A Statement of Information is a legal document filed with the state government to provide current details about a business entity, including its address, management, and ownership. It ensures that the public and government agencies have updated and accurate information on file for regulatory and contact purposes. Timely filing of a Statement of Information is often required to maintain good standing and avoid penalties.

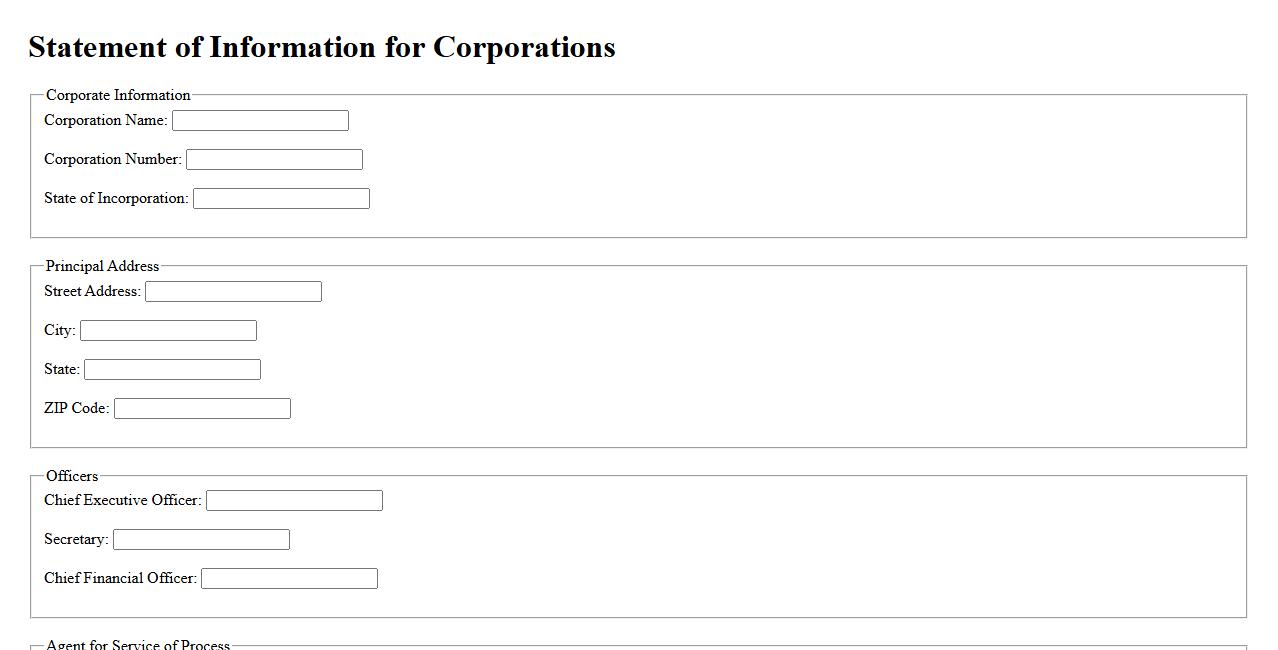

Statement of Information for Corporations

The Statement of Information for Corporations is a mandatory document that provides updated details about a corporation's address, officers, and agent for service of process. Filing this statement ensures compliance with state regulations and maintains corporate good standing. Timely submission helps avoid penalties and keeps public records accurate.

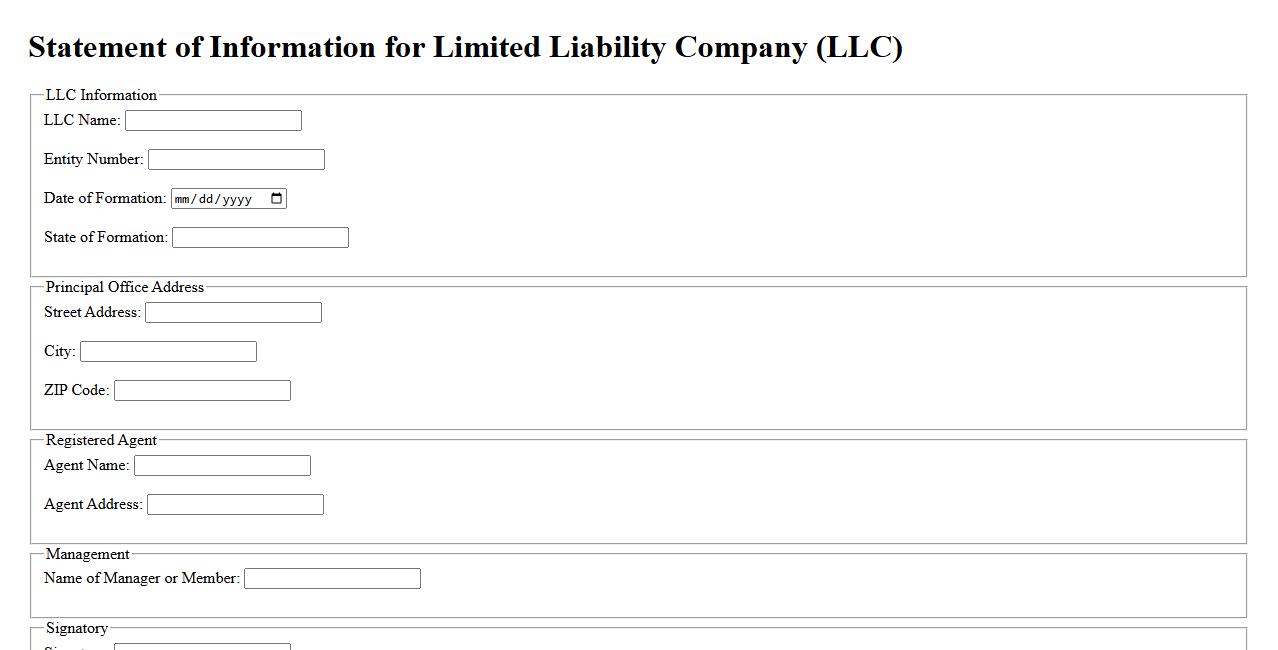

Statement of Information for LLCs

The Statement of Information for LLCs is a required document filed with the state to provide updated details about the limited liability company. It typically includes information such as the LLC's address, management structure, and registered agent. Timely filing ensures compliance and maintains good standing with state authorities.

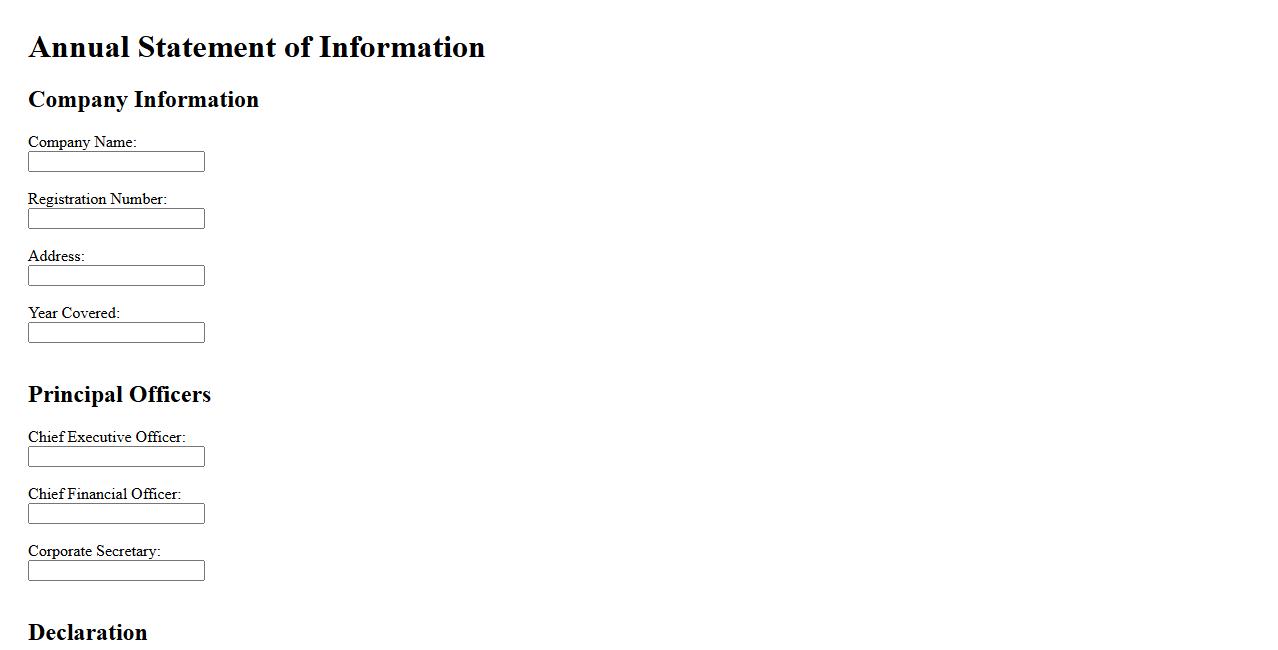

Annual Statement of Information

The Annual Statement of Information is a mandatory document that businesses must file with the state to update their key details. It includes information such as addresses, officers, and registered agents to ensure public records remain accurate. Filing this statement on time helps maintain good standing and compliance with state regulations.

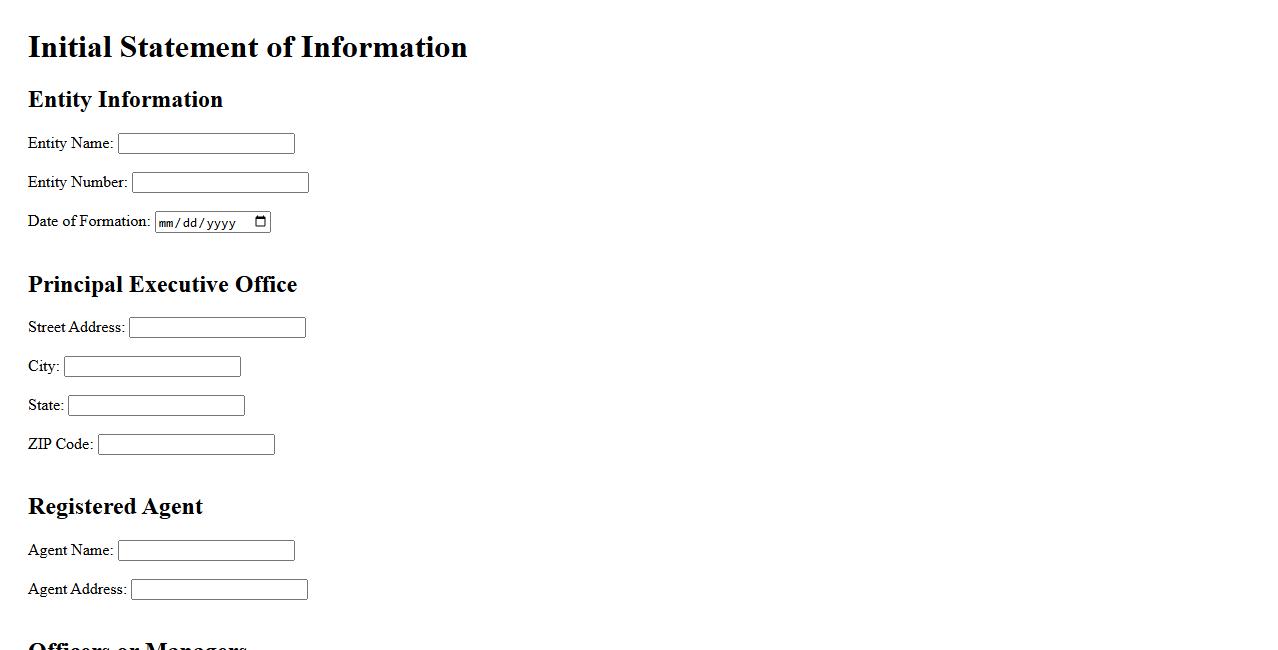

Initial Statement of Information

The Initial Statement of Information is a crucial document filed with the state to provide key details about a new business. It typically includes information about the company's officers, address, and registered agent. Filing this statement ensures compliance and transparency for the corporation or LLC.

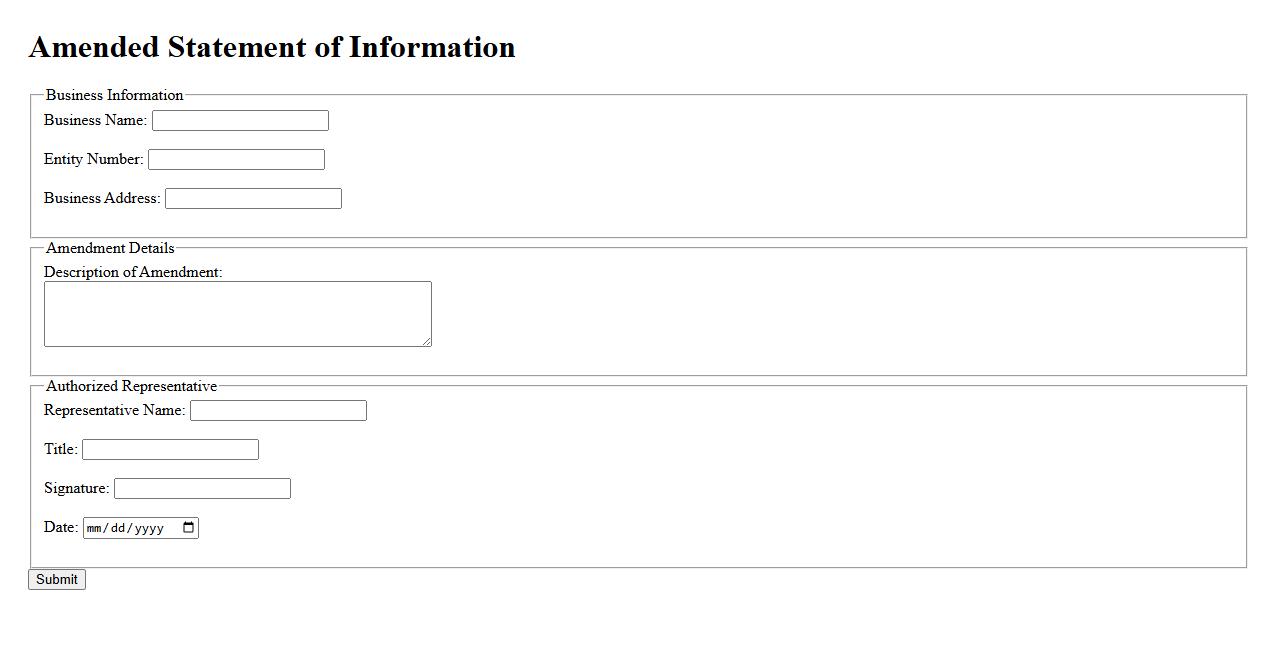

Amended Statement of Information

An Amended Statement of Information is a document filed to update or correct previously submitted business information with the state. This ensures that the company's public records remain accurate and up-to-date. Timely filing of this amendment is crucial for compliance and maintaining good standing.

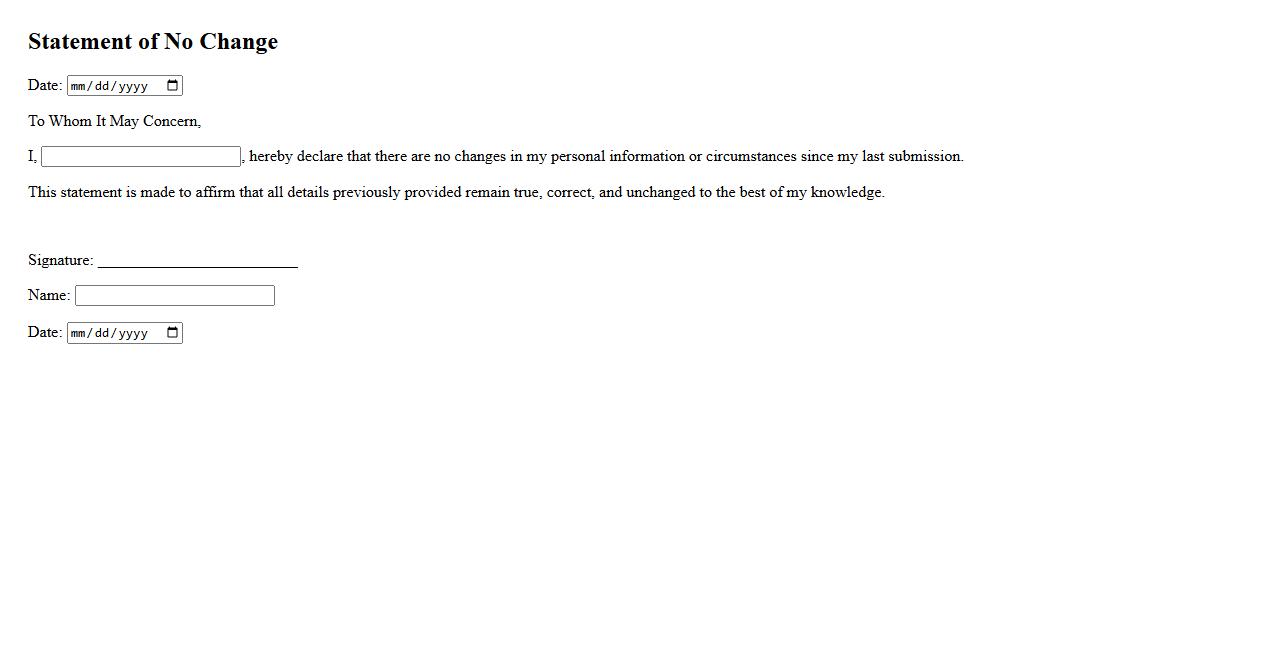

Statement of No Change

A Statement of No Change is a formal declaration submitted to confirm that no modifications have occurred since the last report or filing. It ensures regulatory compliance by verifying that previously submitted information remains accurate and up to date. This document simplifies regulatory processes when no updates are necessary.

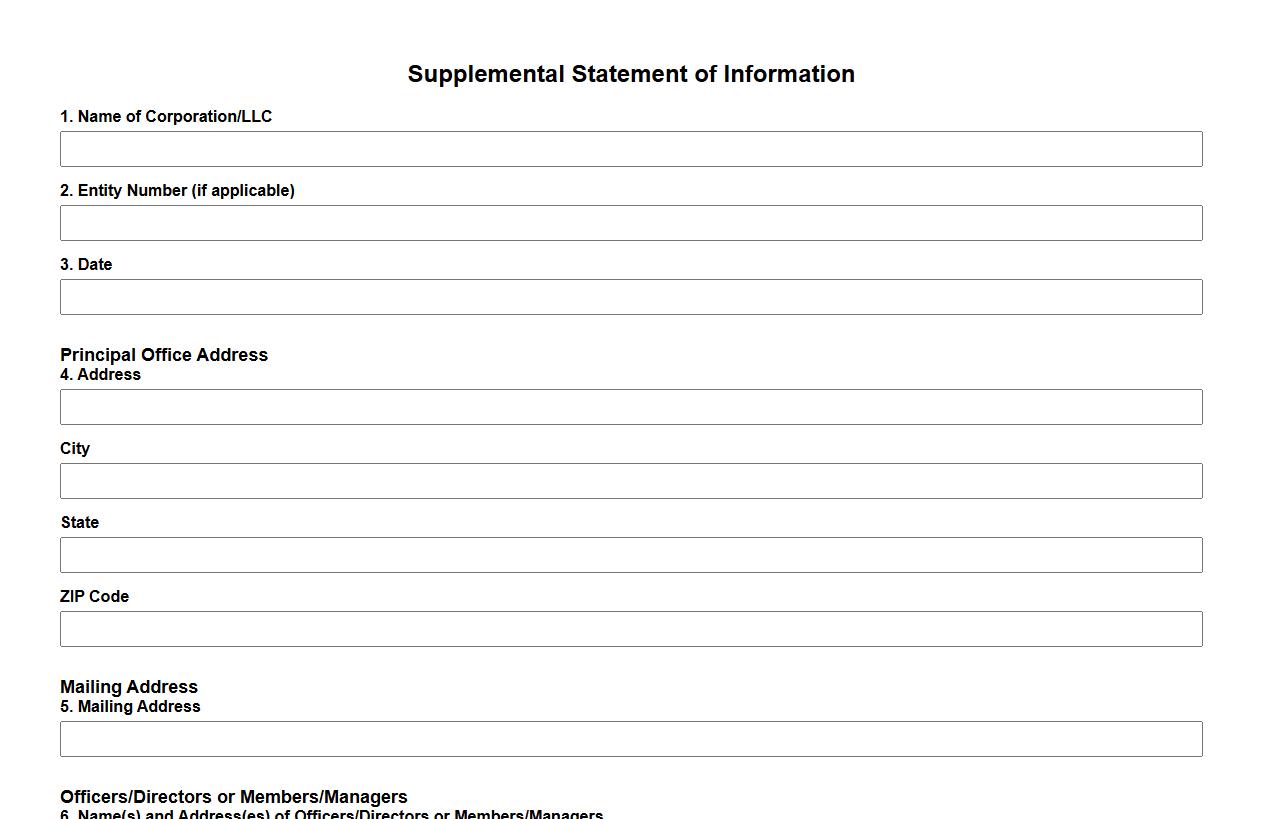

Supplemental Statement of Information

The Supplemental Statement of Information is an important document required by many state governments in the United States to update key details about a business entity. It typically includes information such as addresses, officers, and directors, ensuring accurate public records. Filing this statement helps maintain compliance and transparency for the business.

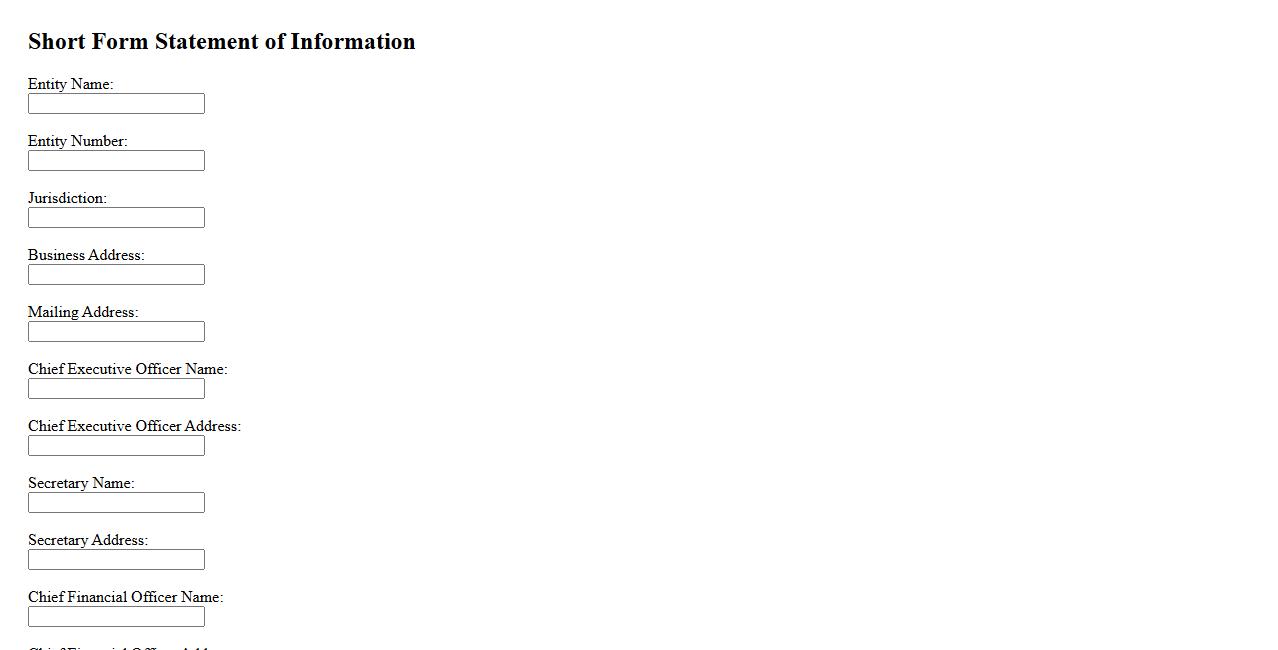

Short Form Statement of Information

The Short Form Statement of Information is a simplified document required for businesses to update their key details with the state. It typically includes basic information such as officer names, addresses, and type of business. This form helps maintain accurate and current public records efficiently.

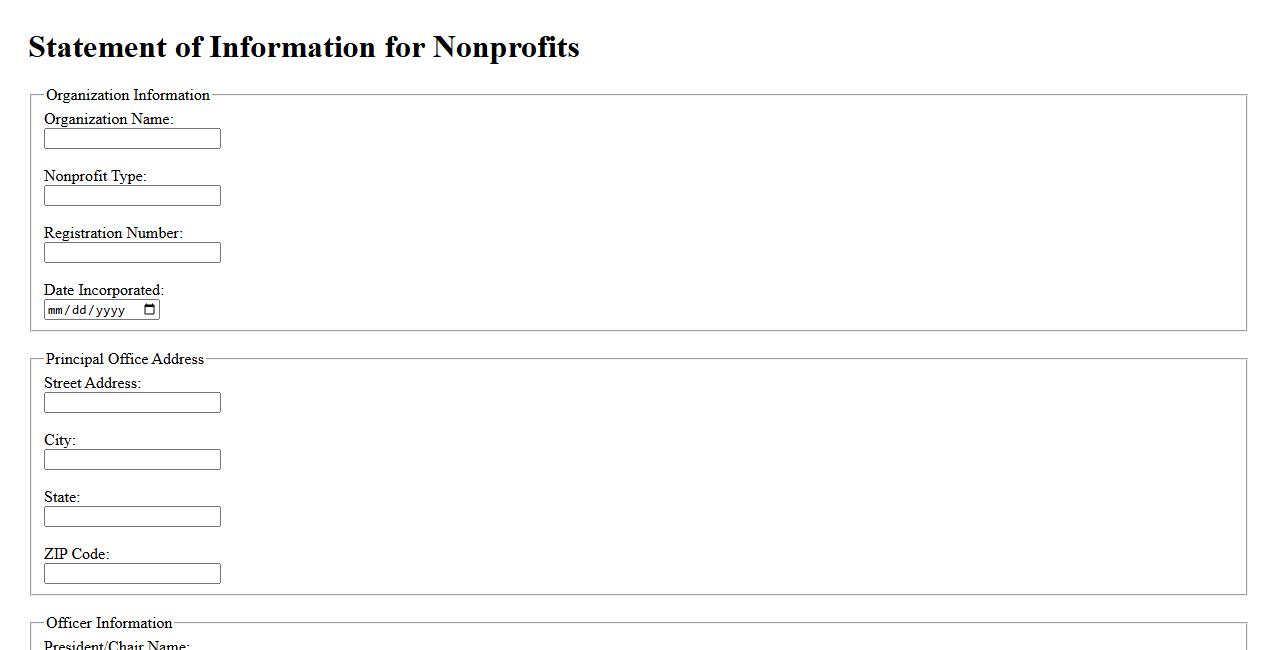

Statement of Information for Nonprofits

The Statement of Information for Nonprofits is a mandatory document that provides essential details about a nonprofit organization to state authorities. It ensures transparency by disclosing key information such as the organization's address, officers, and purpose. Timely filing of this statement helps maintain the nonprofit's good standing and compliance with state regulations.

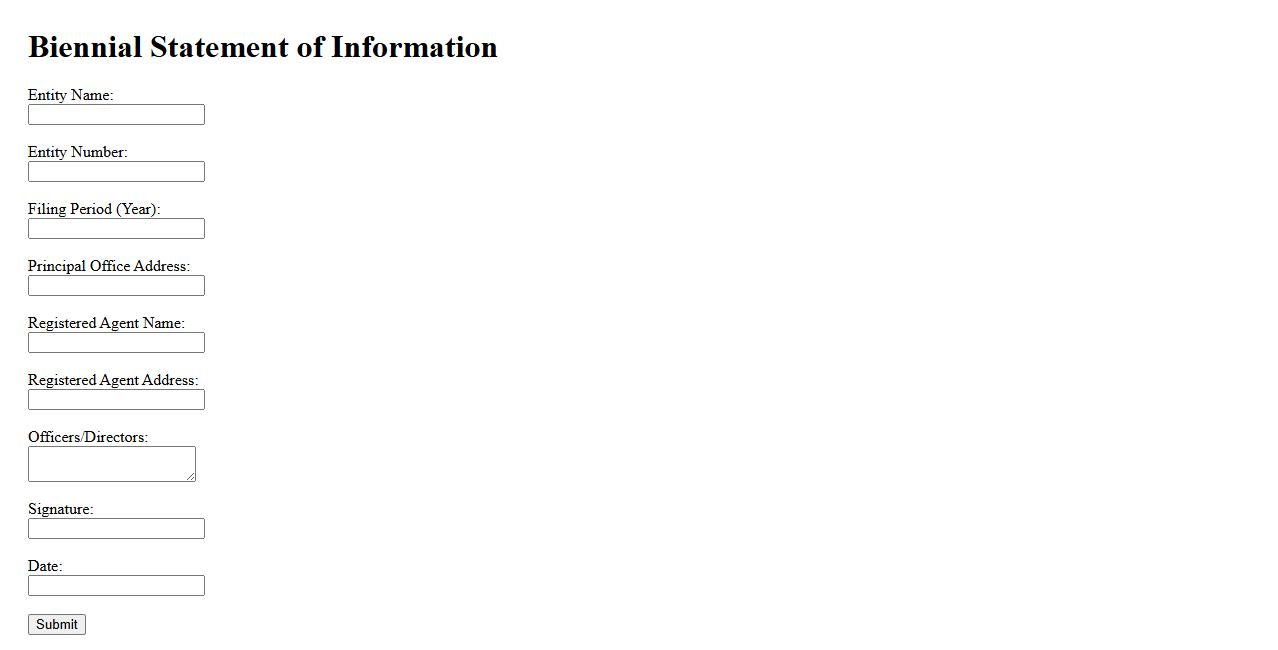

Biennial Statement of Information

The Biennial Statement of Information is a mandatory filing required for certain business entities to provide updated details about their operations. This statement ensures transparency by collecting information such as addresses, management, and agent for service of process. Timely submission helps maintain good standing with regulatory authorities.

What essential information must be included in a corporate Statement of Information?

A corporate Statement of Information must include key details such as the company's name, address, and principal office location. It also requires the names and addresses of officers and directors, along with the type of business activities conducted. This information ensures that the state maintains current and accurate records of the corporation's structure and operations.

How does a Statement of Information help identify company officers and directors?

The Statement of Information provides an official record of the names and addresses of officers and directors within a corporation. This document helps government agencies and the public verify who is responsible for managing the company. It ensures transparency about the individuals holding decision-making authority in the corporation.

When is a Statement of Information required to be filed with the state?

A Statement of Information is typically required to be filed annually or biennially, depending on the jurisdiction. Newly formed corporations must file an initial statement shortly after formation, often within 90 days. Timely filing deadlines are set by the state to maintain active corporate status and updated records.

What are the legal consequences of failing to submit a Statement of Information on time?

Failing to submit the Statement of Information on time can result in penalties, fines, or the suspension of corporate privileges. The state may impose monetary fines for late submissions, and persistent noncompliance can lead to administrative dissolution. This can significantly impact the corporation's ability to conduct business legally.

How does a Statement of Information contribute to corporate transparency and compliance?

The Statement of Information promotes corporate transparency by publicly disclosing essential company details, including leadership and contact information. It ensures corporations remain compliant with state regulations and helps maintain trust with stakeholders and regulators. By keeping records current, it supports accountability in corporate governance.