A Report of Expense Reimbursement is a detailed document submitted by employees to request repayment for business-related expenses they have personally covered. It typically includes itemized receipts, dates, and a justification for the costs incurred. This report ensures transparency and helps companies maintain accurate financial records.

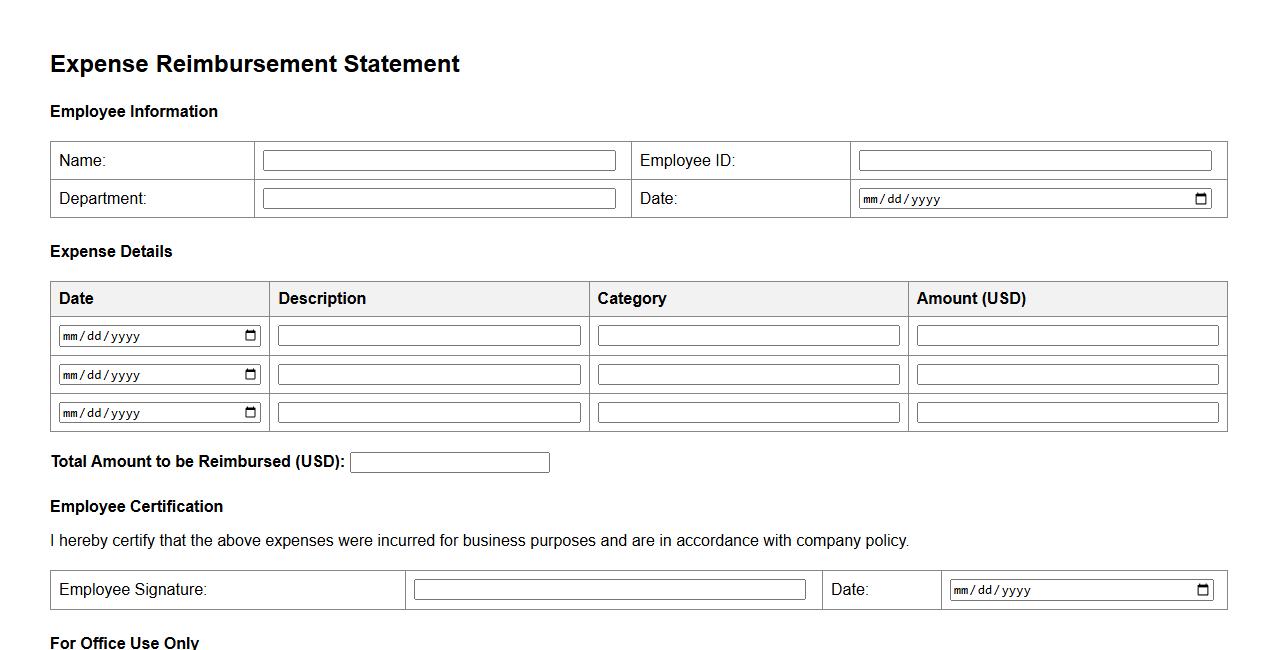

Expense Reimbursement Statement

An Expense Reimbursement Statement is a formal document used to request repayment for business-related expenses incurred by an employee. It details the costs, dates, and purpose of each expense to ensure transparency and accountability. This statement helps streamline the reimbursement process within a company's financial system.

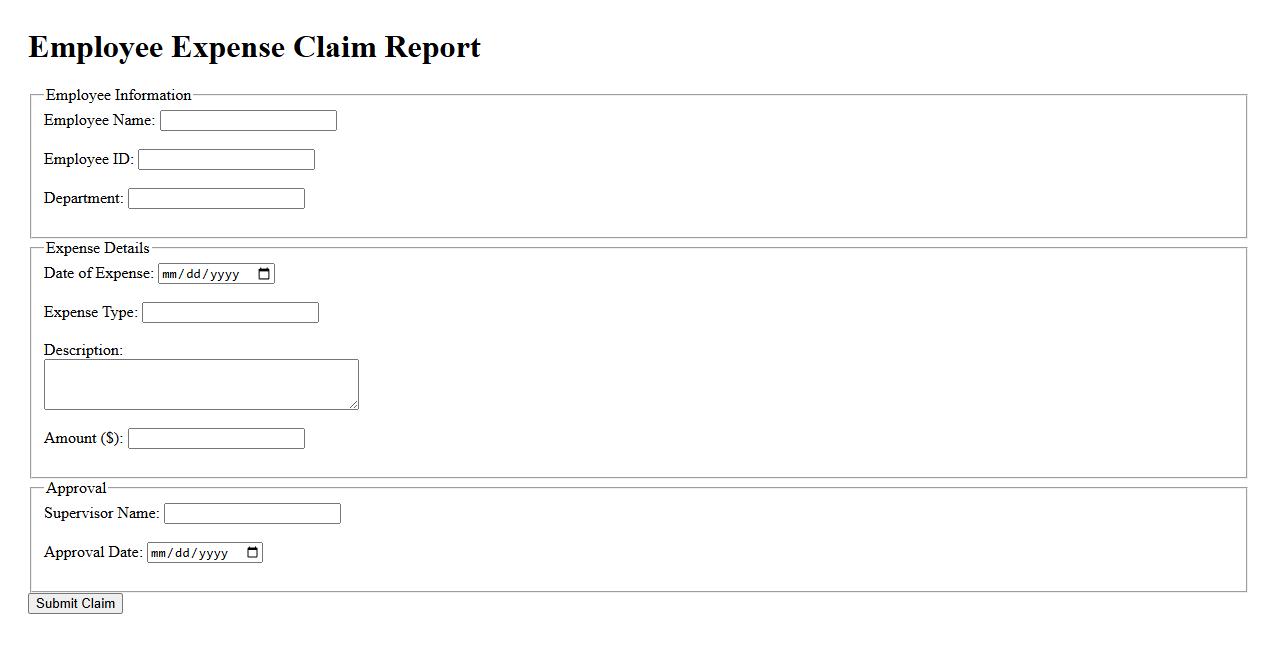

Employee Expense Claim Report

The Employee Expense Claim Report is a detailed summary of all expenses submitted by employees for reimbursement. It helps organizations track, review, and approve expenditures efficiently. This report ensures transparency and accurate financial management within the company.

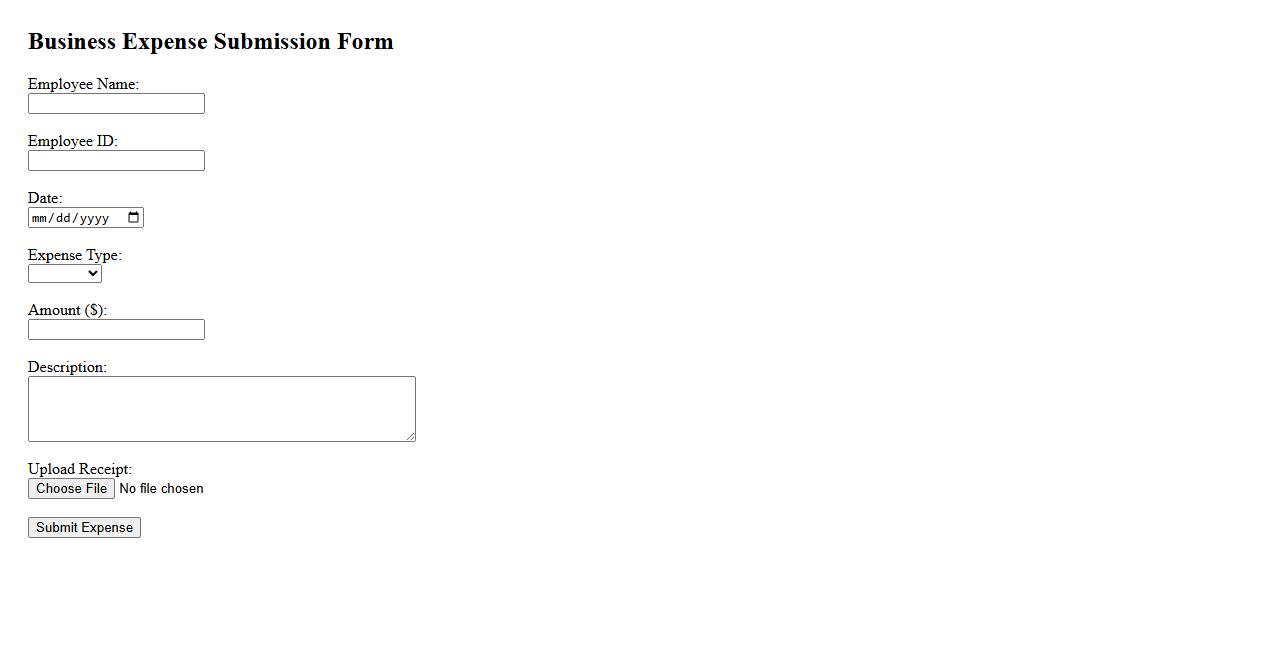

Business Expense Submission

Efficient Business Expense Submission streamlines the process of reporting and reimbursing company expenses. It ensures accuracy and timely approval, helping maintain clear financial records. This practice simplifies tracking business-related costs and supports budget management.

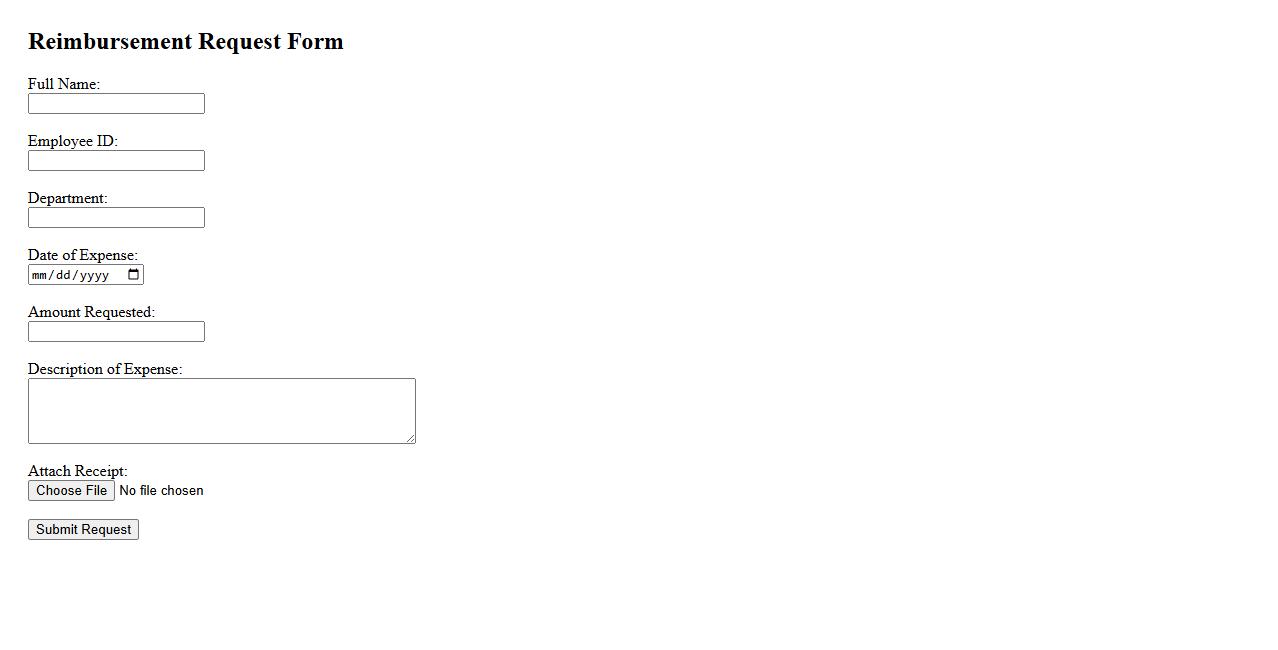

Reimbursement Request Form

The Reimbursement Request Form is designed to streamline the process of claiming expenses made on behalf of a company or organization. This form ensures accurate documentation and approval, facilitating timely reimbursement to employees or stakeholders. Using the form helps maintain transparent financial records and simplifies expense management.

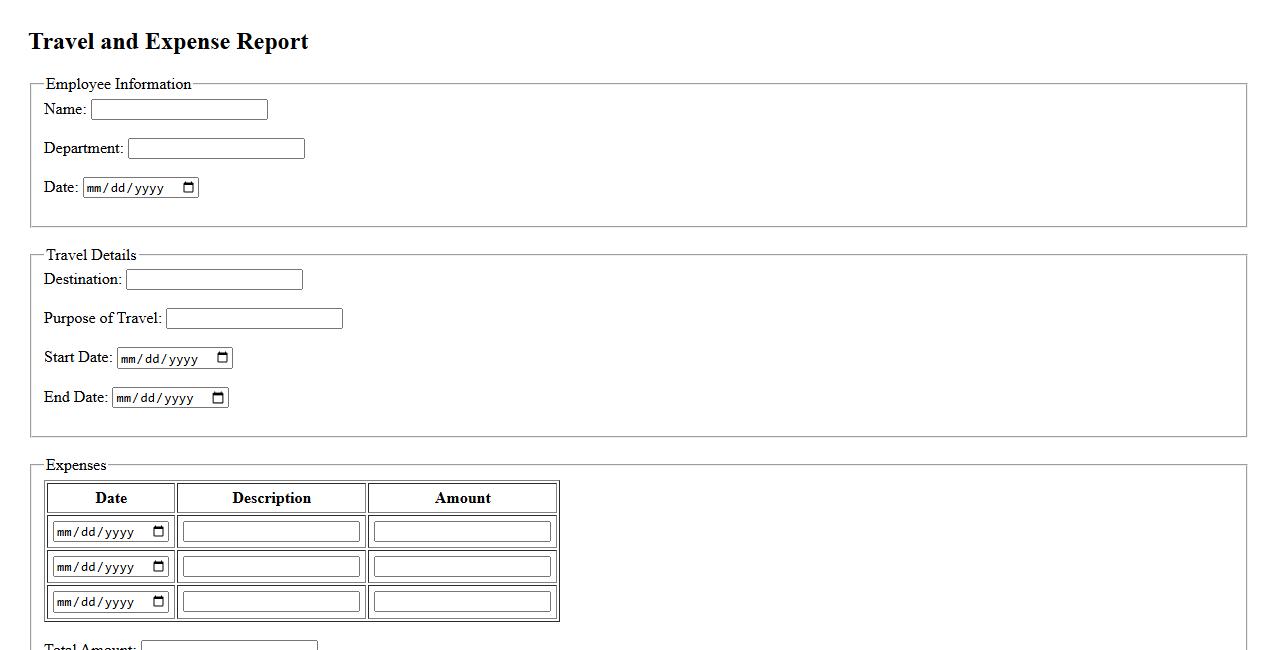

Travel and Expense Report

The Travel and Expense Report is a detailed document used to track and manage costs incurred during business travel. It helps organizations monitor expenditures, ensure policy compliance, and streamline reimbursement processes. Accurate reporting supports financial transparency and budget control.

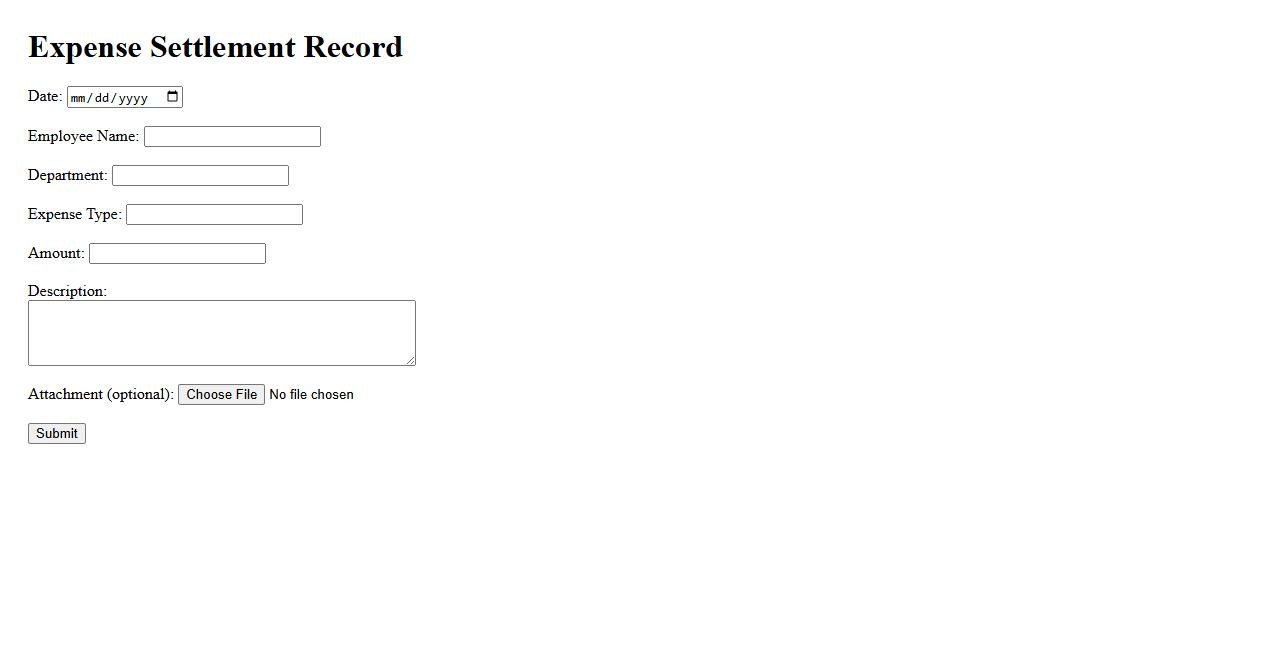

Expense Settlement Record

The Expense Settlement Record is a crucial document that tracks all financial transactions related to reimbursed expenses. It ensures transparency and accuracy in accounting by providing detailed information about payments made and received. Maintaining this record helps streamline financial audits and budget management effectively.

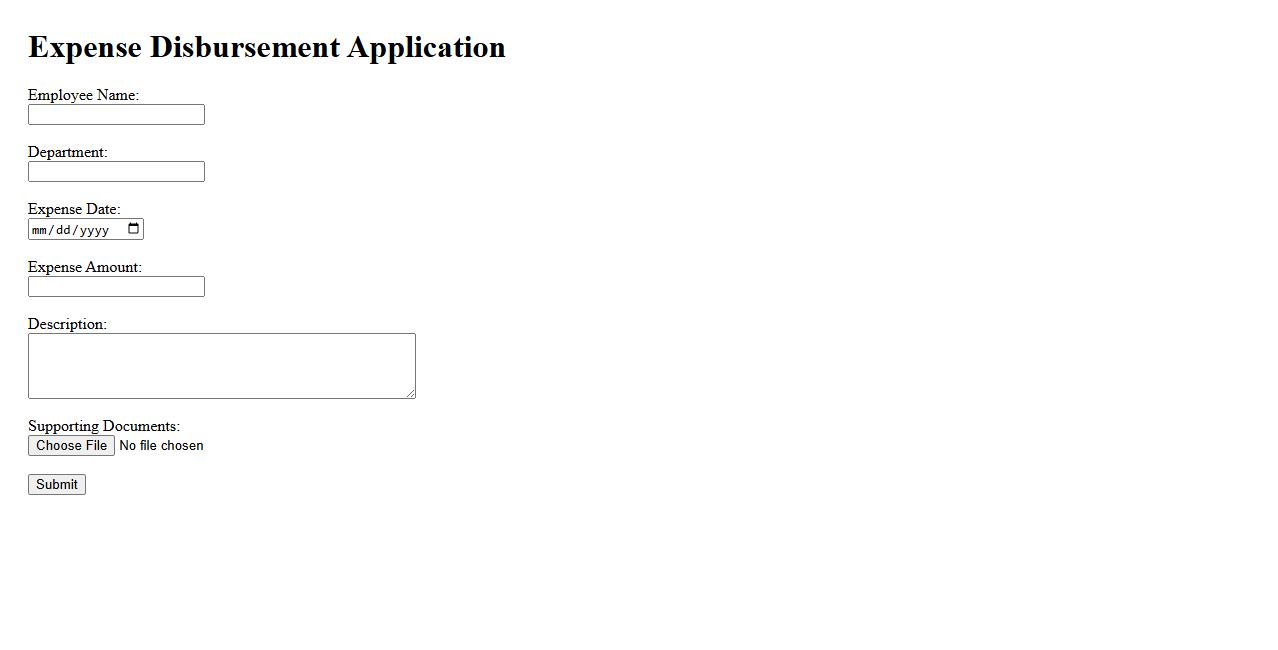

Expense Disbursement Application

The Expense Disbursement Application streamlines the process of managing and tracking financial disbursements efficiently. It allows users to submit, approve, and monitor expenses seamlessly, reducing errors and improving accountability. Ideal for businesses seeking to optimize their expense management workflow.

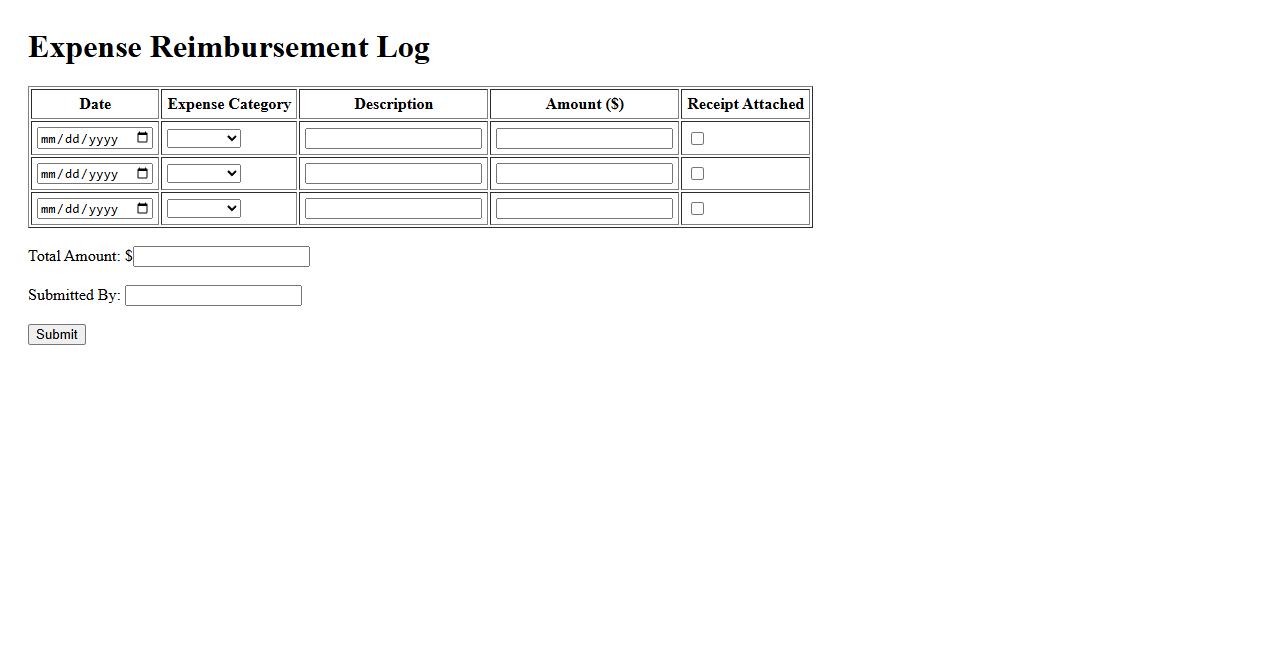

Expense Reimbursement Log

The Expense Reimbursement Log is a vital tool for tracking and managing expenses that need to be reimbursed. It helps ensure accurate documentation and timely repayment of business or personal costs. Maintaining this log improves financial transparency and accountability.

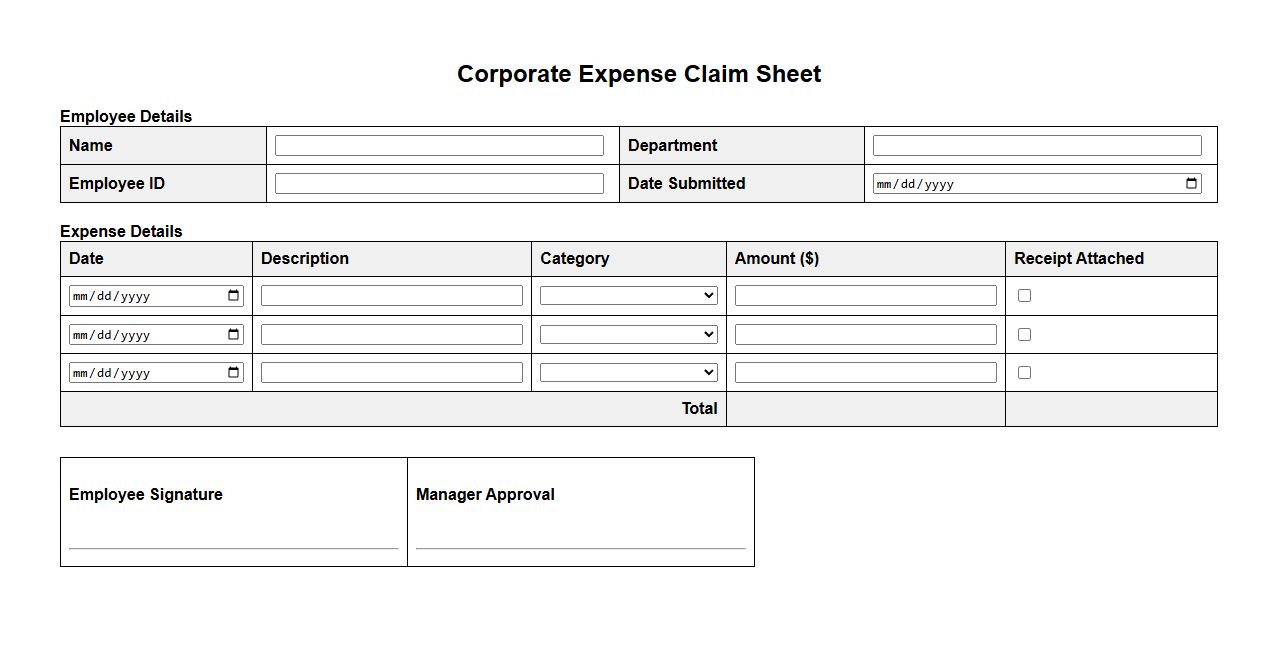

Corporate Expense Claim Sheet

The Corporate Expense Claim Sheet is a vital document used by employees to report and request reimbursement for business-related expenses. It ensures accurate tracking and approval of costs such as travel, meals, and office supplies. Proper use of this sheet streamlines the financial reconciliation process within a company.

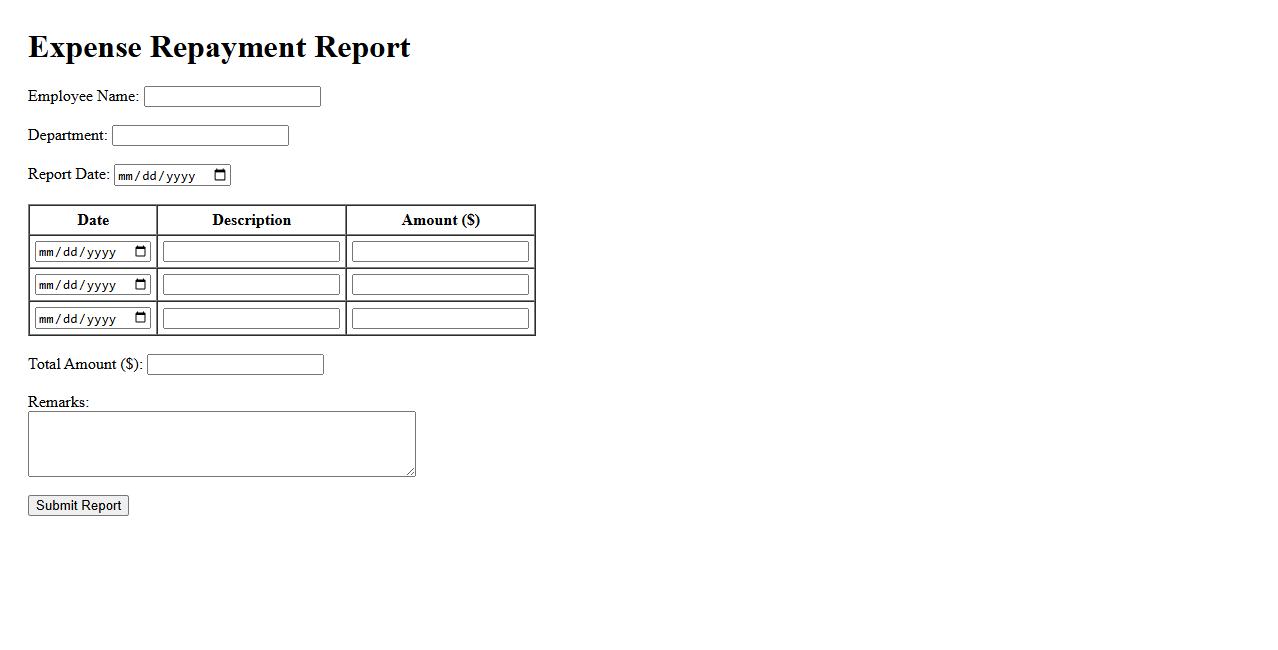

Expense Repayment Report

The Expense Repayment Report provides a detailed summary of reimbursed costs incurred by employees or departments. It helps track repayments, ensuring financial accuracy and transparency within the organization. This report is essential for auditing and budget management purposes.

What is the primary purpose of a Report of Expense Reimbursement document?

The primary purpose of a Report of Expense Reimbursement document is to formally request repayment for expenses incurred. It serves as an official record that details the nature and amount of expenses. This document helps ensure transparent financial transactions between the employee and the organization.

Which details are required for validating reimbursable expenses in the report?

Validating reimbursable expenses requires specific details such as the date of the expense, the amount spent, and the reason for the expenditure. Additionally, the report must include accurate descriptions and classifications for each item. These details ensure that only legitimate expenses are reimbursed according to company policy.

How does the report ensure compliance with organizational expense policies?

The report ensures compliance by aligning submitted expenses with pre-established company guidelines. It includes checks for spending limits, eligible categories, and proper approvals. This systematic validation process helps prevent unauthorized or non-compliant claims.

What supporting documents must be attached to the reimbursement report?

Supporting documents such as receipts, invoices, and proof of payment must be attached to validate the expenses. These attachments provide evidence and substantiate the claims made in the report. Proper documentation is crucial for audit trails and financial accountability.

How are errors or discrepancies in a Report of Expense Reimbursement addressed?

Errors or discrepancies are typically addressed through a formal review and verification process by the finance team. The report may be returned for clarification or correction before approval. This ensures accuracy and maintains the integrity of the reimbursement system.