A Report of Tax Fraud or Identity Theft is a formal notification submitted to tax authorities when fraudulent activities or unauthorized use of an individual's identity compromise tax filings. This report helps initiate an investigation to correct fraudulent tax returns and prevent financial loss. Timely reporting ensures protection of personal information and eligibility for restitution or legal action.

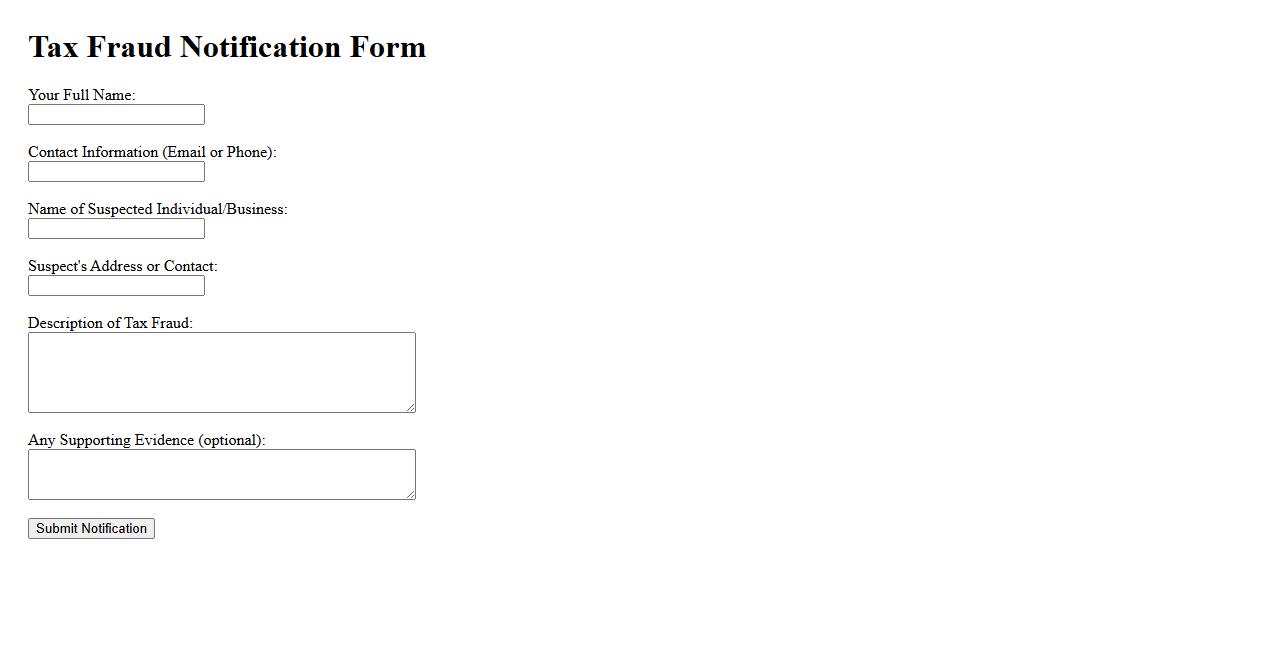

Tax Fraud Notification Form

The Tax Fraud Notification Form is a critical document used to report suspected fraudulent activities related to tax filings. It ensures that authorities can efficiently investigate and take appropriate legal action against tax evasion cases. Submitting accurate and detailed information on this form helps maintain the integrity of the tax system.

Identity Theft Incident Report

An Identity Theft Incident Report is a crucial document for victims to detail unauthorized use of their personal information. It helps authorities investigate and track fraudulent activities effectively. Promptly filing this report is essential to protect one's financial and personal security.

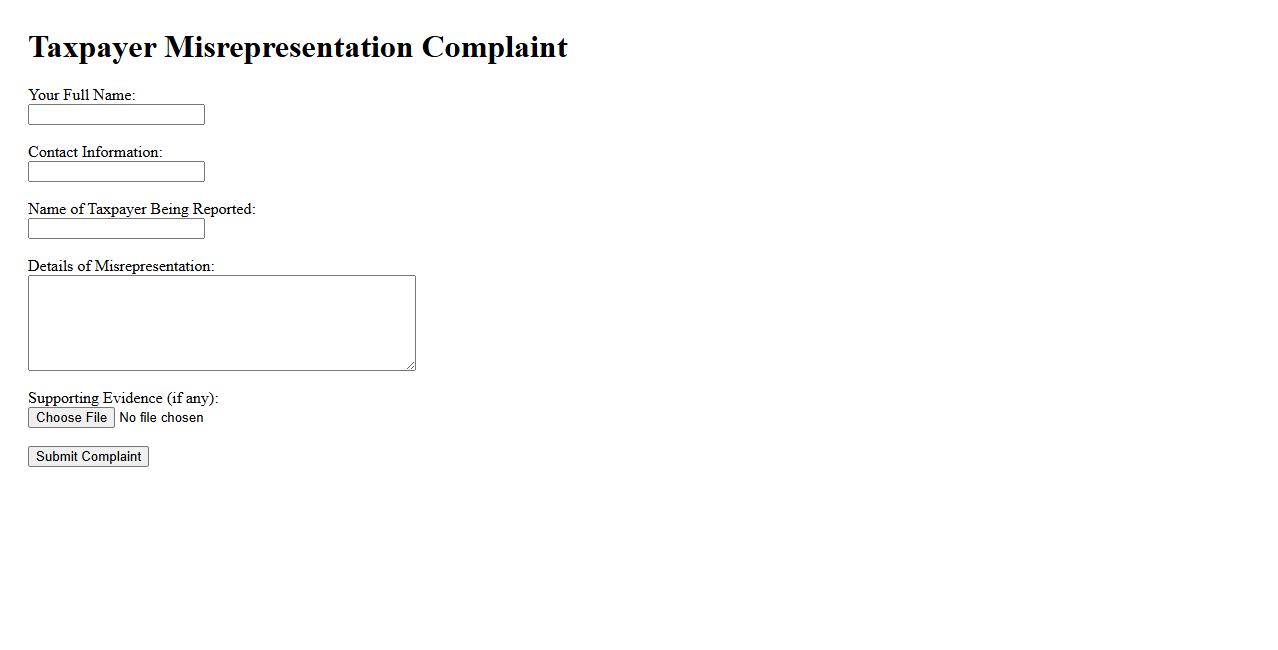

Taxpayer Misrepresentation Complaint

A Taxpayer Misrepresentation Complaint addresses false or misleading information provided by a taxpayer during tax filing or audits. This complaint is critical in ensuring tax compliance and preventing fraud. Authorities investigate such claims to maintain the integrity of the tax system.

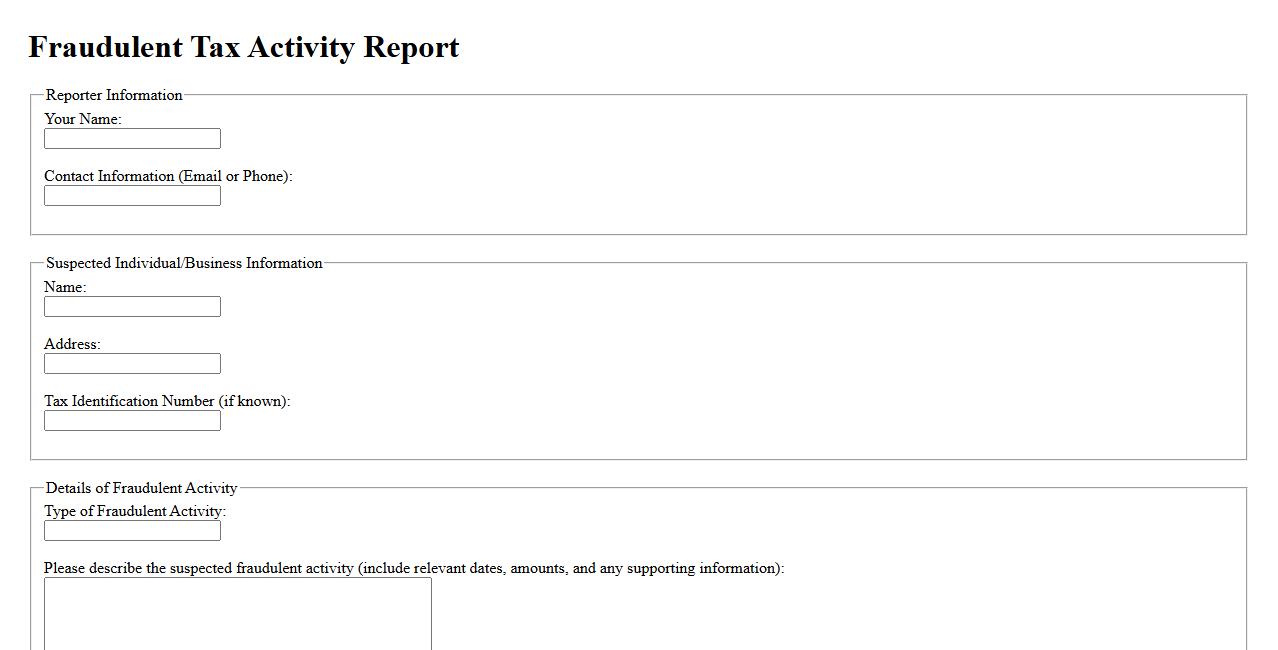

Fraudulent Tax Activity Report

The Fraudulent Tax Activity Report is a crucial document used to identify and report suspicious tax-related transactions. It helps authorities detect potential tax evasion and fraudulent behavior quickly. Timely submission of this report ensures compliance with tax regulations and protects the integrity of the financial system.

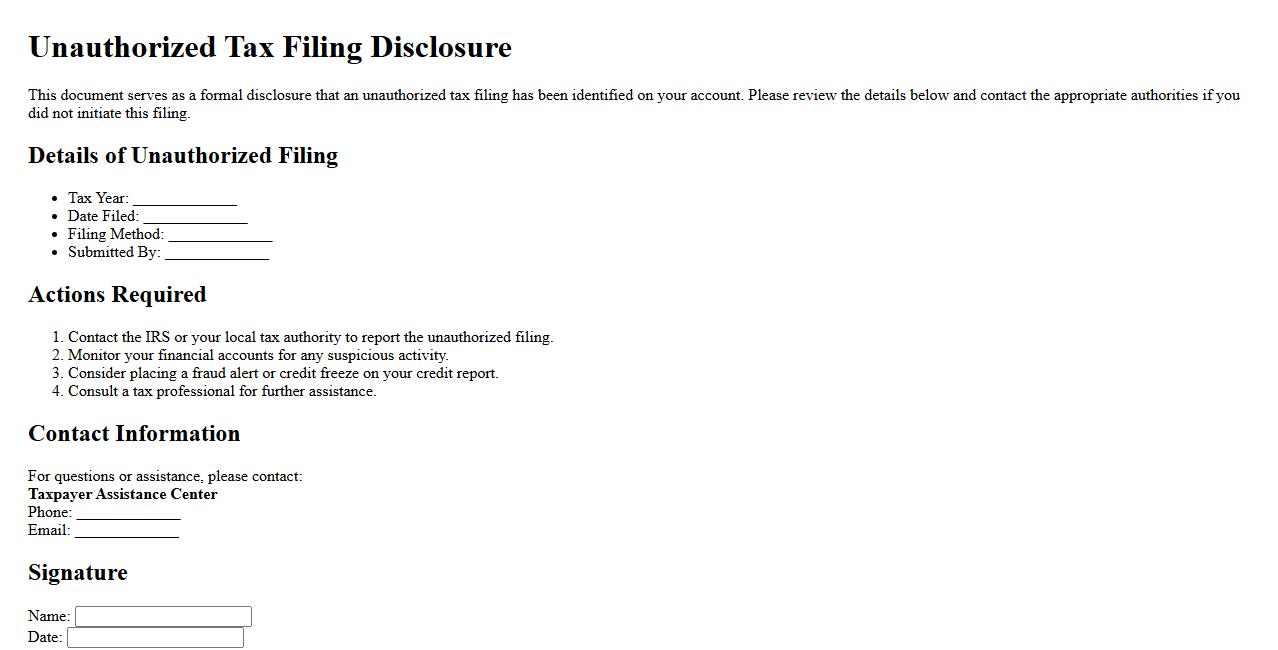

Unauthorized Tax Filing Disclosure

Unauthorized Tax Filing Disclosure refers to the illegal or unpermitted release of personal or financial information during the tax filing process. This breach can lead to identity theft, financial loss, and legal complications for affected individuals. Protecting sensitive tax data is crucial to maintain privacy and prevent fraudulent activities.

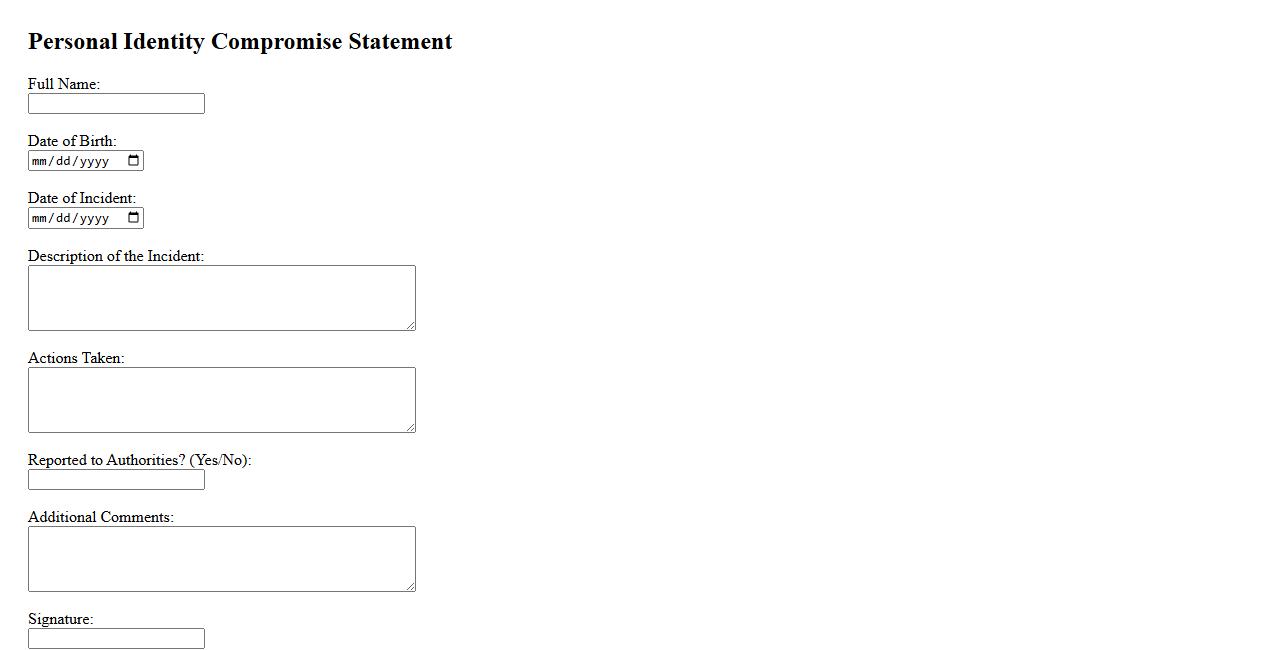

Personal Identity Compromise Statement

The Personal Identity Compromise Statement is a formal declaration used to report unauthorized access or misuse of an individual's personal information. It helps initiate protective measures to prevent further damage and supports investigations into identity theft. This statement is essential for safeguarding privacy and restoring security.

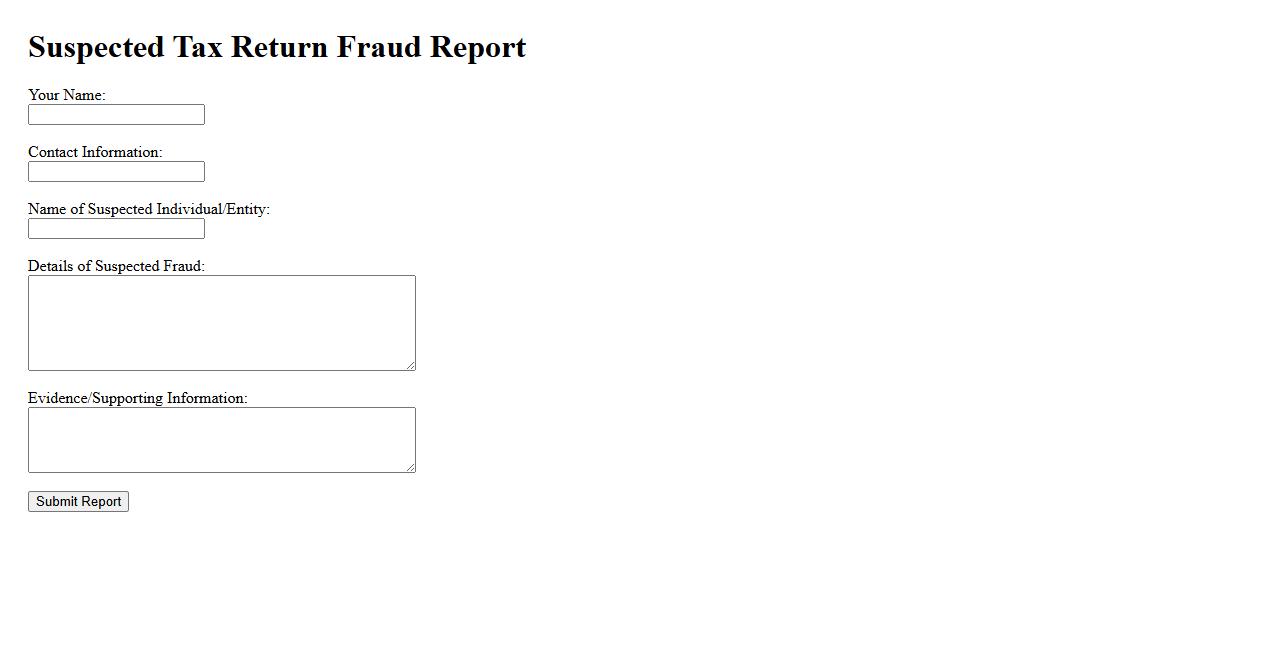

Suspected Tax Return Fraud Report

A Suspected Tax Return Fraud Report is a critical document used to notify authorities about potential fraudulent activities related to tax filings. It helps in identifying and investigating suspicious claims that may involve identity theft or false information. Timely reporting ensures the integrity of the tax system and protects individuals from financial harm.

Stolen Taxpayer Identification Statement

The Stolen Taxpayer Identification Statement is a crucial document used to report and verify the theft or misuse of a taxpayer's identification information. It helps protect individuals from identity theft and fraudulent tax activities by notifying relevant tax authorities. Prompt submission of this statement is essential to safeguard personal financial data and ensure proper corrective measures are taken.

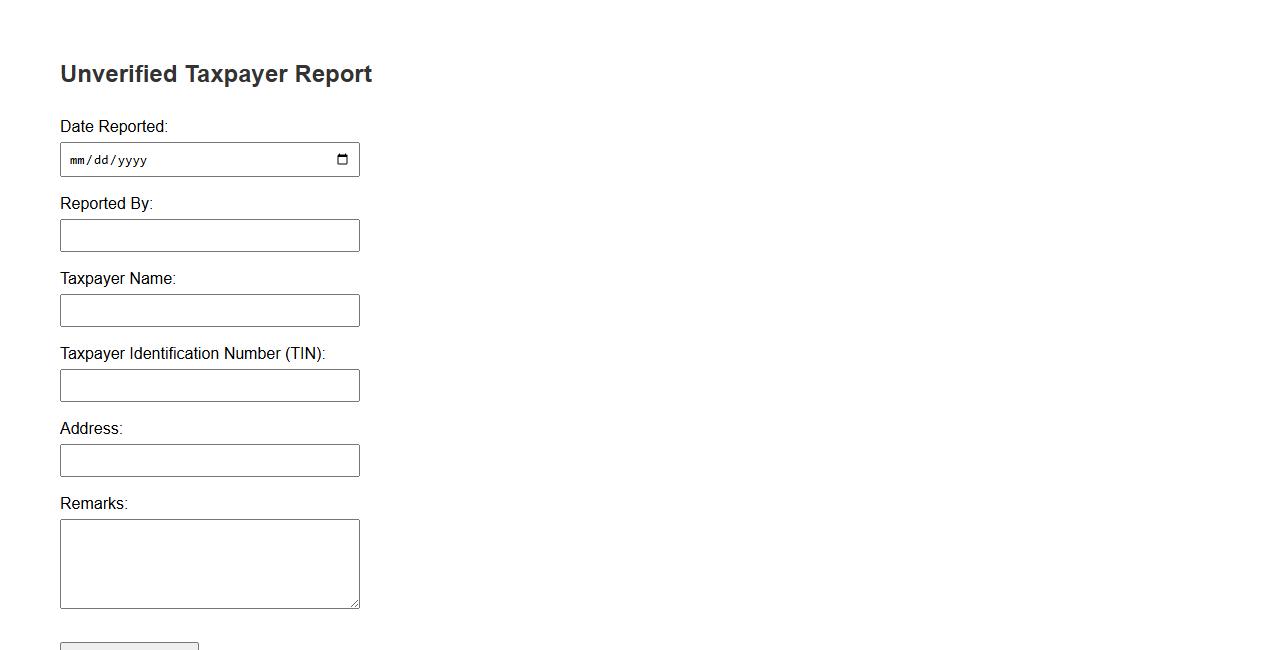

Unverified Taxpayer Report

The Unverified Taxpayer Report provides a detailed summary of taxpayers whose information has not yet been confirmed by the tax authorities. This report helps identify discrepancies or missing data for further investigation. It is crucial for ensuring accuracy in tax records and compliance verification.

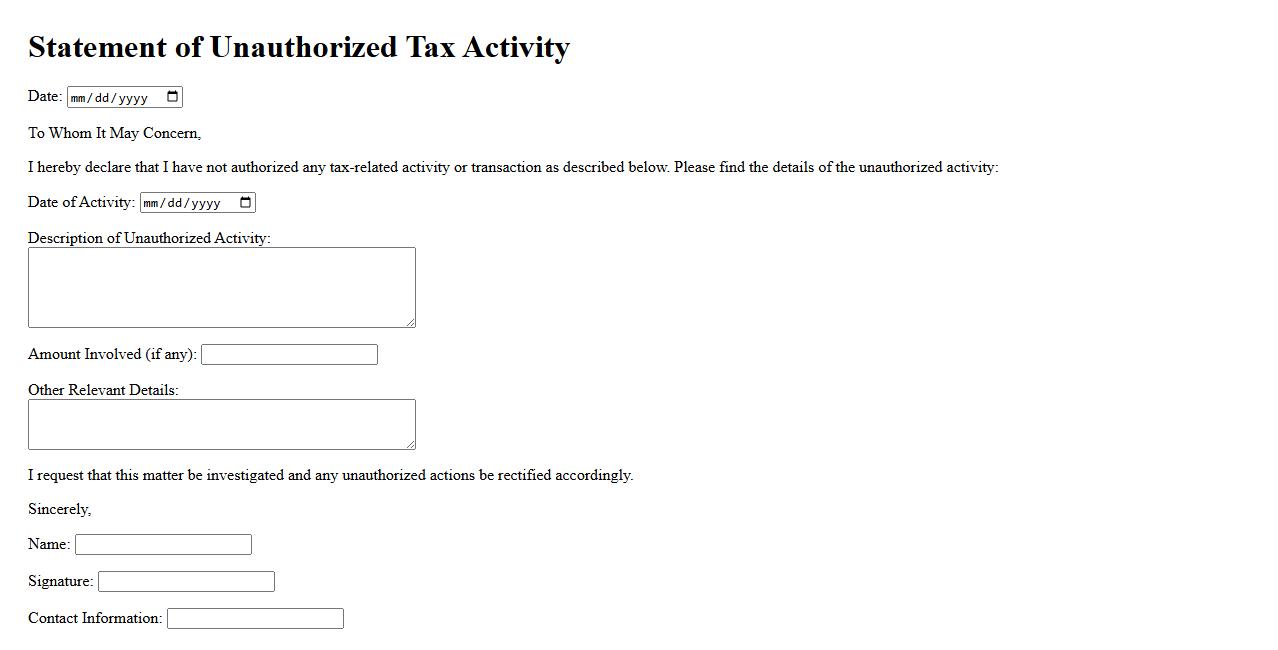

Statement of Unauthorized Tax Activity

A Statement of Unauthorized Tax Activity is a formal document used to report and clarify instances of tax-related actions conducted without proper authorization. It helps individuals or organizations make clear their non-involvement in fraudulent tax activities. This statement protects against legal consequences and supports transparency with tax authorities.

What specific details should be included to accurately report suspected tax fraud or identity theft on a document?

To accurately report suspected tax fraud or identity theft, include detailed personal information of the victim, such as full name and Social Security number. Clearly describe the suspicious activity, including dates, amounts, and any involved parties. Attach any relevant documents or evidence that support your claim to ensure a thorough investigation.

Which government agencies or authorities must receive the completed report?

The completed report should be submitted to the Internal Revenue Service (IRS) for tax fraud cases, using their designated forms or online portals. For identity theft, reports may also be sent to the Federal Trade Commission (FTC) and, if applicable, local law enforcement agencies. Ensuring the correct agency receives the report speeds up the review process and improves resolution chances.

What types of evidence are considered valid to support claims of tax fraud or identity theft?

Valid evidence includes financial statements, copies of fraudulent tax returns, and correspondence from tax authorities. Documentation such as identity theft affidavits, credit reports, and police reports also strengthen the claim. Photographic or digital records that demonstrate unauthorized activity add further credibility to the report.

How is the confidentiality of personal and reported information maintained in the reporting document?

Confidentiality is maintained by using secure submission channels that comply with data protection laws and encryption standards. Agencies limit access to reported information strictly to authorized personnel involved in the investigation. Additionally, clear privacy policies inform reporters about how their sensitive data will be handled and protected.

What are the required steps after submitting a report of tax fraud or identity theft?

After submission, keep copies of all documents and confirmation receipts for your records to track the report status. Monitor your financial accounts and credit reports regularly to detect further suspicious activity. Follow up with the reporting agency if you do not receive updates within their specified timeframe for case review and resolution.