A Statement of Account is a detailed summary of all transactions between a customer and a business over a specific period. It includes invoices, payments, credits, and outstanding balances to provide a clear overview of the account status. This document helps in tracking financial activities and ensuring accurate record-keeping for both parties.

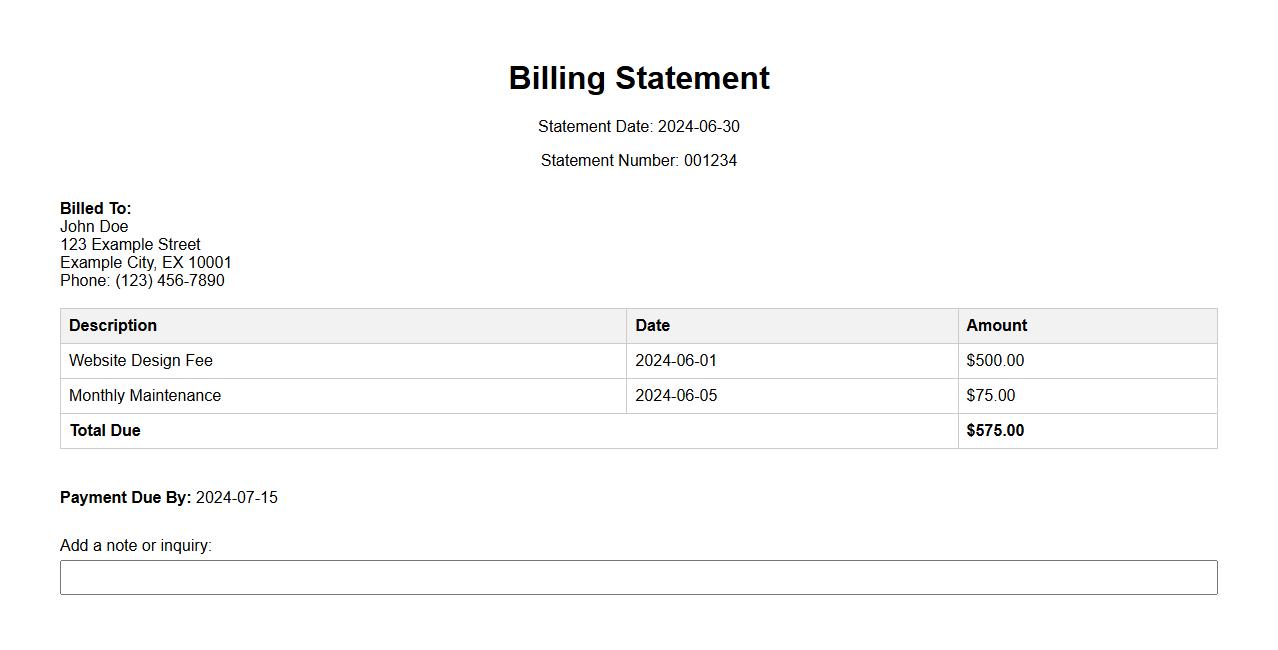

Billing Statement

A Billing Statement provides a detailed summary of charges, payments, and outstanding balances for a specific period. It helps individuals and businesses keep track of their financial transactions clearly and accurately. Regularly reviewing billing statements ensures timely payments and effective budget management.

Account Summary

The Account Summary provides a comprehensive overview of your financial activities, including balances, recent transactions, and account status. It helps you quickly assess your current financial position. Easily track all vital information in one convenient location.

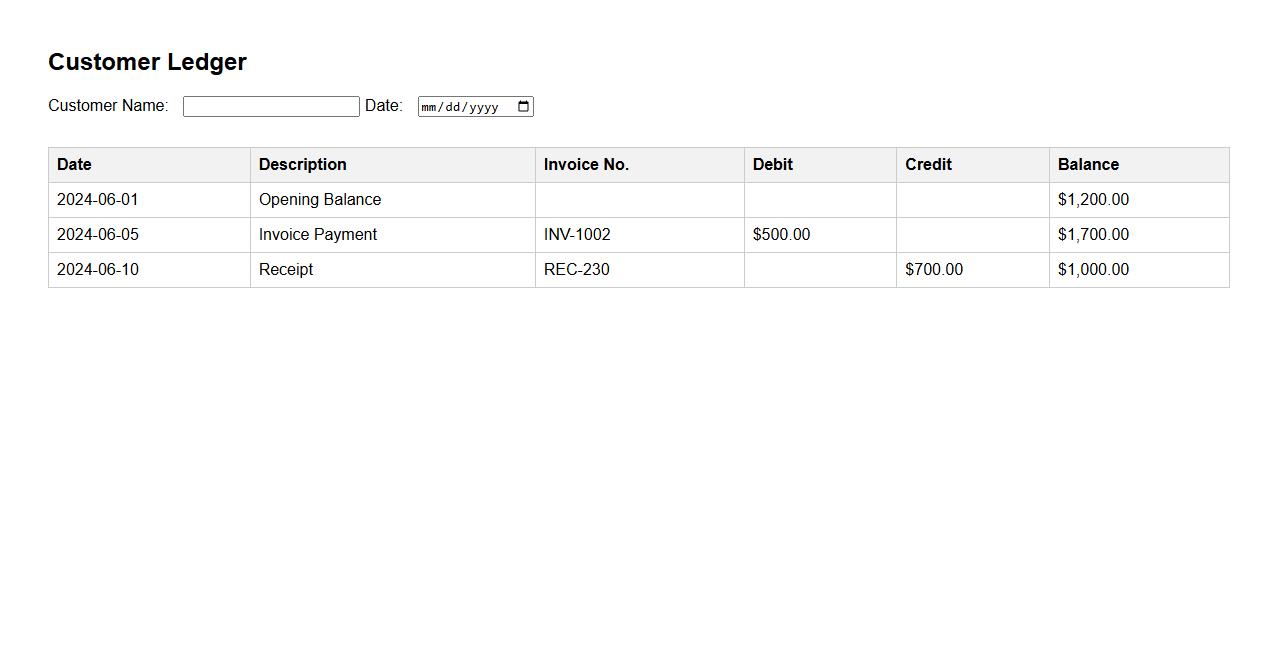

Customer Ledger

The Customer Ledger is a detailed record of all financial transactions between a business and its customers. It helps track invoices, payments, and outstanding balances to maintain accurate accounting. Using this ledger ensures transparent and organized financial management.

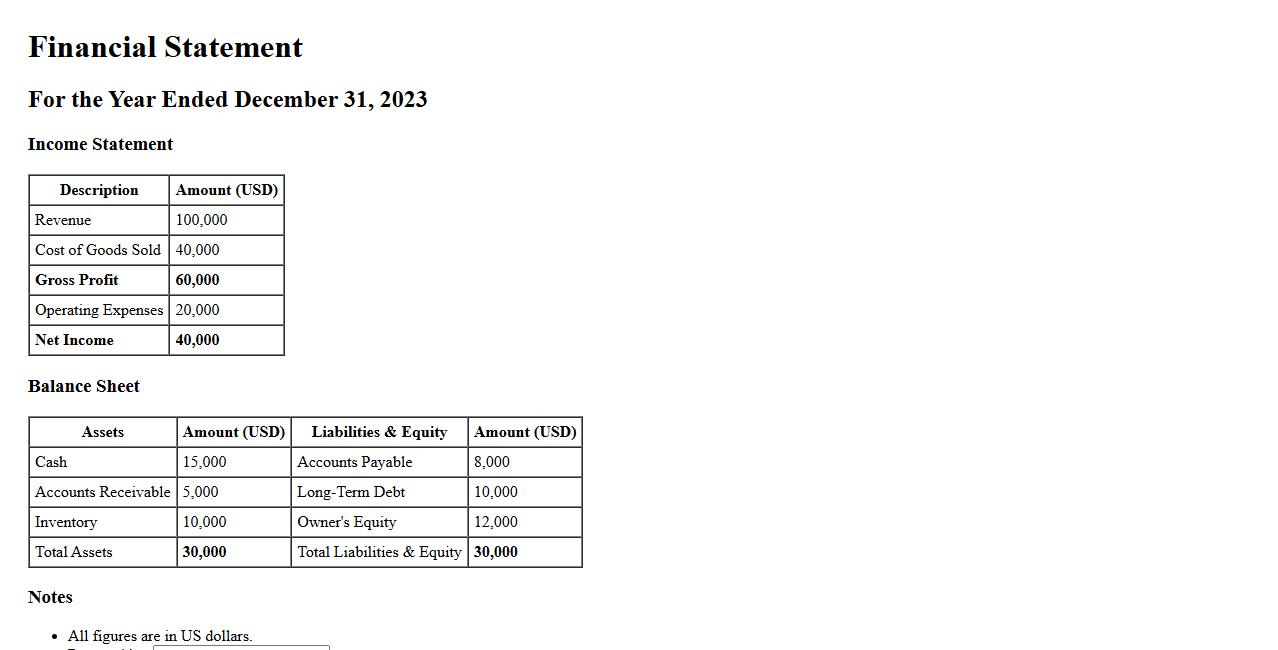

Financial Statement

A financial statement is a formal record of the financial activities and position of a business, person, or entity. It provides detailed information about assets, liabilities, revenue, and expenses. These reports are essential for making informed economic decisions and assessing financial health.

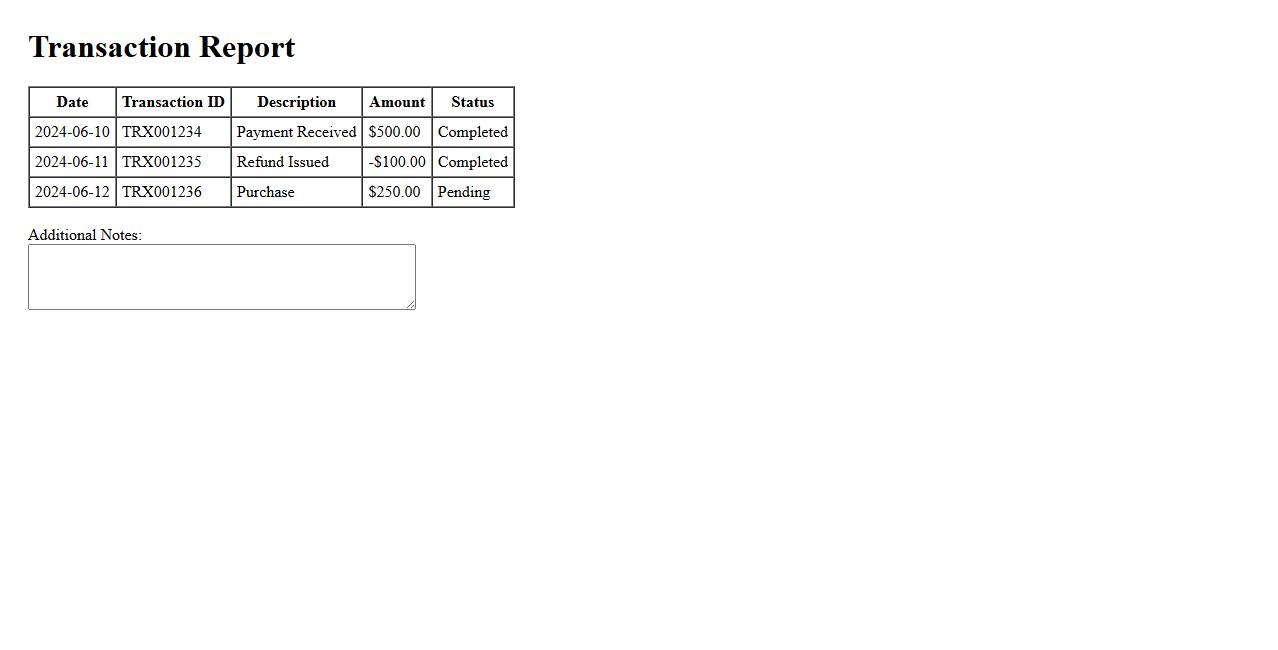

Transaction Report

The Transaction Report provides a detailed summary of all financial activities within a specified period. It allows users to track payments, deposits, and withdrawals efficiently. This report is essential for accurate accounting and financial analysis.

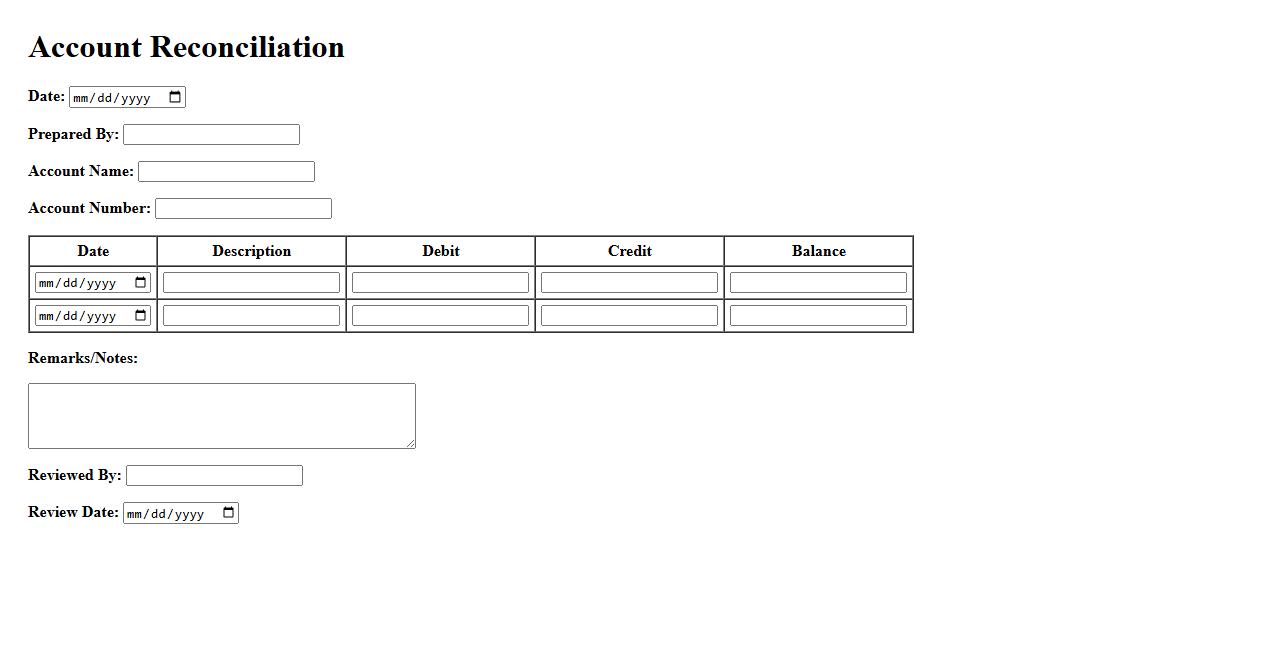

Account Reconciliation

Account Reconciliation is the process of ensuring the accuracy and consistency of financial records by comparing internal accounts against external statements. This crucial task helps identify discrepancies, errors, and potential fraud, maintaining the integrity of financial data. Timely account reconciliation supports informed decision-making and accurate financial reporting.

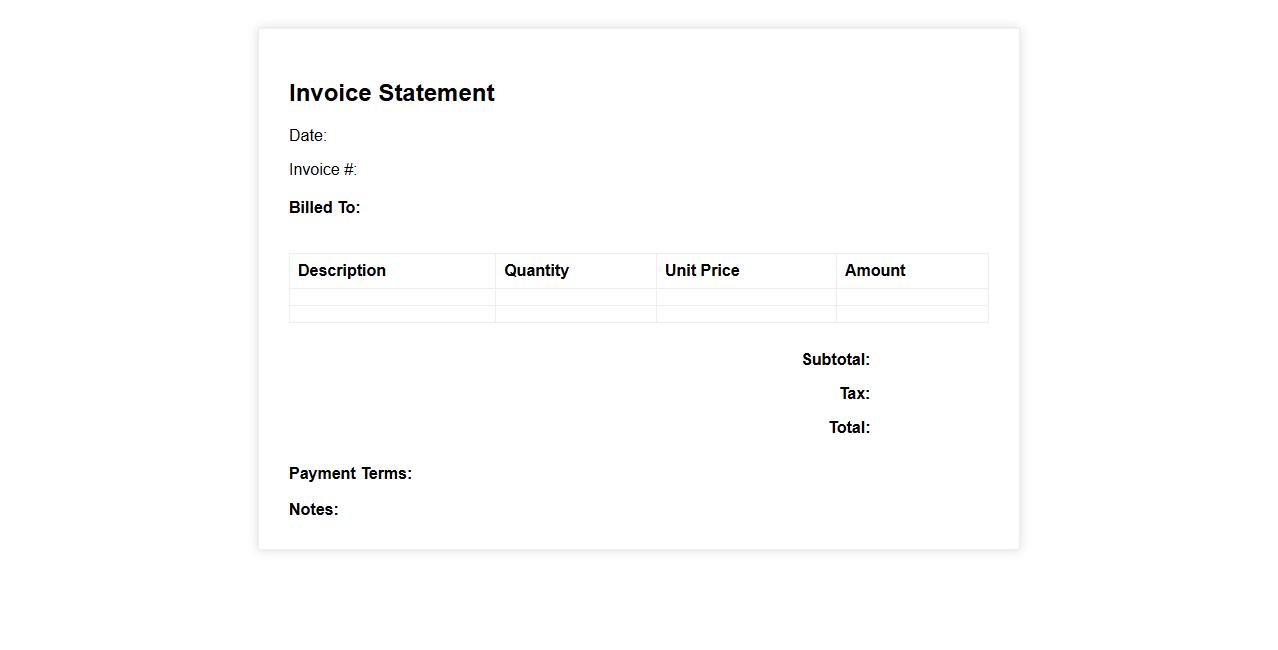

Invoice Statement

An Invoice Statement is a detailed document outlining the transactions between a buyer and a seller. It summarizes outstanding invoices, payments made, and any balances due. This statement helps both parties track financial activity and ensure accurate payment records.

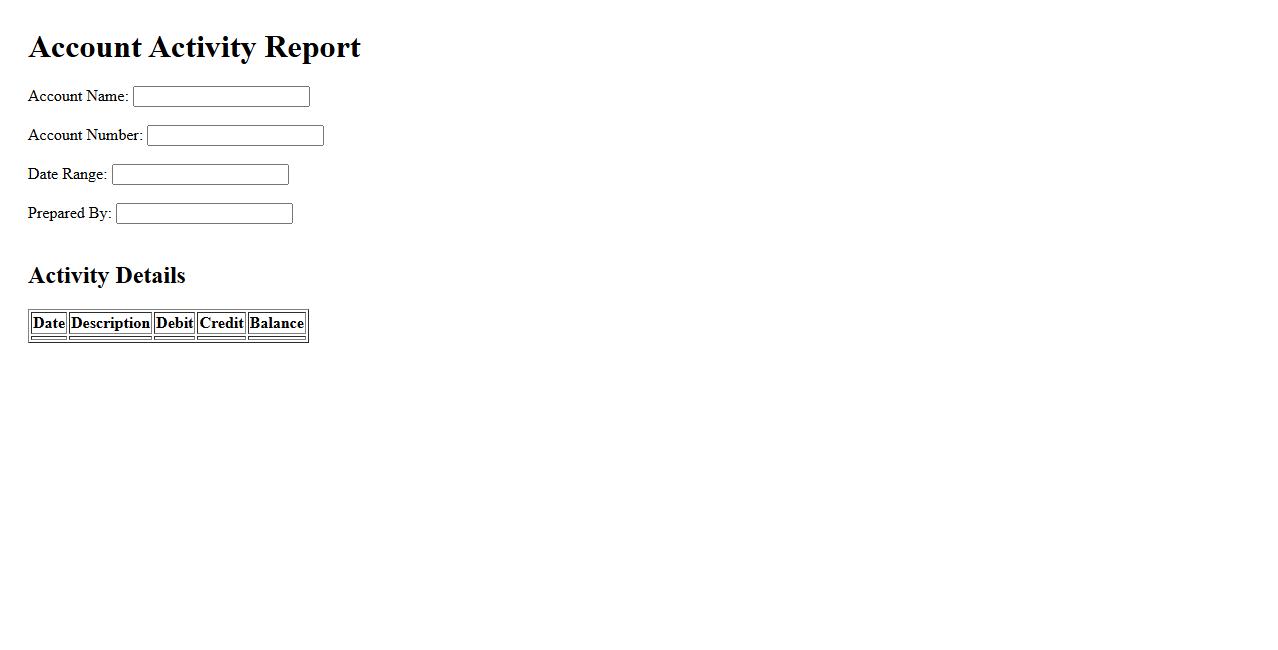

Account Activity Report

The Account Activity Report provides a detailed summary of all transactions and updates within an account over a specific period. It helps users monitor their financial activities, identify discrepancies, and track spending patterns. This report is essential for maintaining accurate records and ensuring transparency.

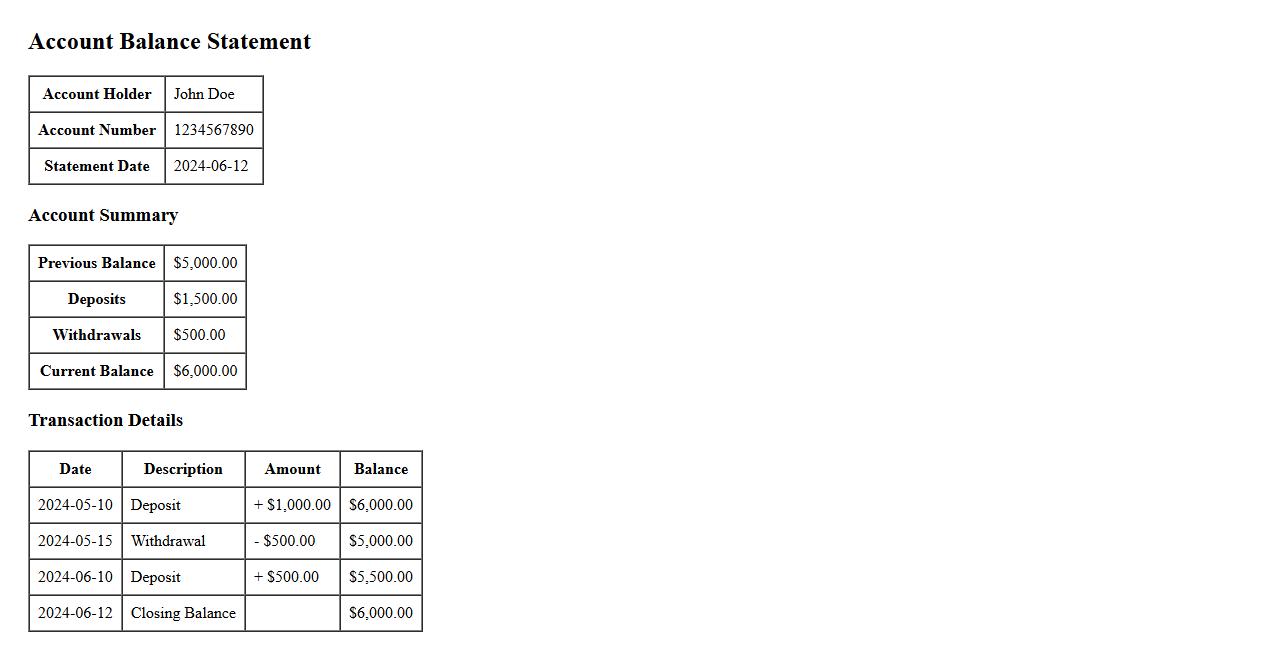

Account Balance Statement

An Account Balance Statement provides a detailed overview of the current status of a financial account, outlining all transactions and the resulting balance. It helps individuals or businesses track income, expenses, and available funds. Regularly reviewing the statement ensures accurate financial management and aids in budgeting decisions.

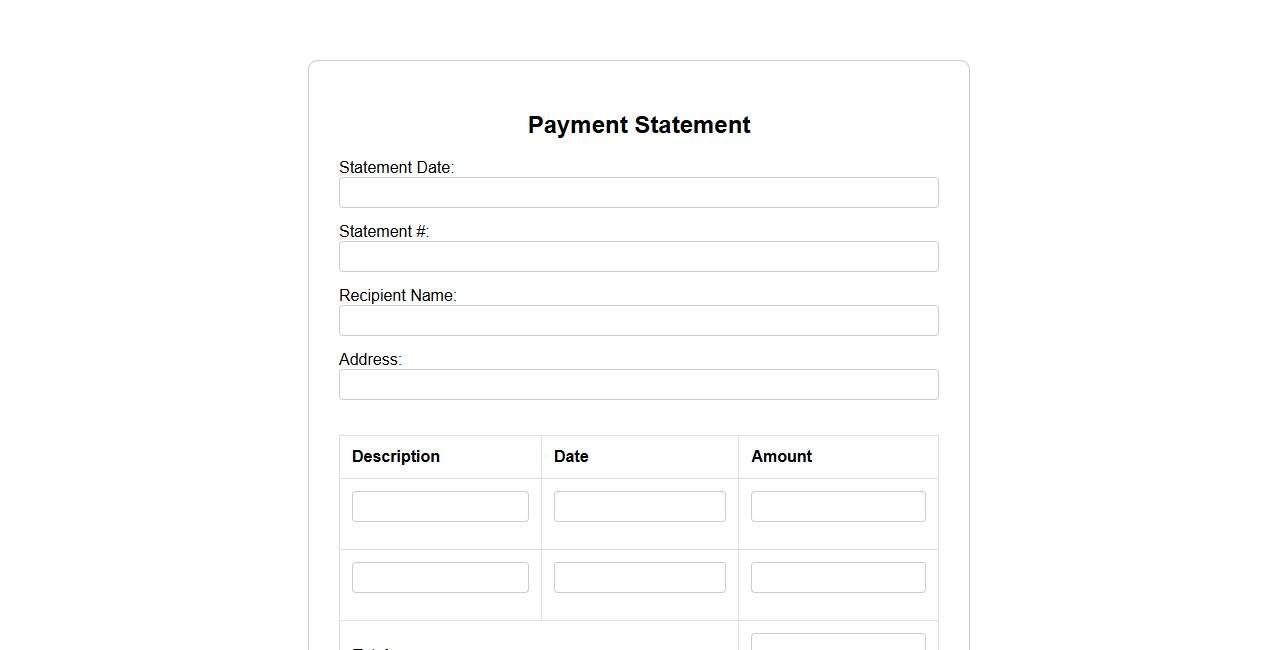

Payment Statement

A Payment Statement is a detailed document outlining all transactions made during a specific period. It provides clarity on amounts paid, due dates, and payment methods. This statement ensures transparency and aids in financial record keeping for both parties.

What is the primary purpose of a Statement of Account?

The primary purpose of a Statement of Account is to provide a summary of financial transactions between a business and its customer. It helps in tracking outstanding balances and recent payments. This document ensures transparency and clarity in financial dealings.

Which key details are typically included in a Statement of Account?

A Statement of Account typically includes key details such as transaction dates, invoice numbers, payment amounts, and outstanding balances. It also lists the names of the parties involved and the billing period covered. These details ensure accurate financial records and easy reference.

How does a Statement of Account facilitate financial reconciliation?

A Statement of Account facilitates financial reconciliation by providing a clear record of all transactions, allowing both parties to verify and match payments against invoices. It helps identify discrepancies or unpaid invoices promptly. This process ensures accurate accounting and prevents disputes.

Who are the intended recipients of a Statement of Account?

The intended recipients of a Statement of Account are typically customers or clients of a business. It may also be sent to internal finance departments for record-keeping and review. Ensuring the right recipients helps maintain clear communication regarding financial status.

How frequently should a Statement of Account be generated or issued?

A Statement of Account should be generated on a regular basis, often monthly, depending on the agreement between parties. Frequent statements promote timely payment and accurate record reconciliation. The timing may vary based on business needs and transaction volume.