The Report of Cash Payments Over $10,000 Received in a Trade or Business is a crucial IRS form used to identify large cash transactions that may indicate money laundering or tax evasion. Businesses must file this report when they receive more than $10,000 in cash from a single transaction or related transactions. Timely filing ensures compliance with federal regulations and helps maintain transparent financial records.

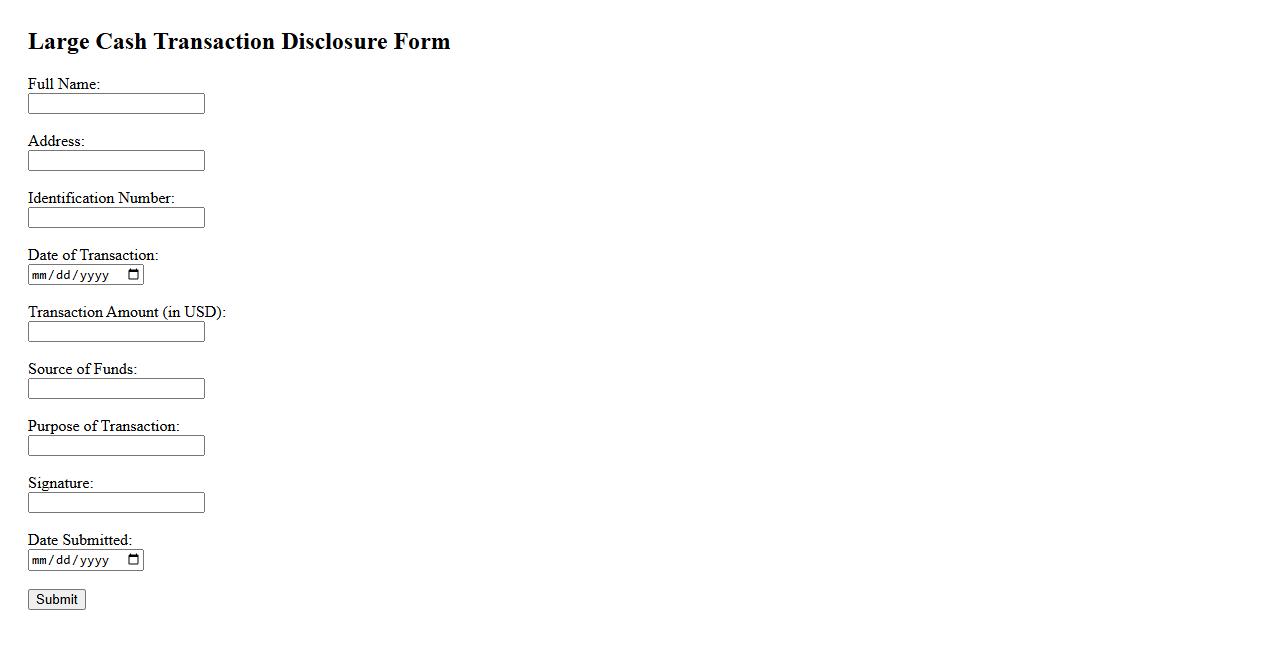

Large Cash Transaction Disclosure Form

The Large Cash Transaction Disclosure Form is essential for reporting cash payments exceeding a specified threshold to regulatory authorities. This form helps in monitoring and preventing money laundering and other financial crimes. Proper completion ensures compliance with legal requirements and promotes transparent financial practices.

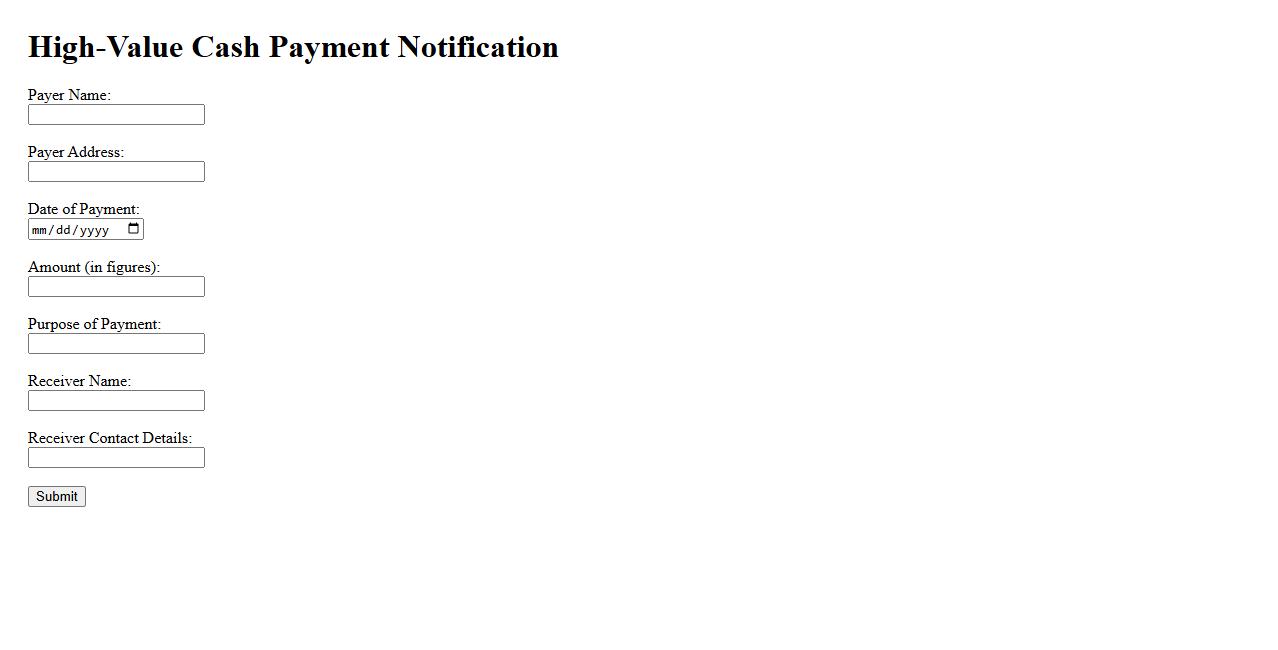

High-Value Cash Payment Notification

The High-Value Cash Payment Notification is a crucial financial document that alerts authorities about significant cash transactions. It helps ensure transparency and prevent money laundering by monitoring large sums of money exchanged. Timely reporting of these payments supports regulatory compliance and secure financial practices.

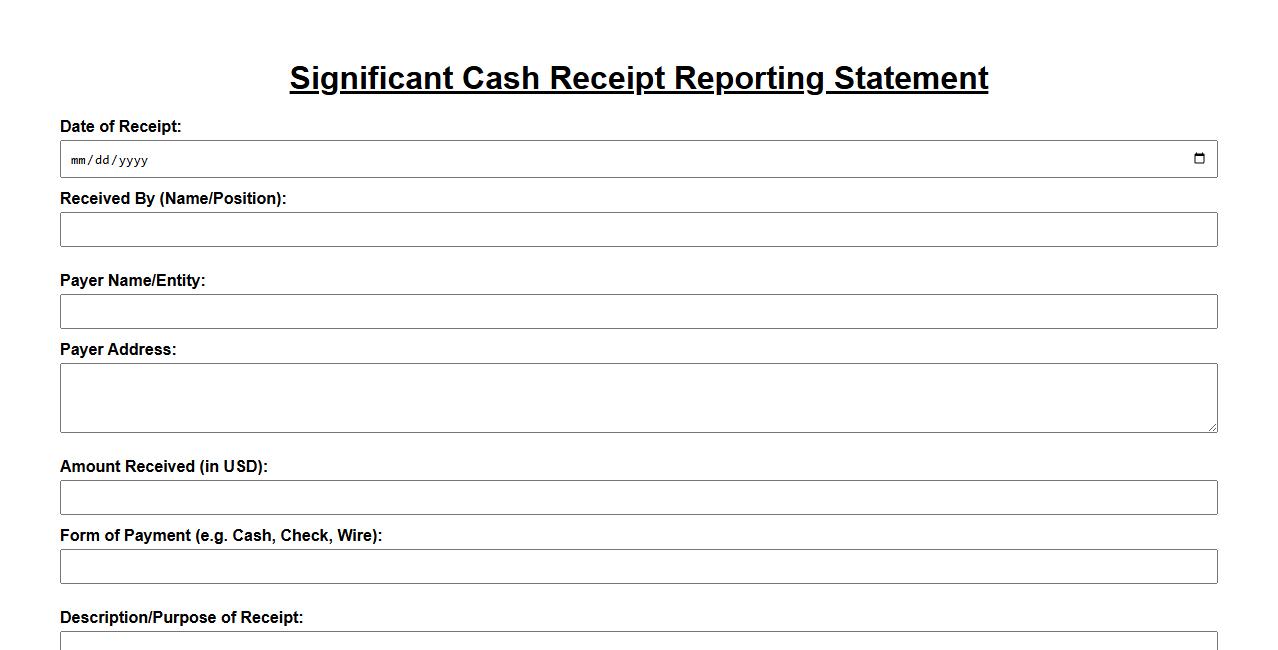

Significant Cash Receipt Reporting Statement

The Significant Cash Receipt Reporting Statement is a crucial financial document that records large cash transactions to ensure transparency and compliance with regulatory standards. It helps businesses monitor substantial cash inflows, aiding in fraud prevention and accurate financial analysis. This statement is essential for maintaining accountability in financial reporting.

Business Cash Transaction Record

Business Cash Transaction Record is a crucial document that tracks all cash inflows and outflows within a company. It ensures accurate financial management and helps in monitoring daily cash activities. Maintaining detailed records supports transparency and simplifies accounting processes.

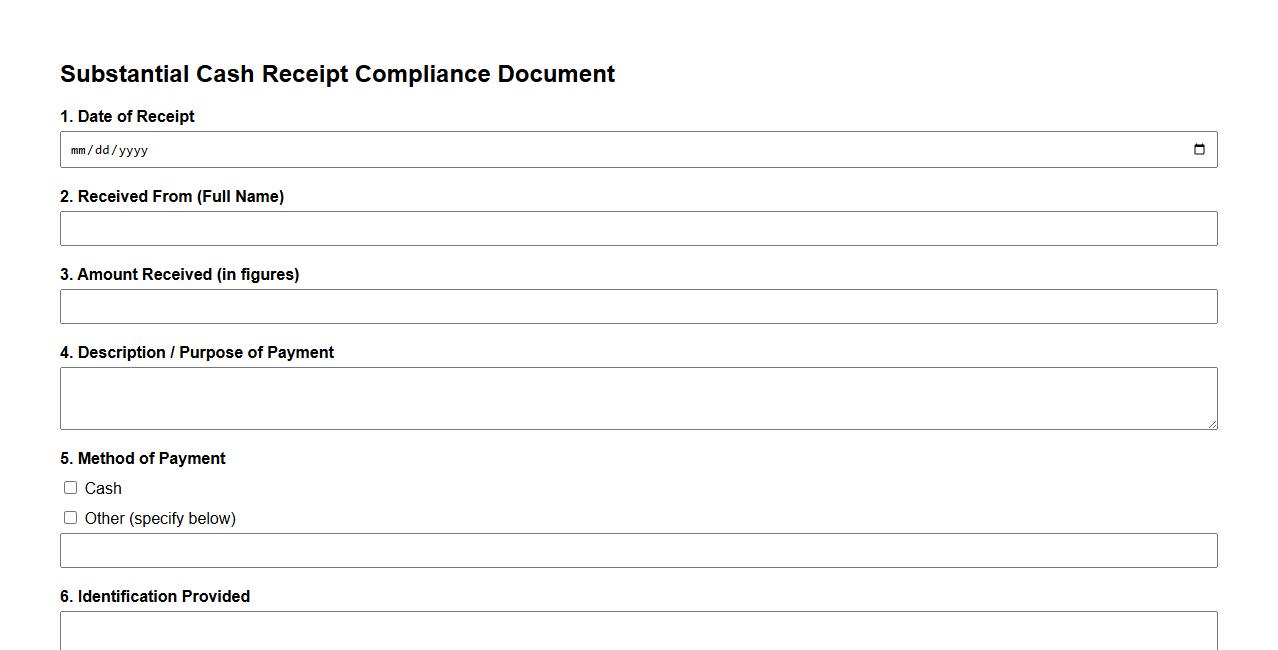

Substantial Cash Receipt Compliance Document

The Substantial Cash Receipt Compliance Document ensures that all significant cash transactions adhere to regulatory standards. It provides a detailed record to support transparency and accountability in financial reporting. Maintaining this document is essential for avoiding legal issues and ensuring audits run smoothly.

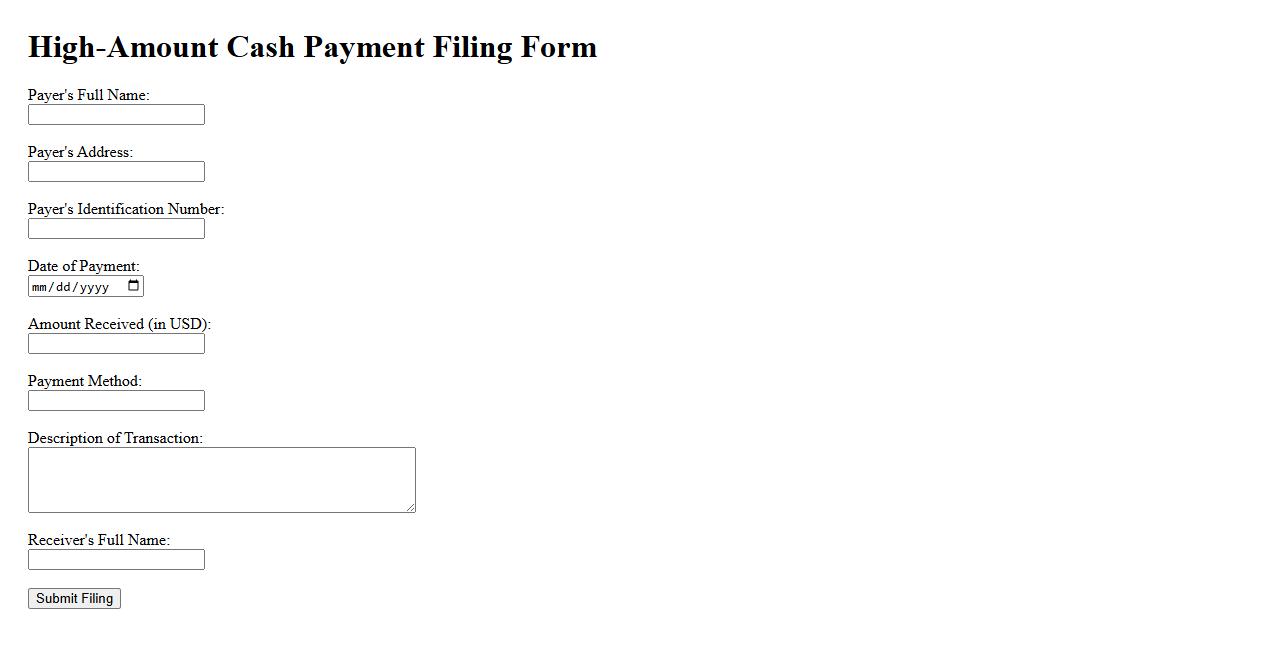

High-Amount Cash Payment Filing

High-Amount Cash Payment Filing refers to the mandatory reporting of large cash transactions to financial authorities. This process helps prevent money laundering and ensures transparency in financial activities. Businesses and individuals must comply with these regulations to avoid legal consequences.

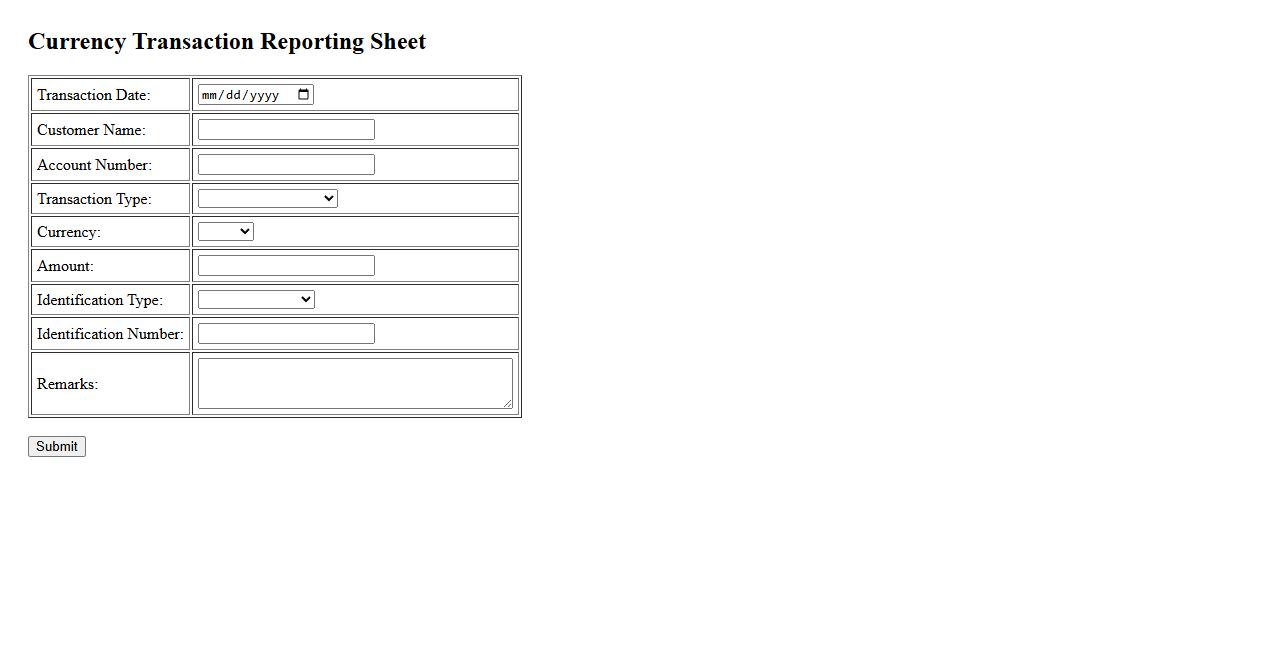

Currency Transaction Reporting Sheet

The Currency Transaction Reporting Sheet is a crucial document used to record and analyze large cash transactions for regulatory compliance. It helps financial institutions monitor suspicious activities and adhere to anti-money laundering laws. Accurate completion of this report ensures transparency and accountability in currency exchanges.

Major Cash Receipt Submission Form

The Major Cash Receipt Submission Form is designed to streamline the process of recording significant financial transactions. It ensures accurate documentation and timely processing of large cash receipts. This form is essential for maintaining transparent and organized financial records within an organization.

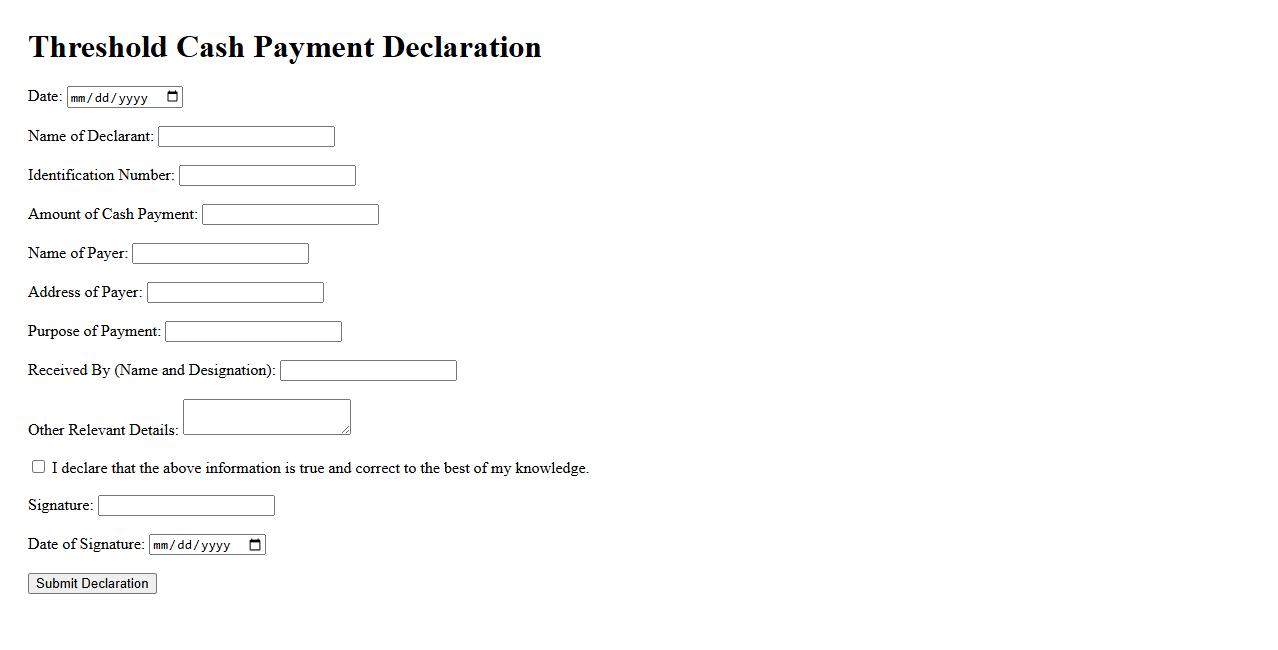

Threshold Cash Payment Declaration

The Threshold Cash Payment Declaration is a mandatory form required to report large cash transactions exceeding a specified limit. This declaration helps regulatory authorities monitor and prevent money laundering and other financial crimes. Timely submission ensures compliance with legal standards and enhances transaction transparency.

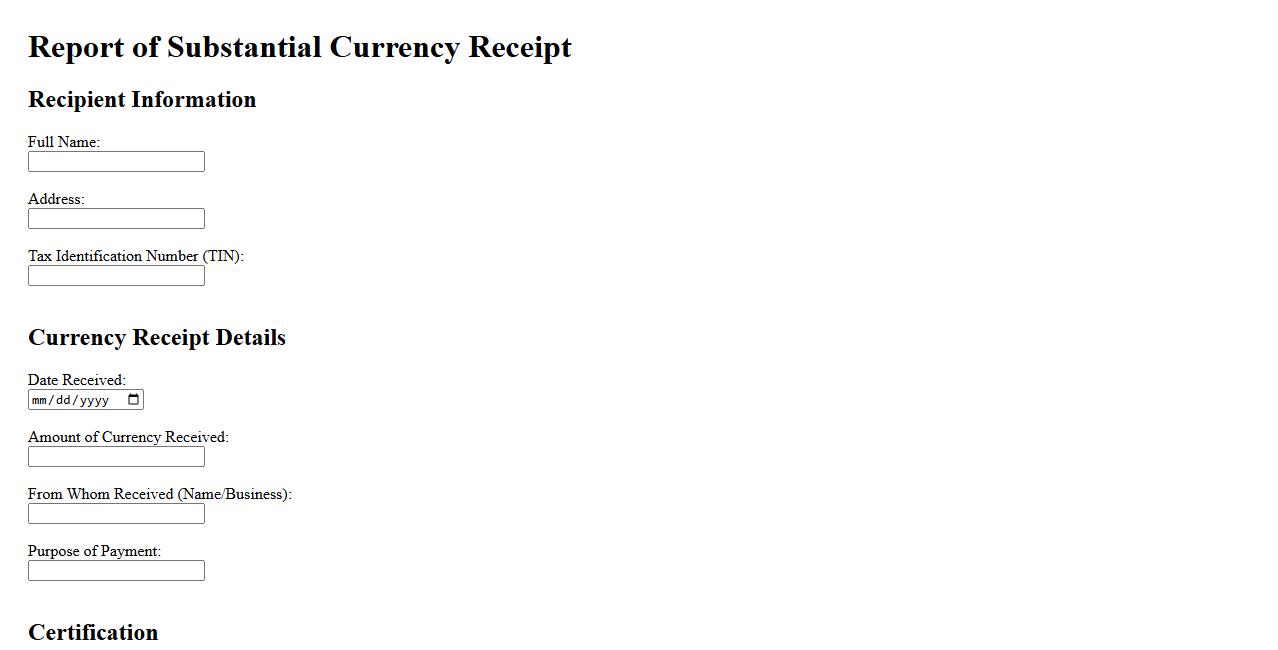

Report of Substantial Currency Receipt

The Report of Substantial Currency Receipt is a crucial document used to disclose large cash transactions exceeding a specific threshold. It ensures compliance with financial regulations by monitoring significant currency inflows. This report helps prevent money laundering and illegal financial activities.

What types of transactions are considered "cash payments" under the Report of Cash Payments Over $10,000 requirements?

Cash payments include currency and coins, as well as certain cashier's checks, bank drafts, and traveler's checks if issued or redeemed by a bank. These payments are typically made in a trade or business setting. The IRS requires reporting to ensure transparency in large cash transactions.

Who is required to file a report when receiving cash payments over $10,000 in a trade or business?

Any person or business engaged in a trade or business that receives a single or multiple related cash payments exceeding $10,000 must file a report. This includes corporations, partnerships, and sole proprietors. The purpose is to help prevent money laundering and structuring of cash transactions.

Within what timeframe must the report of cash payments over $10,000 be filed with the IRS?

The report must be filed within 15 days after the date the cash payment is received. Timely submission is crucial for compliance with IRS regulations. Failure to meet this deadline may lead to penalties or further investigation.

What information must be included about both the payer and the recipient in the cash payment report?

The report must include detailed identifying information such as the payer's and recipient's name, address, and taxpayer identification number (TIN). Additionally, the amount and date of the cash payment must be recorded. This ensures accurate tracking and verification by the IRS.

What are the consequences for failing to file a required report of cash payments over $10,000?

Failure to file the required report can result in significant monetary penalties imposed by the IRS. Additionally, repeated non-compliance may trigger further audits or legal action. Maintaining compliance helps avoid these serious consequences and supports financial transparency.