Obtaining a Registration for Import/Export License is essential for businesses involved in international trade to legally import or export goods. This process typically requires submitting specific documents to government authorities, such as tax identification and proof of business registration. Ensuring proper registration helps comply with trade regulations and facilitates smooth customs clearance.

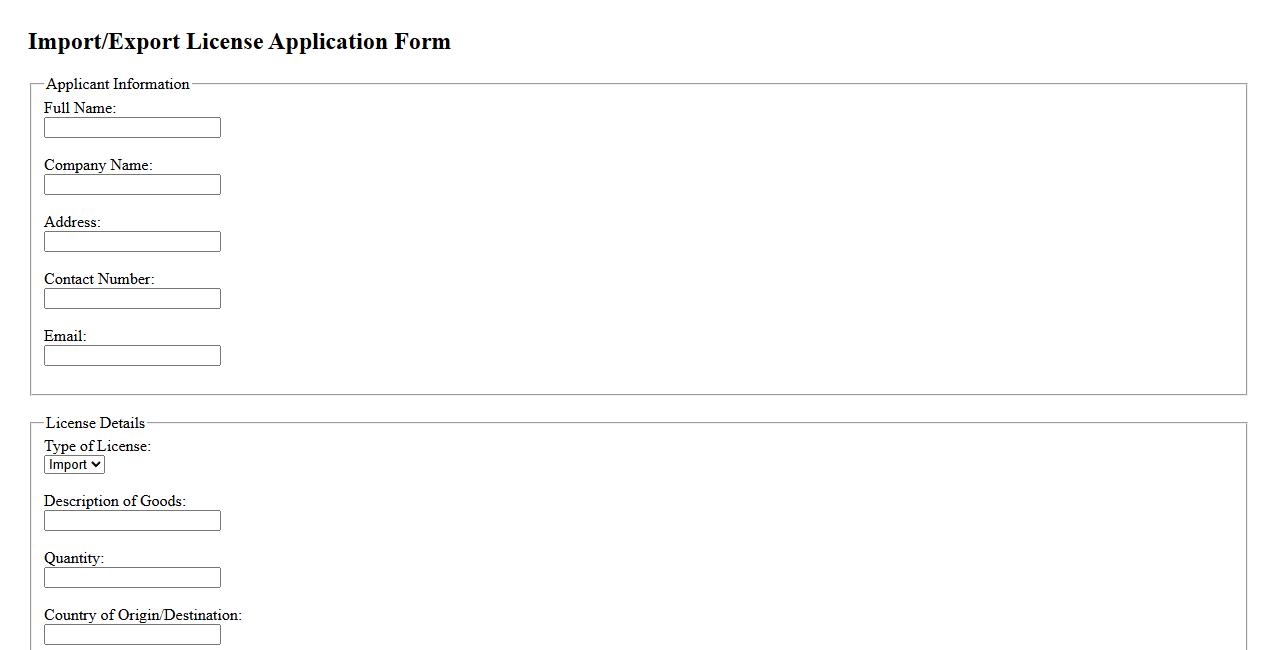

Import/Export License Application Form

The Import/Export License Application Form is a crucial document required for businesses engaged in international trade. It ensures compliance with government regulations and facilitates the legal movement of goods across borders. Filling out this form accurately helps expedite the licensing process and avoid delays in shipments.

Business Registration Certificate

A Business Registration Certificate is an official document issued by government authorities to legally recognize a business entity. It confirms that the business complies with all regulatory requirements and is authorized to operate within a specific jurisdiction. This certificate is essential for establishing credibility and accessing various business services.

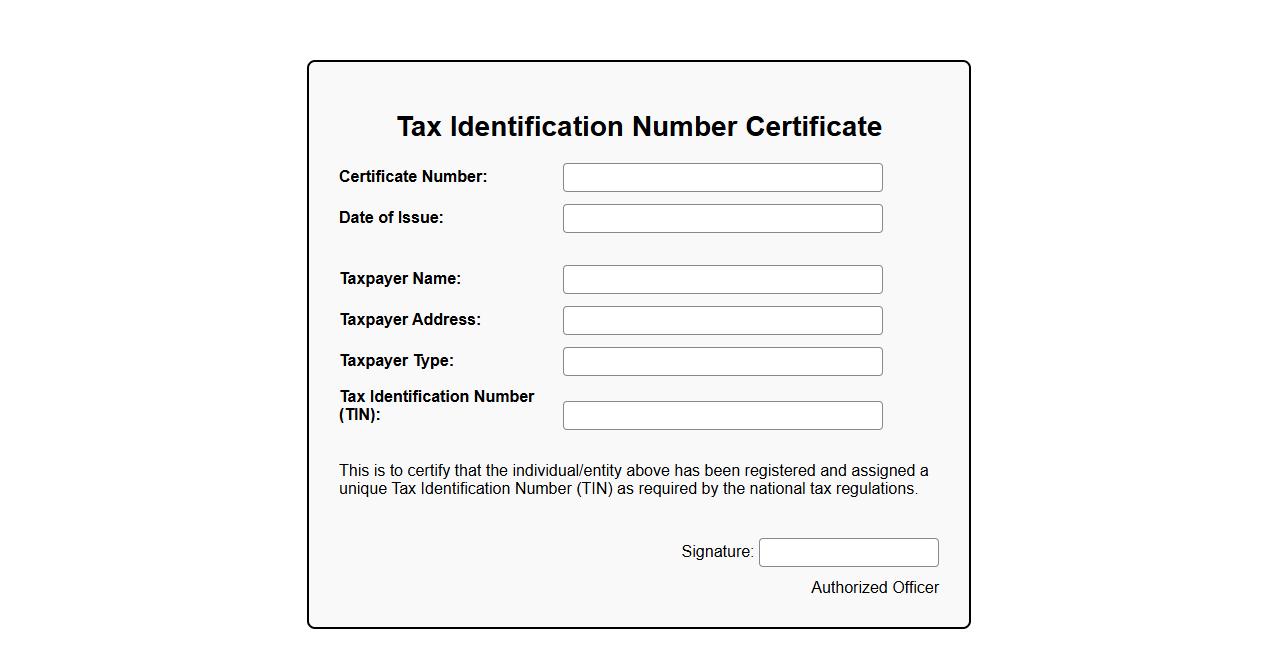

Tax Identification Number Certificate

A Tax Identification Number Certificate is an official document issued by tax authorities to individuals or businesses, confirming their unique tax identification number. This certificate is essential for tax filing, financial transactions, and legal compliance. It helps ensure accurate tax reporting and facilitates communication with government agencies.

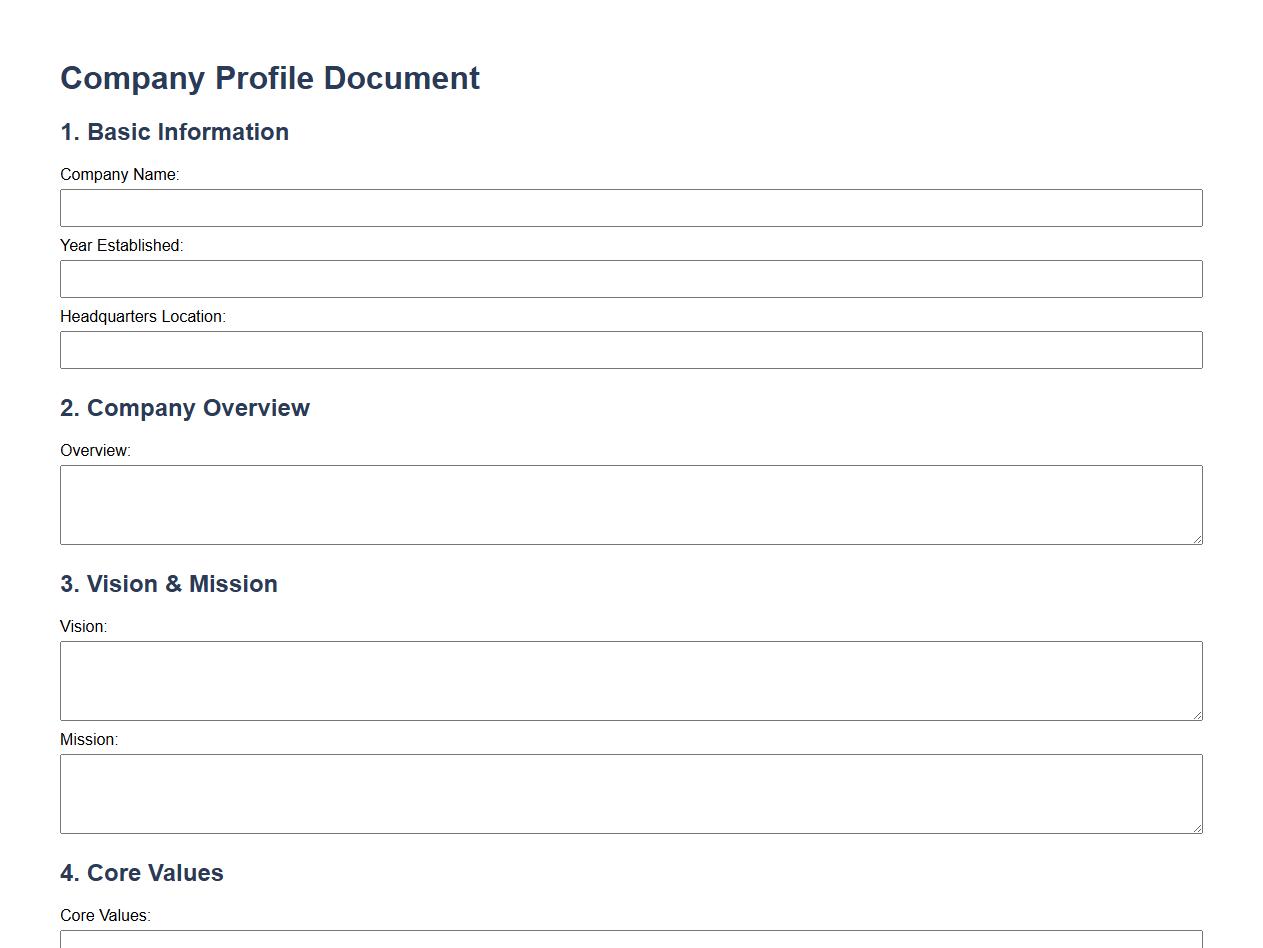

Company Profile Document

A Company Profile Document provides a concise overview of a business, highlighting its mission, values, and core offerings. It serves as a professional introduction to potential clients and investors, showcasing the company's strengths and achievements. This document is essential for establishing credibility and fostering trust in the marketplace.

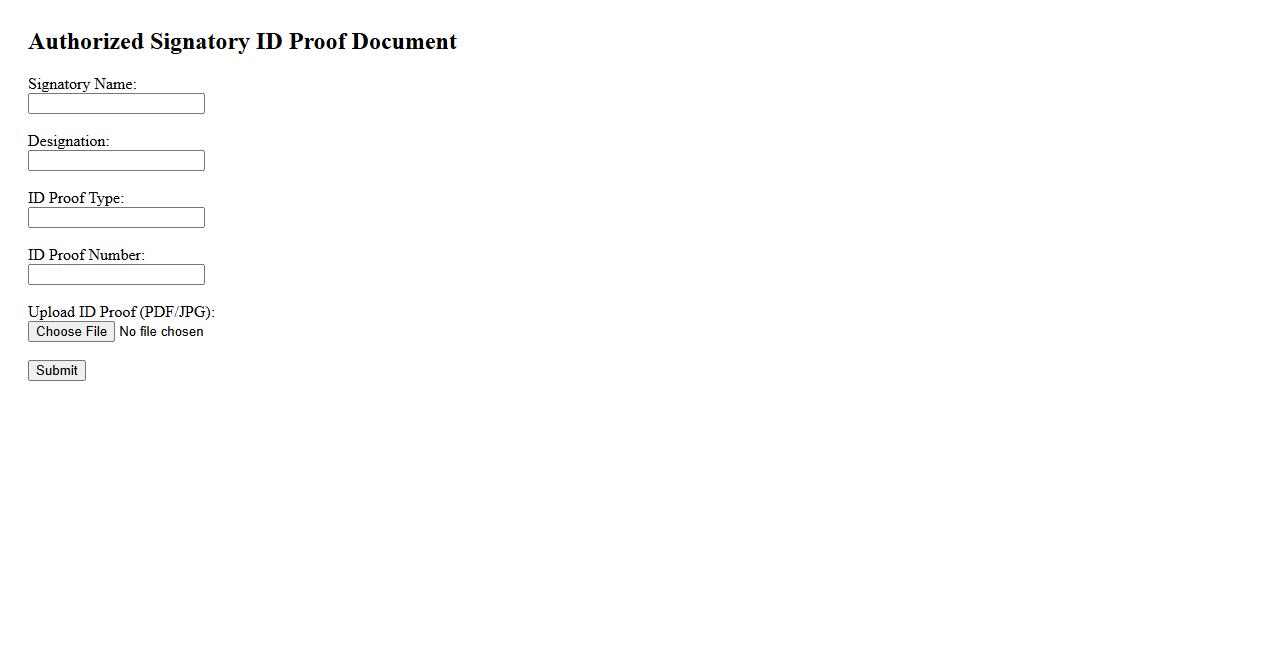

Authorized Signatory ID Proof

An Authorized Signatory ID Proof is a crucial document that verifies the identity of a person authorized to act on behalf of an organization. It ensures legal validation and helps in preventing unauthorized access or transactions. This ID proof typically includes official government-issued identification combined with authorization credentials.

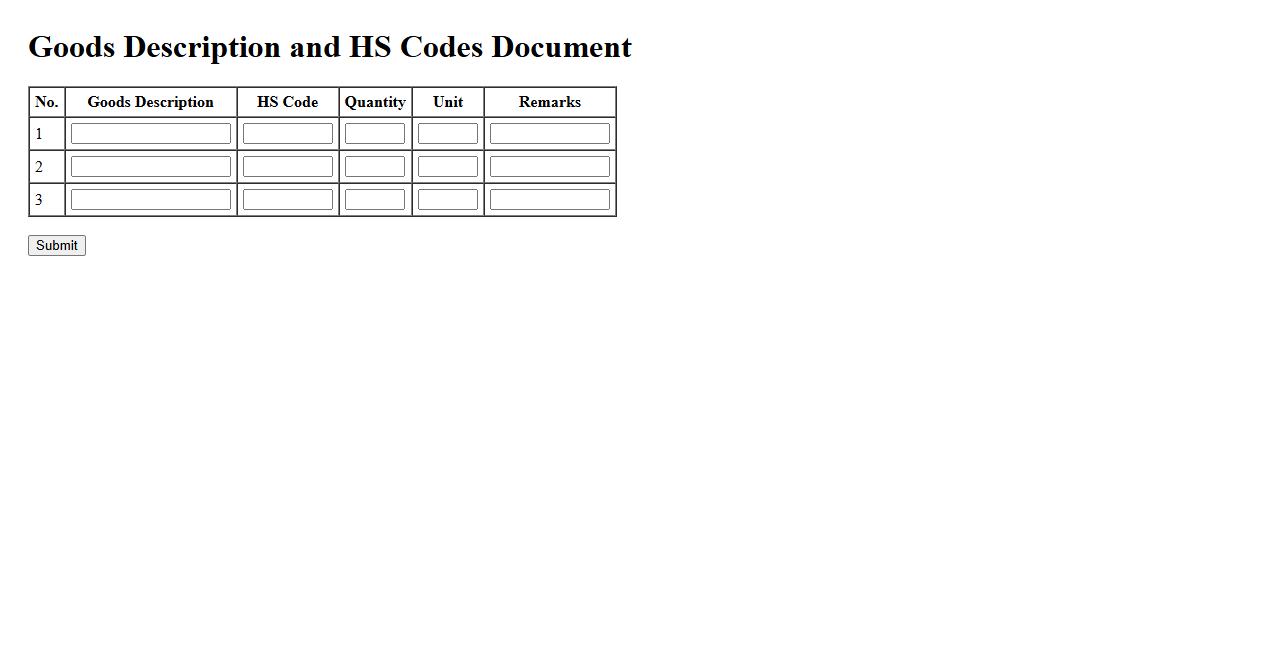

Goods Description and HS Codes Document

The Goods Description and HS Codes Document provides detailed information about products for customs classification. It helps ensure accurate tariff application and compliance with international trade regulations. This document is essential for smooth shipping and customs clearance processes.

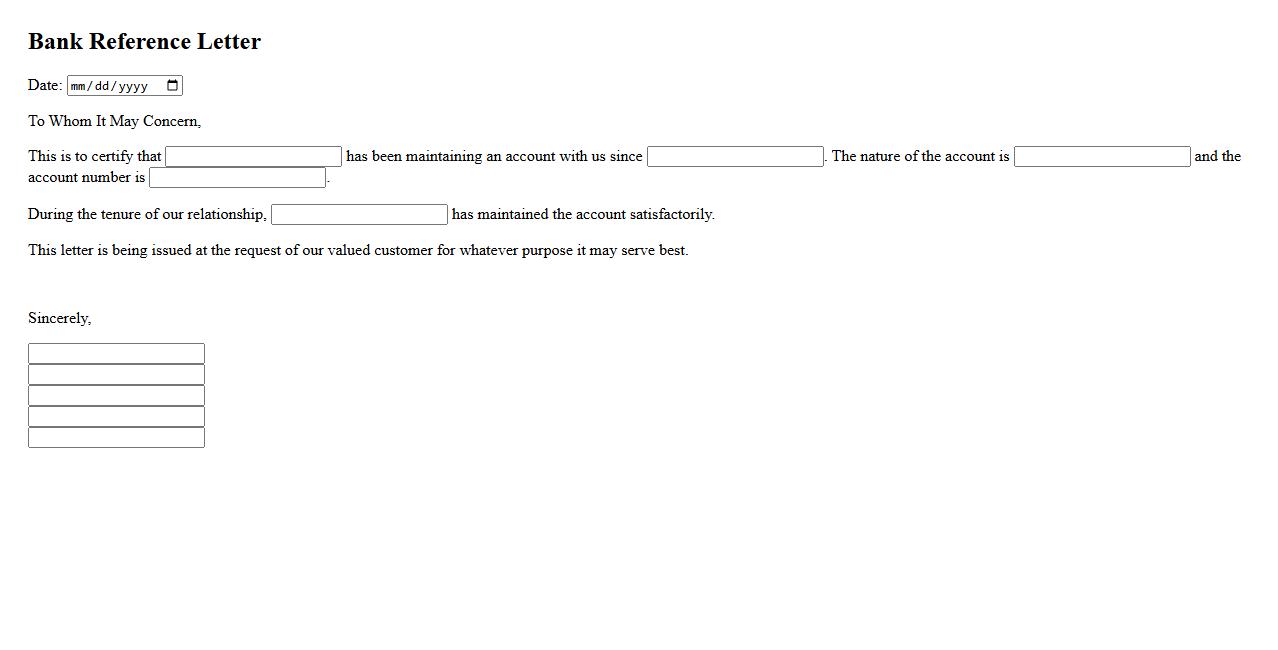

Bank Reference Letter

A Bank Reference Letter is an official document issued by a bank to verify the financial standing and creditworthiness of an individual or business. It serves as proof of the account holder's relationship with the bank, including details about account history and transaction reliability. This letter is often required for loan applications, leasing agreements, or international business transactions.

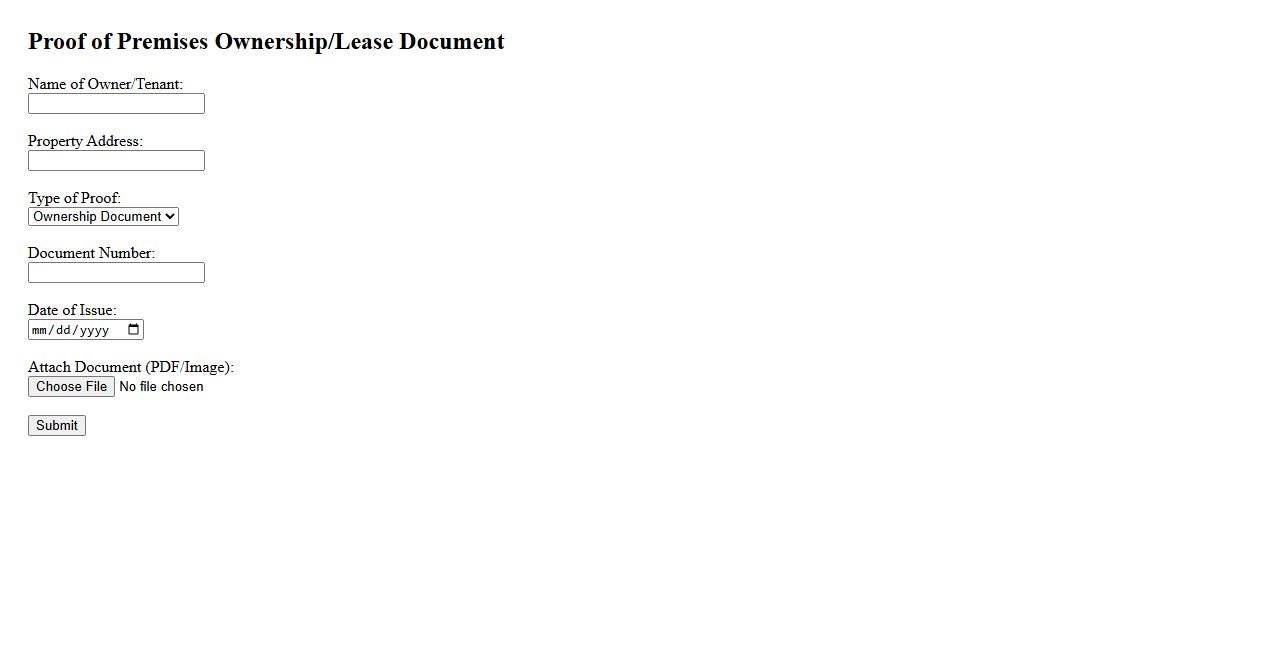

Proof of Premises Ownership/Lease

Proof of Premises Ownership/Lease is a crucial document verifying legal rights to occupy or use a property. It establishes whether an individual or entity owns the property or has a valid lease agreement. This proof is essential for various legal, financial, and administrative purposes.

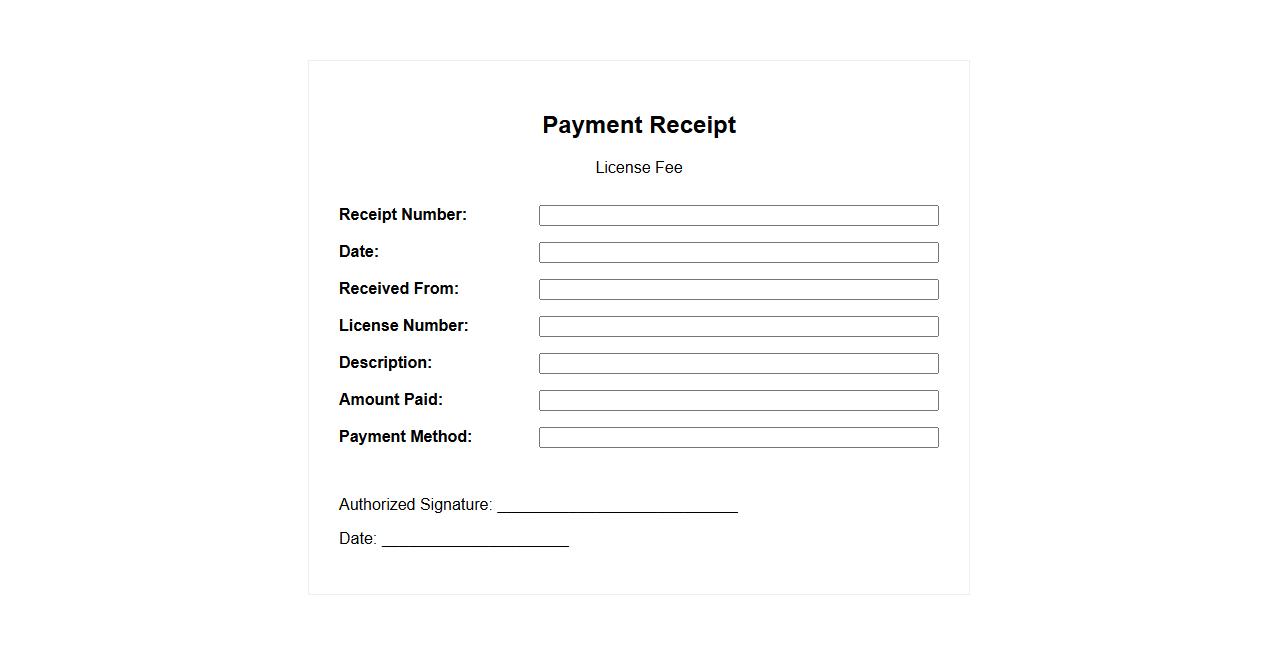

Payment Receipt for License Fee

Your Payment Receipt for License Fee serves as official confirmation of your transaction and payment towards the required licensing. It details the amount paid, date of payment, and license period covered, ensuring transparency and record-keeping. Keep this receipt safe for future reference and proof of compliance.

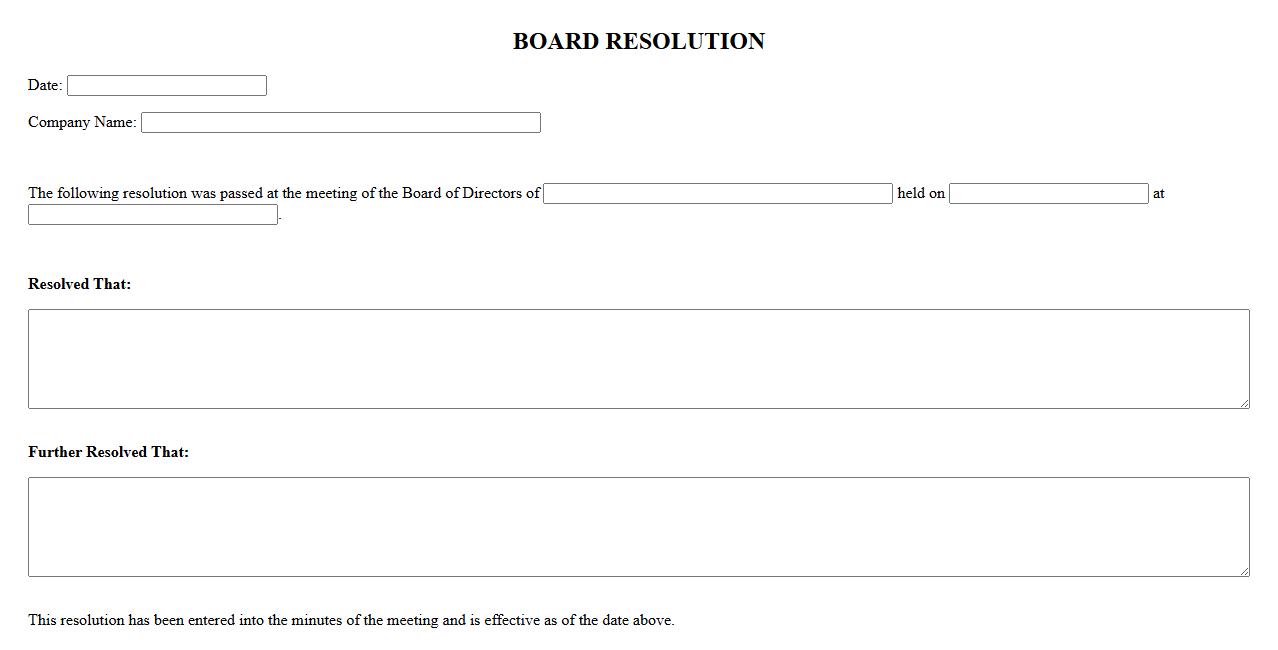

Board Resolution or Power of Attorney

A Board Resolution is an official document that records decisions made by a company's board of directors, giving legal authority for specific actions. A Power of Attorney, on the other hand, grants an individual the legal right to act on behalf of another person or entity. Both instruments are essential for formalizing business decisions and delegating authority effectively.

Eligibility Criteria for Import/Export License

To obtain an import/export license, applicants must meet specific trading and financial standards. Businesses should be legally registered and demonstrate a genuine intention to engage in international trade. The criteria also include compliance with government policies and having a clean legal record.

Supporting Documents Required for Registration

The registration process requires several supporting documents to verify eligibility and authenticity. Key documents include a valid business registration certificate, tax identification number, and proof of financial stability. Additional documents such as identity proofs of directors and a trade plan may also be necessary.

Application Steps for Registration

The application for the import/export license follows a structured submission process. Applicants must complete the online or physical application form and attach all required documents. The process includes review by regulatory authorities, potential background checks, and receiving approval or requests for further information.

Regulations and Compliance Requirements

License holders must adhere to strict regulations and compliance standards to maintain their license validity. This includes abiding by customs laws, accurate record-keeping, and timely reporting of all import/export activities. Non-compliance can result in penalties, license suspension, or revocation.

Renewal Process and Validity Period

The import/export license typically has a validity period defined by the regulatory body, often ranging from one to three years. Renewal involves submitting a renewal application prior to expiration and providing updated compliance documents. Timely renewal ensures uninterrupted trading privileges and avoids legal issues.