A Report of Tax Withholding is a detailed document summarizing the amounts withheld from an individual's or business's income for tax purposes. It provides essential information for both the taxpayer and tax authorities to ensure compliance with tax regulations. Accurate preparation of this report is crucial for timely tax filing and avoiding penalties.

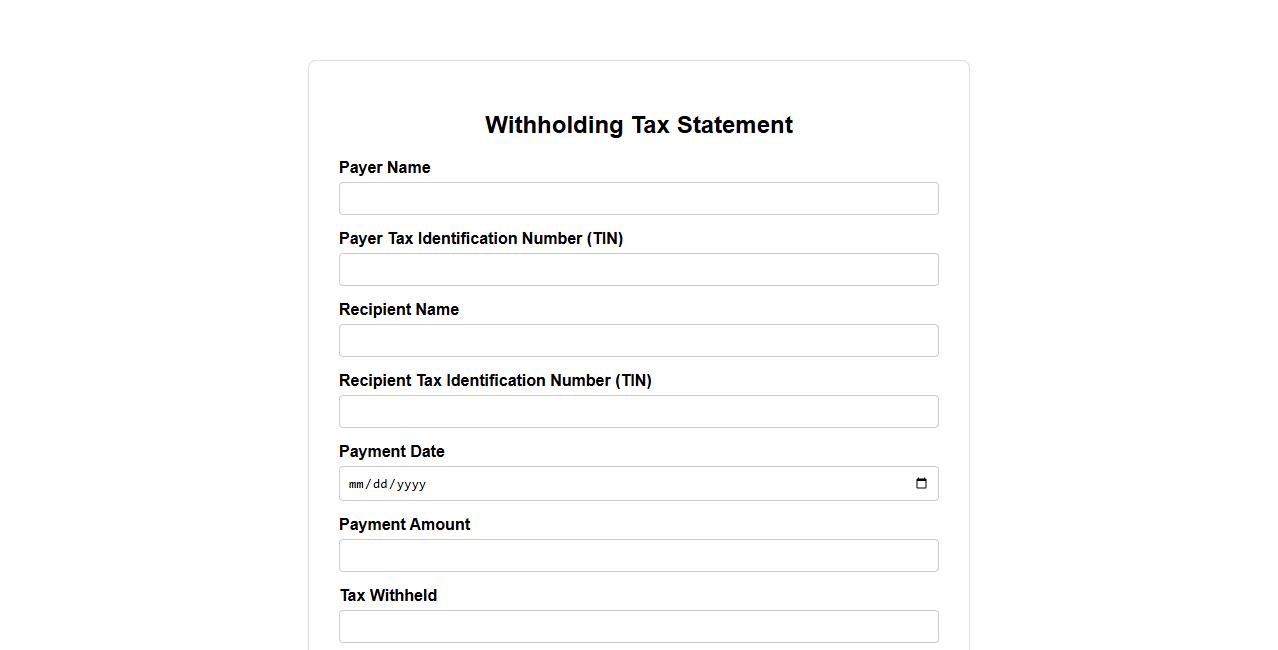

Withholding Tax Statement

The Withholding Tax Statement is a crucial document used to report the amount of tax withheld from payments made to employees or vendors. It serves as proof of tax deduction for both the payer and the recipient. This statement ensures compliance with tax regulations and aids in accurate tax filing.

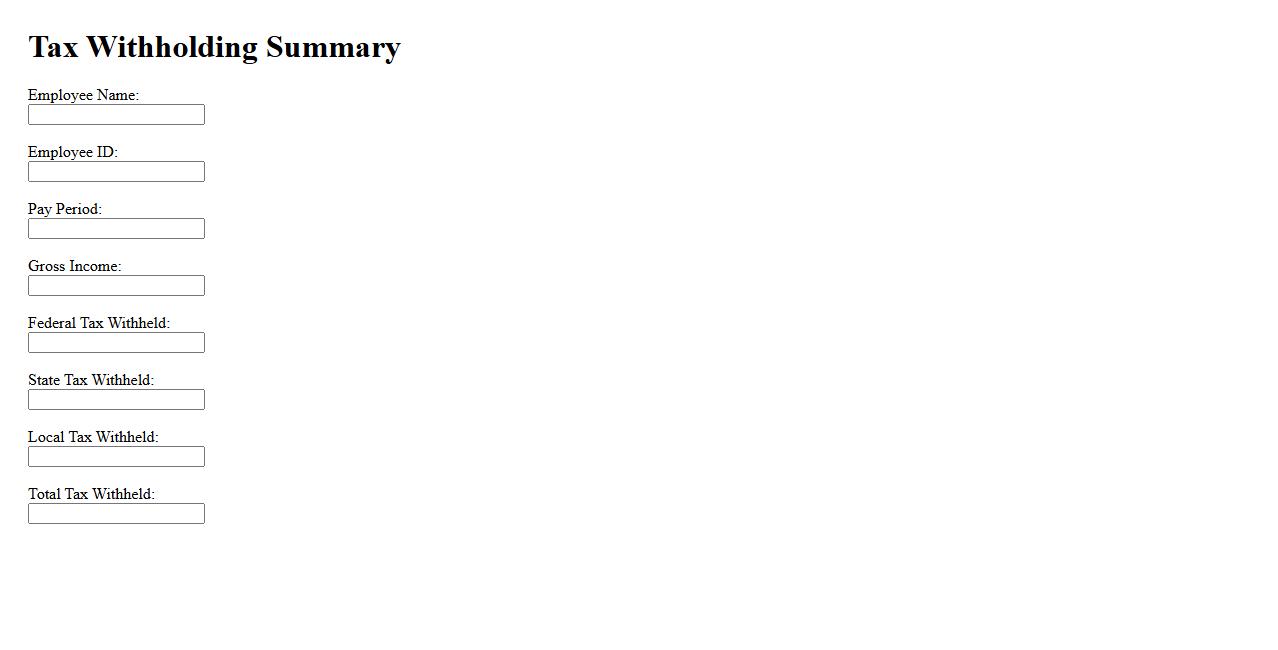

Tax Withholding Summary

The Tax Withholding Summary provides an overview of the taxes withheld from your income throughout the year. It helps you understand the amounts deducted for federal, state, and local taxes. This summary is essential for accurate tax filing and financial planning.

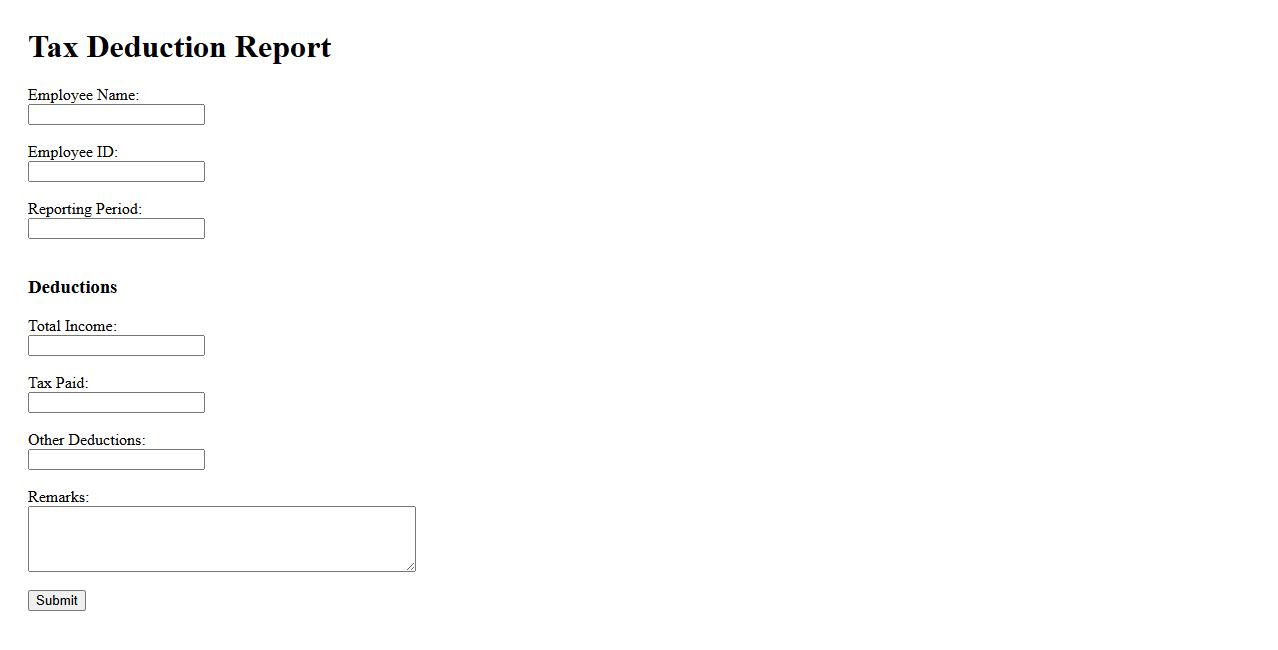

Tax Deduction Report

The Tax Deduction Report provides a detailed summary of all tax deductions applied during a specific period. It helps individuals and businesses track their taxable income and ensure compliance with tax regulations. This report is essential for accurate financial planning and tax filing.

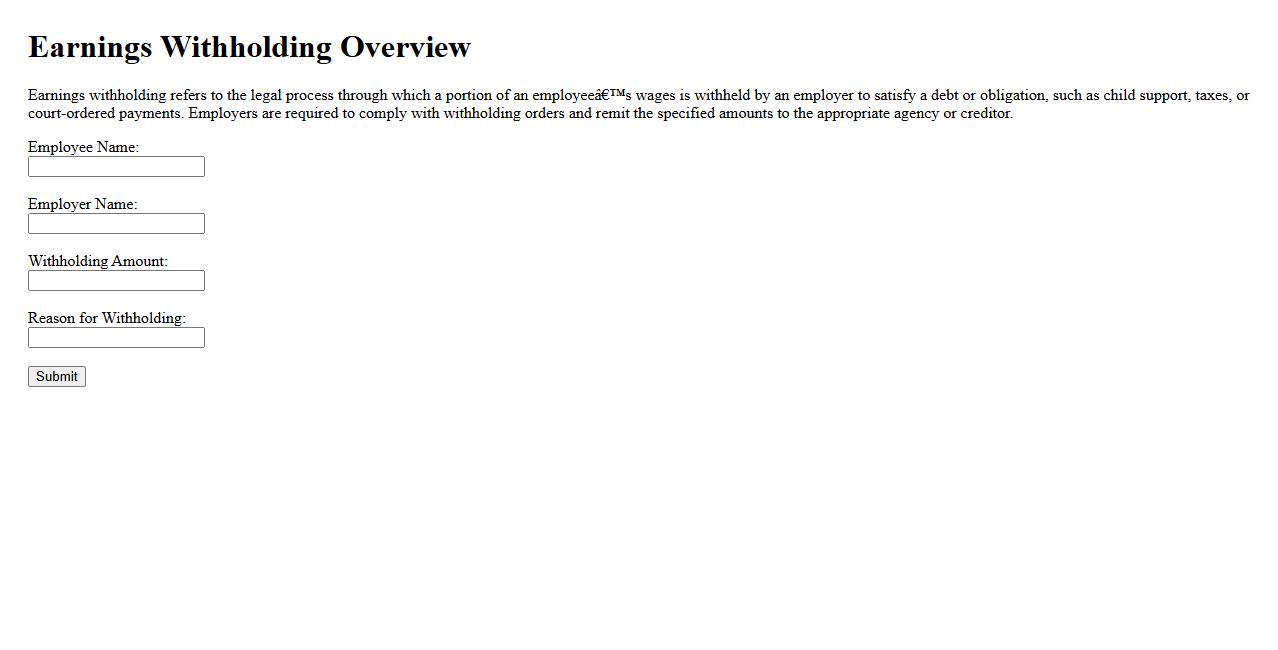

Earnings Withholding Overview

The Earnings Withholding Overview provides a clear explanation of the process by which employers deduct a portion of an employee's earnings to fulfill legal obligations. This overview details the regulations, responsibilities, and rights involved in withholding payments. Understanding this concept is essential for both employers and employees to ensure compliance and avoid penalties.

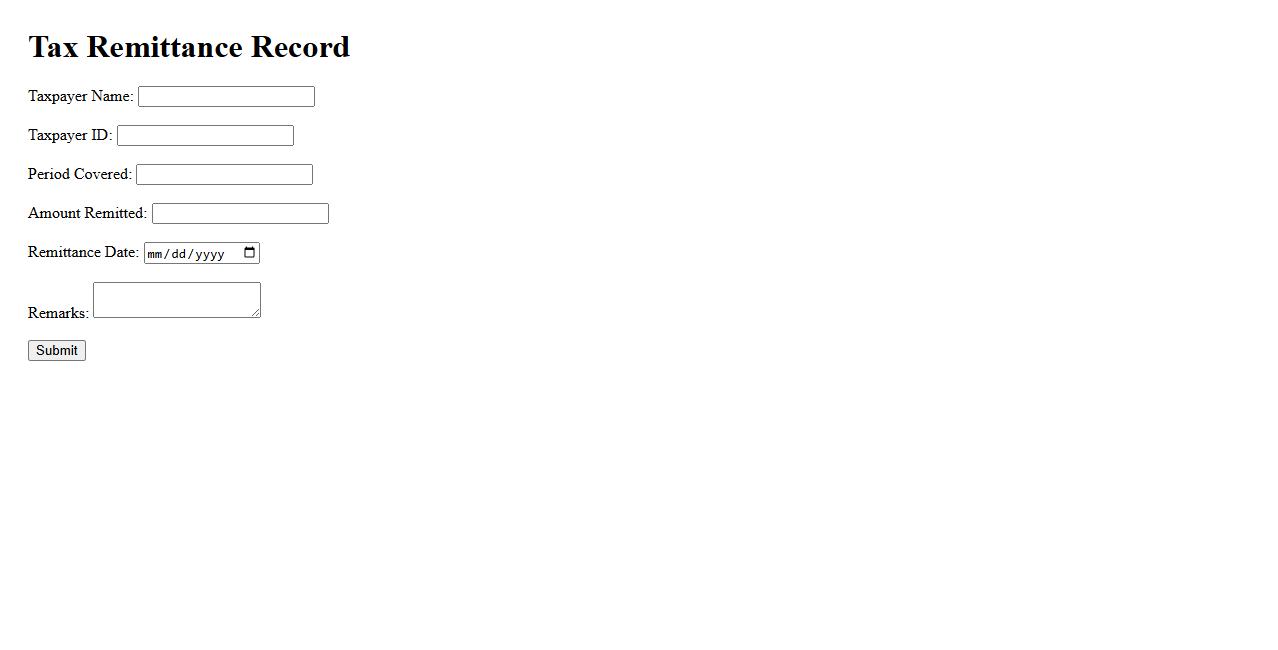

Tax Remittance Record

A Tax Remittance Record is a crucial document that tracks payments made to tax authorities. It ensures accurate reporting and compliance with tax regulations. Maintaining these records helps businesses avoid penalties and streamline audits.

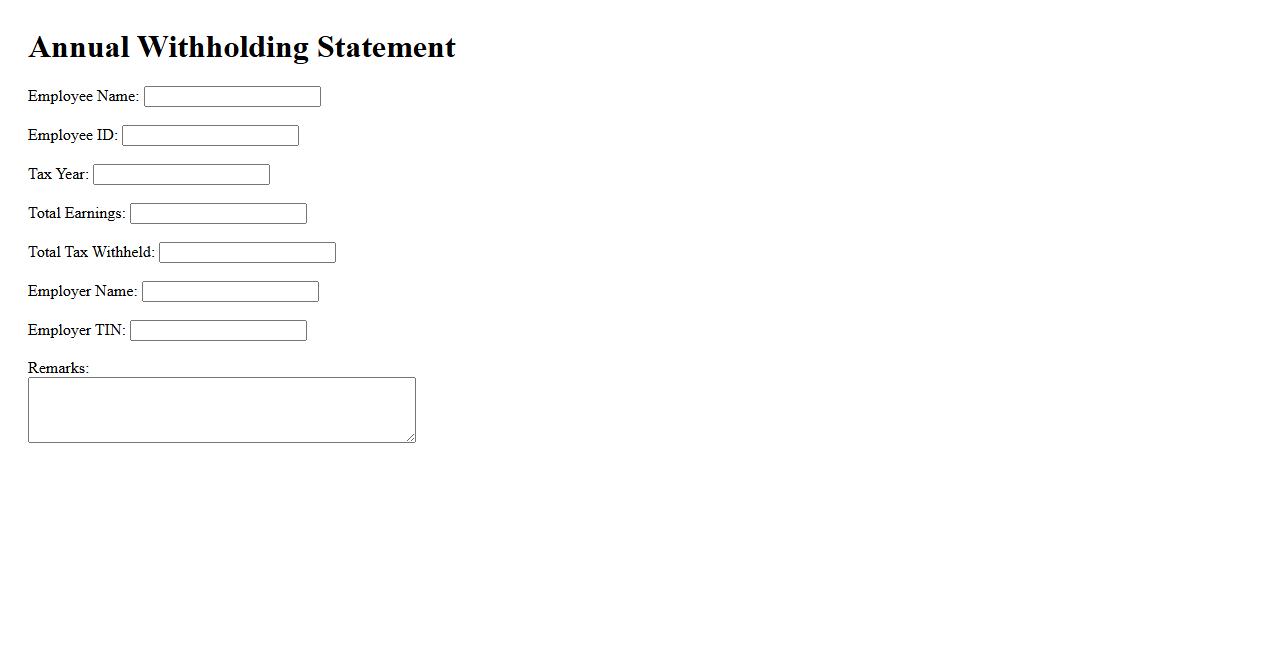

Annual Withholding Statement

The Annual Withholding Statement summarizes the total taxes withheld from an employee's paycheck throughout the year. It is essential for accurately filing income tax returns and ensuring compliance with tax regulations. Employers provide this statement to both employees and tax authorities at the end of the fiscal year.

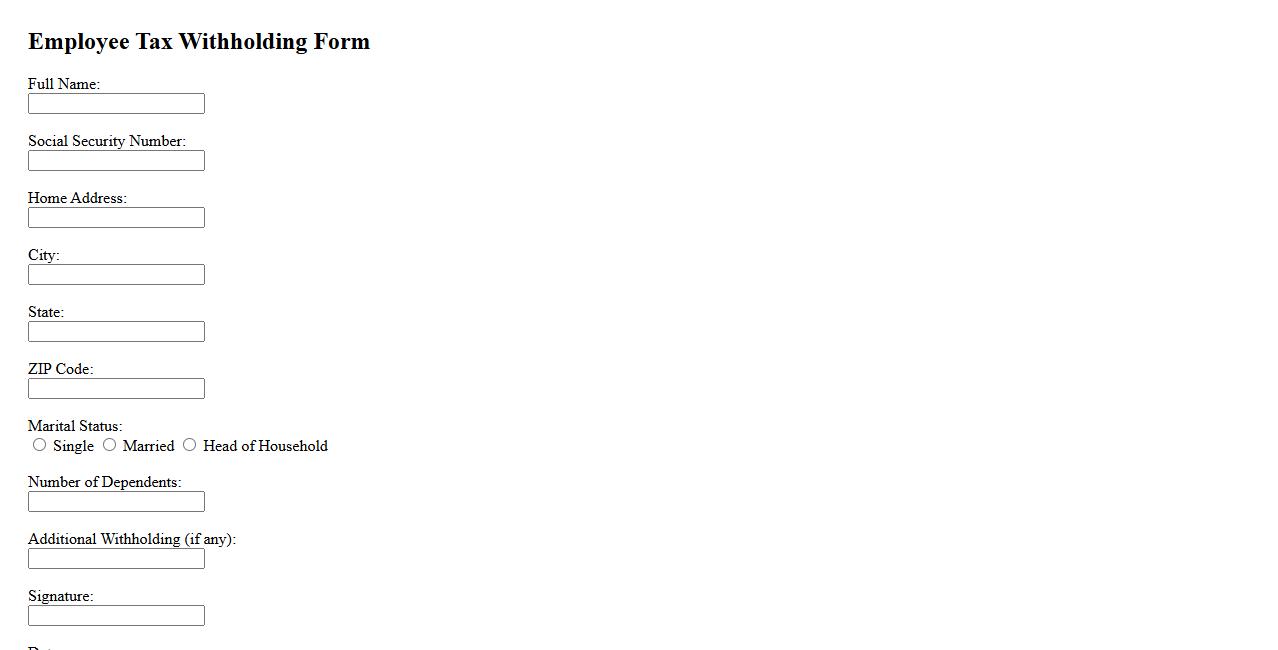

Employee Tax Withholding Form

The Employee Tax Withholding Form is a crucial document used by employers to determine the correct amount of federal income tax to withhold from an employee's paycheck. It ensures accurate tax deductions based on the employee's filing status and allowances. Completing this form correctly helps prevent underpayment or overpayment of taxes throughout the year.

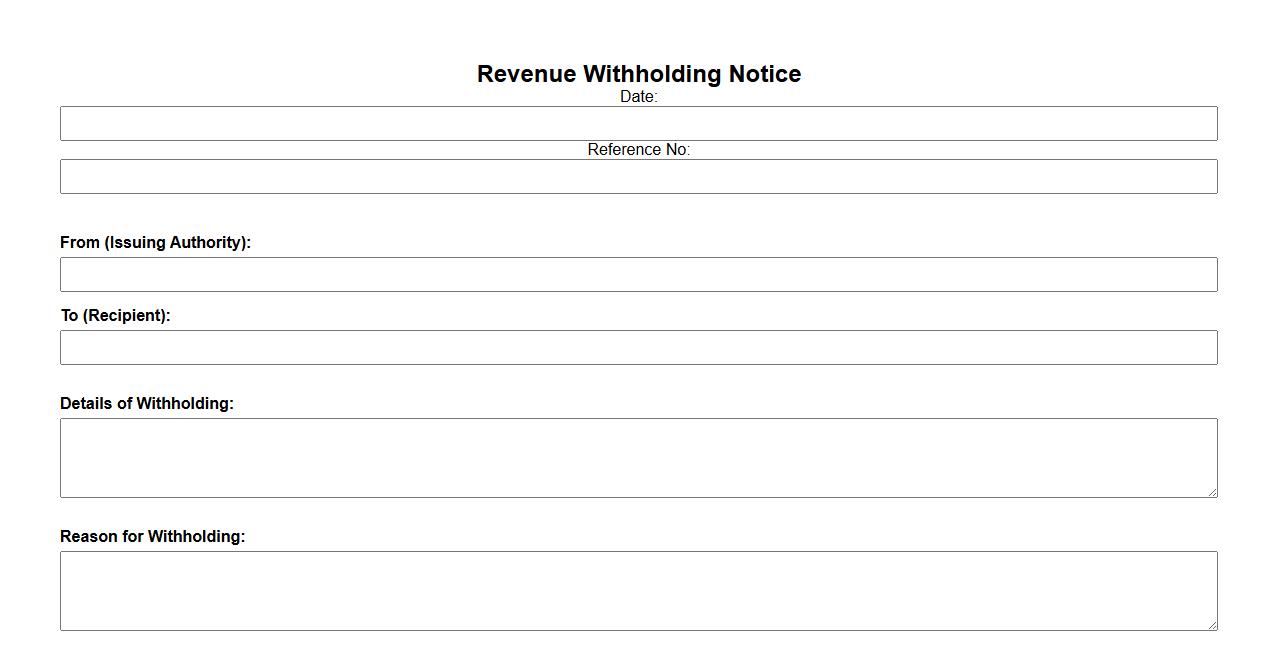

Revenue Withholding Notice

The Revenue Withholding Notice is an official document informing taxpayers about amounts withheld from their income for tax purposes. It ensures transparency and accuracy in tax collection by detailing the withheld revenue. Recipients should review the notice carefully to verify the withheld amounts and report any discrepancies promptly.

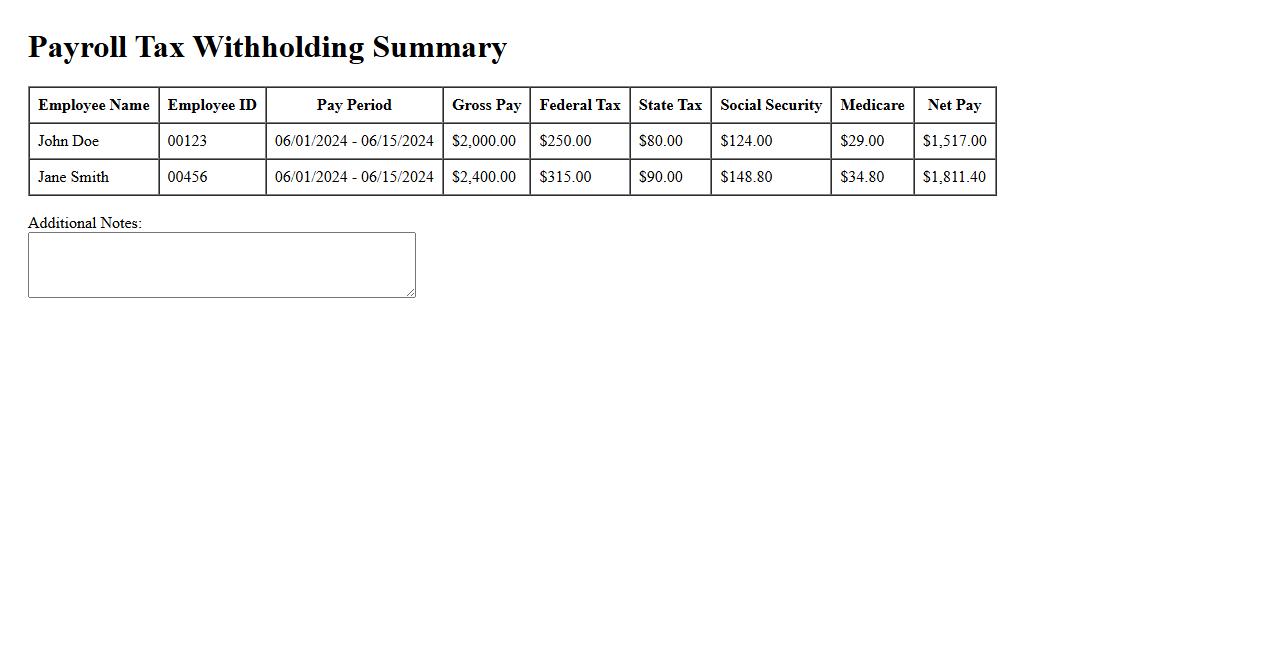

Payroll Tax Withholding Summary

The Payroll Tax Withholding Summary provides a comprehensive overview of all tax deductions withheld from employee wages during a specific period. It helps businesses ensure compliance with tax regulations and simplifies the process of filing tax returns. This summary is essential for accurate payroll management and financial reporting.

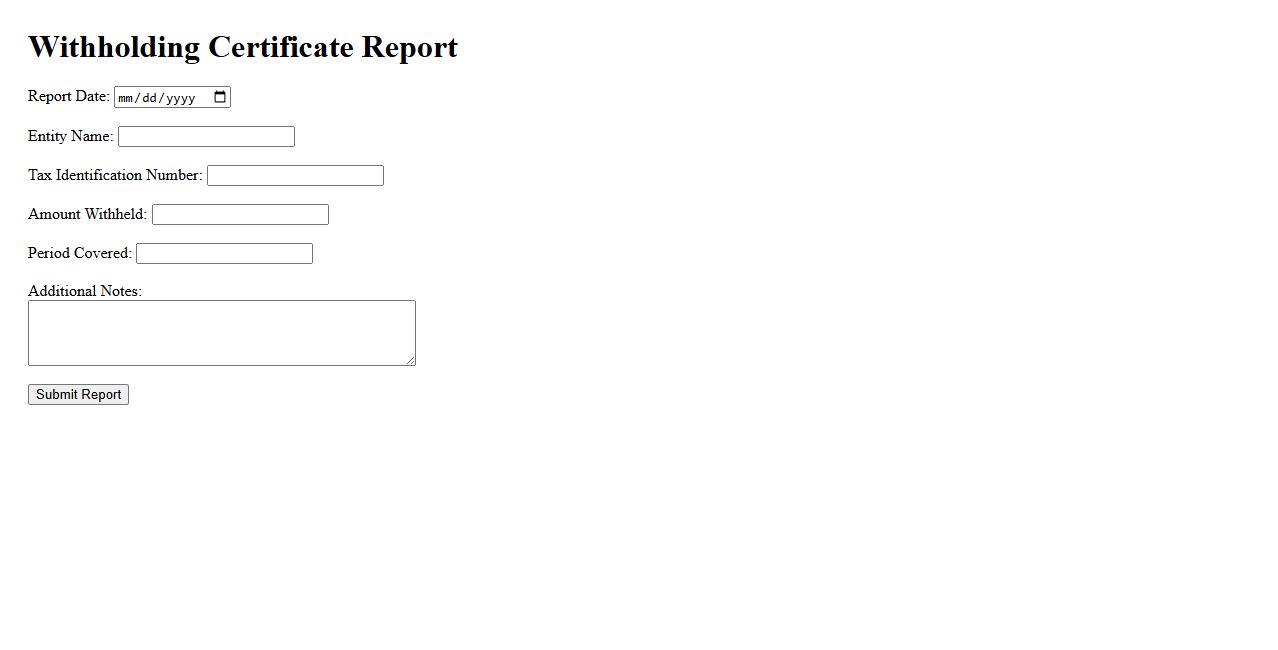

Withholding Certificate Report

The Withholding Certificate Report provides a detailed summary of tax amounts withheld during specific transactions. It helps businesses and individuals comply with tax regulations by accurately documenting withheld taxes. This report is essential for verifying payment and filing accurate tax returns.

What is the primary purpose of a Report of Tax Withholding document?

The primary purpose of a Report of Tax Withholding is to officially record the amounts of tax withheld from payments made to individuals or entities. This document ensures transparency between payers and tax authorities by summarizing withheld taxes. It serves as proof for taxpayers to claim their withholdings during annual tax filings.

Which entities are required to issue a Report of Tax Withholding?

Employers, financial institutions, and businesses that make payments subject to tax withholding are obligated to issue this report. This includes organizations withholding taxes on salaries, interest payments, dividends, or other taxable distributions. Regulatory guidelines usually dictate the frequency and deadlines for issuing these reports.

What essential information must be included in a valid Report of Tax Withholding?

A valid report must clearly state the payer's and payee's identification details, amounts paid, and taxes withheld. It should also include the relevant tax period and any applicable tax codes or rates. Accuracy in these details is crucial to avoid discrepancies during tax reconciliation processes.

How does a Report of Tax Withholding affect an individual's or entity's annual tax filing obligations?

The report allows taxpayers to credit withheld taxes against their total tax liability, ensuring they do not pay taxes twice on the same income. It facilitates accurate tax calculations and helps taxpayers claim refunds if excess withholding occurred. Additionally, the report supports tax authorities in verifying compliance and detecting underreporting.

In what scenarios would corrections or amendments to a Report of Tax Withholding be necessary?

Corrections are required if there are errors in amounts withheld, identification details, or tax codes initially reported. Amendments may also be necessary due to changes in payment information or after audits uncover discrepancies. Timely and accurate corrections help maintain the integrity of taxpayers' records and avoid penalties.