A Report of Asset Disposal documents the process and details involved in removing an asset from a company's records. It includes information such as the asset's identification, disposal method, date, and any financial impact or proceeds from the sale. This report ensures compliance with accounting standards and supports transparent asset management practices.

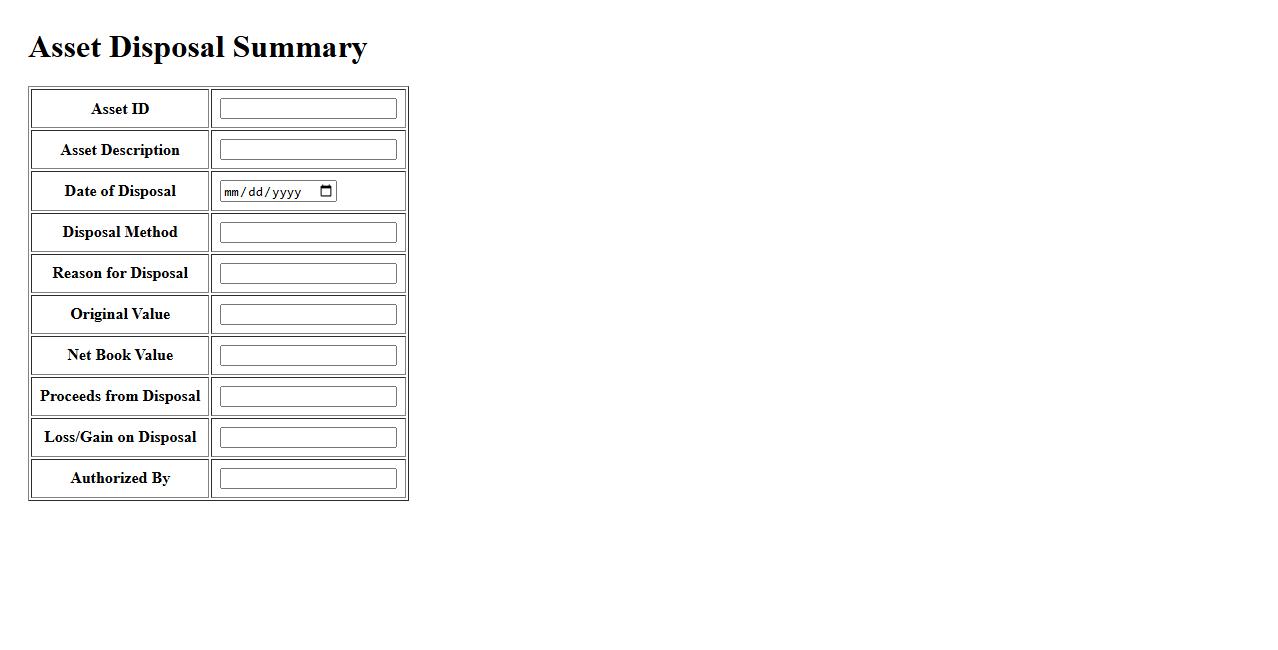

Asset Disposal Summary

The Asset Disposal Summary provides a concise overview of all assets that have been retired or sold within a specified period. It helps organizations track the removal of assets from their records and evaluate the financial impact. This summary ensures transparent and efficient management of asset lifecycle processes.

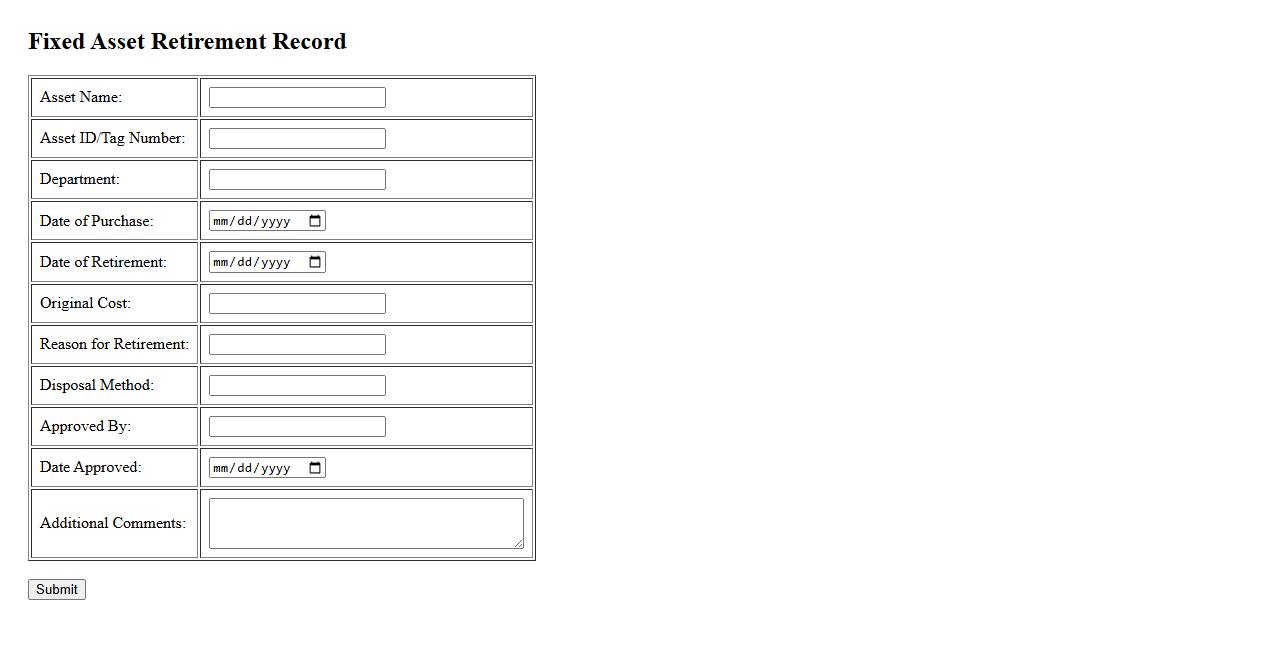

Fixed Asset Retirement Record

The Fixed Asset Retirement Record documents the removal or disposal of company assets, ensuring accurate tracking of asset life cycles. This record helps maintain up-to-date financial statements by reflecting changes in asset value. Proper management of these records is essential for compliance and auditing purposes.

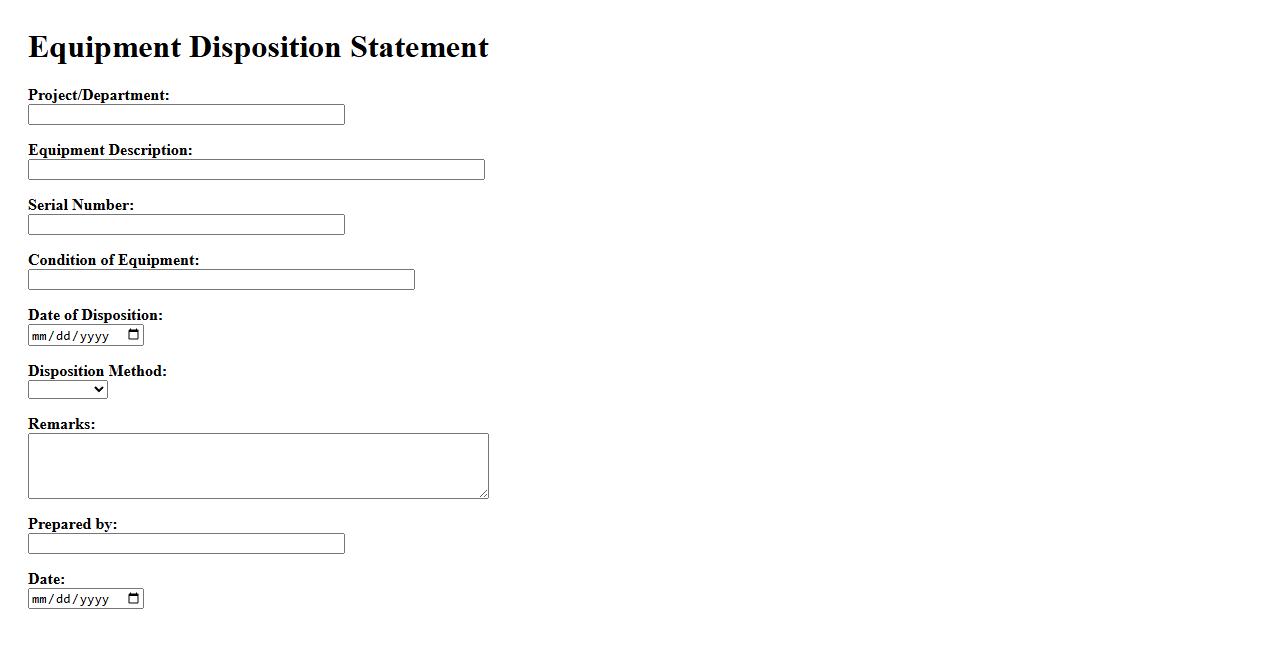

Equipment Disposition Statement

An Equipment Disposition Statement is a formal document detailing the transfer, disposal, or retirement of company assets. It ensures proper tracking and compliance with organizational policies and regulatory requirements. This statement provides a clear record for auditing and inventory management purposes.

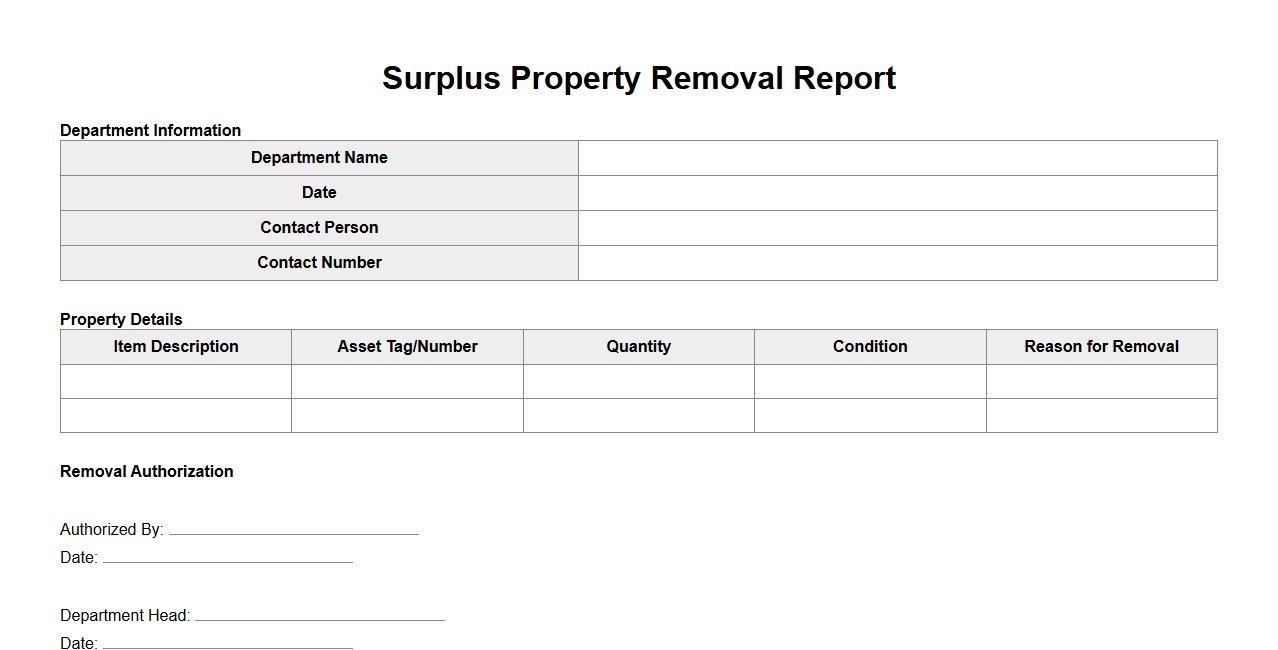

Surplus Property Removal Report

The Surplus Property Removal Report provides a detailed account of assets that are no longer needed by an organization. This report ensures transparent tracking and proper documentation of all items removed from inventory. It helps maintain accurate records for auditing and compliance purposes.

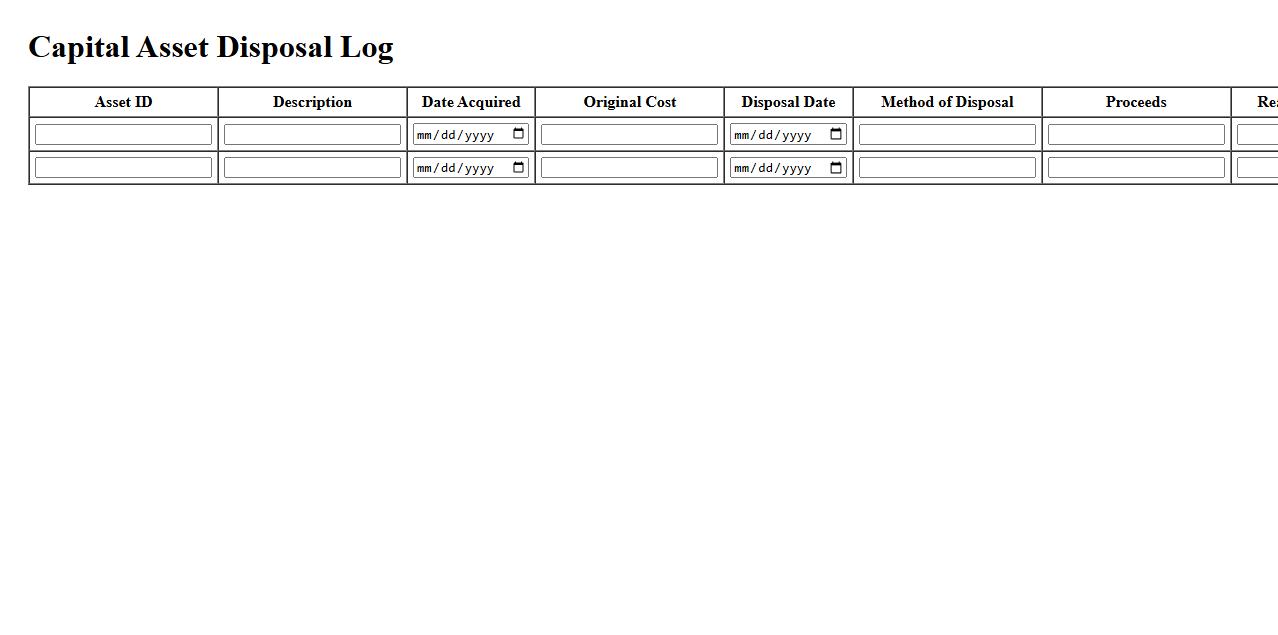

Capital Asset Disposal Log

The Capital Asset Disposal Log is a crucial record that tracks the removal or sale of fixed assets within an organization. It ensures accurate financial reporting and compliance with accounting standards. Maintaining this log helps in auditing and asset management processes.

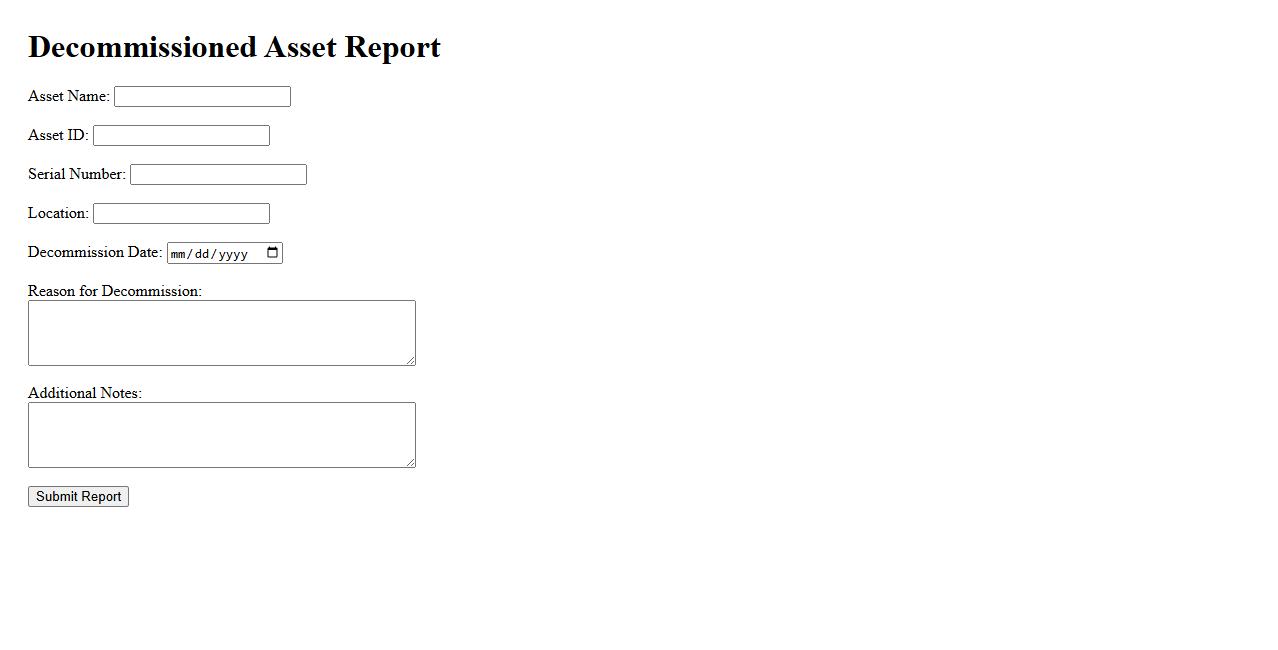

Decommissioned Asset Report

The Decommissioned Asset Report provides a detailed overview of assets that have been retired or removed from active use within an organization. It ensures proper documentation and tracking for auditing and compliance purposes. This report helps in managing asset lifecycle and optimizing resource allocation.

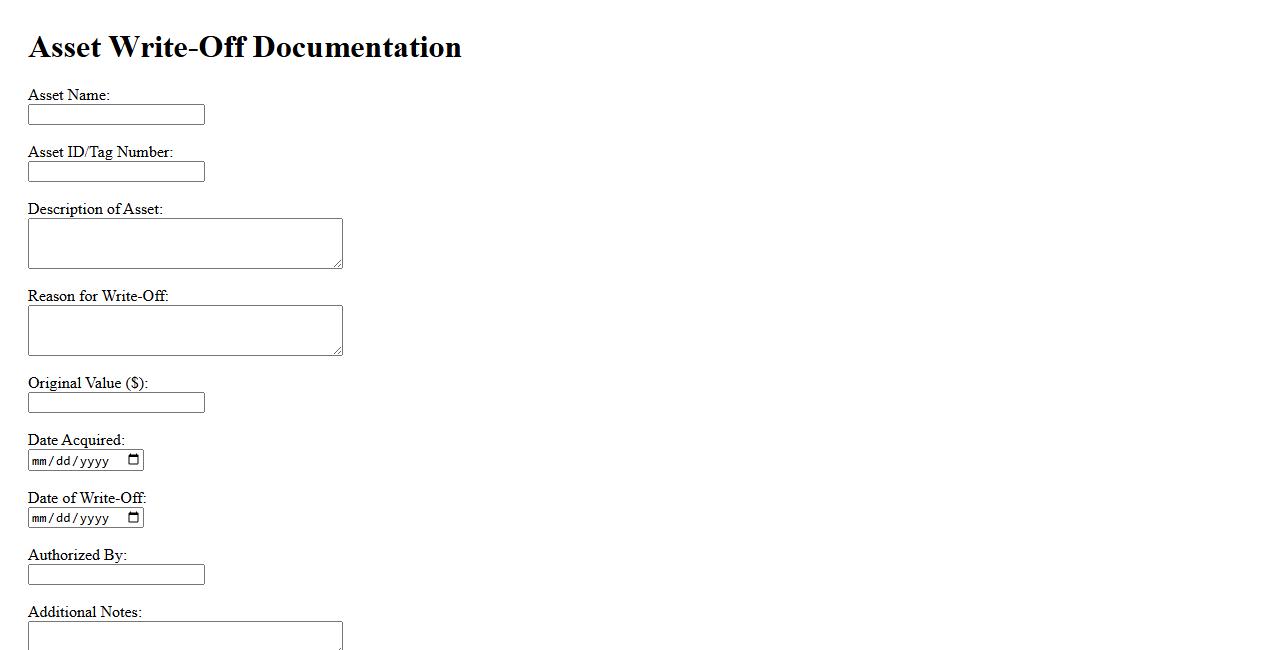

Asset Write-Off Documentation

Proper Asset Write-Off Documentation is essential for maintaining accurate financial records and ensuring compliance with accounting standards. This documentation provides detailed evidence of assets that are no longer usable or have lost their value. It helps organizations track disposals and supports transparent auditing processes.

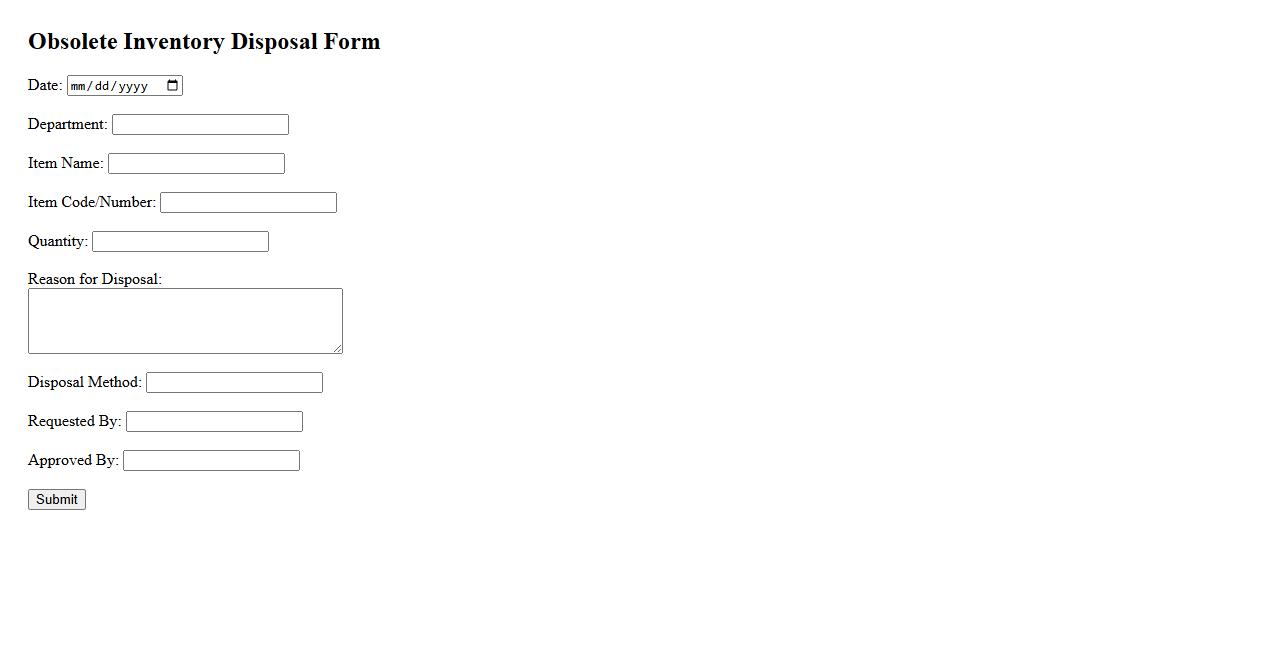

Obsolete Inventory Disposal Form

The Obsolete Inventory Disposal Form is a critical document used to record and authorize the removal of outdated or unused stock. It ensures proper tracking and accountability during the disposal process. This form helps maintain accurate inventory records and supports efficient asset management.

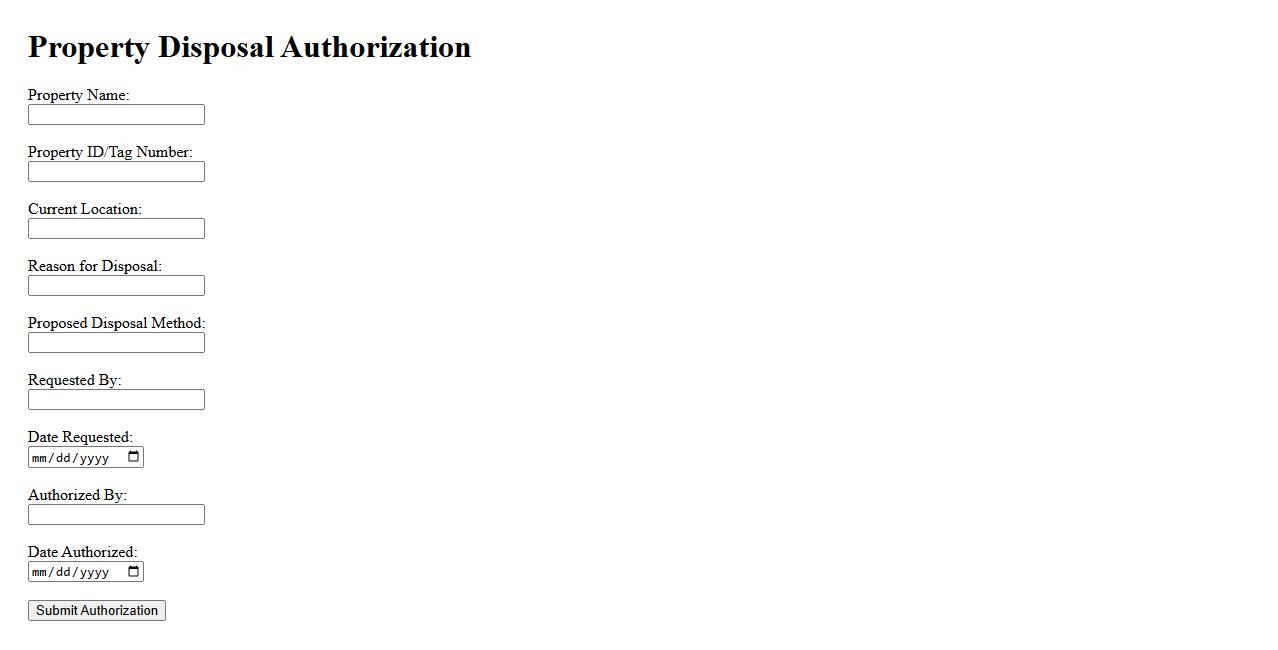

Property Disposal Authorization

Property Disposal Authorization is a formal document that grants permission to dispose of company or organizational assets legally. This authorization ensures compliance with internal policies and regulatory requirements, preventing unauthorized transactions. Proper documentation streamlines the disposal process and maintains accurate records for audit purposes.

Disposed Asset Tracking Sheet

The Disposed Asset Tracking Sheet is an essential tool for documenting and managing assets that have been removed from use. It helps organizations maintain accurate records for audit and compliance purposes. This sheet ensures transparency and accountability in asset disposal processes.

What key details must be included in a Report of Asset Disposal document?

The Report of Asset Disposal must include the asset identification details such as serial numbers and descriptions. It should also specify the date and reason for disposal to maintain clear records. Additionally, the report needs to capture the disposal method used for transparency and compliance.

How does the report classify different types of disposed assets?

The report classifies disposed assets based on their asset category, such as machinery, vehicles, or electronics. Each classification helps in tracking and reporting for accounting and auditing purposes. This structured approach ensures accurate asset management and regulatory adherence.

Which approval authorities are required for completing the asset disposal report?

Typically, the report must be approved by the asset manager or department head responsible for the asset. Final authorization often requires clearance from the finance department to verify financial accuracy. In some cases, executive-level approval is mandatory depending on the asset's value.

What procedures must be documented for asset disposal methods (e.g., sale, donation, destruction)?

The report needs to outline specific procedures for each disposal method to ensure compliance and traceability. For example, details of the sale process, recipient information for donations, or destruction certificates must be included. Proper documentation safeguards against legal and financial risks.

How is the financial impact of asset disposal recorded in the report?

The financial impact is recorded by detailing the book value of the asset at disposal time and the proceeds from the disposal. Any gains or losses on disposal must be clearly stated to reflect accurate financial reporting. This information is crucial for maintaining transparent accounting records and auditing purposes.