A Report of Lost or Missing Check is a formal document filed to notify a bank or financial institution about a check that has been misplaced or not received. This report helps initiate the process of stopping payment to prevent unauthorized use. Filing a Report of Lost or Missing Check ensures the protection of funds and supports the issuance of a replacement check.

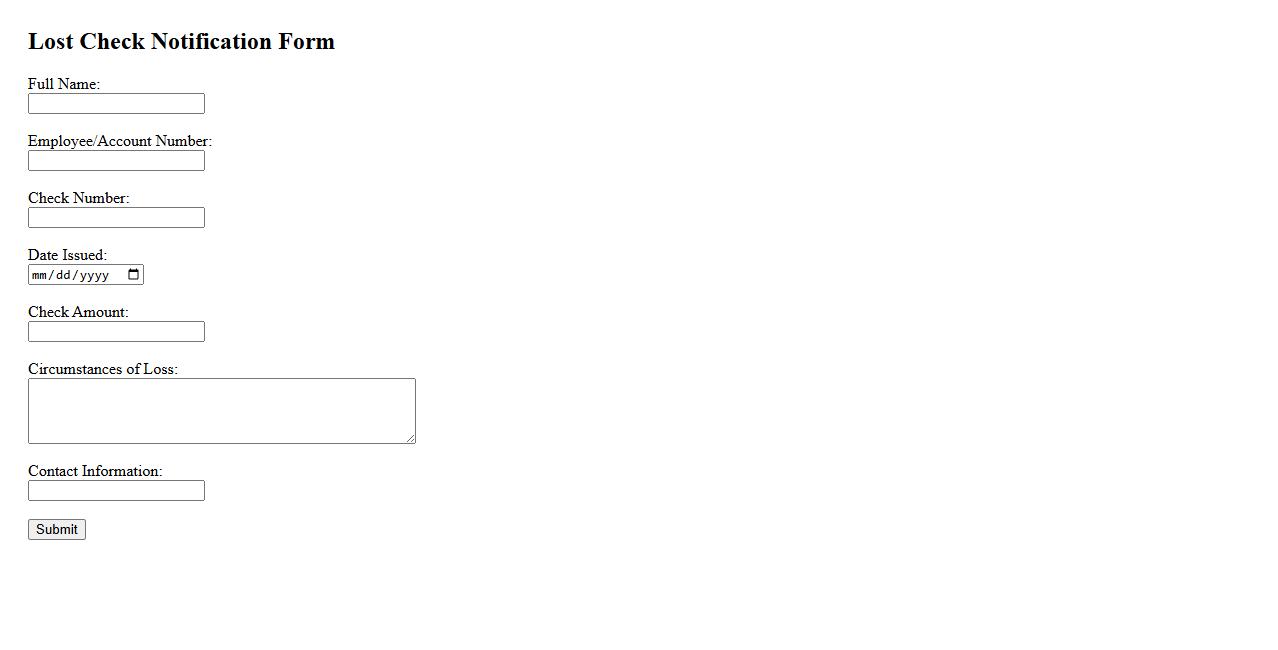

Lost Check Notification Form

The Lost Check Notification Form is essential for reporting and documenting missing checks promptly. It helps organizations prevent unauthorized use and initiate appropriate actions to reissue payments. Submitting this form ensures a secure and efficient resolution process.

Missing Check Incident Report

The Missing Check Incident Report is a formal document used to record the details when a check is lost or unaccounted for. It ensures proper tracking and investigation of the missing payment to prevent financial discrepancies. This report aids in maintaining accurate financial records and supports the resolution process.

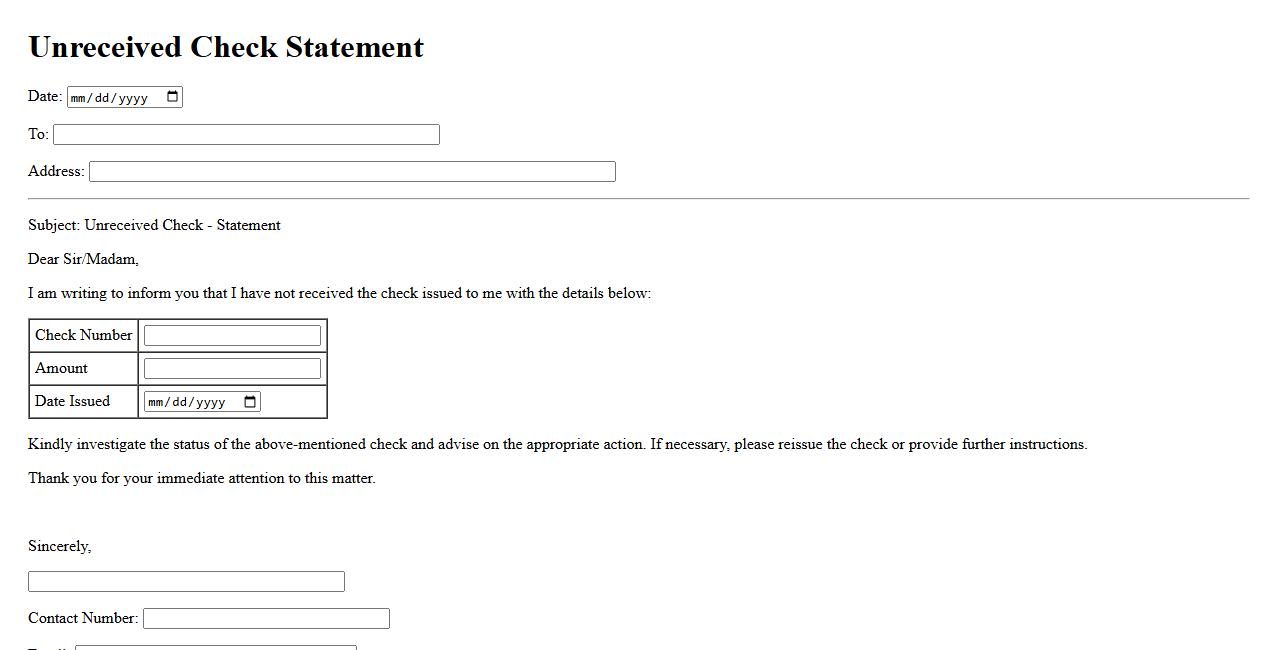

Unreceived Check Statement

An Unreceived Check Statement indicates a financial report detailing checks that have not yet been received by the account holder. This statement helps track pending payments and ensures accurate account reconciliation. Monitoring unreceived checks is essential for effective financial management and fraud prevention.

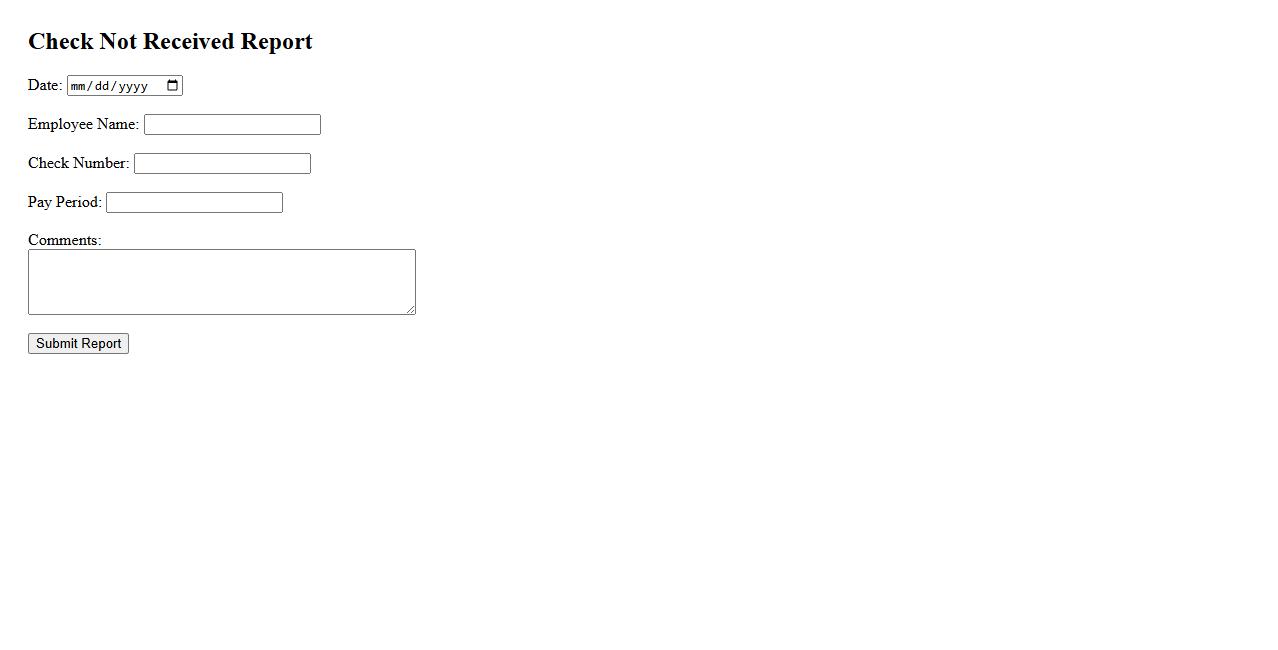

Check Not Received Report

The Check Not Received Report helps track payments that have been issued but not yet received by the payee. It provides detailed information on outstanding checks to ensure timely follow-up and reconciliation. This report is essential for managing cash flow and preventing lost payments.

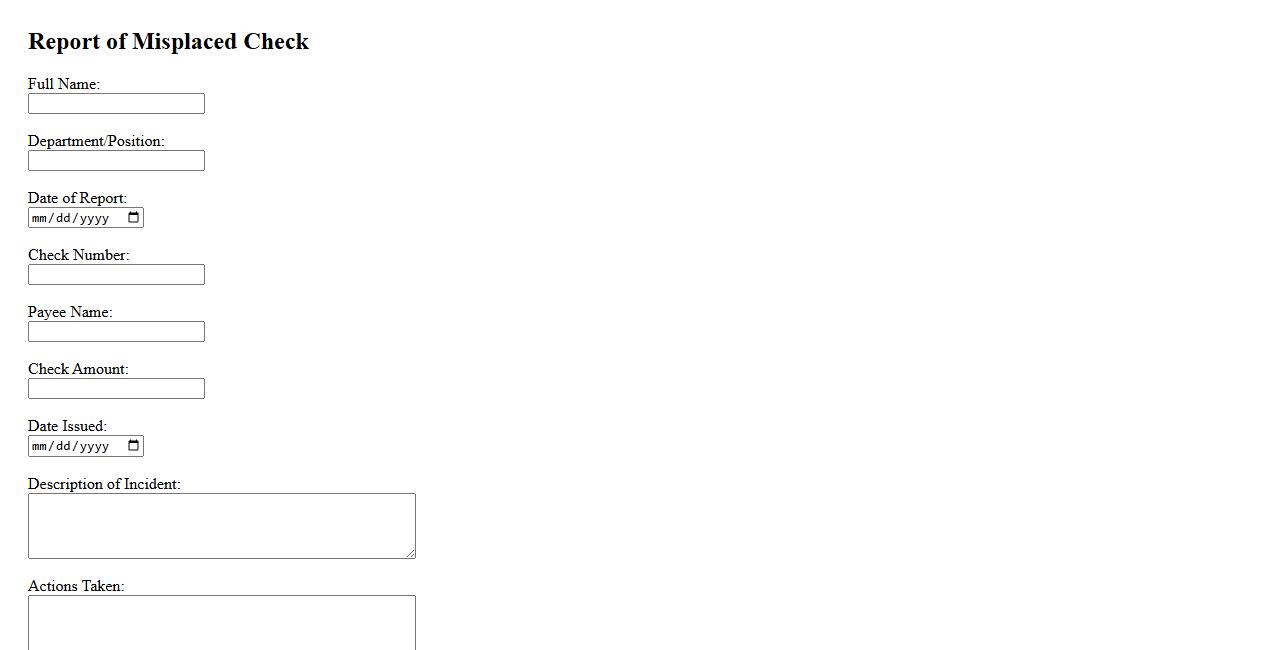

Report of Misplaced Check

The Report of Misplaced Check details the process of tracking and resolving issues related to checks that have been lost or delivered to the wrong recipient. This report helps organizations maintain accurate financial records and ensures timely redressal. It is essential for auditing and preventing potential fraudulent activities.

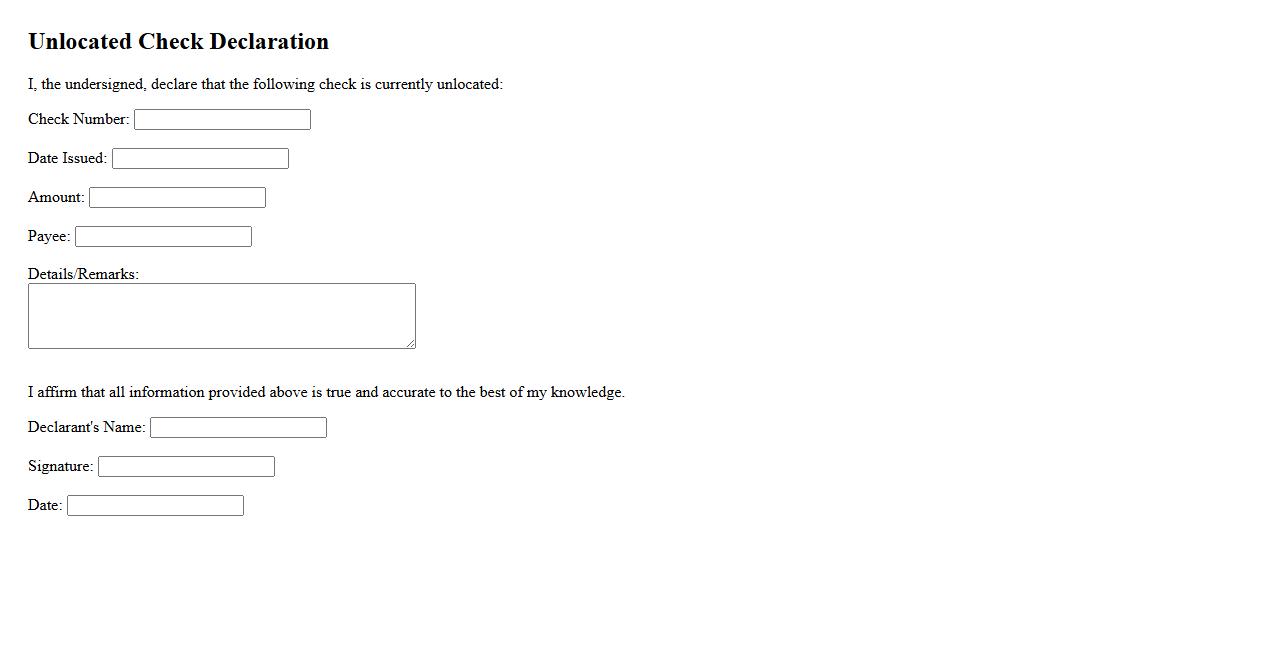

Unlocated Check Declaration

The Unlocated Check Declaration is a formal statement used when a check cannot be found or located. This declaration helps in initiating a stop payment or requesting a reissue from the issuer. It ensures proper documentation for lost or misplaced checks.

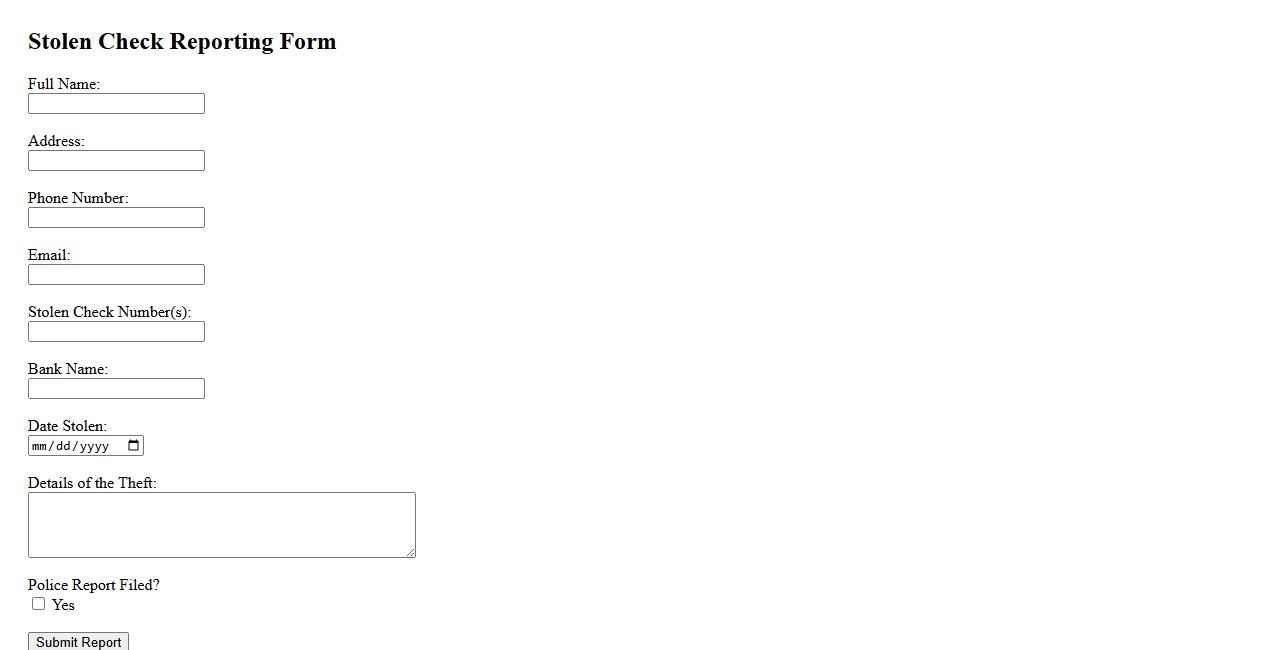

Stolen Check Reporting Form

The Stolen Check Reporting Form is a crucial document used to notify financial institutions about missing or stolen checks. This form helps protect your accounts from unauthorized transactions and potential fraud. Timely submission ensures prompt action to secure your funds and prevent misuse.

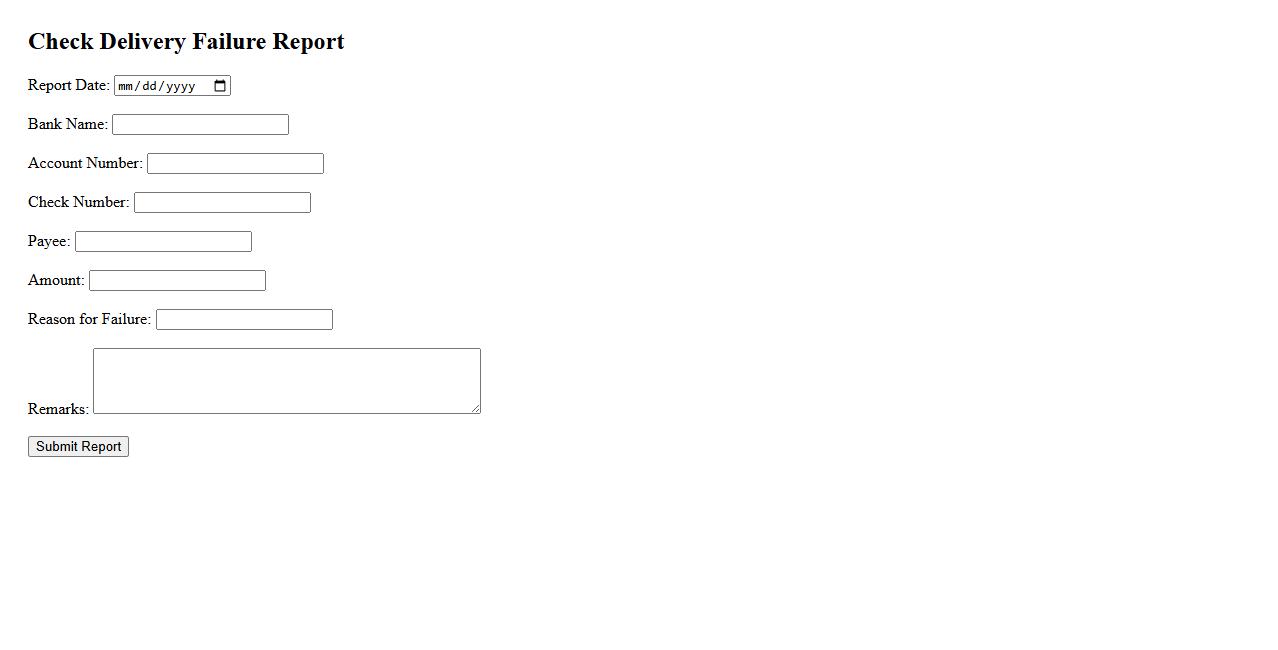

Check Delivery Failure Report

The Check Delivery Failure Report provides detailed insights into unsuccessful delivery attempts, helping businesses identify and resolve issues quickly. This report highlights reasons for failures, enabling efficient troubleshooting and improved customer satisfaction. Regularly reviewing this report ensures timely corrections and optimized delivery performance.

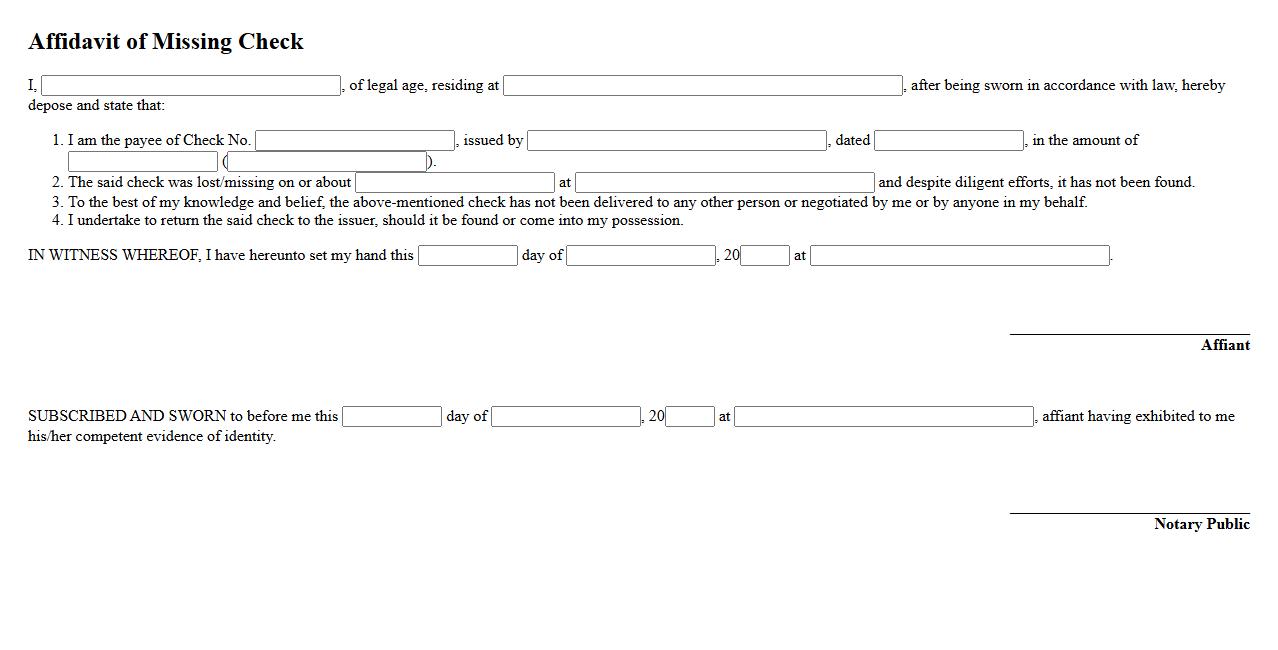

Affidavit of Missing Check

An Affidavit of Missing Check is a legal document used to declare that a specific check has not been received or is lost. It helps protect the issuer from liability and initiates the process for reissuing the payment. This affidavit must be signed under oath to ensure its authenticity and legal validity.

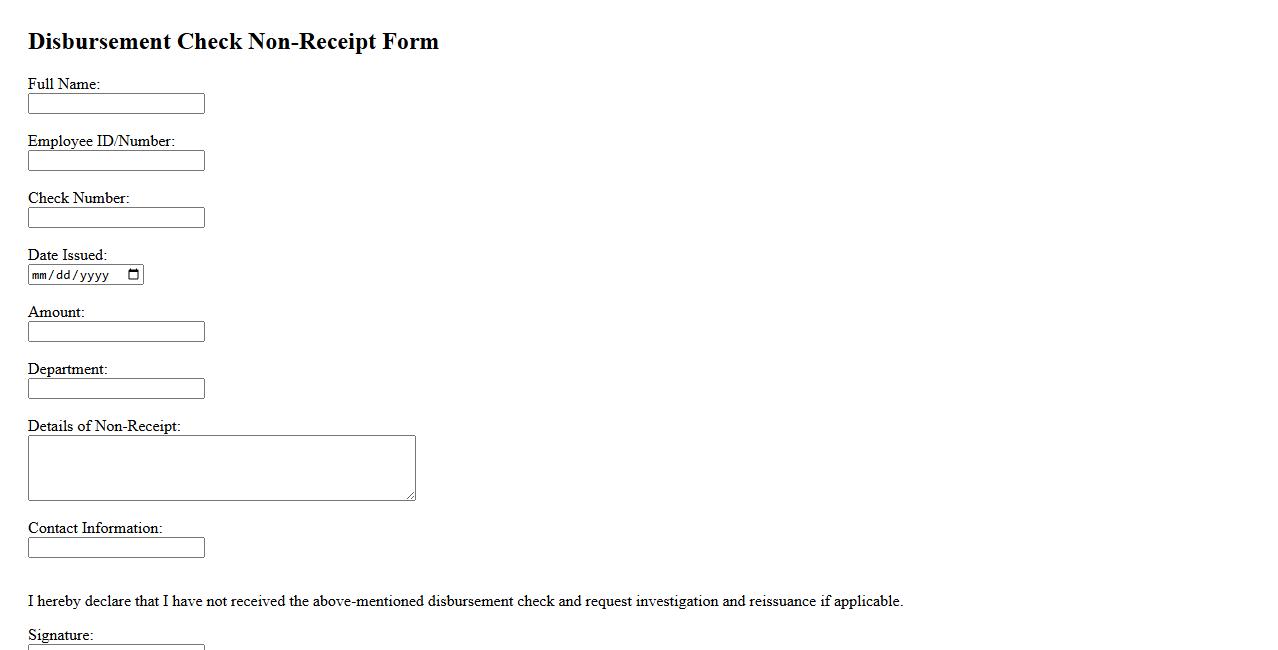

Disbursement Check Non-Receipt Form

The Disbursement Check Non-Receipt Form is used to formally report and request a replacement for a check that has not been received. This document ensures proper verification and processing of lost or missing disbursement payments. Timely submission of the form helps expedite the resolution and issuance of a new check.

What specific details about the lost or missing check are required in the report?

The report must include the check number and the exact amount of the check. Additionally, the date of issuance and the payee's name are essential to accurately identify the check. Providing these details helps ensure proper tracking and prevents fraudulent use.

Who is authorized to file a report of a lost or missing check?

Only the payee or the account holder issuing the check is authorized to file a report. In some organizations, an authorized representative with documented permission may also report the missing check. This restriction maintains security and accountability in the reporting process.

What actions must be taken immediately after discovering a check is lost or missing?

Upon discovery, the payee or issuer must promptly notify the issuing bank or financial institution. Filing a formal lost check report is essential to initiate protective measures. Immediate action helps prevent unauthorized cashing and potential financial loss.

What documentation or identification must accompany the report of a lost or missing check?

The report should be accompanied by valid photo identification of the individual filing it. Additionally, a written statement describing the circumstances under which the check was lost may be required. Providing thorough documentation ensures authenticity and aids the investigation process.

How does reporting a lost or missing check impact the reissuance or cancellation process?

Reporting a check as lost typically triggers a stop payment order on the original check by the bank. This action allows the reissuance of a new check after verification and prevents duplicate payments. Timely reporting ensures the cancellation of the missing check and facilitates secure reissuance.