The Statement of Income is a financial document that summarizes a company's revenues, expenses, and profits over a specific period. It provides crucial insights into business performance, highlighting how efficiently a company generates profit from its operations. This statement is essential for investors, management, and stakeholders to assess financial health and make informed decisions.

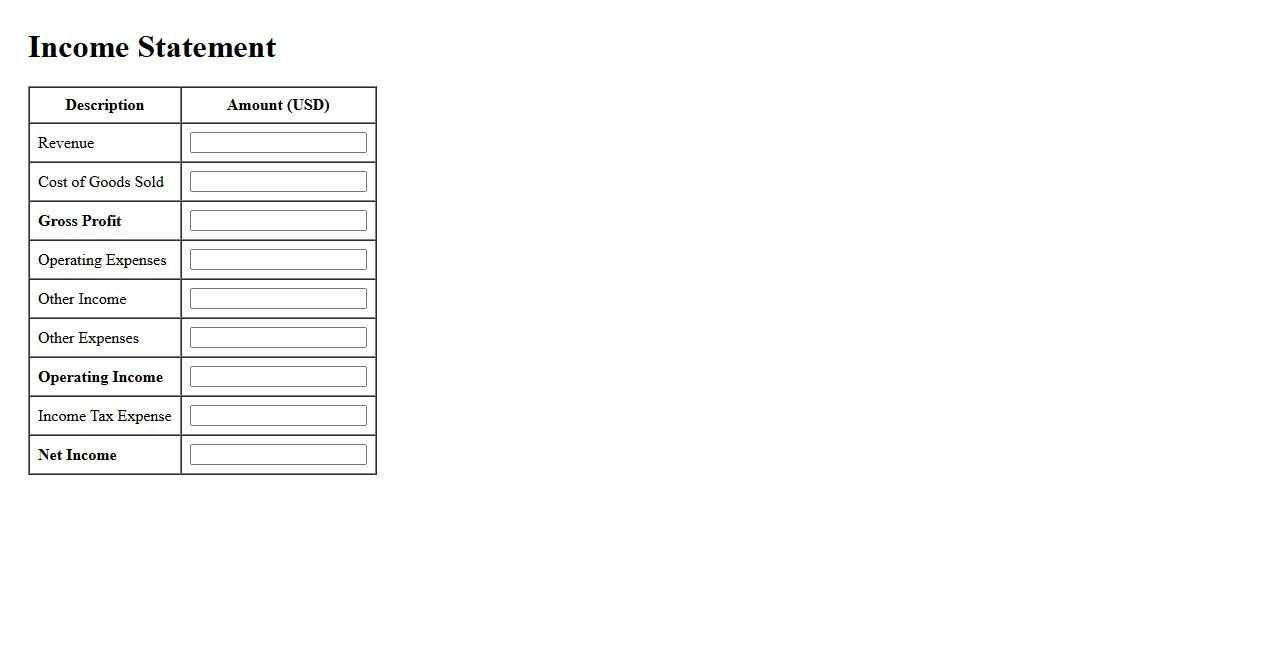

Income Statement

The Income Statement is a financial document that summarizes a company's revenues and expenses over a specific period. It provides insight into the company's profitability by showing net income or loss. This statement is essential for investors and management to assess financial performance.

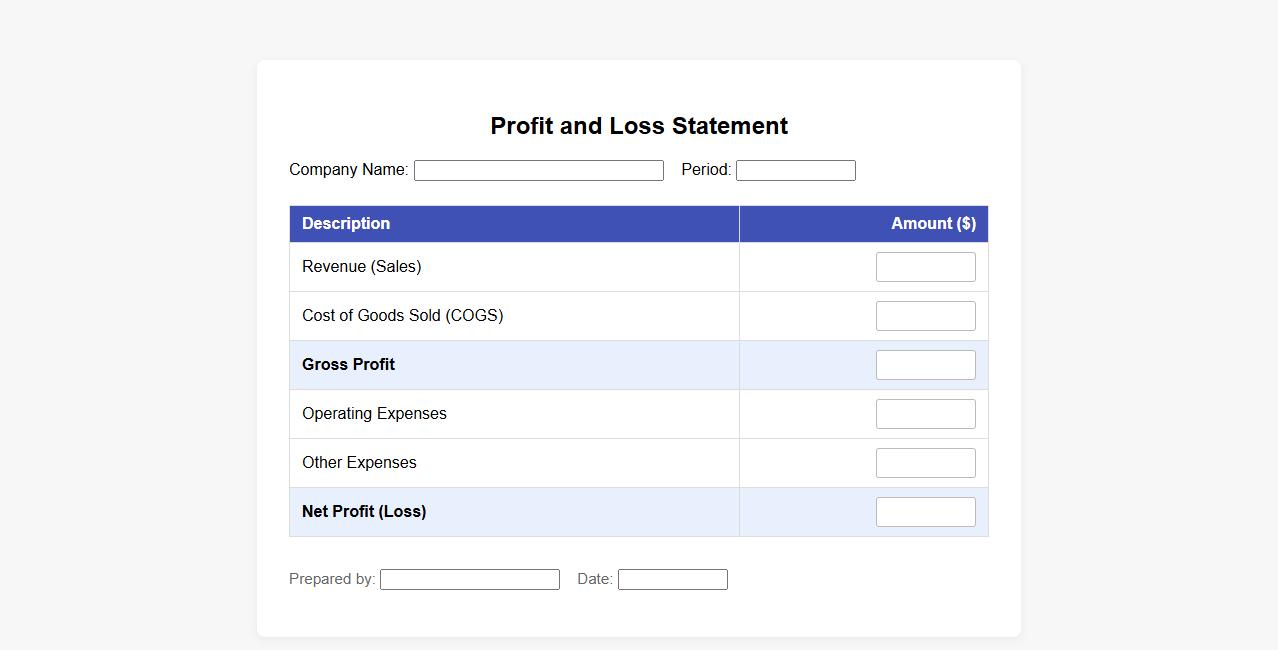

Profit and Loss Statement

A Profit and Loss Statement is a financial report that summarizes the revenues, costs, and expenses incurred during a specific period. It provides insight into a company's ability to generate profit by subtracting losses from income. This statement is essential for evaluating business performance and making informed financial decisions.

Earnings Report

An earnings report is a financial statement released by a company to disclose its profitability over a specific period. It includes key data such as revenue, expenses, and net income, providing insight into the company's performance. Investors and analysts use these reports to make informed decisions about buying or selling stocks.

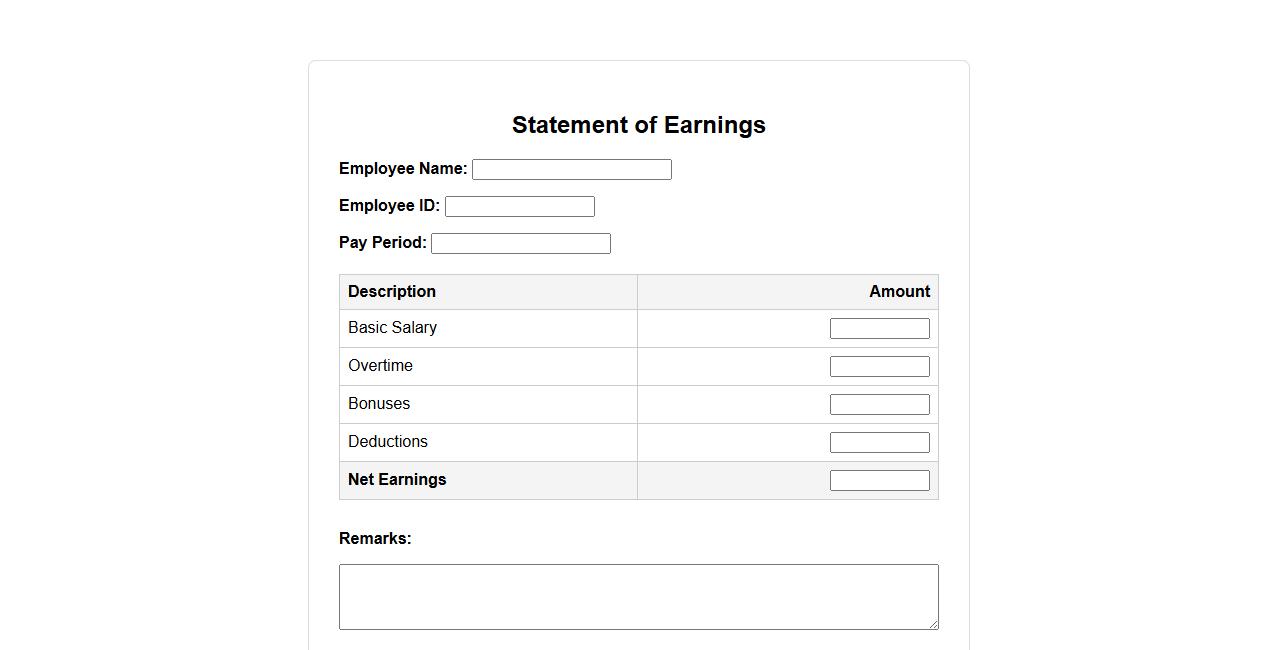

Statement of Earnings

The Statement of Earnings provides a detailed summary of a company's revenues and expenses over a specific period. It highlights the net profit or loss, reflecting the business's financial performance. This statement is essential for investors and management to assess profitability and make informed decisions.

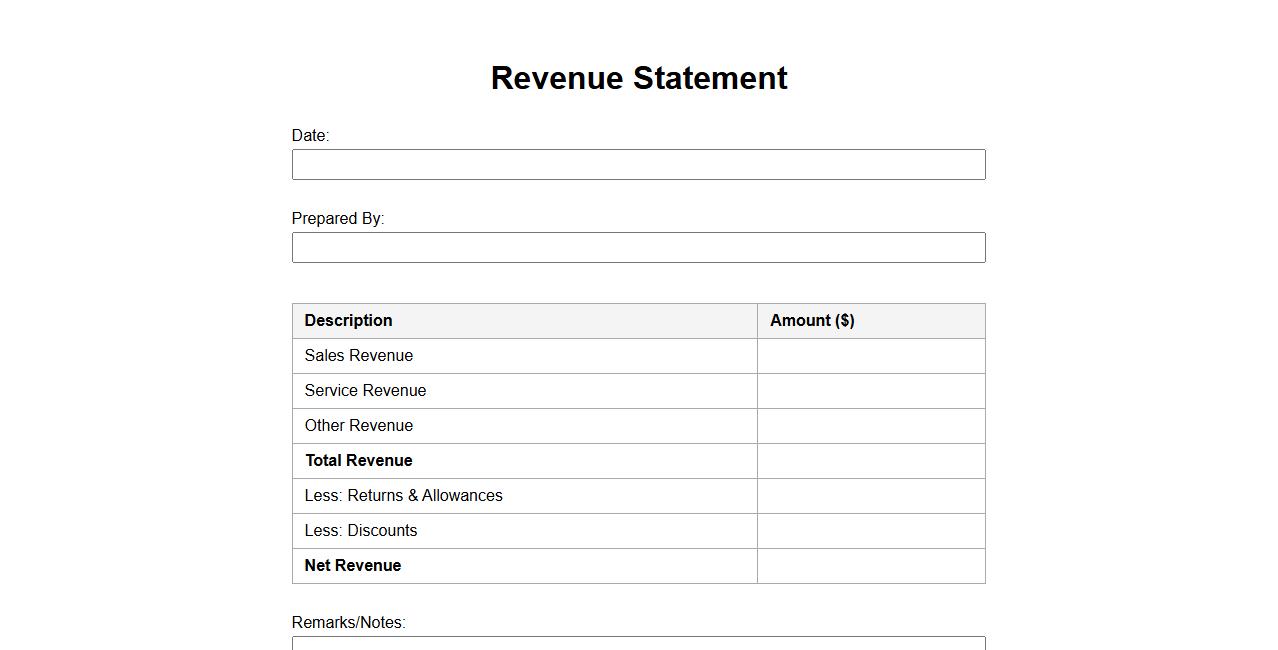

Revenue Statement

The Revenue Statement provides a detailed overview of a company's income generated from its core business activities during a specific period. It highlights the total sales, net revenue, and any deductions such as returns or discounts. This statement is essential for analyzing the financial performance and growth of a business.

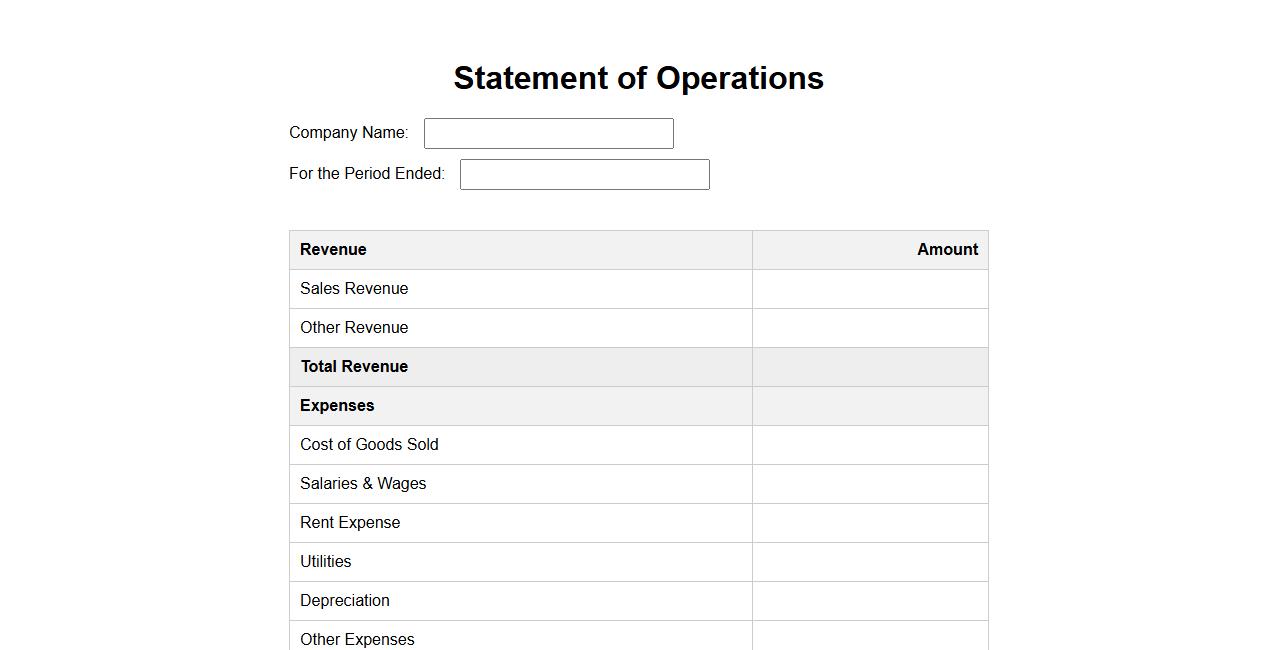

Statement of Operations

The Statement of Operations provides a detailed summary of a company's revenues, expenses, and profits over a specific period. It is essential for evaluating financial performance and business profitability. This statement helps stakeholders make informed decisions about the company's economic health.

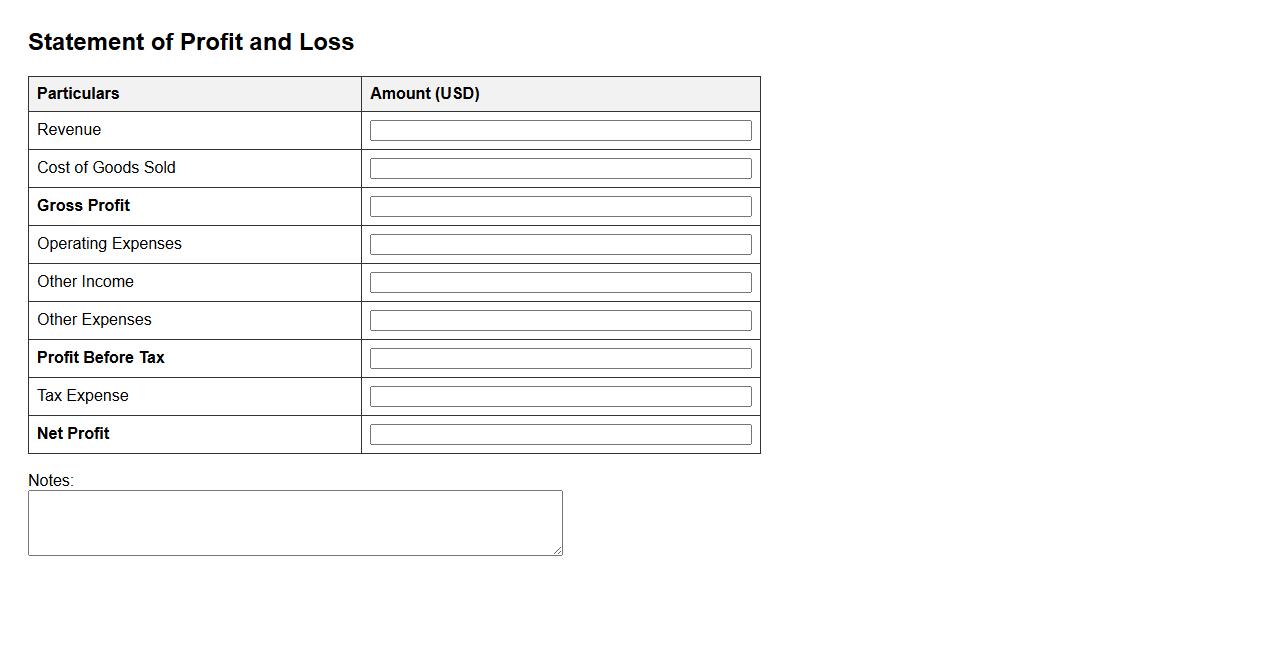

Statement of Profit and Loss

The Statement of Profit and Loss is a financial report that summarizes a company's revenues, expenses, and profits over a specific period. It provides insights into the company's operational performance and profitability. This statement is essential for stakeholders to assess the financial health and make informed decisions.

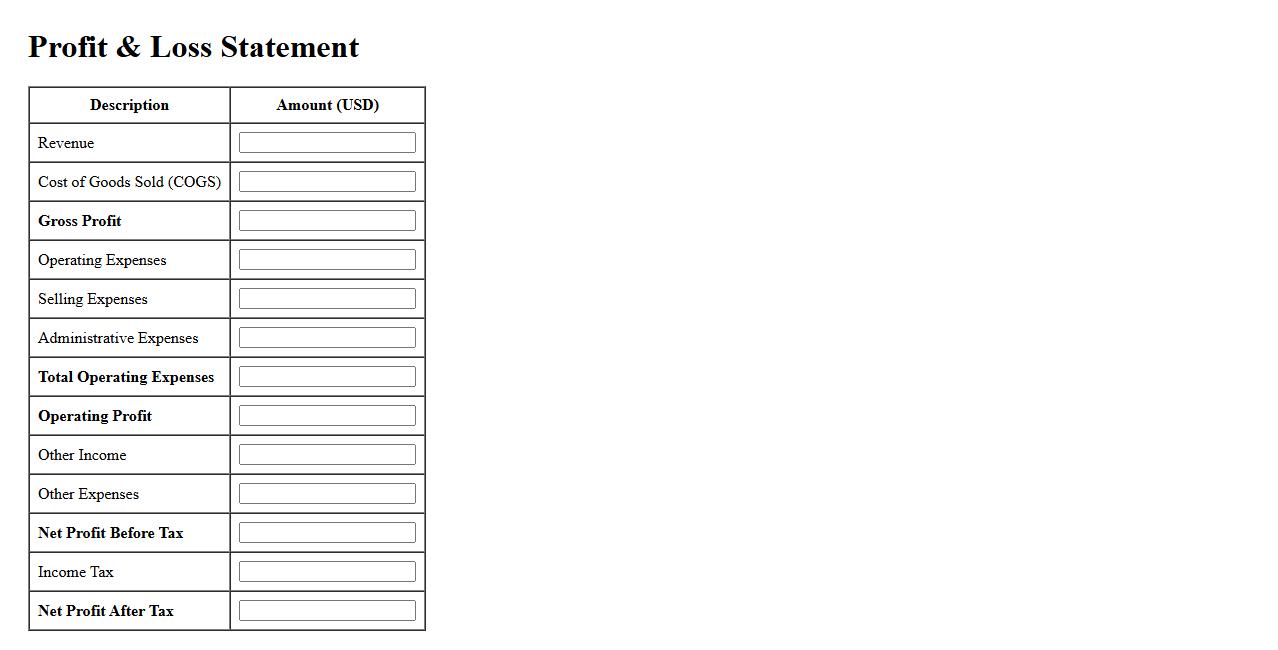

P&L Statement

A P&L Statement, or Profit and Loss Statement, is a financial report that summarizes revenues, costs, and expenses during a specific period. It provides insight into a company's ability to generate profit by detailing income and deducting costs. This statement is essential for evaluating business performance and making informed financial decisions.

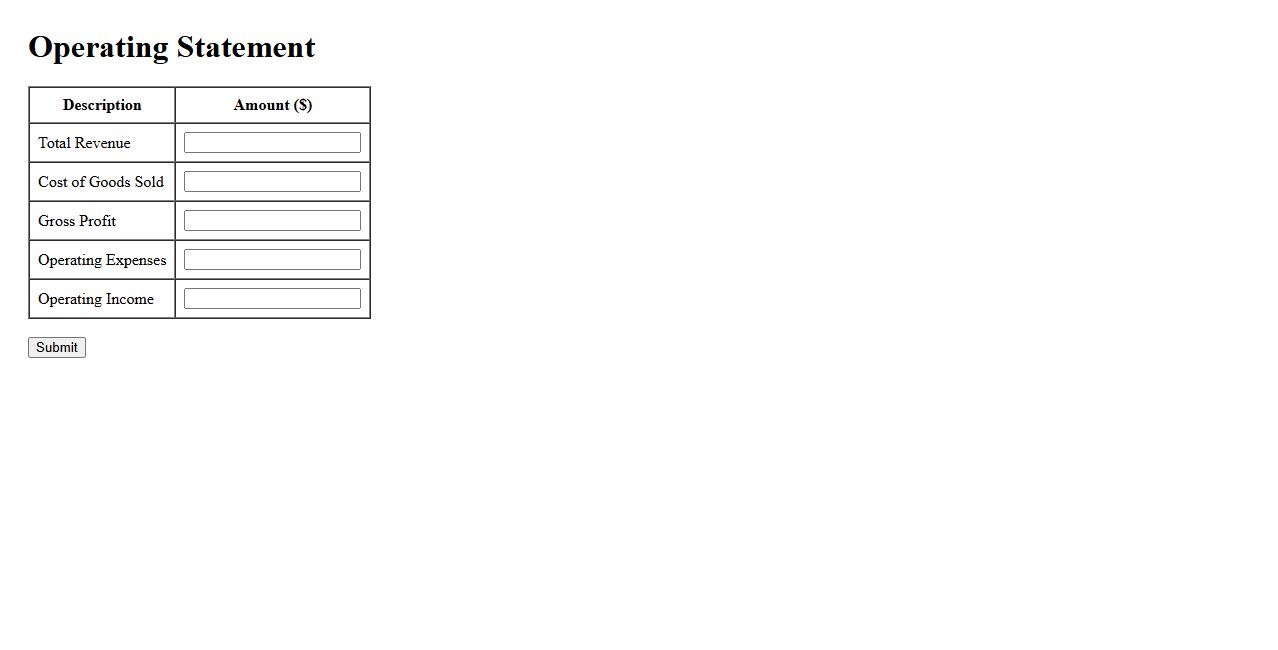

Operating Statement

An Operating Statement provides a detailed summary of a company's revenues, expenses, and profits over a specific period. It is essential for assessing financial performance and making informed business decisions. This document helps stakeholders understand how efficiently a company is generating income from its core operations.

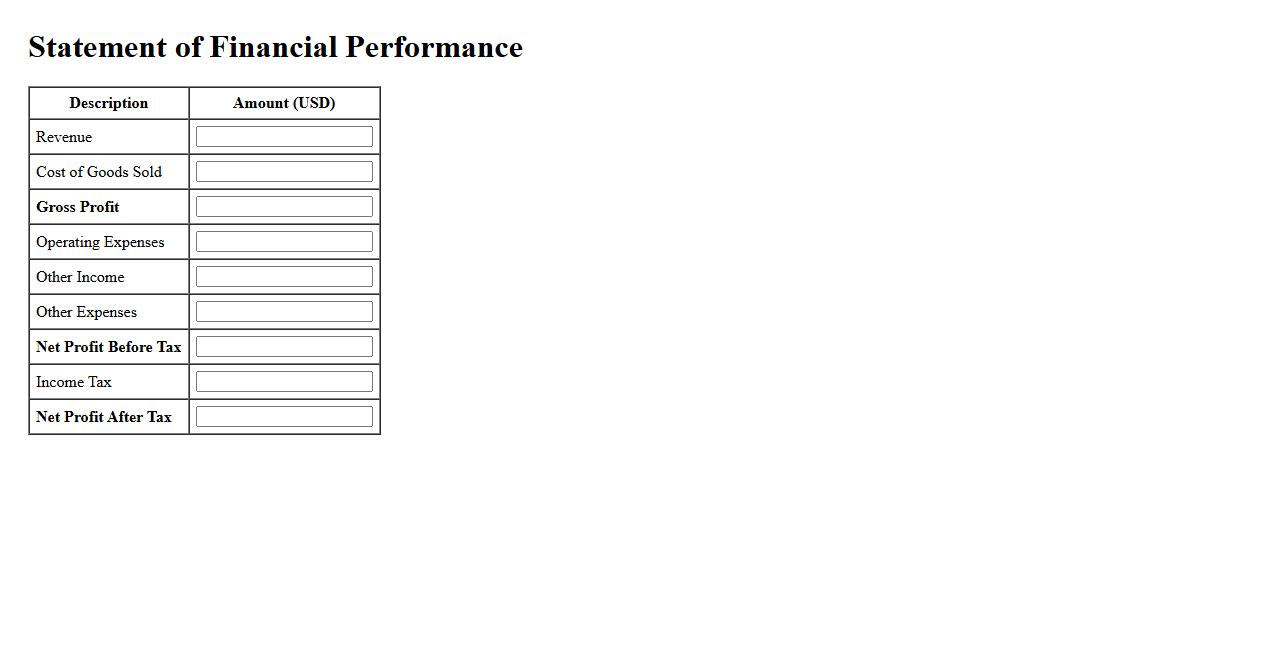

Statement of Financial Performance

The Statement of Financial Performance provides a summary of an entity's revenues and expenses over a specific period, highlighting its profitability. It is essential for assessing the financial health and operational efficiency of a business. This statement helps stakeholders make informed decisions based on income and expenditure trends.

What are the main components typically found in a Statement of Income?

The Statement of Income usually includes key components such as revenue, expenses, and net income. Revenue indicates the total income generated from sales or services during the period. Expenses reflect all costs incurred to generate that revenue, including operating and non-operating expenses.

How does the Statement of Income distinguish between revenue and expenses?

The Statement of Income clearly separates revenue as the inflow of economic benefits from expenses as the outflows or costs. Revenue is recorded at the top, followed by various categories of expenses deducted to compute profitability. This distinction helps track business performance by showing how income is earned and spent.

What is the significance of gross profit on the Statement of Income?

Gross profit represents the difference between revenue and the cost of goods sold. It measures the efficiency of production and sales before operating expenses are considered. Gross profit is a vital indicator of a company's ability to manage core business costs and generate profit from its primary activities.

How does the Statement of Income reflect net income or loss for a given period?

The Statement of Income calculates net income or net loss by subtracting total expenses from total revenue. This final figure summarizes the overall profitability of the company during the reporting period. A positive result indicates profit, while a negative result signals a loss.

In what ways does the Statement of Income support decision-making for stakeholders?

The Statement of Income provides critical information about a company's financial performance, helping stakeholders assess profitability and operational efficiency. Investors and creditors use it to make informed decisions regarding investments and creditworthiness. Management relies on this statement to identify areas for cost control and revenue improvement.