Registration for Excise Tax is a mandatory process for businesses involved in the production, sale, or importation of taxable goods. This registration enables the proper tracking and collection of excise duties as required by law. Completing Excise Tax registration ensures compliance with government regulations and helps avoid penalties.

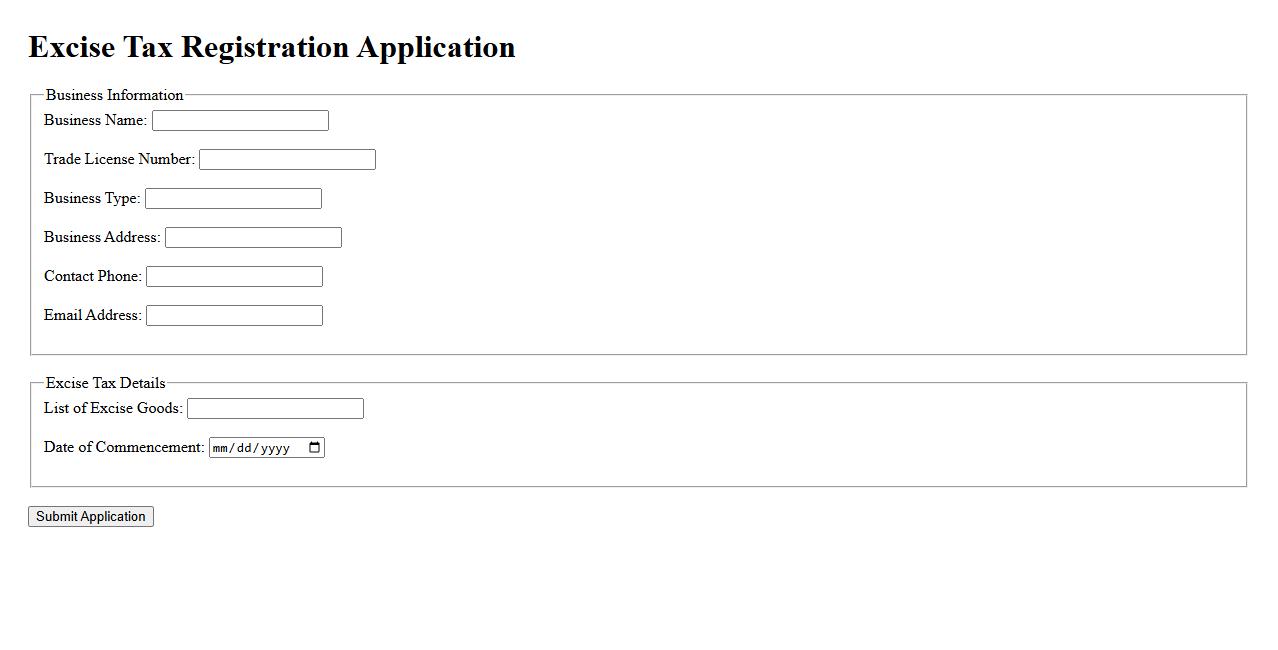

Excise Tax Registration Application

The Excise Tax Registration Application is a formal process required for businesses to comply with government regulations by registering for excise tax purposes. This application ensures that companies properly report and pay taxes on specific goods and services subject to excise duties. Completing this registration is essential for legal operation and tax compliance within the relevant jurisdiction.

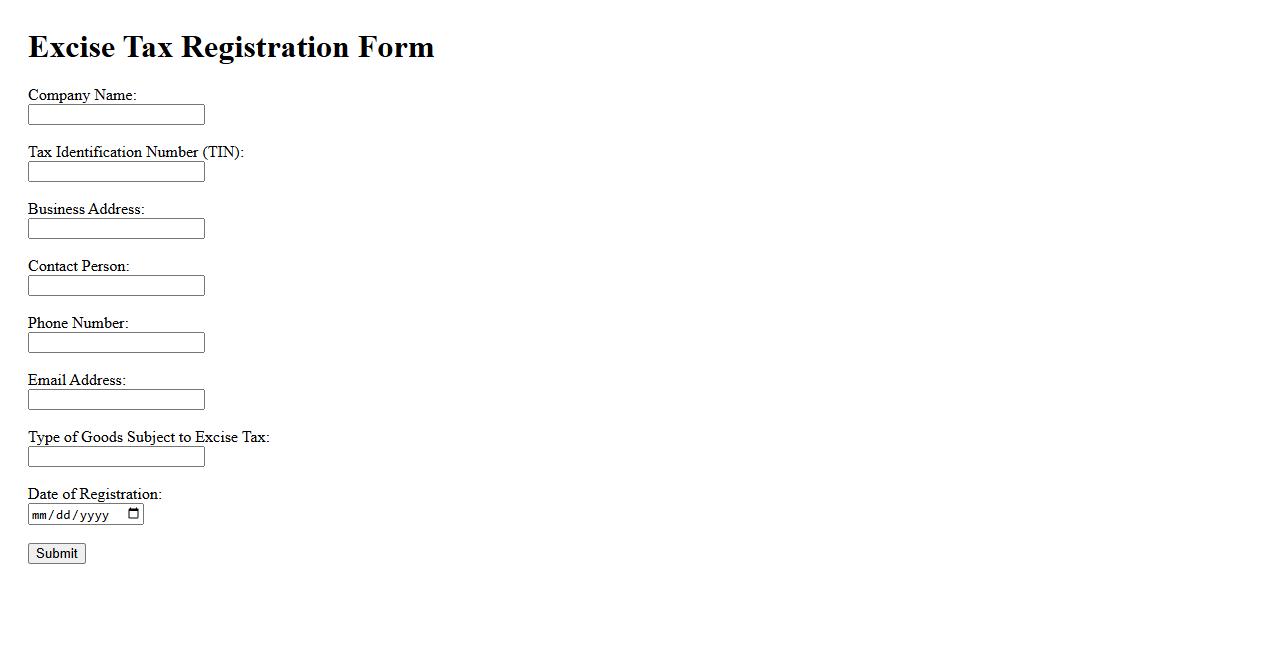

Excise Tax Registration Form

The Excise Tax Registration Form is a crucial document required for businesses subject to excise tax regulations. It facilitates the registration process with the tax authorities, enabling proper compliance and reporting. Completing this form ensures legally mandated tax collection and payment procedures are followed accurately.

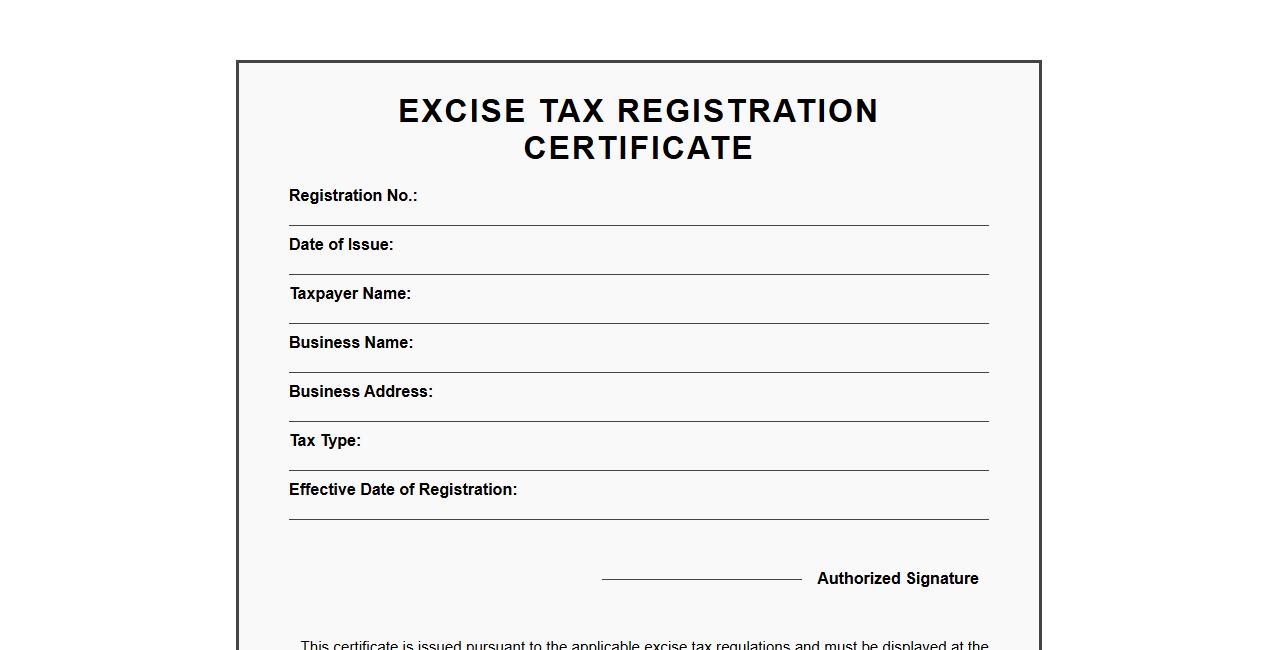

Excise Tax Registration Certificate

An Excise Tax Registration Certificate is an official document issued by tax authorities to businesses liable for excise tax. It verifies that the business is registered and authorized to collect and remit excise taxes on specific goods or services. This certificate is essential for legal compliance and smooth business operations involving taxable products.

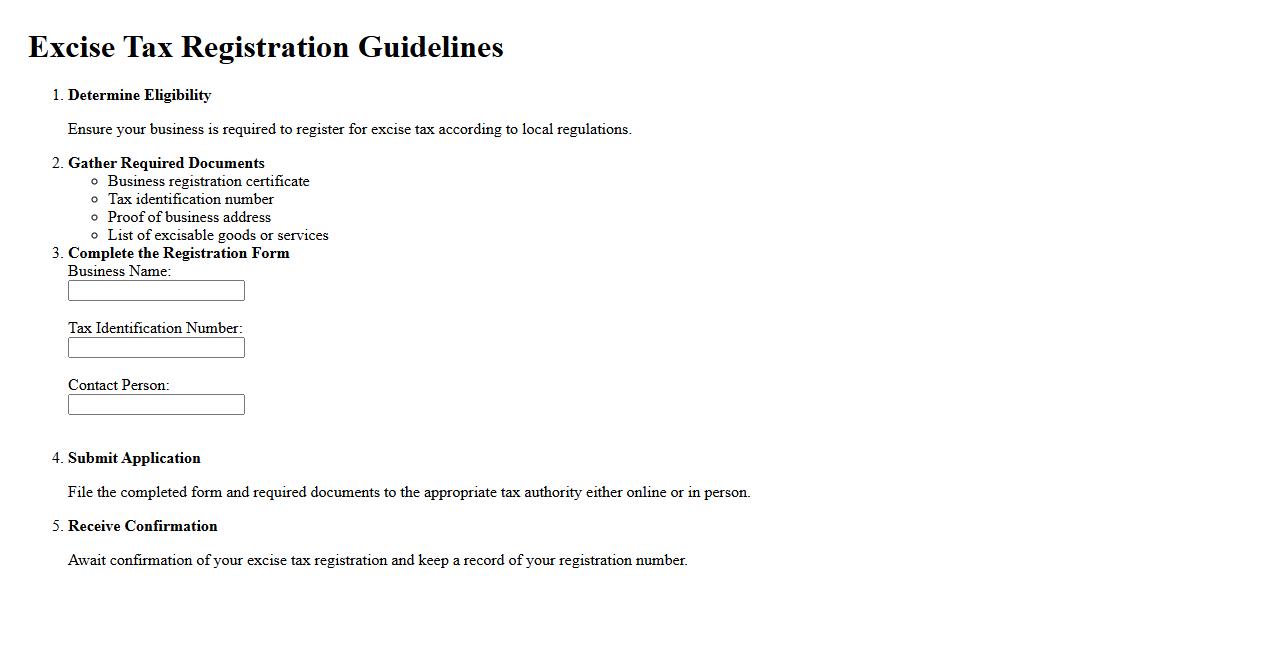

Excise Tax Registration Guidelines

Understanding Excise Tax Registration guidelines is essential for compliance with government regulations. These guidelines outline the necessary steps and documentation required to register for excise tax. Proper registration ensures businesses accurately report and remit taxes on taxable goods and services.

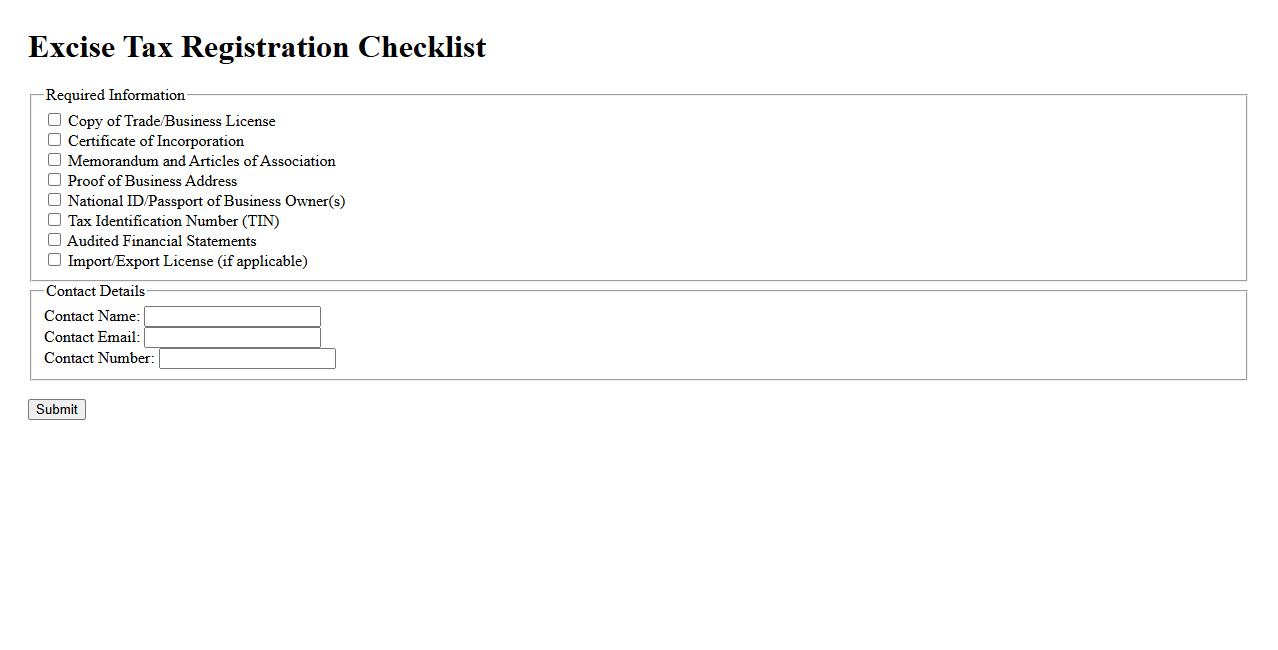

Excise Tax Registration Checklist

The Excise Tax Registration Checklist is essential for businesses to ensure compliance with government regulations. It outlines all necessary documents and steps required to register properly for excise tax purposes. Following this checklist helps avoid delays and penalties during the registration process.

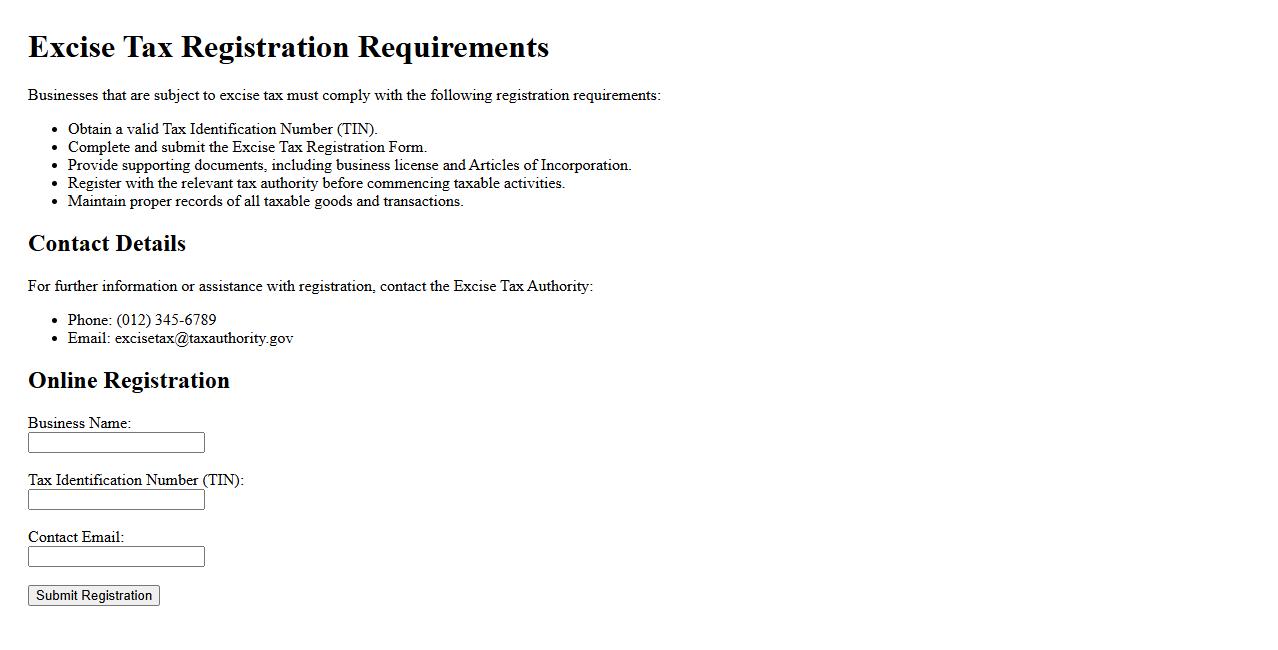

Excise Tax Registration Requirements

Understanding excise tax registration requirements is essential for businesses involved in the production or sale of certain goods. These regulations mandate that eligible business entities register with the appropriate tax authorities to ensure compliance. Proper registration helps avoid penalties and facilitates smooth tax reporting and payment processes.

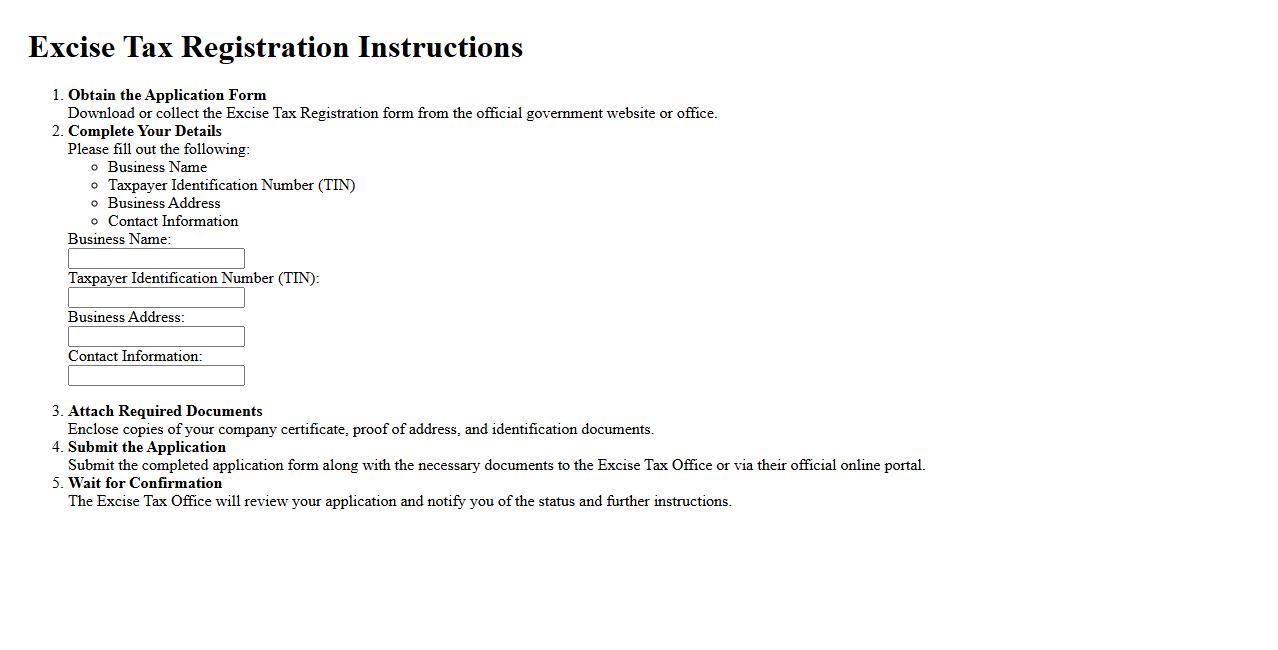

Excise Tax Registration Instructions

Follow these Excise Tax Registration Instructions carefully to ensure compliance with government regulations. The process involves submitting necessary forms and documentation to the appropriate tax authority. Completing registration accurately helps avoid penalties and facilitates smooth excise tax reporting.

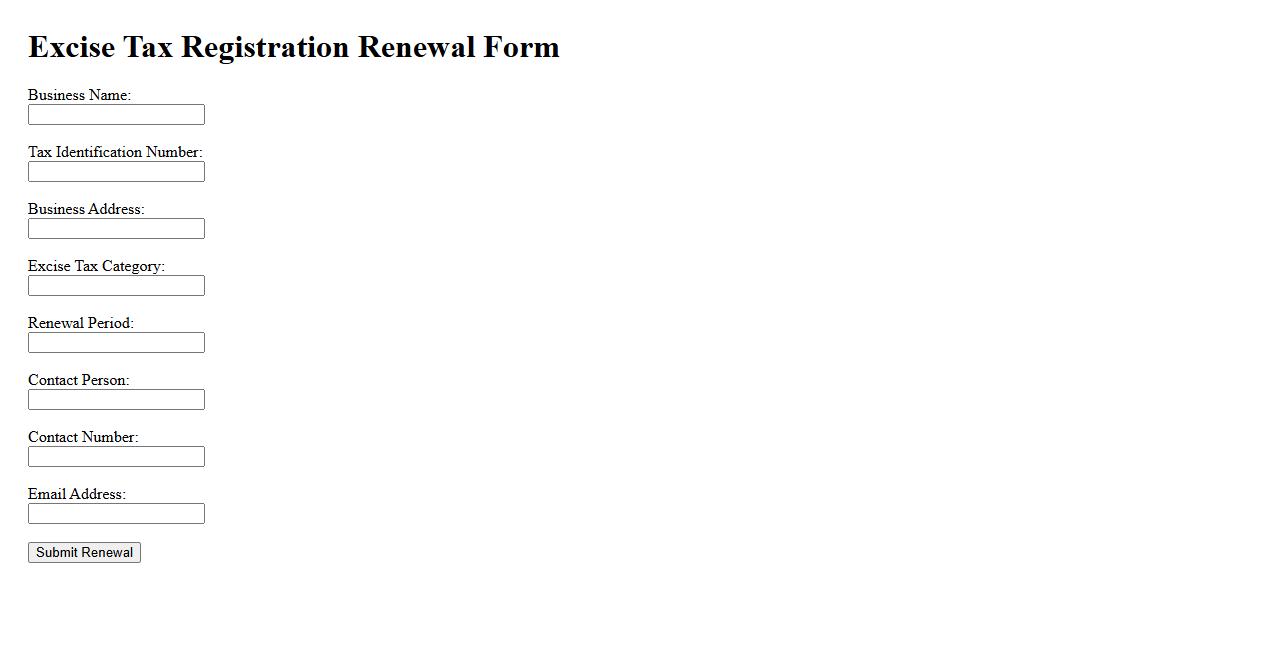

Excise Tax Registration Renewal

Renewing your Excise Tax Registration is essential to maintain compliance with government regulations. The renewal process ensures that your business can legally continue to produce or distribute taxable goods. Timely renewal helps avoid penalties and interruptions in business operations.

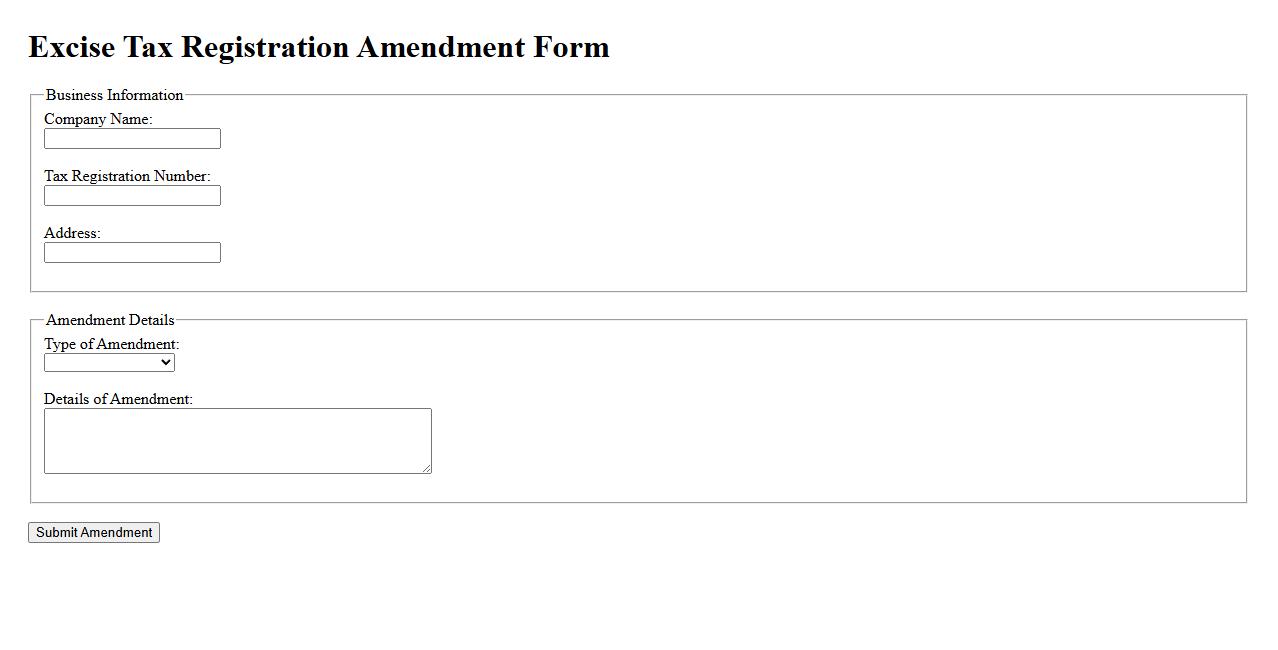

Excise Tax Registration Amendment

The Excise Tax Registration Amendment process involves updating registered information to comply with new regulations or correct previous data. This ensures businesses maintain accurate excise tax records and avoid penalties. Timely amendments help streamline tax reporting and improve compliance with government requirements.

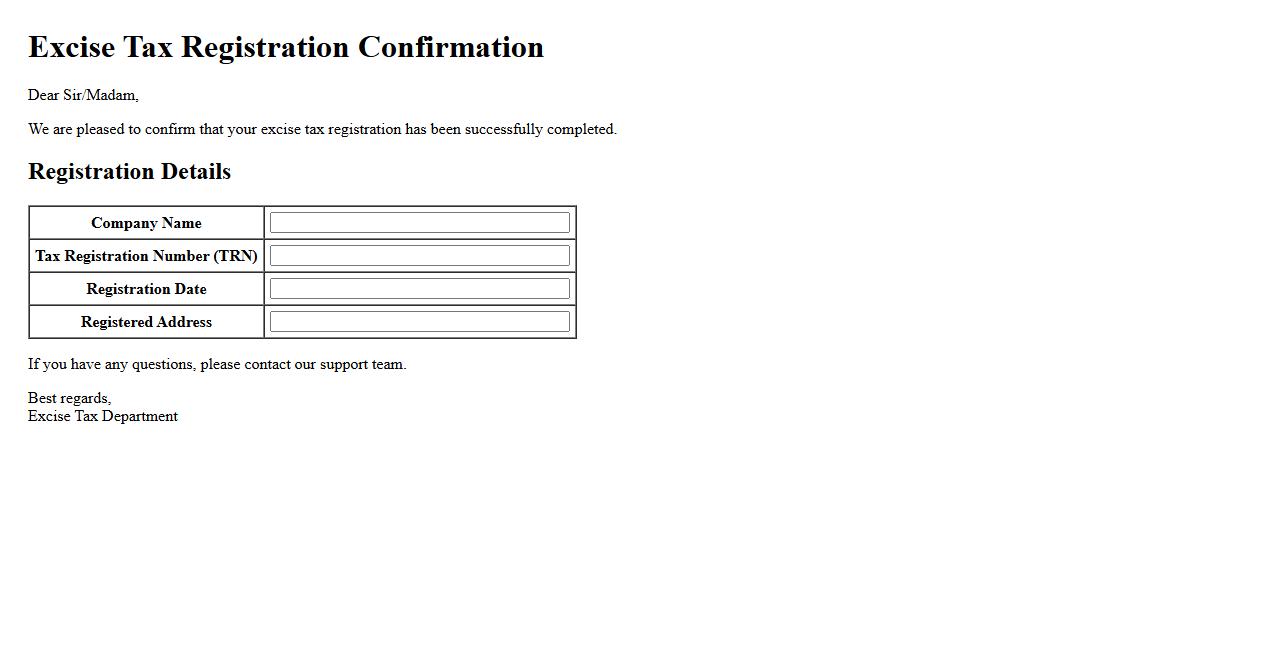

Excise Tax Registration Confirmation

The Excise Tax Registration Confirmation is an official document that verifies a business or individual's registration for excise tax purposes. It serves as proof of compliance with tax regulations related to specific goods and services. This confirmation is essential for lawful operation within industries subject to excise taxes.

What are the required documents for excise tax registration?

The required documents for excise tax registration typically include a valid business permit, proof of business registration, and identification of the business owner or authorized representative. Additionally, a filled application form and tax identification number (TIN) must be submitted. Some jurisdictions also require specific documents related to the goods subject to excise tax.

Who is eligible or mandated to register for excise tax?

Businesses or individuals who manufacture, import, or sell goods subject to excise tax are mandated to register. This includes manufacturers, importers, and sometimes distributors of excisable goods. Registration ensures proper tax compliance according to local laws and regulations.

Which goods or services are subject to excise tax registration?

Goods subject to excise tax often include alcohol, tobacco, petroleum products, and luxury items. In some regions, specific services linked to these goods may also require excise tax registration. The list of excisable goods is defined by local tax authorities for regulatory purposes.

What is the process flow for excise tax registration approval?

The process flow starts with submission of the required documents to the tax authority, followed by document verification. An inspection or evaluation may occur to ensure compliance before final approval. Once approved, the registrant receives an excise taxpayer identification or certificate.

What are the consequences of failing to register for excise tax?

Failure to register can result in severe legal and financial penalties, including fines and interest on unpaid taxes. The business may also be subject to audits, suspension of operations, or confiscation of excisable goods. Compliance is essential to avoid these consequences and ensure lawful business operations.