A Statement of Loss is a formal document detailing the specifics of damages or losses incurred, often used in insurance claims or legal matters. It outlines the nature, extent, and circumstances of the loss to provide a clear record for assessment and settlement purposes. Accurate information in a Statement of Loss helps expedite the claims process and ensures proper compensation.

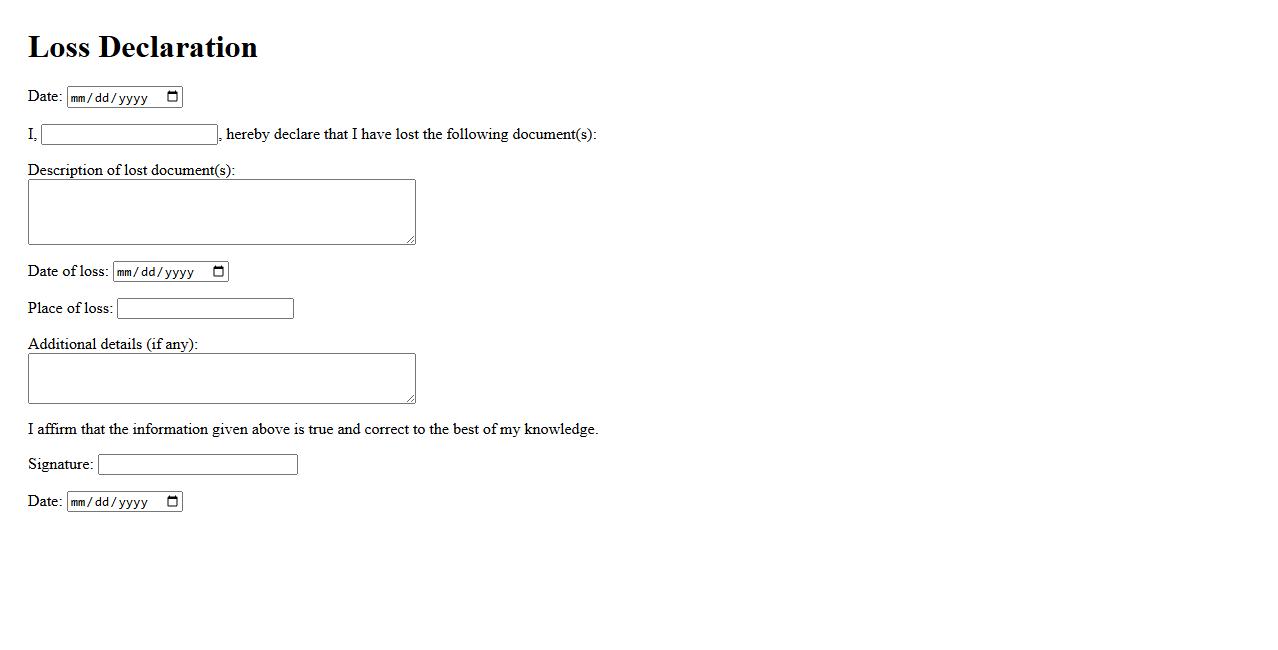

Loss Declaration

A Loss Declaration is a formal statement detailing the extent and nature of damages or losses experienced. It is essential for insurance claims and legal documentation to ensure accurate assessment and resolution. Timely and precise declarations help facilitate efficient compensation and recovery processes.

Damage Report

A Damage Report provides a detailed account of any harm or defects identified in property, equipment, or goods. It is essential for documenting the extent of damage for insurance claims, repairs, or legal purposes. This report helps ensure accurate communication and timely resolution of issues.

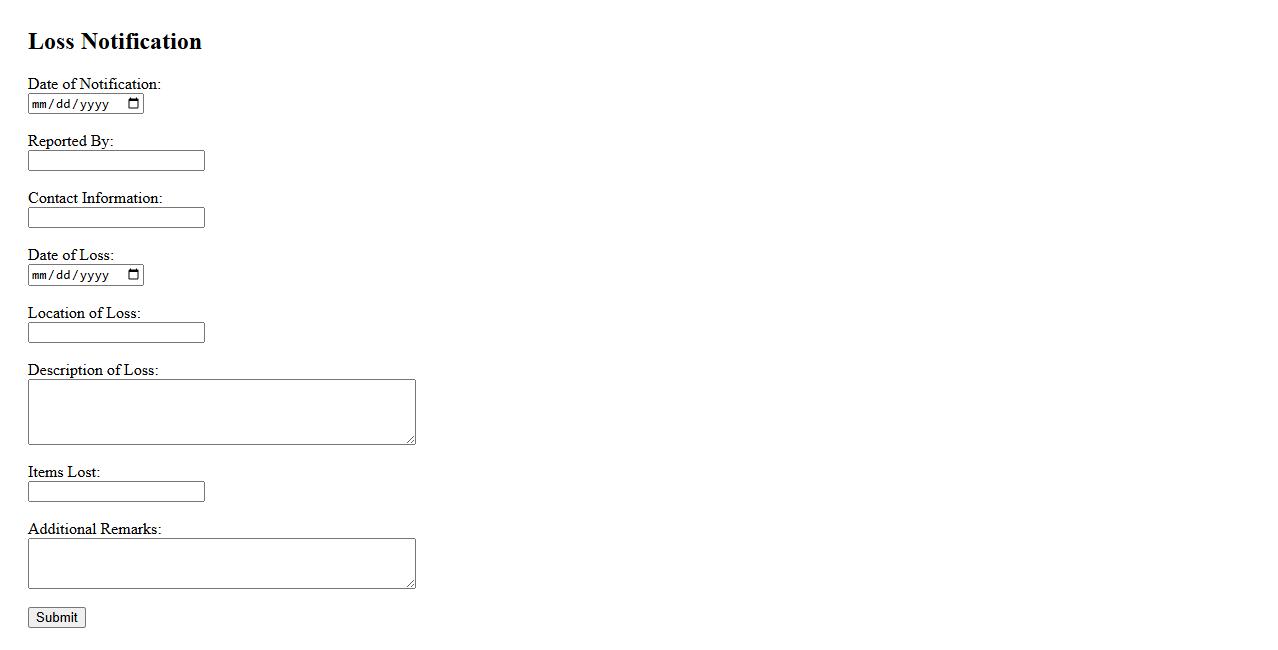

Loss Notification

Loss Notification is a critical process in risk management where an individual or organization reports an incident of loss or damage to the relevant authority or insurer. This timely communication ensures that claims are handled efficiently and appropriate measures are taken. Proper loss notification helps in minimizing further risks and facilitates swift resolution.

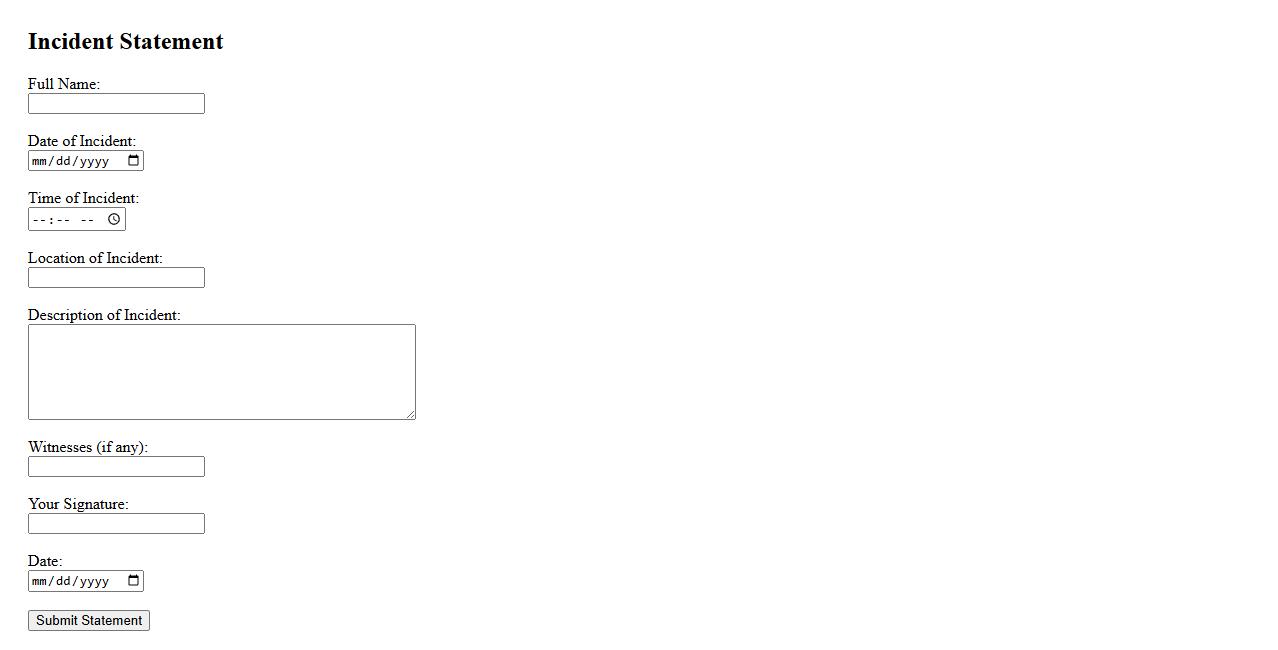

Incident Statement

An Incident Statement is a clear and concise description of an event that has occurred, detailing the facts without bias. It serves as an essential record for investigations, helping to identify causes and prevent future occurrences. Accurate incident statements improve communication and support accountability in any organization.

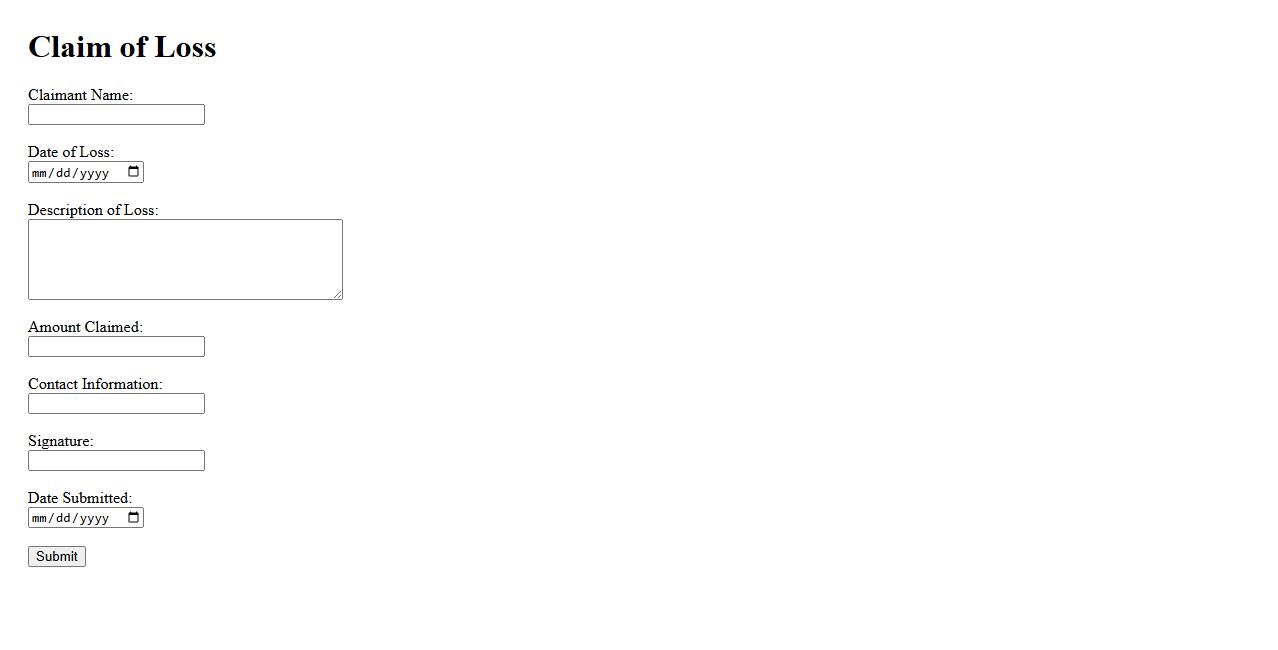

Claim of Loss

A Claim of Loss is a formal request submitted to an insurance company to recover financial compensation for damages or stolen property. It initiates the process of evaluating the extent of the loss and the validity of the claim. Accurate documentation and timely filing are crucial for a successful claim resolution.

Property Loss Form

The Property Loss Form is a crucial document used to report and record damages or losses to personal or business property. It ensures accurate documentation for insurance claims or internal records. Timely and detailed completion of this form helps in efficient claim processing and recovery.

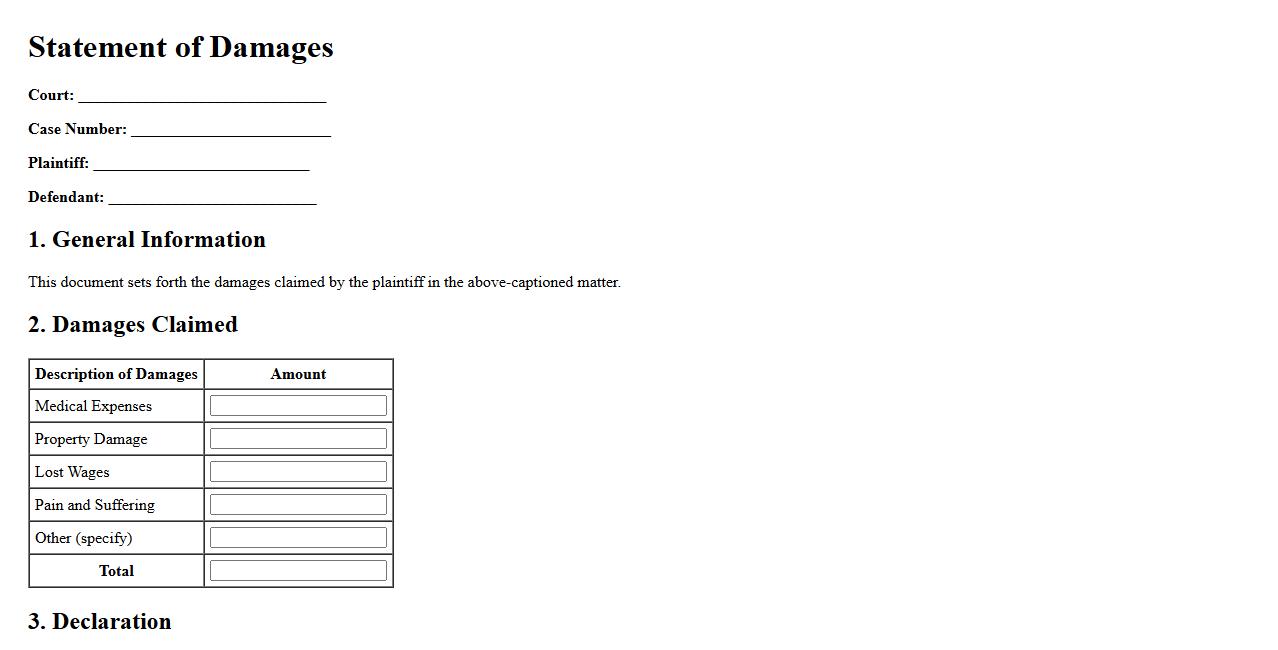

Statement of Damages

The Statement of Damages is a legal document detailing the monetary compensation sought by a plaintiff for injuries or losses incurred. It itemizes medical expenses, lost wages, and other damages to establish the financial impact of the defendant's actions. This statement is crucial in litigation to quantify the claim's value accurately.

Loss Incident Report

A Loss Incident Report is a formal document used to record details of any loss, damage, or theft within an organization. It helps in identifying the cause and implementing measures to prevent future occurrences. Accurate reporting ensures accountability and supports insurance claims or investigations.

Missing Item Declaration

Missing Item Declaration is a formal statement made to report items that were expected but not received in a shipment or delivery. This declaration helps initiate investigations and claim processes to recover or compensate for the missing goods. Prompt submission of this document is essential to resolve discrepancies efficiently and maintain accurate inventory records.

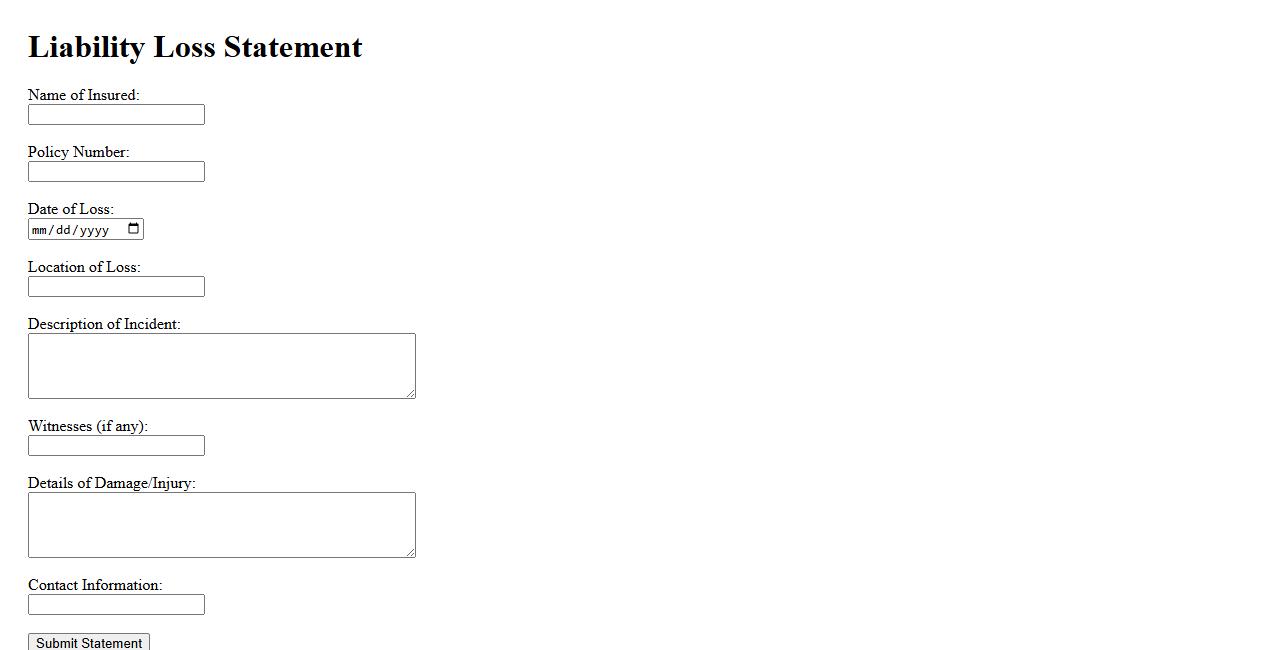

Liability Loss Statement

A Liability Loss Statement is a crucial document used in insurance claims to detail the extent of damages and responsibility. It outlines the circumstances of the incident and the financial impact on the liable party. This statement helps insurers assess the claim accurately and determine appropriate compensation.

What is the primary purpose of a Statement of Loss in insurance documentation?

The primary purpose of a Statement of Loss is to provide a detailed account of the loss or damage suffered by the insured party. It serves as formal evidence to the insurance company concerning the extent and nature of the claim. This document is essential for initiating the claims process accurately and efficiently.

Which key details must be included in a Statement of Loss form?

A Statement of Loss must include key details such as the date and cause of the loss, a comprehensive description of the damaged or lost property, and the estimated value of the loss. It should also contain the policyholder's contact information and policy number. This information helps the insurer assess the claim's validity and value.

How does a Statement of Loss support the claims process for policyholders?

The Statement of Loss supports the claims process by providing a clear and documented record of the claim, facilitating faster assessment by the insurance company. It helps avoid delays by ensuring all necessary information is supplied upfront. Additionally, it acts as a reference point throughout the claim investigation and settlement stages.

In what situations is submitting a Statement of Loss mandatory?

Submitting a Statement of Loss is mandatory whenever a policyholder suffers a loss covered under the insurance policy, such as theft, fire, or accidental damage. It is particularly required during significant claims involving substantial property or financial loss. Failure to provide this document can result in claim denial or delays.

Who is authorized to complete and sign a Statement of Loss document?

The Statement of Loss must be completed and signed by the insured policyholder or an authorized representative with legal authority. In certain cases, a witness or legal guardian may also be required to sign. This ensures the authenticity and accuracy of the information provided to the insurer.