The Report of Foreign Bank and Financial Accounts (FBAR) is a mandatory filing required by the U.S. Treasury Department for U.S. persons holding financial interests or signature authority over foreign financial accounts exceeding $10,000 during the calendar year. This report helps prevent tax evasion by ensuring transparency of overseas assets. Failure to file the FBAR can result in severe penalties and legal consequences.

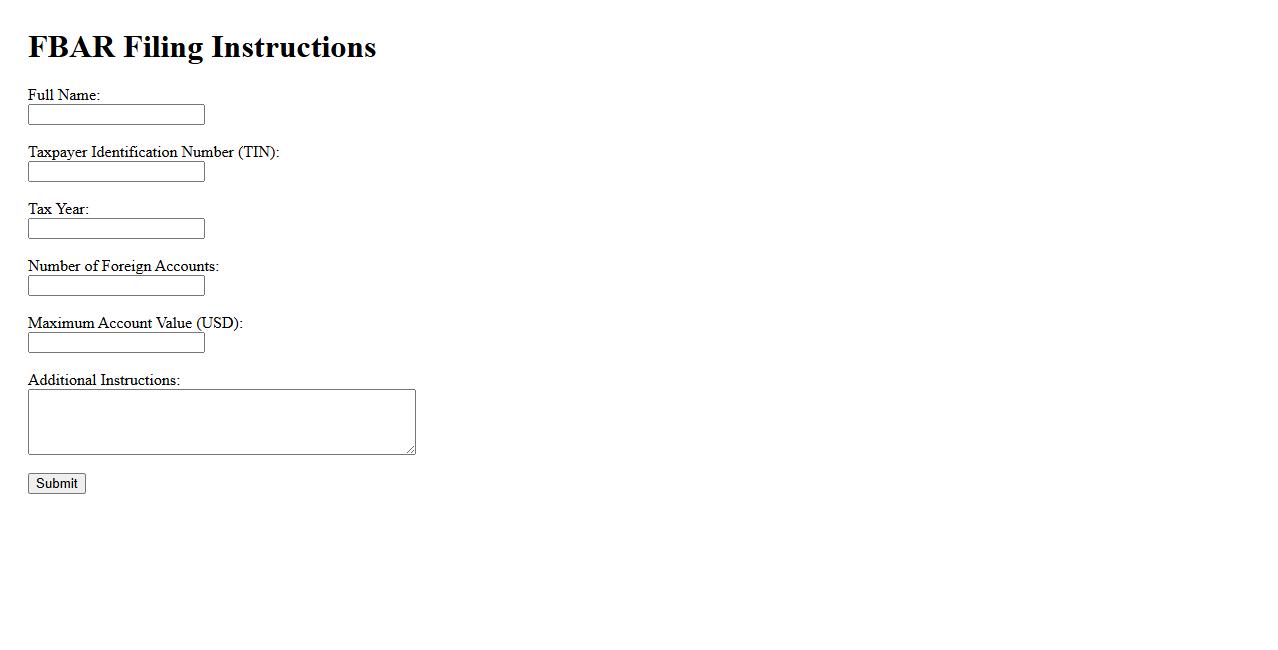

FBAR filing instructions

Filing the FBAR (Foreign Bank Account Report) is essential for U.S. taxpayers with foreign financial accounts exceeding $10,000. To comply, use FinCEN Form 114 and submit it electronically through the BSA E-Filing System by the April deadline. Accurate reporting helps avoid penalties and ensures adherence to IRS regulations.

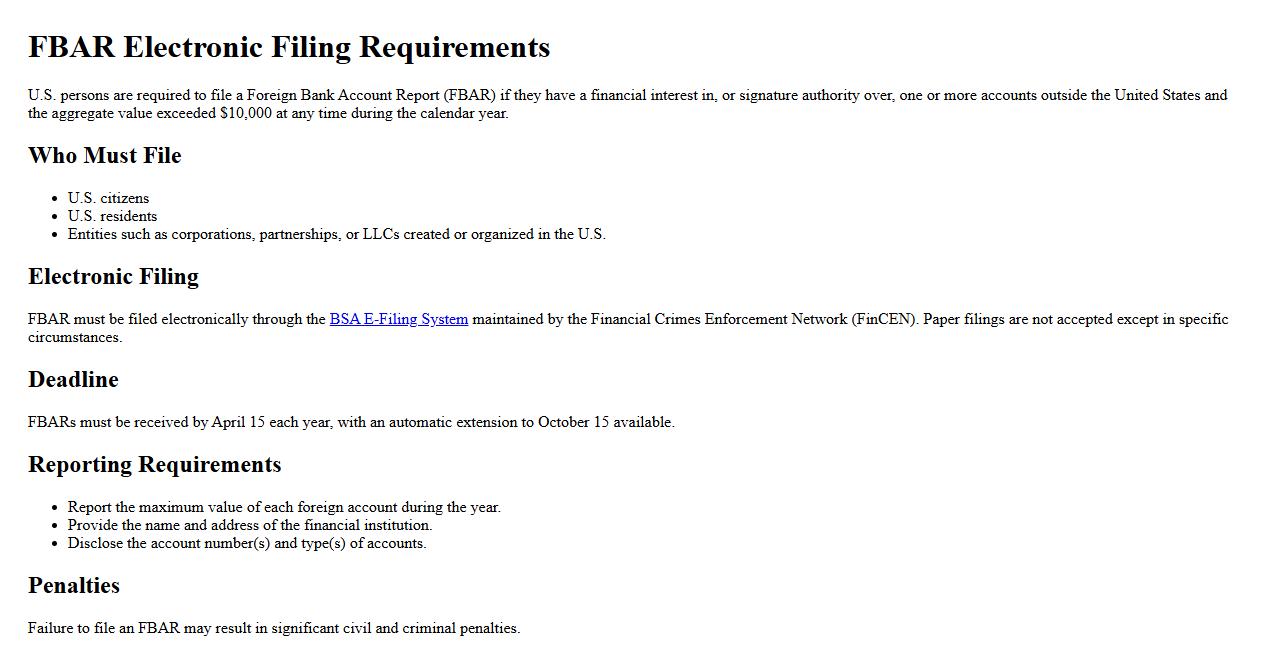

FBAR electronic filing requirements

The FBAR electronic filing requirements mandate that U.S. persons with foreign financial accounts exceeding $10,000 must file the Report of Foreign Bank and Financial Accounts (FBAR) electronically through the Financial Crimes Enforcement Network's BSA E-Filing System. This ensures timely and secure submission of sensitive financial information to prevent tax evasion. Failure to comply with these electronic filing rules can result in significant penalties.

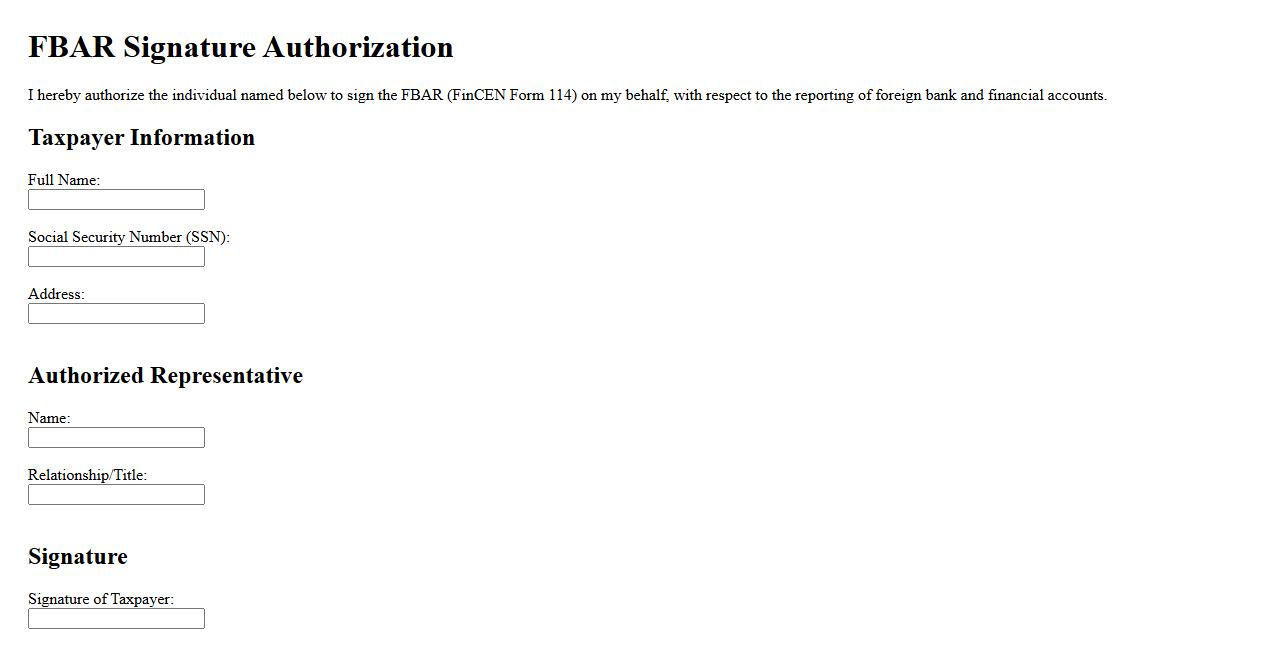

FBAR signature authorization

The FBAR signature authorization is a critical process allowing a designated individual to sign the Report of Foreign Bank and Financial Accounts on behalf of the filer. This authorization ensures compliance with U.S. Treasury Department regulations related to foreign financial assets. Proper signature authorization helps prevent filing errors and potential penalties.

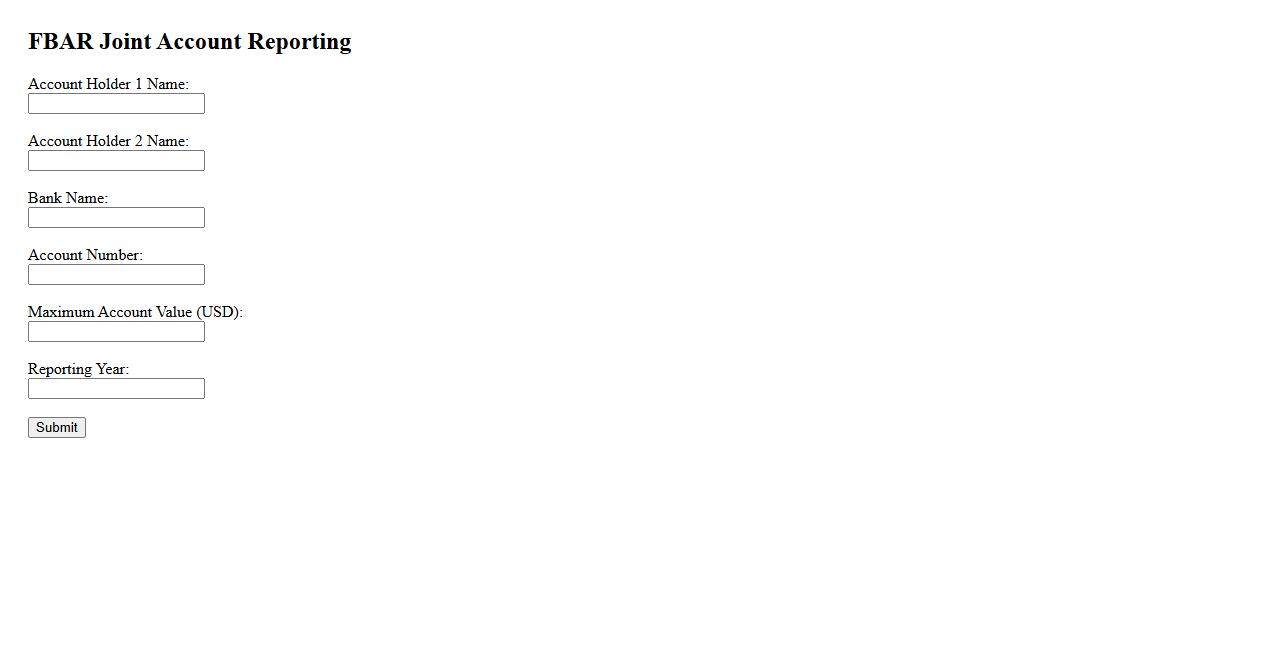

FBAR joint account reporting

Filing the FBAR joint account reporting is crucial for U.S. taxpayers holding financial interests in foreign accounts jointly. This requirement ensures transparency and compliance with IRS regulations to prevent tax evasion. Proper joint reporting helps avoid penalties and supports accurate tax filings.

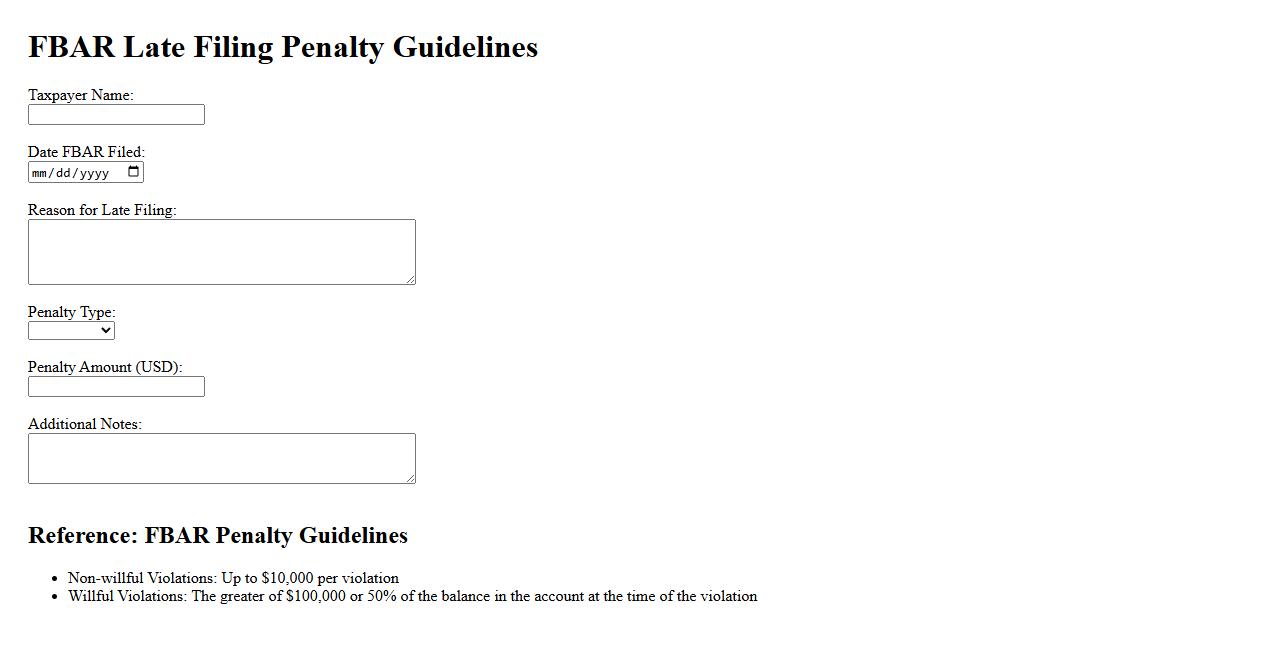

FBAR late filing penalty guidelines

The FBAR late filing penalty guidelines outline the consequences for failing to timely submit the Report of Foreign Bank and Financial Accounts. These penalties can be substantial, often based on whether the violation was willful or non-willful. Understanding these guidelines is crucial to avoid severe financial repercussions.

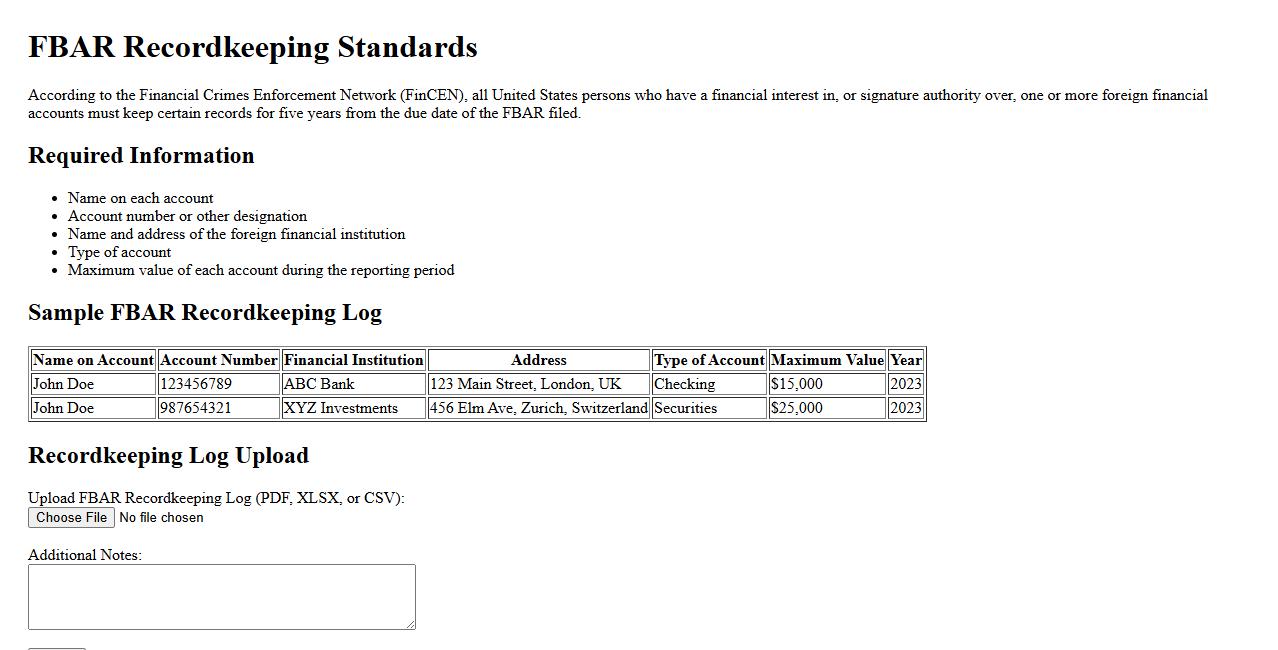

FBAR recordkeeping standards

The FBAR recordkeeping standards require U.S. taxpayers to maintain detailed records of foreign financial accounts. These standards ensure accurate reporting and compliance with the Bank Secrecy Act. Proper documentation helps prevent penalties and supports transparency in international financial activities.

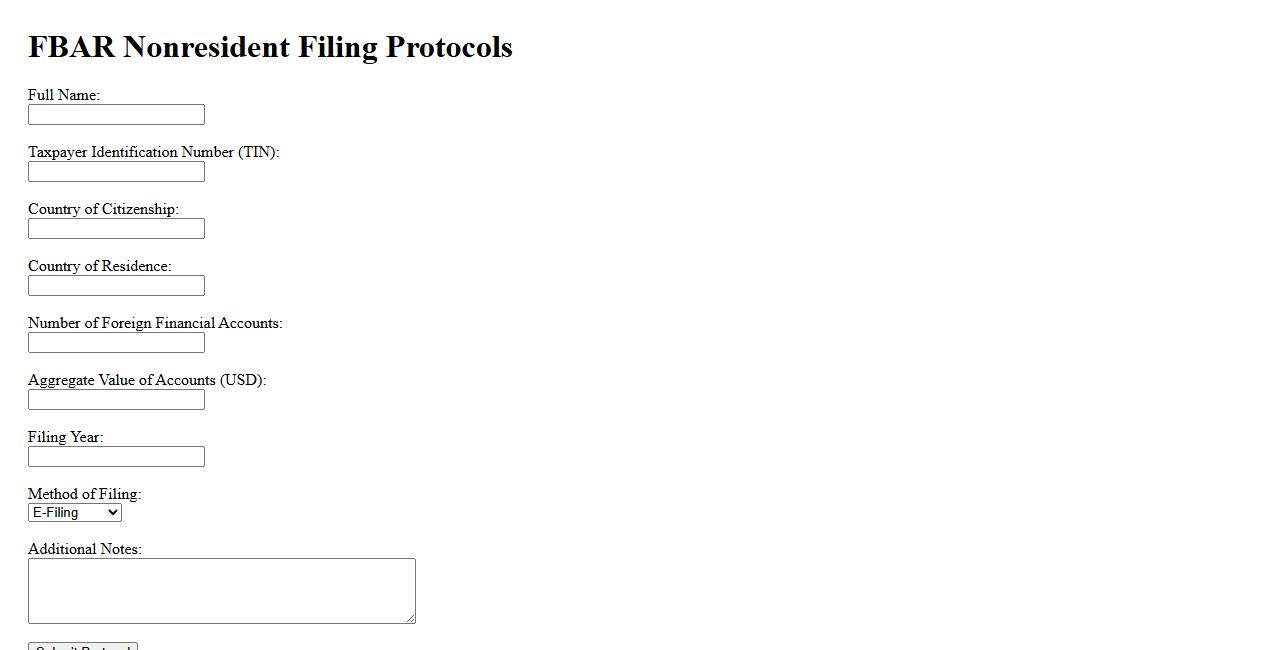

FBAR nonresident filing protocols

The FBAR nonresident filing protocols require foreign financial account holders who are non-U.S. residents to report their accounts if the aggregate value exceeds $10,000. These protocols ensure compliance with U.S. Treasury Department regulations to prevent tax evasion. Nonresidents must file the FBAR electronically using the FinCEN Form 114 by the designated deadline each year.

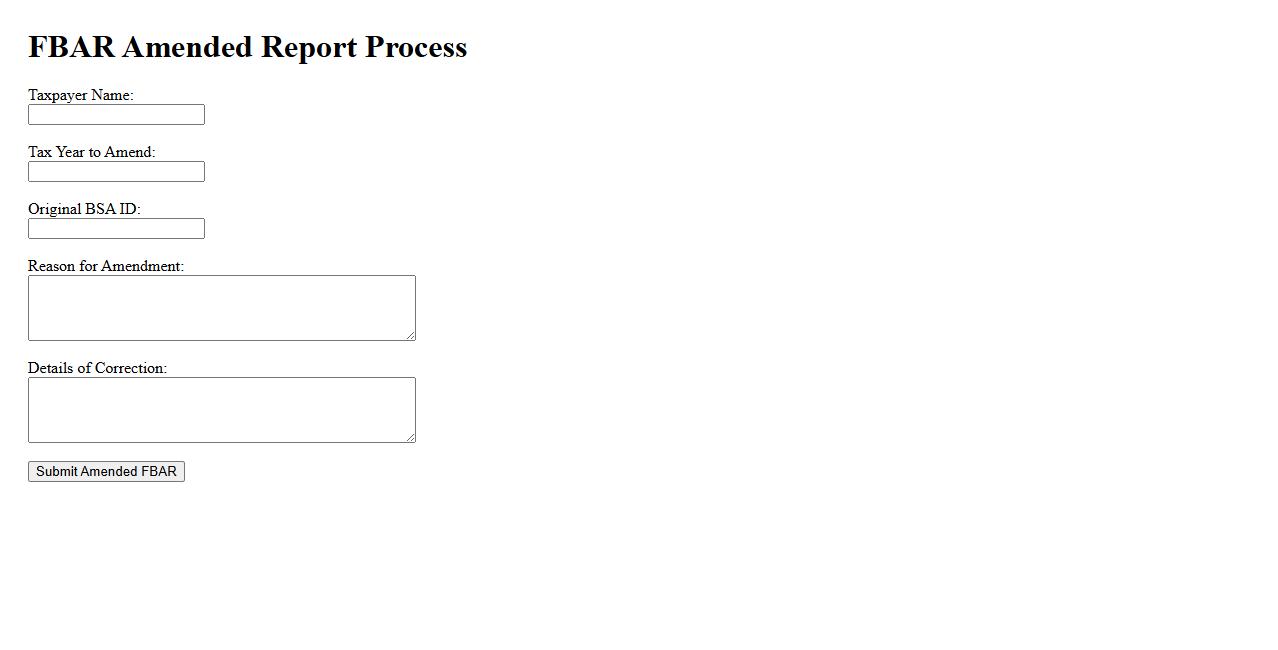

FBAR amended report process

The FBAR amended report process allows taxpayers to correct errors or omissions on previously filed Foreign Bank Account Reports. To amend an FBAR, individuals must submit a new report with accurate information, clearly marked as an amendment. This process ensures compliance with U.S. Treasury regulations and helps avoid potential penalties for incomplete disclosures.

FBAR maximum account value calculation

The FBAR maximum account value calculation is essential for determining the highest balance held in a foreign financial account during the calendar year. This value must be reported to comply with U.S. Treasury regulations and avoid penalties. Accurate calculation ensures proper disclosure of foreign assets on the FBAR form.

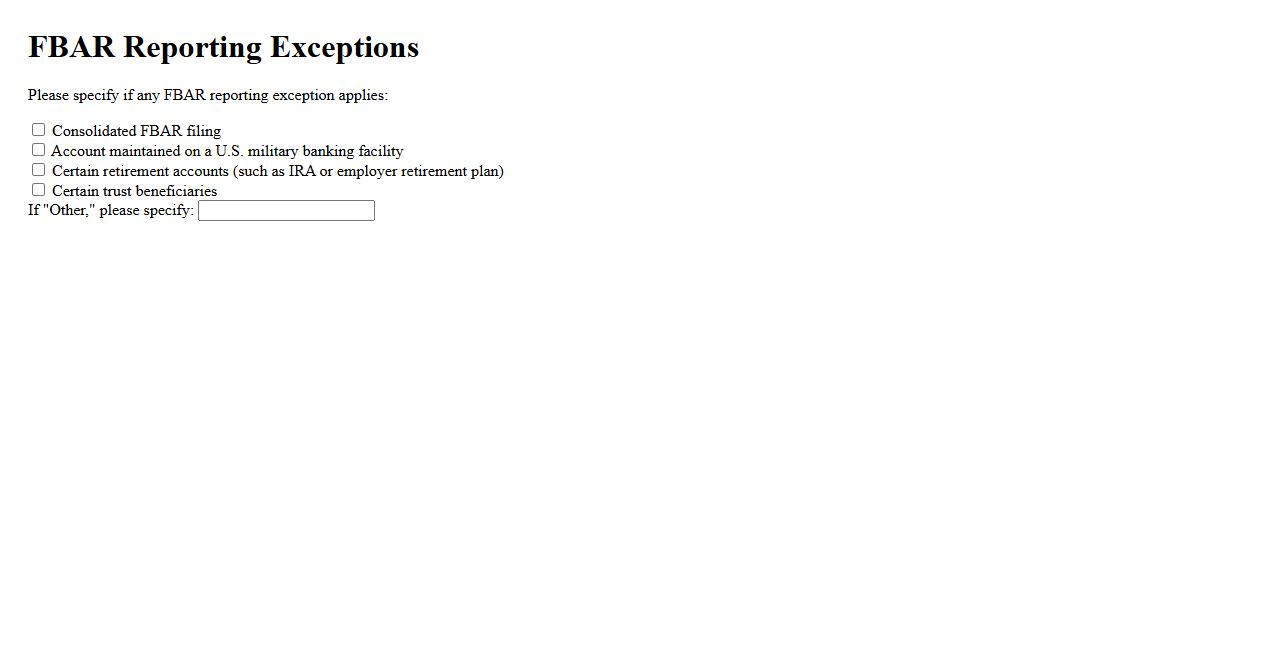

FBAR reporting exceptions

Understanding FBAR reporting exceptions is essential for taxpayers with foreign financial accounts. These exceptions outline circumstances where filing the Foreign Bank Account Report is not required, such as having minimal account balances or certain foreign accounts owned by financial institutions. Proper knowledge of these exceptions helps ensure compliance with reporting regulations while avoiding unnecessary filings.

What constitutes a "financial interest" or "signature authority" over foreign accounts for FBAR purposes?

A financial interest exists when you own the foreign financial account directly or indirectly. Signature authority means you have the power to control the disposition of assets in the account by direct communication with the financial institution. Both types of control require disclosure under FBAR regulations.

Which types of foreign financial accounts must be reported on the FBAR?

The FBAR requires reporting of foreign bank accounts, securities accounts, and other financial accounts held at foreign financial institutions. This includes savings, checking, brokerage, mutual funds, and certain insurance policies. The key factor is the account must be held at a non-U.S. financial institution.

Who is required to file an FBAR under current U.S. regulations?

U.S. citizens, residents, and entities such as corporations, partnerships, or trusts must file an FBAR if they have a financial interest in or signature authority over foreign accounts. This obligation applies regardless if the income earned on the accounts is reported on a tax return. The report must be filed annually with the FinCEN.

What is the annual aggregate threshold amount that triggers the FBAR filing requirement?

An FBAR must be filed if the aggregate value of all foreign financial accounts exceeds $10,000 at any time during the calendar year. This threshold applies to the combined total value of all accounts, not each account individually. Failure to meet this threshold means there is no FBAR filing obligation.

What are the key penalties for failing to file an accurate and timely FBAR?

Failing to file an FBAR can result in severe civil and criminal penalties, including fines up to $100,000 or 50% of the account balance per violation. Criminal penalties may include imprisonment for willful violations. Timely and accurate filing is critical to avoid these significant legal consequences.