A Report of Financial Interest is a document that discloses an individual's financial holdings, investments, and affiliations to identify potential conflicts of interest. It is commonly required by institutions, employers, or regulatory bodies to ensure transparency and maintain ethical standards. This report helps in assessing whether financial interests could unduly influence professional decisions or actions.

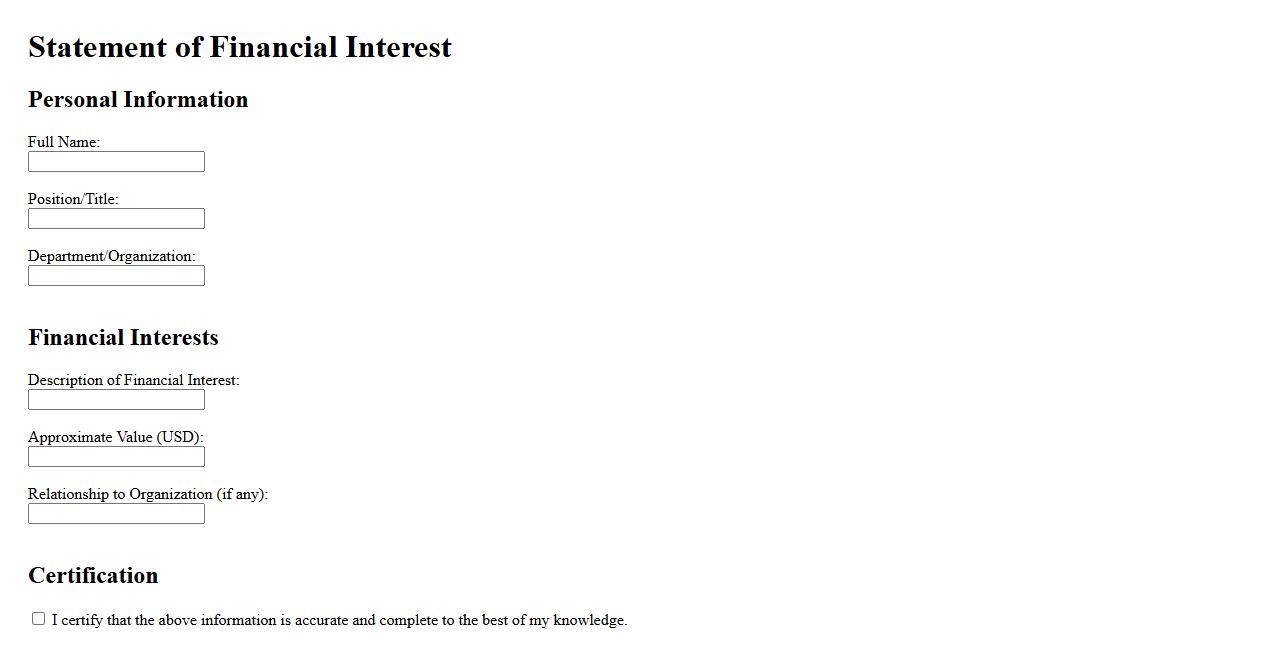

Statement of Financial Interest

A Statement of Financial Interest is a formal document disclosing an individual's financial relationships and holdings. It ensures transparency and helps prevent conflicts of interest in professional settings. This statement is crucial for maintaining trust and integrity in financial and organizational decisions.

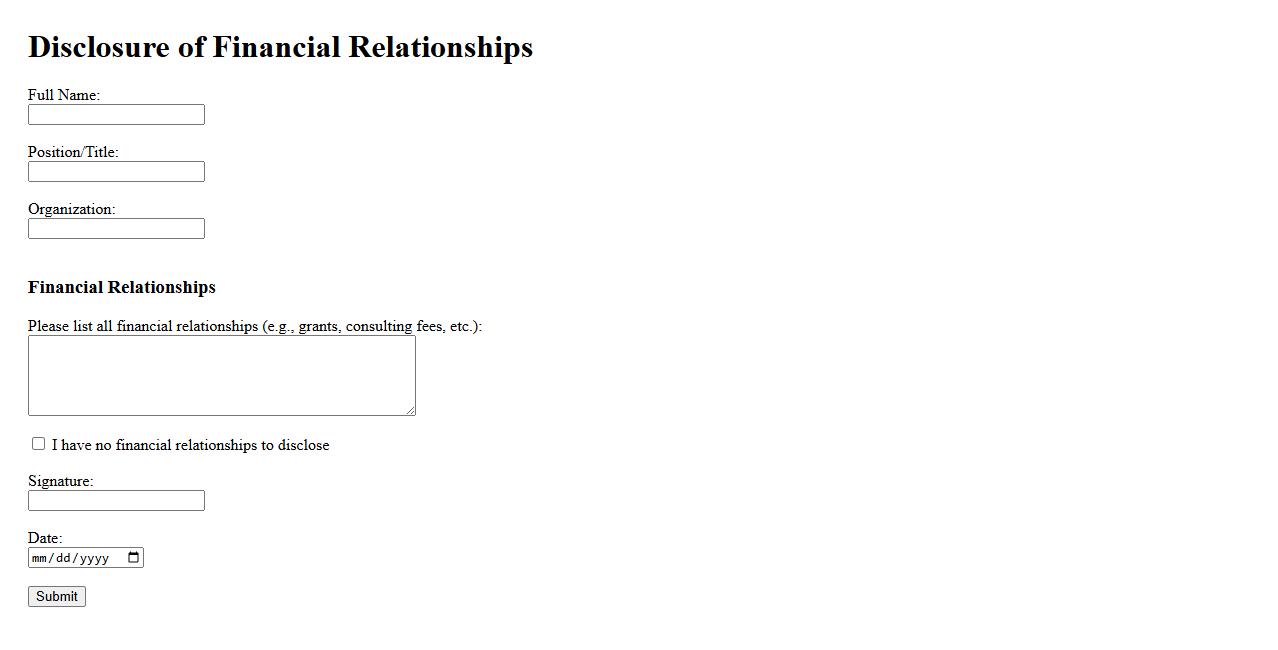

Disclosure of Financial Relationships

The Disclosure of Financial Relationships ensures transparency by revealing any financial ties that could influence decision-making. This practice helps maintain trust and integrity in professional and academic settings. Clear disclosure allows audiences to assess potential biases effectively.

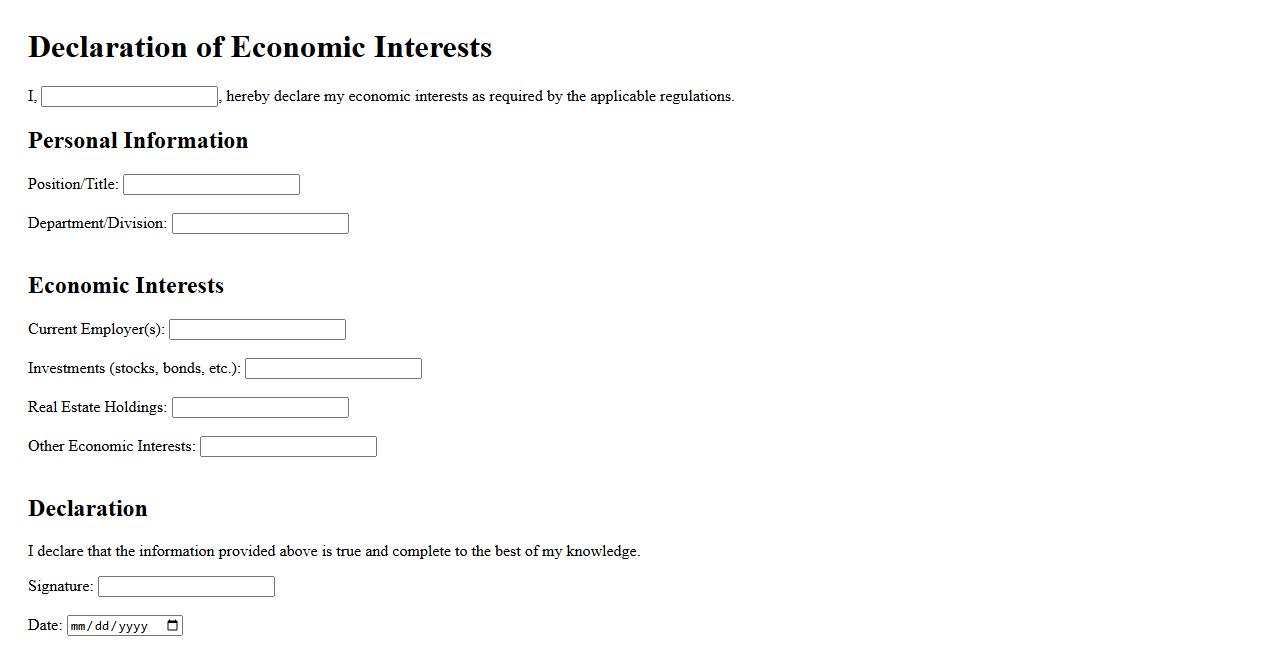

Declaration of Economic Interests

The Declaration of Economic Interests is a formal document required from public officials to disclose their financial assets and potential conflicts of interest. This declaration promotes transparency and accountability in government by preventing corruption. It ensures that decisions are made in the public's best interest, free from undue influence.

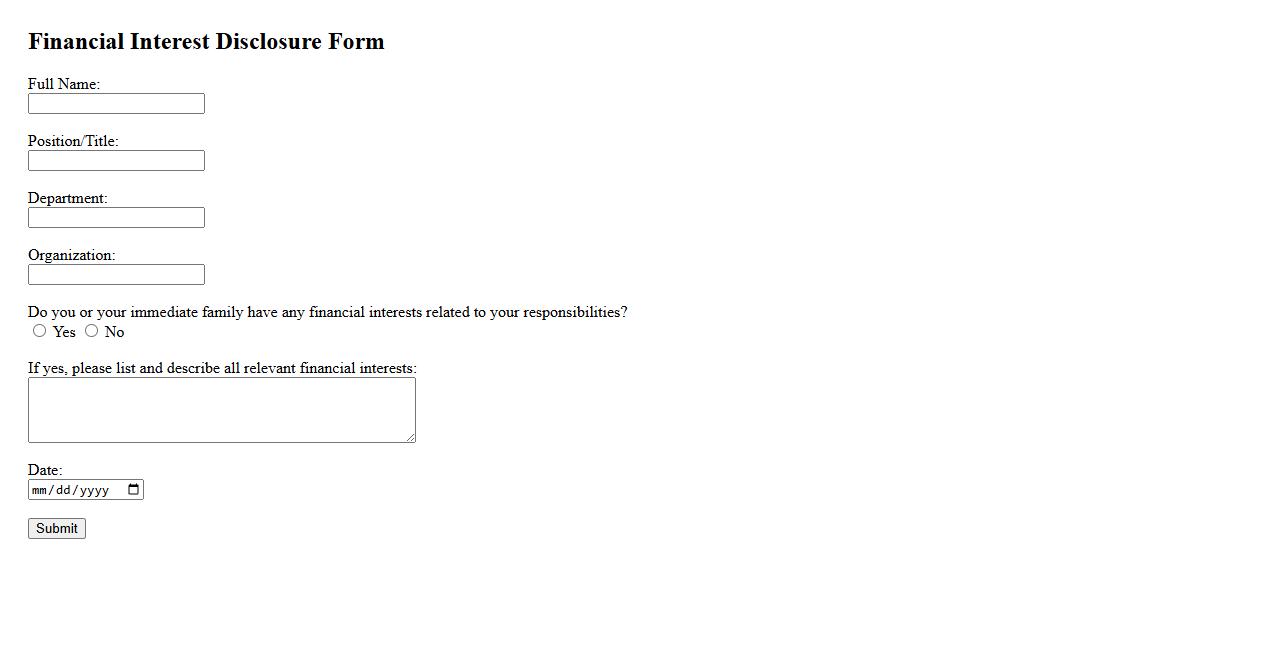

Financial Interest Disclosure Form

The Financial Interest Disclosure Form is a crucial document used by organizations to identify potential conflicts of interest. It ensures transparency by requiring individuals to disclose any financial interests that could influence their decision-making. This form helps maintain integrity and ethical standards within the organization.

Record of Financial Holdings

The Record of Financial Holdings provides a detailed overview of an individual's or organization's assets, including cash, investments, and other valuable financial resources. This information is essential for effective portfolio management and accurate financial planning. Maintaining updated records ensures transparency and supports informed decision-making.

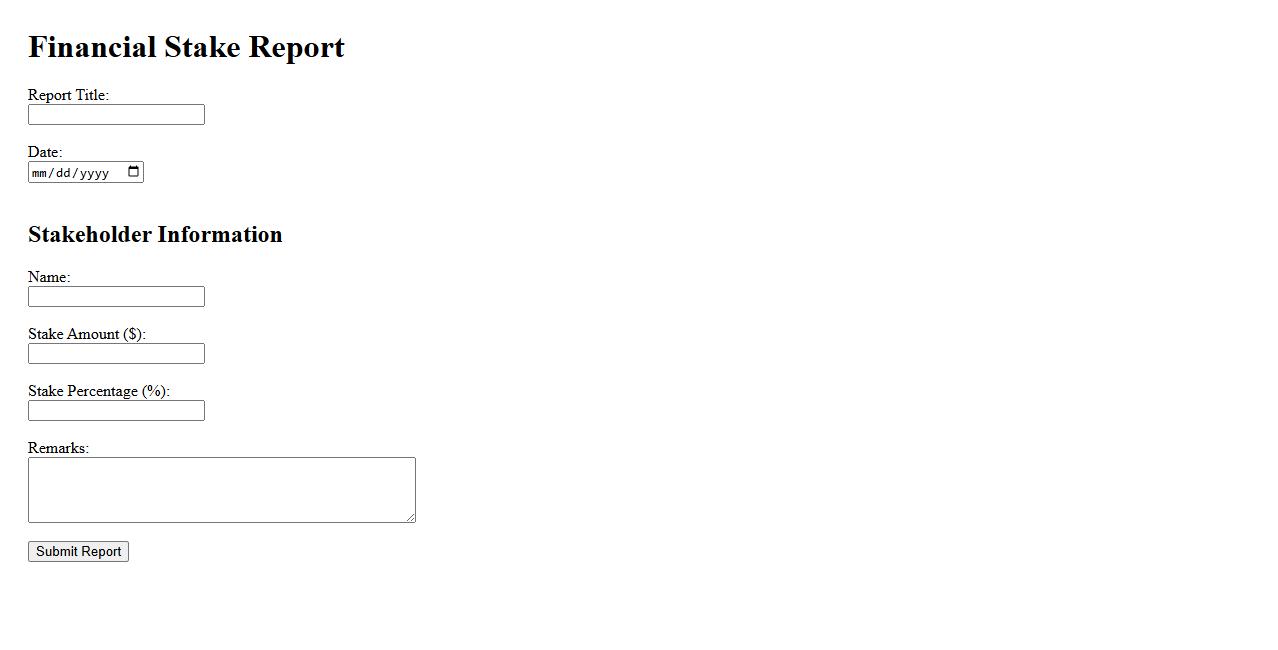

Financial Stake Report

The Financial Stake Report provides a comprehensive overview of investments and their current values. It offers detailed insights into stakeholder contributions and portfolio performance. This report is essential for making informed financial decisions and strategic planning.

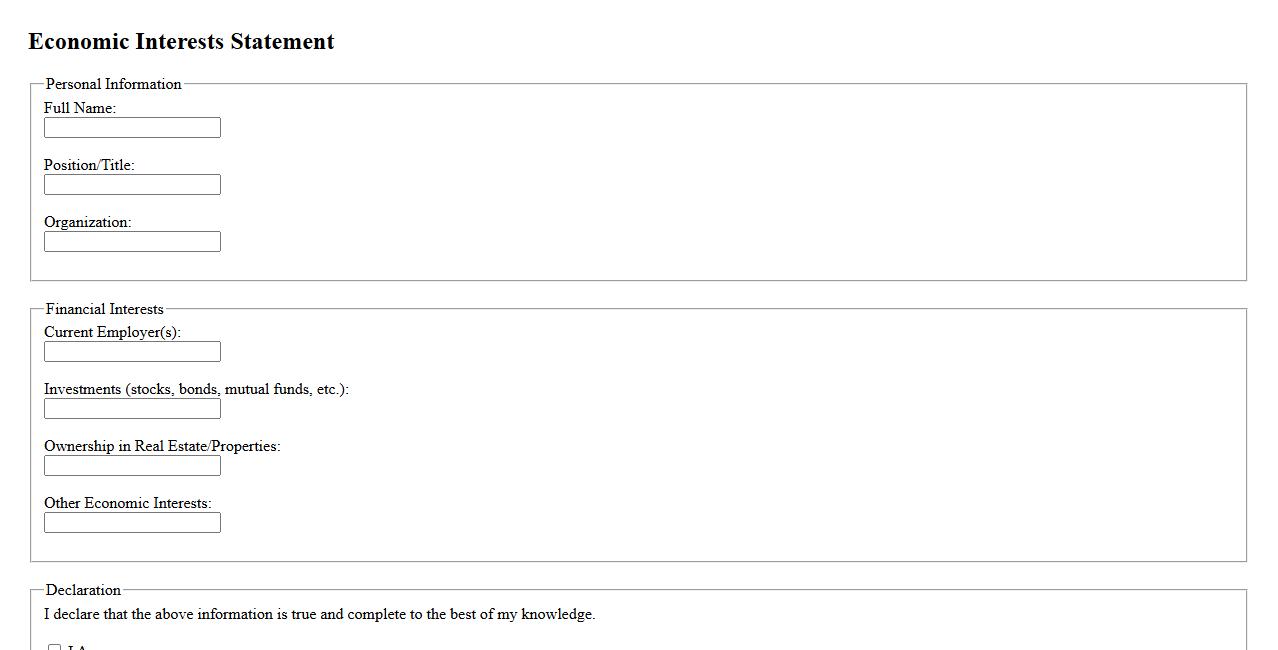

Economic Interests Statement

An Economic Interests Statement ensures transparency by requiring individuals to disclose their financial interests. This disclosure helps prevent conflicts of interest in professional or governmental roles. It promotes trust and accountability within organizations and public institutions.

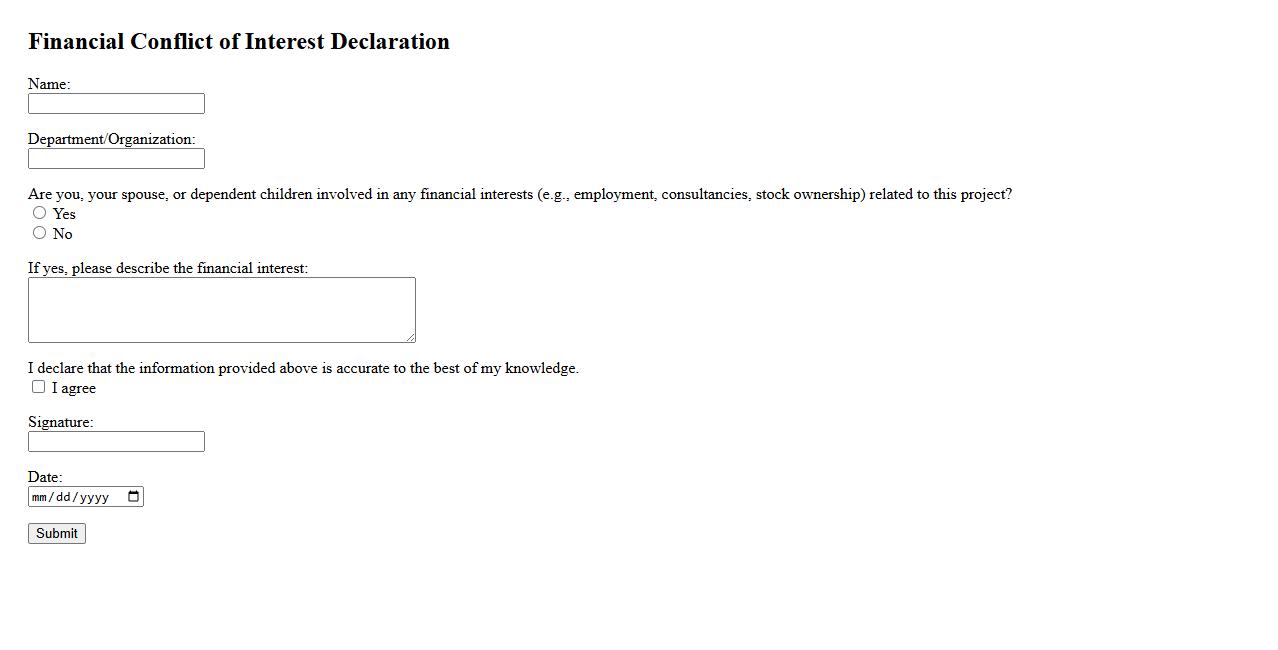

Financial Conflict of Interest Declaration

The Financial Conflict of Interest Declaration is a formal statement used to disclose any personal financial interests that may affect one's objectivity in professional activities. It ensures transparency and helps maintain ethical standards in research and business environments. Proper declaration minimizes risks of bias and protects the integrity of the decision-making process.

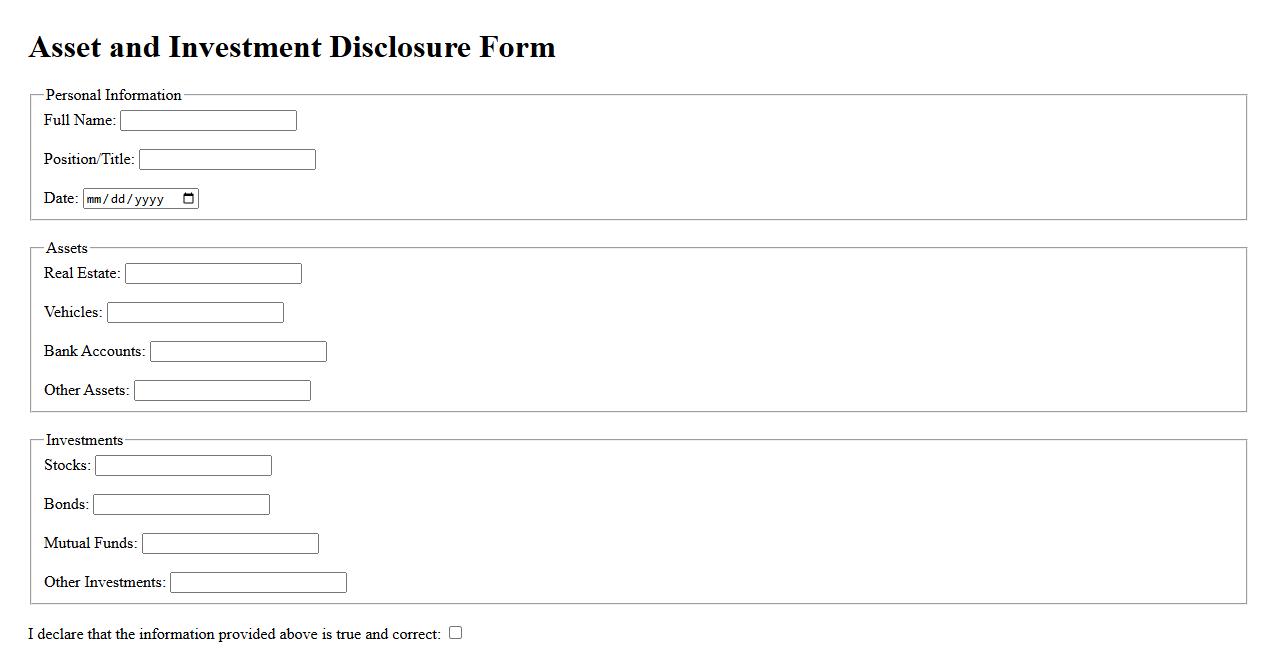

Asset and Investment Disclosure

Asset and Investment Disclosure is a critical process for transparency in financial reporting. It involves the detailed declaration of all assets and investments held by an individual or organization. This practice ensures accountability and helps prevent conflicts of interest.

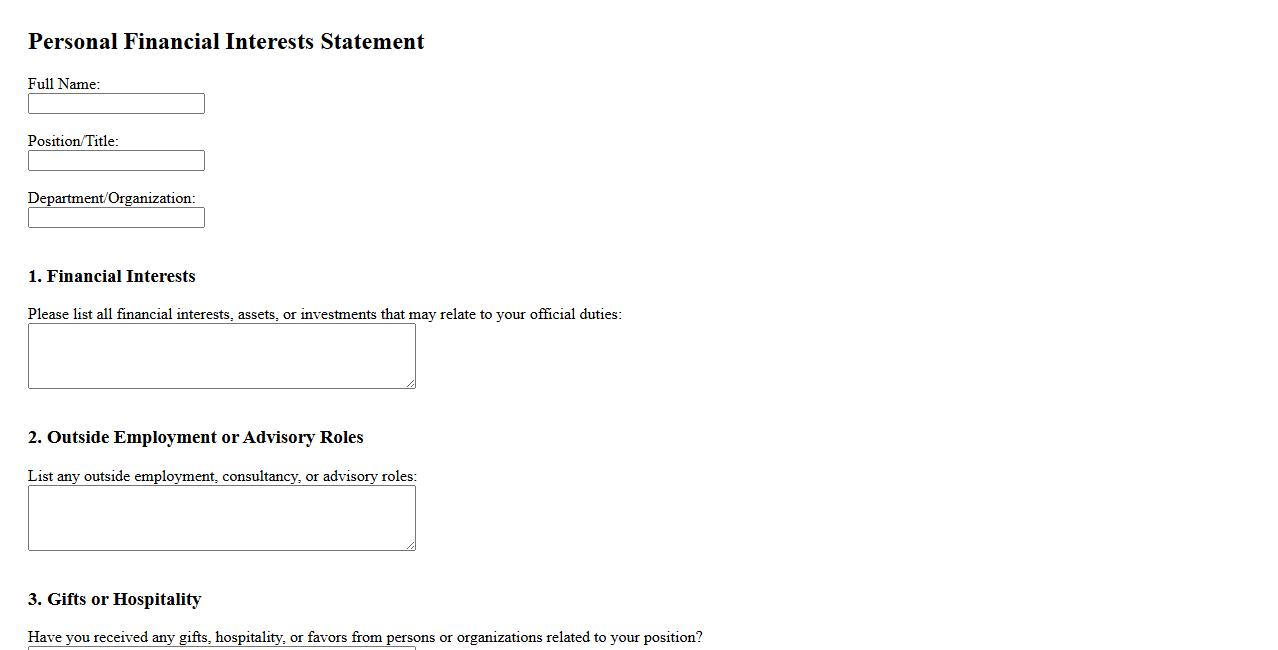

Personal Financial Interests Statement

The Personal Financial Interests Statement is a formal document used to disclose an individual's financial interests that may influence their professional decisions. It promotes transparency and helps to prevent conflicts of interest in various organizational settings. This statement is essential for maintaining trust and integrity in financial and administrative processes.

What is the primary purpose of a Report of Financial Interest document?

The primary purpose of a Report of Financial Interest document is to disclose any financial relationships that may influence professional judgments. This ensures transparency and maintains the integrity of decision-making processes. It helps organizations identify potential biases that could affect their operations.

Which financial interests must be disclosed according to the report guidelines?

According to the guidelines, all significant financial interests including stocks, dividends, consulting fees, and intellectual property rights must be disclosed. This includes interests held by the individual, their family members, or affiliated entities. Thorough disclosure allows for proper evaluation and management of potential conflicts.

Who is required to submit a Report of Financial Interest?

Individuals in positions of authority or influence within an organization, such as executives, researchers, and board members, are typically required to submit a Report of Financial Interest. This requirement also extends to employees involved in decision-making or regulatory roles. The obligation ensures accountability and ethical compliance across the organization.

How does the document define a "conflict of interest"?

The document defines a "conflict of interest" as a situation where personal financial interests could compromise or appear to compromise professional responsibilities. It highlights the importance of recognizing both actual and perceived conflicts. Identifying conflicts helps maintain trust and uphold ethical standards.

What are the consequences of failing to file or misreporting financial interests?

Failing to file or intentionally misreporting financial interests can lead to serious consequences such as disciplinary action, legal penalties, and damage to professional reputation. Organizations may impose sanctions, including termination or loss of funding. Accurate reporting is essential to avoid these negative outcomes and preserve organizational integrity.