A Statement of Trust is a legal document outlining the roles, rights, and responsibilities of trustees and beneficiaries within a trust agreement. It clearly defines how the trust assets should be managed and distributed according to the settlor's intentions. This document is essential for maintaining transparency and ensuring proper administration of the trust.

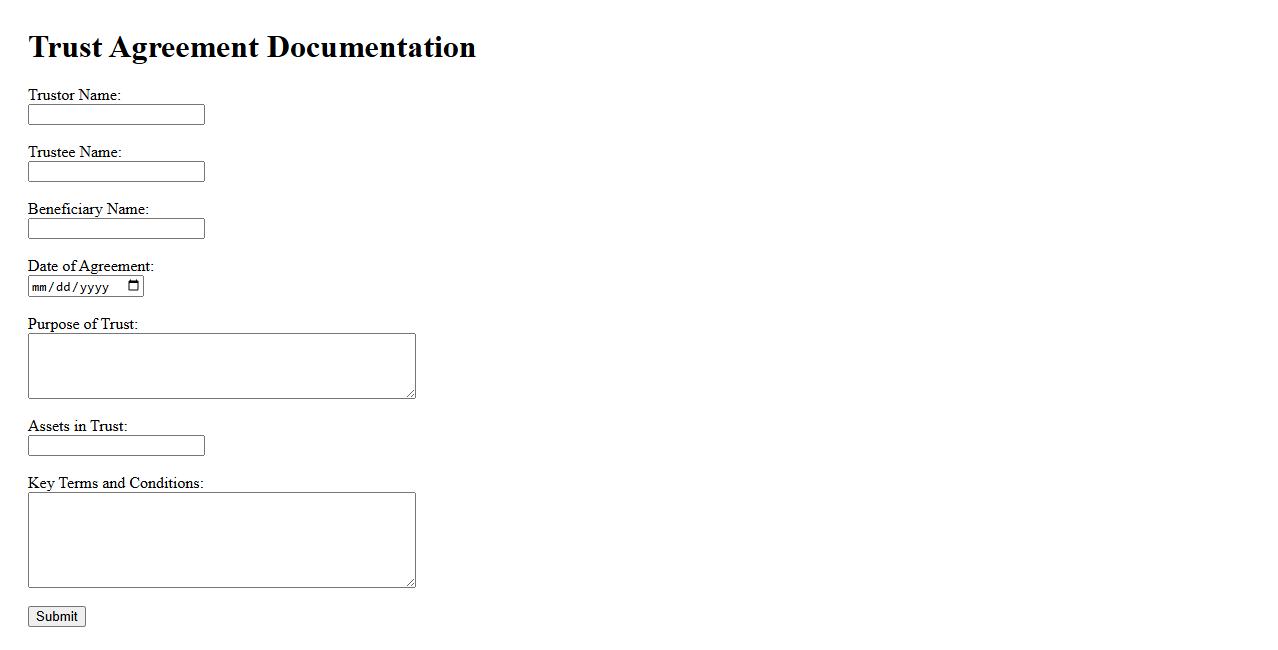

Trust Agreement Documentation

Trust Agreement Documentation is a legal document that outlines the terms, conditions, and parties involved in the creation of a trust. It ensures clear communication of the settlor's intentions and provides a framework for managing trust assets. Proper documentation is essential for avoiding disputes and ensuring compliance with relevant laws.

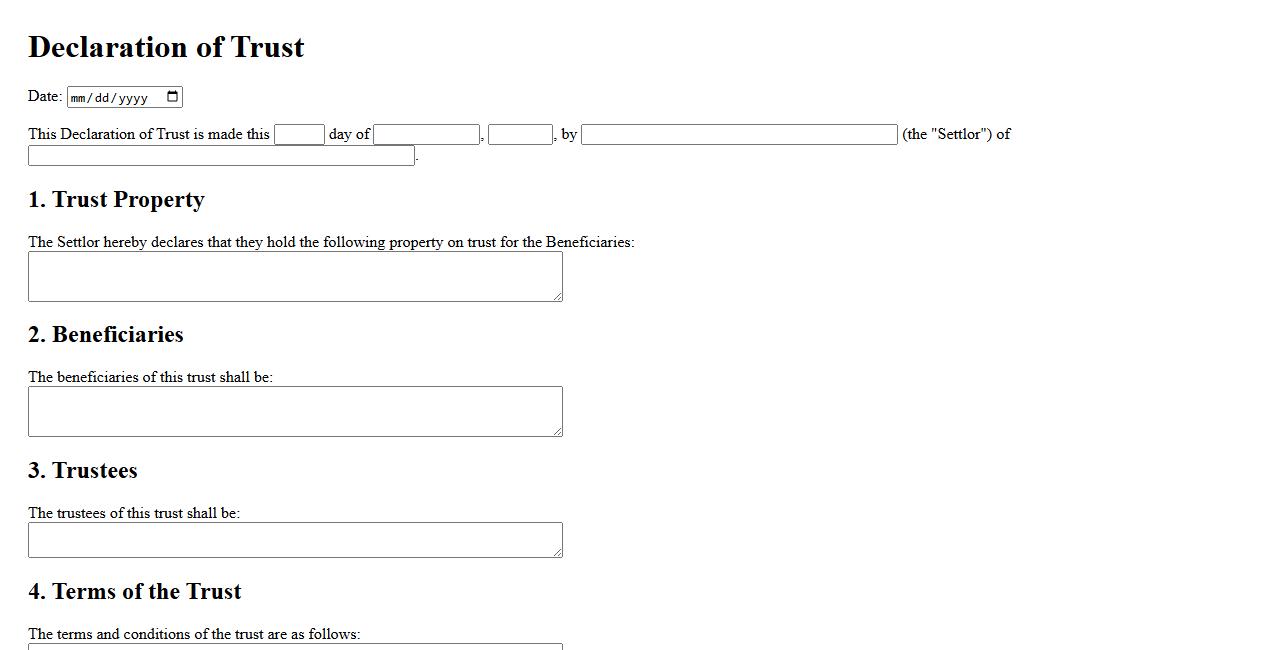

Declaration of Trust

A Declaration of Trust is a legal document that establishes the relationship between the trustee and the beneficiaries regarding certain assets. It clearly outlines the trustee's responsibilities and the terms under which the trust is managed. This document ensures that the assets are held and administered according to the grantor's intentions.

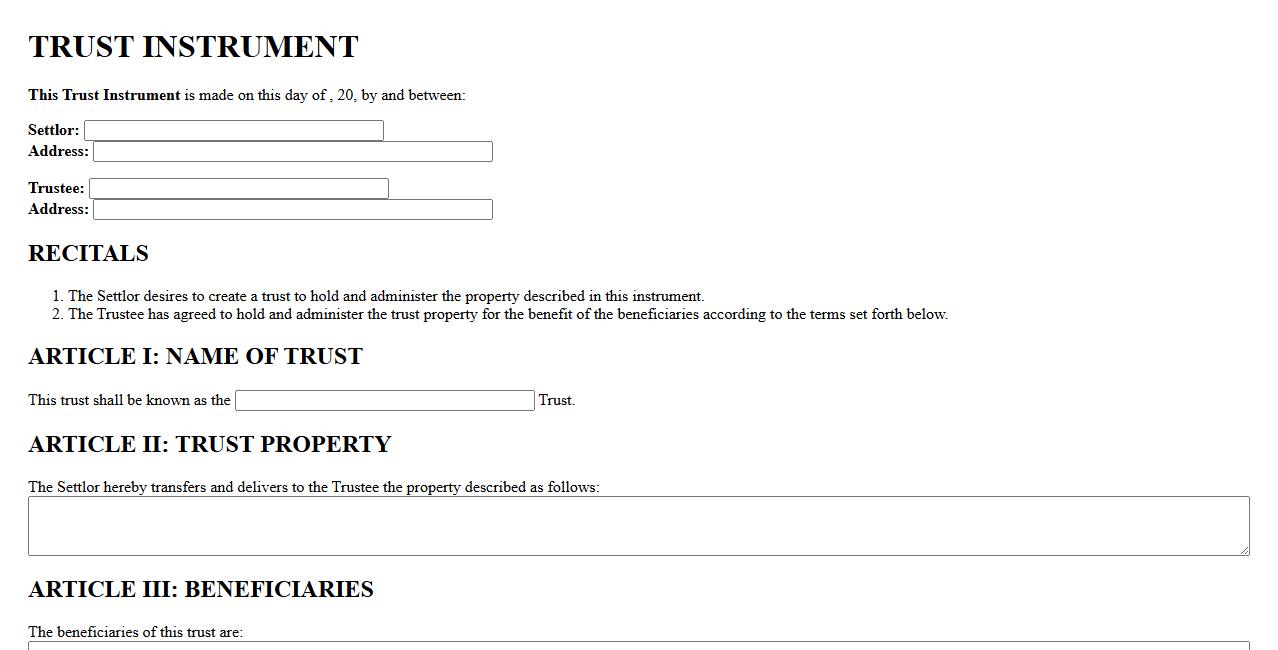

Trust Instrument

A Trust Instrument is a legal document that establishes the terms and conditions of a trust. It specifies the roles of the trustee, beneficiaries, and the assets involved. This document ensures the proper management and distribution of the trust property according to the grantor's wishes.

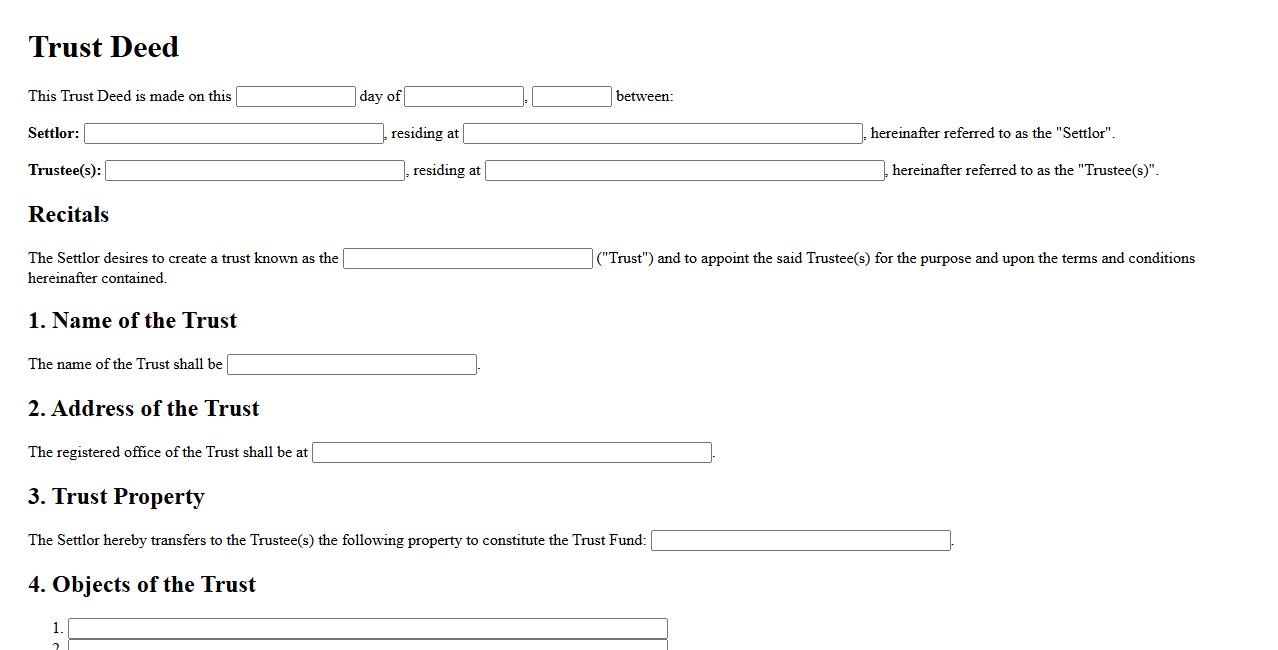

Trust Deed

A Trust Deed is a legal document that outlines the terms and conditions agreed upon by parties in a trust arrangement. It serves to protect the interests of beneficiaries by clearly defining the responsibilities of the trustee. This document is essential for ensuring transparency and enforcing the trust's purpose effectively.

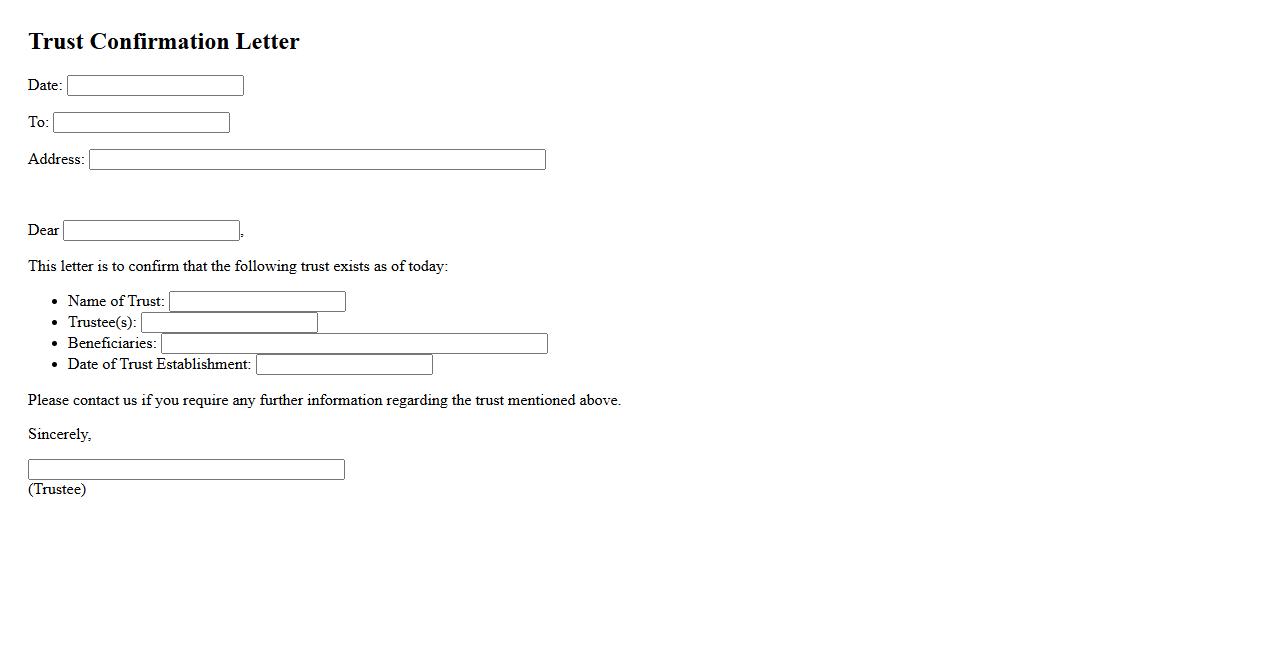

Trust Confirmation Letter

A Trust Confirmation Letter is a formal document used to verify the existence and details of a trust. It provides assurance to third parties about the trust's legitimacy and its terms. This letter is essential for legal and financial transactions involving the trust.

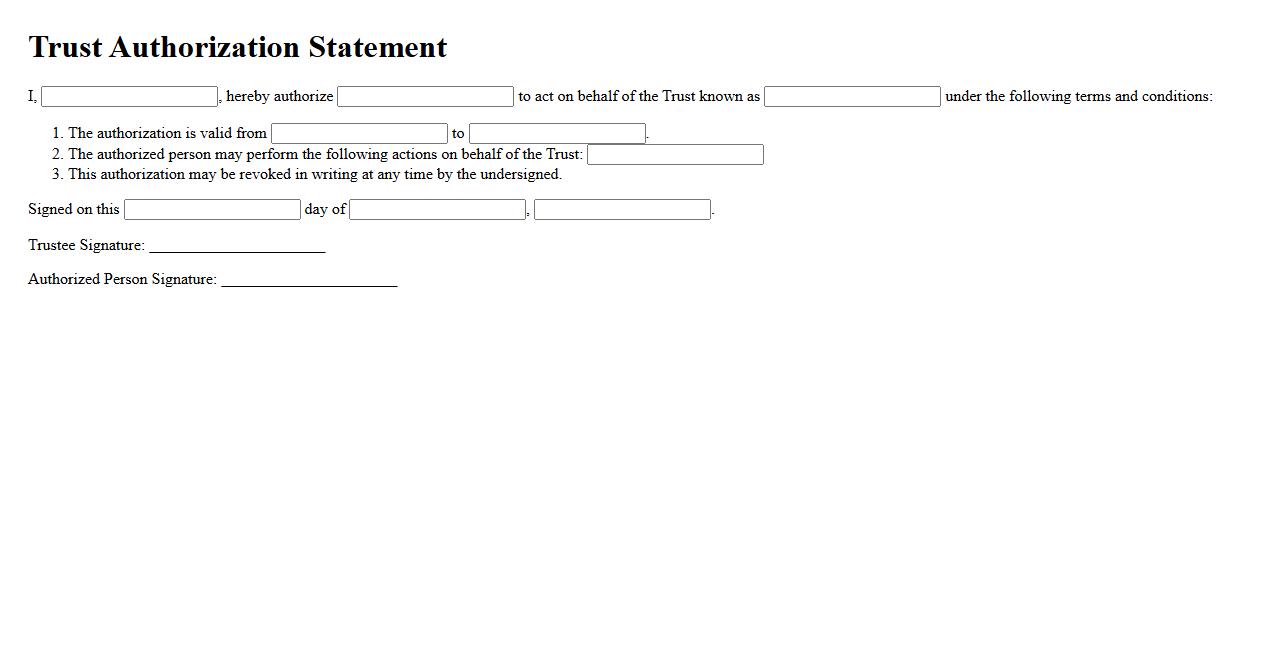

Trust Authorization Statement

The Trust Authorization Statement is a legal document that formally grants permission to a trustee or agent to manage and control assets on behalf of the trustor. It outlines the scope of authority and responsibilities entrusted to the designated person, ensuring clear guidelines for asset management. This statement is essential for maintaining transparency and proper administration within trust agreements.

Beneficiary Designation Statement

The Beneficiary Designation Statement is a crucial legal document that specifies who will receive assets or benefits from accounts such as life insurance, retirement plans, or bank accounts upon the owner's death. It ensures that the designated individuals or entities receive these assets directly, bypassing probate. Properly completing this statement helps avoid disputes and guarantees that your wishes are honored.

Trustee Appointment Certificate

The Trustee Appointment Certificate is an official document that verifies the designation of an individual as a trustee of a trust. It outlines the trustee's responsibilities and authority to manage trust assets on behalf of beneficiaries. This certificate ensures legal recognition and clarity in trust administration.

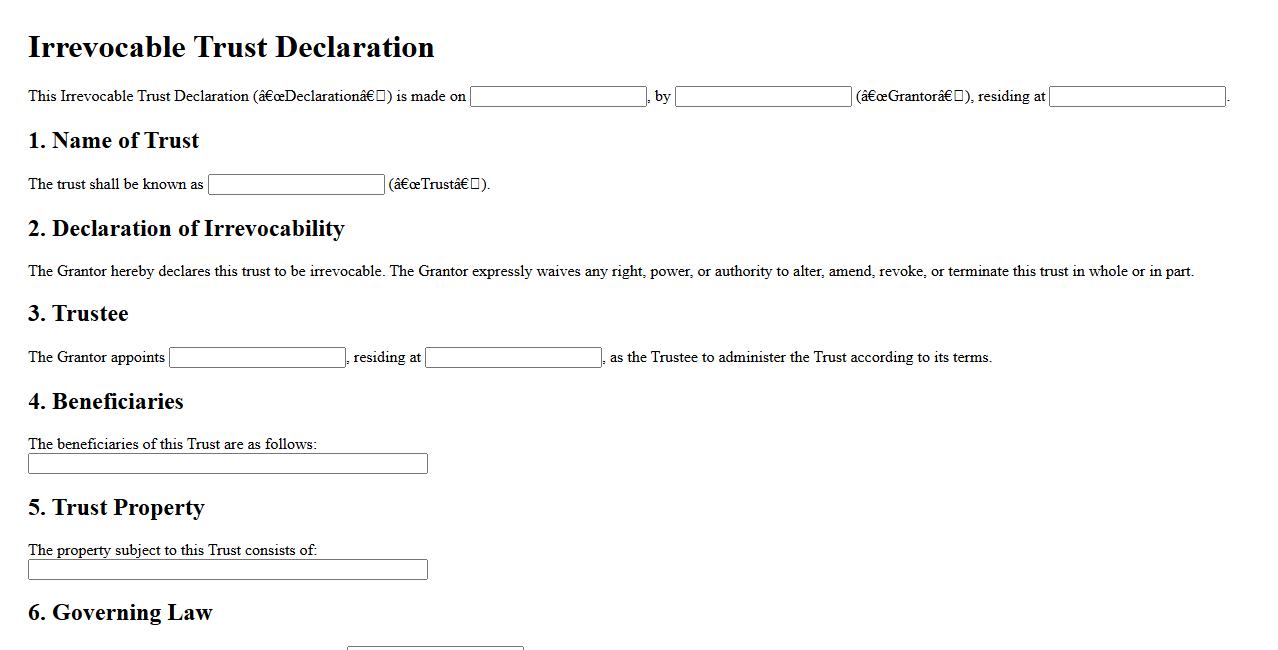

Irrevocable Trust Declaration

An Irrevocable Trust Declaration is a legal document that establishes a trust which cannot be altered or revoked by the grantor once created. This type of trust provides asset protection and potential tax benefits by transferring ownership to the trust. It is commonly used for estate planning to secure and manage assets for beneficiaries.

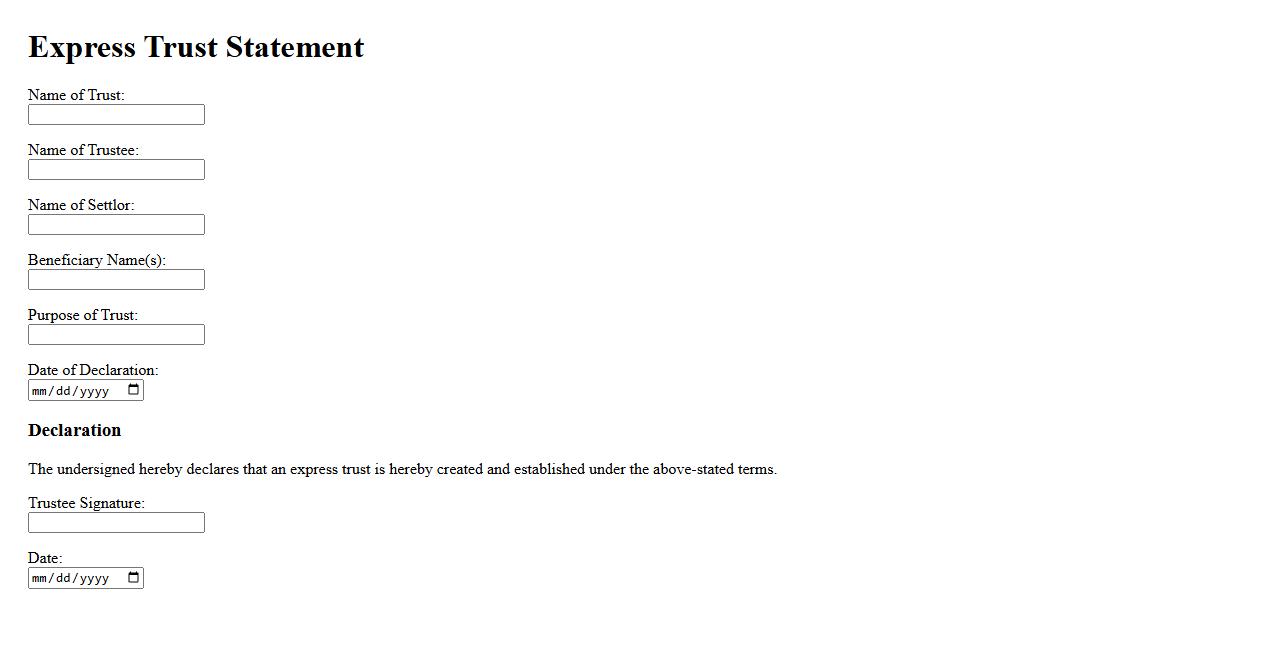

Express Trust Statement

An Express Trust Statement clearly outlines the intentions of a settlor to create a trust. It defines the roles, responsibilities, and assets involved, ensuring legal clarity and protection. This statement forms the foundation for managing and distributing trust property.

Entities or Individuals Designated as Trustees and Beneficiaries in the Statement of Trust

The Statement of Trust explicitly identifies the trustees responsible for managing the trust assets and the beneficiaries entitled to receive benefits. Trustees may include individuals or institutions appointed to oversee the trust's administration. Beneficiaries are typically named persons or entities who have legal rights to the trust's income or principal.

Specific Powers and Duties Assigned to the Trustee

The trustee is granted powers to administer, manage, and invest trust assets prudently. Duties include fiduciary responsibilities to act in the best interest of the beneficiaries while following the trust's terms. Trustees must comply with legal standards to preserve and enhance the trust's value.

Management, Distribution, and Investment of Assets

According to the Statement of Trust, assets are to be managed in a manner consistent with investment guidelines aimed at preserving and growing the trust estate. Distribution procedures specify how and when beneficiaries receive trust income or principal. Investment strategies must align with the trust's purpose and beneficiary needs, ensuring sustainable asset growth.

Conditions or Events Modifying or Terminating the Trust

The trust document outlines specific conditions or triggering events that can modify terms or lead to termination. Such events may include the death of beneficiaries, expiration of a set trust duration, or fulfillment of trust purposes. Amendments or revocations are subject to legal provisions and trustee authority.

Successor Trustee Appointments and Trustee Incapacity

The Statement of Trust provides clear guidance for appointing successor trustees in case of resignation, incapacity, or death of the current trustee. Procedures ensure uninterrupted trust administration by naming alternates or allowing beneficiary involvement. Addressing trustee incapacity protects the trust from management gaps and maintains proper oversight.