A Statement of Lost Wages is a formal document used to itemize and verify income lost due to injury, illness, or other incapacity preventing work. It typically includes details such as the claimant's regular earnings, the period of lost work, and the total amount of wages lost during that time. This statement is essential for insurance claims, legal cases, or compensation purposes to substantiate financial losses.

Lost Income Declaration

The Lost Income Declaration is a formal document used to claim compensation for income lost due to unforeseen circumstances. It provides detailed information about the claimant's earnings prior to the loss and the reasons for the income disruption. This declaration is essential for processing insurance or legal claims efficiently.

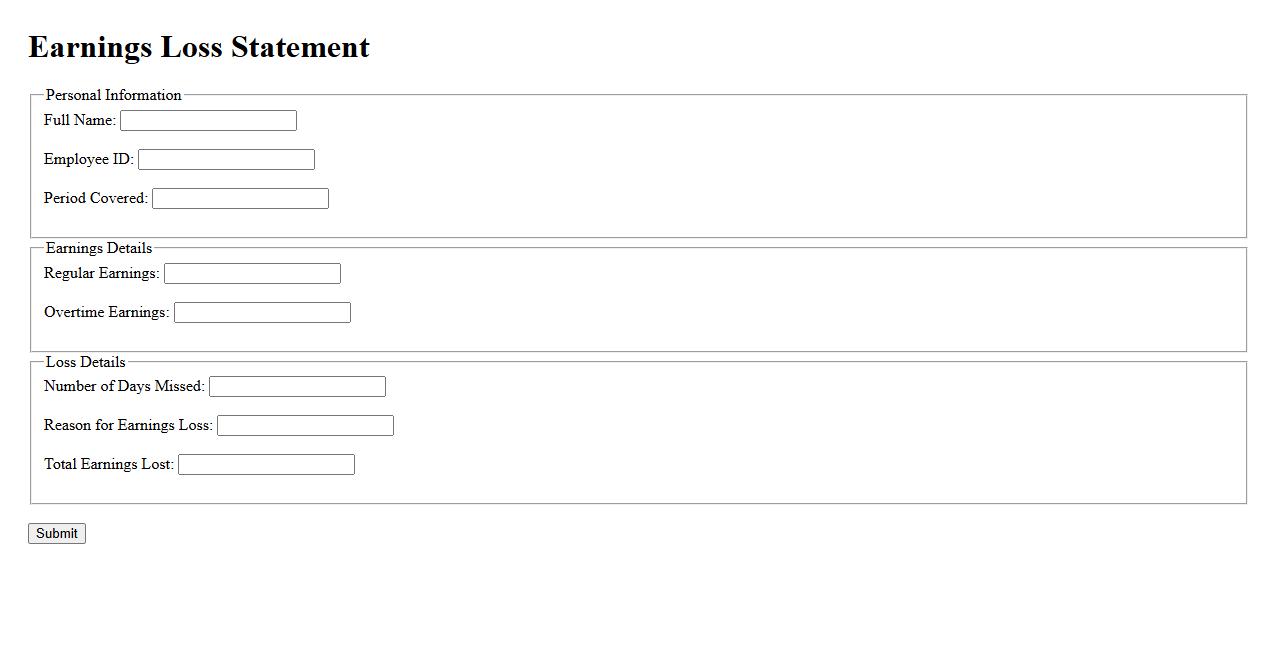

Earnings Loss Statement

An Earnings Loss Statement is a financial document that outlines the reduction in income due to unforeseen circumstances such as accidents or business interruptions. It provides a detailed account of lost wages or profits during the affected period. This statement is essential for insurance claims and legal proceedings related to compensations.

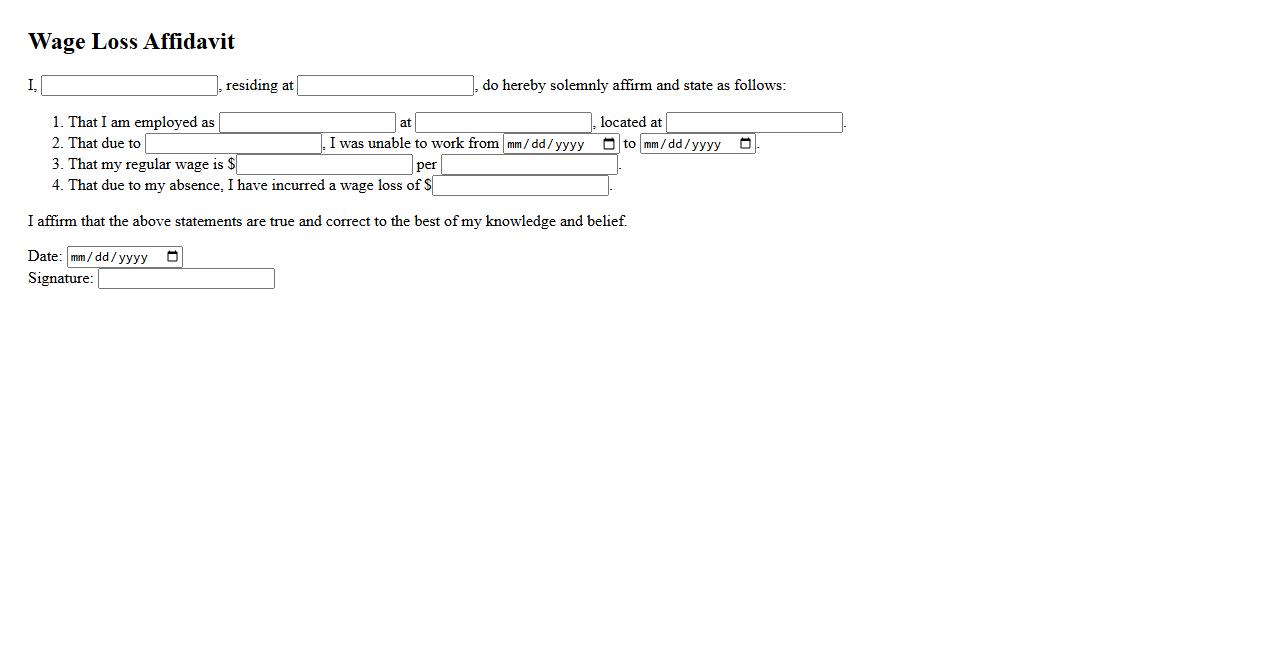

Wage Loss Affidavit

A Wage Loss Affidavit is a legal document used to declare lost income due to an injury or other circumstances. It provides essential information to support claims for compensation or benefits. This affidavit helps ensure accurate assessment of financial impact caused by the wage loss.

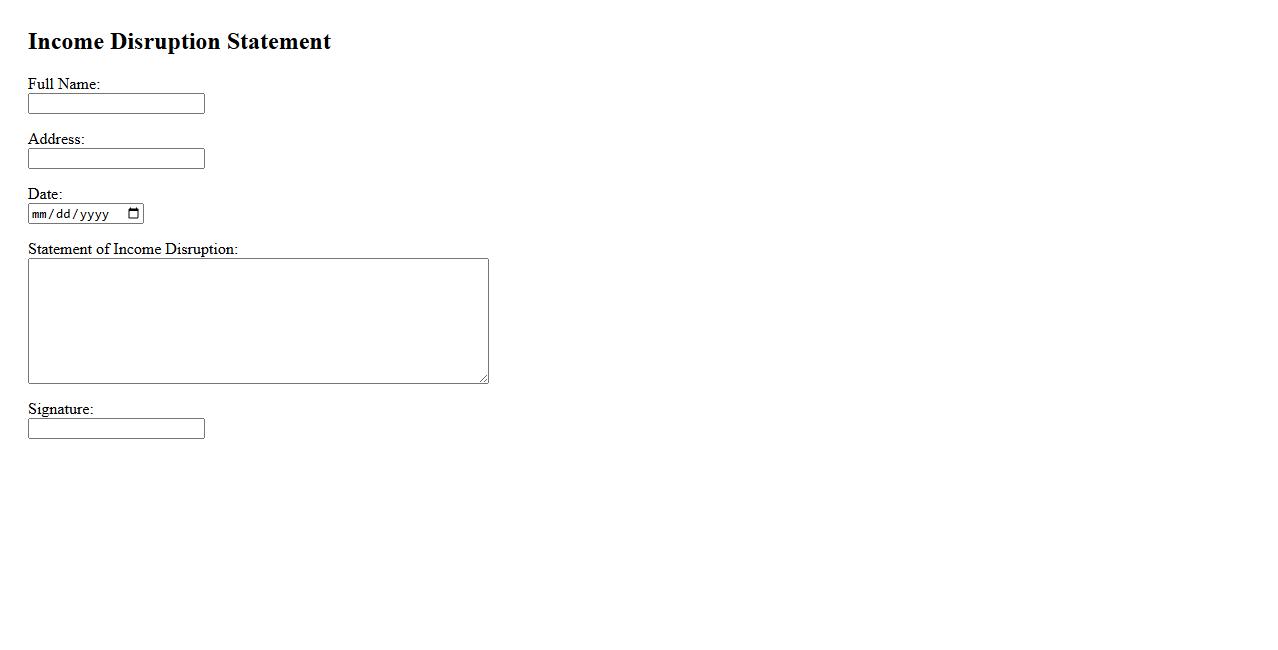

Income Disruption Statement

An Income Disruption Statement is a formal document used to explain changes or interruptions in an individual's income. It provides detailed information regarding the reasons for income loss, ensuring transparency and aiding in financial assessments. This statement is often required by lenders or financial institutions during loan or credit evaluations.

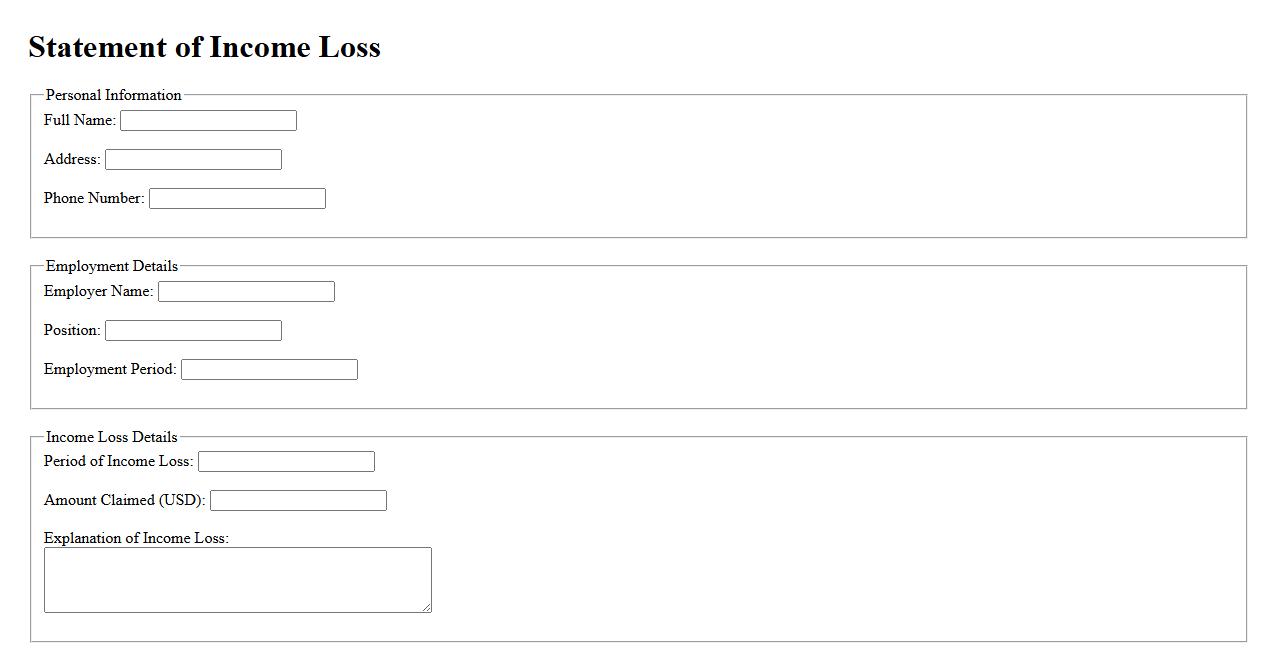

Statement of Income Loss

The Statement of Income Loss is a financial document that details a company's revenues and expenses over a specific period. It highlights the net loss encountered when expenses exceed income, providing insight into the business's financial health. This statement is essential for stakeholders to assess operational efficiency and make informed decisions.

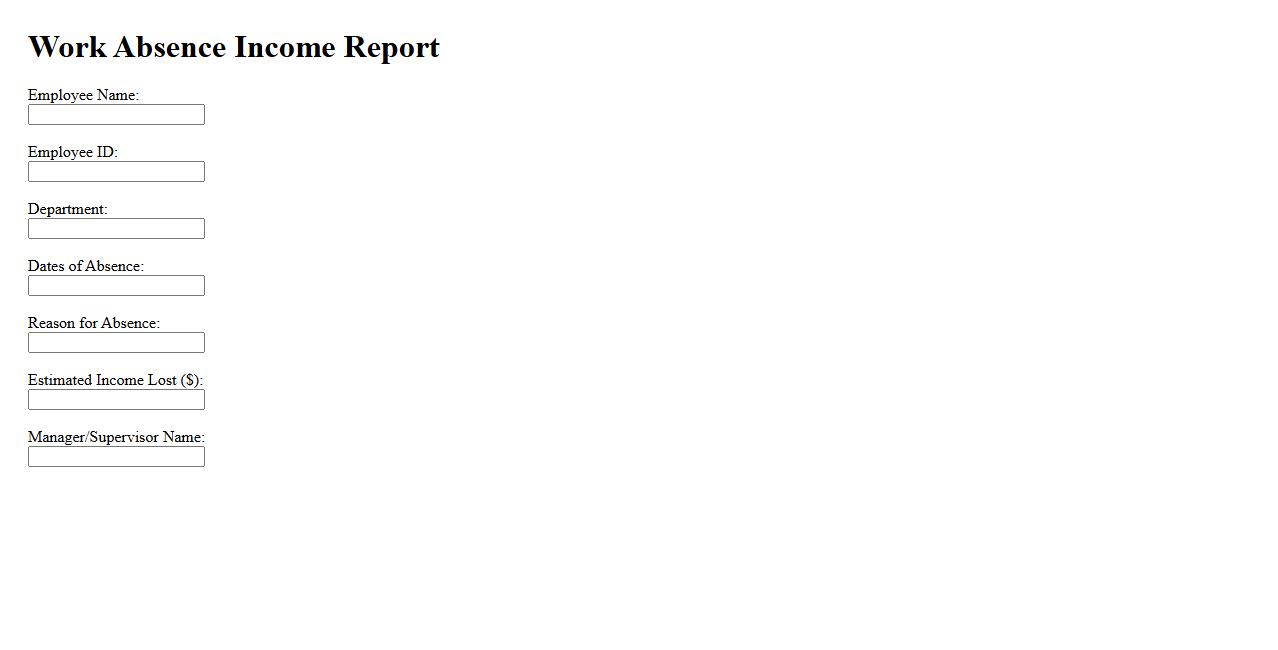

Work Absence Income Report

The Work Absence Income Report provides a detailed summary of earnings during periods of employee absence. It helps employers and employees track income fluctuations and ensures accurate payroll management. This report is essential for maintaining transparency in compensation during leave periods.

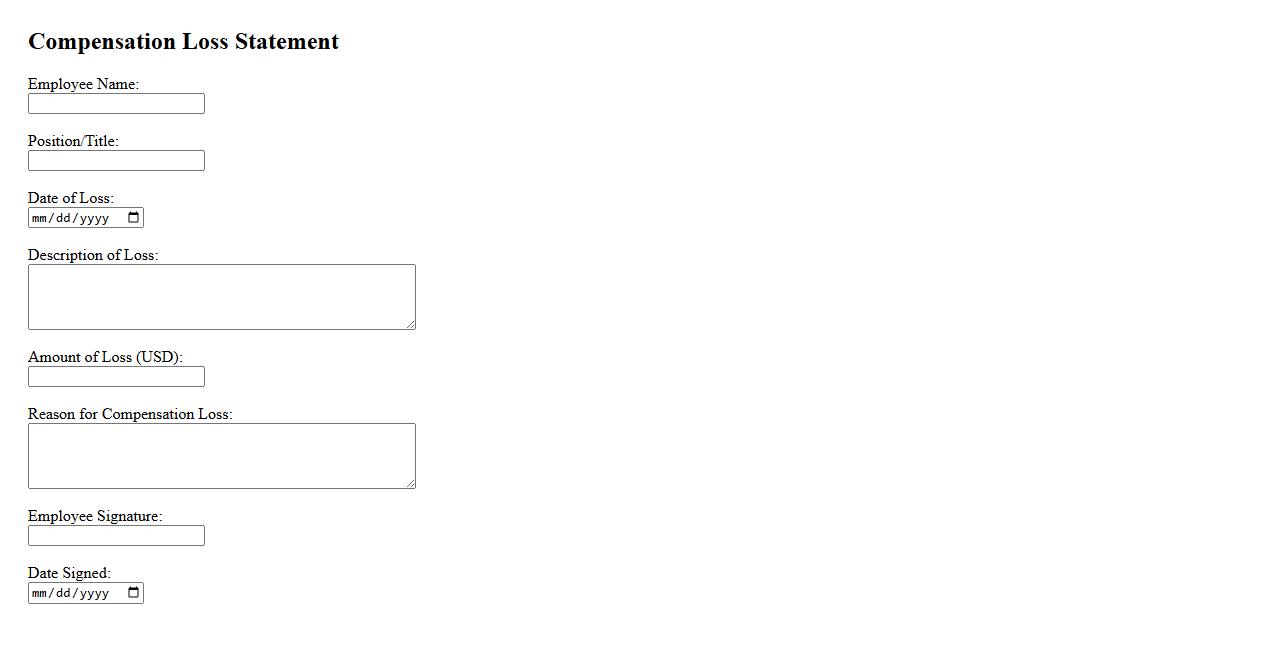

Compensation Loss Statement

A Compensation Loss Statement is a formal document outlining the details and value of financial losses incurred due to an incident or accident. It is used to claim reimbursement or compensation from an employer, insurance company, or responsible party. This statement provides clear evidence to support the compensation process efficiently.

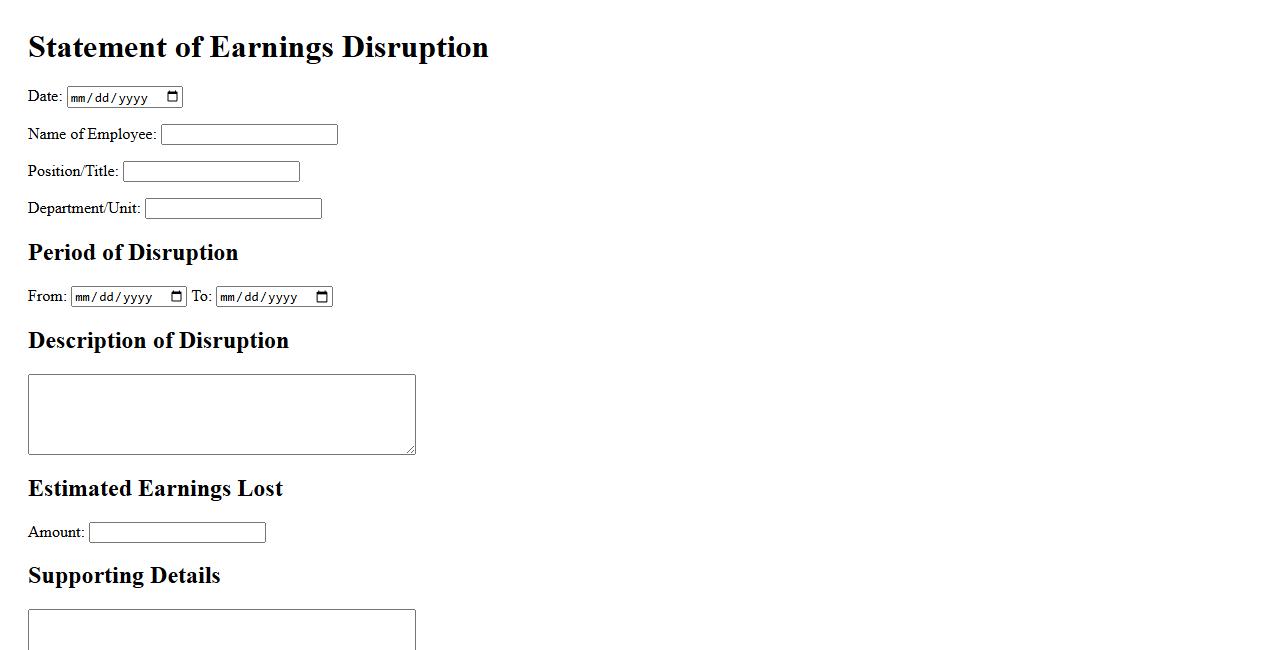

Statement of Earnings Disruption

The Statement of Earnings Disruption highlights the financial impact caused by unexpected events on a company's revenue streams. It details the variations in earnings and provides insight into operational challenges. This statement is essential for stakeholders to assess business stability during disruptions.

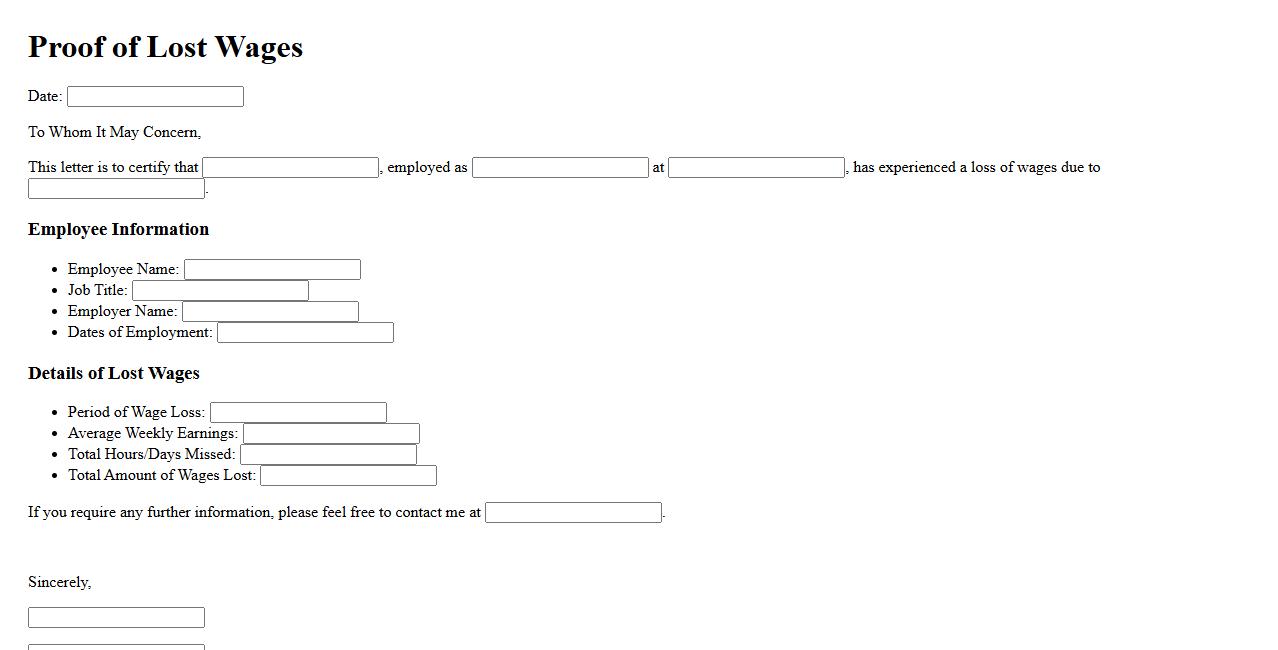

Proof of Lost Wages

Proof of Lost Wages is a crucial document used to verify the income lost by an individual due to illness, injury, or other unavoidable circumstances. It often includes pay stubs, tax returns, or employer statements that confirm the amount of wages not earned. This proof is essential for insurance claims, legal cases, or compensation requests related to financial loss.

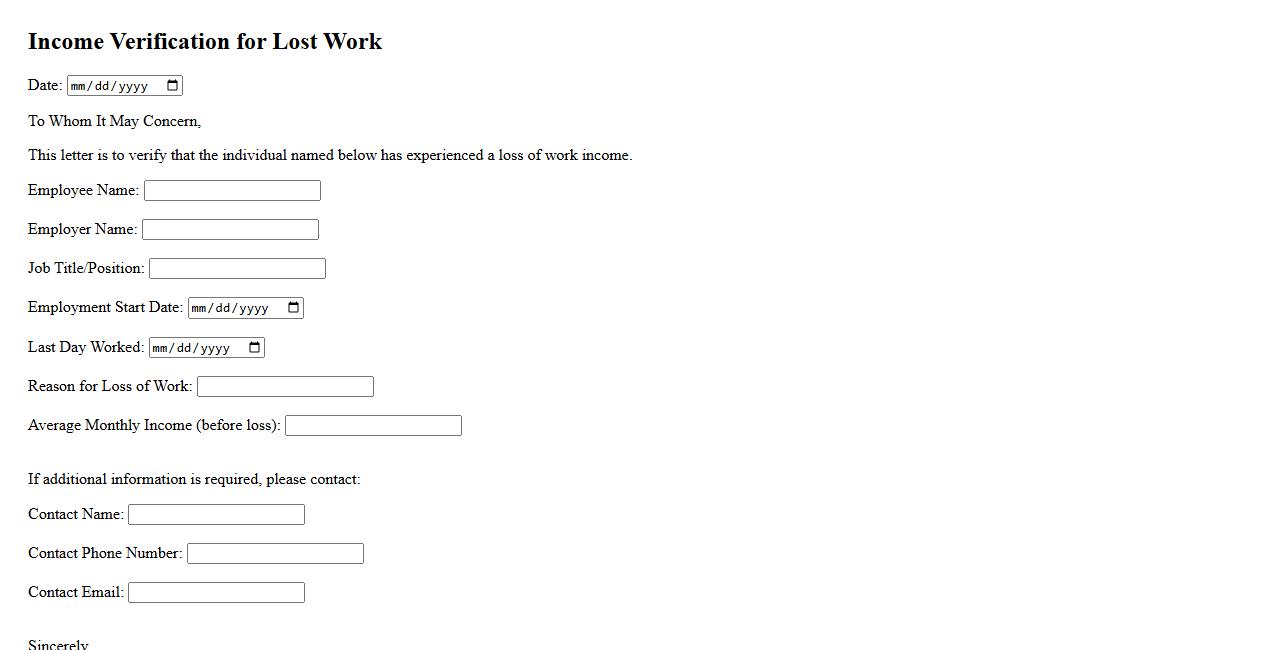

Income Verification for Lost Work

Income verification for lost work is a crucial process to confirm an individual's earnings when they are unable to work due to unforeseen circumstances. This verification helps in determining eligibility for benefits, insurance claims, or financial assistance. Accurate documentation ensures timely support during periods of income interruption.

What specific dates are covered by the lost wages statement?

The lost wages statement covers the period from January 1, 2024, to March 31, 2024. This timeframe reflects the duration during which the employee was unable to work. All calculations and claims are based on this precise date range.

What is the total amount of lost wages being claimed?

The total amount of lost wages being claimed is $7,500. This sum represents the earnings forfeited due to the employee's absence. It has been carefully calculated based on the regular pay rate and the number of missed workdays.

What was the claimant's regular rate of pay before the wage loss?

The claimant's regular rate of pay before the wage loss was $25 per hour. This hourly wage served as the basis for calculating lost earnings. It is consistent with payroll records and employment agreements.

What documentation supports the reason for the wage loss?

The wage loss is supported by medical certificates and a formal leave approval letter. These documents verify the claimant's inability to work due to illness. They provide essential evidence for the legitimacy of the wage loss claim.

Who is the employer verifying the details of lost wages?

The employer verifying the lost wages details is XYZ Corporation Human Resources Department. They are responsible for confirming the accuracy of the wage loss statement. This includes validating employment status and payment records.