Registering for Tax Exemption involves submitting specific documents and completing required forms with the appropriate tax authority to qualify for reduced or waived tax obligations. This process ensures businesses or individuals meet eligibility criteria, such as nonprofit status or specific industry qualifications. Proper Tax Exemption Registration can result in significant financial savings and compliance with legal regulations.

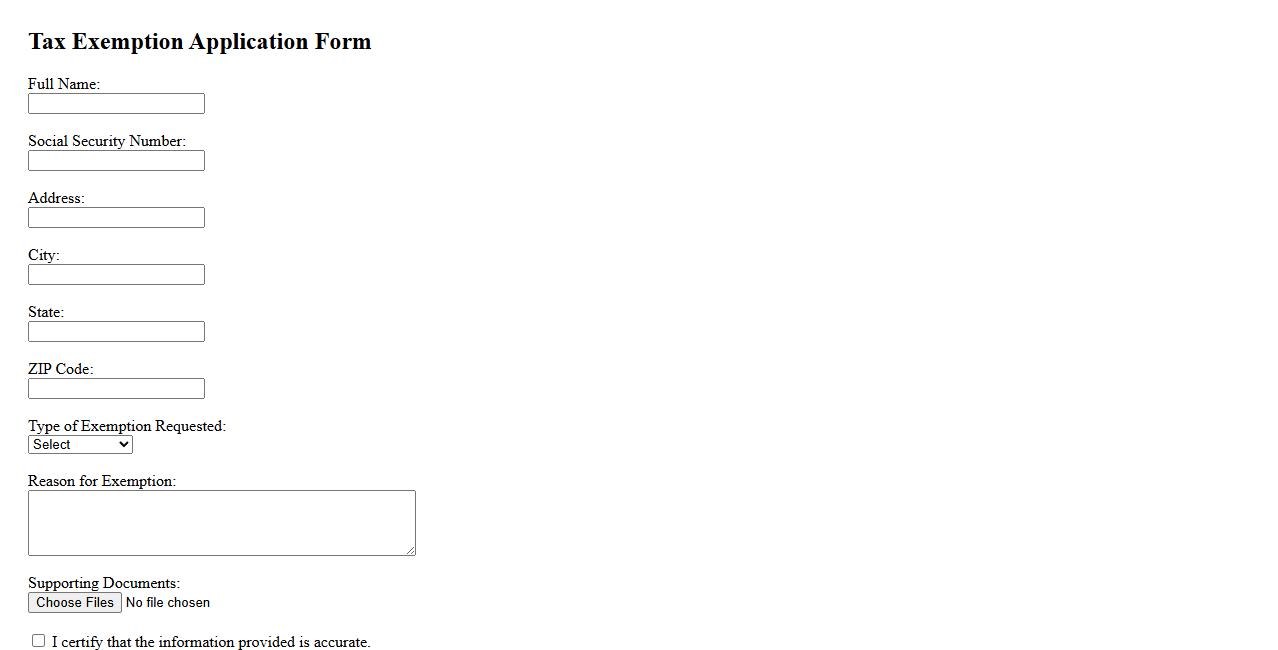

Tax Exemption Application Form

The Tax Exemption Application Form is a crucial document used to request relief from certain taxes. It helps individuals or organizations certify their eligibility for tax-exempt status. Completing this form accurately ensures compliance with tax regulations and can result in significant financial benefits.

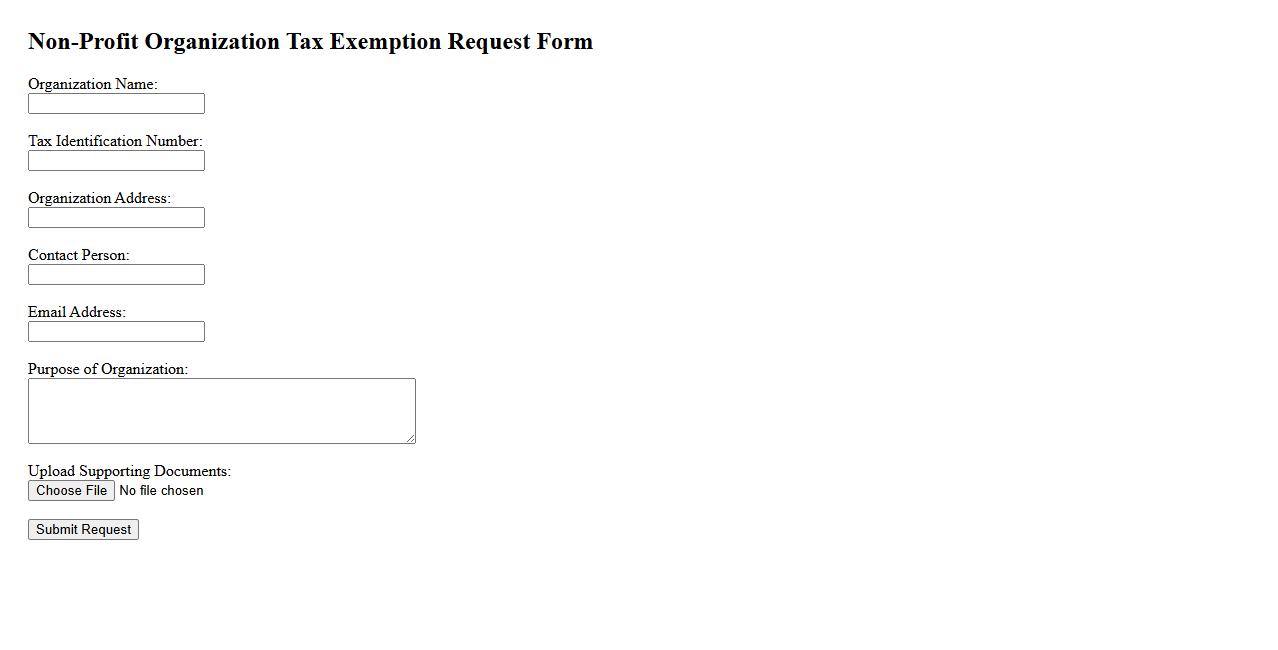

Non-Profit Organization Tax Exemption Request

Submitting a Non-Profit Organization Tax Exemption Request is essential for qualifying your entity to receive tax benefits. This process involves providing specific documentation to demonstrate your organization's charitable purpose. Approval grants exemption from certain federal and state taxes, supporting your mission's financial sustainability.

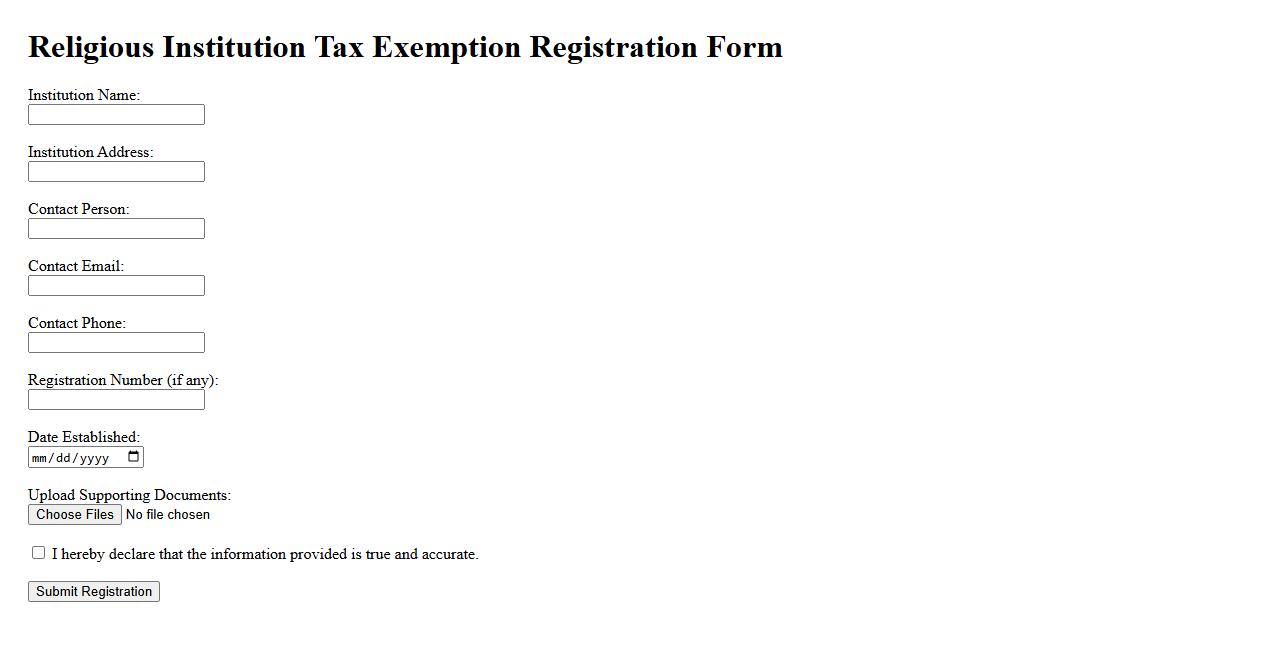

Religious Institution Tax Exemption Registration

The Religious Institution Tax Exemption Registration process allows religious organizations to officially obtain tax-exempt status. This registration provides relief from certain federal and state taxes, supporting the institution's mission and operations. Proper registration ensures compliance with legal requirements and eligibility for various benefits.

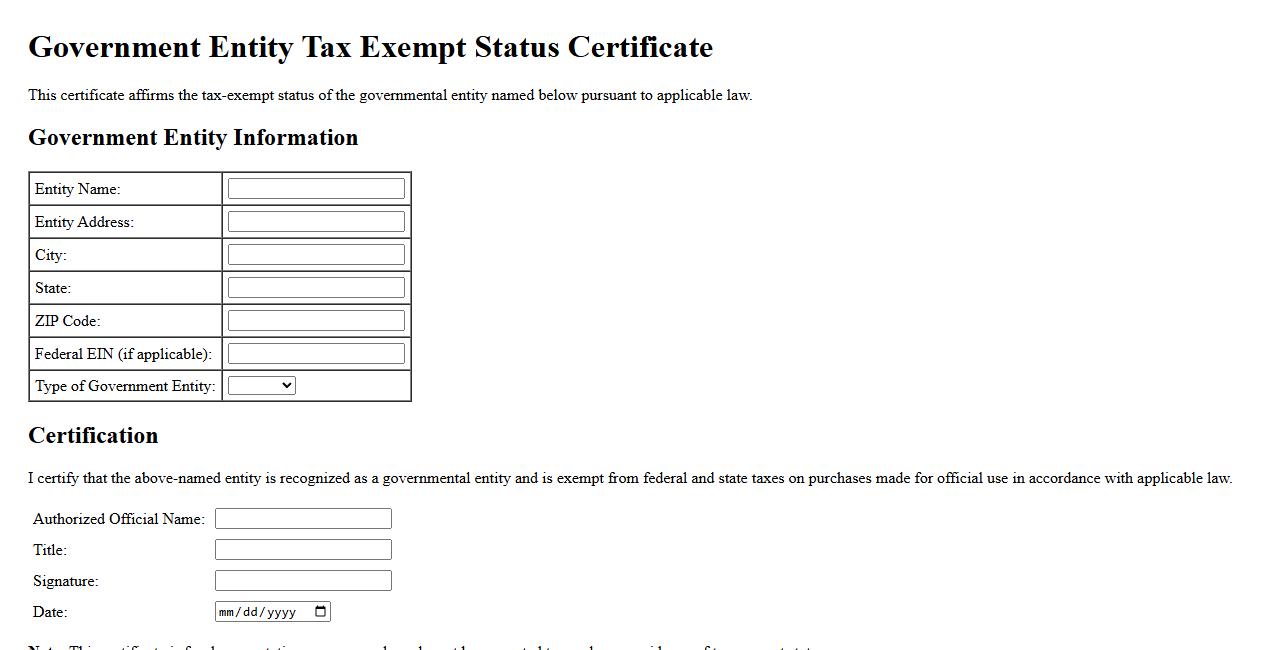

Government Entity Tax Exempt Status Certificate

The Government Entity Tax Exempt Status Certificate is an official document that certifies a government organization's exemption from certain taxes. This certificate is essential for verifying tax-exempt status in financial transactions and compliance processes. It helps streamline operations by ensuring that eligible government entities are not subjected to unnecessary tax burdens.

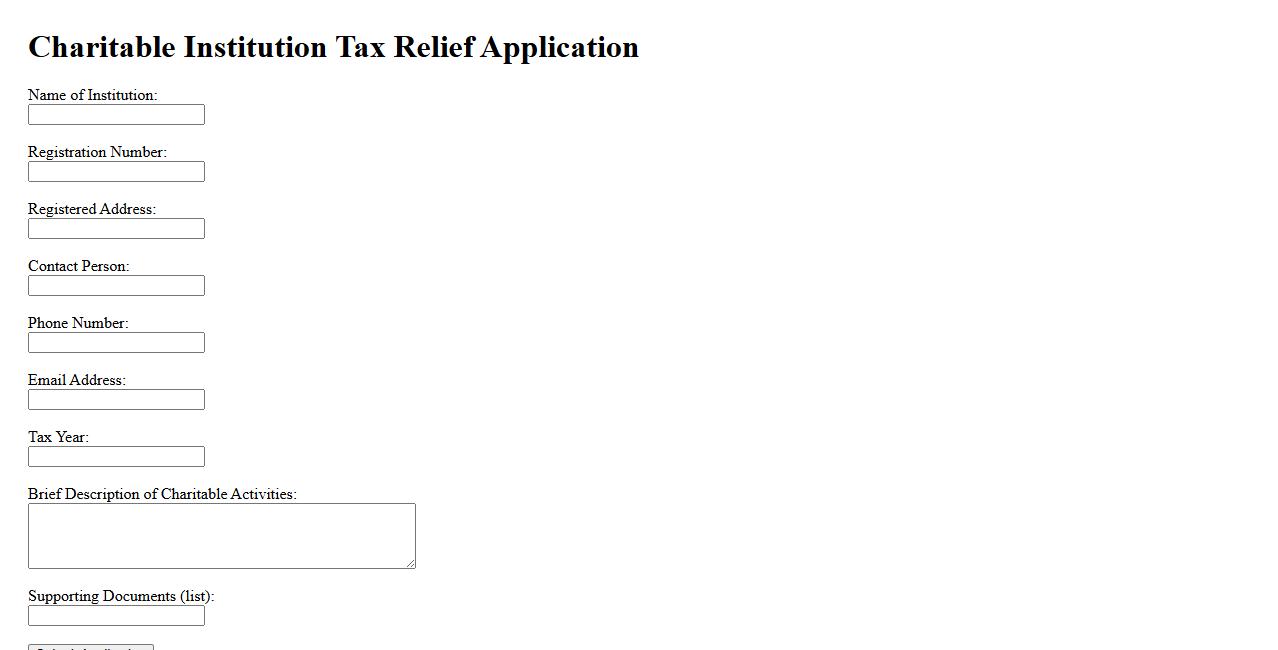

Charitable Institution Tax Relief Application

The Charitable Institution Tax Relief Application is a vital process for nonprofits seeking financial benefits. It allows eligible organizations to apply for exemptions or reductions in taxes, supporting their mission-driven activities. This relief helps maximize resources dedicated to community service and social impact.

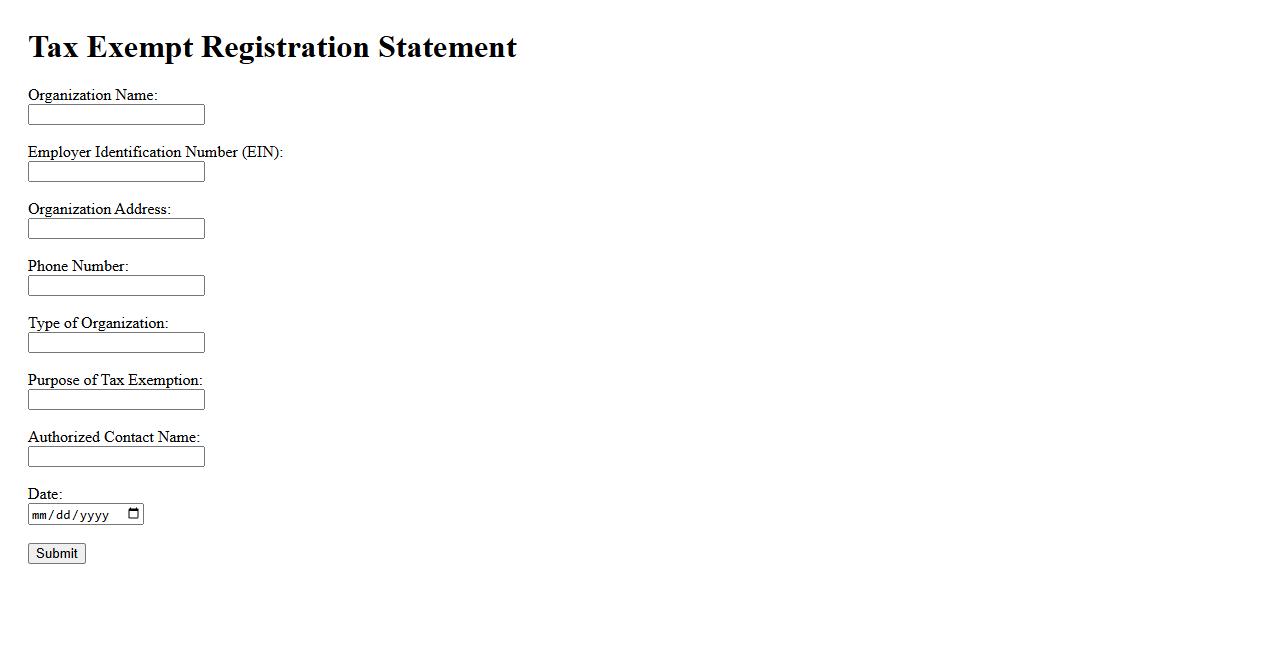

Tax Exempt Registration Statement

The Tax Exempt Registration Statement is a crucial document required by tax authorities for entities seeking exemption from certain taxes. This statement provides detailed information about the organization's purpose, activities, and eligibility for tax-exempt status. Proper filing ensures compliance and access to tax benefits designed for nonprofit and charitable organizations.

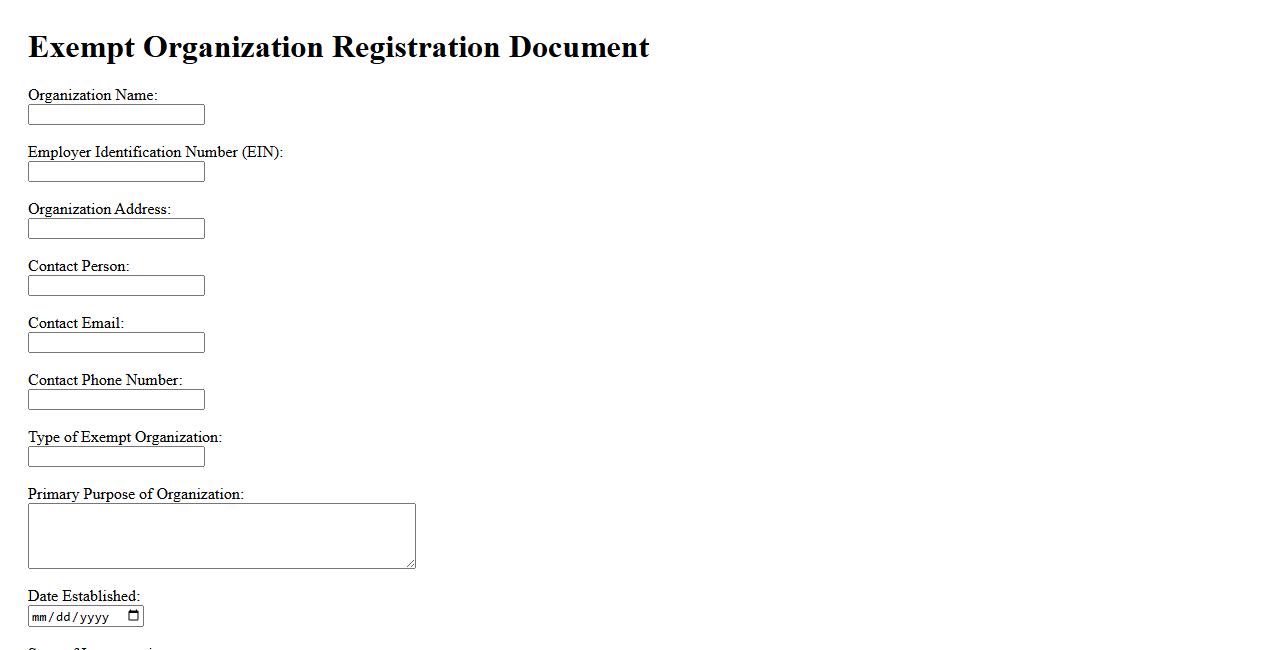

Exempt Organization Registration Document

The Exempt Organization Registration Document is a crucial form that nonprofit entities must file to obtain tax-exempt status. This document ensures compliance with government regulations and allows organizations to operate without certain tax obligations. Proper registration fosters transparency and public trust in the nonprofit sector.

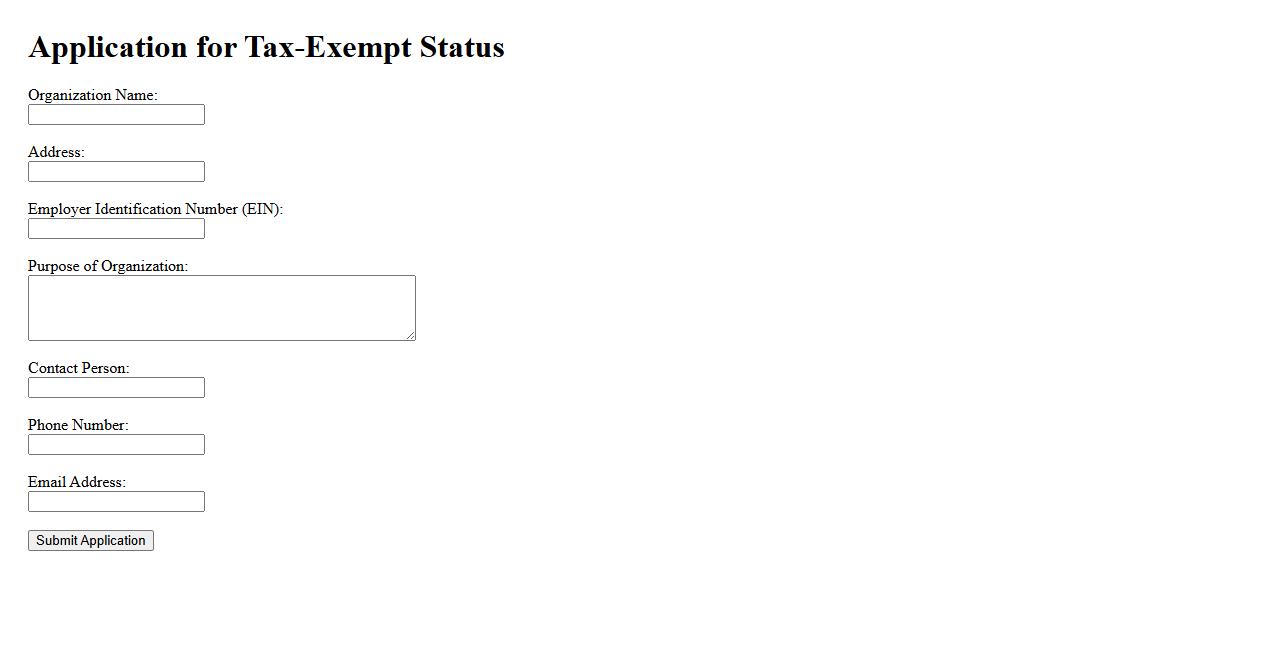

Application for Tax-Exempt Status

Applying for tax-exempt status allows organizations to be exempt from federal income taxes. This application process requires submitting detailed documentation to the IRS, proving the organization's eligibility. Obtaining this status can provide significant financial benefits and increase credibility.

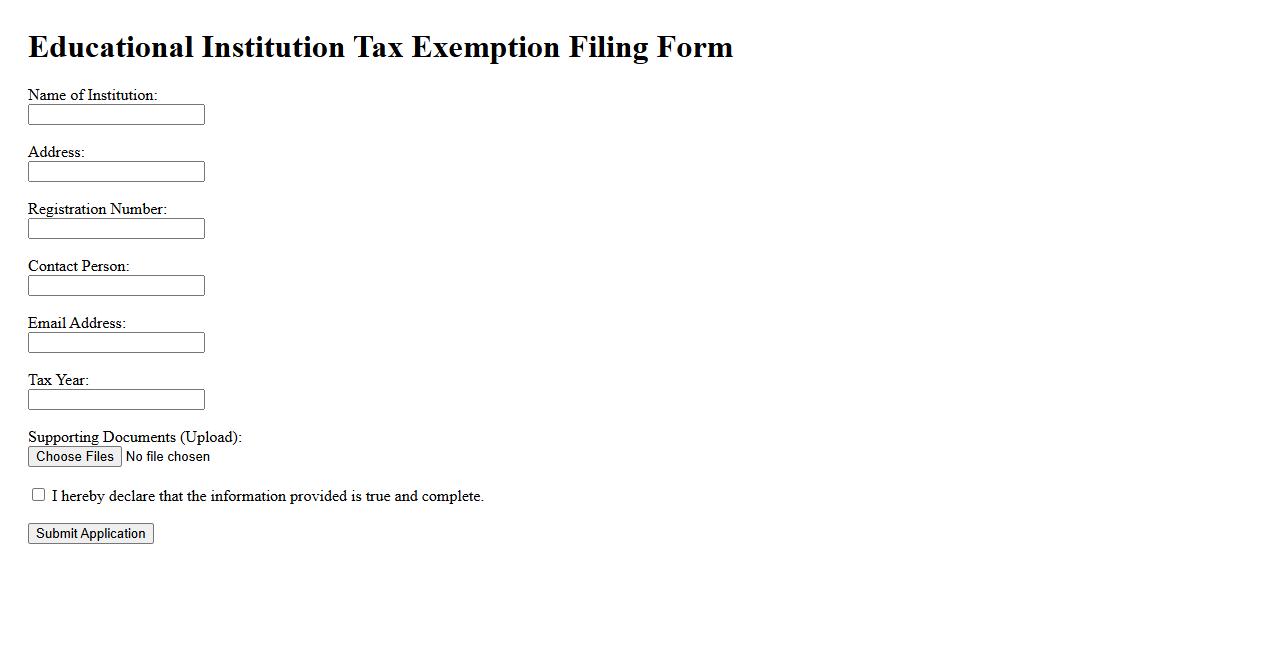

Educational Institution Tax Exemption Filing

Filing for educational institution tax exemption ensures that qualified schools and colleges are relieved from certain tax obligations. This process involves submitting the appropriate documentation to the relevant tax authorities to verify the institution's eligibility. Proper filing helps organizations maintain compliance while maximizing financial resources for educational purposes.

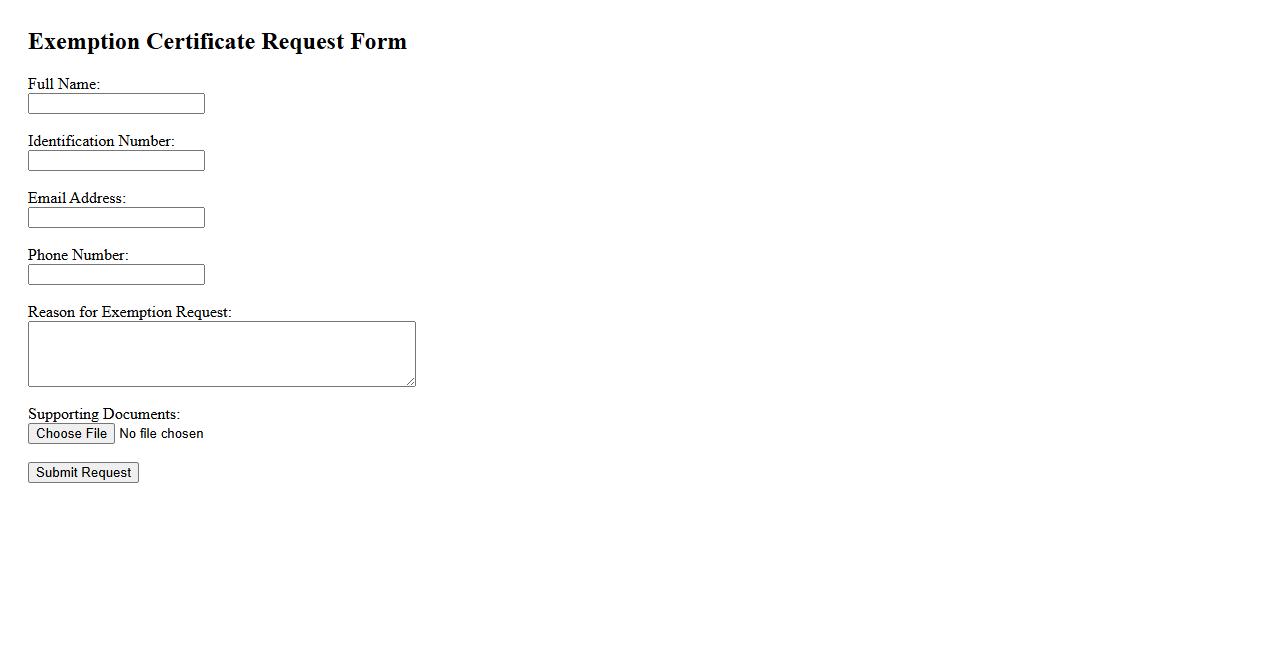

Exemption Certificate Request Form

The Exemption Certificate Request Form is a crucial document used to apply for tax exemption on specific purchases. It helps businesses and individuals avoid paying sales tax when eligible under state law. Accurate completion of this form ensures compliance and smooth processing of tax-exempt transactions.

What are the eligibility criteria for an entity to register for tax exemption?

To qualify for tax exemption registration, an entity must meet specific criteria set by tax authorities. Eligibility often requires the organization to operate exclusively for religious, charitable, educational, or similar non-profit purposes. Additionally, the entity must not distribute profits to private individuals and comply with local regulatory requirements.

Which documents are required to support a tax exemption registration application?

Applicants typically need to provide a range of supporting documents including proof of incorporation, bylaws, and financial statements. A detailed description of the organization's activities and intended public benefit is also required. In many cases, a letter of determination or previous tax exemption certificates must accompany the application.

What types of organizations typically qualify for tax exemption registration?

Organizations qualifying for tax exemption generally include charities, religious groups, educational institutions, and social welfare organizations. Non-profits engaged in scientific or literary activities may also be eligible. These organizations must demonstrate a clear public benefit aligned with tax laws to qualify.

How does the registration for tax exemption impact an organization's tax obligations?

Registering for tax exemption typically reduces or eliminates federal, state, and local tax liabilities for qualifying organizations. It allows entities to receive tax-deductible donations, increasing funding opportunities. However, organizations must maintain compliance with reporting requirements to retain their exempt status.

What are the common reasons for rejection of tax exemption registration applications?

Applications for tax exemption may be rejected due to incomplete documentation or failure to demonstrate a qualified exempt purpose. Non-compliance with organizational structure requirements or evidence of profit distribution to private stakeholders can also lead to denial. Additionally, lack of transparency in financial operations is a frequent cause for rejection.