A Report of Benefit Overpayment details instances where individuals have received more benefits than entitled, requiring repayment. This document outlines the amount overpaid, reasons for the overpayment, and instructions for resolving the discrepancy. Employers or agencies use this report to maintain accurate financial records and ensure compliance with benefit regulations.

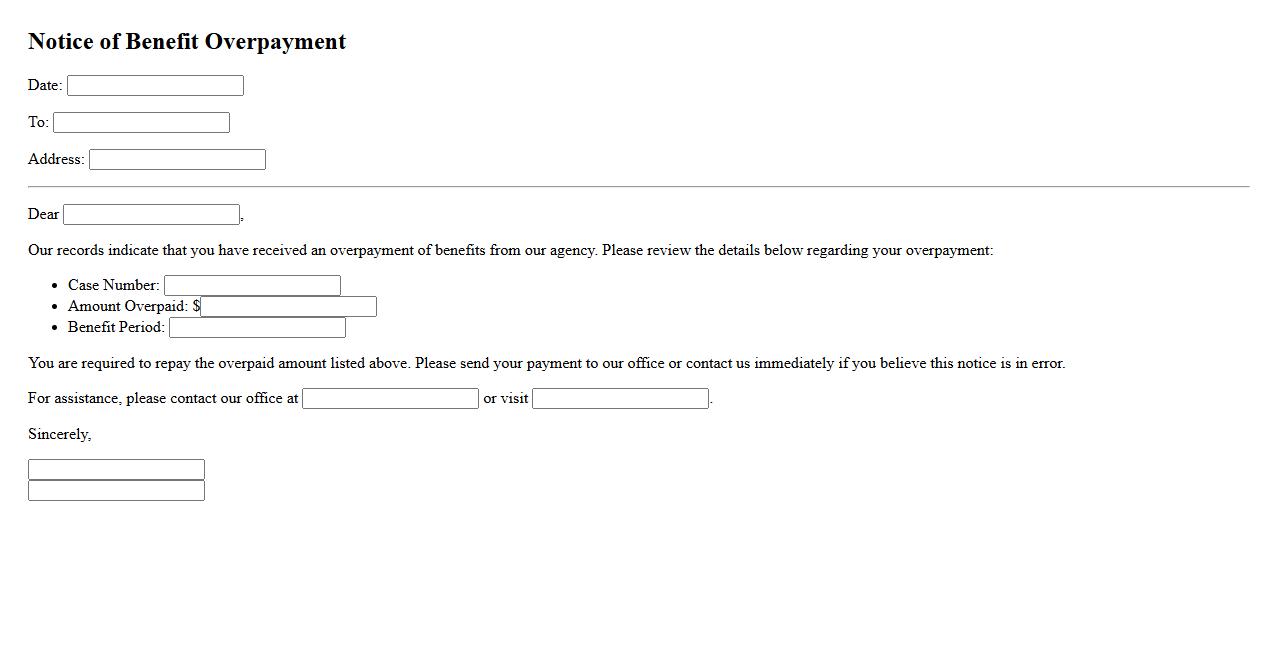

Notice of Benefit Overpayment

A Notice of Benefit Overpayment informs recipients that they have received more benefits than they were entitled to. This notice details the amount overpaid and provides instructions for repayment or appeal. It is important to respond promptly to avoid further penalties or interest charges.

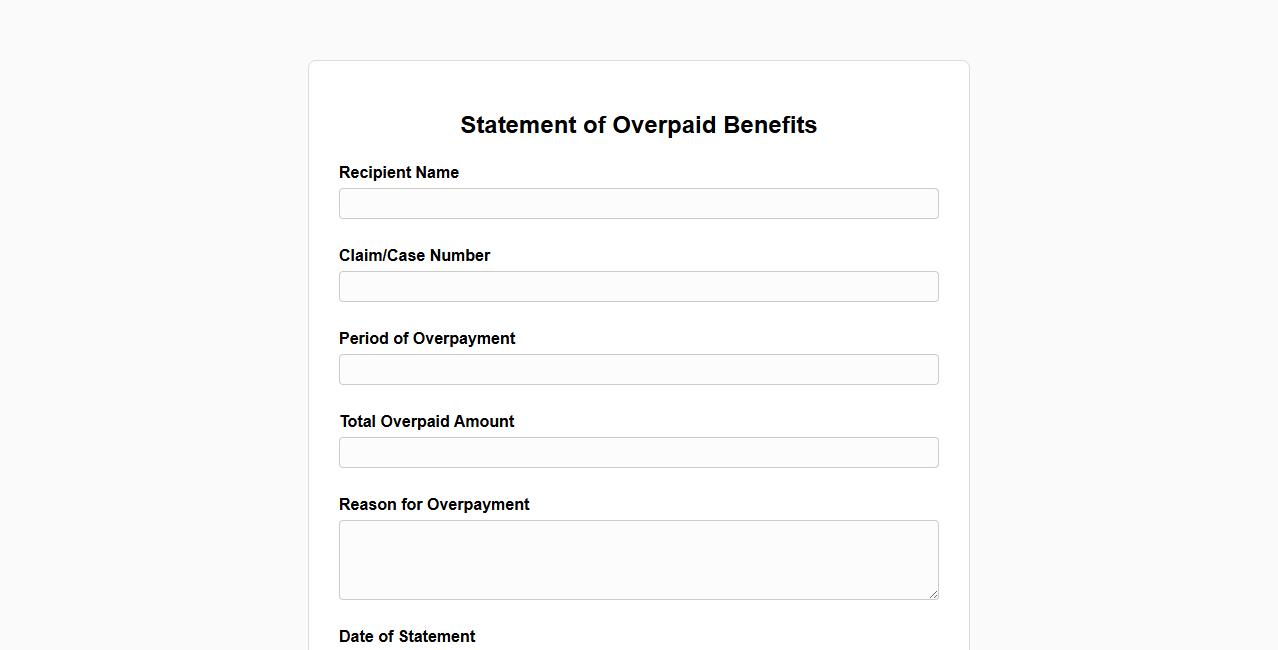

Statement of Overpaid Benefits

The Statement of Overpaid Benefits is a detailed document outlining the excess payments received by an individual. It helps clarify the amount that needs to be repaid to correct the financial records. This statement ensures transparency and accurate benefit management.

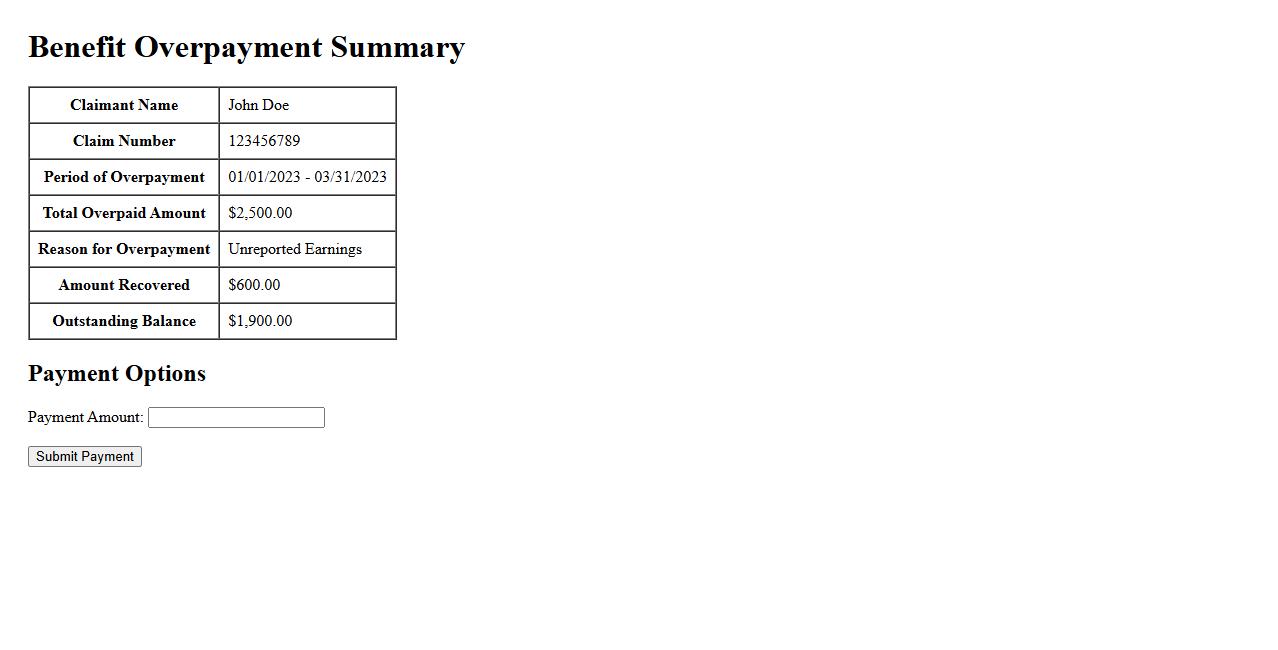

Benefit Overpayment Summary

The Benefit Overpayment Summary provides a clear overview of any excess payments received. It helps individuals understand the amount owed and the reasons behind the overpayment. This summary ensures transparency and facilitates the repayment process efficiently.

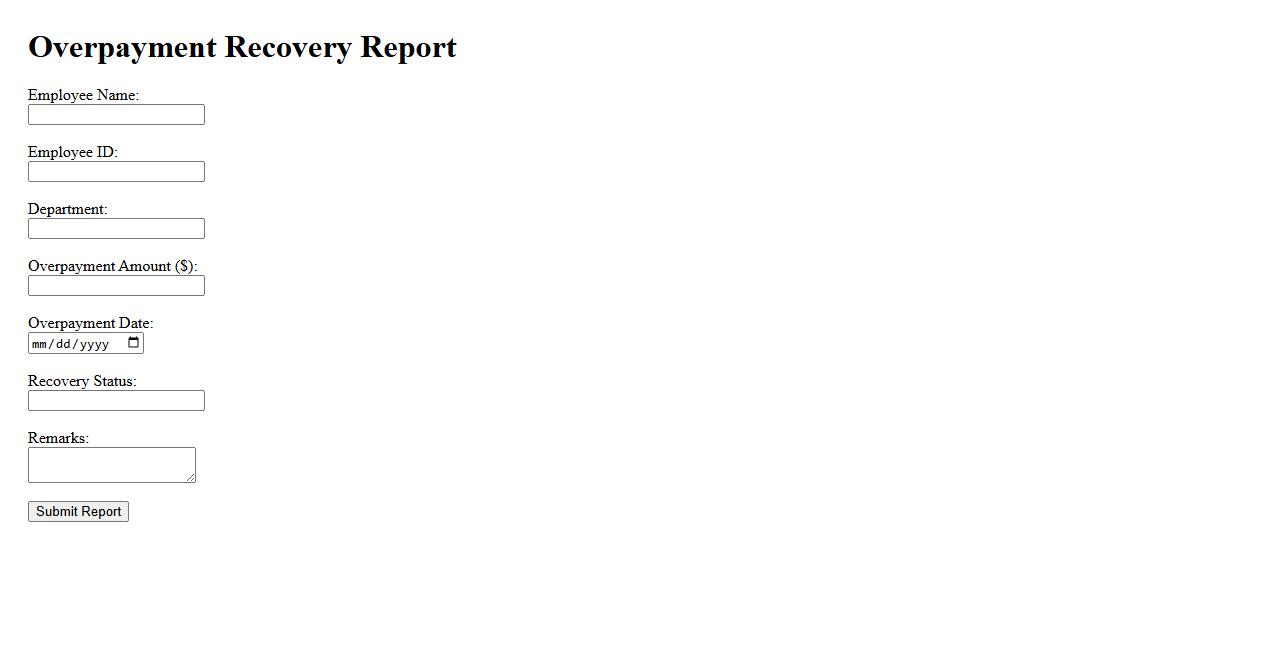

Overpayment Recovery Report

The Overpayment Recovery Report provides detailed insights into recovered funds from overpaid transactions. It helps organizations track and manage financial corrections efficiently. This report is essential for maintaining accurate accounting records and reducing financial discrepancies.

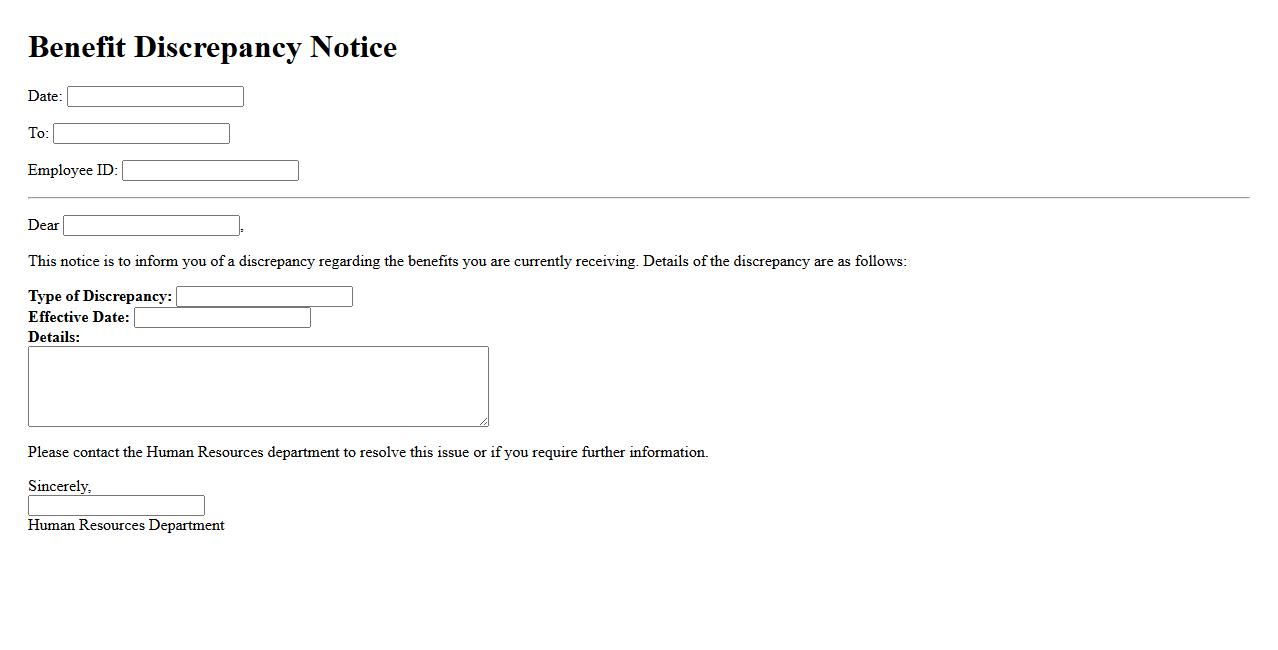

Benefit Discrepancy Notice

A Benefit Discrepancy Notice informs employees about differences between expected and received benefits. It helps clarify misunderstandings and ensures accurate records. This notice is essential for maintaining transparency and trust in benefit administration.

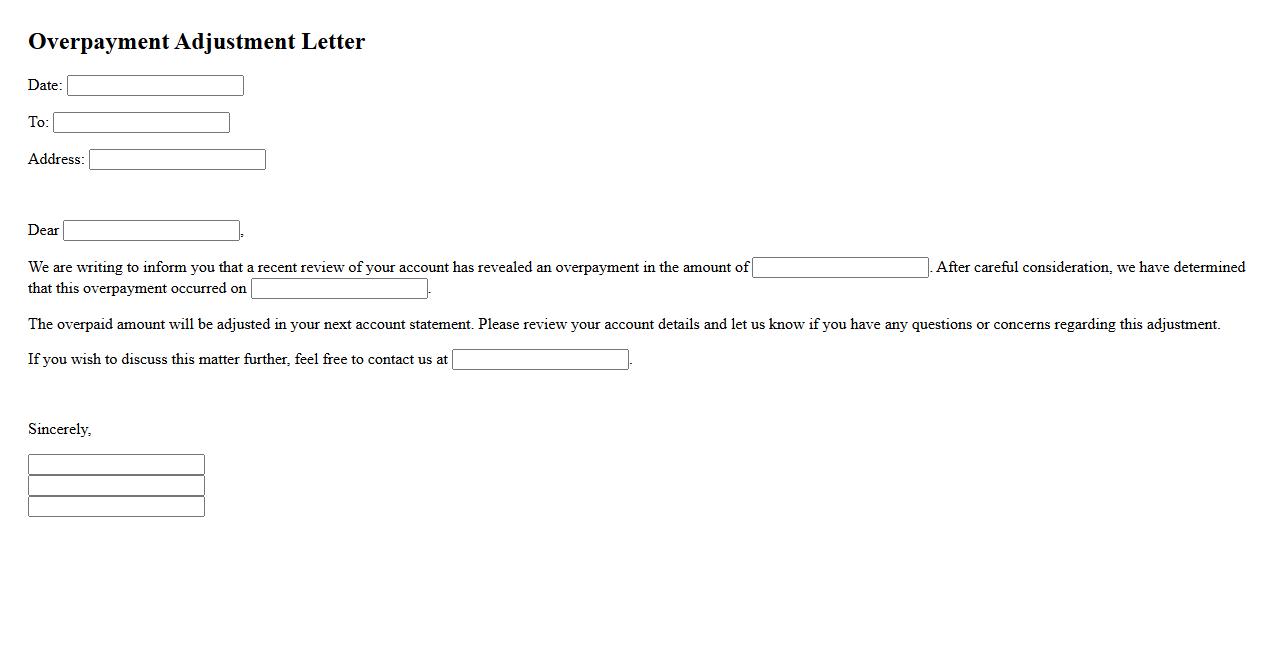

Overpayment Adjustment Letter

An Overpayment Adjustment Letter is a formal document sent to notify an individual or organization about an excess payment that needs correction. It details the amount overpaid and the necessary steps to resolve the discrepancy. This letter helps ensure accurate financial records and prompt adjustments.

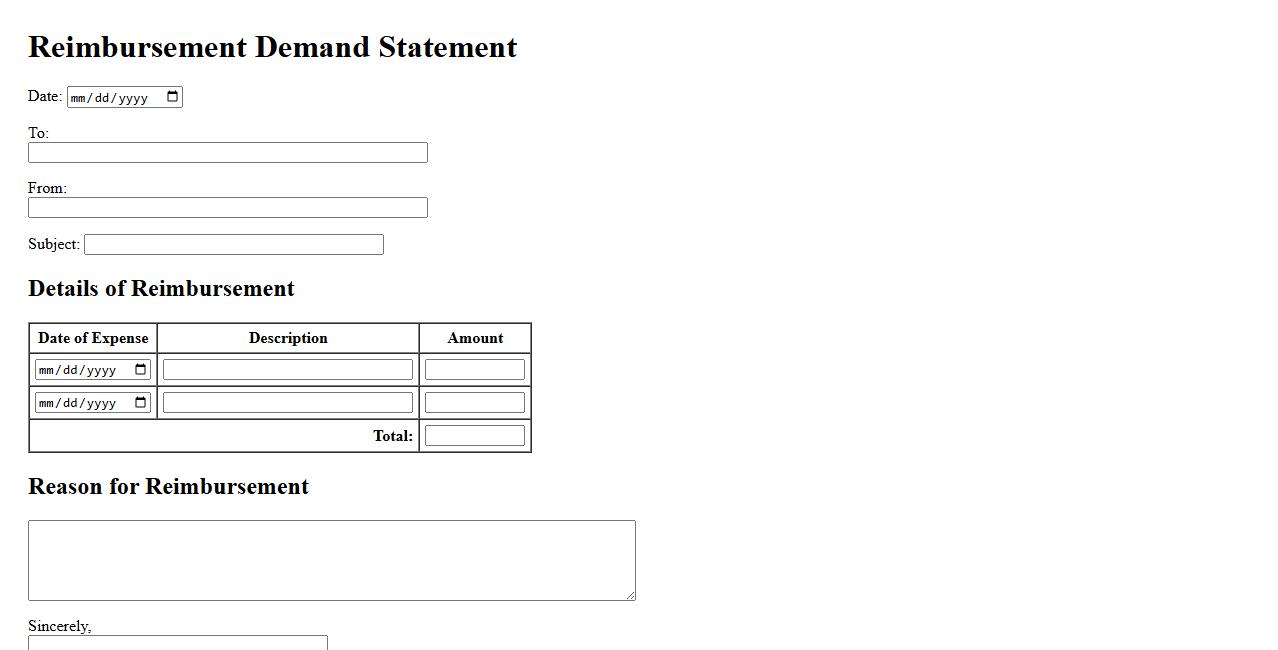

Reimbursement Demand Statement

A Reimbursement Demand Statement is a formal document used to request repayment for expenses incurred. It clearly outlines the amounts owed, supporting evidence, and the basis for the claim. This statement ensures transparent communication and facilitates timely reimbursement processes.

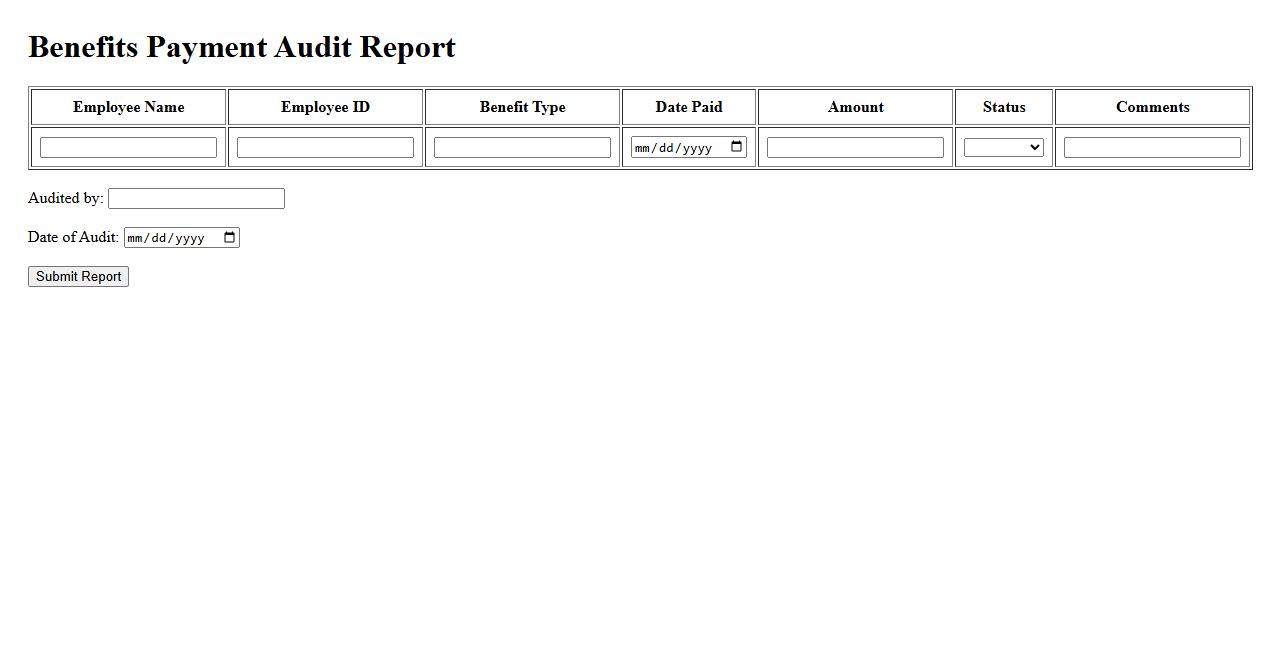

Benefits Payment Audit Report

The Benefits Payment Audit Report ensures accuracy and compliance in disbursing benefits. It identifies discrepancies and prevents fraudulent claims, safeguarding financial resources. This report supports transparent and efficient audit processes for organizations.

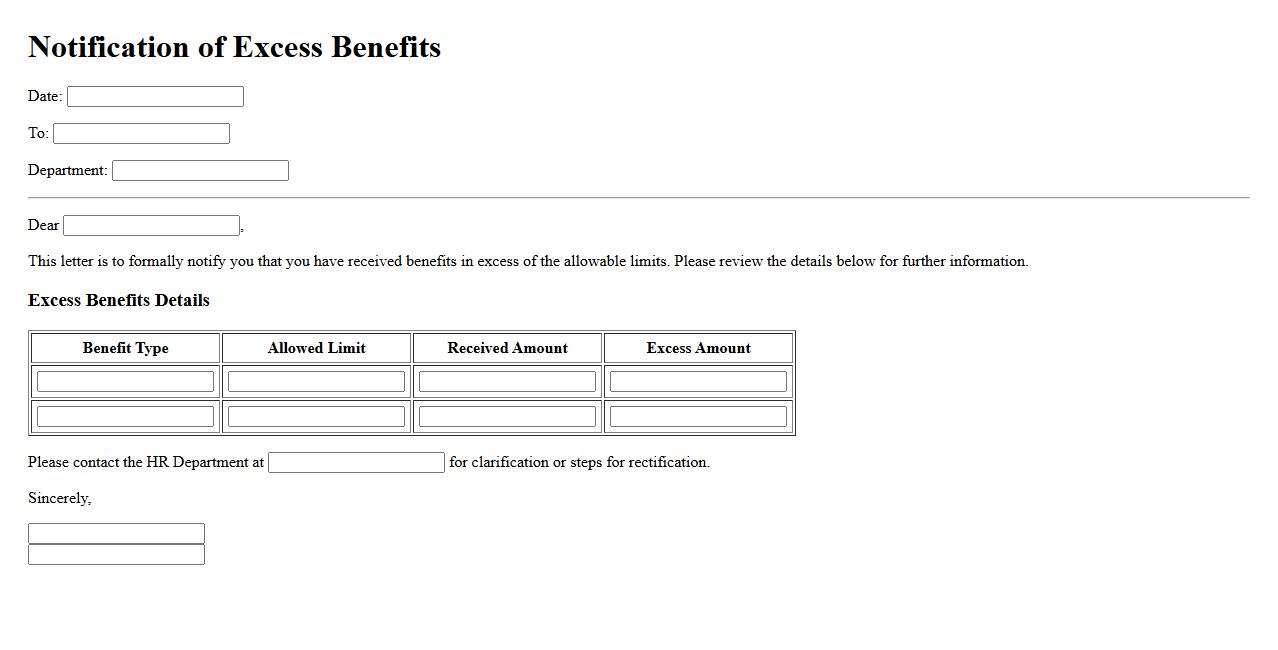

Notification of Excess Benefits

Notification of Excess Benefits informs individuals or organizations when compensation or payments exceed allowable limits. This alert helps ensure compliance with legal and regulatory standards. Timely notification prevents potential penalties and promotes transparency.

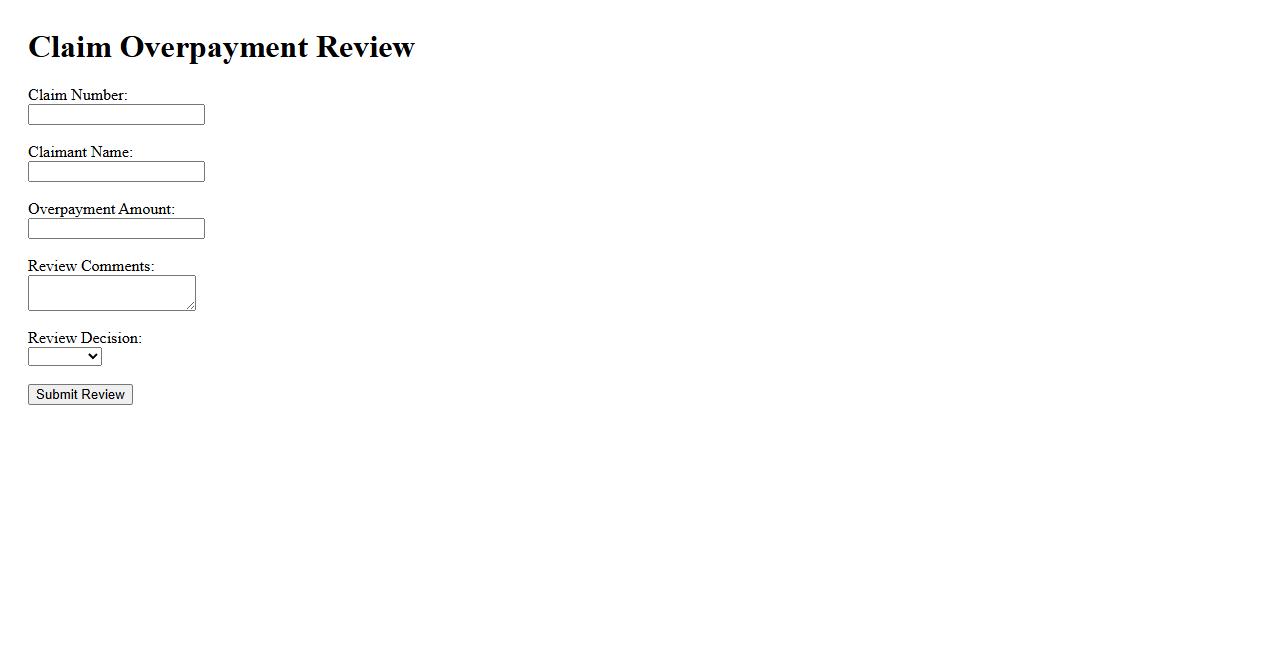

Claim Overpayment Review

The Claim Overpayment Review process ensures that any excess payments made on insurance claims are identified and addressed promptly. This review helps maintain financial accuracy and prevents potential losses. By conducting a thorough assessment, organizations can recover overpaid amounts efficiently.

What is the primary purpose of a Report of Benefit Overpayment document?

The primary purpose of a Report of Benefit Overpayment document is to formally identify and document instances where benefits have been paid in excess to an individual or entity. This report serves as an official notification that an overpayment has occurred and outlines the details necessary for recovery. It ensures transparency and accountability in managing benefit programs.

Which parties are typically involved in the creation and review of a Benefit Overpayment report?

The creation and review of a Benefit Overpayment report typically involve benefit administrators, claims reviewers, and the recipient of the benefits. These parties collaborate to verify the accuracy of the overpayment and ensure all pertinent information is included. Legal or compliance teams may also be involved to oversee adherence to regulatory requirements.

What specific information is required to accurately complete a Benefit Overpayment report?

To accurately complete a Benefit Overpayment report, detailed information such as the recipient's identification details, benefit payment dates, and amounts is required. It must also include the reason for the overpayment, documentation supporting the claim, and any prior communications regarding the issue. Accurate record-keeping ensures proper resolution and facilitates recovery procedures.

How does the report define and calculate the amount identified as an overpayment?

The report defines overpayment as the excess amount of benefits paid beyond what was entitled under the program rules. It calculates this amount by comparing total benefit payments made against the correct entitlement amount, factoring in any adjustments or deductions. Detailed calculations are provided to justify the sum that must be recovered.

What options or procedures for dispute or appeal are detailed within the document?

The document outlines specific dispute and appeal procedures available to recipients who contest the overpayment claim. These options typically include submitting a written appeal, requesting a hearing, or providing additional evidence for review. Clear timelines and contact information for appeals are provided to ensure a fair and transparent process.