An Agreement for Installment Payments outlines the terms under which a debtor agrees to pay a creditor in smaller, scheduled amounts instead of a lump sum. This contract specifies the payment schedule, amounts, due dates, and any applicable interest or fees. It ensures clarity and legal protection for both parties during the payment period.

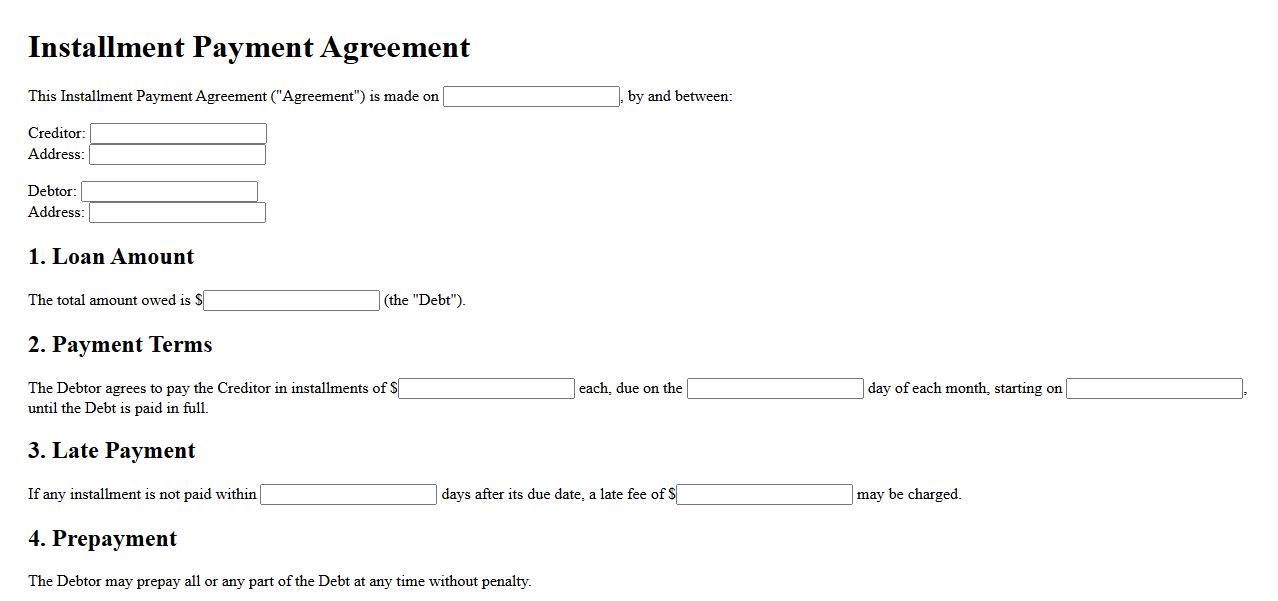

Installment Payment Agreement

An Installment Payment Agreement allows individuals or businesses to pay off a debt over time through scheduled payments. This arrangement helps manage financial obligations without paying a lump sum upfront. It is commonly used for taxes, loans, or other large expenses.

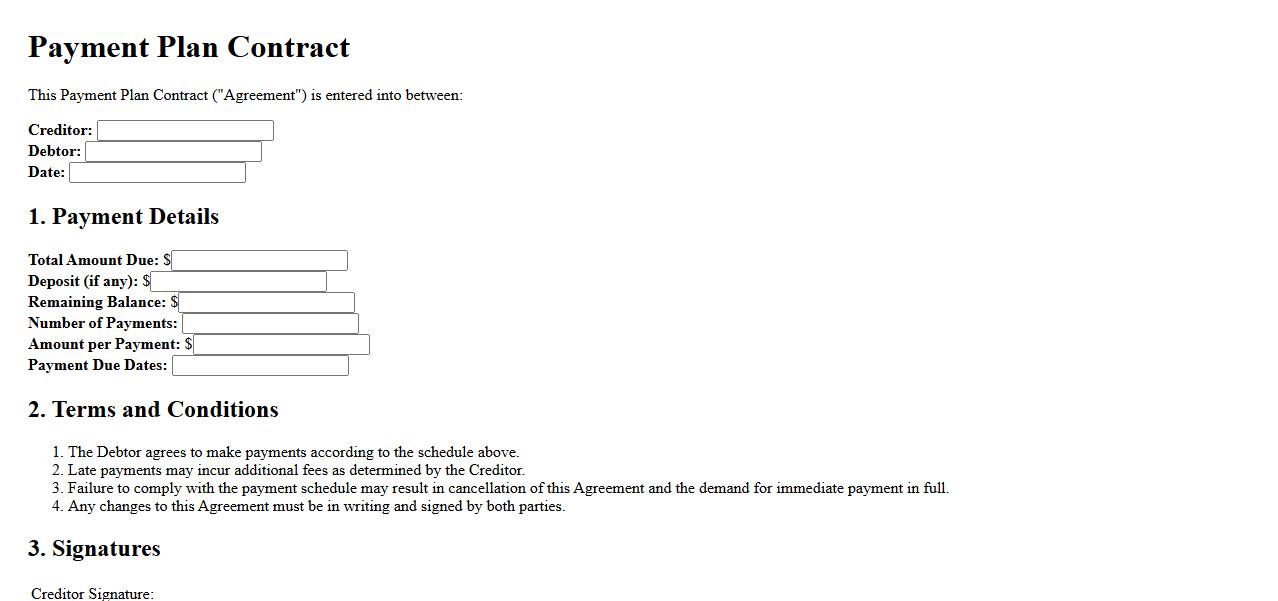

Payment Plan Contract

A Payment Plan Contract is a legal agreement outlining the terms for repaying a debt in installments. It provides clarity on payment amounts, due dates, and consequences of missed payments. This contract helps both parties manage financial obligations efficiently and securely.

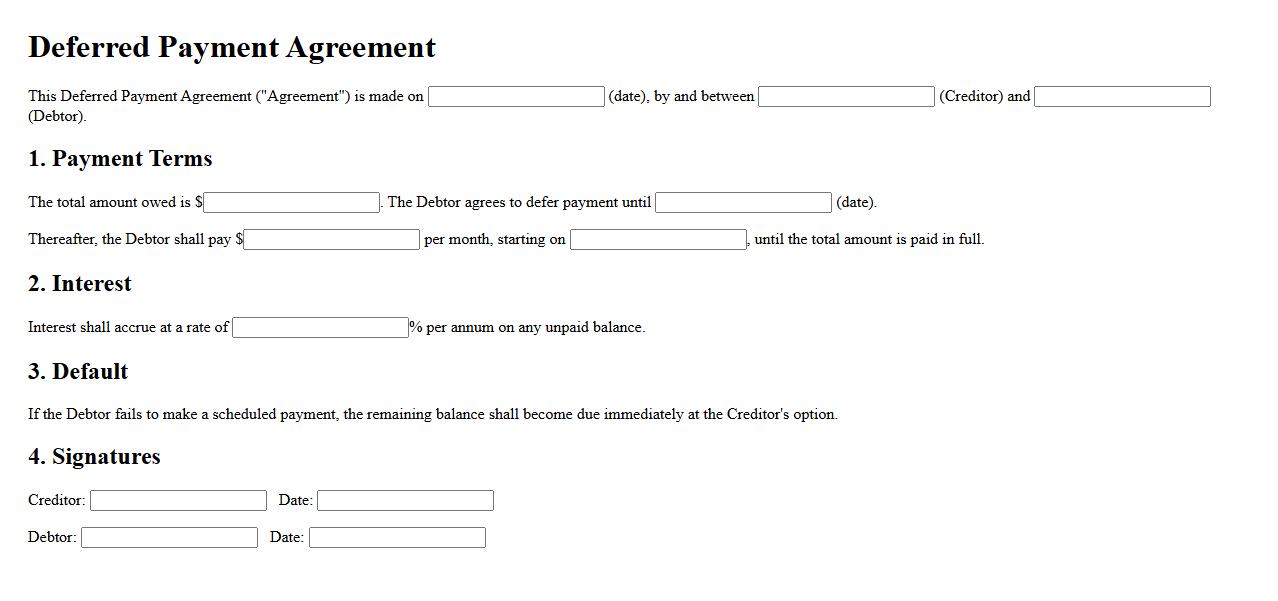

Deferred Payment Agreement

A Deferred Payment Agreement is a financial arrangement that allows a debtor to postpone payments to a later date. This agreement helps manage cash flow by providing flexibility in meeting payment obligations. It is commonly used in personal loans, business contracts, and installment plans.

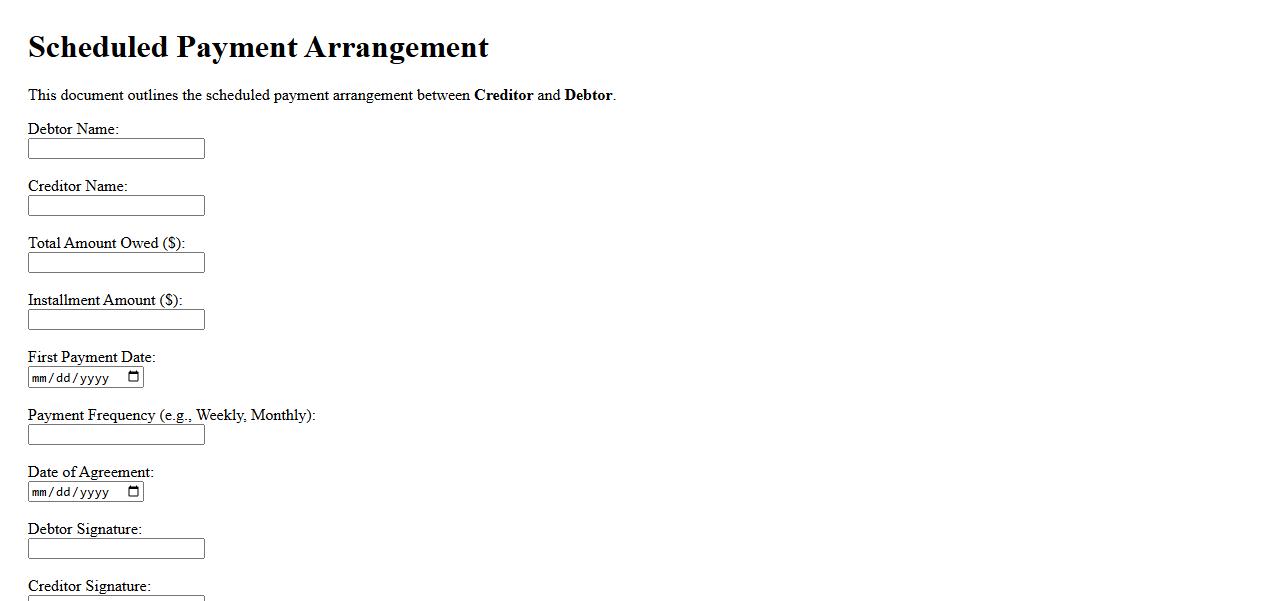

Scheduled Payment Arrangement

A Scheduled Payment Arrangement allows customers to manage their outstanding balances by setting up a structured plan to pay over time. This option helps maintain financial stability by breaking down large payments into manageable installments. It ensures timely payments while avoiding penalties or service interruptions.

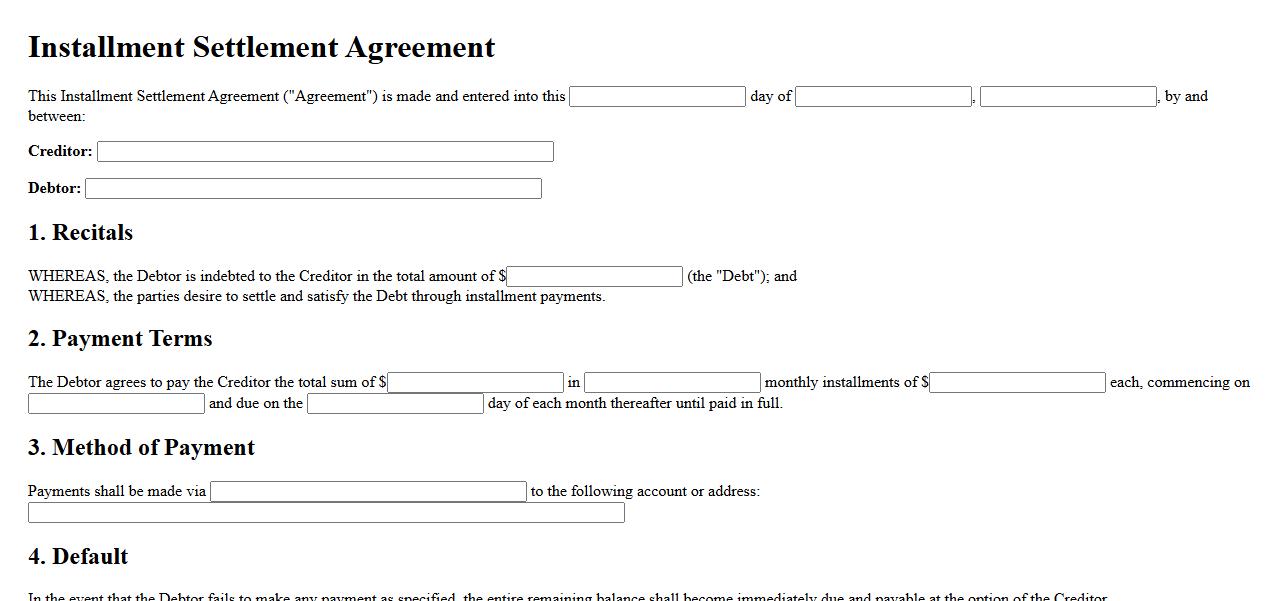

Installment Settlement Agreement

An Installment Settlement Agreement is a legally binding contract between parties to resolve a debt through scheduled payments over time. It allows the debtor to repay the owed amount in manageable installments, avoiding immediate lump-sum payment. This agreement helps protect both parties by clearly outlining payment terms and conditions.

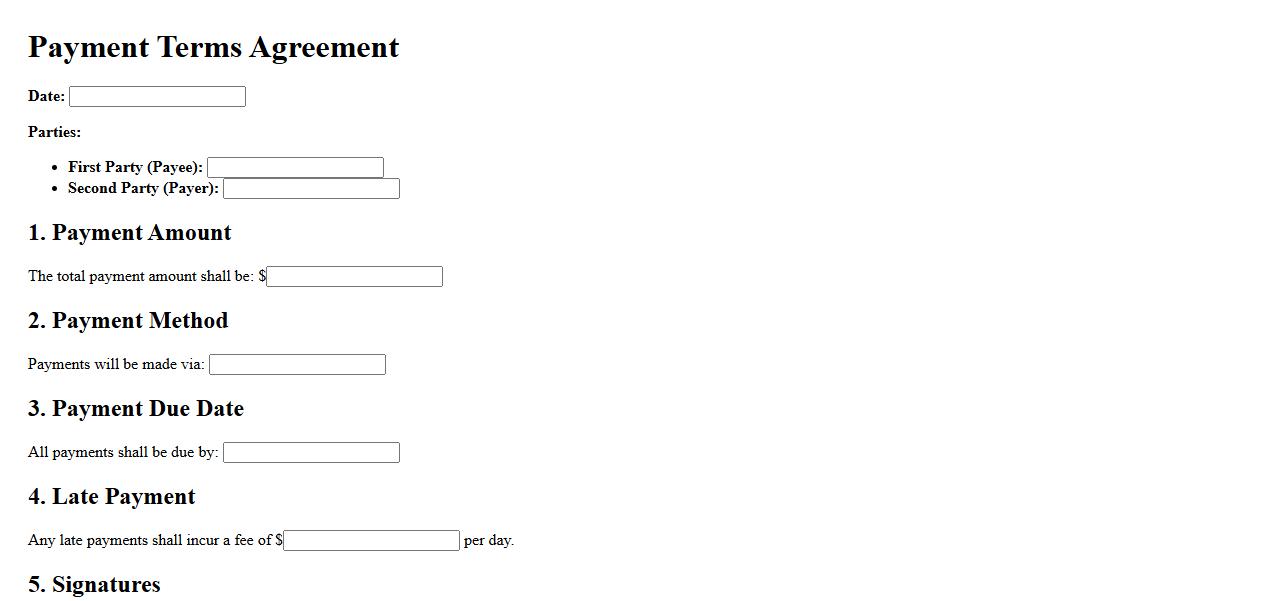

Payment Terms Agreement

The Payment Terms Agreement outlines the conditions under which payments must be made between parties. It specifies deadlines, methods, and any penalties for late payments to ensure clear understanding. This agreement helps prevent disputes and facilitates smooth financial transactions.

Structured Payment Contract

A Structured Payment Contract is a financial agreement that outlines a series of scheduled payments over a specified period. It provides a clear and organized method for managing debt repayment or installment purchases. This type of contract ensures both parties agree on payment amounts and deadlines, reducing the risk of disputes.

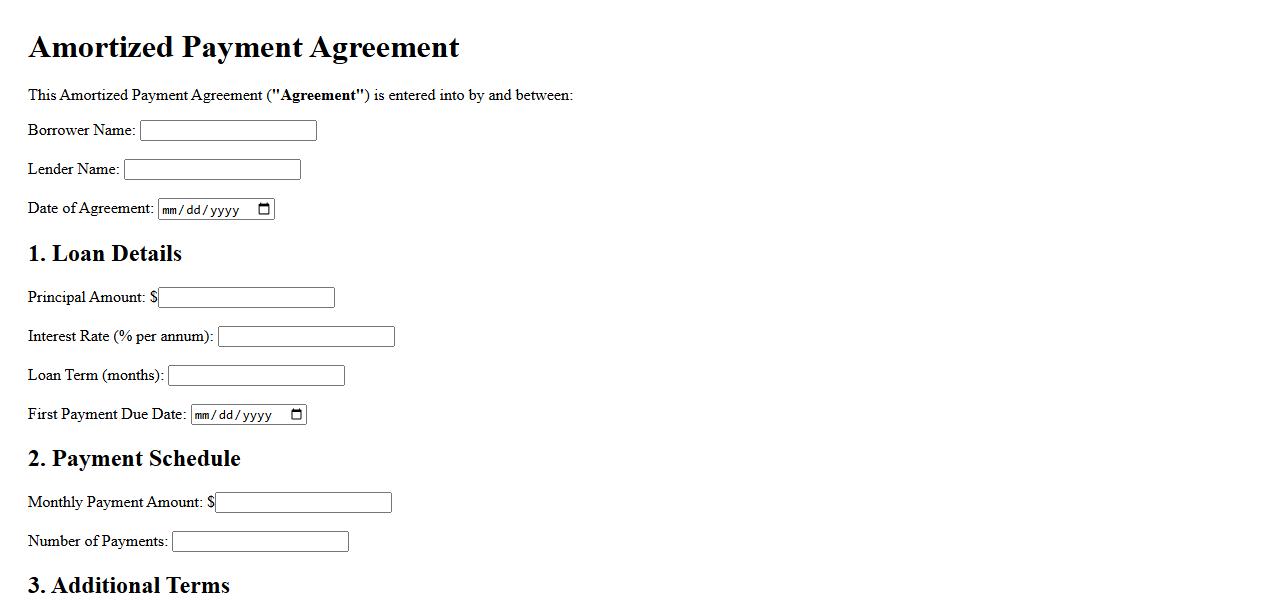

Amortized Payment Agreement

An Amortized Payment Agreement is a financial arrangement where payments are spread out evenly over a specified period. This method ensures that each payment covers both principal and interest, making budgeting predictable and manageable. It is commonly used for loans like mortgages and auto financing.

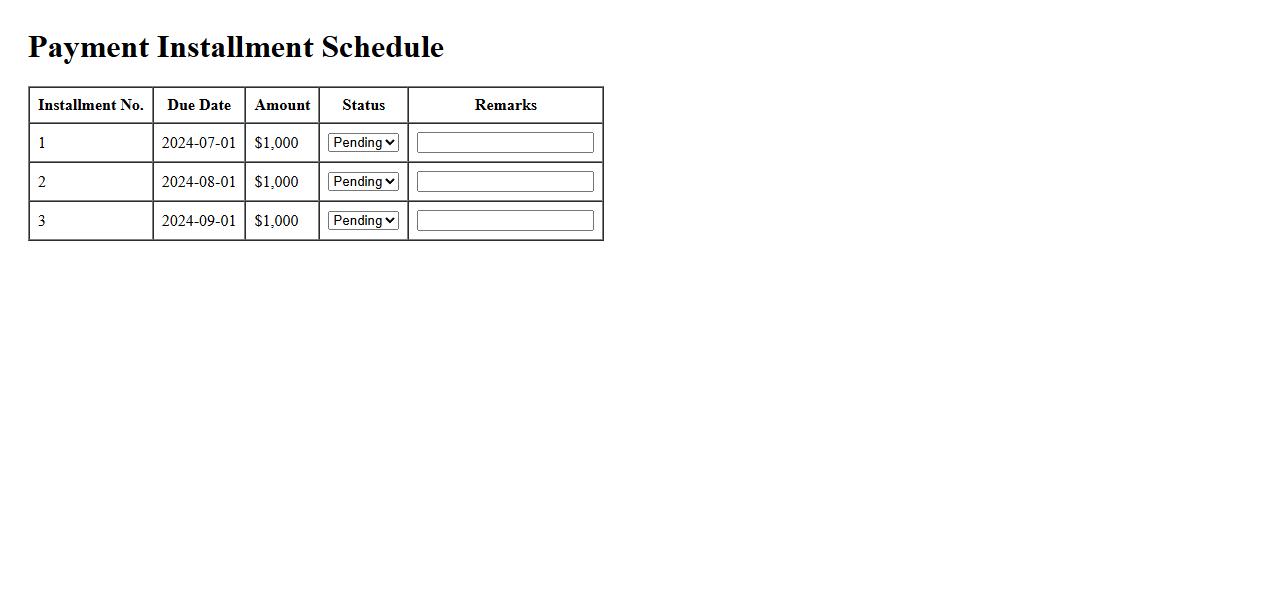

Payment Installment Schedule

The Payment Installment Schedule outlines the specific dates and amounts for each payment, ensuring clear and timely financial planning. It helps both parties track payment progress and avoid misunderstandings. This schedule is essential for managing budgets and maintaining financial commitments.

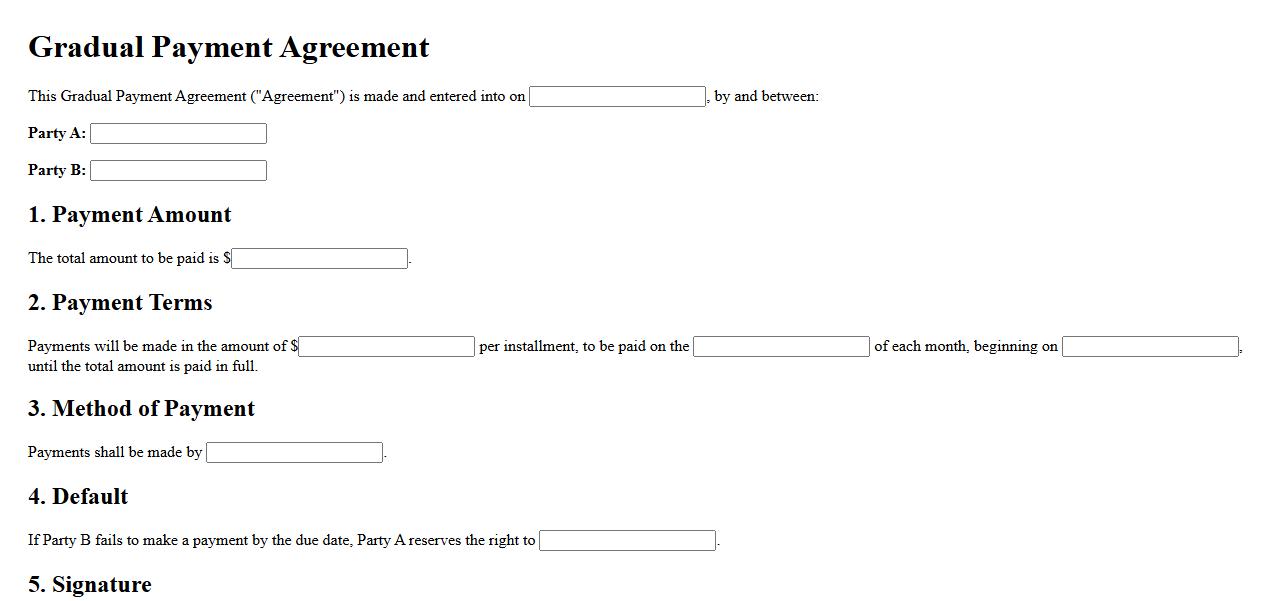

Gradual Payment Agreement

A Gradual Payment Agreement is a structured financial arrangement that allows payments to be made incrementally over time. This approach helps manage cash flow and reduces the burden of large, upfront costs. It is commonly used in business contracts and loan repayments to provide flexibility for both parties.

What are the key obligations of each party under the Agreement for Installment Payments?

Each party in the agreement has specific responsibilities to ensure smooth payment processing. The payer must make timely installment payments as outlined, while the payee is obligated to provide any agreed goods or services upon receipt of payments. Both parties must adhere to the terms to maintain the contract's validity.

How is the installment payment schedule structured in the agreement?

The payment schedule is generally divided into a series of fixed installments over a defined period. Each installment has a specified due date and payment amount, clearly detailed within the agreement. This structure provides predictability and clarity for both parties regarding financial commitments.

What are the consequences of missed or late installment payments?

Missing or delaying payments typically triggers penalties outlined in the agreement, such as late fees or increased interest rates. Persistent non-payment may lead to termination of the agreement or legal action. These consequences encourage adherence to the agreed payment timeline.

What terms govern the modification or termination of the installment agreement?

The agreement usually contains clauses that specify the conditions for modification or early termination of the installment plan. Any changes require mutual consent and formal documentation to validate the amendment. Termination provisions outline the obligations and rights of each party if the agreement ends prematurely.

How is interest or additional charges calculated within the installment payment arrangement?

Interest or extra charges are often calculated based on a predetermined interest rate applied to the outstanding payment balance. The agreement should detail the formula or method used for calculating these amounts. This transparency helps avoid disputes and ensures fair compensation for delayed payments.