A Statement of Beneficiary is a formal document that designates individuals or entities entitled to receive assets or benefits from an account, insurance policy, or trust. It ensures the clear transfer of ownership or benefits according to the account holder's wishes. This statement helps prevent confusion or disputes among potential beneficiaries.

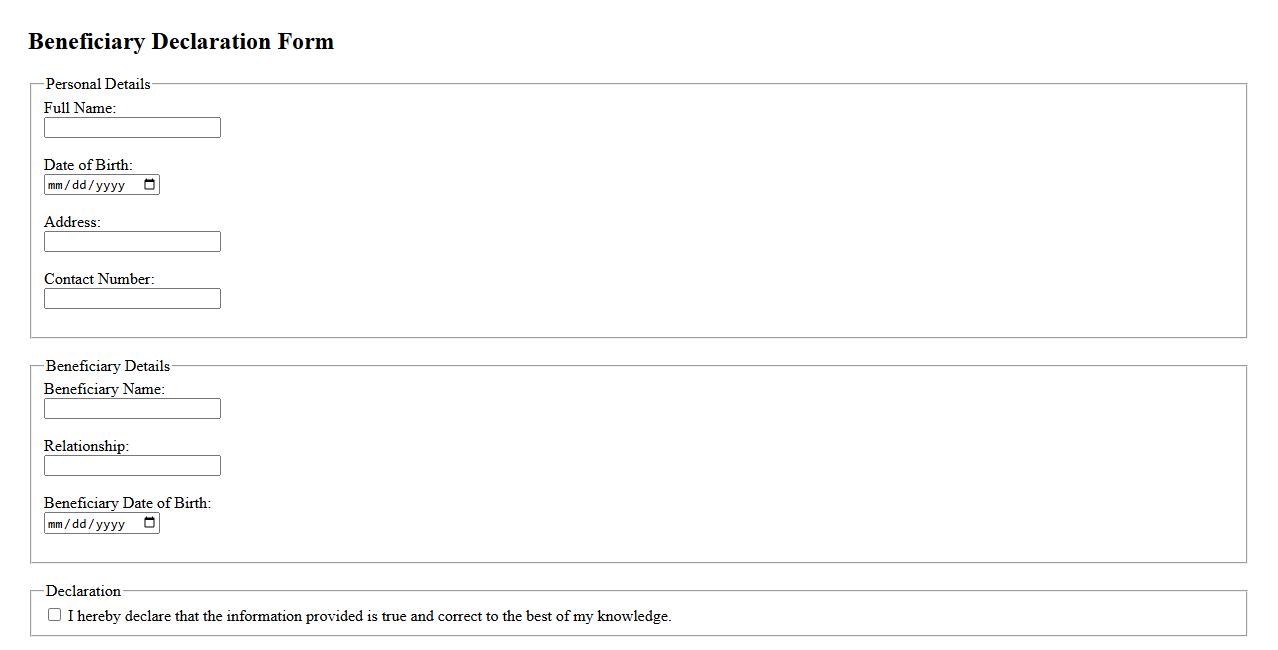

Beneficiary Declaration Form

The Beneficiary Declaration Form is a crucial document used to designate individuals or entities entitled to receive benefits from a policy or account. It ensures that the assets are distributed according to the account holder's wishes, providing clarity and legal recognition. This form is essential for smooth claim processing and avoiding disputes among potential beneficiaries.

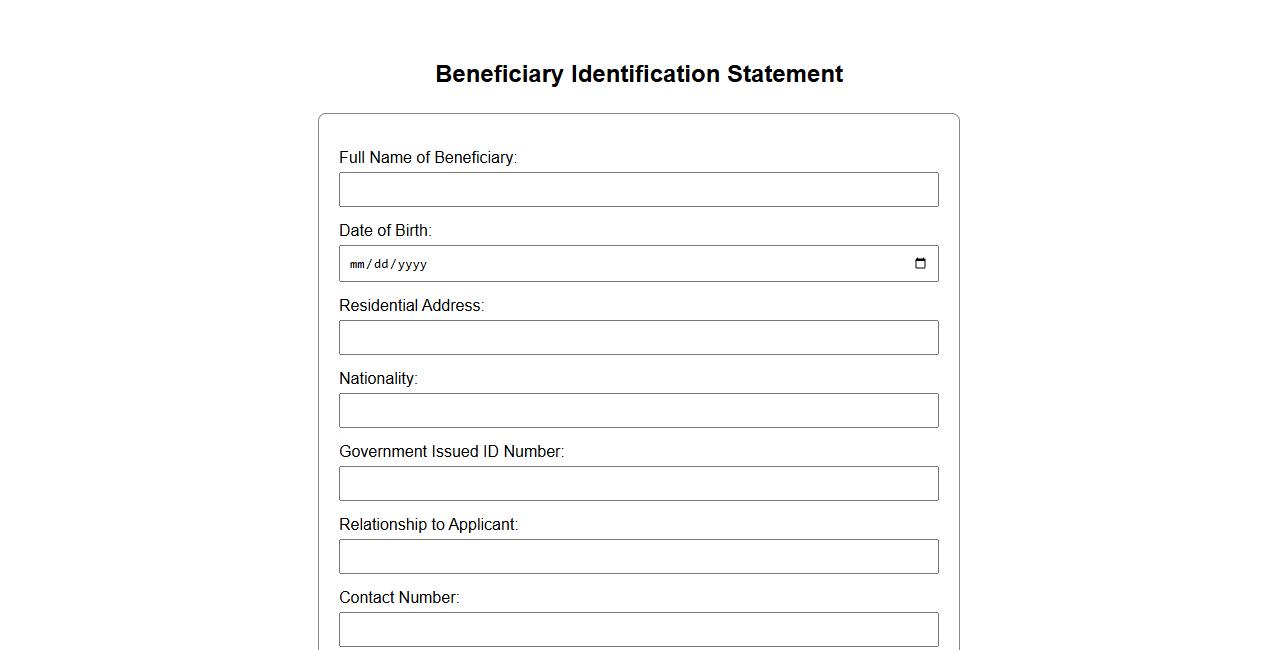

Beneficiary Identification Statement

The Beneficiary Identification Statement is a crucial document used to verify and confirm the identity of beneficiaries in legal and financial transactions. It ensures that the correct individuals receive designated assets or benefits. Accurate identification helps prevent fraud and simplifies the distribution process.

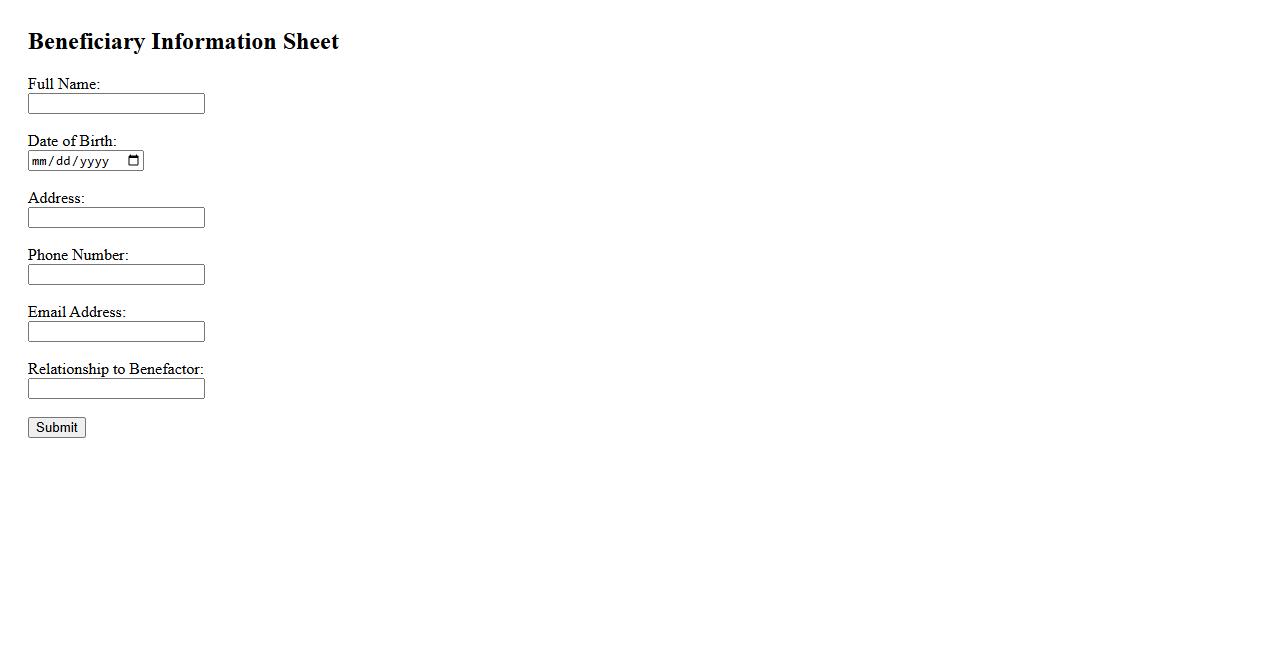

Beneficiary Information Sheet

The Beneficiary Information Sheet provides essential details about individuals entitled to receive benefits. It helps ensure accurate and timely distribution of funds or services. This document is crucial for maintaining up-to-date records and facilitating communication with beneficiaries.

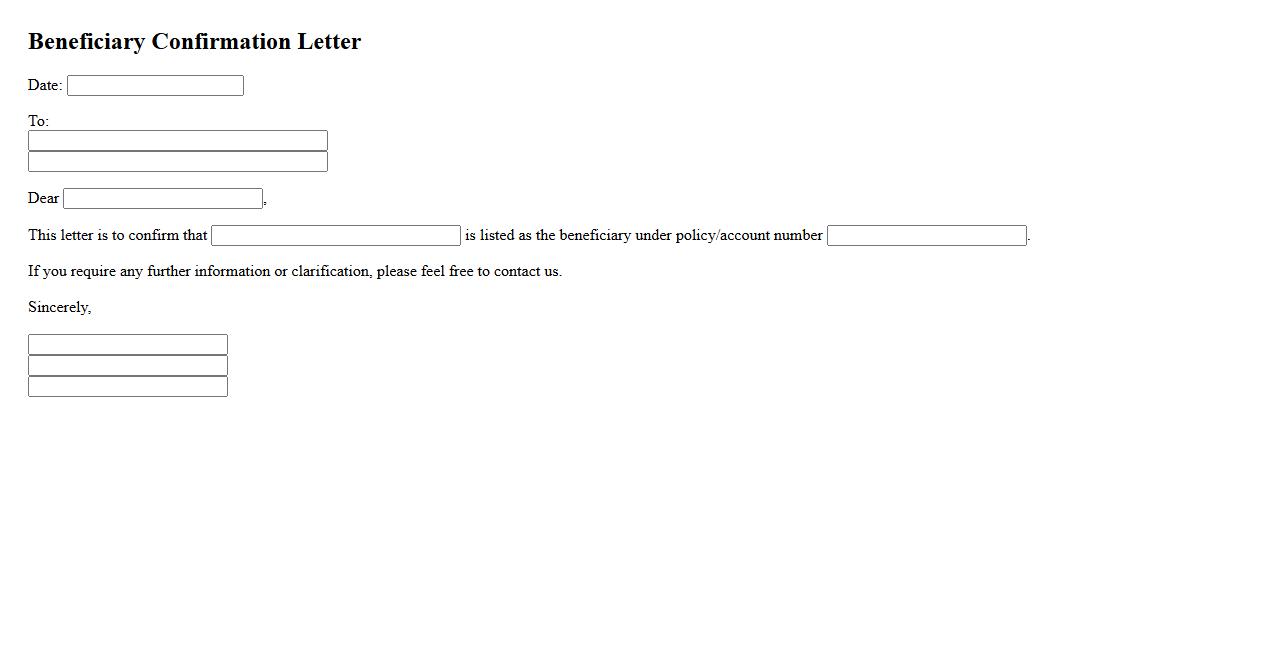

Beneficiary Confirmation Letter

A Beneficiary Confirmation Letter is an official document used to verify the identity and details of a beneficiary before proceeding with the disbursement of funds or assets. This letter ensures that the rightful recipient is acknowledged and minimizes the risk of fraud or miscommunication. It is commonly required by banks, insurance companies, and legal entities during inheritance or claim settlements.

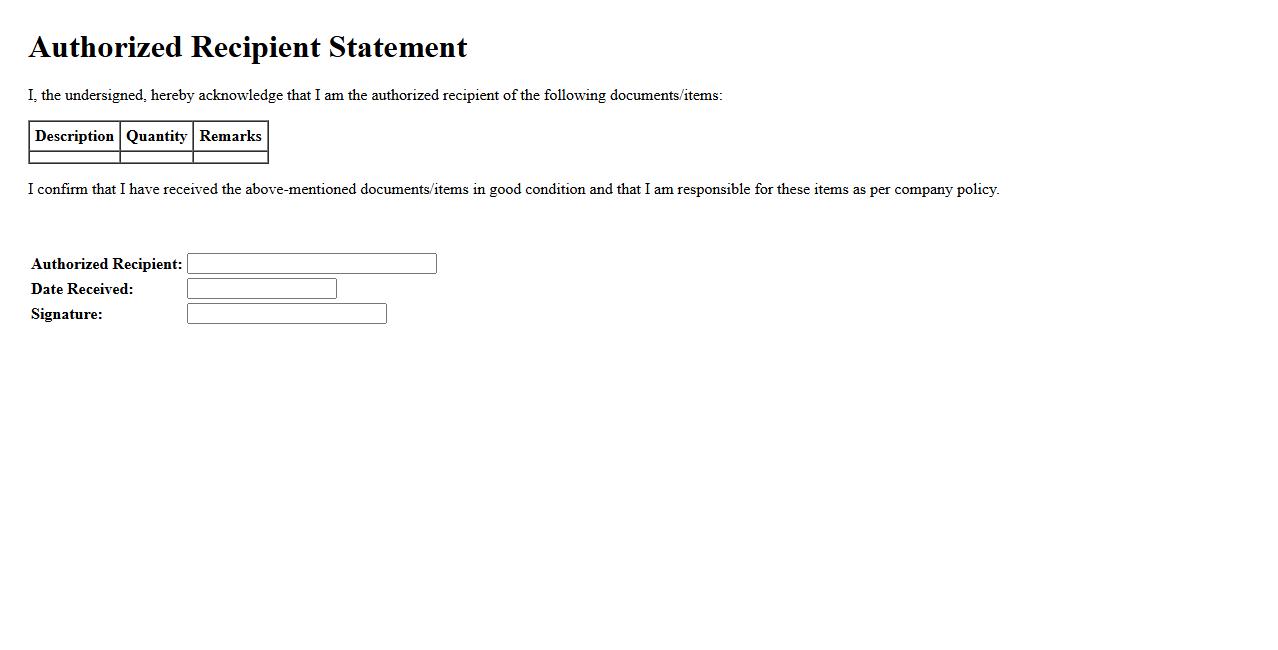

Authorized Recipient Statement

The Authorized Recipient Statement is a formal document that grants permission to a designated individual to receive specific information or materials on behalf of another party. This statement ensures clear authorization and helps maintain privacy and security standards. It is commonly used in legal, medical, and business contexts to verify the recipient's legitimacy.

Beneficiary Details Record

The Beneficiary Details Record contains essential information about individuals or entities designated to receive benefits, ensuring accurate and timely distribution. It includes personal identification, contact information, and the nature of their entitlement. Maintaining precise beneficiary records helps uphold transparency and legal compliance in benefit management.

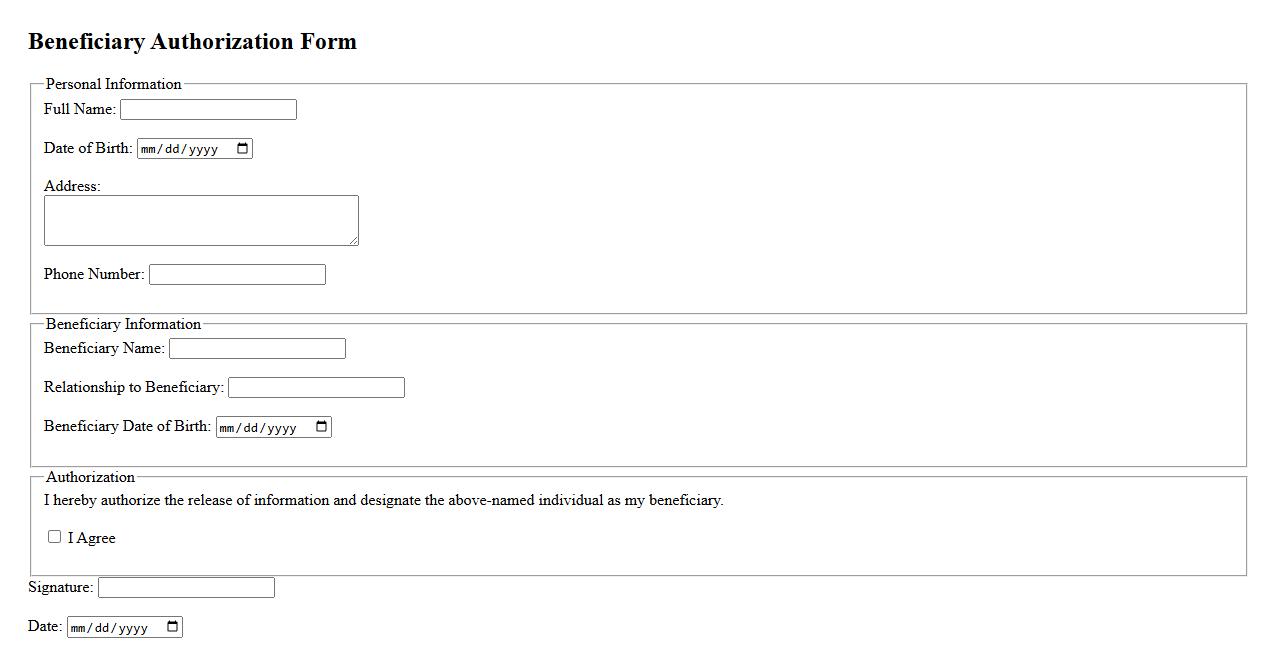

Beneficiary Authorization Form

The Beneficiary Authorization Form is a crucial document used to designate individuals who are entitled to receive benefits from a policy or account. It ensures that the rightful beneficiaries are clearly identified and protected. Completing this form accurately helps prevent disputes and facilitates smooth processing of claims.

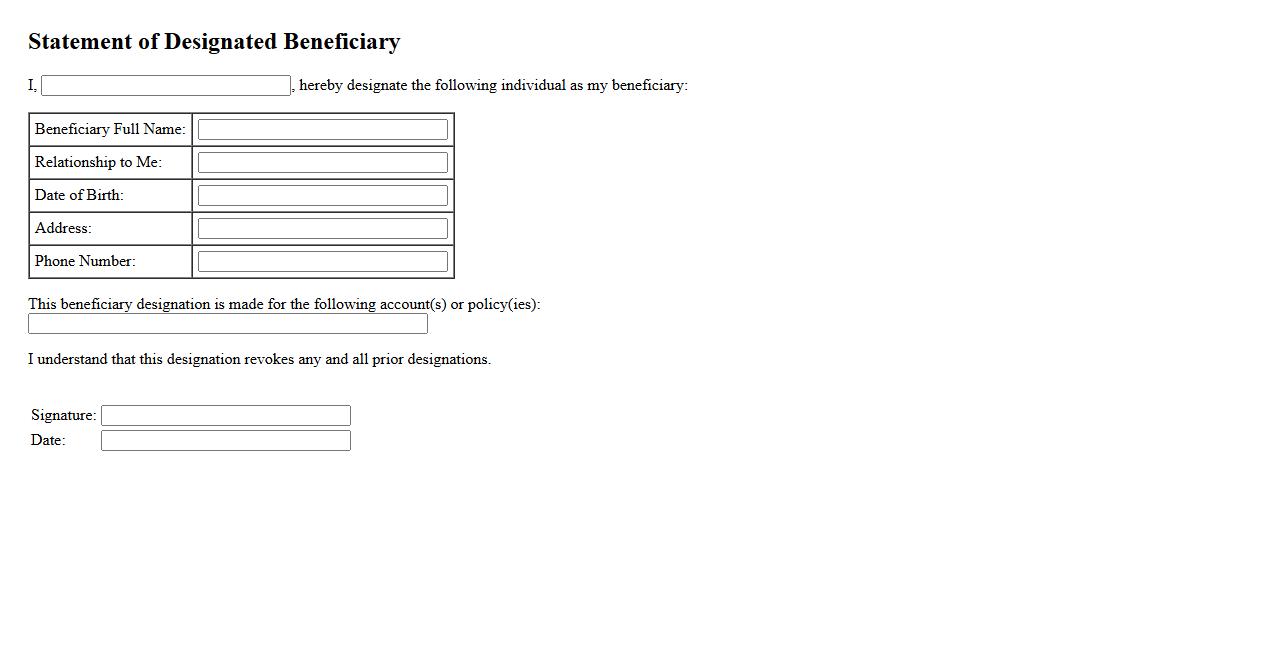

Statement of Designated Beneficiary

The Statement of Designated Beneficiary is a crucial document that specifies who will receive benefits from a financial account or insurance policy in the event of the account holder's death. This statement ensures that the designated individuals are clearly identified to avoid any legal complications. It provides clarity and security for both account holders and beneficiaries.

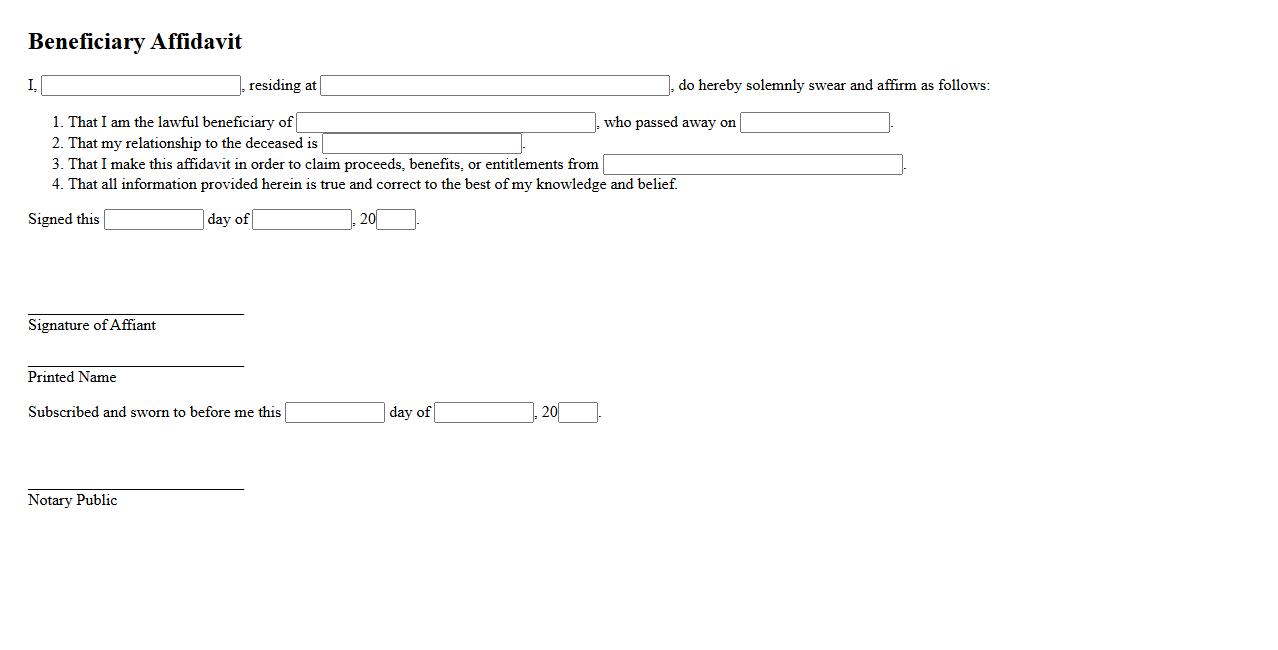

Beneficiary Affidavit

A Beneficiary Affidavit is a legal document used to declare the rightful recipient of assets from an estate. It helps in verifying and claiming the inheritance without court intervention. This affidavit ensures a smooth transfer of property to the designated beneficiary.

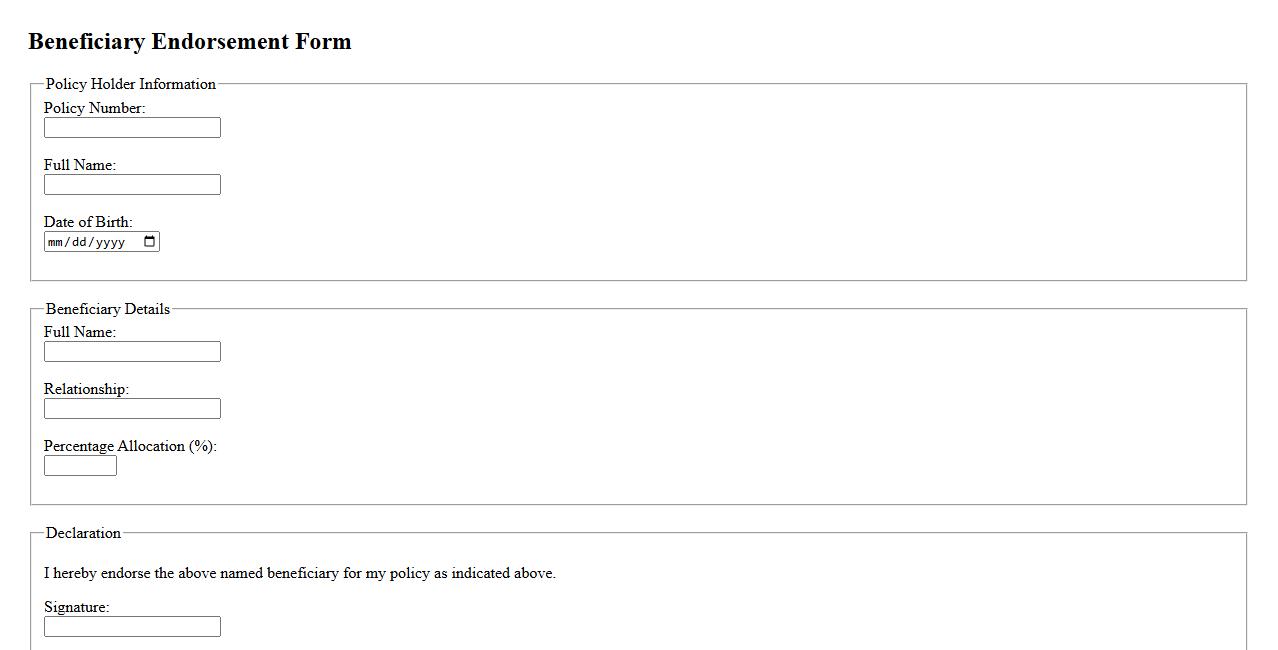

Beneficiary Endorsement Form

The Beneficiary Endorsement Form is a crucial document used to update or confirm the beneficiary details associated with an account or policy. It ensures that the designated individuals receive the benefits as intended by the account holder or policy owner. Proper completion and submission of this form is essential for accurate record-keeping and benefit disbursement.

What information must be included in a valid Statement of Beneficiary document?

A valid Statement of Beneficiary must include the full name of the beneficiary to ensure clear identification. It should also specify the relationship to the deceased or policyholder, if applicable, to establish eligibility. Additionally, the document must detail the specific assets or benefits assigned to the named beneficiary.

How can the authenticity of a Statement of Beneficiary be verified?

The authenticity of a Statement of Beneficiary can be verified by checking for official signatures and notarization to confirm its legitimacy. Reviewing the document against the original insurance policy or asset agreement ensures consistency. Furthermore, contacting the issuing institution or legal entity helps confirm the statement's validity.

In what situations is a Statement of Beneficiary legally required or accepted?

A Statement of Beneficiary is legally required during the distribution of insurance proceeds after the policyholder's death. It is also accepted when transferring ownership of retirement accounts or certain investment assets. Courts and financial institutions rely on this document to confirm rightful recipients of designated assets.

Who is authorized to issue or amend a Statement of Beneficiary?

The policyholder or account owner is primarily authorized to issue or amend a Statement of Beneficiary. Sometimes, the issuing organization, such as an insurance company or financial institution, facilitates the documentation process. Amendments must typically follow formal procedures and may require notarization or legal approval.

What are the legal implications and responsibilities of being named in a Statement of Beneficiary?

Being named as a beneficiary establishes a legal right to receive specified assets or benefits after the policyholder's death. It may also impose fiduciary duties if the beneficiary acts as a trustee or executor. Additionally, beneficiaries should be aware of tax obligations and the need to provide documentation to claim the inheritance or benefits.