A Statement of Non-Filing is an official document issued by the IRS confirming that a taxpayer did not file a tax return for a specific year. This statement is often required for financial aid applications or visa processing to verify non-filing status. It serves as proof that the IRS has no record of a filed tax return for the requested tax period.

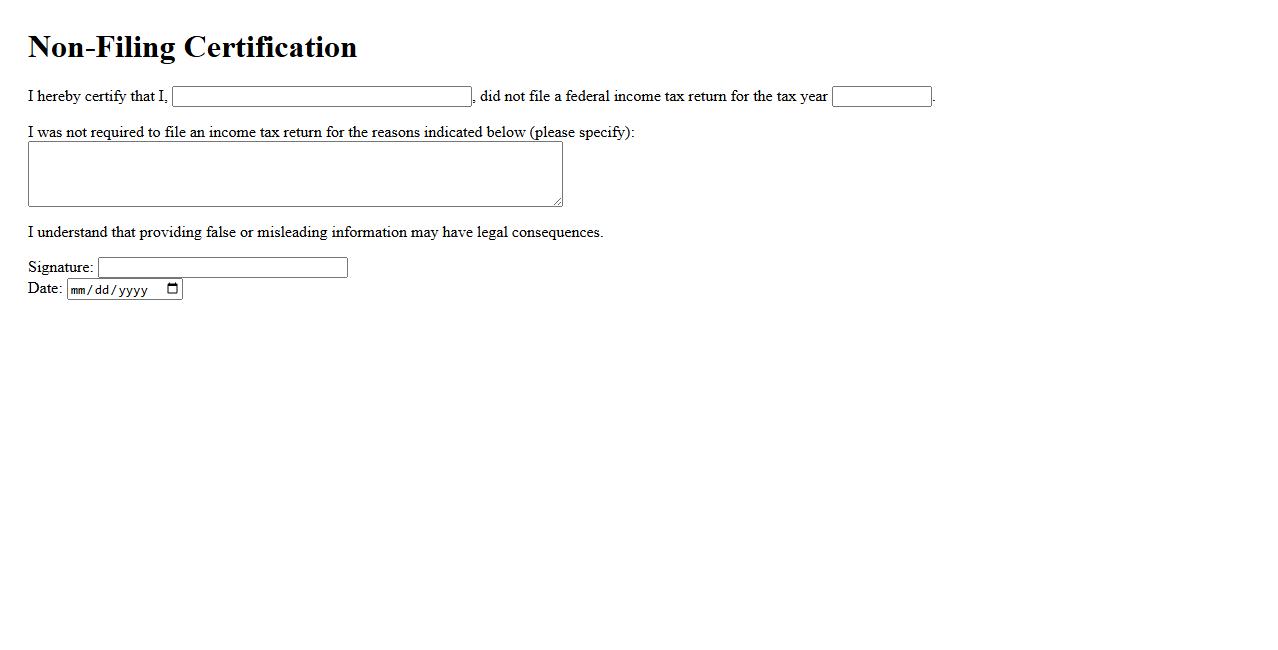

Non-Filing Certification

Non-Filing Certification is an official document confirming that an individual or entity did not file a tax return for a specific year. This certification is often required for financial aid applications, loan approvals, or legal purposes. It provides verification to institutions that no tax return was submitted during the designated period.

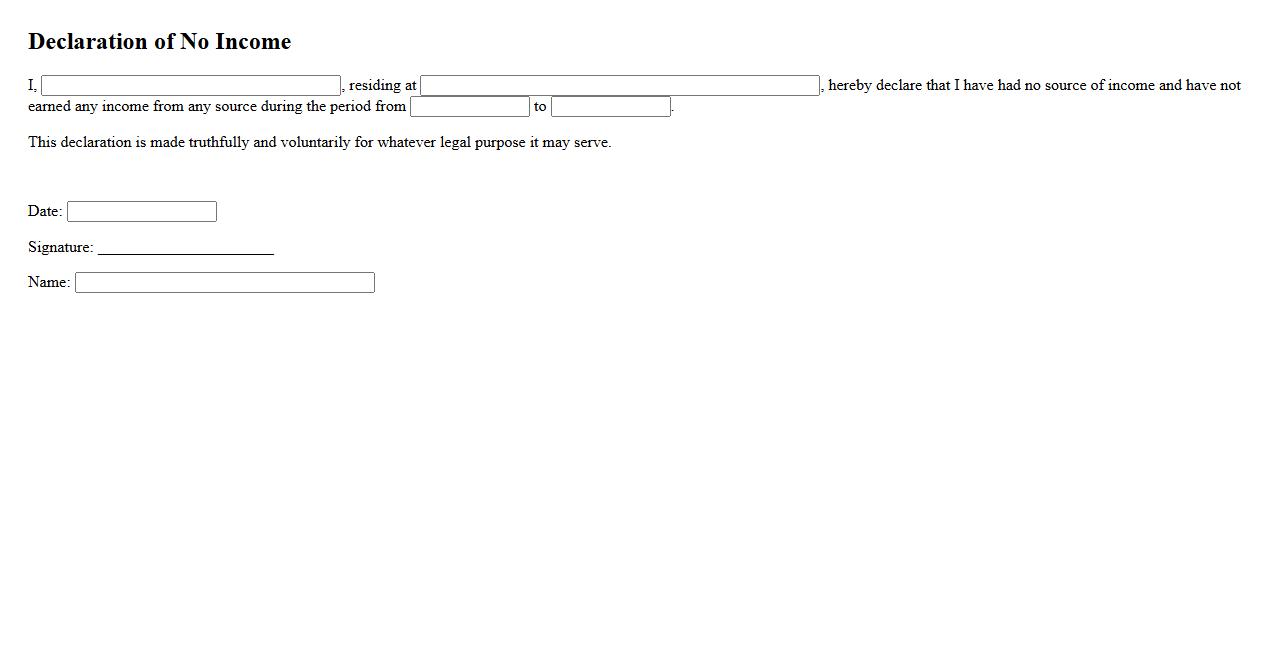

Declaration of No Income

The Declaration of No Income is a formal statement used to affirm that an individual currently has no source of income. This document is often required for loan applications, financial aid, or government assistance to verify financial status. It serves as proof of income absence for official and legal purposes.

Statement of No Tax Return Filed

A Statement of No Tax Return Filed is a formal declaration indicating that an individual or entity did not submit a tax return for a specific period. This document is often required by tax authorities or financial institutions to confirm the absence of filing obligations. It helps clarify the taxpayer's compliance status and avoid penalties.

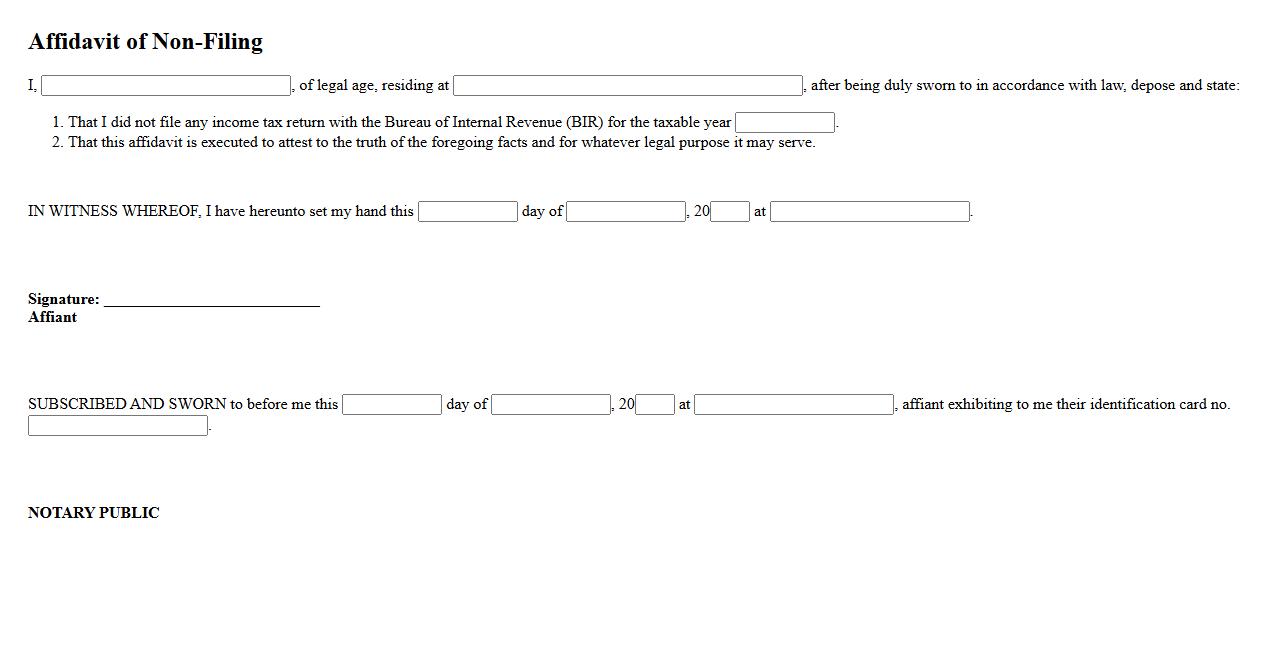

Affidavit of Non-Filing

An Affidavit of Non-Filing is a sworn statement confirming that an individual has not filed a tax return for a specific period. This document is commonly required by financial institutions or government agencies as proof of non-filing status. It helps verify income information when a tax return is not available.

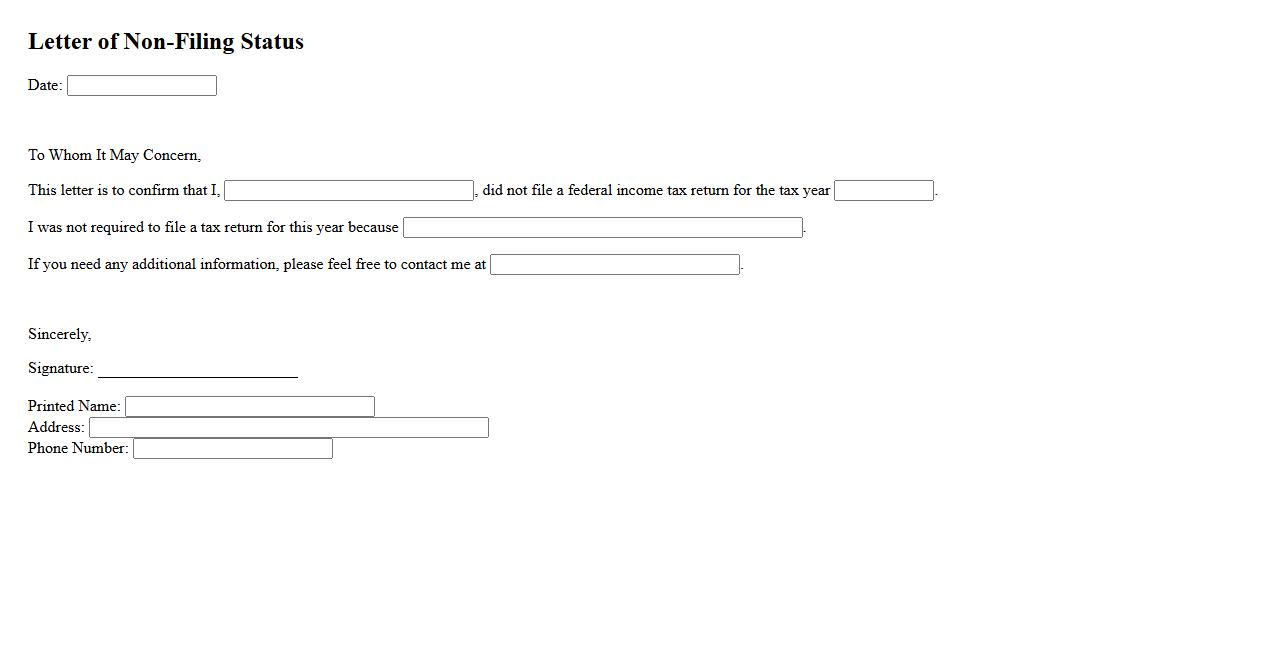

Letter of Non-Filing Status

The Letter of Non-Filing Status is an official document issued by the IRS confirming that a taxpayer did not file a tax return for a specific year. This letter serves as proof to financial institutions or government agencies that no tax return was submitted. It is often required for loan applications, financial aid, or other verification purposes.

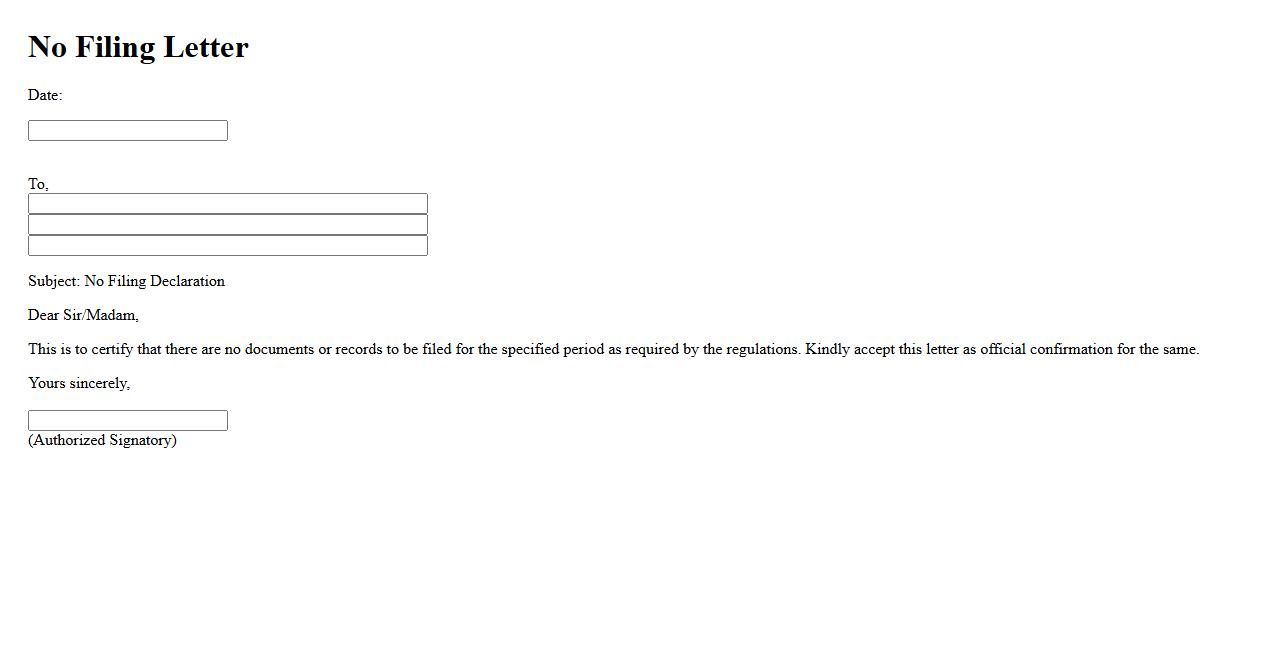

No Filing Letter

A No Filing Letter is an official document issued by a regulatory authority confirming that no formal filing has been submitted for a particular matter. This letter is often used to verify the absence of records or applications related to specific transactions or compliance requirements. It provides legal assurance and clarity for businesses and individuals involved.

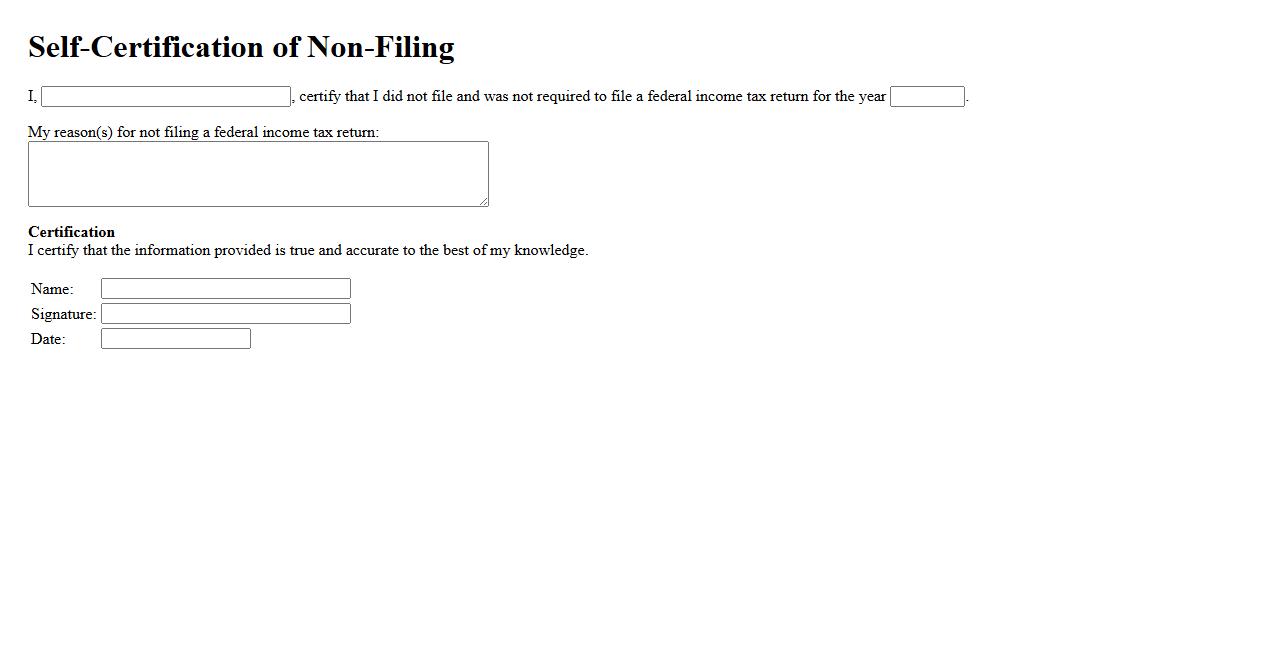

Self-Certification of Non-Filing

Self-Certification of Non-Filing is a formal declaration by an individual stating they did not file a tax return for a specific year. This document is often required by financial institutions or government agencies to verify income status. It helps streamline verification processes without needing official tax documents.

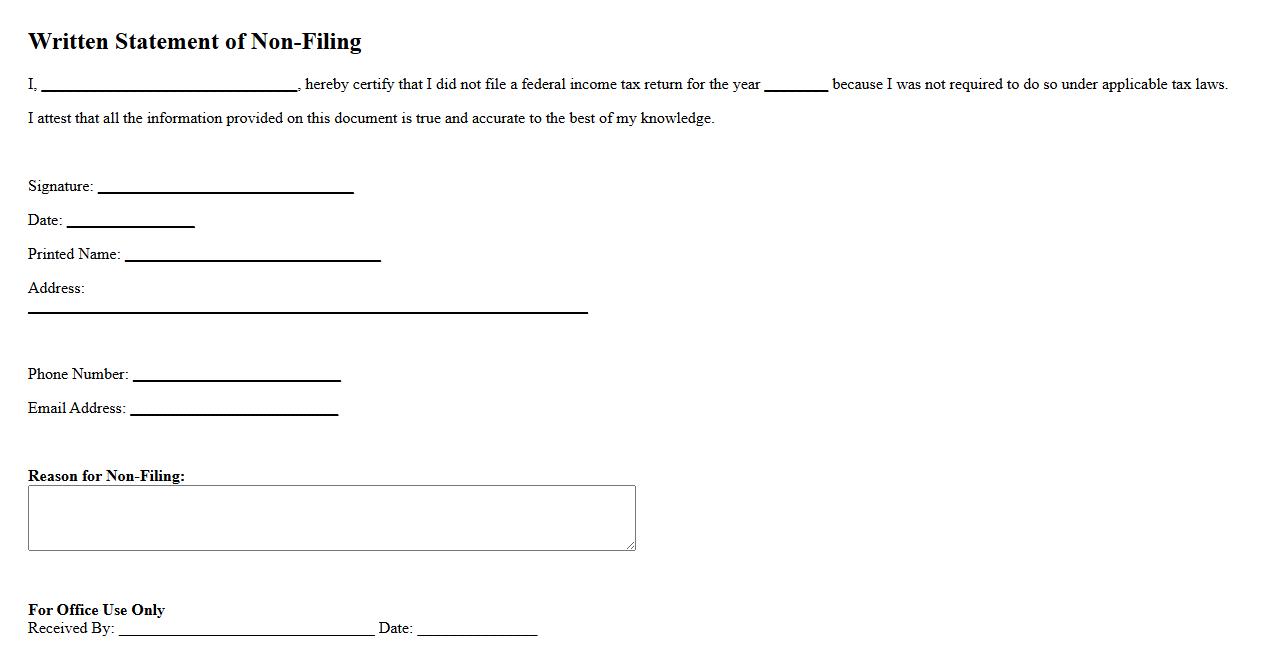

Written Statement of Non-Filing

A Written Statement of Non-Filing is an official document used to confirm that an individual has not filed tax returns for a specific period. This statement is often required by financial institutions or government agencies to verify tax status. It serves as proof of non-filing, ensuring compliance with regulatory requirements.

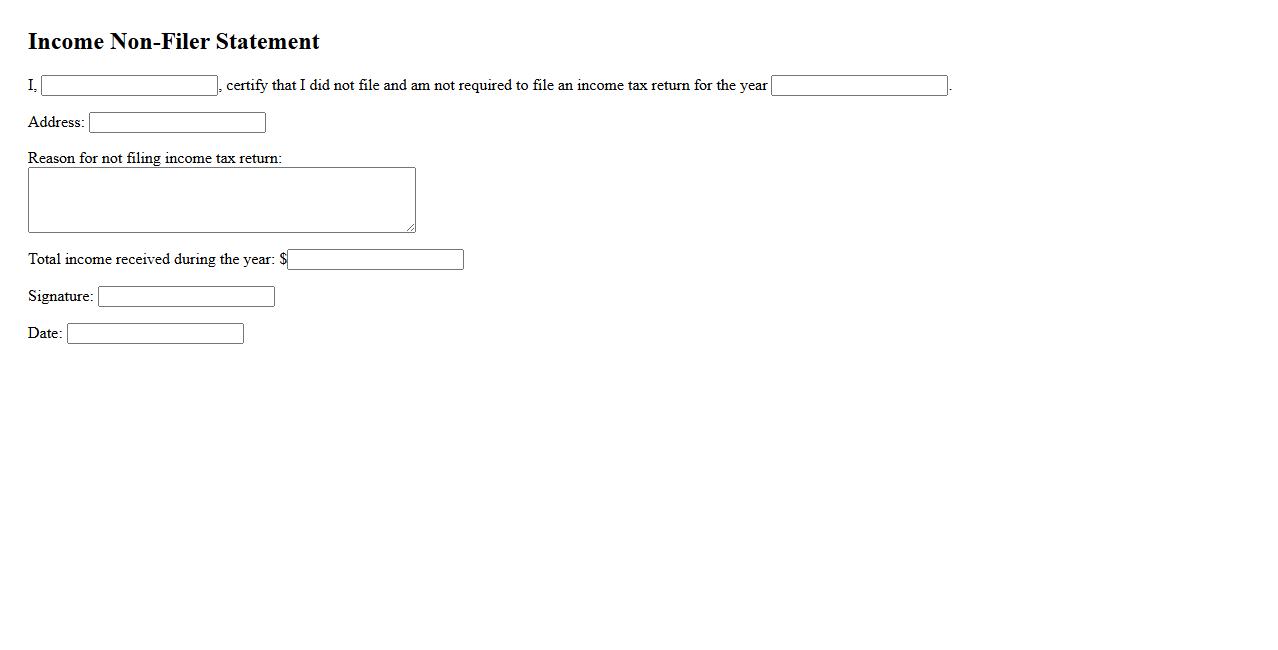

Income Non-Filer Statement

An Income Non-Filer Statement is a document used to verify that an individual did not earn taxable income during a specific period. It is often required by financial institutions or government agencies to confirm financial status when no tax return was filed. This statement helps ensure transparency and compliance in situations where traditional income records are unavailable.

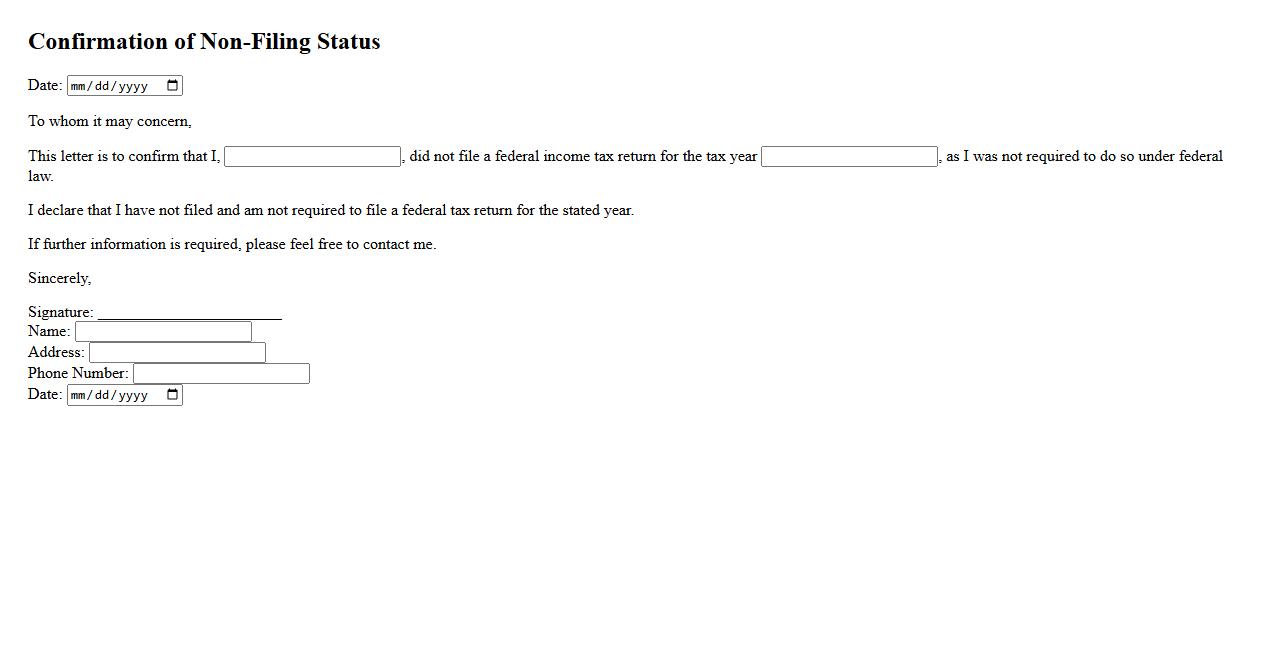

Confirmation of Non-Filing Status

The Confirmation of Non-Filing Status is an official document from the IRS verifying that an individual did not file a tax return for a specific year. This confirmation is often required for financial aid applications or loan approvals. It serves as proof that no income tax return was submitted for that period.

What is the primary purpose of a Statement of Non-Filing document?

The primary purpose of a Statement of Non-Filing is to certify that an individual or entity did not file a federal income tax return for a specific year. This document serves as official confirmation in situations where proof of non-filing is required. It helps verify financial or legal status for various applications or benefits.

Who is eligible to submit a Statement of Non-Filing?

Individuals or entities who did not submit a federal tax return for the year in question are eligible to request this statement. Typically, applicants must have met the IRS filing requirements as non-filers. This includes those with income below the filing threshold or exempt due to special circumstances.

Which official entity typically provides or verifies a Statement of Non-Filing?

The Internal Revenue Service (IRS) is the official entity responsible for issuing and verifying a Statement of Non-Filing. They maintain records confirming whether a tax return was filed for a given year. Requests are submitted to the IRS through their designated procedures and forms.

In what situations is a Statement of Non-Filing commonly required?

A Statement of Non-Filing is commonly required during financial aid applications, loan approvals, or government assistance programs. It acts as proof when income records or tax returns are not available. Organizations use this document to confirm an applicant's tax status and eligibility.

What critical information must be included in a valid Statement of Non-Filing?

A valid Statement of Non-Filing must include the tax year in question, the applicant's identifying information, and certification from the IRS that no return was filed. It should also specify the date the statement was issued. This ensures authenticity and completeness for official purposes.