A Statement of Non-Residency is an official document confirming that an individual or entity does not reside in a particular jurisdiction for tax purposes. This statement is often required by financial institutions or tax authorities to establish tax obligations or exemptions. It helps prevent double taxation by verifying residency status for international tax compliance.

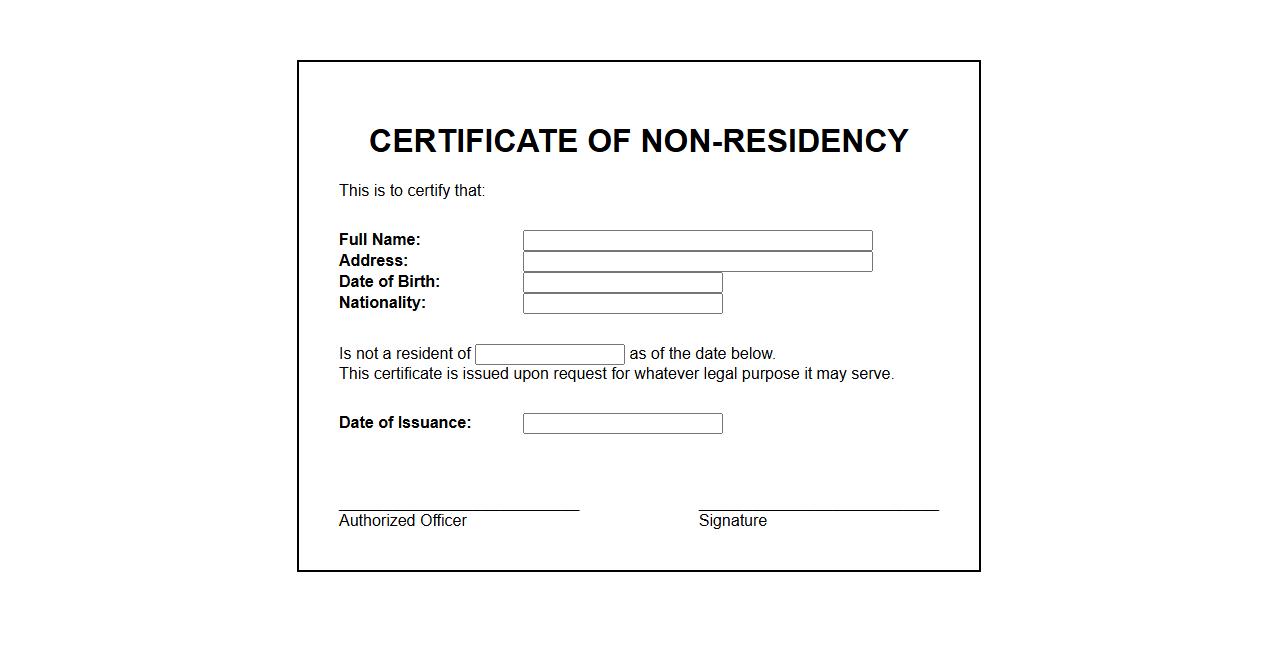

Certificate of Non-Residency

The Certificate of Non-Residency is an official document issued to confirm that an individual or entity does not reside within a specific jurisdiction. It is often required for tax purposes or legal matters to establish non-resident status. This certificate helps in clarifying tax obligations and eligibility for certain benefits.

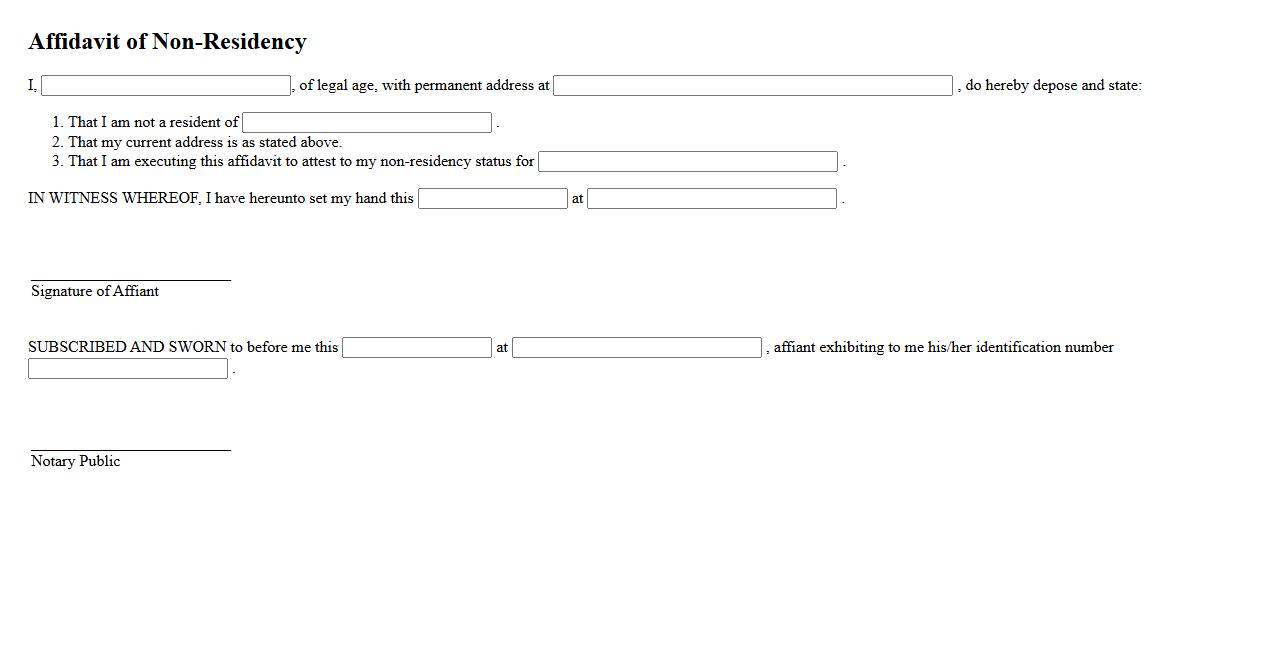

Affidavit of Non-Residency

An Affidavit of Non-Residency is a legal document used to declare that an individual does not reside in a particular jurisdiction. This affidavit is often required for tax or legal purposes to establish the person's residency status. It ensures compliance with specific regulations by providing formal proof of non-residency.

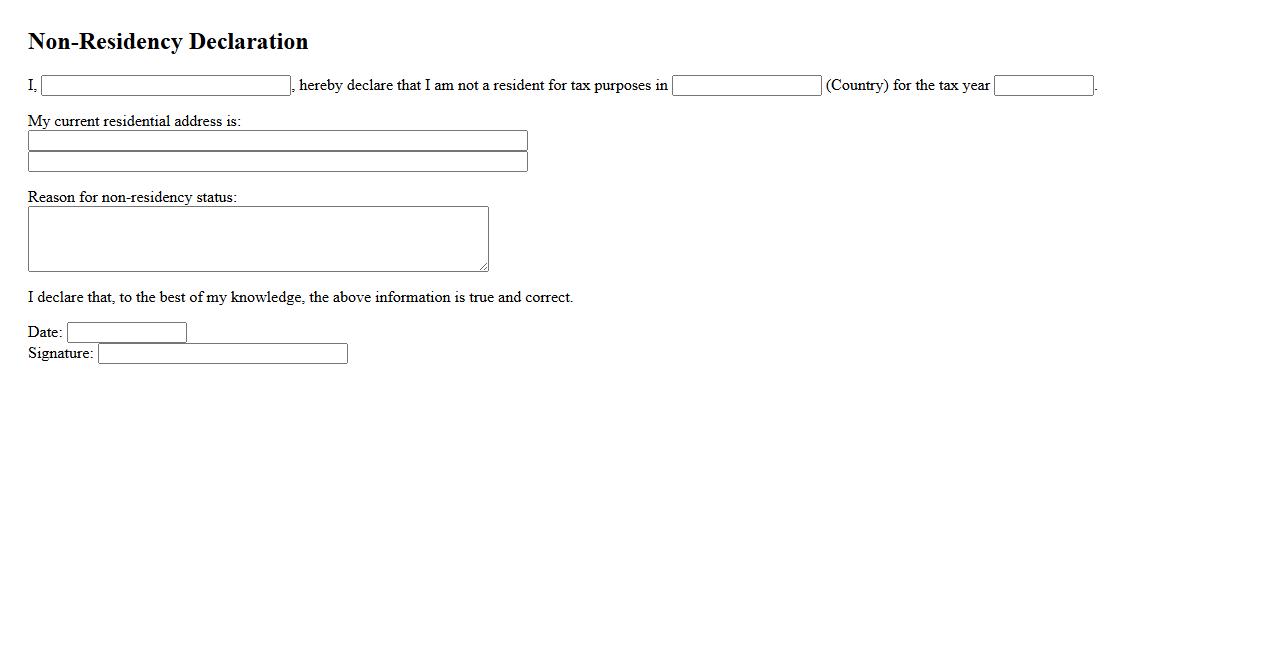

Non-Residency Declaration

The Non-Residency Declaration is an official document used to confirm an individual's status as a non-resident for legal or tax purposes. It helps authorities determine applicable regulations and tax obligations. Accurate submission of this declaration ensures compliance with relevant laws and can prevent unnecessary penalties.

Non-Resident Statement

The Non-Resident Statement is a crucial document used to report income earned by individuals or entities residing outside the country. It ensures proper tax compliance and accurate financial disclosures for non-residents. This statement helps streamline international tax regulations and prevent tax evasion.

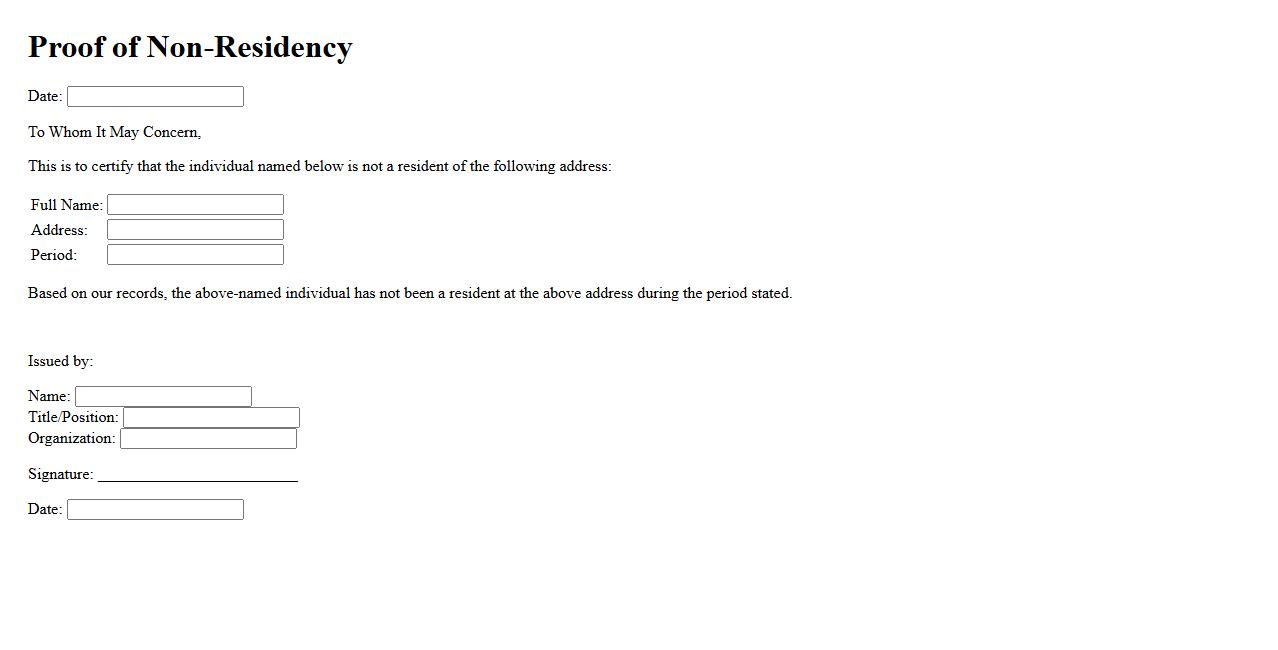

Proof of Non-Residency

Proof of Non-Residency is a vital document used to confirm an individual's status as a non-resident in a specific country or region. This certification is essential for tax purposes, legal matters, and eligibility for certain benefits or exemptions. Obtaining valid proof helps ensure compliance with international laws and regulations.

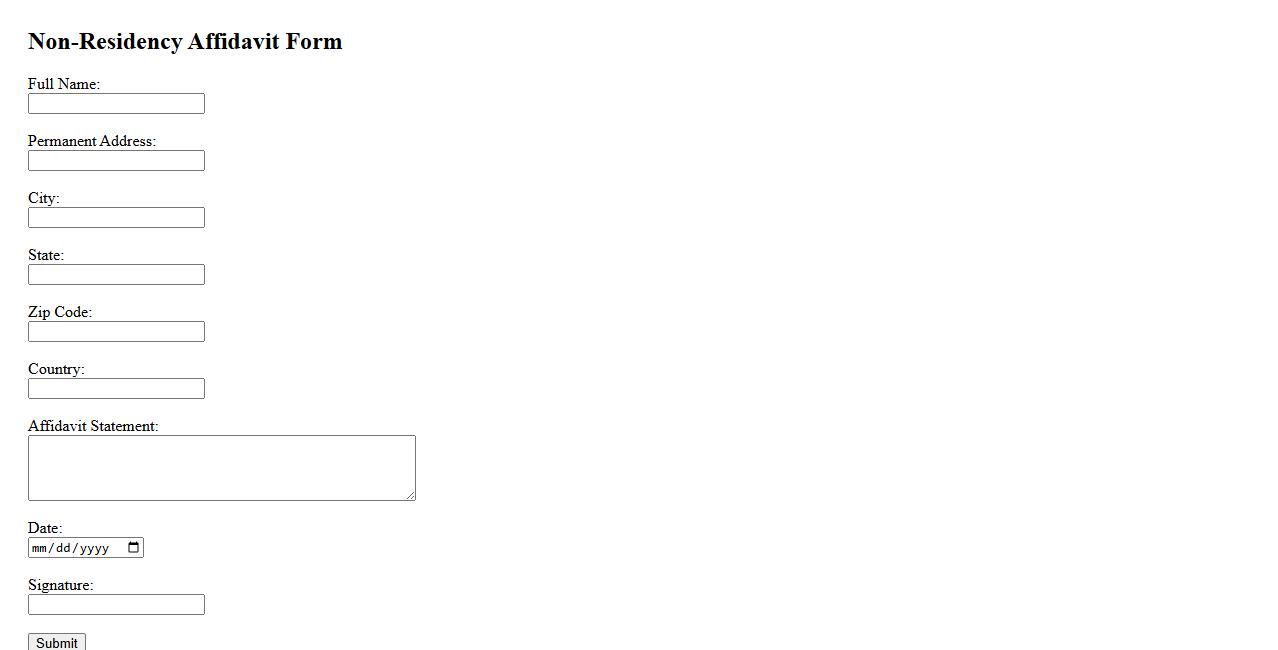

Non-Residency Affidavit Form

The Non-Residency Affidavit Form is a legal document used to declare an individual's non-resident status within a specific jurisdiction. This form is essential for tax, legal, or educational purposes to verify that a person does not reside in a particular area. Proper completion of the affidavit ensures accurate processing of residency-related claims and benefits.

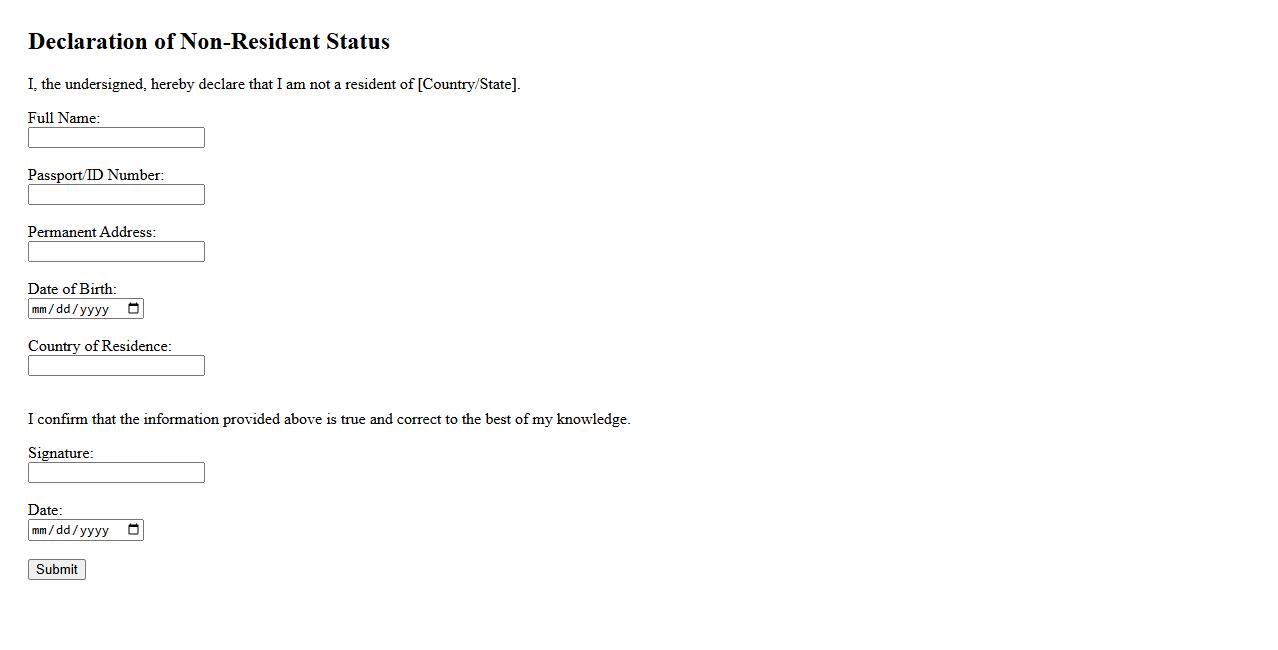

Declaration of Non-Resident Status

The Declaration of Non-Resident Status is a formal document used to confirm an individual's residency status for tax or legal purposes. It helps authorities determine the applicable regulations and obligations for non-residents. This declaration is essential for ensuring proper compliance with local laws and avoiding unnecessary taxation.

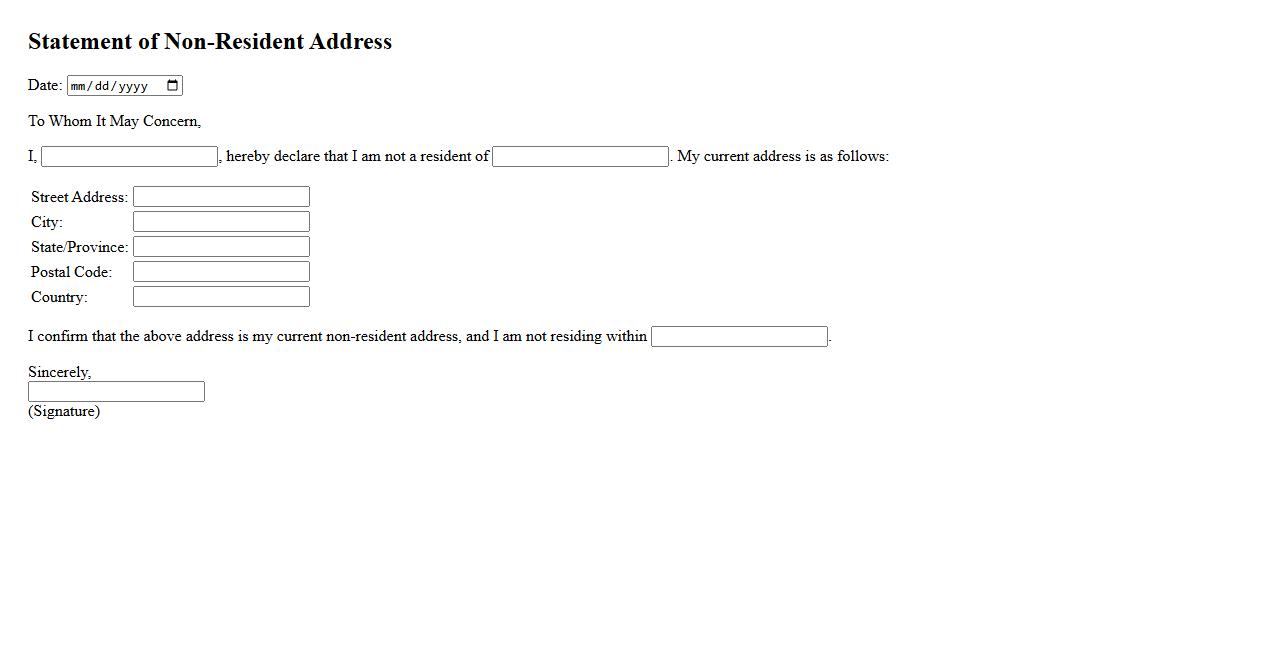

Statement of Non-Resident Address

A Statement of Non-Resident Address is an official document used to confirm an individual's residential address outside the country of origin. It is often required for legal, financial, or administrative purposes to verify the person's foreign residency status. This statement helps establish compliance with jurisdictional requirements and supports accurate record-keeping.

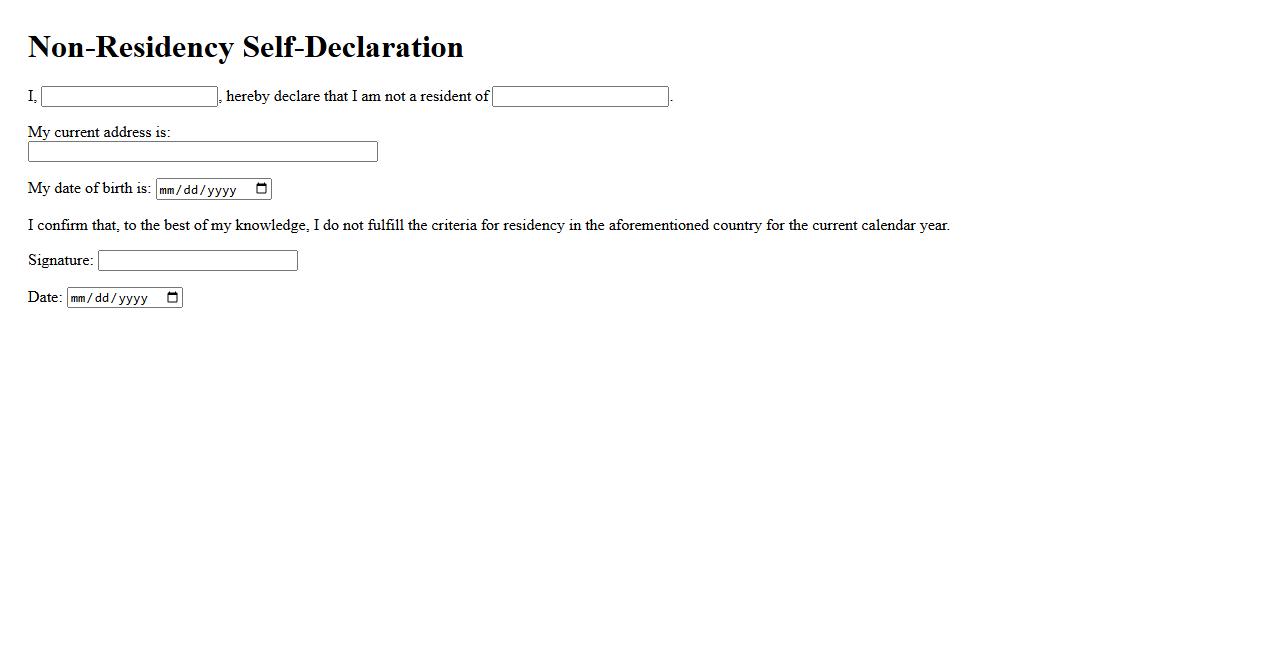

Non-Residency Self-Declaration

The Non-Residency Self-Declaration is an essential document used to confirm an individual's tax residency status outside a particular country. It helps financial institutions and authorities verify compliance with international tax laws. Accurate completion of this declaration ensures proper reporting and avoids potential legal complications.

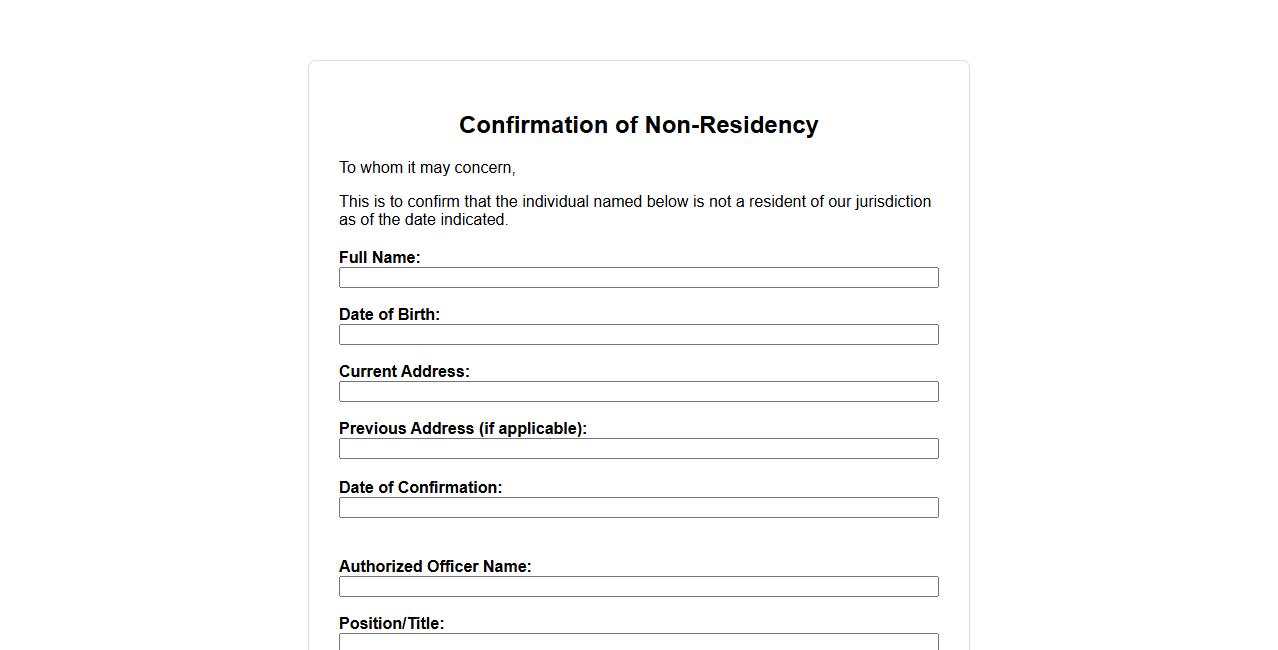

Confirmation of Non-Residency

The Confirmation of Non-Residency is an official document that verifies an individual's or entity's tax status outside a specific jurisdiction. It is essential for avoiding double taxation and ensuring compliance with international tax regulations. This confirmation helps streamline financial transactions and supports accurate tax reporting.

What criteria determine an individual's non-residency status for this document?

Non-residency status is determined primarily by the individual's physical presence in a specific country within a given tax year. It also considers factors such as permanent home and center of vital interests. Meeting the required conditions under relevant tax treaties or local laws confirms non-residency.

Which timeframes or periods are relevant for establishing non-residency in the statement?

The key period for establishing non-residency is the tax year or fiscal year specified in the declaration. Specific days of presence or absence within this timeframe are crucial. Additionally, any relevant look-back periods mandated by tax authorities must be considered.

What type of evidence or documentation must accompany a Statement of Non-Residency?

Supporting documentation usually includes official residence certificates or proof of address in another country. Copies of tax returns filed as a non-resident may be required. Other relevant documents could be travel records or employer attestations verifying the individual's status.

How does the Statement of Non-Residency impact taxation or legal obligations?

The Statement of Non-Residency can relieve the individual from domestic taxation on global income in the issuing country. It helps avoid double taxation under applicable tax treaties. The document also clarifies legal responsibilities regarding tax reporting and withholding obligations.

Who is authorized to issue, sign, or validate the Statement of Non-Residency?

The issuing authority is typically a tax office or government agency responsible for residency determinations. In some cases, authorized representatives such as certified tax professionals may sign the statement. Validation often requires official stamps or seals to confirm authenticity.