Registration for Employer Identification Number involves applying to the IRS to obtain a unique nine-digit number assigned to businesses for tax reporting purposes. This number is essential for managing payroll, filing tax returns, and opening business bank accounts. The process can be completed online, by mail, or by fax, streamlining business operations and compliance.

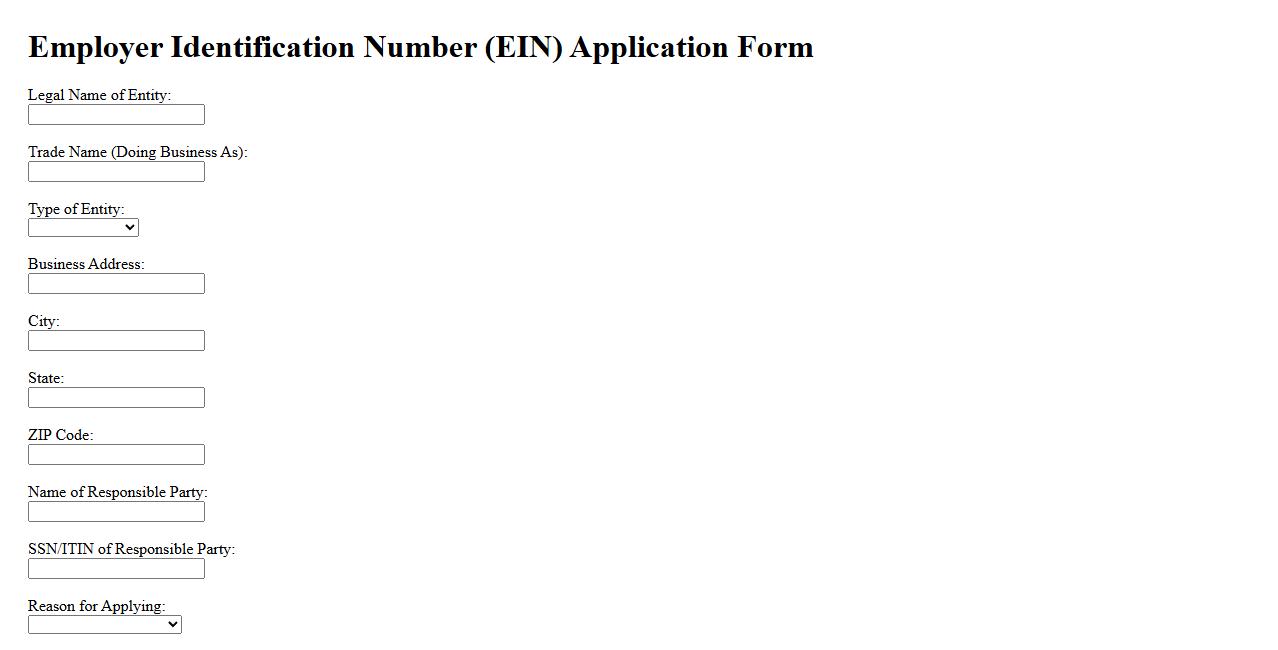

EIN Application Form

The EIN Application Form is an essential document used by businesses to apply for an Employer Identification Number from the IRS. This unique number is required for tax reporting, opening bank accounts, and hiring employees. Completing the form accurately ensures a smooth registration process and compliance with federal regulations.

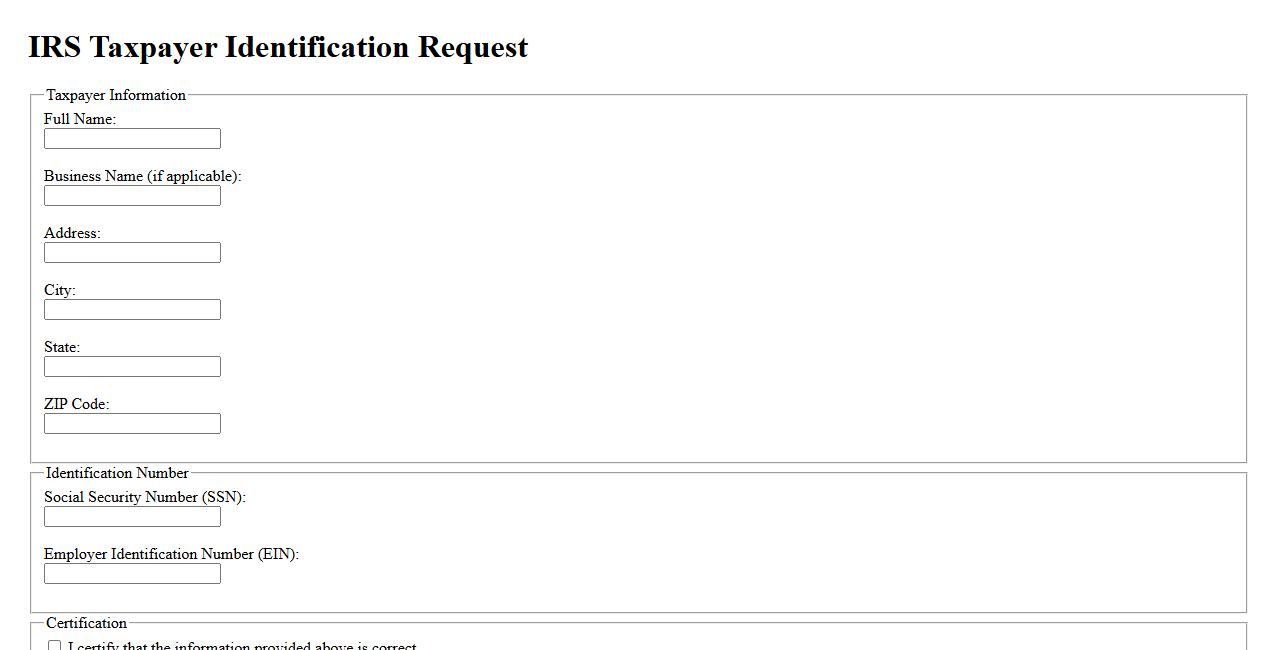

IRS Taxpayer Identification Request

The IRS Taxpayer Identification Request is a formal process used to obtain a unique identification number for individuals and entities for tax purposes. This number is essential for filing tax returns, reporting income, and fulfilling other tax obligations. Properly completing the request ensures accurate taxpayer identification and compliance with IRS regulations.

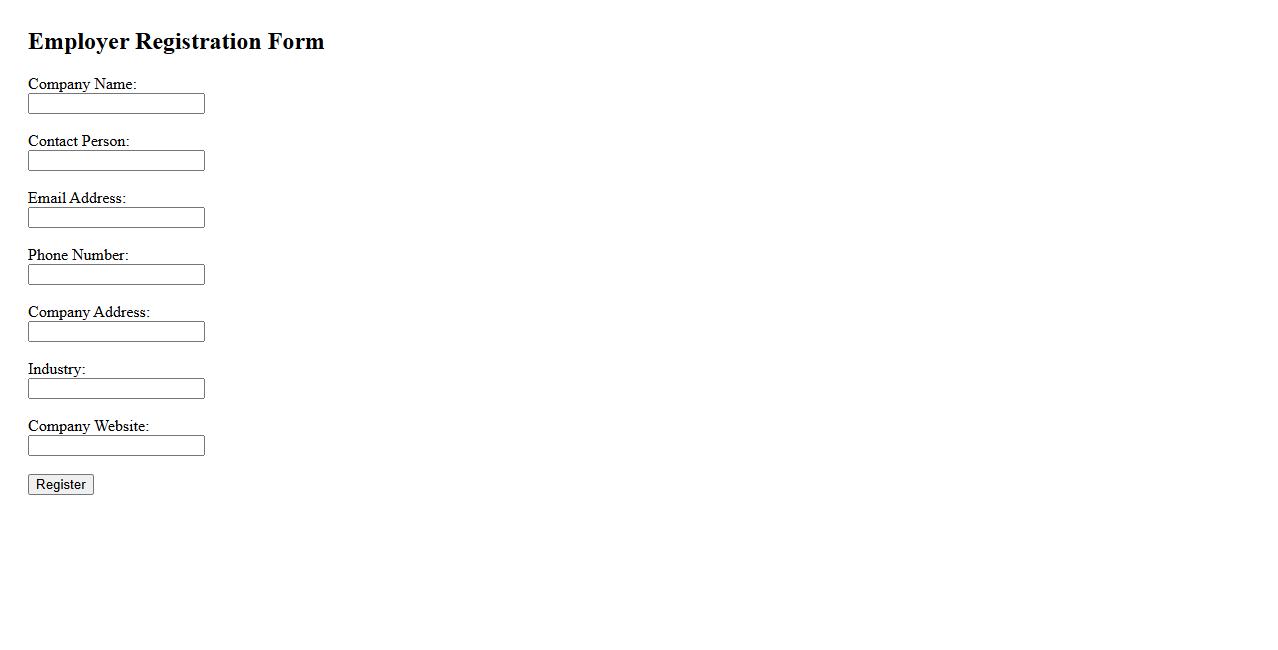

Employer Registration Form

The Employer Registration Form is a crucial document used to officially register a business or organization as an employer with relevant government agencies. It collects essential information about the company, such as its name, address, and tax identification number. Accurate completion of this form ensures compliance with employment laws and eligibility for employee-related benefits.

Business Tax ID Enrollment

Enroll your company with a Business Tax ID to ensure compliance with federal and state tax regulations. This unique identifier streamlines tax reporting and simplifies financial transactions. Obtaining a Business Tax ID is essential for opening bank accounts and hiring employees.

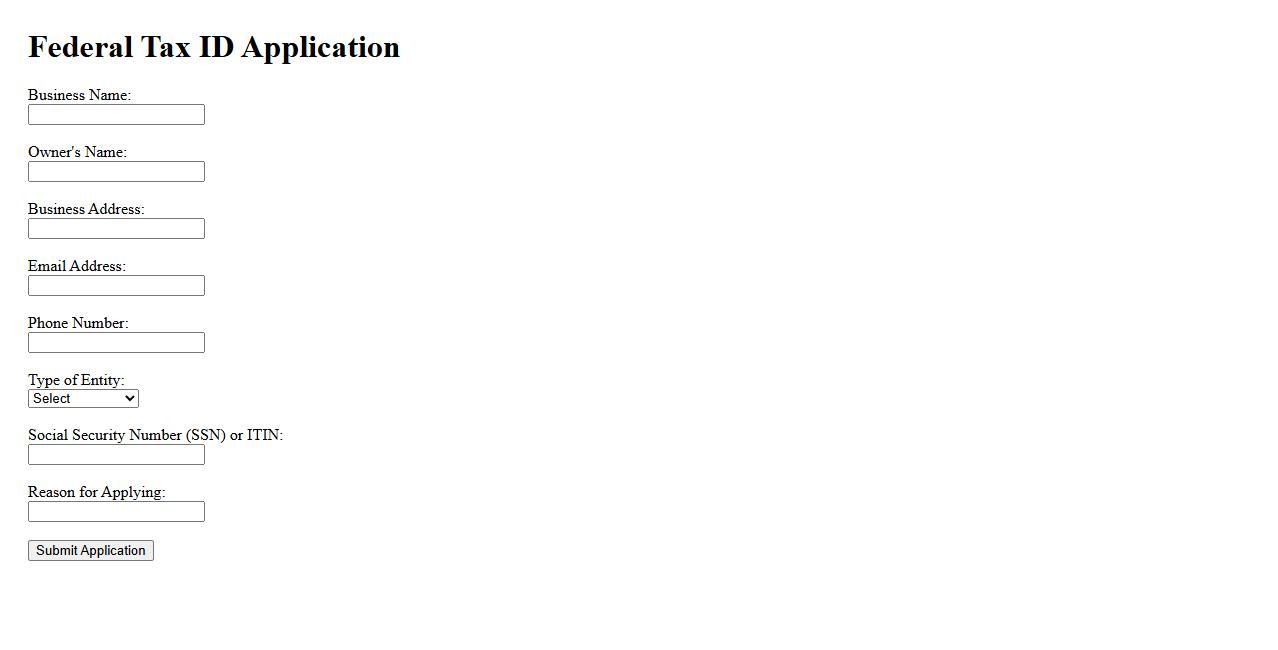

Federal Tax ID Application

The Federal Tax ID Application is a process used to obtain an Employer Identification Number (EIN) from the IRS. This unique number is essential for business identification, tax reporting, and opening bank accounts. Applying online ensures a swift and secure way to meet federal tax obligations.

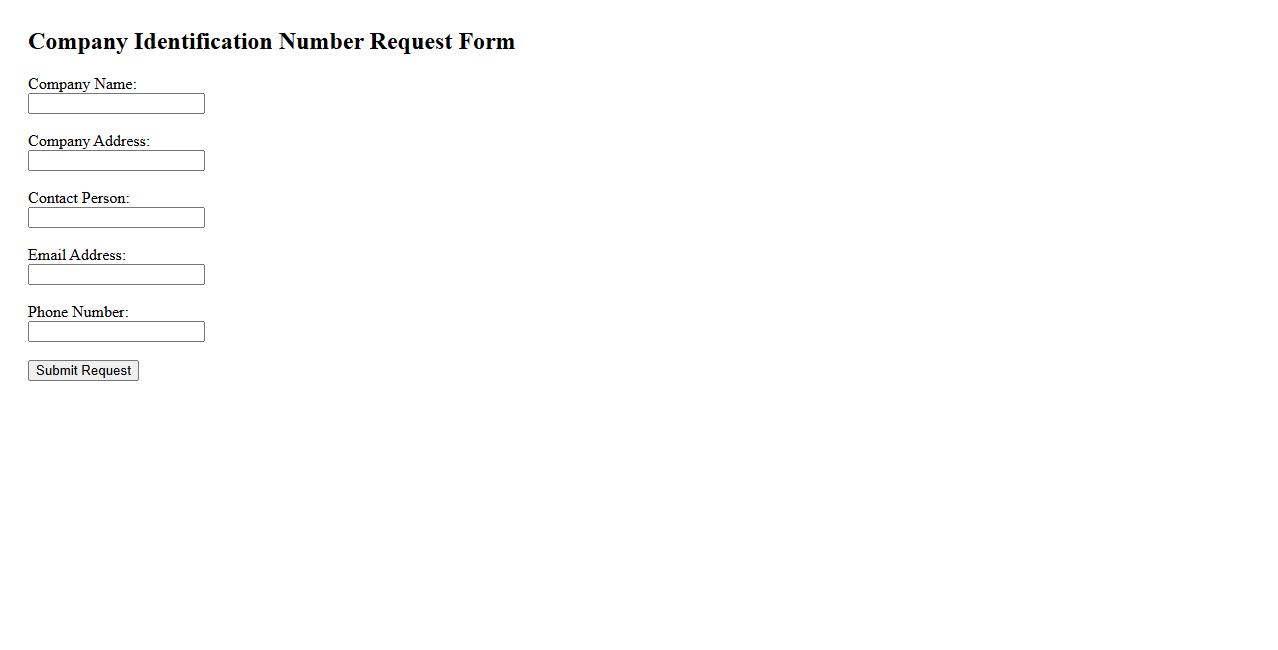

Company Identification Number Request

The Company Identification Number Request is a process used to obtain a unique identifier for businesses. This number is essential for legal, tax, and regulatory purposes, ensuring proper company recognition. Applying early helps streamline official communications and compliance requirements.

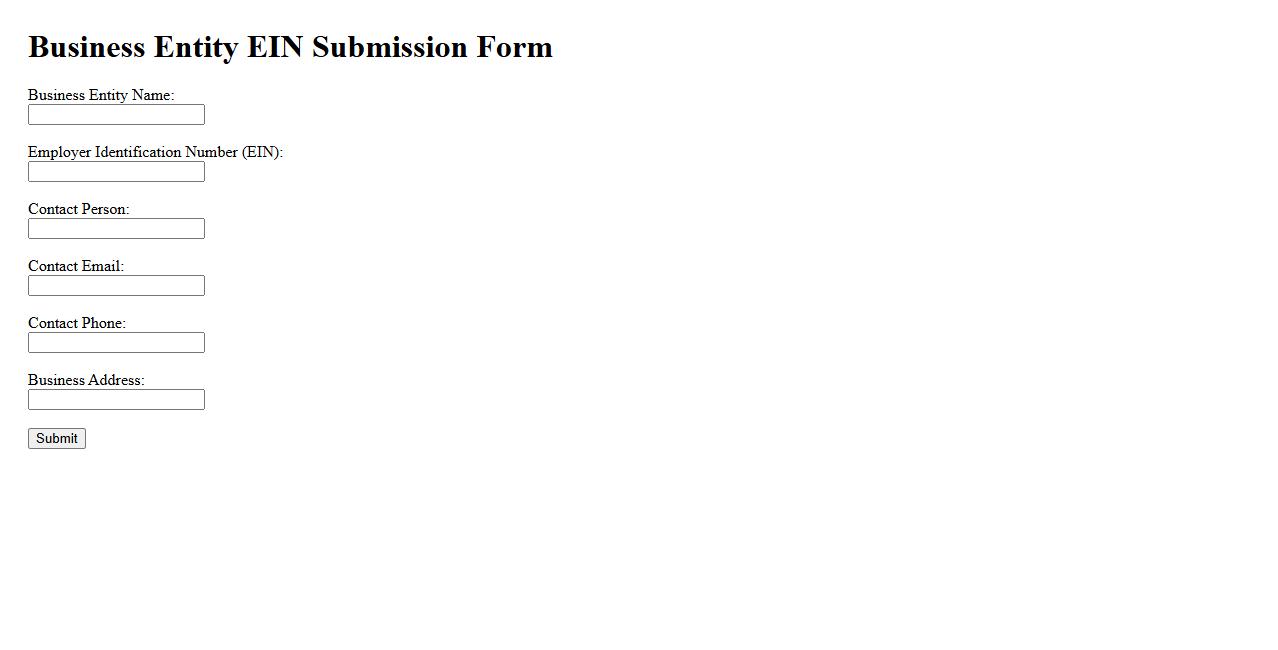

Business Entity EIN Submission

Submitting a Business Entity EIN is essential for tax identification and legal compliance. This unique number allows businesses to open bank accounts, hire employees, and manage taxes efficiently. Proper EIN submission ensures your business operates smoothly under federal regulations.

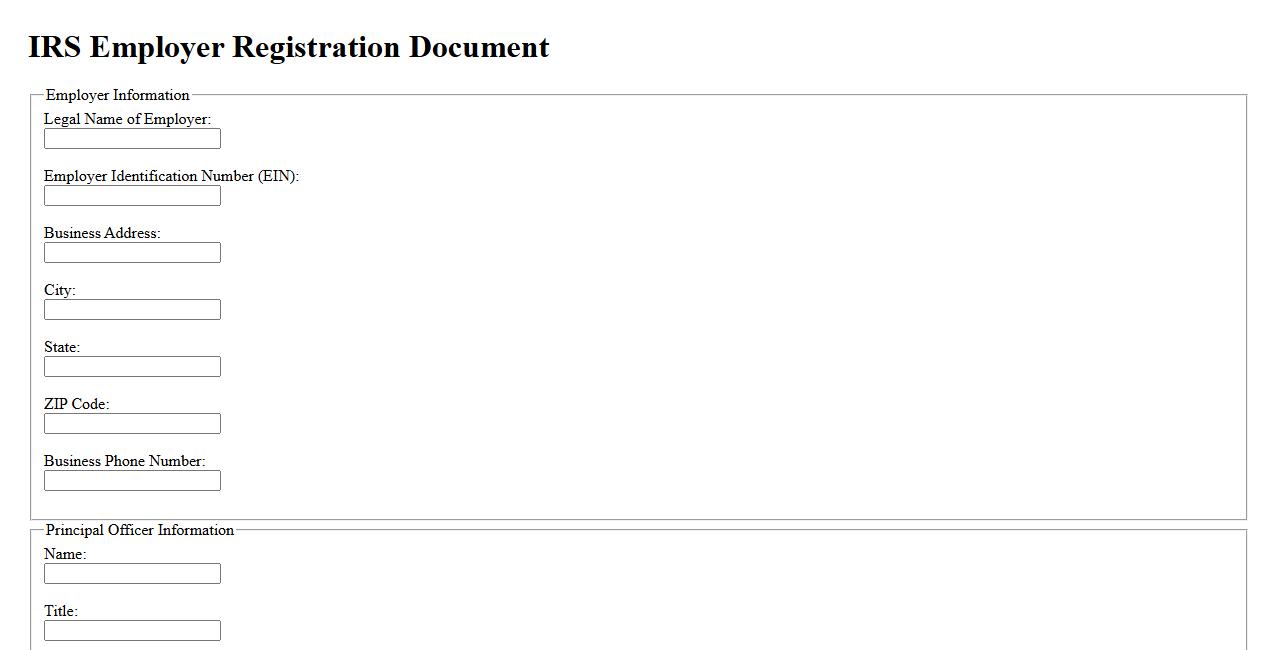

IRS Employer Registration Document

The IRS Employer Registration Document is essential for businesses to register with the Internal Revenue Service. It ensures the employer complies with federal tax requirements and obtains an Employer Identification Number (EIN). This document is crucial for hiring employees and managing payroll taxes efficiently.

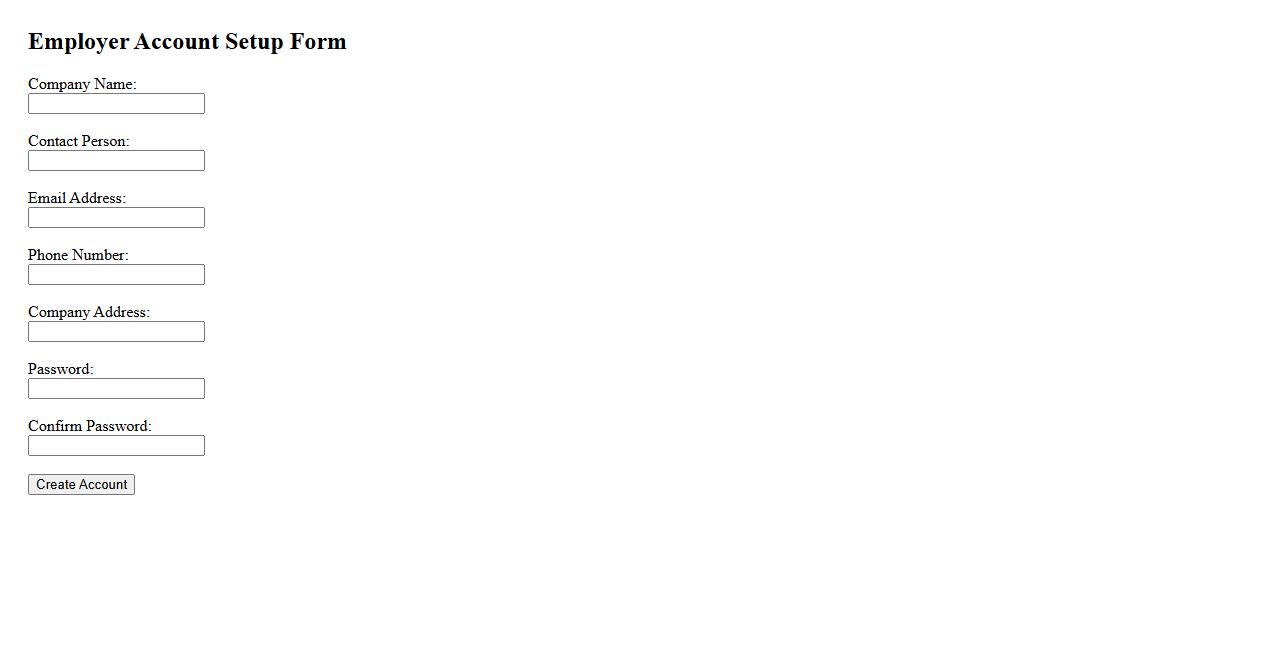

Employer Account Setup Form

The Employer Account Setup Form is designed to streamline the registration process for new employers. It collects essential company information to ensure accurate account creation and compliance. Completing this form allows employers to access tailored services and manage their workforce efficiently.

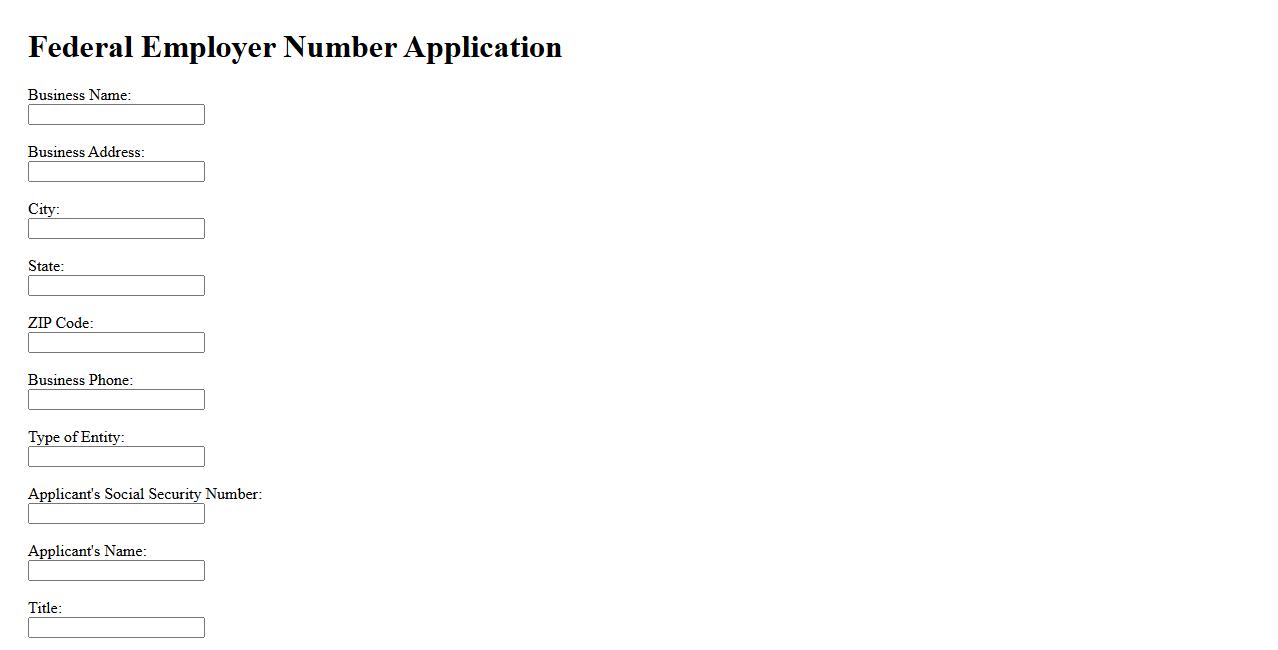

Federal Employer Number Application

The Federal Employer Number Application is a necessary process for businesses to obtain an Employer Identification Number (EIN) from the IRS. This unique identifier is essential for tax reporting, hiring employees, and opening business bank accounts. Applying online ensures a fast and secure way to receive your EIN promptly.

What is the purpose of obtaining an Employer Identification Number (EIN)?

The Employer Identification Number (EIN) is a unique identifier for a business entity. It is primarily used for tax reporting and administration by the Internal Revenue Service (IRS). Obtaining an EIN helps businesses separate their financial activities from personal finances, ensuring proper compliance with federal tax regulations.

Which entities are required to register for an EIN?

Entities like corporations, partnerships, and limited liability companies must register for an EIN. Additionally, sole proprietors with employees or those who meet certain criteria are also required to obtain one. Non-profit organizations and trusts that need to file tax returns typically need an EIN as well.

What information must be provided on the EIN registration document?

The EIN registration requires detailed information such as the legal name of the entity and its mailing address. Applicants must provide the responsible party's name and Social Security Number or Individual Taxpayer Identification Number. Business type and reason for applying are also critical components.

How does the EIN registration process differ for individuals versus organizations?

For individuals owning a sole proprietorship, the EIN application is simpler and often does not require extensive documentation. In contrast, organizations must provide additional documents like formation papers and detailed business information. Both processes, however, can be completed online, by fax, or via mail through the IRS.

What are the potential consequences of failing to register for an EIN?

Failing to obtain an EIN can lead to penalties and delays in tax filings for businesses. Without an EIN, a business may not open bank accounts or apply for credit in the entity's name. Additionally, the IRS may impose fines and withhold refunds for non-compliance.