A Report of Income for Tax Purposes details an individual's or business's earnings, providing essential information for accurate tax calculation. This report includes various income sources, such as wages, dividends, and rental income, ensuring compliance with tax regulations. Accurate completion of the Report of Income for Tax Purposes helps avoid penalties and facilitates smooth processing of tax returns.

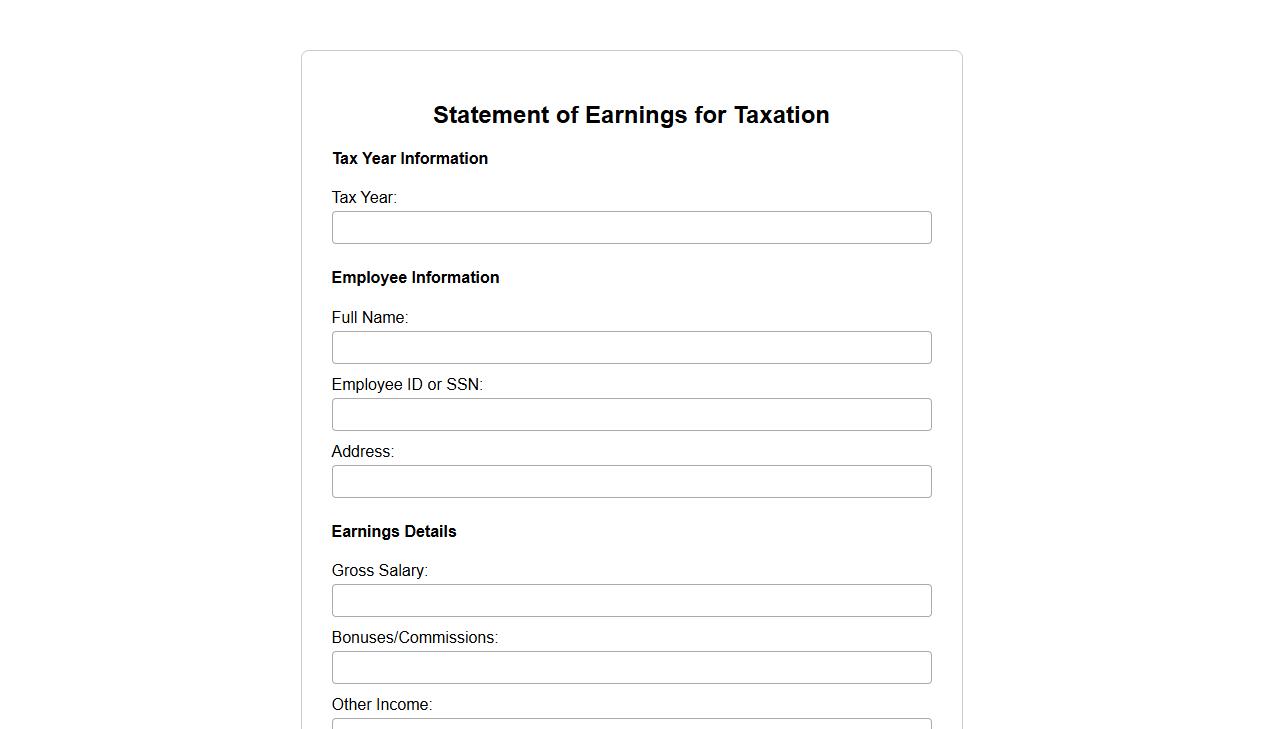

Statement of Earnings for Taxation

The Statement of Earnings for Taxation is a crucial document that details the income earned by an individual or business during a fiscal year. It is used to calculate taxable income and determine tax obligations accurately. This statement ensures compliance with tax regulations by providing clear and organized financial information.

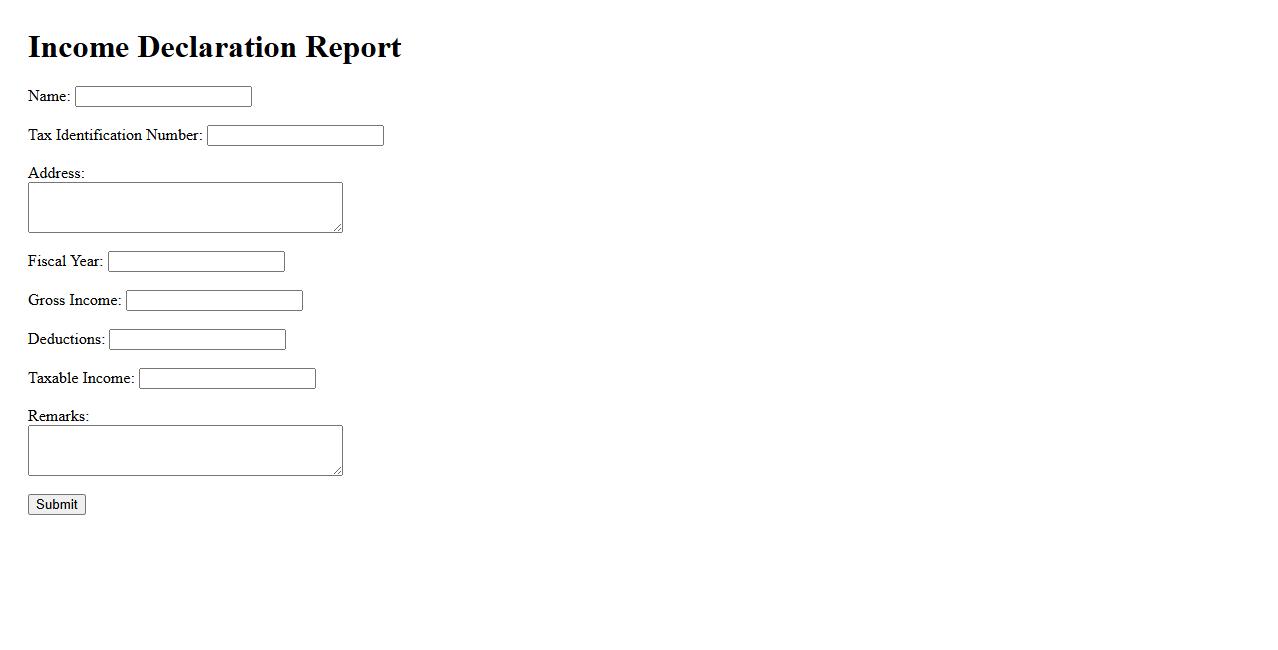

Income Declaration Report

The Income Declaration Report provides a detailed summary of earnings for a specified period, ensuring transparency and compliance with tax regulations. It helps individuals and organizations accurately report their income sources to relevant authorities. This report is essential for financial audits and budget planning.

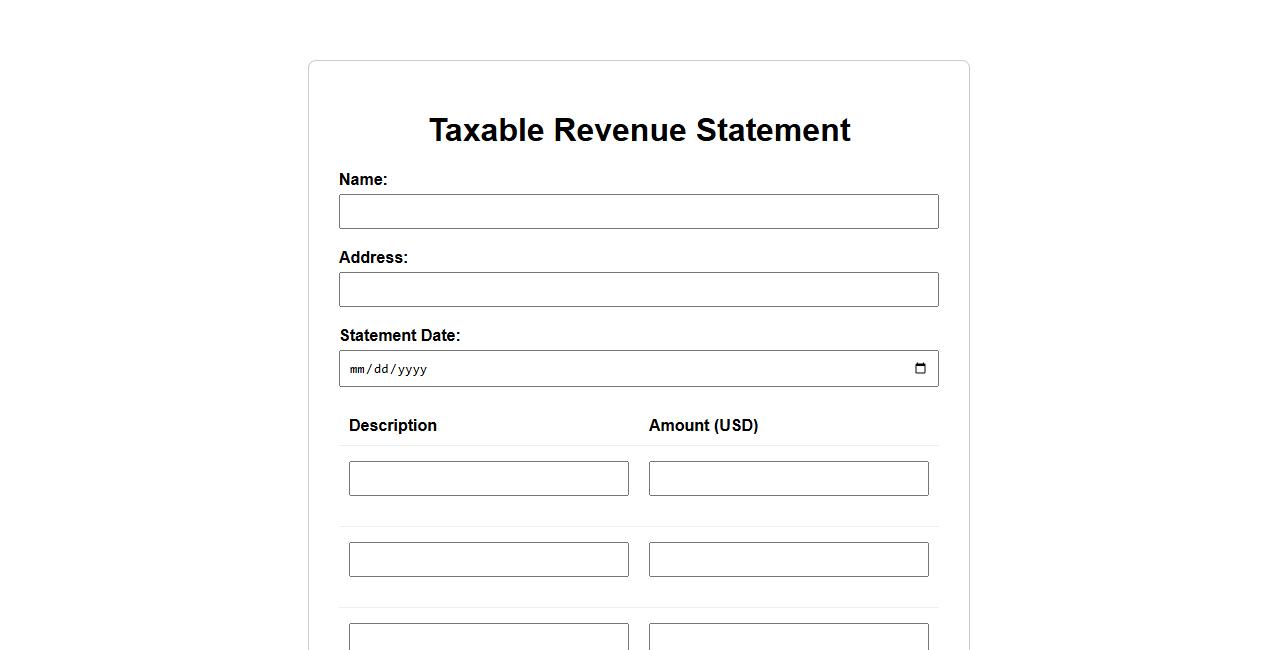

Taxable Revenue Statement

The Taxable Revenue Statement is a crucial financial document that outlines the total income subject to taxation. It provides a detailed breakdown of revenue streams, ensuring accurate tax reporting and compliance. This statement helps businesses and individuals understand their tax obligations clearly and efficiently.

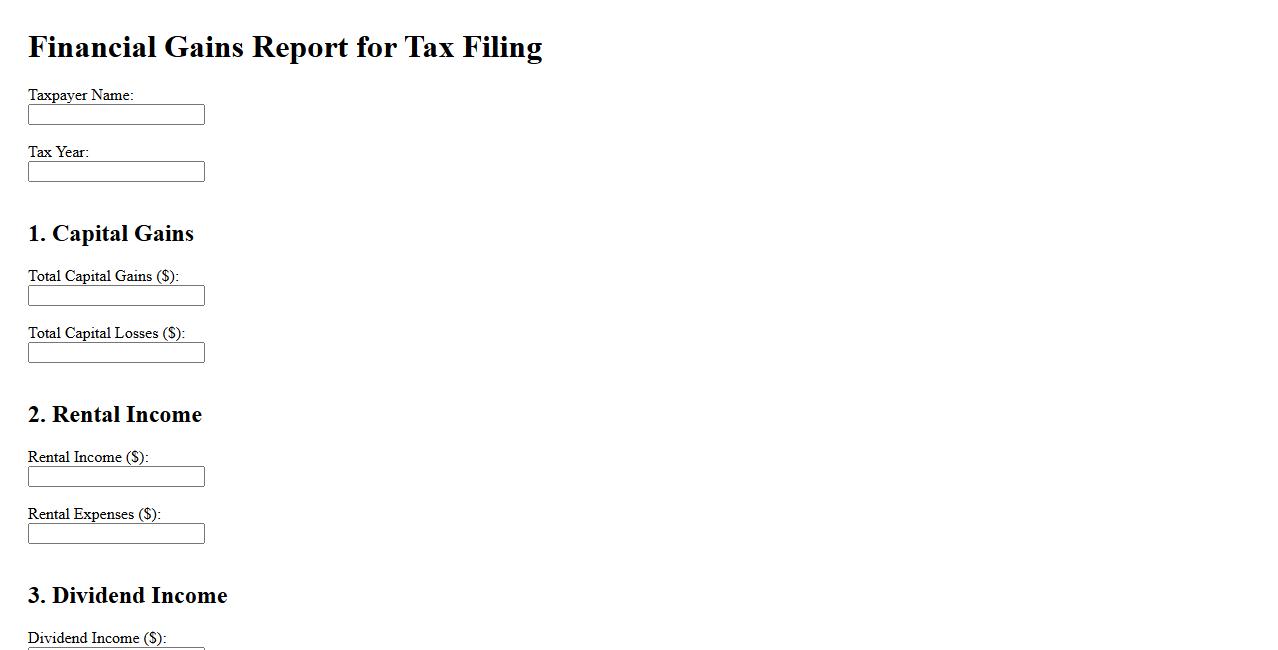

Financial Gains Report for Tax Filing

The Financial Gains Report for Tax Filing provides a comprehensive summary of all taxable income and investment profits throughout the fiscal year. It helps ensure accuracy and compliance when preparing your tax returns. This report simplifies tracking and reporting financial gains to tax authorities.

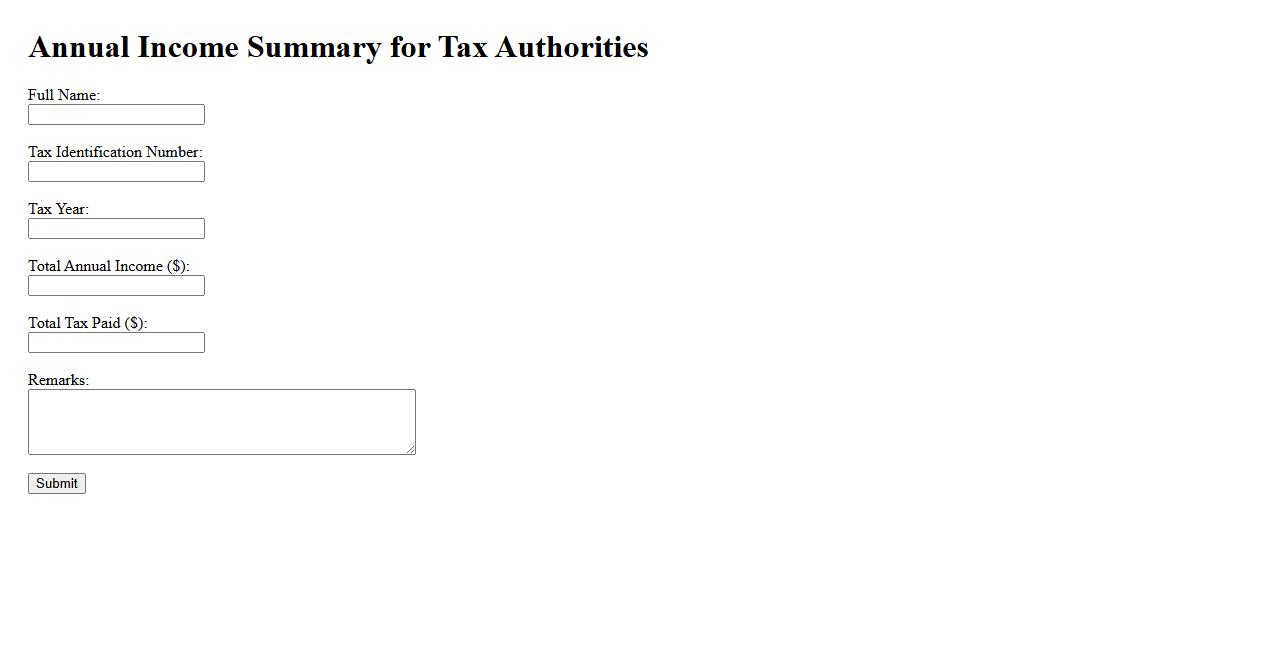

Annual Income Summary for Tax Authorities

The Annual Income Summary for Tax Authorities provides a comprehensive overview of an individual's or business's total earnings within a fiscal year. This document is essential for accurate tax reporting and compliance with government regulations. It ensures transparency and helps prevent discrepancies during tax assessments.

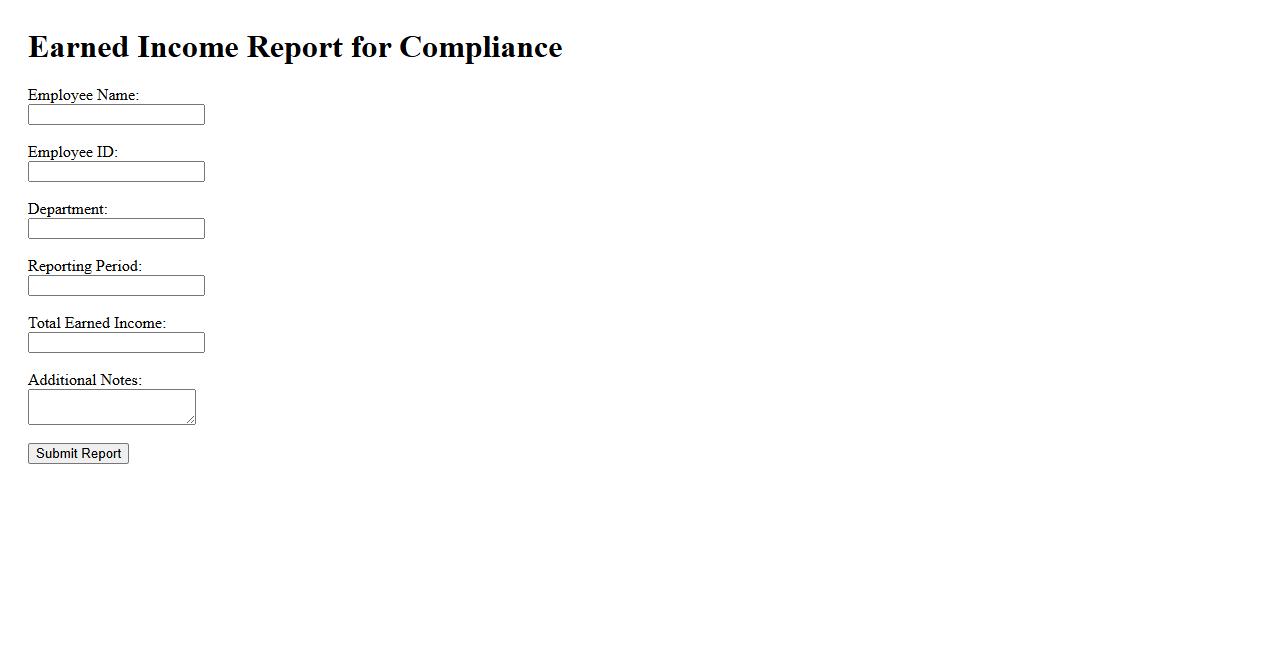

Earned Income Report for Compliance

The Earned Income Report for Compliance provides a detailed summary of all income earned during a specific period to ensure adherence to regulatory requirements. It helps organizations verify accuracy and maintain transparency in financial reporting. This report is essential for audits and maintaining legal compliance.

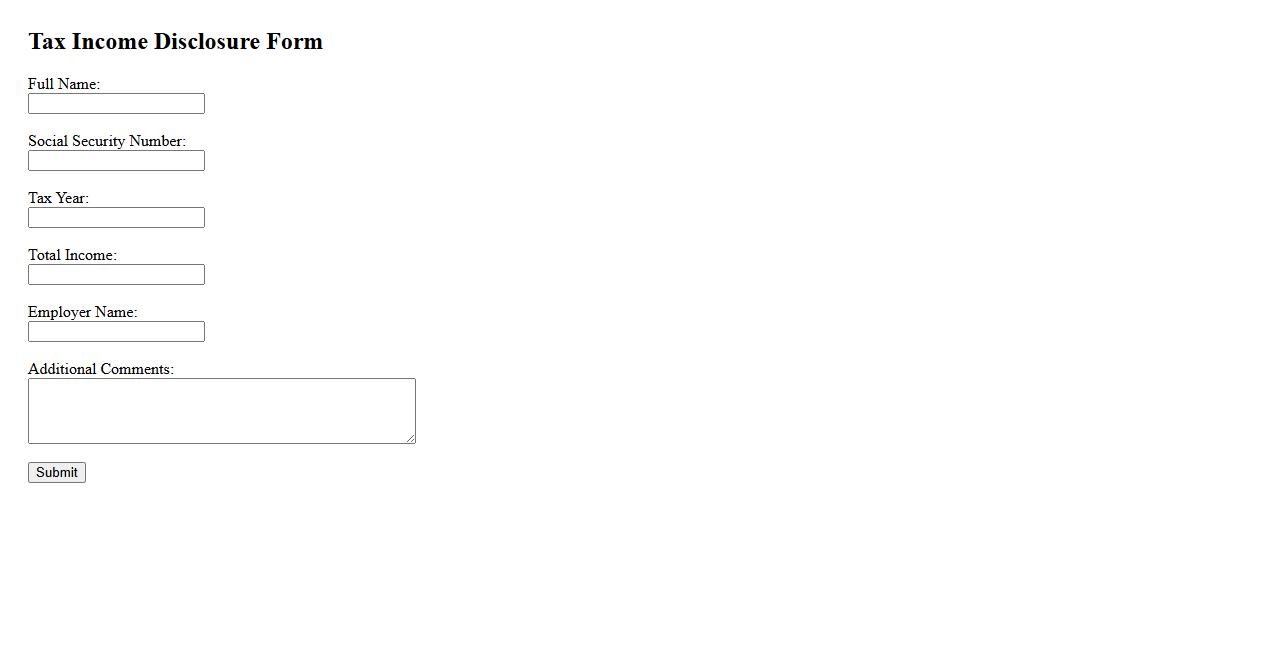

Tax Income Disclosure Form

The Tax Income Disclosure Form is a crucial document used to report an individual's or entity's income for tax purposes. It ensures transparency and compliance with tax regulations by providing accurate financial information to tax authorities. Filing this form correctly helps avoid penalties and facilitates the proper assessment of tax liabilities.

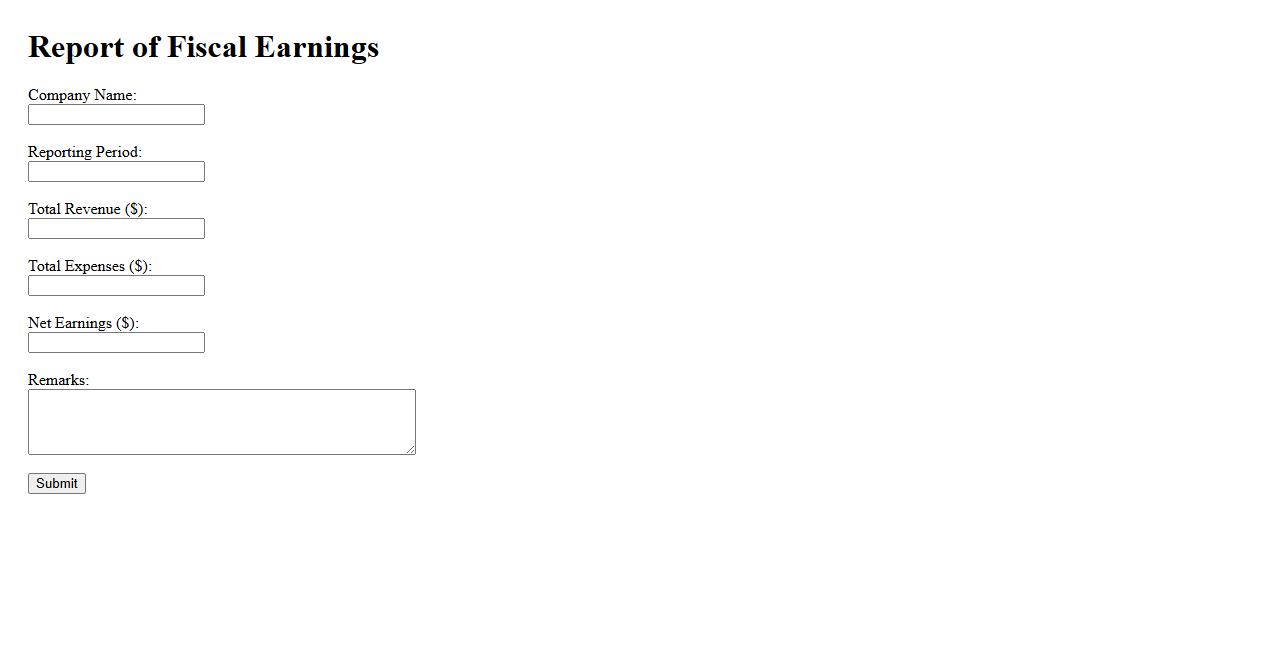

Report of Fiscal Earnings

The Report of Fiscal Earnings provides a comprehensive overview of an organization's financial performance over a specific period. It highlights key revenue streams, expenditures, and net profits, enabling stakeholders to make informed decisions. This report is essential for assessing economic health and planning future budgets.

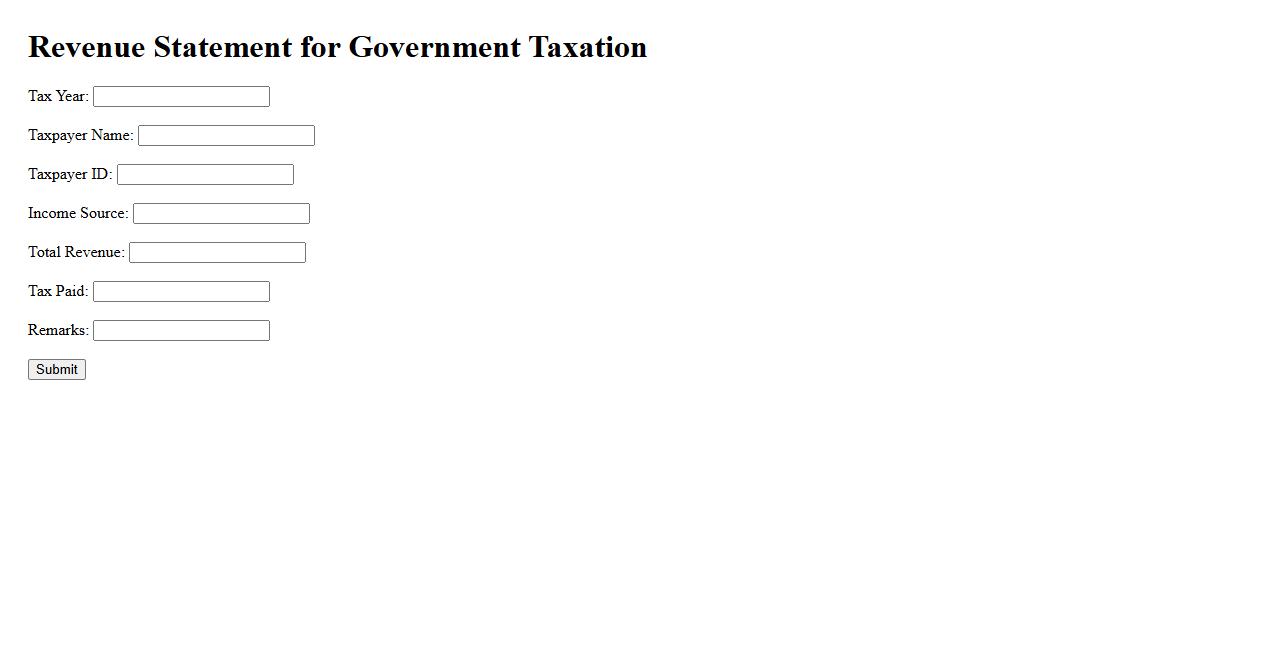

Revenue Statement for Government Taxation

The Revenue Statement for Government Taxation outlines the total income generated through various tax sources within a fiscal period. This document is crucial for assessing the government's financial health and planning future budgets. Accurate revenue statements ensure transparency and accountability in public finance management.

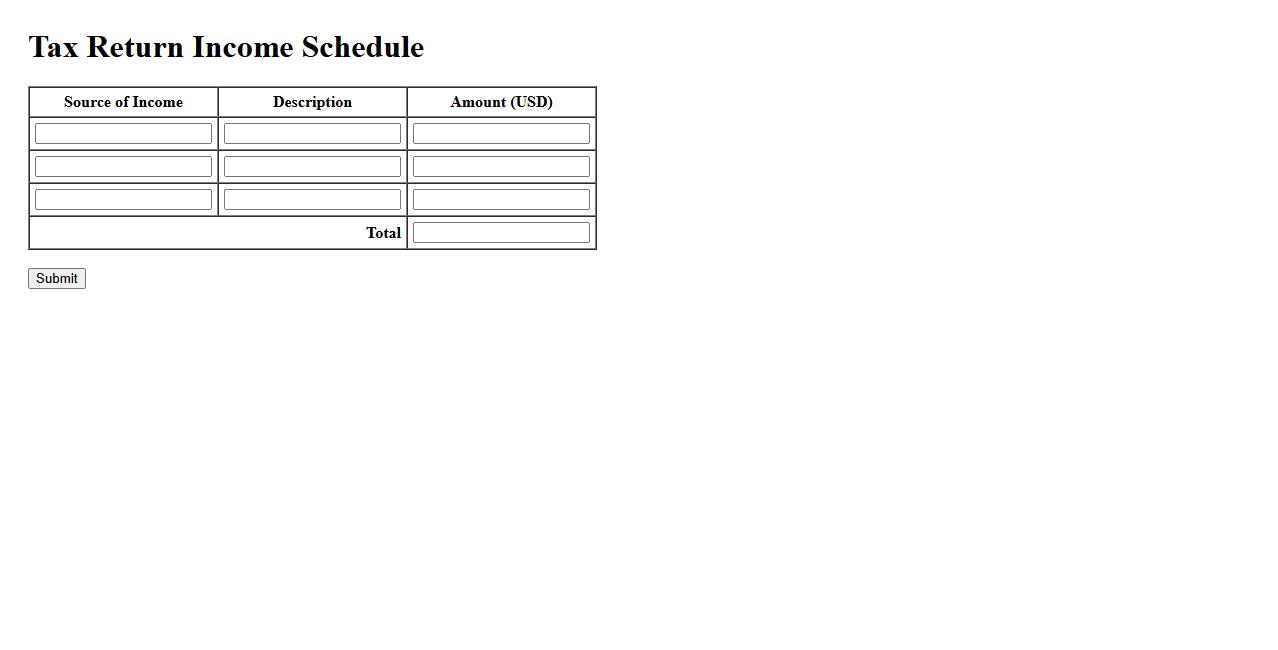

Tax Return Income Schedule

The Tax Return Income Schedule is a detailed document that outlines all sources of income for an individual or business. It helps ensure accurate reporting to tax authorities and supports the calculation of tax liabilities. This schedule is essential for maintaining compliance and maximizing eligible deductions.

What constitutes taxable income on a report of income for tax purposes?

Taxable income includes all income received from various sources such as salaries, wages, bonuses, business profits, dividends, and interest. It also covers income from property rentals, pensions, and certain government benefits. Accurately reporting all sources ensures compliance with tax laws and proper tax calculation.

Which types of income must be disclosed in the income tax report?

All income types including earned income, investment income, rental income, and capital gains must be disclosed. Non-cash benefits, foreign income, and certain gifts may also need to be reported depending on jurisdiction. Transparently declaring all income sources prevents legal issues and potential penalties.

What supporting documents are required to verify reported income?

Supporting documents such as pay stubs, bank statements, 1099 or W-2 forms, and dividend statements are essential for verification. For business income, invoices, receipts, and profit and loss statements may be required. Proper documentation substantiates the reported income and facilitates accurate tax processing.

How should deductions and exemptions be documented in the income report?

Deductions and exemptions must be documented with relevant receipts, invoices, and official certificates. Taxpayers should maintain organized records to support claims like education expenses, mortgage interest, and charitable donations. Well-documented deductions help maximize tax benefits and minimize audit risks.

What are the consequences of inaccurate information on the income tax report?

Providing inaccurate information can lead to penalties, interest charges, and possible legal action. It may trigger audits, delayed refunds, and increased scrutiny from tax authorities. Ensuring truthful and precise reporting protects taxpayers from financial and legal repercussions.