A Report of Suspected Tax Fraud is a formal document submitted to tax authorities when there is a belief that illegal activities related to tax evasion or underreporting have occurred. This report enables authorities to investigate and take necessary actions to ensure compliance with tax laws. Timely and accurate reporting is crucial to maintaining the integrity of the tax system and preventing financial losses.

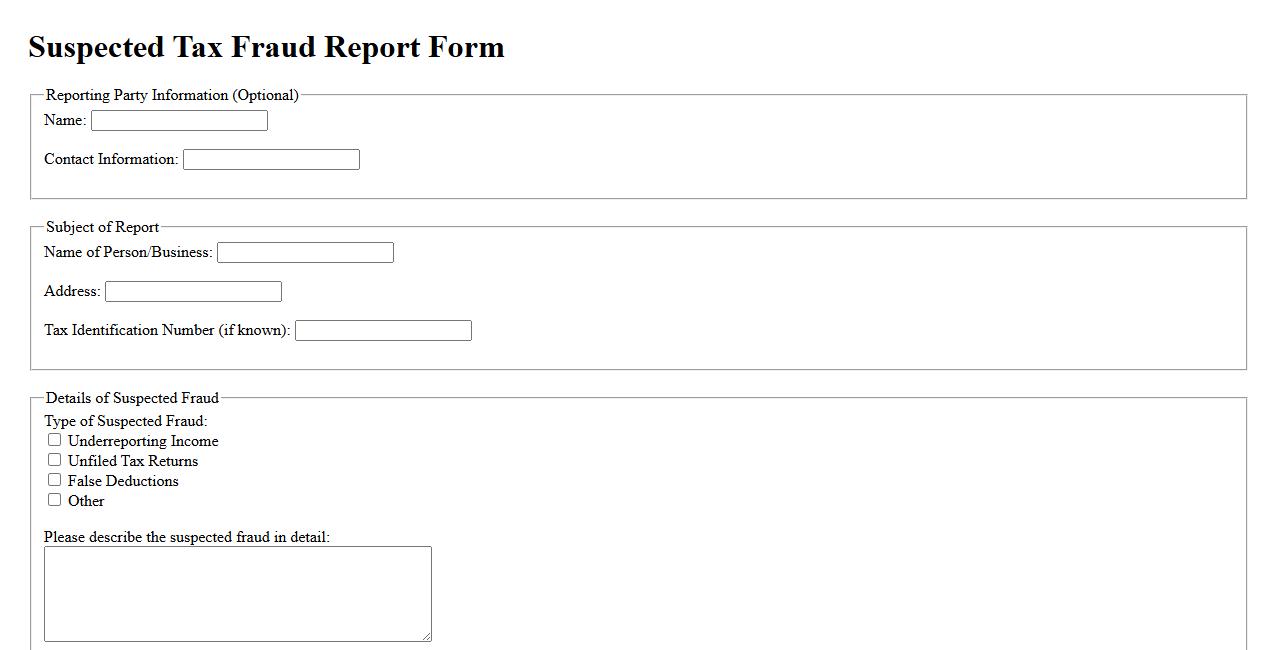

Suspected Tax Fraud Report Form

The Suspected Tax Fraud Report Form is a crucial document used to report any suspicious activities related to tax evasion. It helps tax authorities investigate and prevent fraudulent tax practices effectively. Completing this form ensures that potential fraud cases are addressed promptly and accurately.

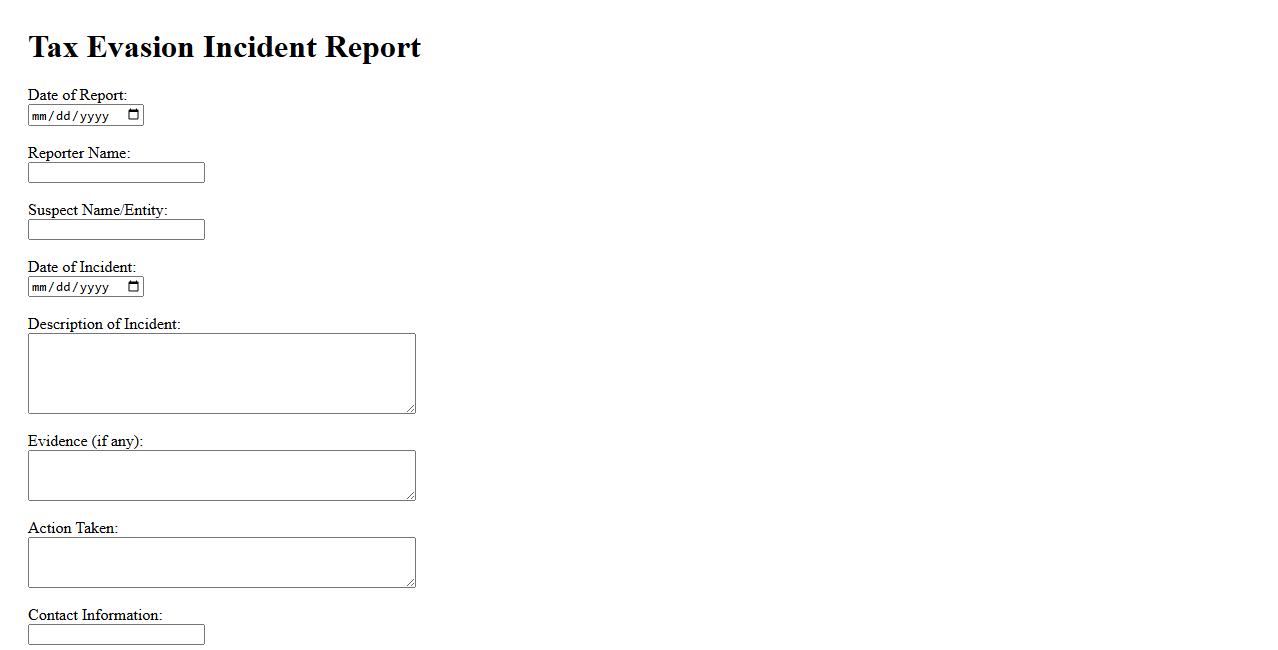

Tax Evasion Incident Report

The Tax Evasion Incident Report details occurrences where individuals or entities intentionally avoid paying taxes owed. It provides crucial information for authorities to investigate and enforce tax compliance. This report helps maintain financial transparency and uphold the integrity of the tax system.

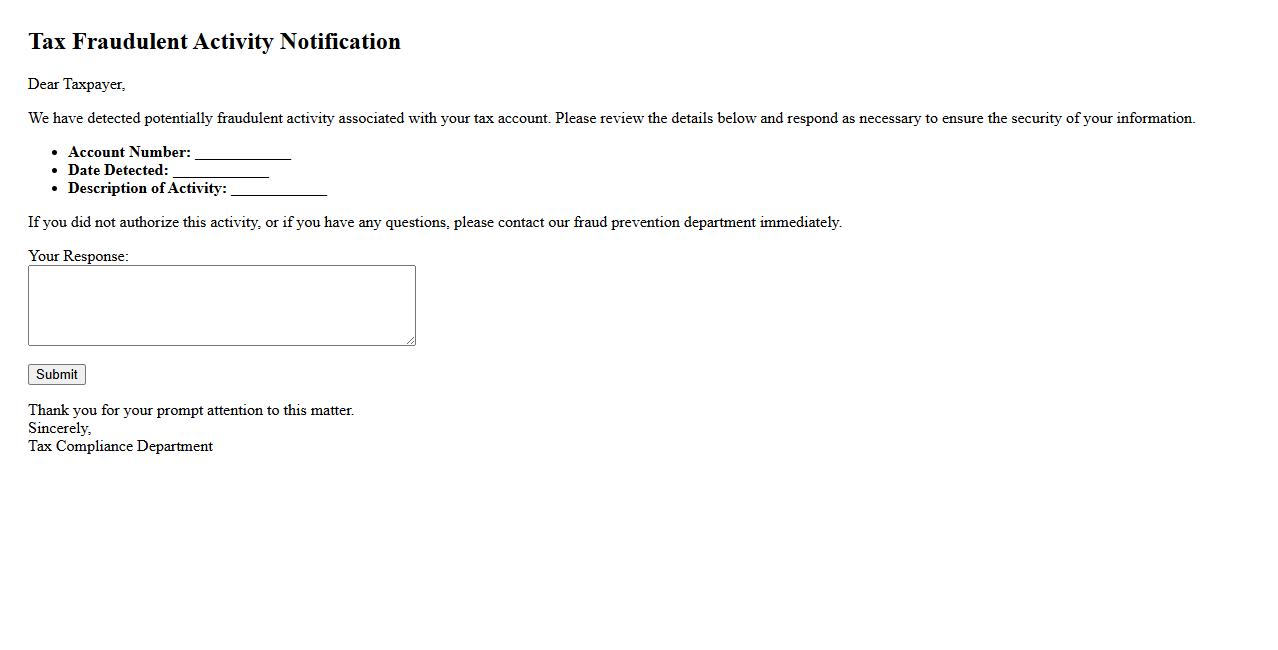

Tax Fraudulent Activity Notification

Receiving a Tax Fraudulent Activity Notification indicates suspicious actions related to your tax filings. It is crucial to review the notice carefully and verify your tax information promptly. Taking immediate steps can help prevent potential identity theft and financial penalties.

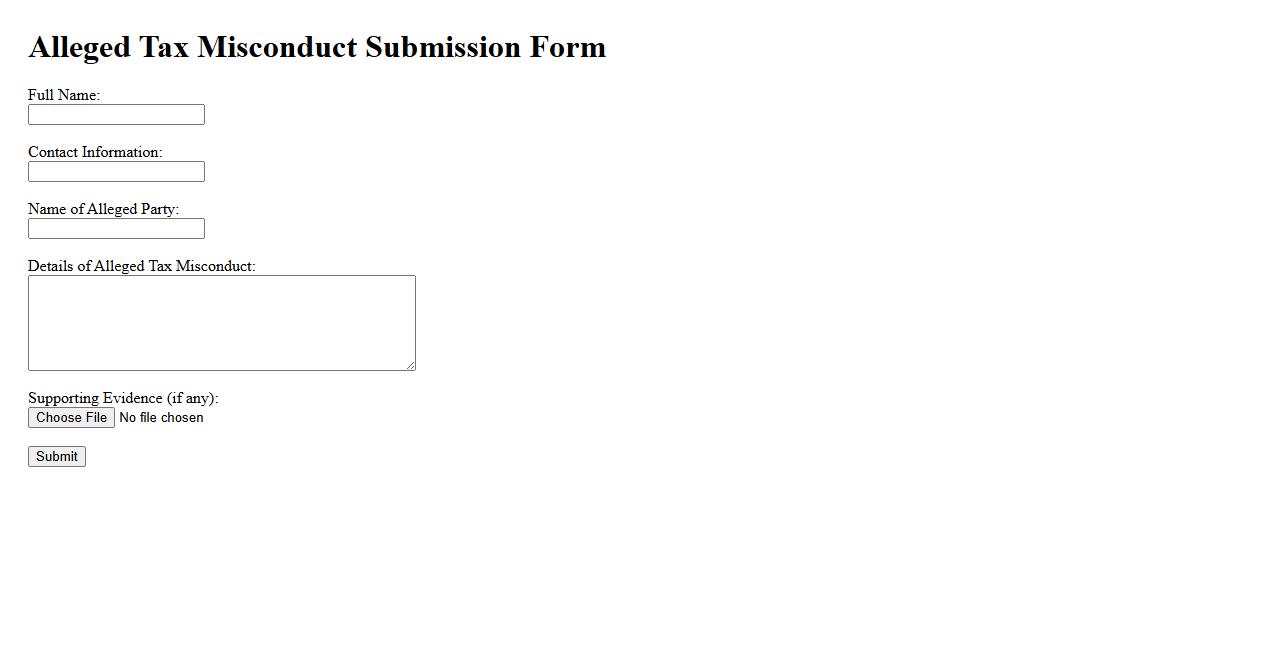

Alleged Tax Misconduct Submission

The Alleged Tax Misconduct Submission refers to the formal reporting of suspected improper tax activities. This process ensures transparency and accountability in financial matters. Timely submissions help authorities investigate and address potential tax violations effectively.

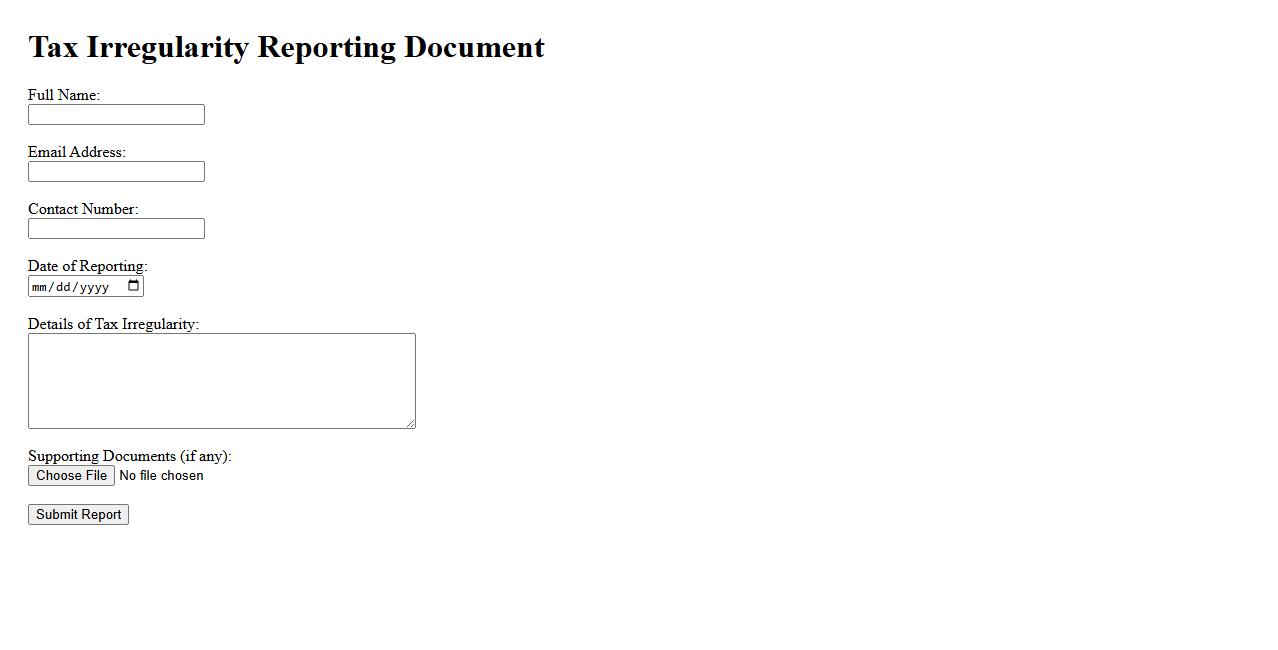

Tax Irregularity Reporting Document

The Tax Irregularity Reporting Document is a crucial tool for identifying and reporting discrepancies in tax filings. It helps ensure compliance by documenting any irregularities detected during audits or reviews. This document supports transparent communication between taxpayers and tax authorities.

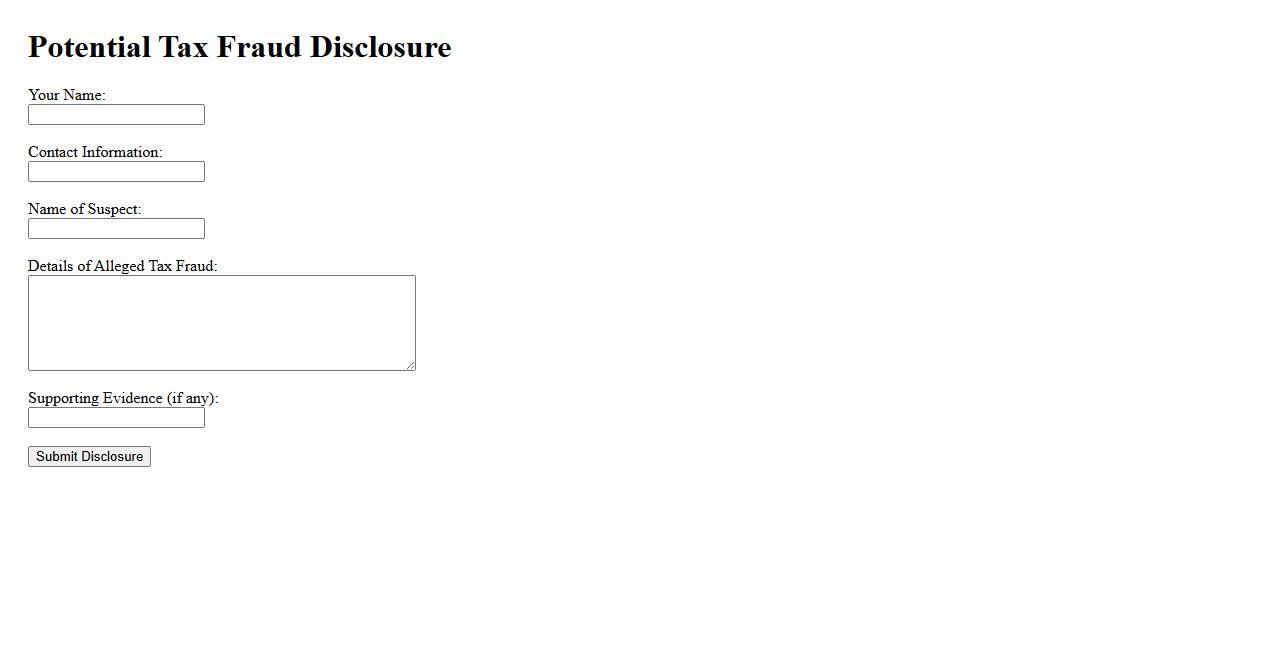

Potential Tax Fraud Disclosure

Potential tax fraud disclosure refers to the process of identifying and reporting suspicious activities that may indicate fraudulent tax behavior. It is crucial for maintaining transparency and compliance with tax laws. Properly addressing potential tax fraud disclosure helps prevent legal consequences and protects financial integrity.

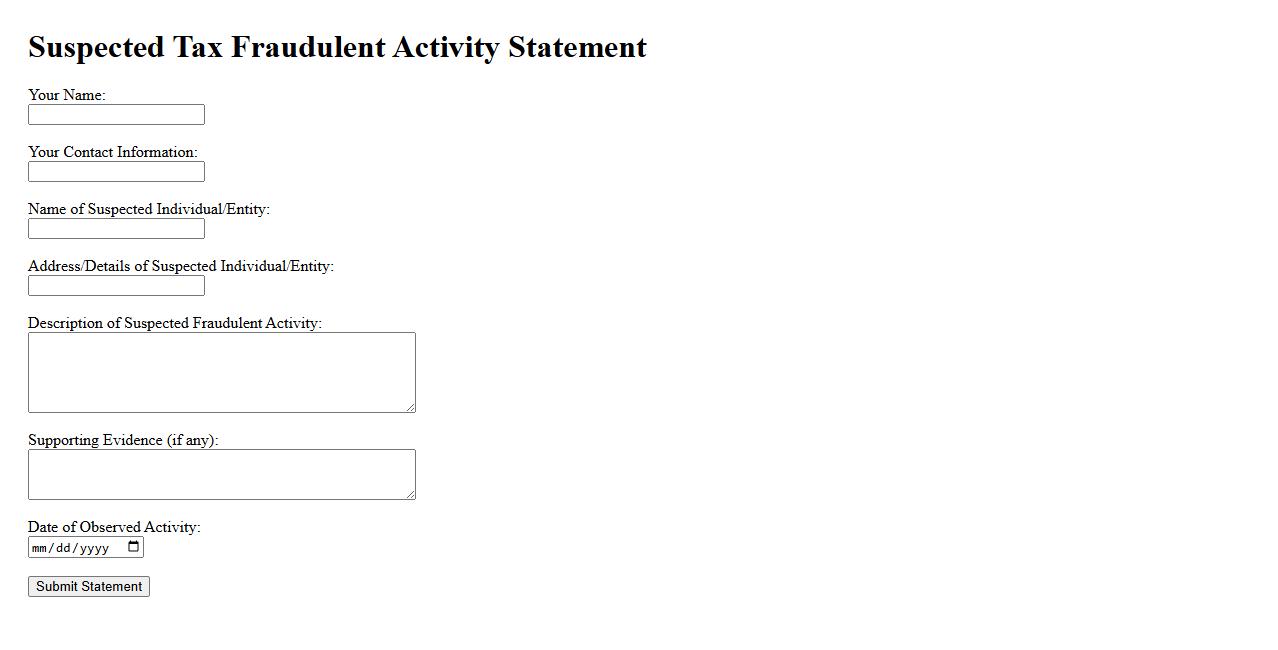

Suspected Tax Fraudulent Activity Statement

The Suspected Tax Fraudulent Activity Statement is a formal document used to report potential tax evasion or fraudulent behavior. It serves to alert authorities about suspicious financial activities that may violate tax laws. Timely submission of this statement helps maintain transparency and compliance within the tax system.

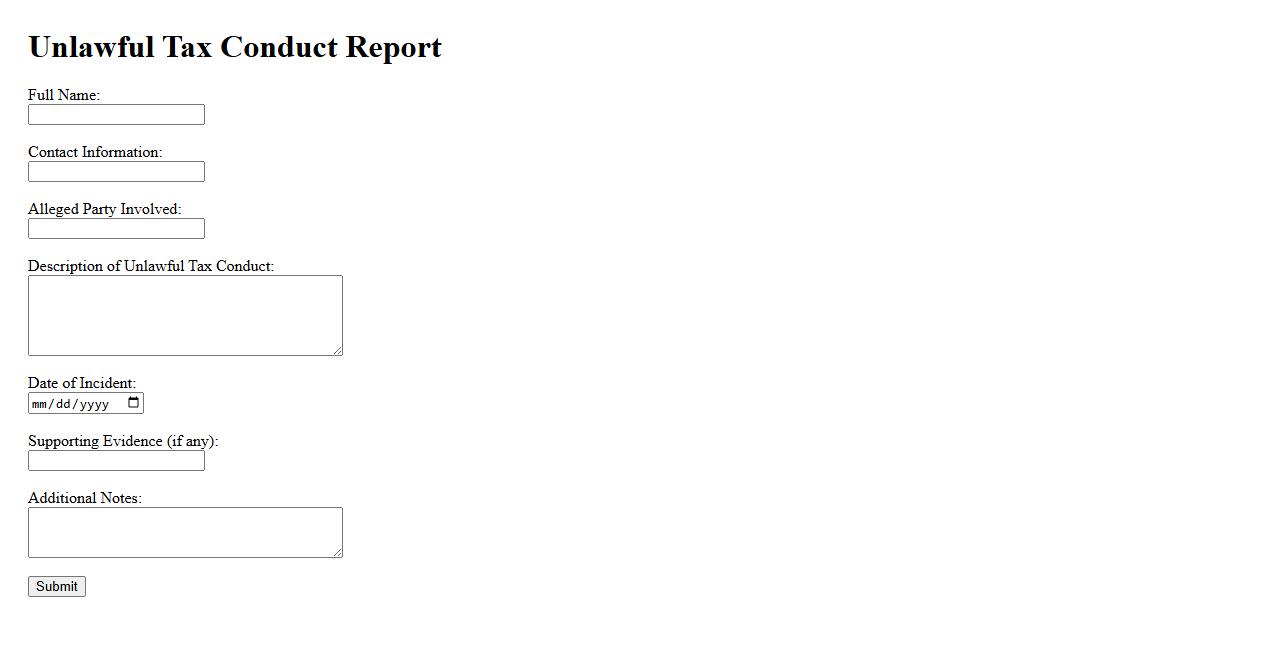

Unlawful Tax Conduct Report

The Unlawful Tax Conduct Report provides detailed documentation of illegal activities related to tax evasion or fraud. It is essential for identifying discrepancies and ensuring compliance with tax regulations. This report helps authorities take appropriate legal actions against unlawful tax behaviors.

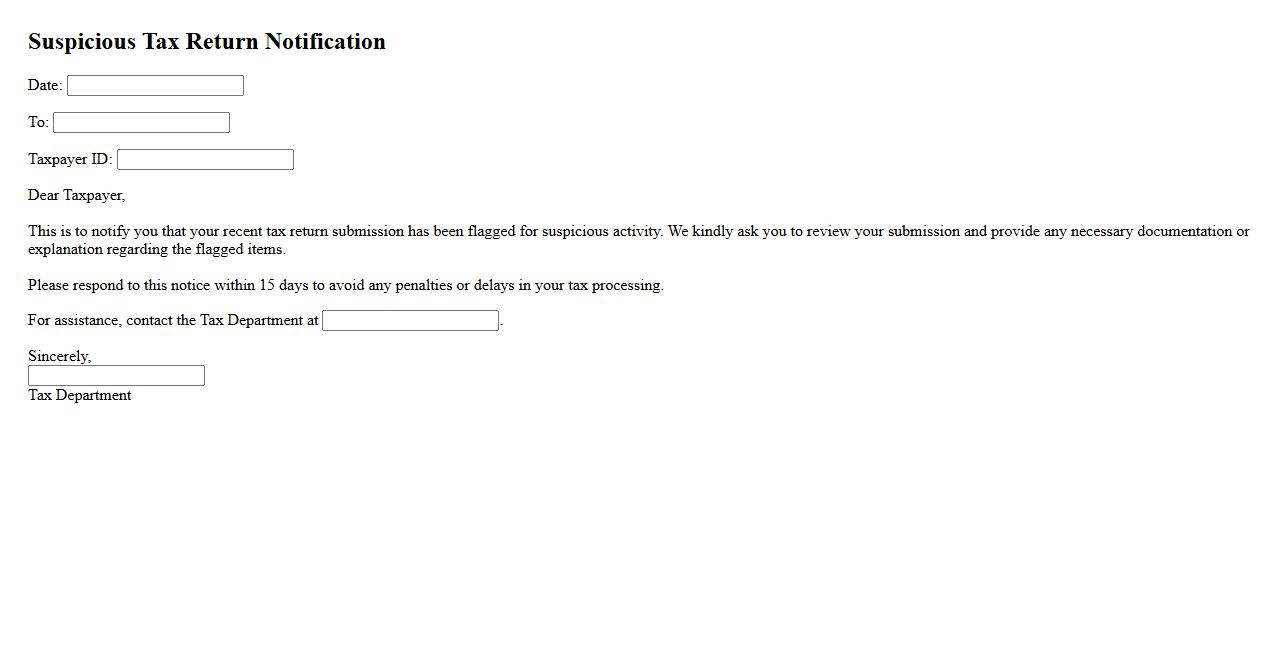

Suspicious Tax Return Notification

If you receive a Suspicious Tax Return Notification, it means there may be unusual activity associated with your tax filing. This alert helps protect against potential identity theft or fraudulent returns. Promptly reviewing and verifying the information can prevent financial loss and ensure your records remain secure.

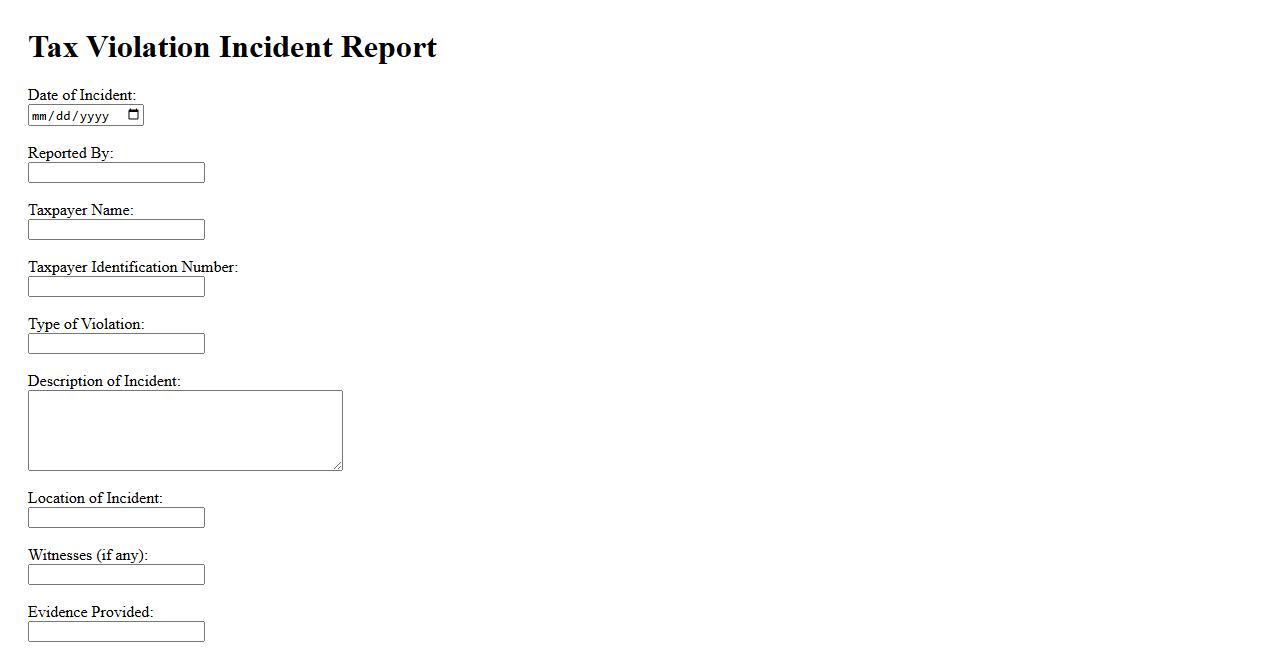

Tax Violation Incident Report

The Tax Violation Incident Report is a crucial document used to detail instances of non-compliance with tax regulations. It provides a clear record of the violation, including relevant facts and evidence. This report helps authorities take appropriate corrective actions to ensure legal compliance.

What specific incidents or transactions indicate suspected tax fraud in this report?

The report highlights several suspicious transactions that suggest tax underreporting and improper deductions. Unusually large cash deposits and inconsistent income declarations are key indicators. Additionally, the report cites discrepancies between reported revenue and actual financial activity as evidence of potential fraud.

Which individuals or entities are identified as parties involved in the suspected tax fraud?

The report identifies multiple individuals and corporate entities linked to the suspected tax fraud. These parties include business owners, financial advisors, and affiliated companies engaged in questionable financial practices. Their roles vary from direct perpetrators to facilitators of the fraudulent schemes.

What types of tax laws or regulations are allegedly violated according to the document?

The document alleges violations of several tax laws and regulations, including income tax evasion and fraudulent claims for tax credits. It also points to breaches of reporting requirements and failure to comply with withholding tax obligations. These infractions undermine the integrity of the tax system and warrant further investigation.

How is the evidence or supporting documentation for the suspected fraud presented in the report?

The evidence is presented through a combination of financial records, audit trails, and expert testimonies. The report includes detailed analyses of bank statements, invoices, and transaction logs. These documents provide a comprehensive view supporting the allegations of tax fraud.

What recommended actions or next steps does the report suggest for addressing the suspected tax fraud?

The report recommends initiating formal investigations and legal proceedings against the identified parties. It advises enhancing audit activities and improving compliance monitoring mechanisms. Furthermore, the report suggests collaborating with law enforcement to ensure accountability and recovery of unpaid taxes.