A Statement of Reconciliation is a financial document that explains the differences between two sets of records, such as a company's accounting ledger and bank statements. It ensures accuracy and consistency in financial reporting by identifying and resolving discrepancies. This statement is essential for maintaining transparent and reliable financial management.

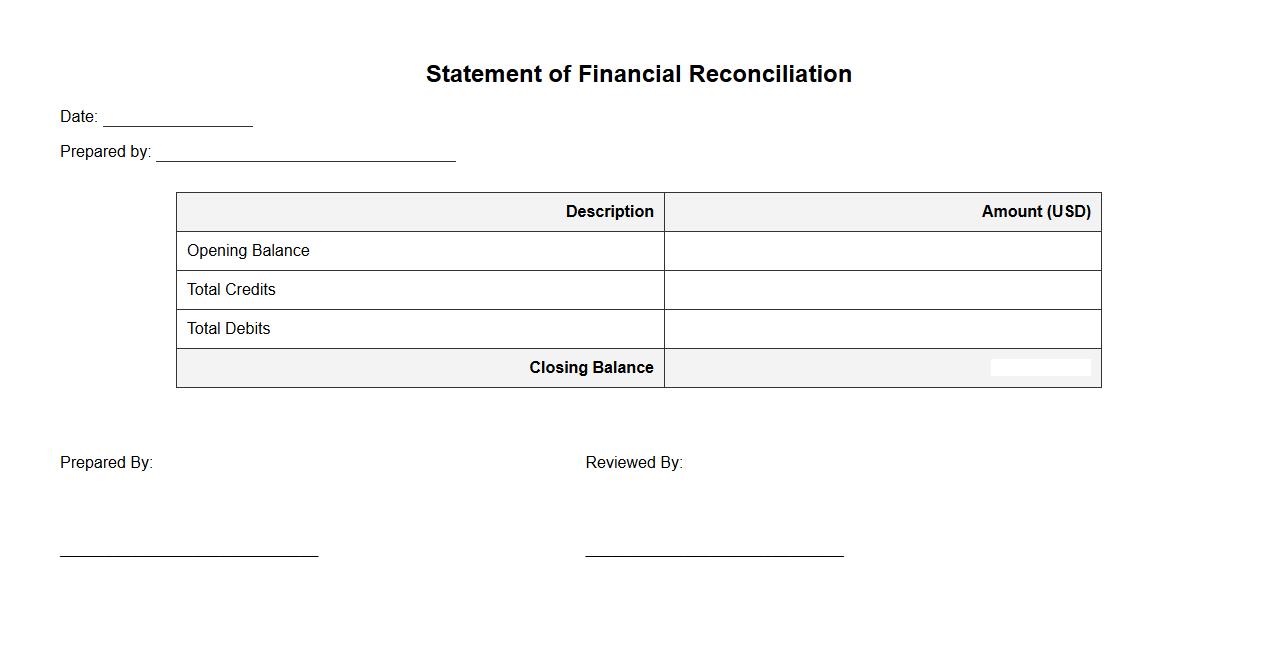

Statement of Financial Reconciliation

The Statement of Financial Reconciliation provides a detailed overview of all financial transactions to ensure accuracy and consistency in accounting records. It serves as a crucial tool for identifying discrepancies and verifying that internal financial statements align with external reports. This statement enhances transparency and accountability within an organization's financial management.

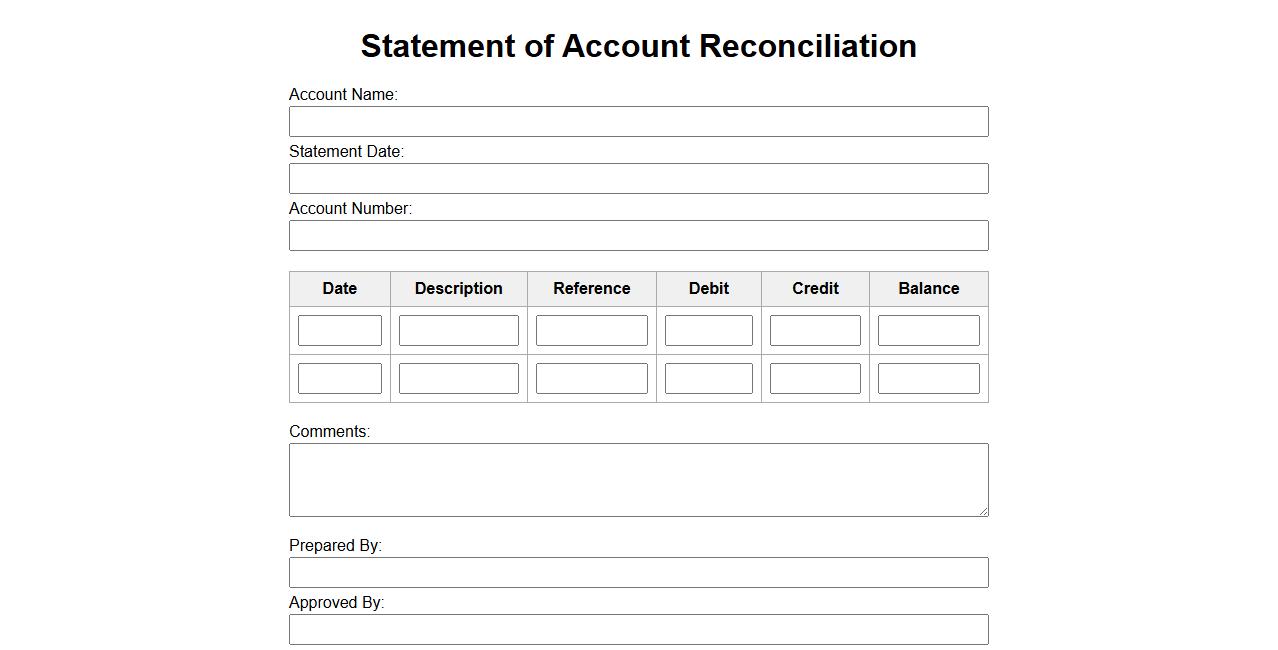

Statement of Account Reconciliation

Statement of Account Reconciliation is the process of ensuring that the balances in an account statement match the corresponding entries in financial records. This verification helps identify discrepancies, errors, or unauthorized transactions. Regular reconciliation maintains accurate financial reporting and strengthens internal controls.

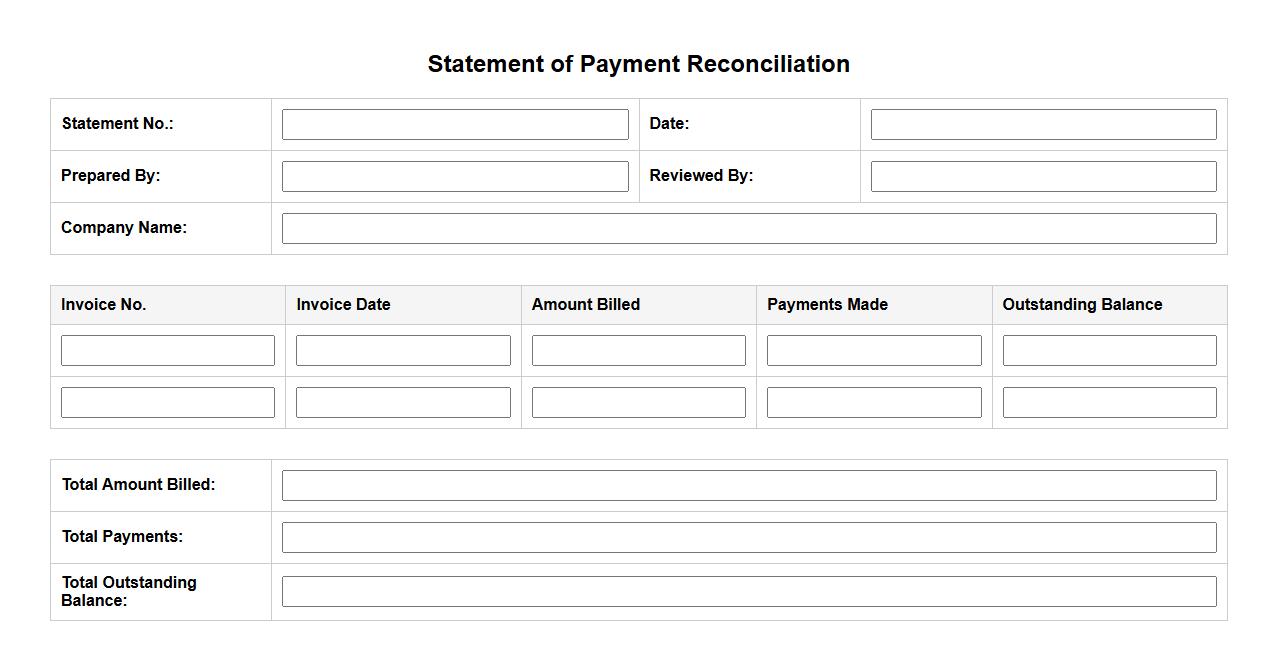

Statement of Payment Reconciliation

The Statement of Payment Reconciliation is a financial document that summarizes and compares payment transactions against invoices. It ensures accuracy by identifying discrepancies between amounts paid and amounts owed. This statement helps maintain transparent and organized accounting records for businesses.

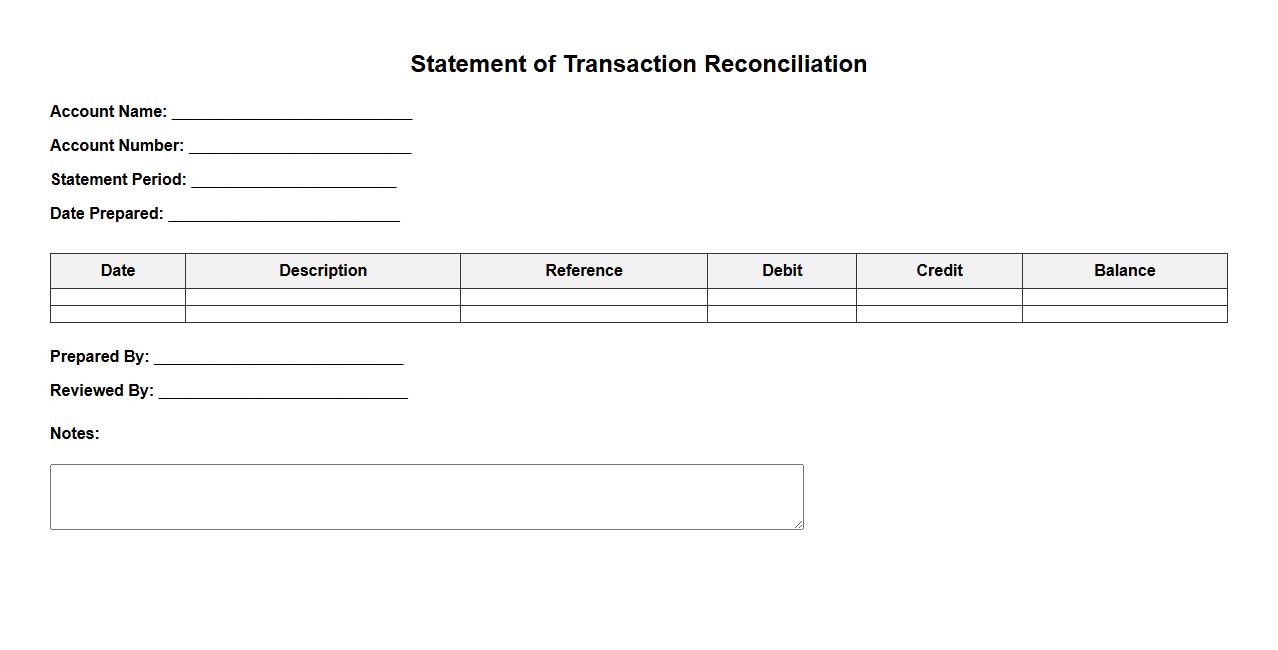

Statement of Transaction Reconciliation

The Statement of Transaction Reconciliation is a detailed report that compares and verifies transaction records between two sources. It ensures accuracy by identifying discrepancies and confirming that all entries match. This process is essential for maintaining financial integrity and transparency.

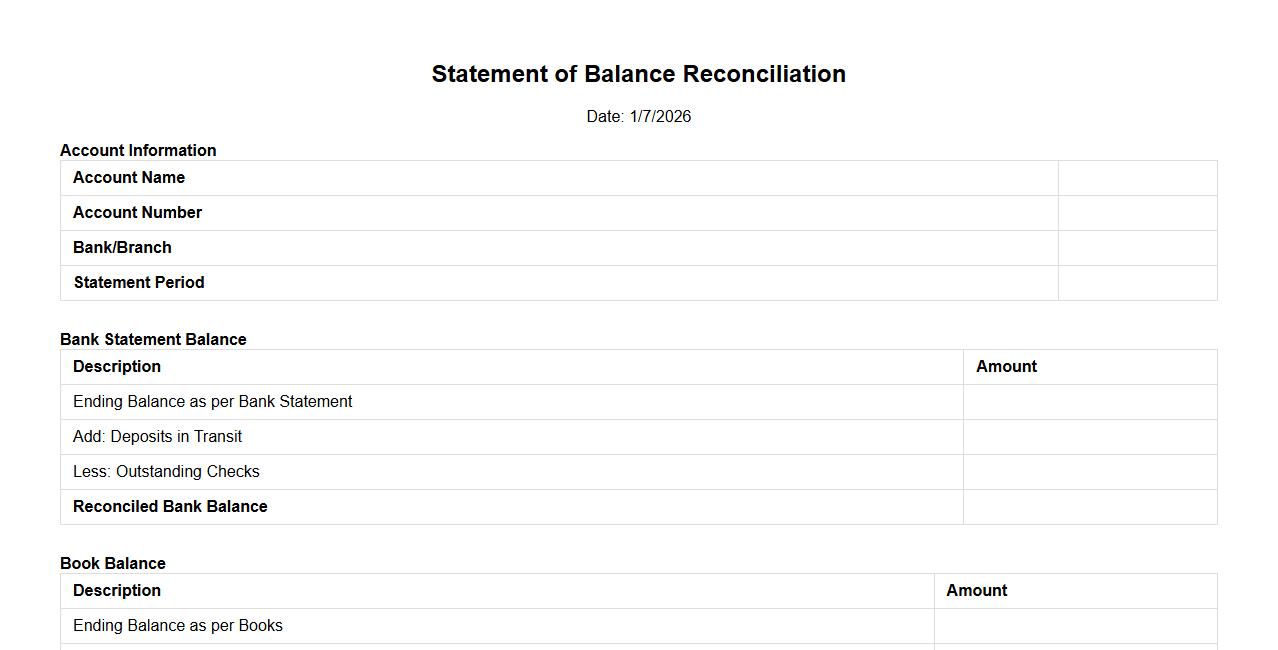

Statement of Balance Reconciliation

The Statement of Balance Reconciliation is a financial process used to ensure that the balances in accounting records match the corresponding statements. This procedure helps identify discrepancies and errors between internal records and external statements. Accurate reconciliation is essential for maintaining trustworthy financial reporting and effective cash flow management.

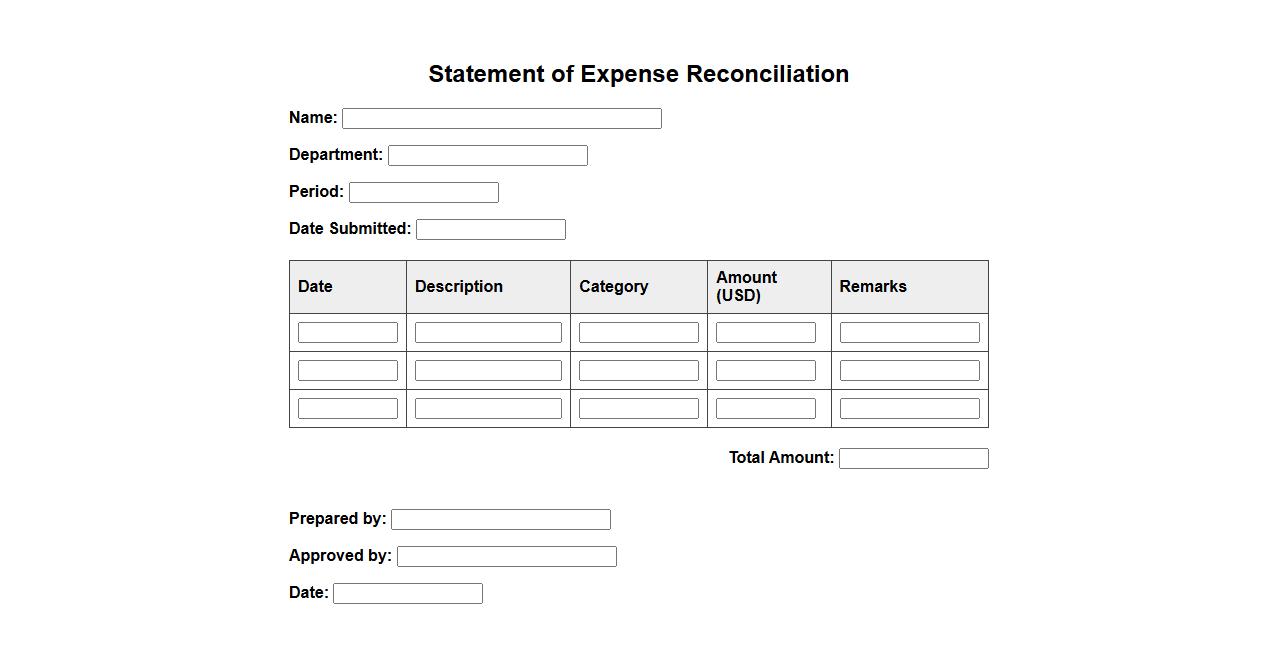

Statement of Expense Reconciliation

The Statement of Expense Reconciliation is a financial document that ensures all recorded expenses align with actual transactions. It helps identify discrepancies and maintain accurate accounting records. This process is essential for transparent financial reporting and budget management.

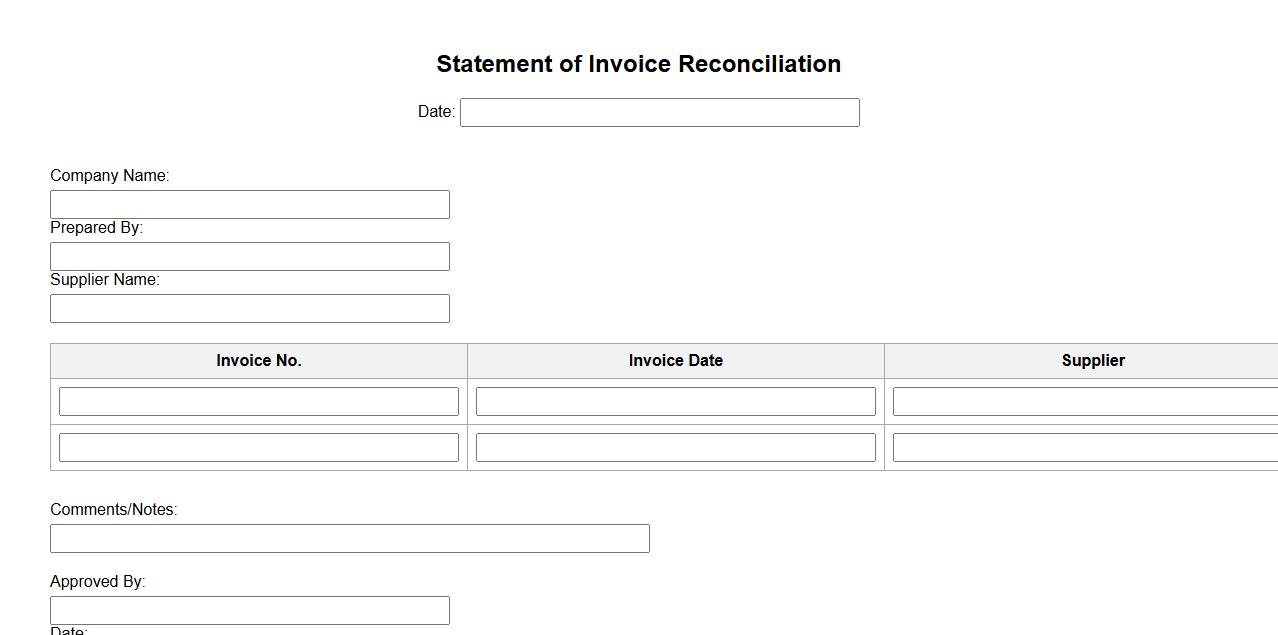

Statement of Invoice Reconciliation

The Statement of Invoice Reconciliation is a detailed document that verifies and matches invoices against payments and purchase records. It ensures financial accuracy by identifying discrepancies or outstanding balances between parties. This reconciliation process is essential for maintaining transparent and reliable accounting practices.

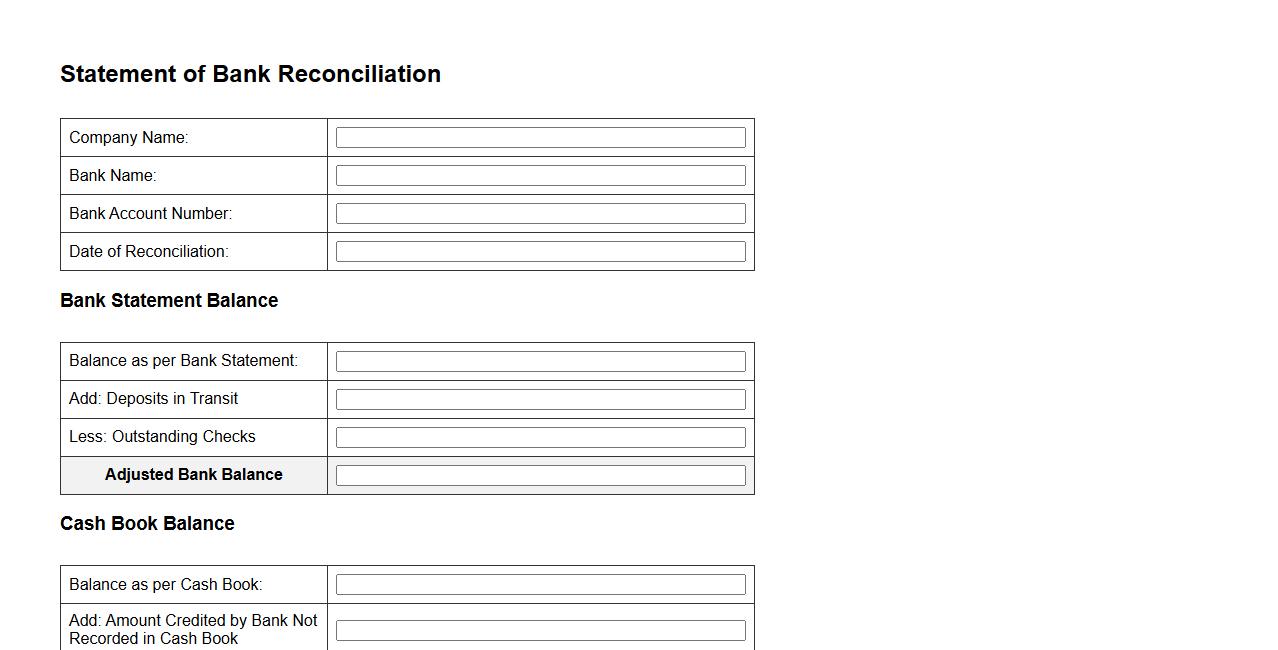

Statement of Bank Reconciliation

A Statement of Bank Reconciliation is a financial document that compares the cash balance on a company's books to the corresponding amount on its bank statement. This process helps identify discrepancies due to transactions in transit, errors, or unauthorized activities. Regular reconciliation ensures accurate financial records and effective cash management.

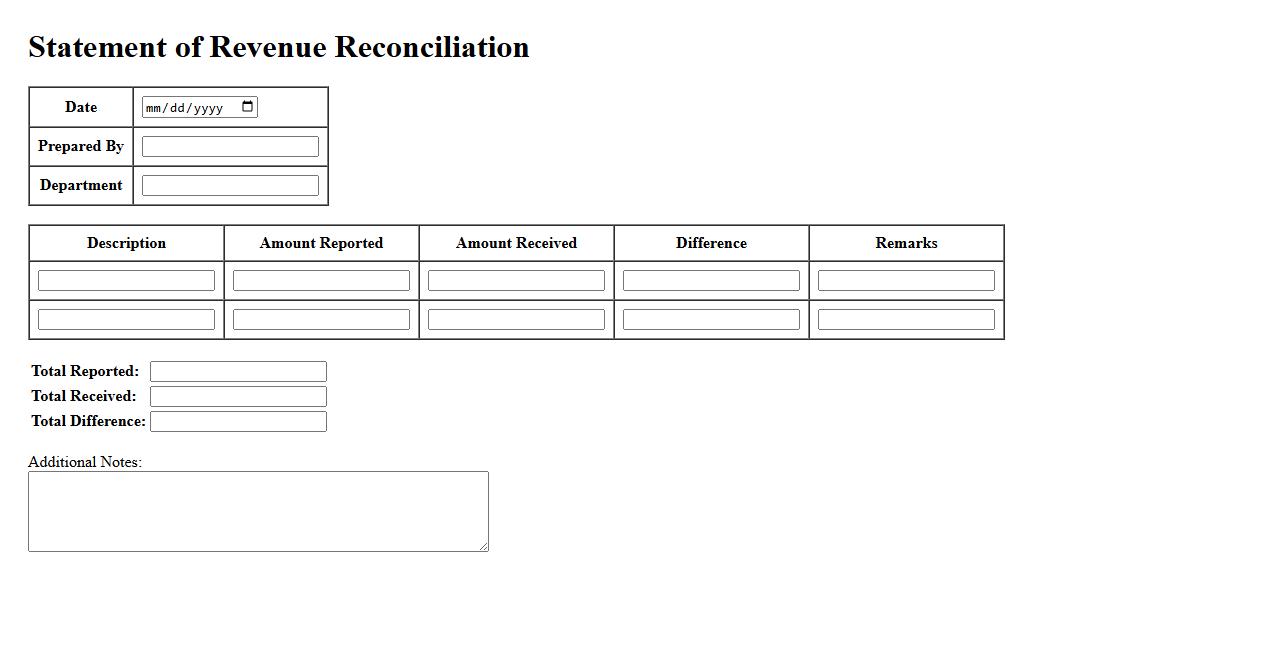

Statement of Revenue Reconciliation

The Statement of Revenue Reconciliation is a financial document that details the differences between reported revenue and adjusted revenue figures. It helps ensure accuracy and transparency by reconciling discrepancies arising from various accounting methods or adjustments. This statement is essential for stakeholders to understand the true financial performance of a business.

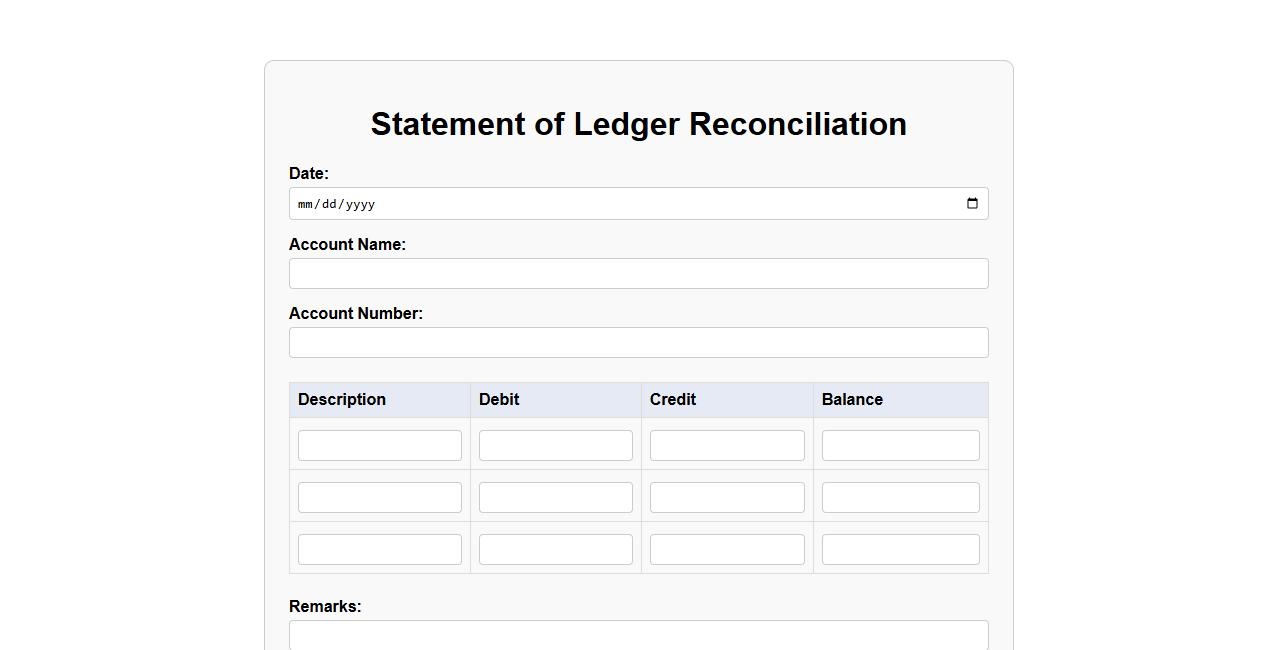

Statement of Ledger Reconciliation

The Statement of Ledger Reconciliation is a crucial financial document that ensures the accuracy and consistency of account balances by comparing ledger entries with supporting records. It helps identify discrepancies, errors, or fraudulent activities in financial transactions. Regular reconciliation enhances transparency and supports effective financial management.

What key principles of reconciliation are reflected in the Statement of Reconciliation?

The Statement of Reconciliation emphasizes the principle of respect for Indigenous cultures and histories. It highlights the importance of recognition of past wrongs and injustices. Additionally, it advocates for collaboration and mutual understanding between Indigenous and non-Indigenous communities.

How does the Statement of Reconciliation address historical injustices toward Indigenous peoples?

The Statement openly acknowledges the past injustices and harms caused by colonial policies and actions. It commits to acknowledging and learning from these historical wrongs. This approach fosters responsibility and supports efforts to redress these harms in meaningful ways.

What commitments or actions are outlined in the Statement of Reconciliation?

The Statement commits to building partnerships based on trust and respect with Indigenous peoples. It outlines actions such as promoting education about Indigenous cultures and histories. Furthermore, it calls for ongoing dialogue and cooperation to achieve lasting reconciliation.

Who are the primary parties acknowledged or addressed in the Statement of Reconciliation?

The Statement primarily acknowledges Indigenous peoples as key stakeholders in the reconciliation process. It also addresses government bodies, institutions, and broader society as responsible parties. These collective groups are called upon to participate actively in reconciliation efforts.

In what ways does the Statement of Reconciliation support healing and relationship-building?

The Statement fosters an environment of trust and mutual respect essential for healing. It encourages the creation of safe spaces for dialogue and sharing experiences. Through these efforts, it promotes long-term relationships founded on understanding and cooperation.