The Report of Non-Covered Employment is a document used to record employment periods not covered under certain insurance or social security programs. Employers submit this report to ensure accurate tracking of workers' employment history outside the standard coverage. Proper submission helps maintain correct benefit calculations and compliance with regulatory requirements.

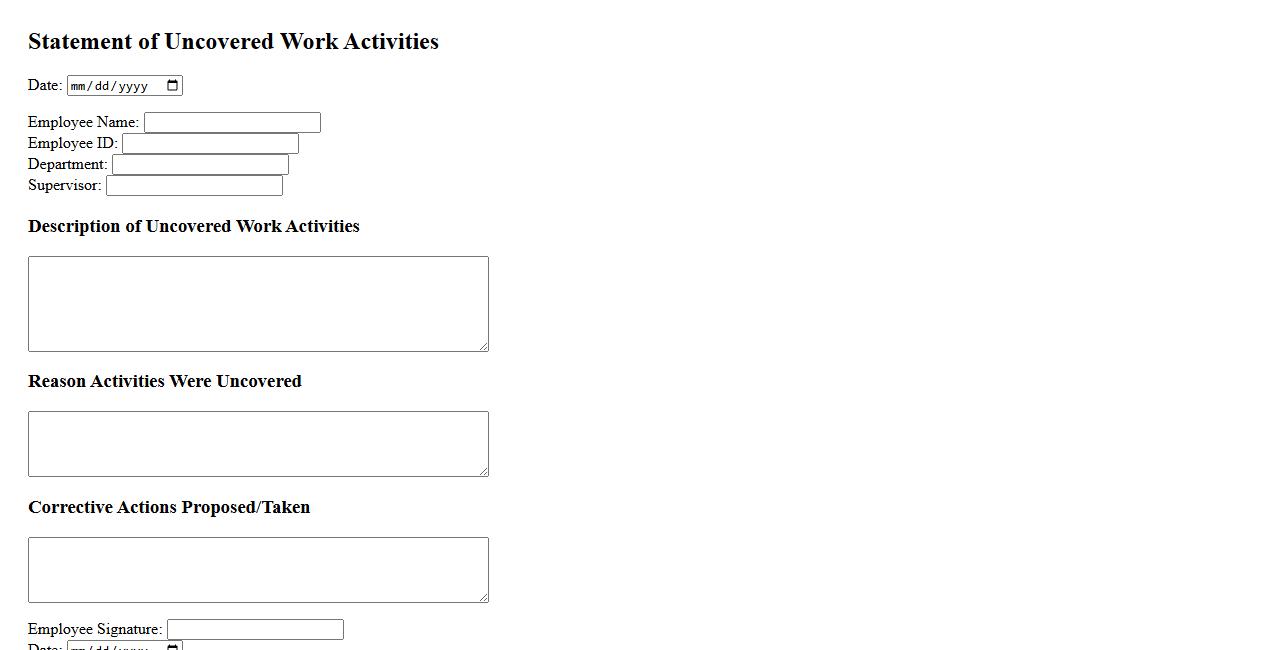

Statement of Uncovered Work Activities

The Statement of Uncovered Work Activities outlines specific tasks or responsibilities that are not included within the scope of a project or contract. This document helps clarify boundaries and ensures all parties understand which activities are excluded from the agreed-upon work. Clearly defining these exclusions prevents misunderstandings and aids in effective project management.

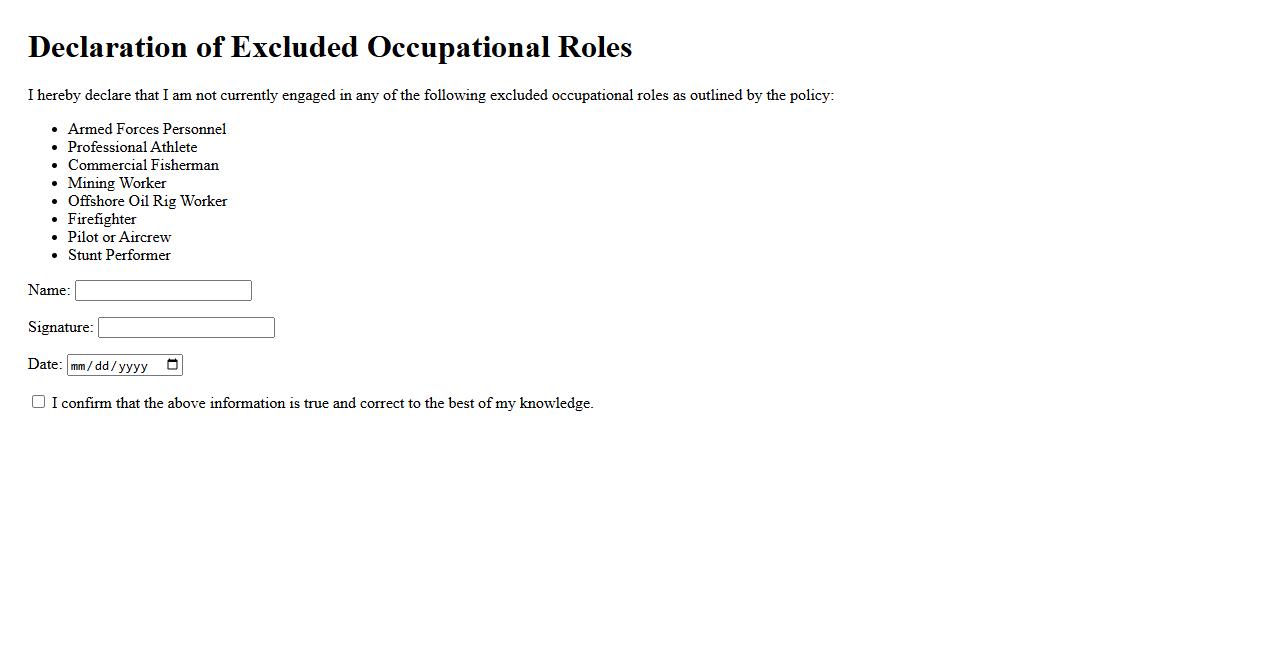

Declaration of Excluded Occupational Roles

The Declaration of Excluded Occupational Roles is a formal statement outlining specific jobs that are exempt from certain regulations or policies. It helps organizations clearly define roles that do not fall under particular employment or safety standards. This declaration ensures transparency and compliance within a company's workforce management.

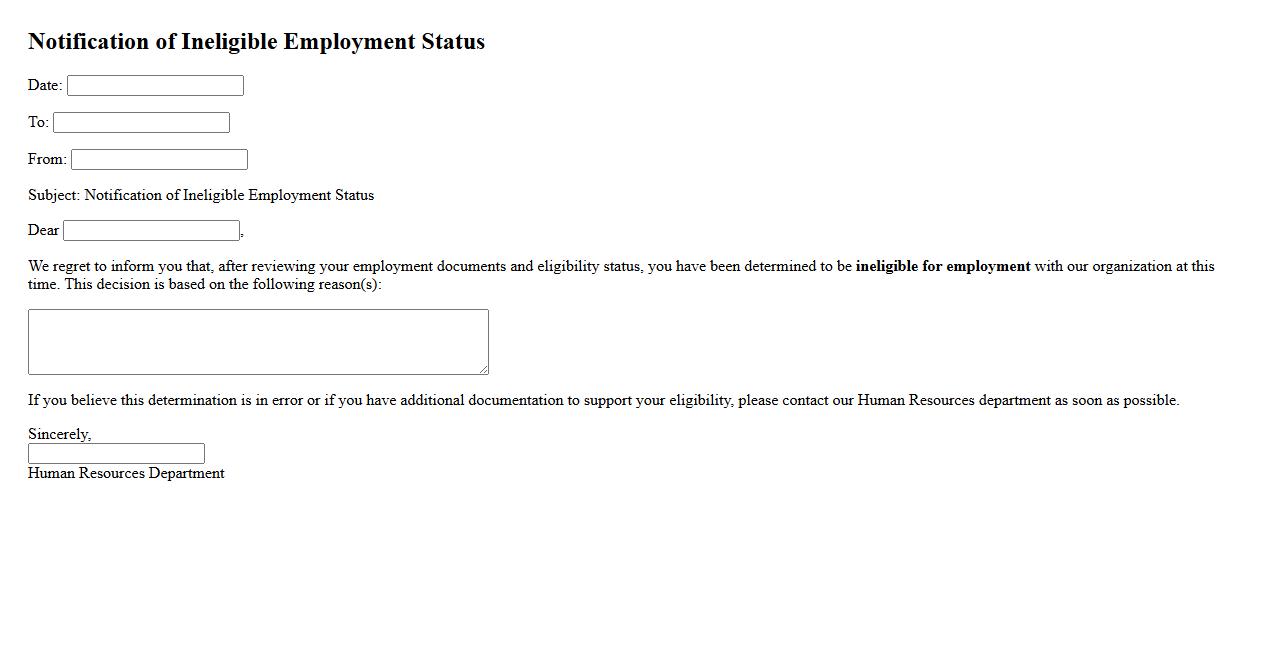

Notification of Ineligible Employment Status

The Notification of Ineligible Employment Status is an important document that informs an employee or applicant about their current ineligibility for employment. This notification outlines the specific reasons why the employment status is considered ineligible, ensuring transparency and compliance with legal standards. Timely communication of this status helps both the employer and the individual understand necessary steps for future eligibility.

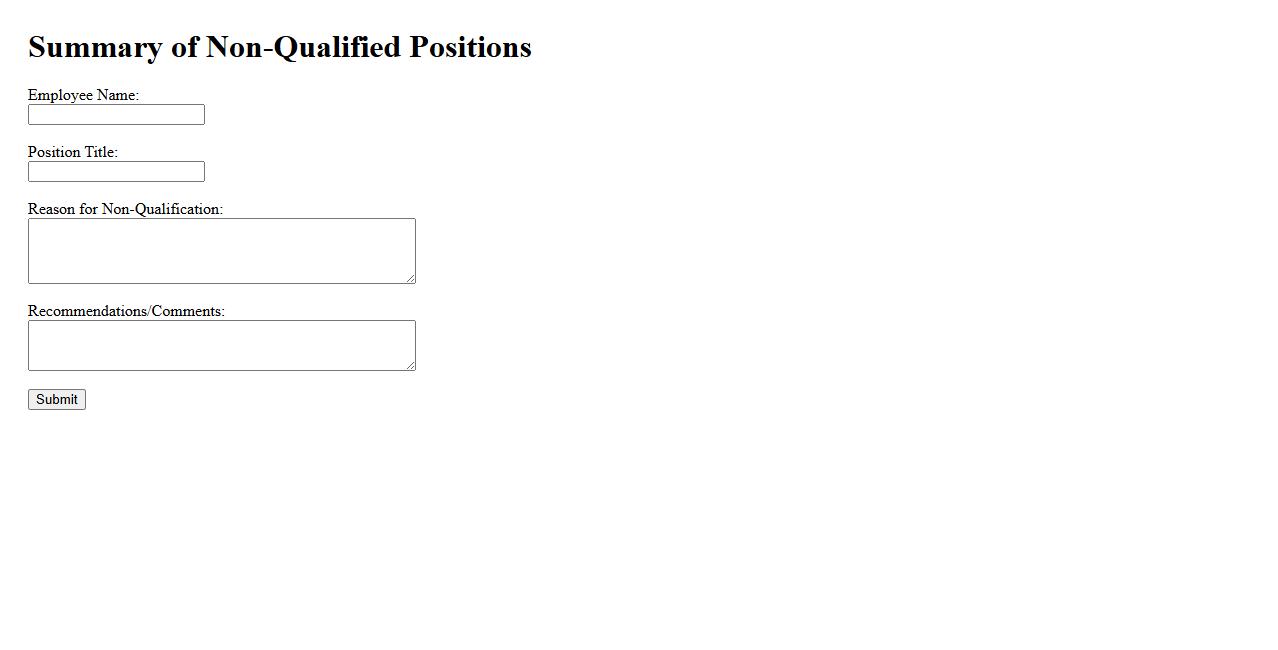

Summary of Non-Qualified Positions

The summary of non-qualified positions provides a detailed overview of job roles that do not meet specific qualification criteria. These positions often require additional training or experience for advancement. Understanding this summary helps organizations identify skill gaps and workforce needs effectively.

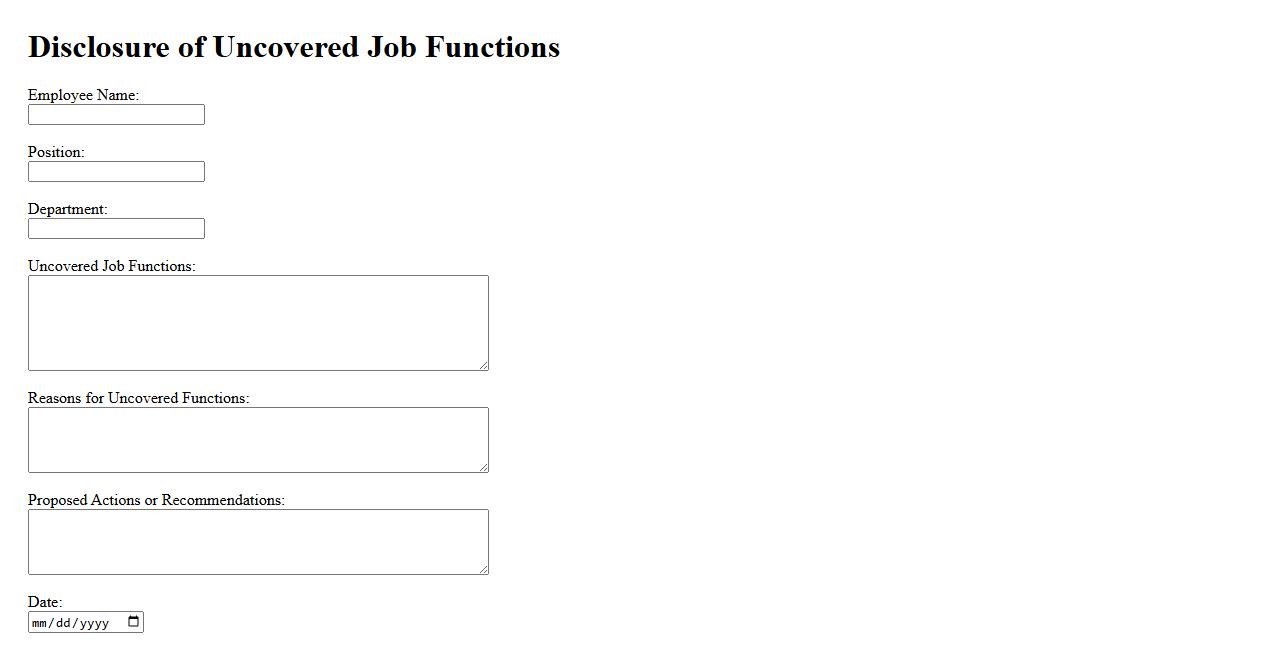

Disclosure of Uncovered Job Functions

The disclosure of uncovered job functions is essential for transparency in employment agreements. It ensures that all duties not explicitly listed are communicated to employees to avoid misunderstandings. This practice promotes clarity and protects both the employer and employee.

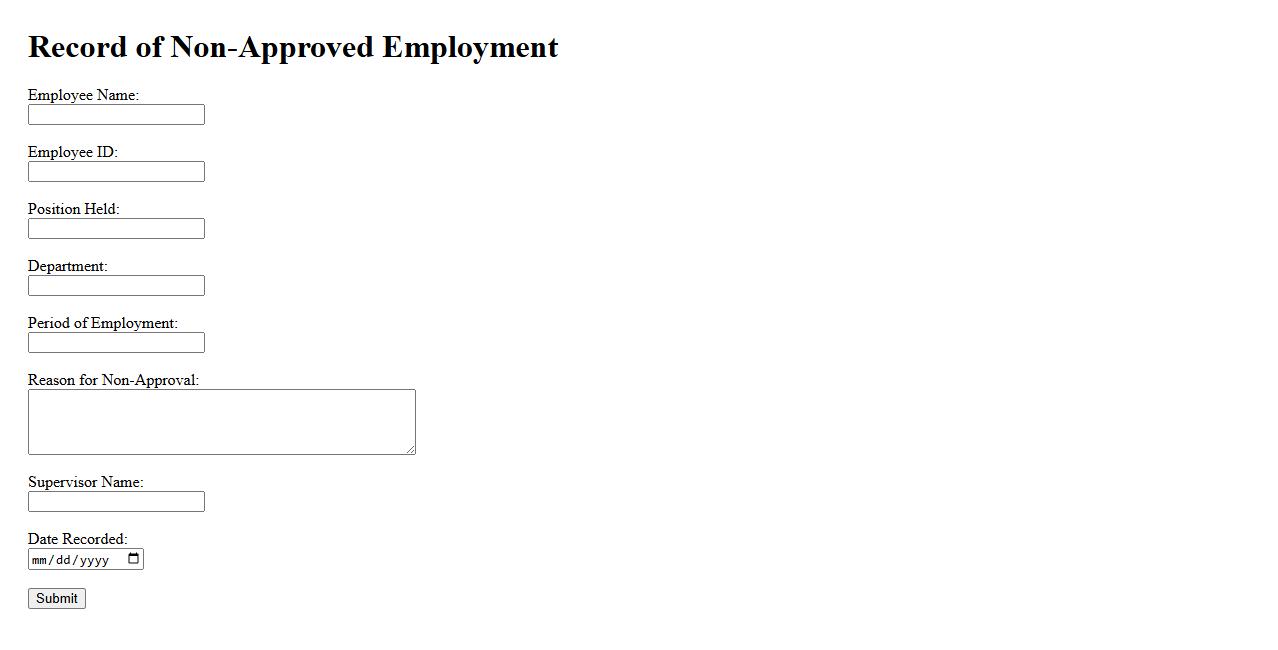

Record of Non-Approved Employment

The Record of Non-Approved Employment documents instances where employment activities are not authorized by the relevant authorities. This record helps maintain compliance with legal and organizational employment standards. It serves as a critical reference for audits and employment verifications.

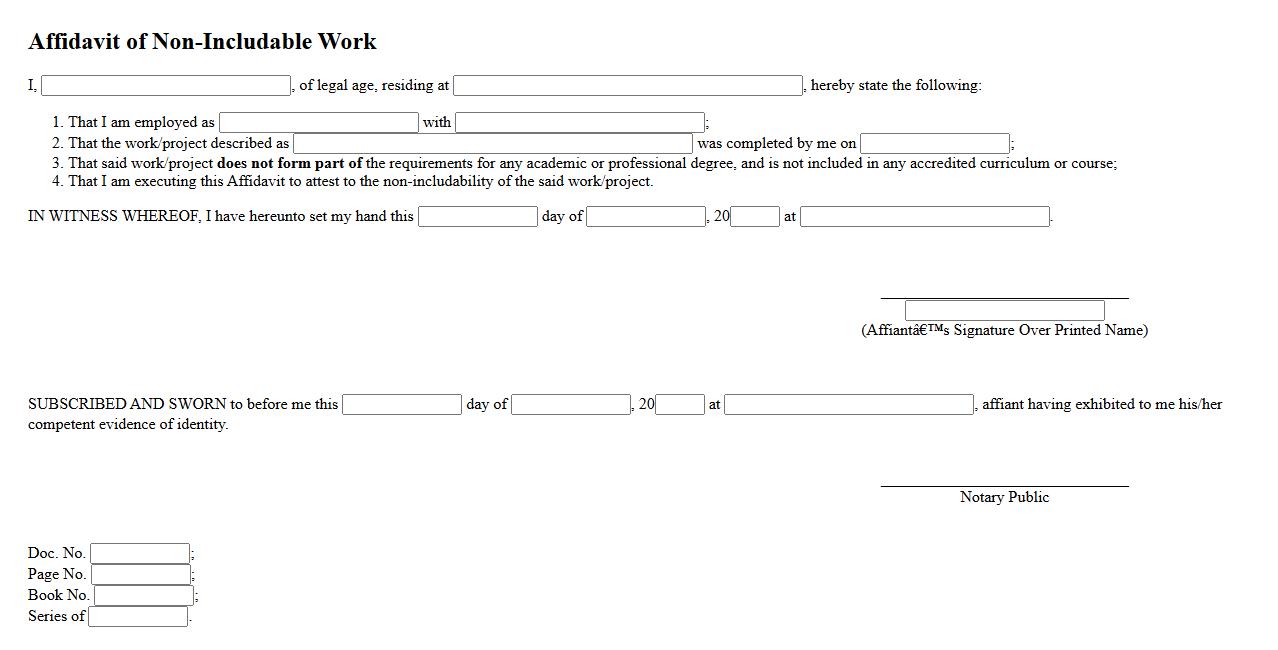

Affidavit of Non-Includable Work

An Affidavit of Non-Includable Work is a legal document used to declare specific tasks or work that should not be counted towards a contractor's total workload or contract obligations. This affidavit helps clarify and exclude certain activities from project evaluations or payment calculations. It ensures clear communication and proper documentation in construction or service agreements.

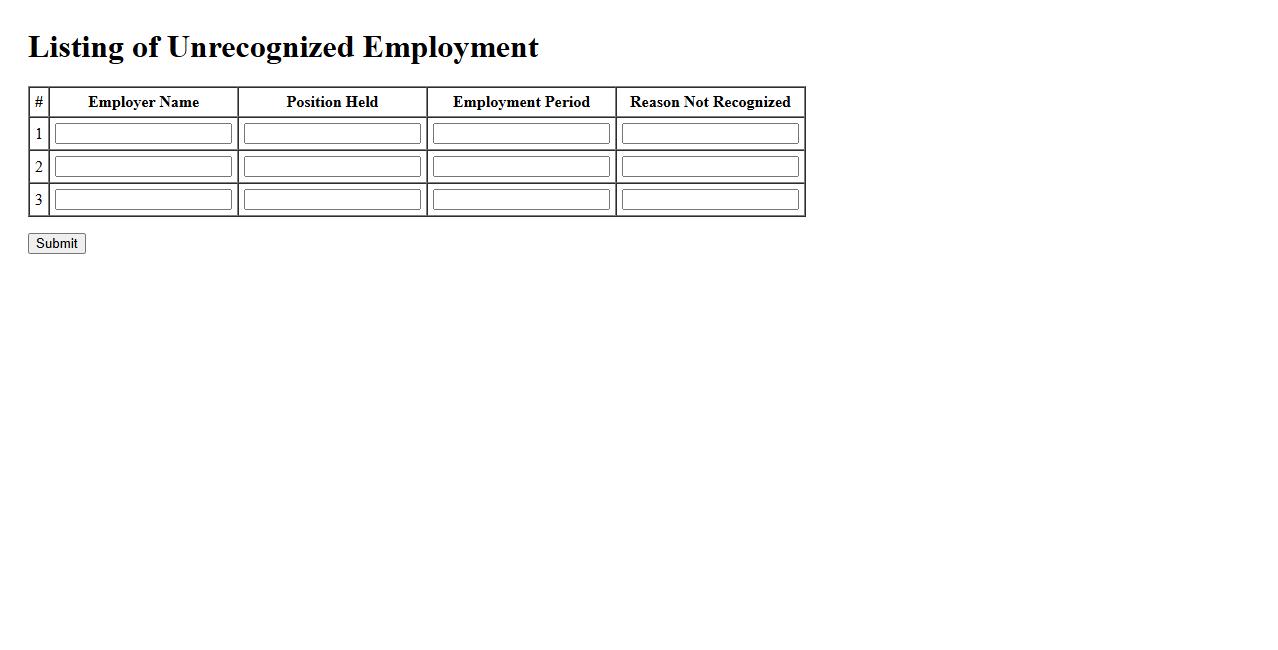

Listing of Unrecognized Employment

The listing of unrecognized employment refers to documented cases where work positions or job roles are not officially acknowledged or regulated by governmental labor authorities. This can result in employees lacking legal protections, benefits, and fair wages. Understanding these listings is crucial for addressing labor rights and ensuring fair employment practices.

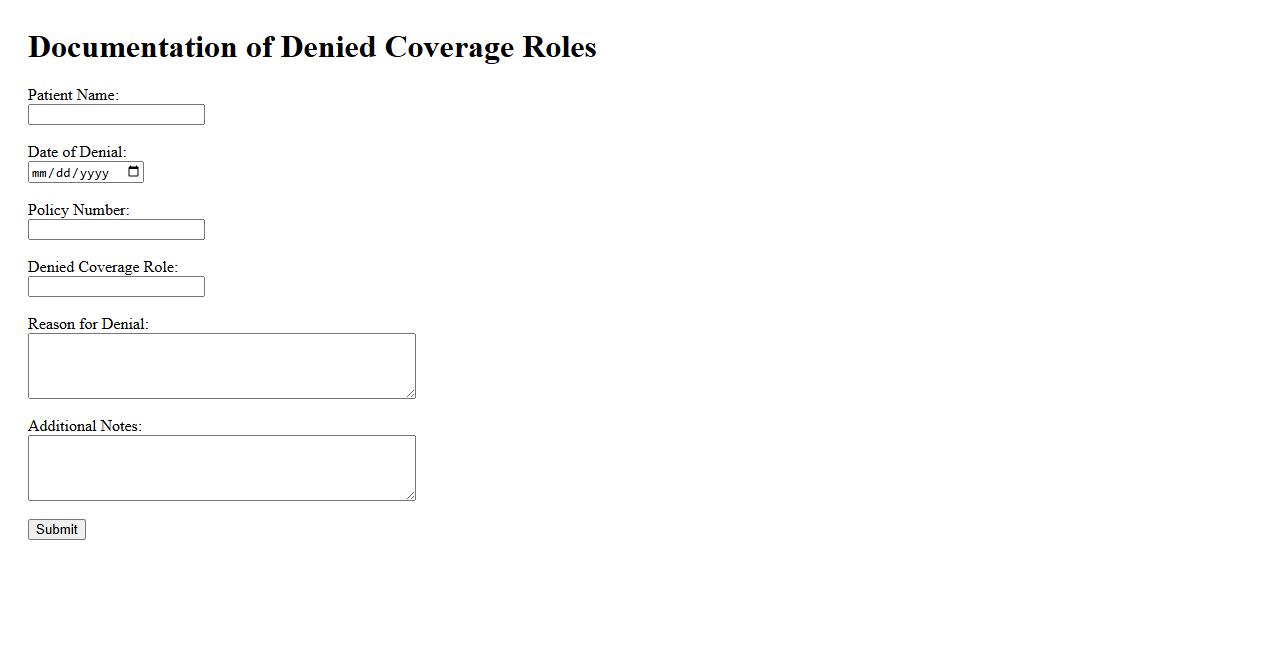

Documentation of Denied Coverage Roles

The Documentation of Denied Coverage Roles ensures that all instances where coverage is refused are thoroughly recorded for accountability. This process aids in transparent communication among stakeholders and supports compliance with regulatory requirements. Proper documentation helps identify patterns and improve future coverage decisions.

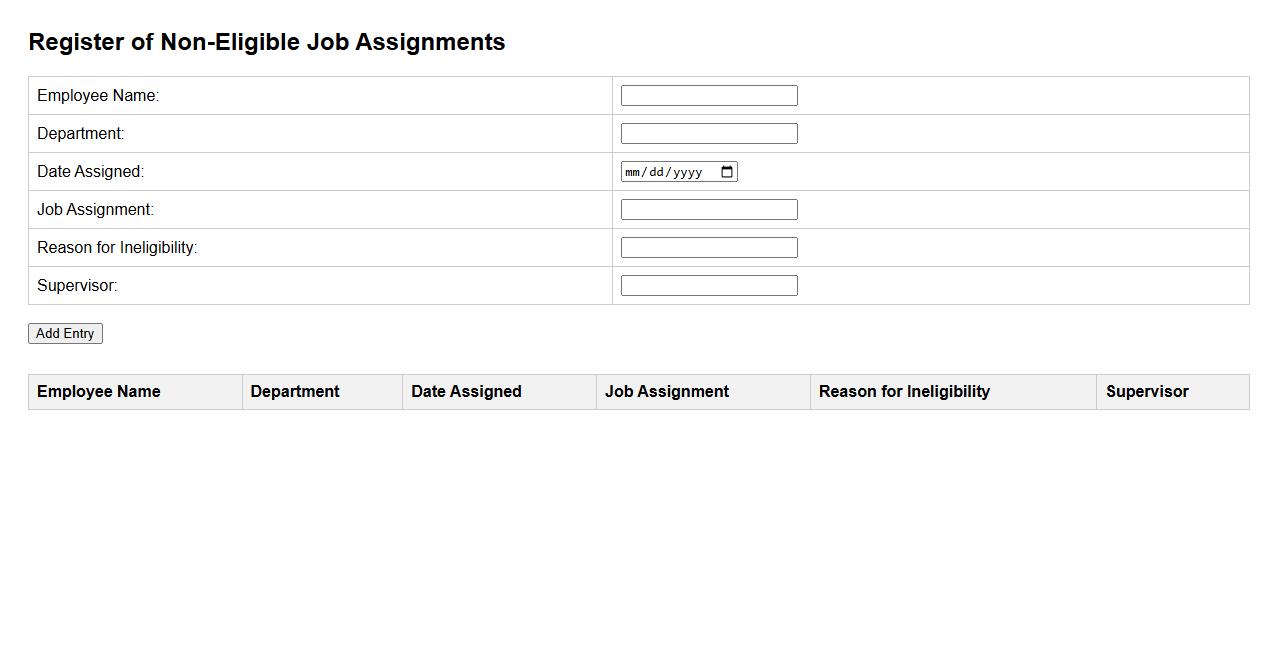

Register of Non-Eligible Job Assignments

The Register of Non-Eligible Job Assignments is a crucial tool used by organizations to track positions that do not meet specific eligibility criteria. This register helps ensure compliance with internal policies and external regulations by clearly listing restricted roles. Maintaining an accurate and updated register supports effective workforce management and transparency.

What is the primary purpose of the Report of Non-Covered Employment document?

The Report of Non-Covered Employment document is primarily used to identify jobs or positions that are exempt from Social Security coverage. This report ensures accurate tracking of employment types that do not contribute to Social Security taxes. It helps maintain the integrity of employment records for benefit assessments and compliance.

Which types of jobs or positions are classified as "non-covered employment"?

Non-covered employment typically includes certain government jobs, religious occupations, and specific nonprofit roles exempt from Social Security taxes. These positions are excluded by law or regulations from mandatory Social Security coverage. Identifying these roles helps clarify an employee's benefit eligibility and tax obligations.

How does reporting non-covered employment affect eligibility for social security or other benefits?

Reporting non-covered employment accurately impacts the worker's eligibility for Social Security benefits by delineating periods not subject to Social Security taxes. This can influence qualification for retirement, disability, and other benefit programs. Proper reporting ensures the correct calculation of work credits and benefit entitlements.

What specific information must be included when submitting a Report of Non-Covered Employment?

The report must include the employer's name, employee details, job classification, and dates of employment not covered by Social Security. Accurate job descriptions and reasons for non-coverage are also essential. This information guarantees that records are complete and compliant with Social Security regulations.

Who is responsible for completing and submitting the Report of Non-Covered Employment?

Employers are responsible for completing and submitting the Report of Non-Covered Employment to the appropriate agency. They must ensure all non-covered jobs are properly documented in a timely manner. This responsibility helps avoid penalties and maintains correct employee benefit records.