibility Acknowledgment is a crucial document that confirms an individual's commitment to managing and repaying any financial obligations. It ensures clarity and accountability between parties involved in a financial agreement. Recognizing this responsibility helps prevent misunderstandings and promotes trust in financial transactions.

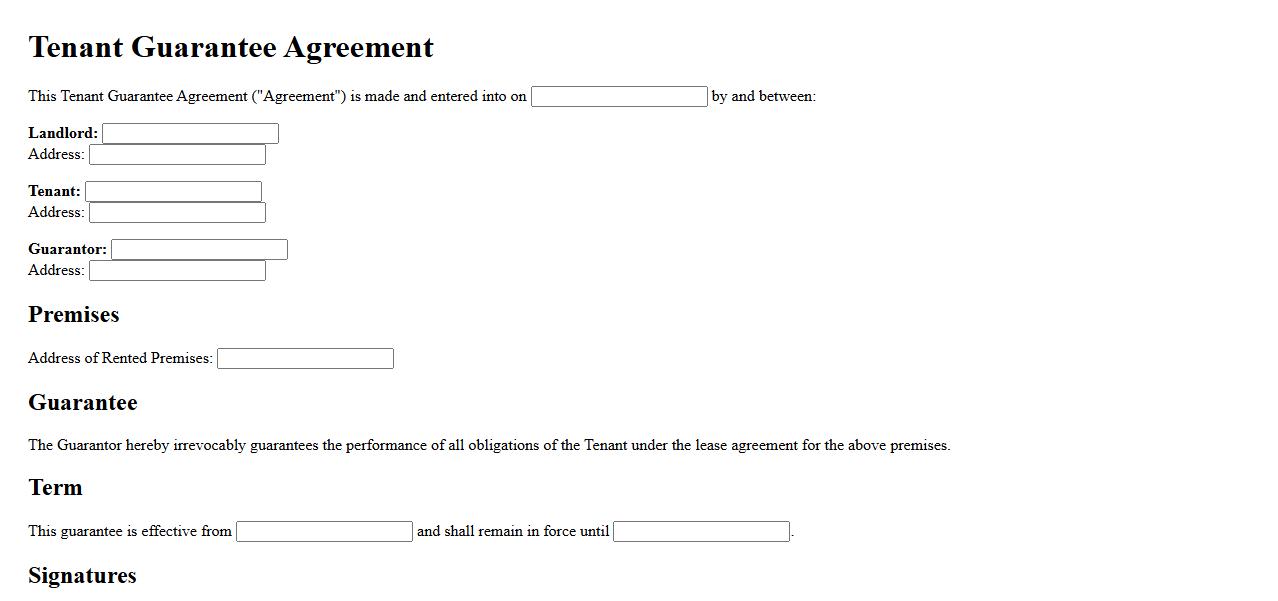

Tenant Guarantee Agreement

A Tenant Guarantee Agreement is a legal contract that ensures the tenant fulfills all lease obligations. It protects landlords by holding a third party responsible if the tenant defaults. This agreement provides added security and peace of mind in rental arrangements.

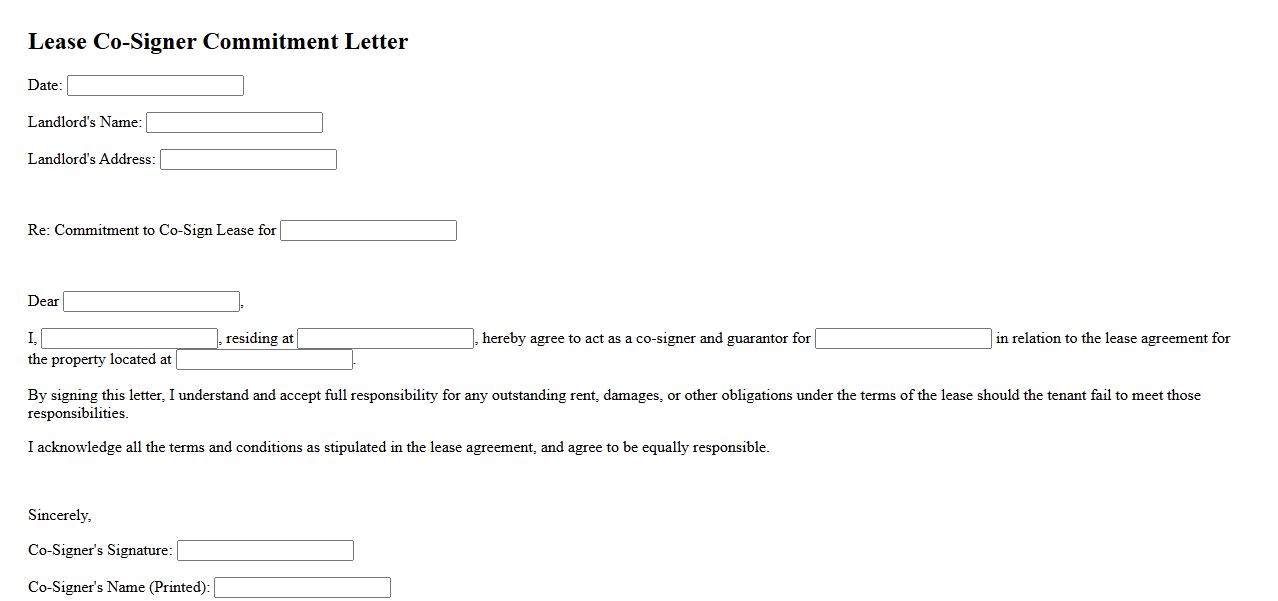

Lease Co-Signer Commitment Letter

A Lease Co-Signer Commitment Letter is a formal document where a co-signer agrees to take responsibility for a lease agreement if the primary tenant defaults. This letter provides landlords with added security, ensuring rent payments and lease terms are honored. It is essential for tenants who may not meet credit or income requirements on their own.

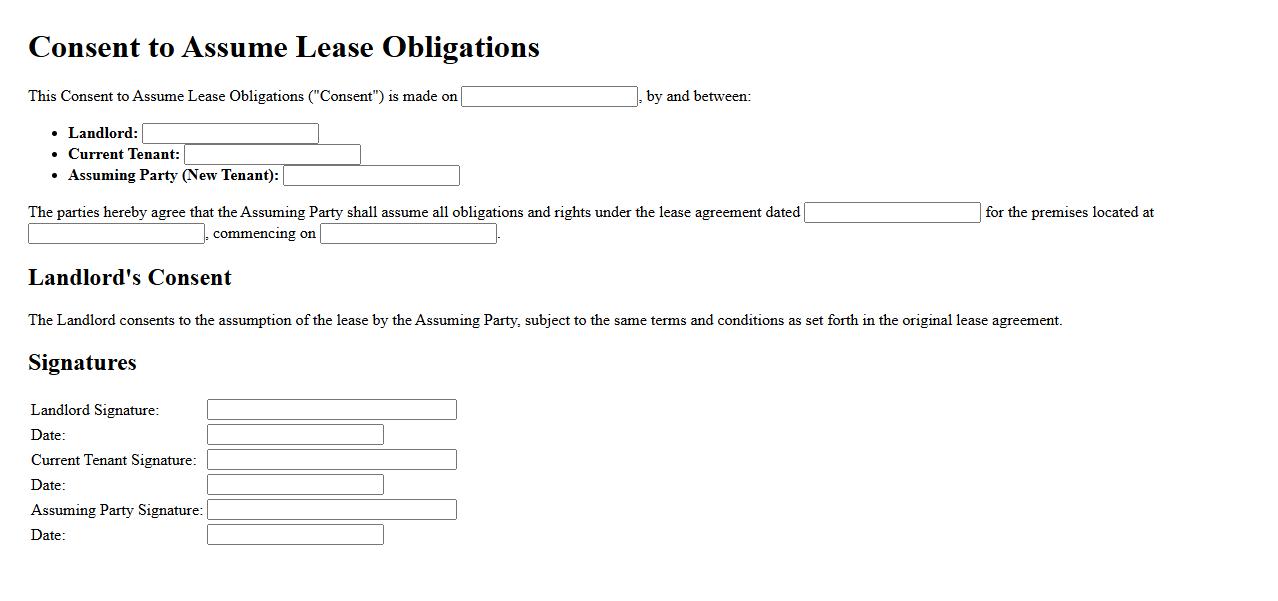

Consent to Assume Lease Obligations

Consent to Assume Lease Obligations is a formal agreement where a landlord approves a tenant's request for another party to take over the existing lease. This consent ensures that the new tenant agrees to fulfill all lease terms and conditions. Obtaining this approval is crucial to legally transfer responsibilities and avoid potential disputes.

Suretyship Confirmation Form

The Suretyship Confirmation Form is a legal document used to verify the commitment of a surety to guarantee the obligations of a principal. It ensures that all parties acknowledge and agree to the terms of the suretyship agreement. This form is essential for maintaining clear and binding financial or contractual responsibilities.

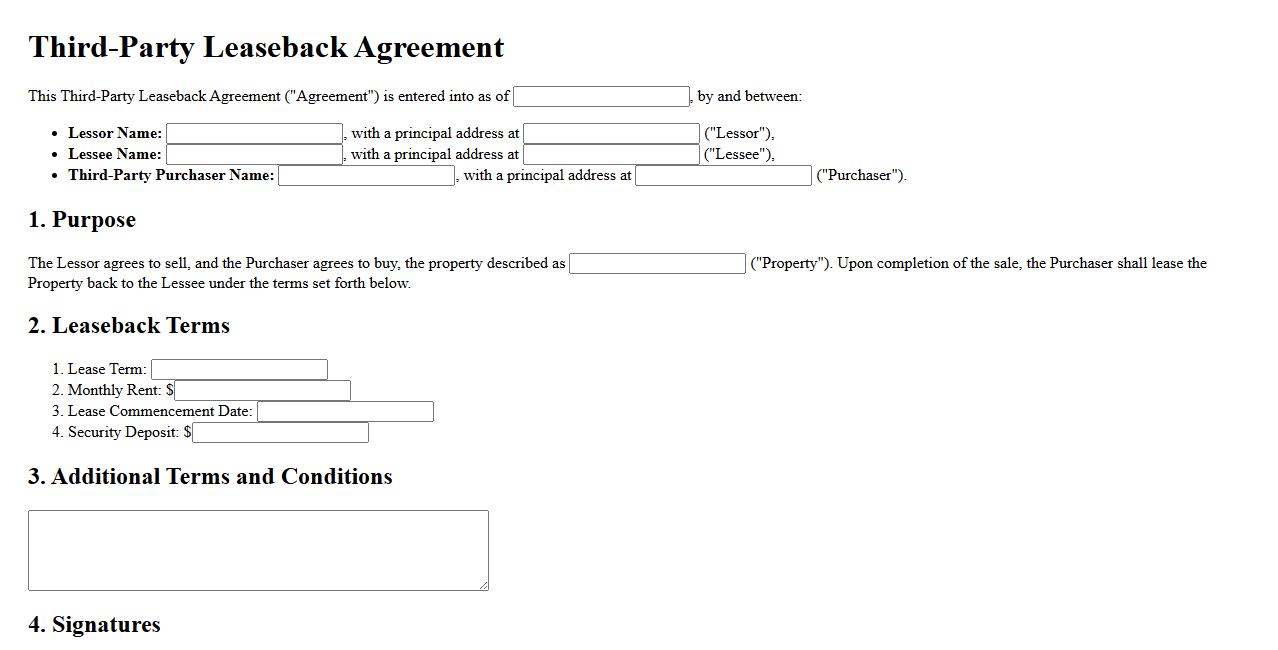

Third-Party Leaseback Agreement

A Third-Party Leaseback Agreement is a legal contract where the owner of a property sells it to a third party and simultaneously leases it back. This arrangement allows the original owner to free up capital while retaining the right to use the property. It is commonly used in real estate and commercial transactions to improve cash flow and operational flexibility.

What are the legal obligations of a co-signer in this agreement?

The legal obligations of a co-signer include guaranteeing the payment of rent and adherence to all terms outlined in the lease. They are equally responsible if the primary tenant fails to meet their contractual duties. The co-signer acts as a secondary party ensuring the landlord is protected.

Under what conditions does the co-signing agreement terminate?

The termination of the co-signing agreement occurs when the lease expires or is legally ended by mutual consent. It can also terminate if all financial obligations and liabilities of the primary tenant are fully satisfied. Specific terms in the agreement may outline additional conditions for ending the co-signing role.

Which specific lease terms or liabilities is the co-signer guaranteeing?

The co-signer guarantees the payment of rent, coverage of damages, and any other financial liabilities specified in the lease. This includes late fees, legal costs, and potential eviction costs. Their guarantee ensures the landlord does not suffer losses due to tenant default.

What are the consequences for the co-signer if the primary tenant defaults?

If the primary tenant defaults, the co-signer is responsible for paying any outstanding rent and damages. The co-signer's credit may be negatively affected, and legal action can be taken against them to recover losses. This highlights the significant financial risk assumed by the co-signer.

Is there a limit to the co-signer's financial responsibility under this agreement?

The co-signer's financial responsibility is typically limited to the amounts specified in the lease, such as rent and repair costs. However, it may extend to legal fees and other related expenses depending on the agreement terms. It is essential to review the contract carefully to understand any financial caps or exclusions.