The Report of Income Change is a document used to notify relevant authorities or organizations about any variations in an individual's or business's earnings. This report helps ensure accurate adjustments in benefits, taxes, or financial obligations based on the updated income information. Timely submission of the Report of Income Change is crucial to avoid penalties or disruptions in services.

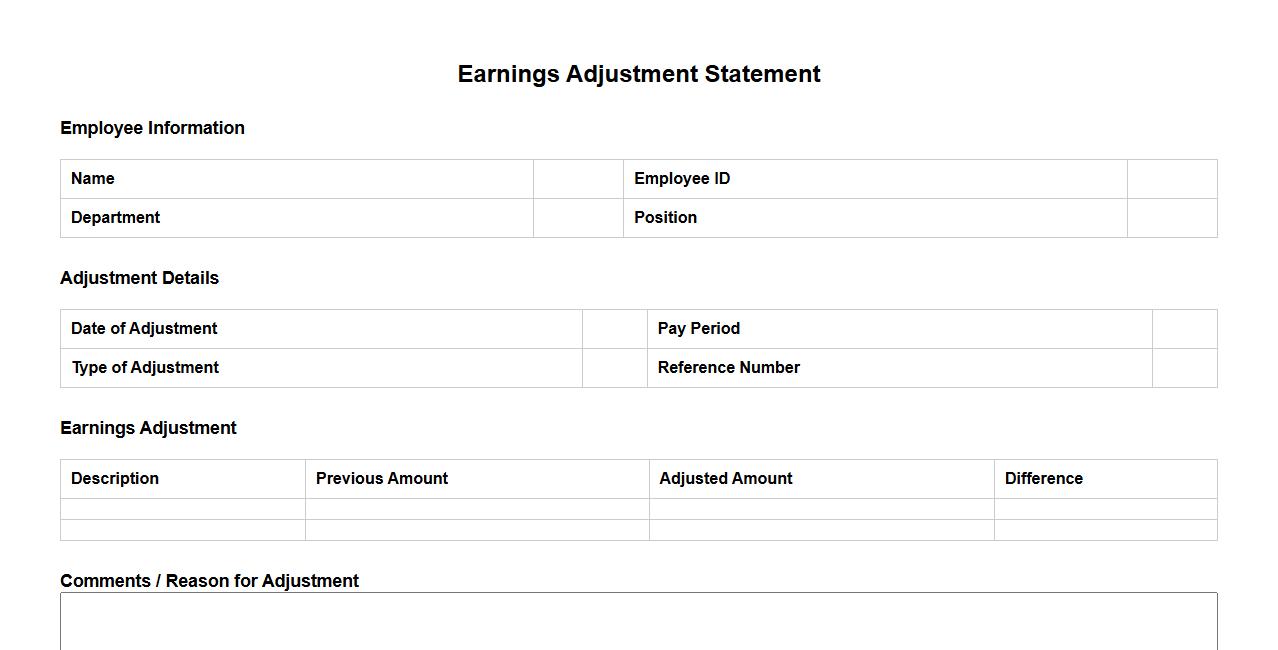

Earnings Adjustment Statement

The Earnings Adjustment Statement is a document detailing corrections or updates to previously reported income figures. It ensures accuracy in financial records for compliance and reporting purposes. This statement is essential for both employers and employees to reconcile payroll discrepancies.

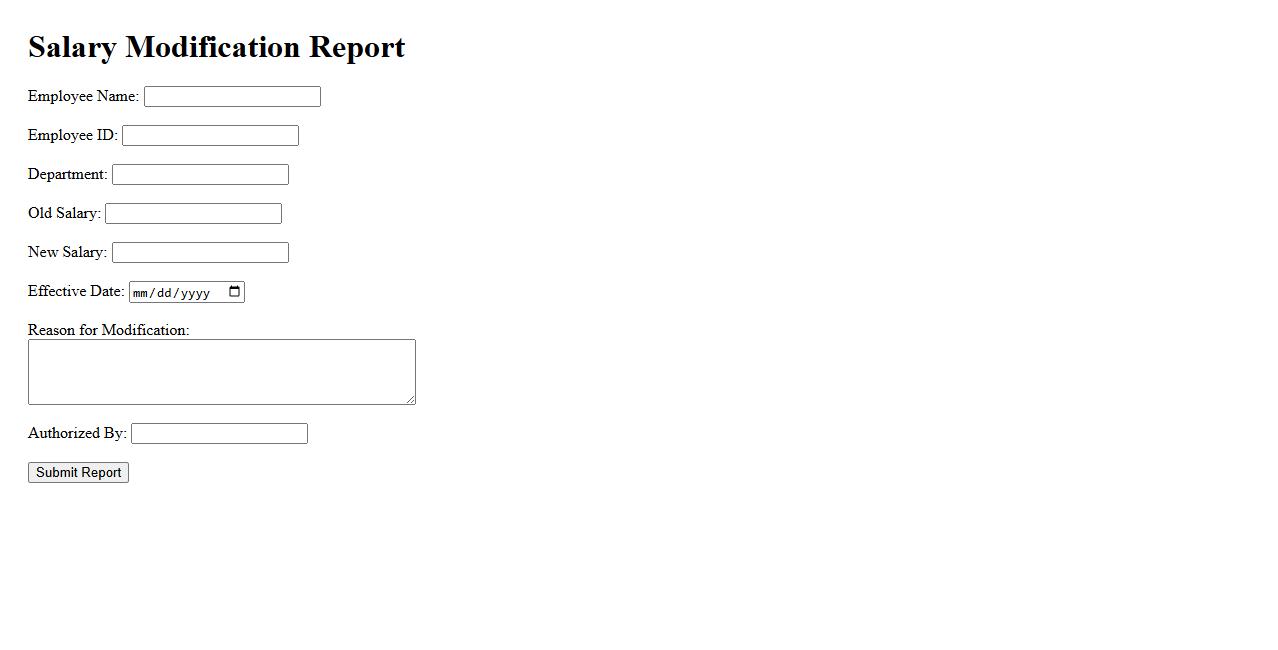

Salary Modification Report

The Salary Modification Report provides a detailed overview of all changes made to employee salaries within a specific period. It helps HR and management track adjustments, bonuses, and increments efficiently. This report is essential for maintaining transparent and accurate payroll records.

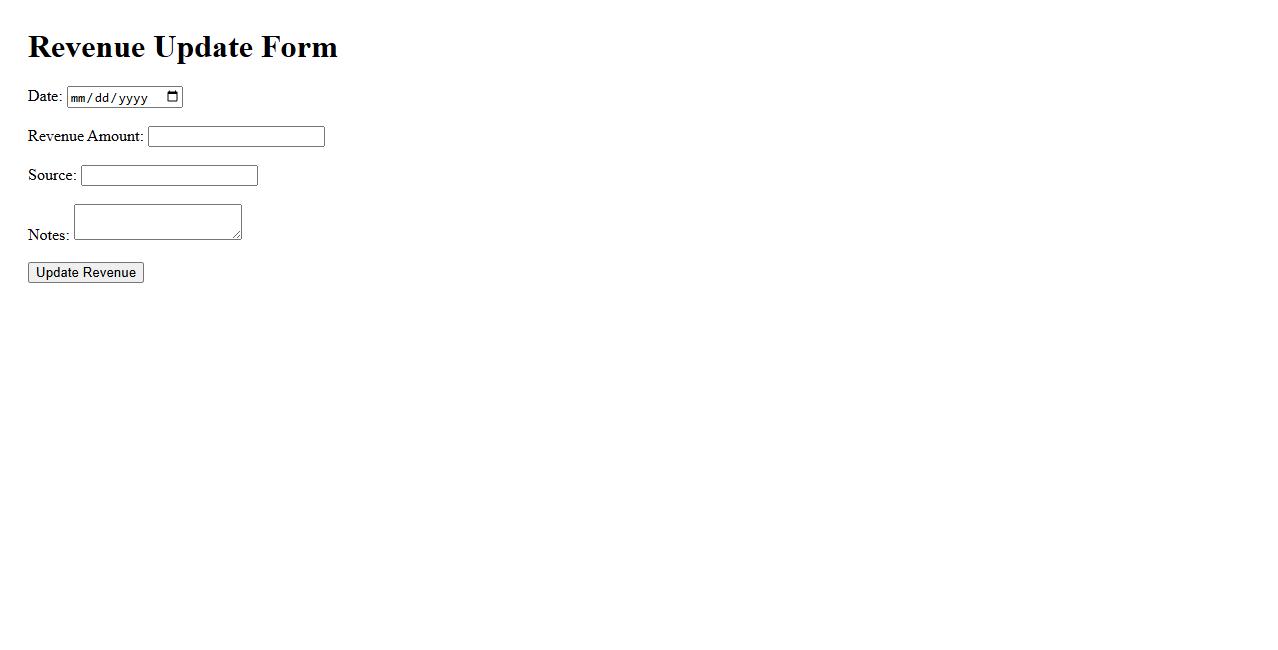

Revenue Update Form

The Revenue Update Form is designed to collect accurate financial information for timely analysis and reporting. It ensures that all revenue changes are documented and processed efficiently. This form is essential for maintaining up-to-date financial records within the organization.

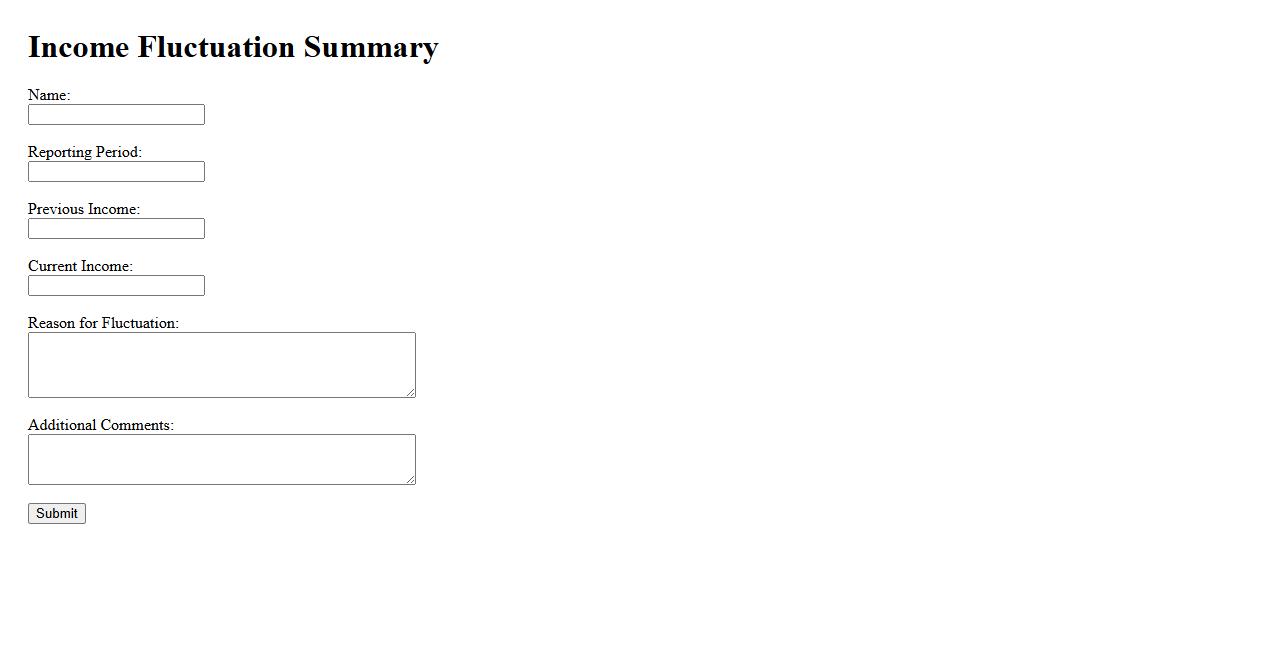

Income Fluctuation Summary

The Income Fluctuation Summary provides a clear overview of variations in earnings over a specific period. It helps identify patterns and trends in income changes, enabling better financial planning. This summary is essential for understanding financial stability and managing cash flow effectively.

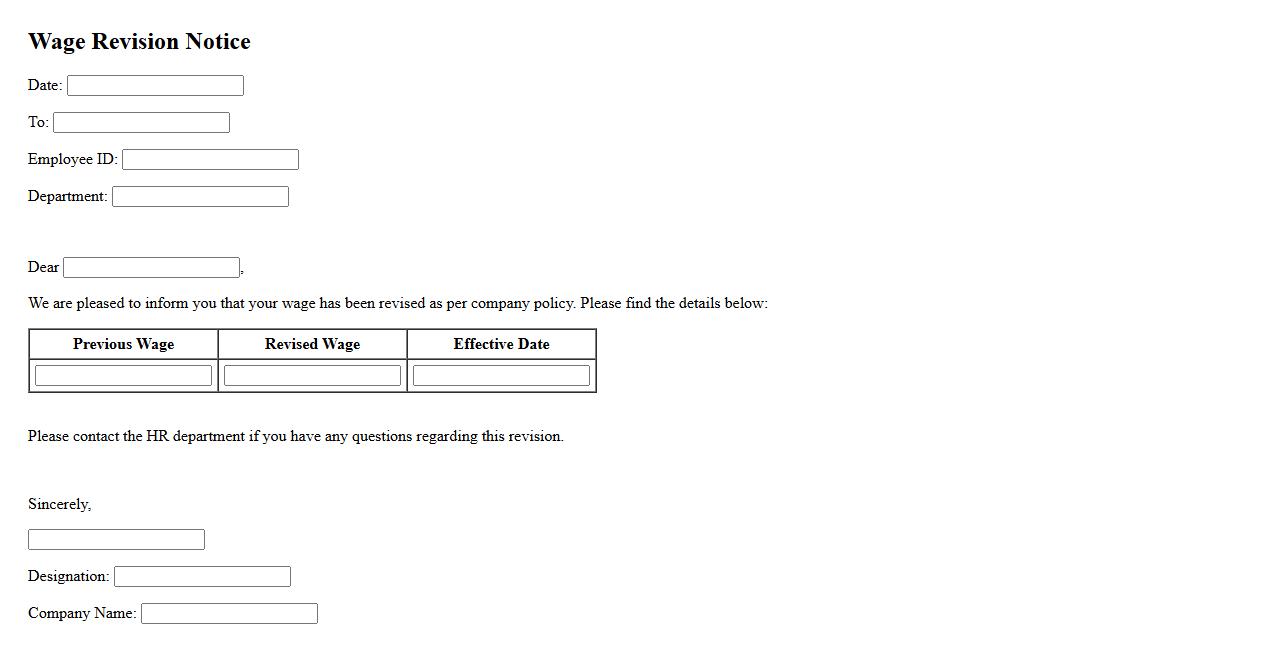

Wage Revision Notice

A Wage Revision Notice is a formal document issued by an employer to announce changes in employee salary structures. It outlines the new wage rates, effective dates, and any related terms or conditions. This notice ensures transparency and compliance with labor regulations.

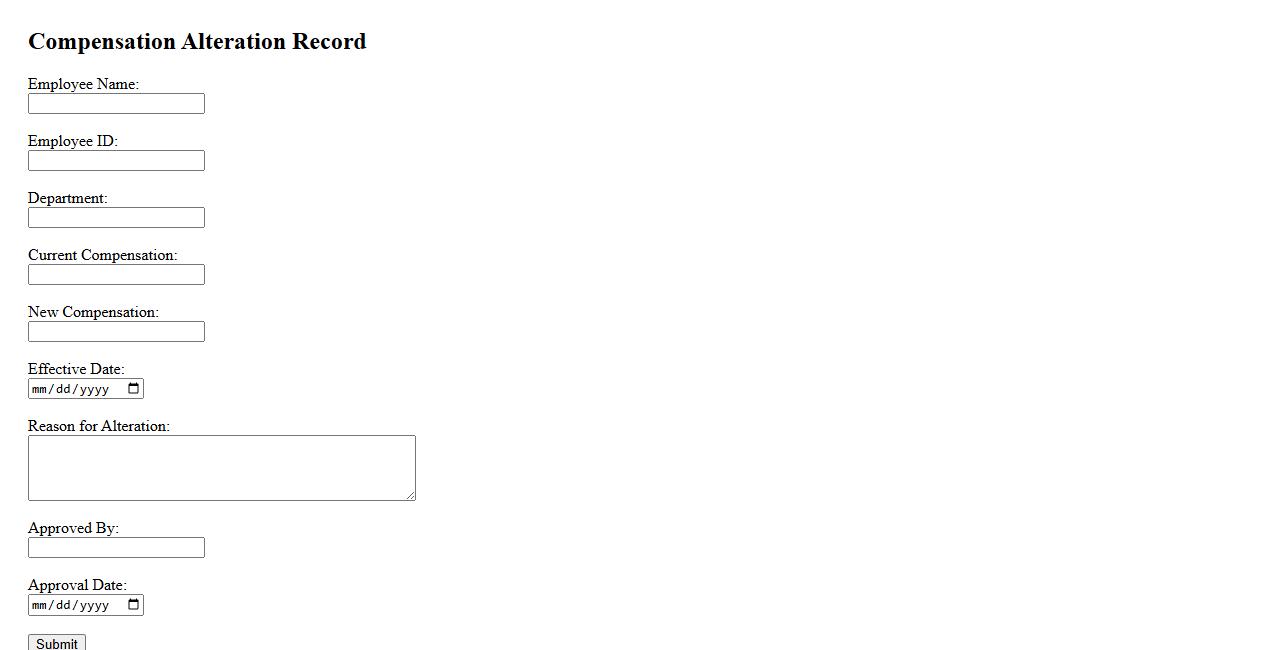

Compensation Alteration Record

The Compensation Alteration Record is a detailed document tracking changes in an employee's salary or benefits. It ensures transparency and accuracy in payroll management by recording all modifications. This record is essential for maintaining up-to-date compensation data within an organization.

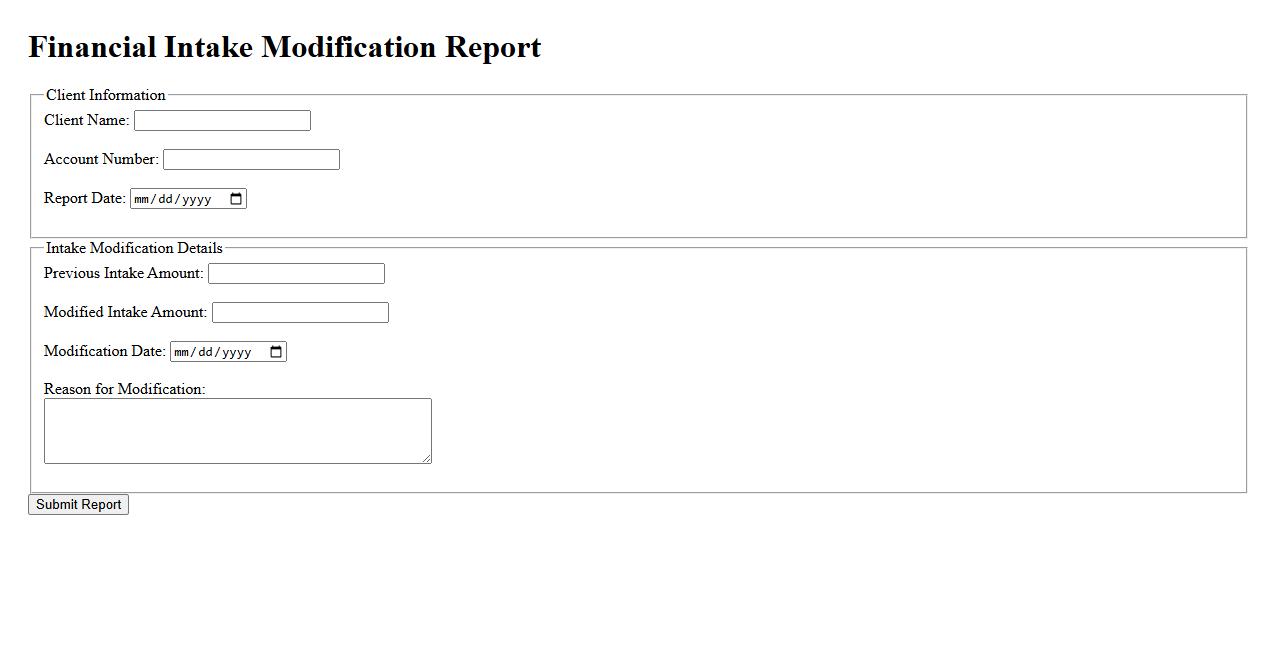

Financial Intake Modification Report

The Financial Intake Modification Report provides a detailed analysis of changes in financial inputs over a specific period. It helps organizations track adjustments and ensure accurate budgeting and forecasting. This report is essential for maintaining financial transparency and making informed business decisions.

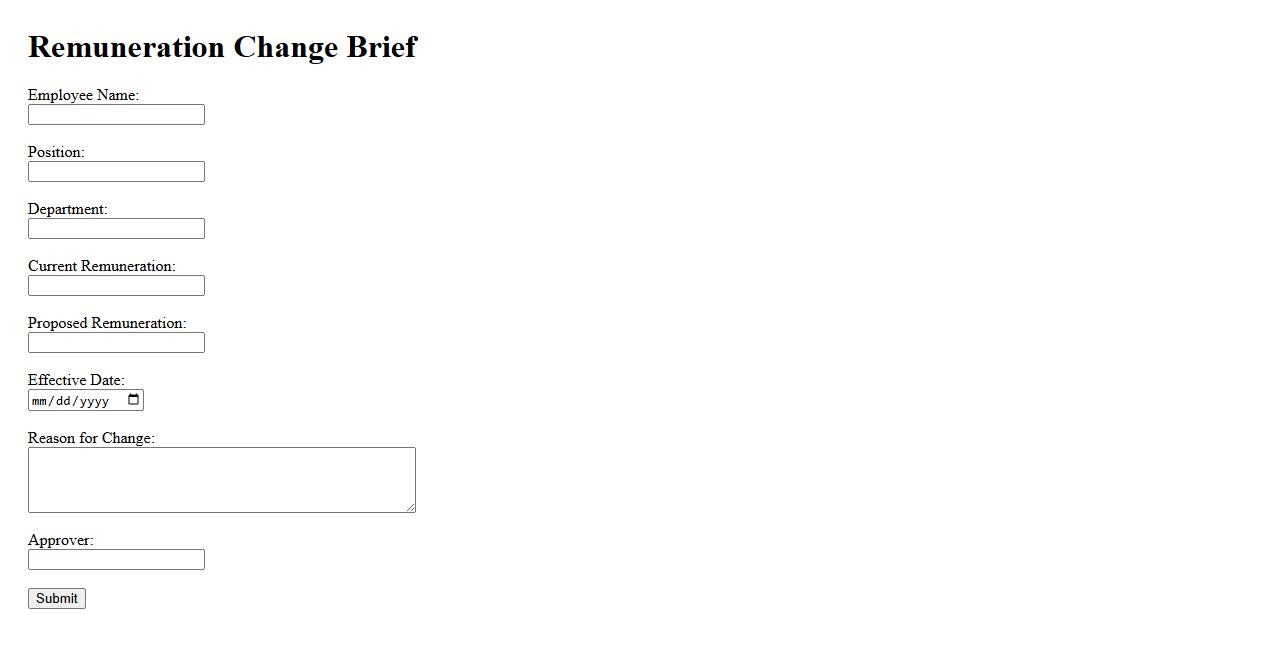

Remuneration Change Brief

The Remuneration Change Brief provides a clear overview of updates to employee compensation structures. It outlines adjustments in salaries, bonuses, and benefits to ensure transparency and fairness. This brief helps stakeholders stay informed about key remuneration decisions.

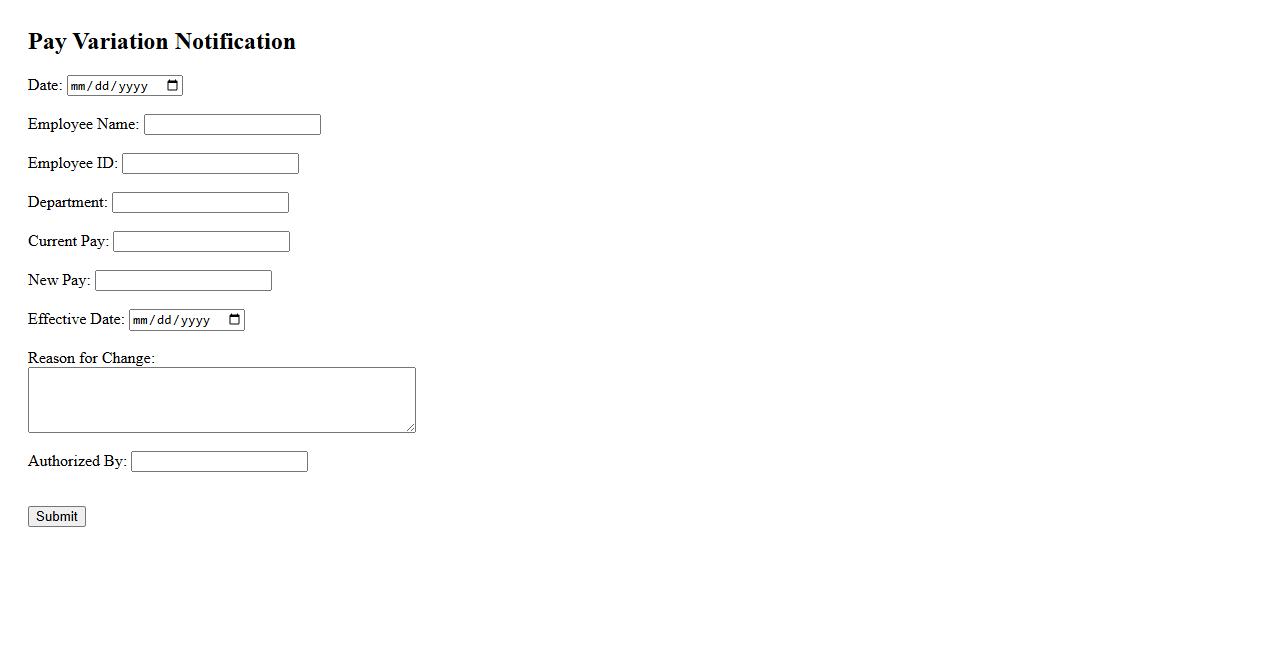

Pay Variation Notification

The Pay Variation Notification informs employees about any changes in their salary or wages. This important communication ensures transparency and keeps staff updated on adjustments in their compensation. Timely notifications help maintain clear employer-employee relationships and compliance with labor regulations.

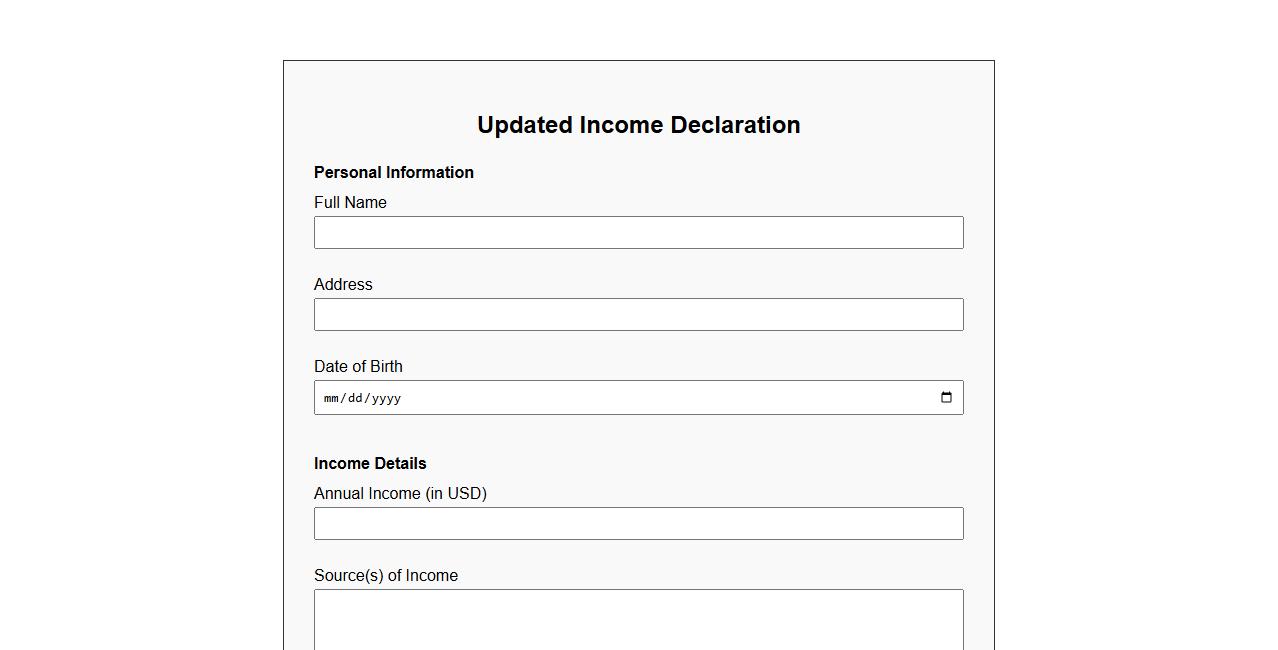

Updated Income Declaration

The Updated Income Declaration provides the latest financial details required for accurate assessment and verification. It ensures transparency and compliance with current regulations, helping individuals and organizations maintain up-to-date records. Timely submission of this declaration is crucial for effective financial planning and reporting.

What event or transaction triggered the income change reported in the document?

The income change was triggered by a significant event or transaction such as a job promotion, salary adjustment, or new employment contract. This event directly affected the reported earnings. Accurate identification of the triggering event is essential for proper documentation.

How does the new reported income compare to previous earnings or statements?

The new income reflects an increase or decrease when compared to prior earnings or statements. It is important to analyze the percentage change to understand the financial impact fully. Consistent comparison ensures transparency and accuracy in reporting.

What supporting documentation is required to verify the income change?

Verification of the income change requires official documents such as pay stubs, tax returns, employment contracts, or bank statements. These documents provide proof of the reported income adjustment. Proper validation helps maintain integrity in financial reporting.

What are the effective dates associated with the reported income change?

The effective dates specify when the income change began and the duration it covers. These dates are critical for determining eligibility and calculating benefits or obligations. Clear documentation of timelines prevents discrepancies.

What impact does the reported income change have on existing benefits, obligations, or agreements?

The income change can affect eligibility for benefits, repayment obligations, or contractual agreements. It may lead to adjustments in benefit levels or modification of financial responsibilities. Understanding this impact ensures compliance and accurate financial planning.