A Report of Suspected Tax Fraud Activity serves as a critical tool for alerting tax authorities about potential illegal practices such as underreporting income or falsifying documents. This report enables investigations to ensure compliance with tax laws and protect government revenue. Timely submission of such reports helps maintain the integrity of the tax system and deters fraudulent behavior.

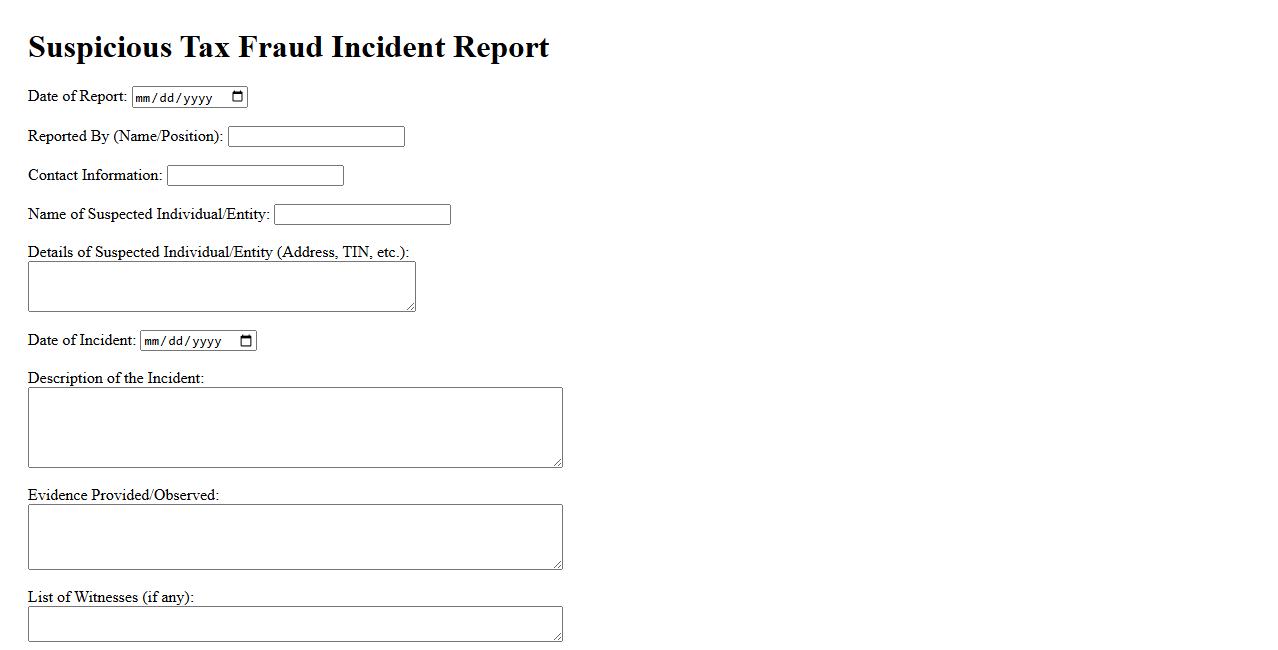

Suspicious Tax Fraud Incident Report

The Suspicious Tax Fraud Incident Report is a critical document used to flag potentially fraudulent activities related to tax filings. It helps authorities identify and investigate irregularities to prevent financial crimes. Timely submission of this report ensures compliance and supports regulatory enforcement efforts.

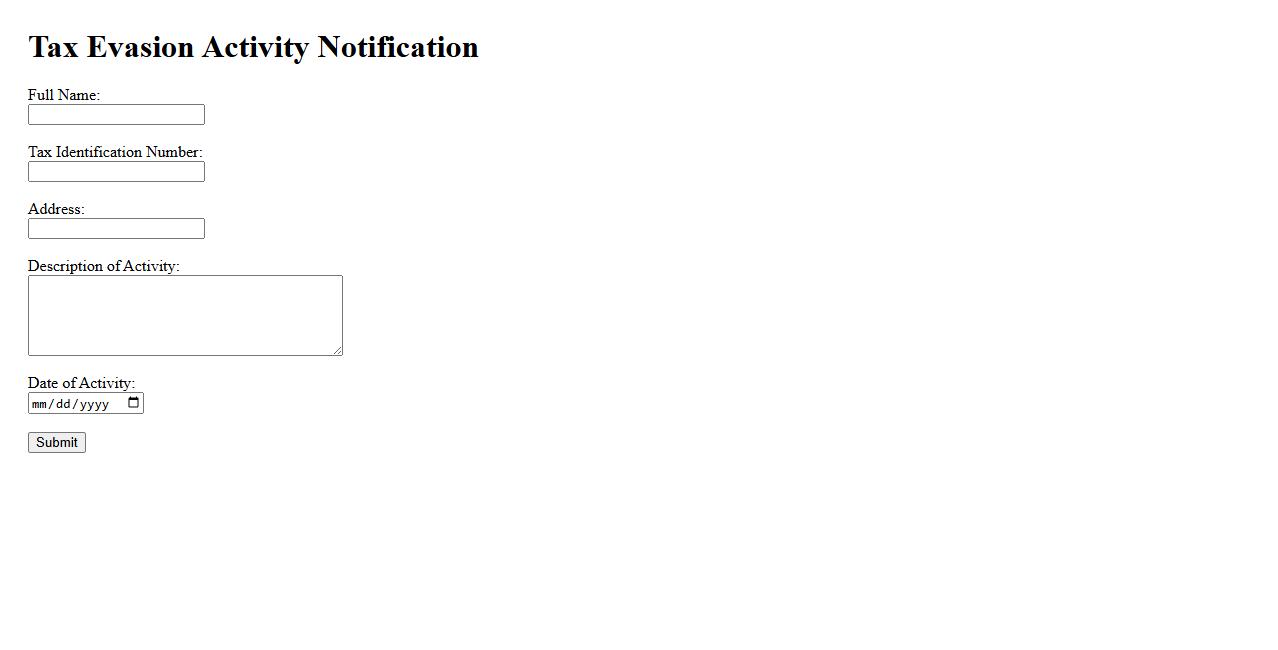

Tax Evasion Activity Notification

The Tax Evasion Activity Notification informs individuals or businesses about suspected tax evasion practices. It serves as an official alert to address discrepancies in reported income or financial activities. Prompt response to this notification is crucial to avoid legal penalties.

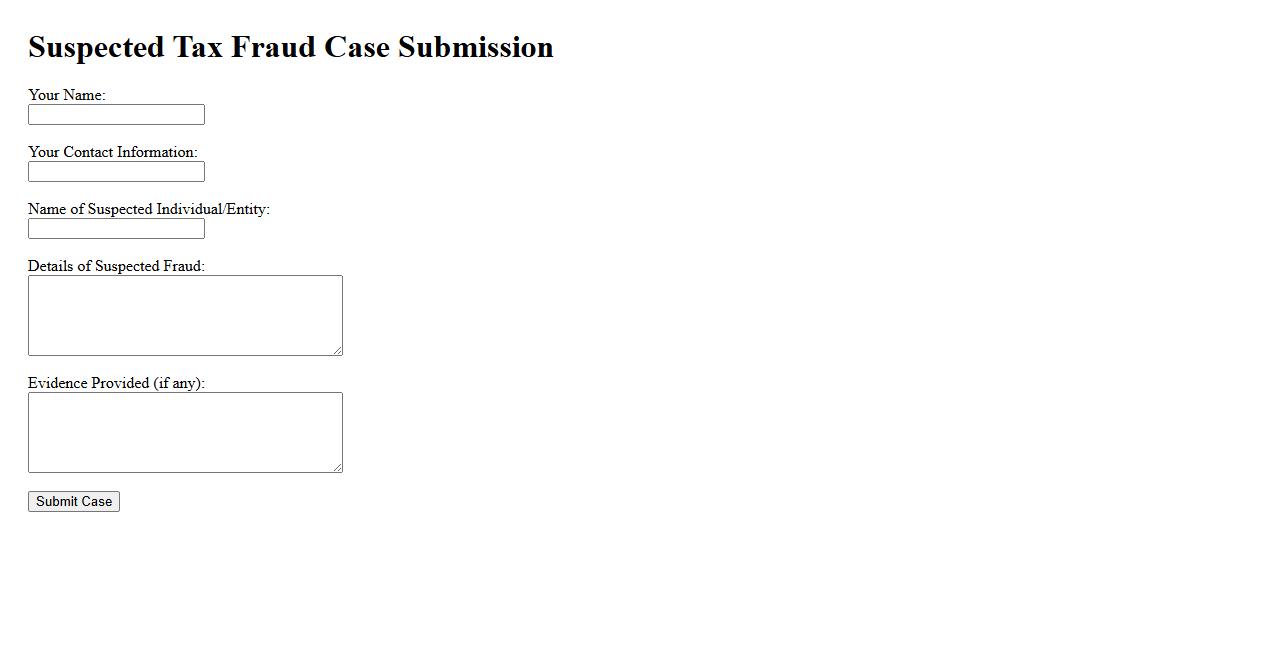

Suspected Tax Fraud Case Submission

The Suspected Tax Fraud Case Submission process allows individuals or entities to report potential tax evasion activities confidentially. This system ensures that all cases are thoroughly reviewed and investigated by the appropriate authorities. Timely submissions help maintain fairness and compliance within the tax system.

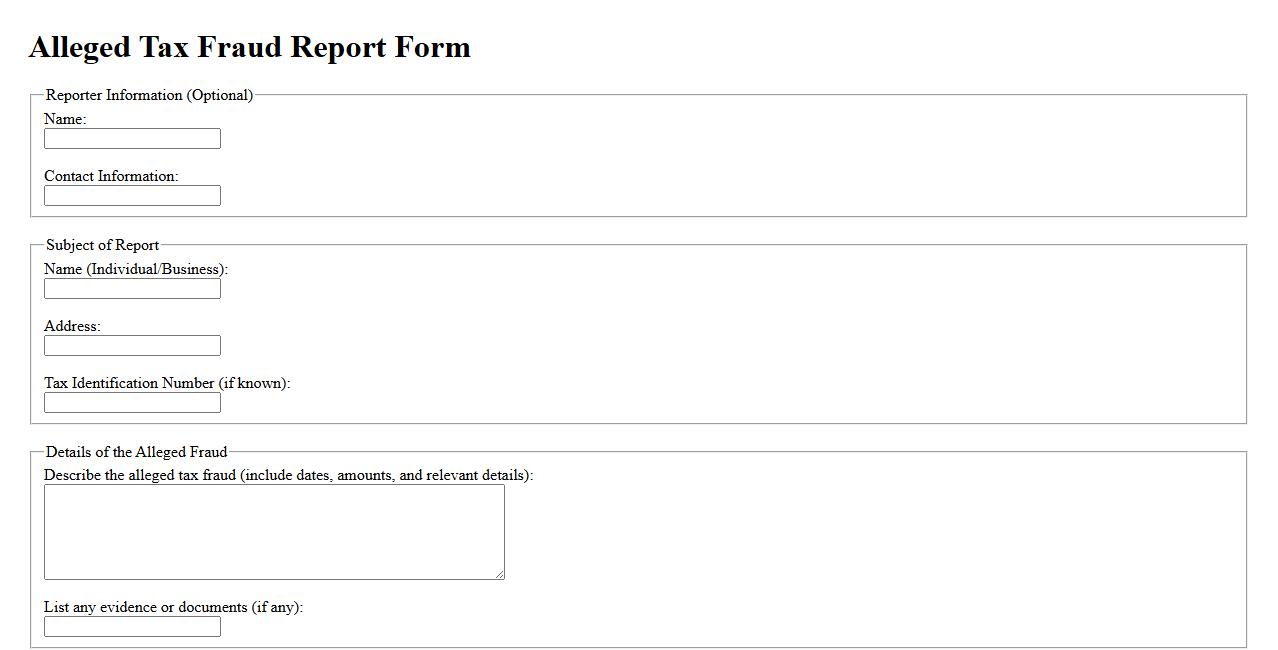

Alleged Tax Fraud Report Form

The Alleged Tax Fraud Report Form allows individuals to report suspected tax violations confidentially. This form is crucial for maintaining tax compliance and supporting government investigations. Accurate and detailed submissions help authorities address fraudulent activities effectively.

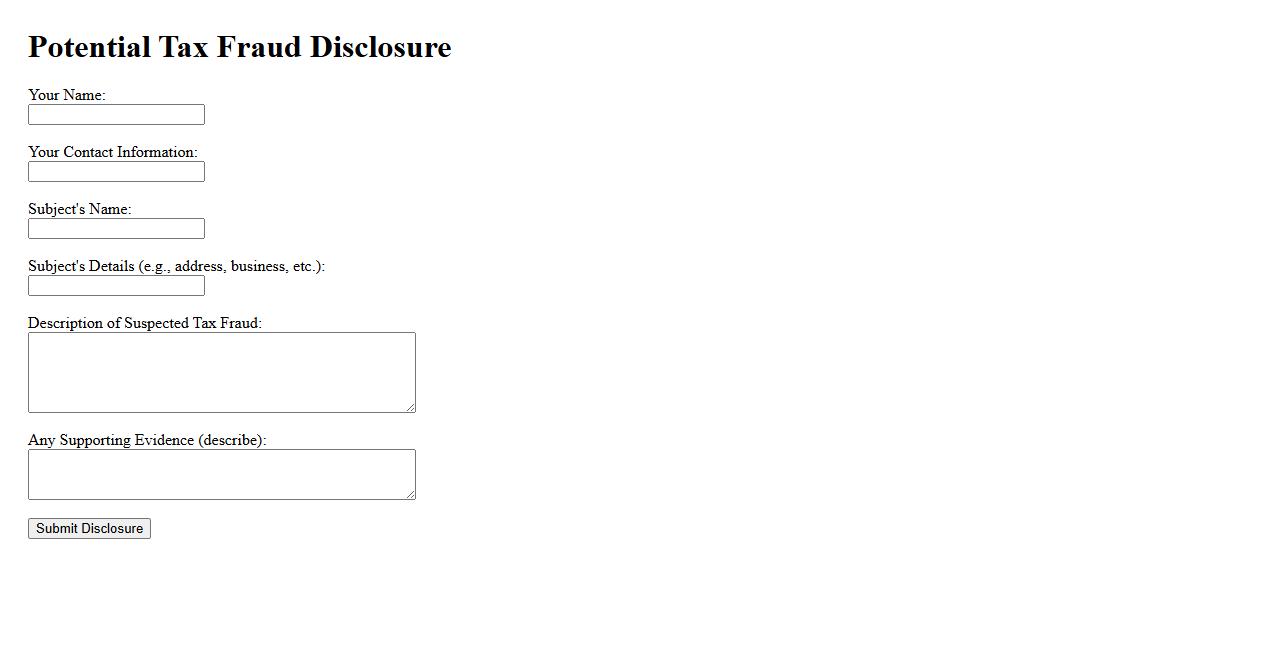

Potential Tax Fraud Disclosure

Potential tax fraud disclosure involves reporting suspected illegal activities related to tax evasion or misrepresentation. Timely disclosure helps authorities investigate and prevent financial crimes effectively. It is essential for maintaining transparency and compliance within the tax system.

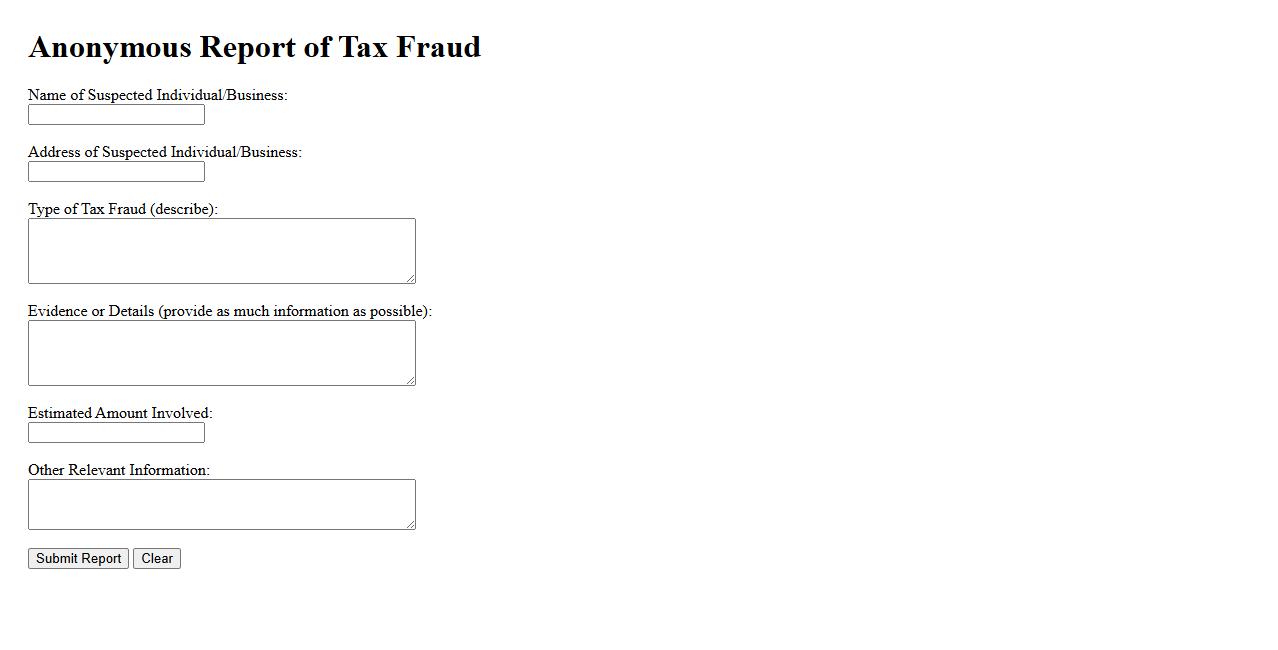

Anonymous Report of Tax Fraud

An Anonymous Report of Tax Fraud allows individuals to confidentially notify authorities about illegal tax activities without revealing their identity. This process helps maintain integrity in tax collection and encourages whistleblowers to come forward safely. Such reports can lead to investigations and enforcement actions against fraudulent practices.

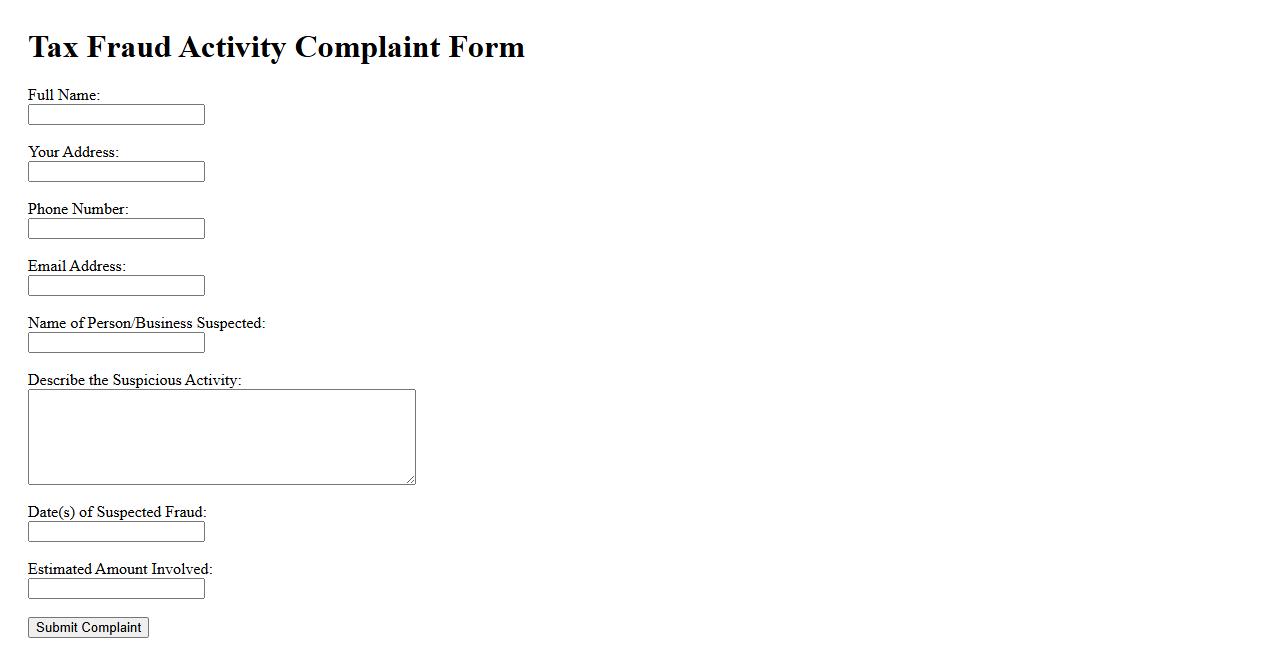

Tax Fraud Activity Complaint

A Tax Fraud Activity Complaint is a formal report submitted to authorities detailing suspected illegal actions related to tax evasion or deception. This complaint helps ensure compliance with tax laws and protects government revenue. Reporting such activities is crucial for maintaining the integrity of the tax system.

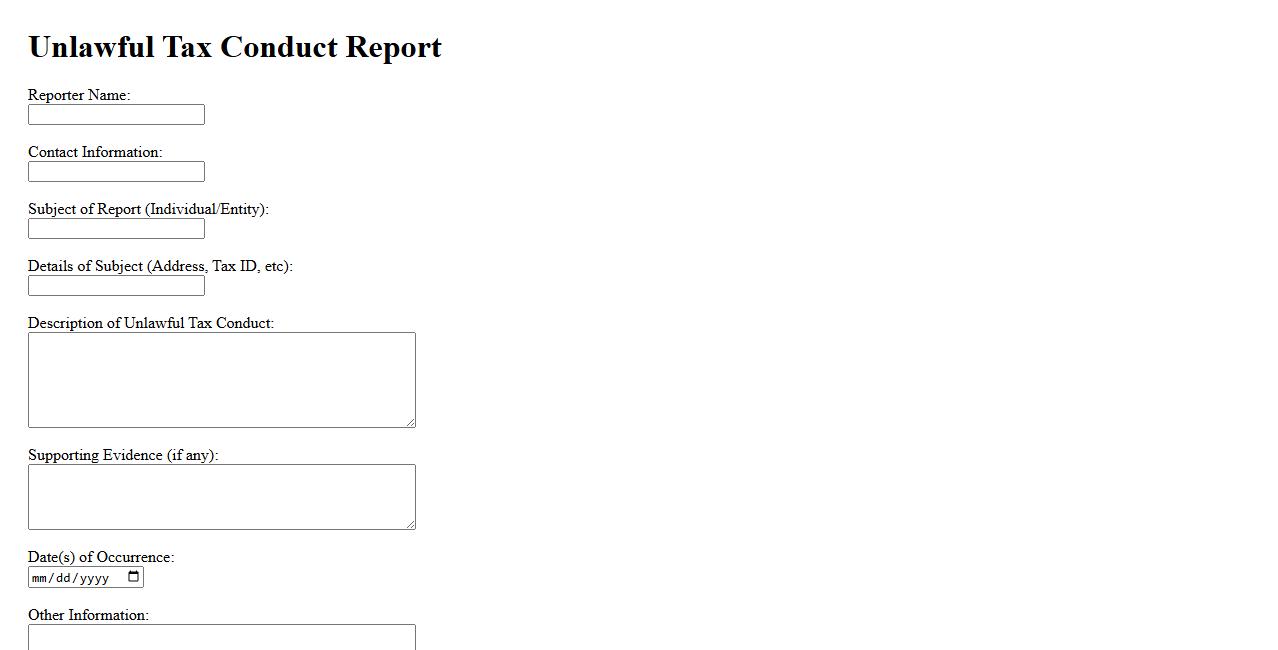

Unlawful Tax Conduct Report

The Unlawful Tax Conduct Report provides a detailed account of activities violating tax laws and regulations. It is essential for identifying fraudulent behavior and ensuring compliance with legal standards. This report aids authorities in taking corrective actions and maintaining financial integrity.

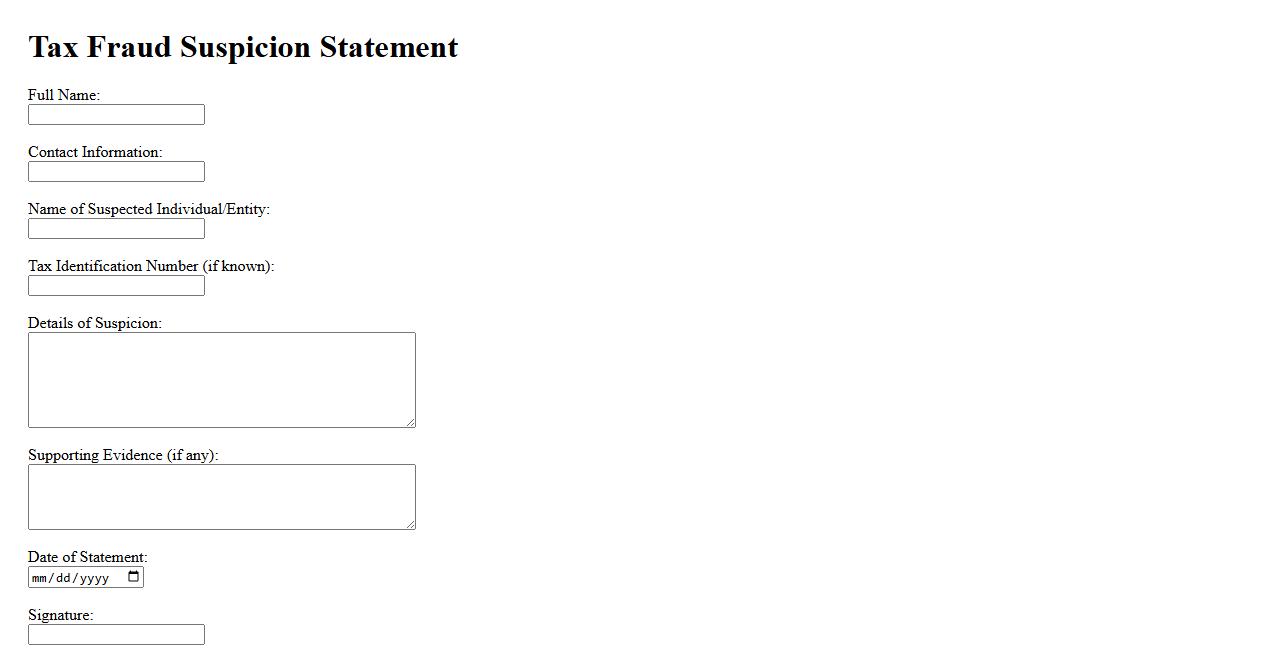

Tax Fraud Suspicion Statement

The Tax Fraud Suspicion Statement is a crucial document used by authorities to highlight potential fraudulent activities related to tax filings. It details discrepancies and provides evidence warranting further investigation. This statement aims to ensure compliance and uphold the integrity of the tax system.

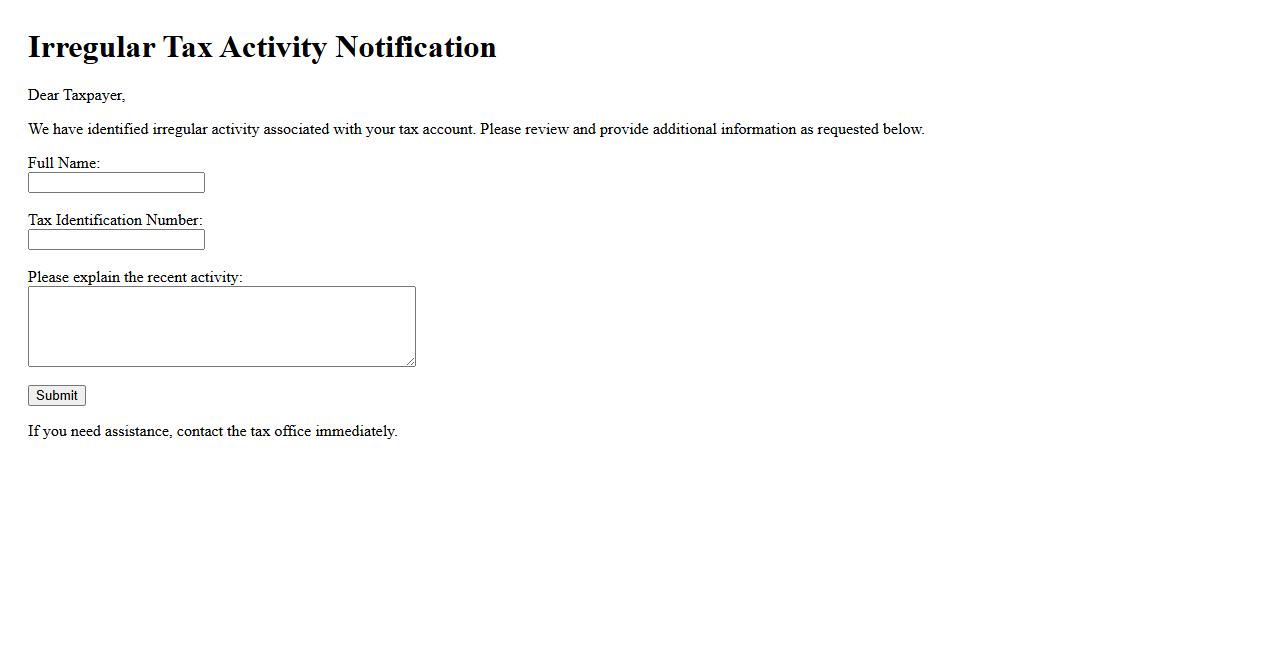

Irregular Tax Activity Notification

An Irregular Tax Activity Notification alerts individuals or businesses to unusual patterns or discrepancies in their tax filings. It serves as a prompt to review financial records and ensure compliance with tax regulations. Timely response to such notifications can prevent potential audits or penalties.

What specific tax laws or regulations are suspected to have been violated in the reported activity?

The report highlights suspected violations of the Internal Revenue Code, particularly those related to income misreporting and tax evasion. It indicates potential breaches of regulations concerning underreporting income and failure to maintain proper financial records. These violations undermine the integrity of the tax system and prompt further investigation by authorities.

What type of document or evidence supports the suspicion of tax fraud in this report?

The suspicion of tax fraud is supported by financial statements that show discrepancies and inconsistencies in reported income. Additionally, bank records and third-party transaction reports serve as critical evidence. Audit trails and whistleblower affidavits further corroborate the claims of fraudulent activity.

Which individual(s) or entity (entities) are identified as being involved in the suspected tax fraud activity?

The report identifies specific business entities and individual taxpayers allegedly engaged in tax fraud schemes. It details the involvement of certain company executives and financial officers. These actors are under investigation for orchestrating and facilitating the fraudulent declarations.

What is the estimated amount of unreported, underreported, or fraudulent income indicated in the report?

The estimated amount involved in the suspected tax fraud exceeds $5 million according to the report's findings. This figure reflects unreported income, understated revenues, and improperly claimed deductions. The substantial financial impact suggests a deliberate attempt to evade taxes.

What time period does the suspected tax fraud activity in the report cover?

The fraudulent activity spans a period of five years, covering tax years from 2018 through 2022. This timeframe aligns with significant financial discrepancies noted in the documents reviewed. Continuous monitoring and investigation aim to uncover the full extent of the misconduct during this duration.