A Agreement for Payment Plan outlines the terms under which a debtor agrees to repay a creditor over time in installments. It specifies the payment schedule, amounts, and any interest or fees applicable to the outstanding balance. This legally binding document helps both parties manage financial obligations clearly and avoid disputes.

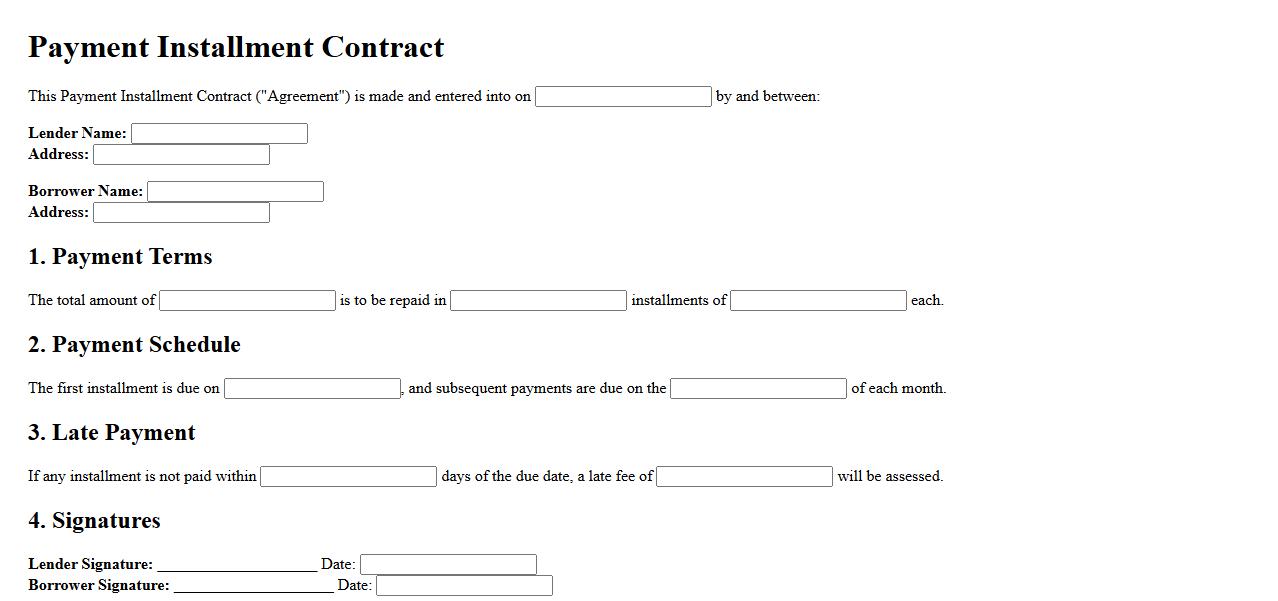

Payment Installment Contract

A Payment Installment Contract is a legally binding agreement that allows buyers to pay for goods or services over time through scheduled payments. This contract outlines the payment terms, amounts, and due dates to protect both parties. It ensures clarity and commitment, reducing financial risk for sellers and providing flexibility for buyers.

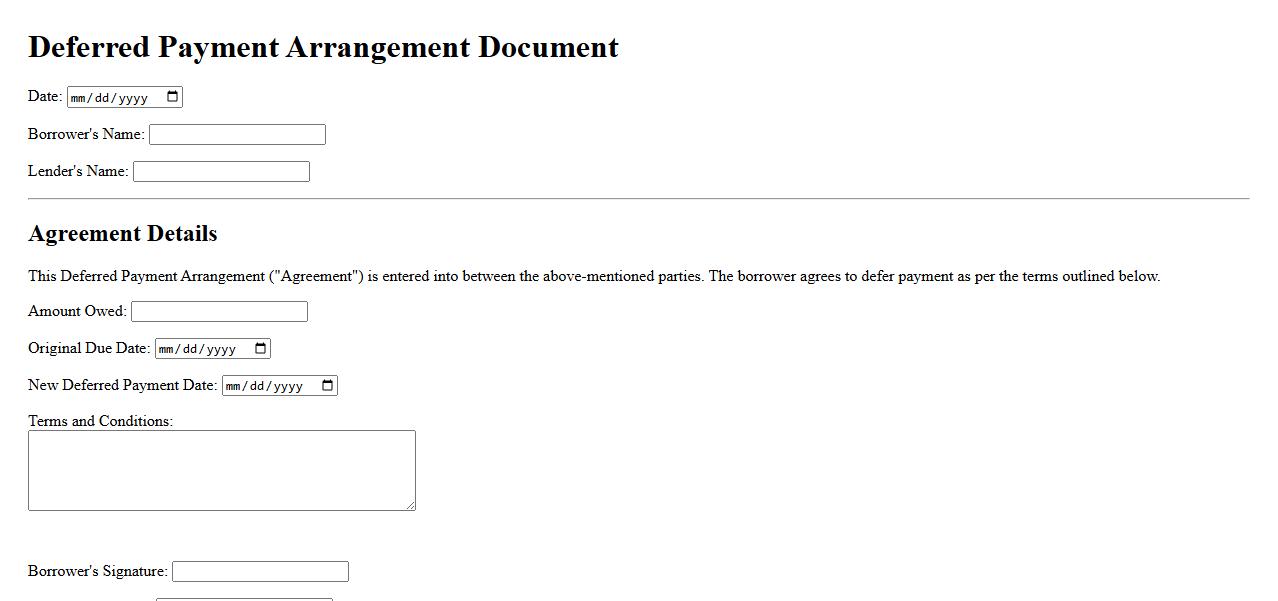

Deferred Payment Arrangement

A Deferred Payment Arrangement allows individuals or businesses to postpone payment obligations to a later date, providing financial flexibility. This option is often used to manage cash flow during challenging times without defaulting on debts. Deferred payments can help maintain good credit standing while addressing immediate financial constraints.

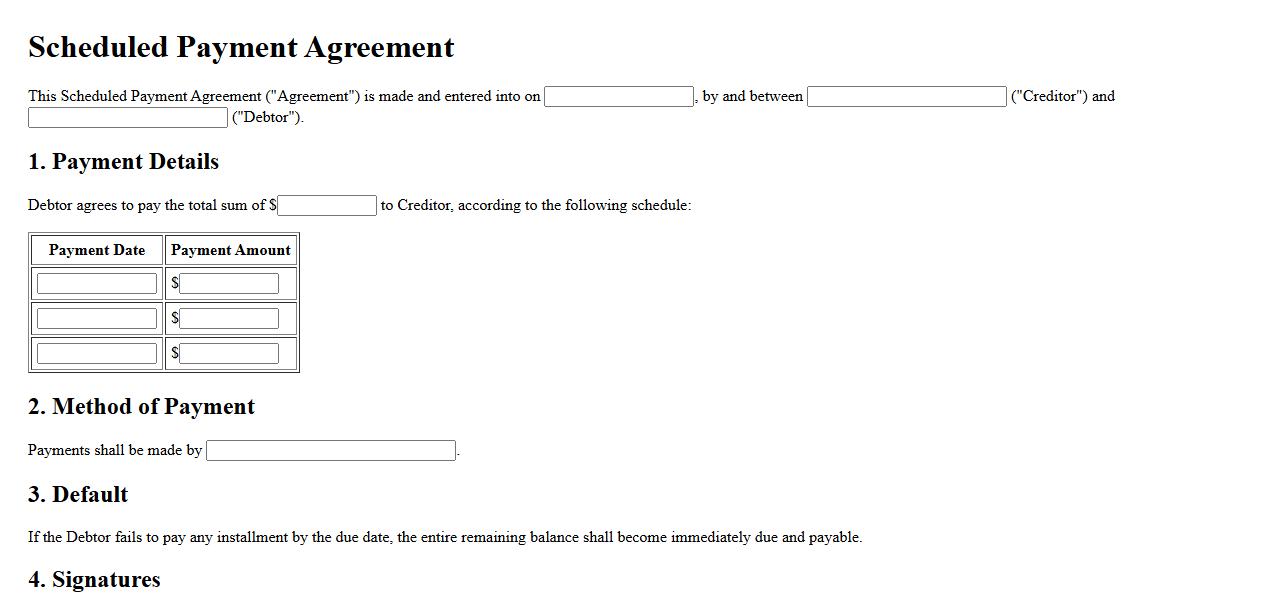

Scheduled Payment Agreement

A Scheduled Payment Agreement is a formal arrangement between a debtor and creditor outlining specific dates and amounts for repayments. It helps manage debt efficiently by breaking down large payments into smaller, manageable installments. This agreement ensures clarity and accountability for both parties involved.

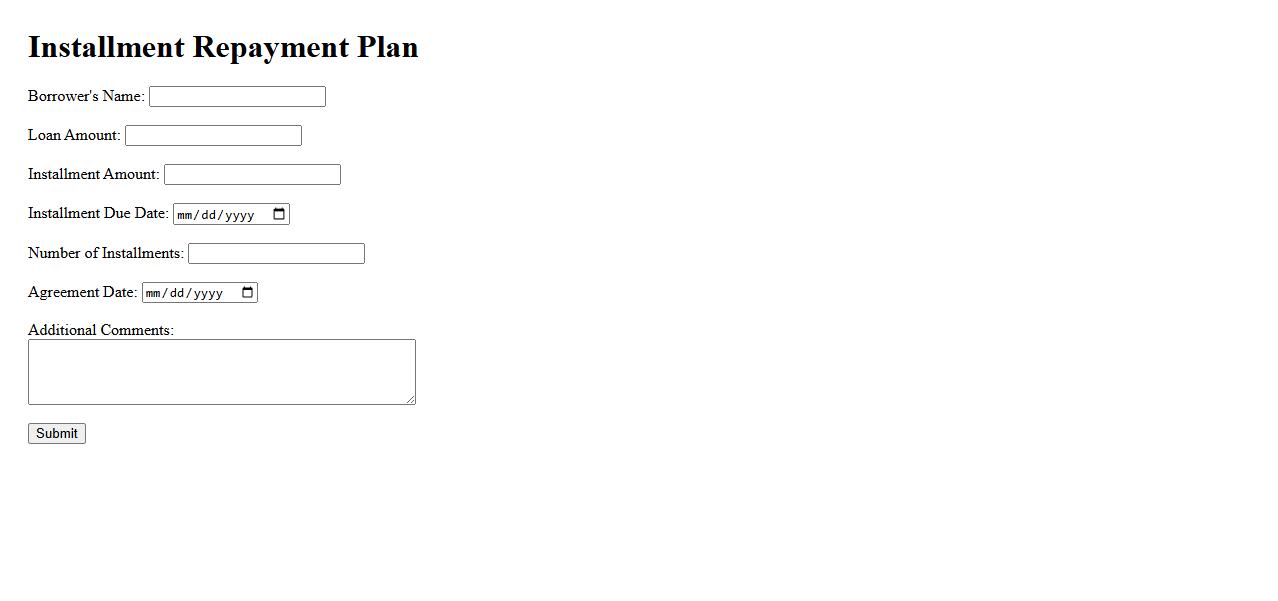

Installment Repayment Plan

An Installment Repayment Plan allows borrowers to repay their debt in smaller, manageable payments over a set period. This method helps reduce financial strain by breaking the total amount into scheduled installments. It is ideal for individuals seeking flexibility in managing their repayment obligations.

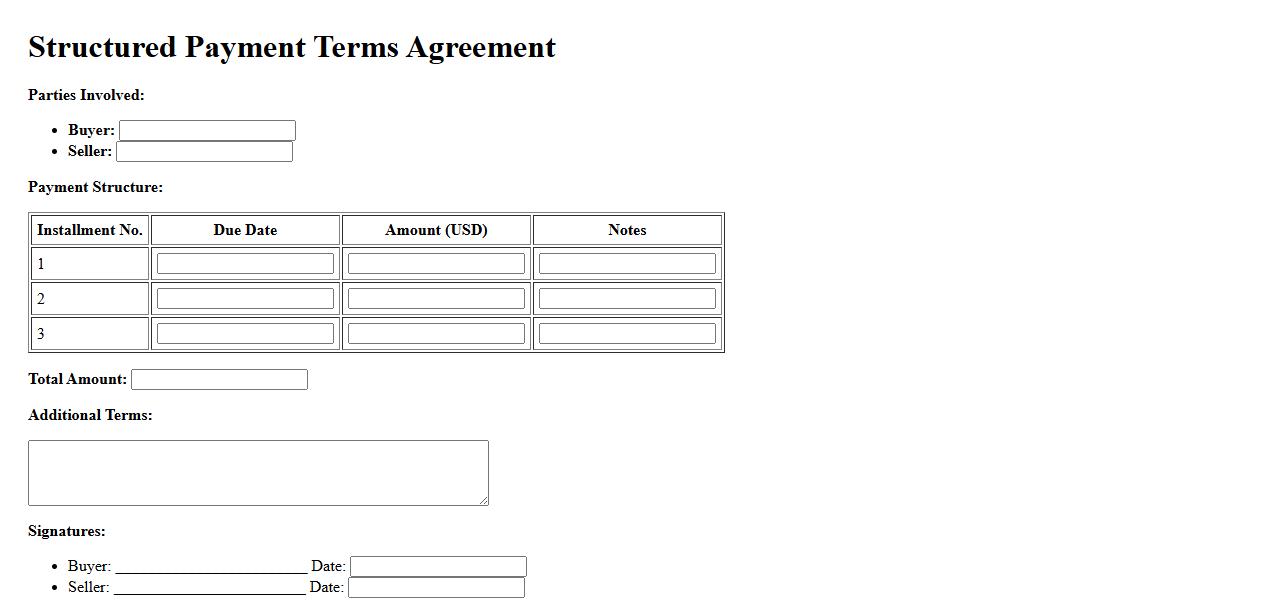

Structured Payment Terms

Structured Payment Terms refer to a clearly defined schedule and conditions for payments agreed upon by all parties involved in a transaction. These terms help ensure transparency and consistency, reducing the risk of disputes and delays. Properly structured payment terms facilitate smoother financial planning and improved cash flow management for businesses.

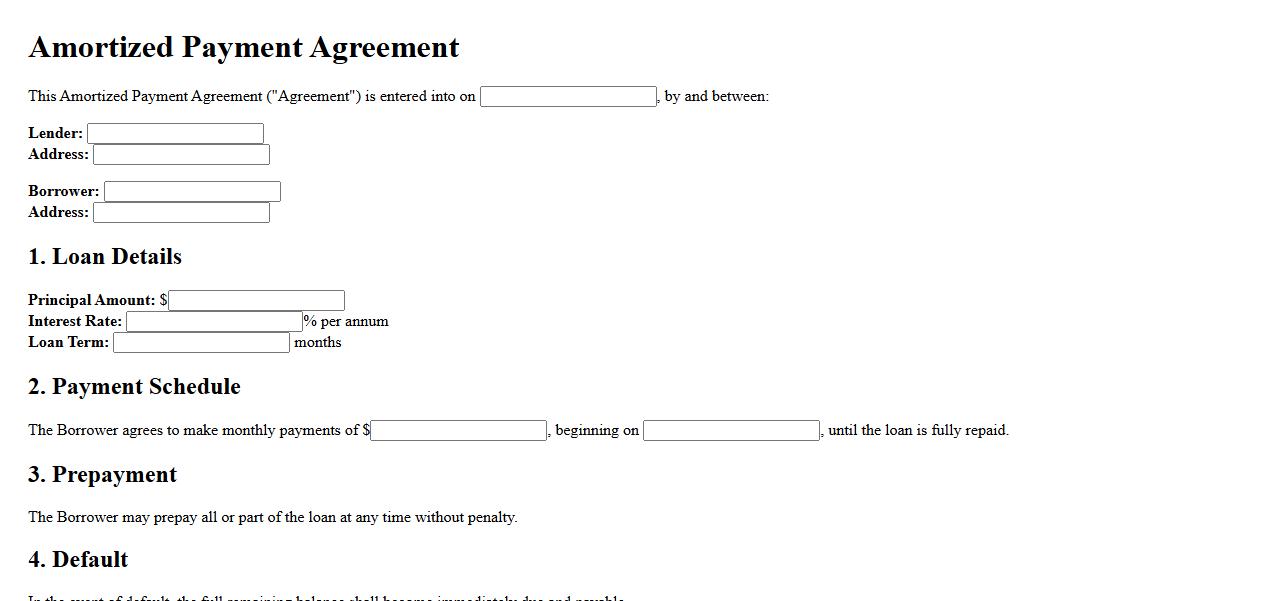

Amortized Payment Agreement

An Amortized Payment Agreement is a financial arrangement where a borrower repays a loan through regular, fixed payments over a specified period. Each payment covers both principal and interest, gradually reducing the outstanding balance. This method provides predictability and helps manage debt effectively.

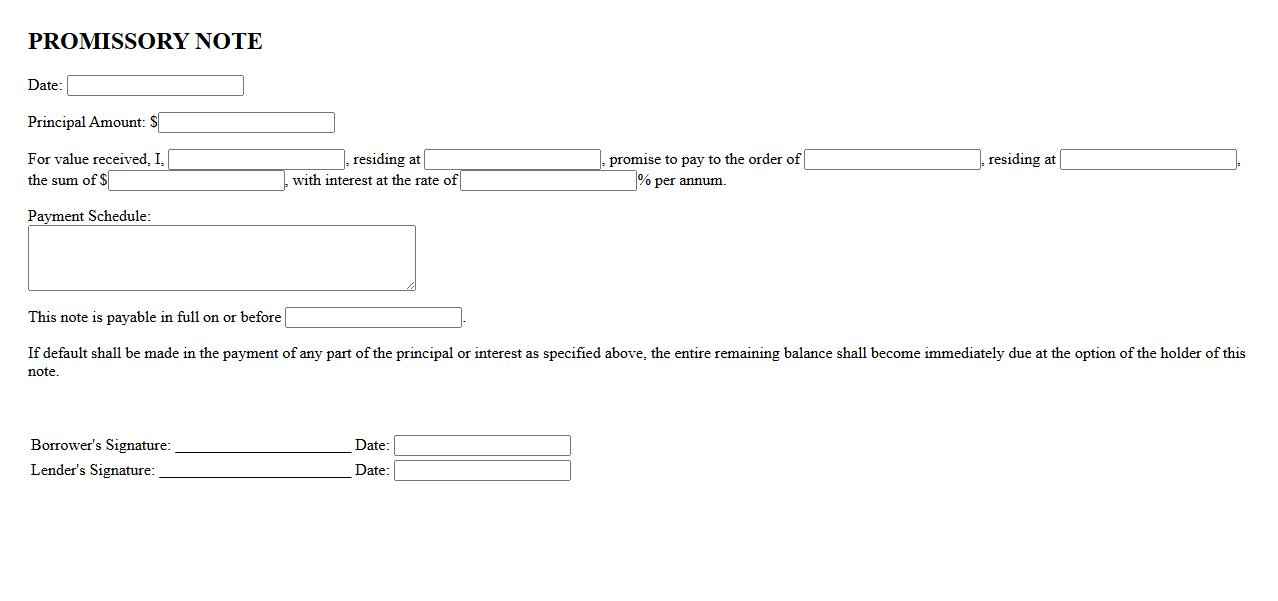

Promissory Note for Payments

A Promissory Note for Payments is a legal document that outlines the terms and conditions of a loan or debt repayment. It serves as a written promise by the borrower to pay a specific amount to the lender within a specified timeframe. This note helps ensure clarity and protects both parties in financial transactions.

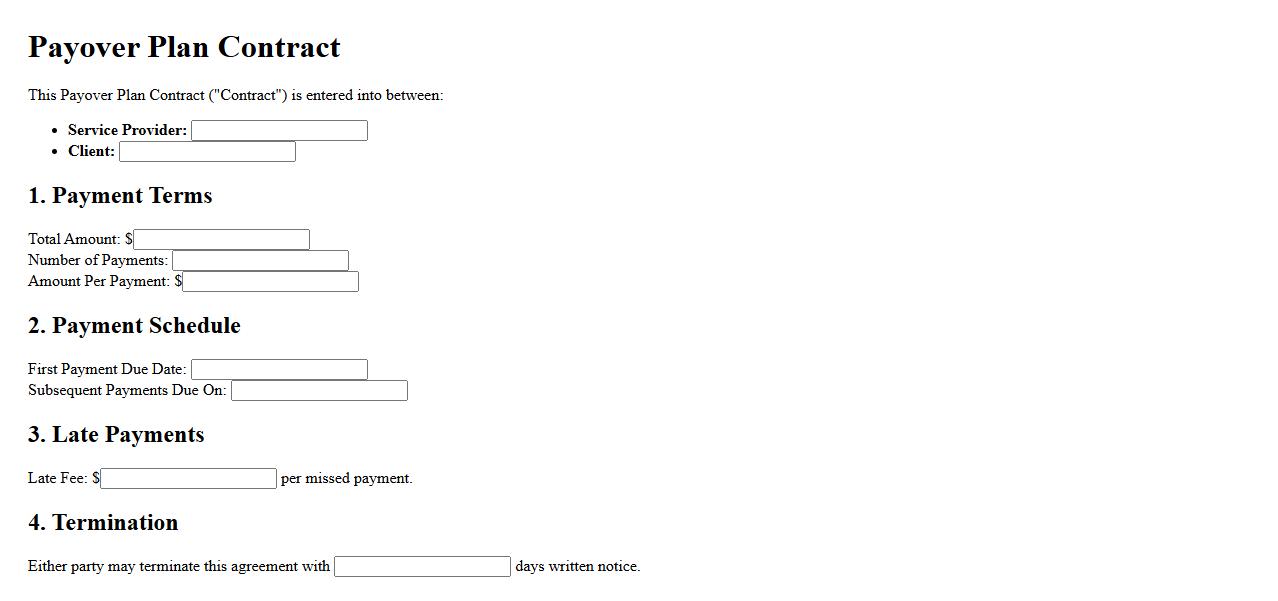

Payover Plan Contract

The Payover Plan Contract outlines the terms and conditions for installment payments, ensuring clarity and security for both parties involved. It specifies the payment schedule, amounts, and obligations, providing a transparent agreement. This contract is essential for managing financial commitments effectively over time.

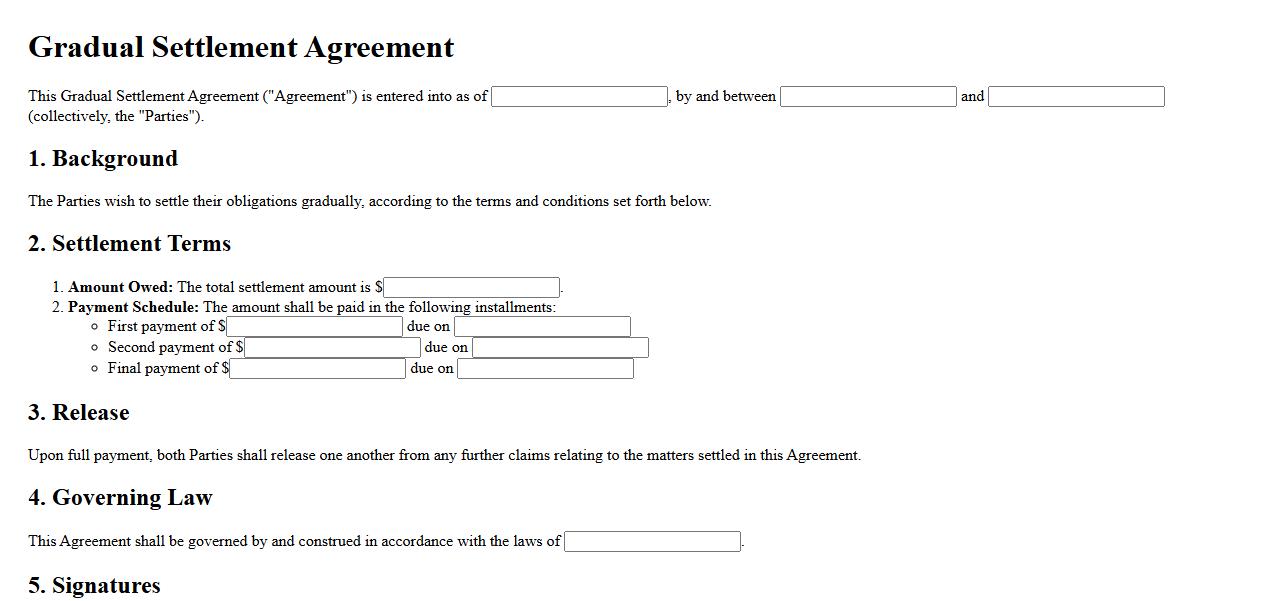

Gradual Settlement Agreement

A Gradual Settlement Agreement is a legal arrangement where parties agree to resolve disputes or claims incrementally over a specified period. This approach allows for manageable payments or actions, reducing immediate financial or operational burdens. It is commonly used in contractual, financial, and real estate contexts to ensure fairness and feasibility for all involved.

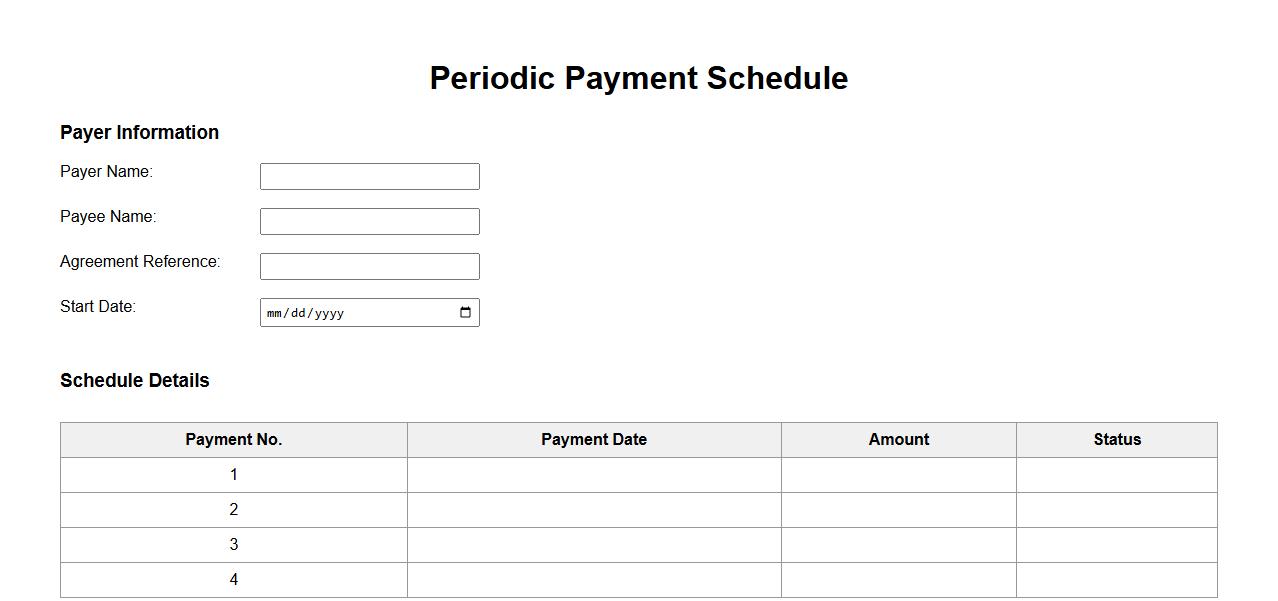

Periodic Payment Schedule

The Periodic Payment Schedule outlines predetermined dates and amounts for payments to be made over a specified period. This schedule ensures consistent cash flow management and helps both parties maintain clear financial expectations. Adhering to the payment timeline reduces the risk of missed or late payments.

What are the clearly defined payment amounts and due dates specified in the agreement?

The agreement outlines specific payment amounts that must be paid by the borrower. Each payment has a clearly established due date to ensure timely transactions. These schedules help maintain transparency and prevent confusion between parties.

What are the consequences for late or missed payments according to the document?

The document specifies strict penalties for late or missed payments, including additional fees or interest charges. Persistent delays may lead to an acceleration of the entire remaining balance. These measures incentivize timely payments and protect the lender.

What events or conditions allow for termination or modification of the payment plan?

The agreement details certain conditions for termination or modification, such as financial hardship or mutual consent. Specific breach events also permit termination of the payment plan. This flexibility ensures that the plan remains fair and adaptable to changing circumstances.

What obligations and responsibilities are assigned to each party in the agreement?

Both parties have clearly defined obligations and responsibilities to fulfill their part of the agreement. The borrower must make payments as scheduled, while the lender agrees to provide accurate account statements. This clarity helps prevent disputes and promotes accountability.

What provisions are included for dispute resolution or enforcement of the payment plan?

The agreement includes dispute resolution provisions that specify mediation or arbitration as primary methods. It also outlines enforcement mechanisms, such as legal action, if the payment plan is violated. These clauses ensure that conflicts are managed professionally and fairly.