Registration for Sole Proprietorship involves completing the necessary legal formalities to establish a business owned and operated by a single individual. This process typically requires obtaining the required licenses and permits, registering the business name, and adhering to local government regulations. Proper registration ensures compliance and allows the sole proprietor to operate legally and build credibility with customers and suppliers.

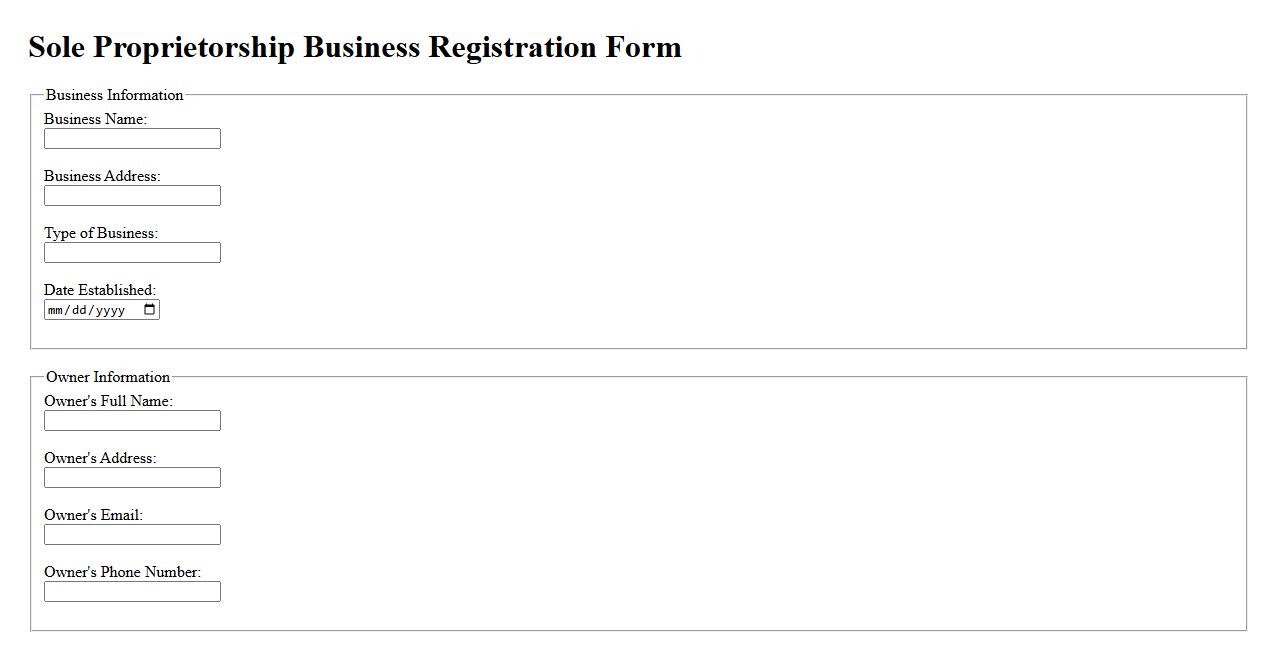

Sole Proprietorship Business Registration Form

The Sole Proprietorship Business Registration Form is a crucial document for entrepreneurs looking to establish their business legally. It collects essential information about the owner and the business, ensuring compliance with local regulations. Completing this form is the first step toward operating a sole proprietorship officially and gaining necessary permits.

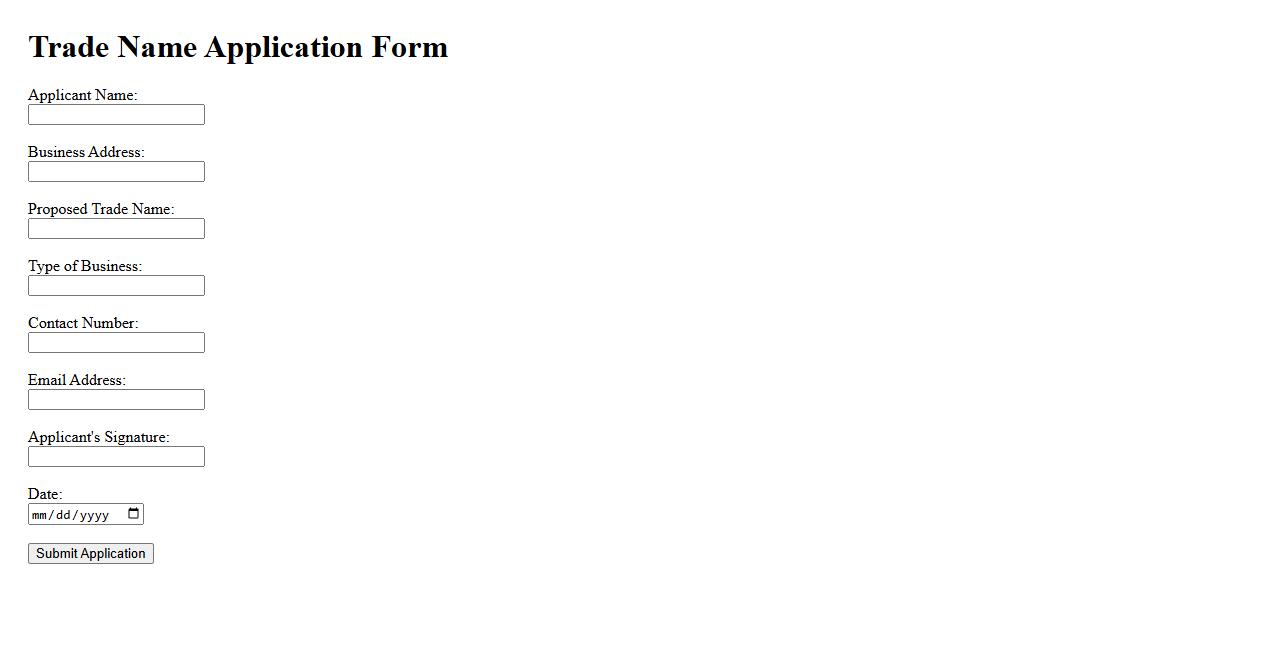

Trade Name Application

The Trade Name Application is a legal document submitted to register a business name that is different from the owner's personal name. This process ensures exclusive rights to use the trade name within a specific jurisdiction. Registering a trade name protects your brand identity and helps avoid legal conflicts.

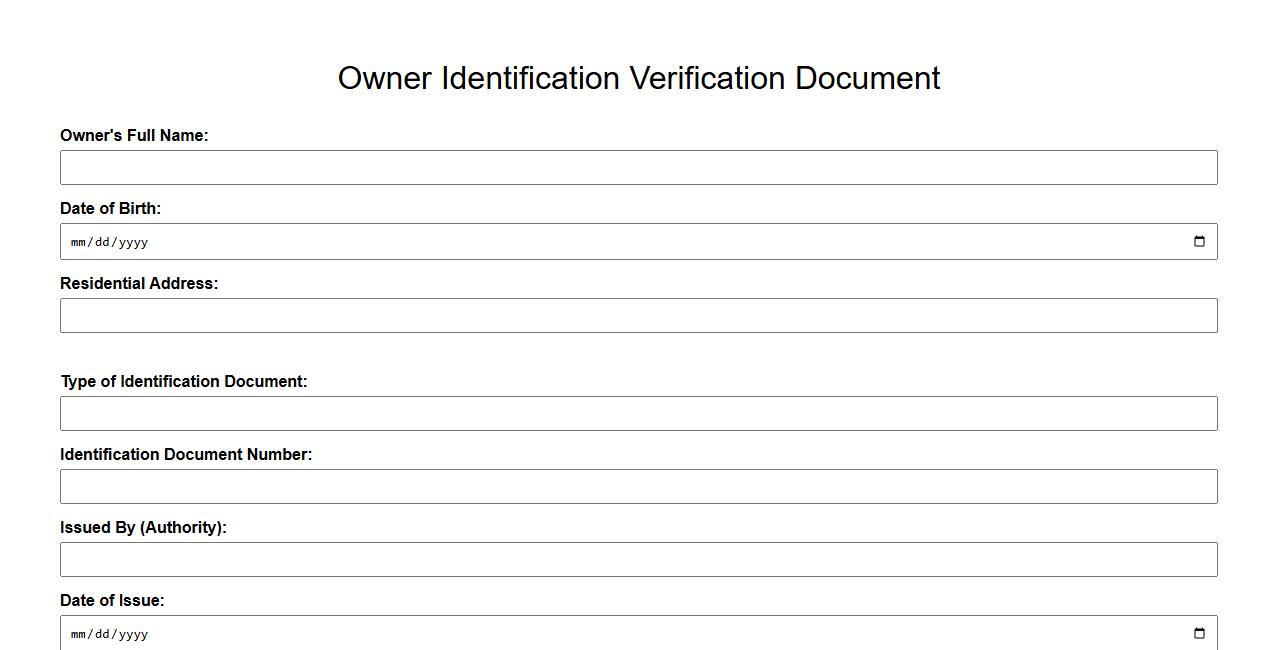

Owner Identification Verification Document

The Owner Identification Verification Document is essential for confirming the identity of property or asset owners. It ensures legal compliance by providing accurate and verifiable personal information. This document plays a crucial role in ownership transfer and official record-keeping processes.

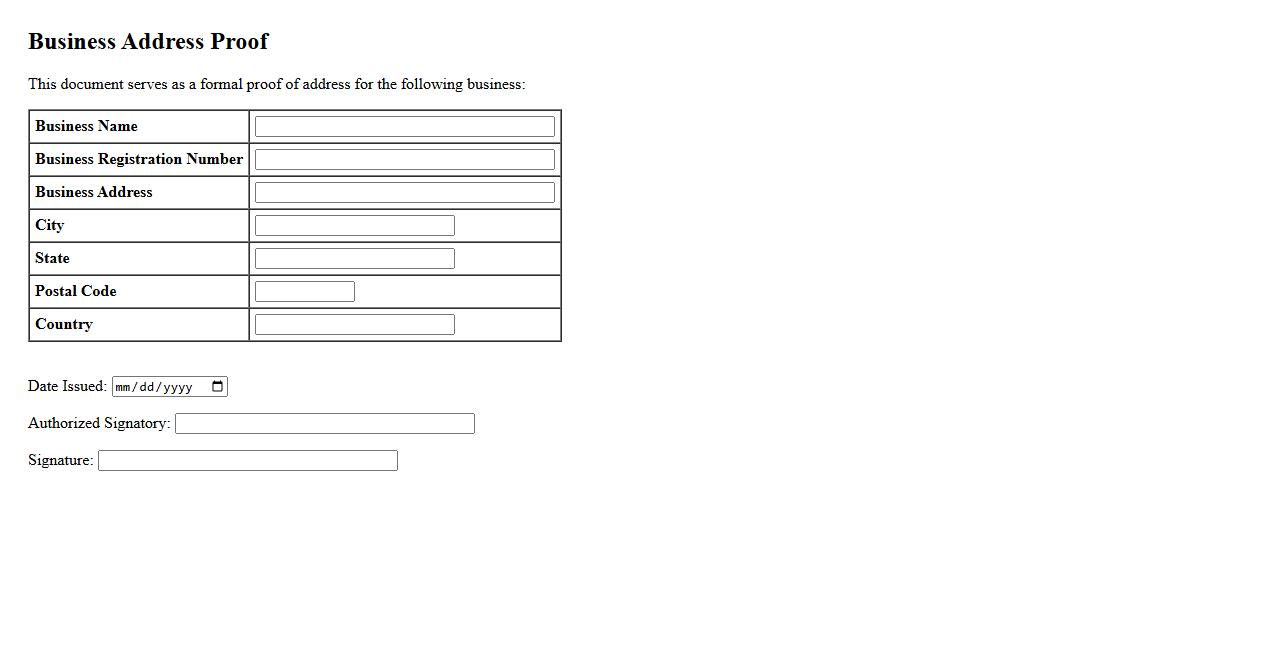

Business Address Proof

Business Address Proof is an official document that verifies the physical location of a business. It is essential for legal registration, banking, and compliance purposes. Common forms include utility bills, lease agreements, or government-issued certificates.

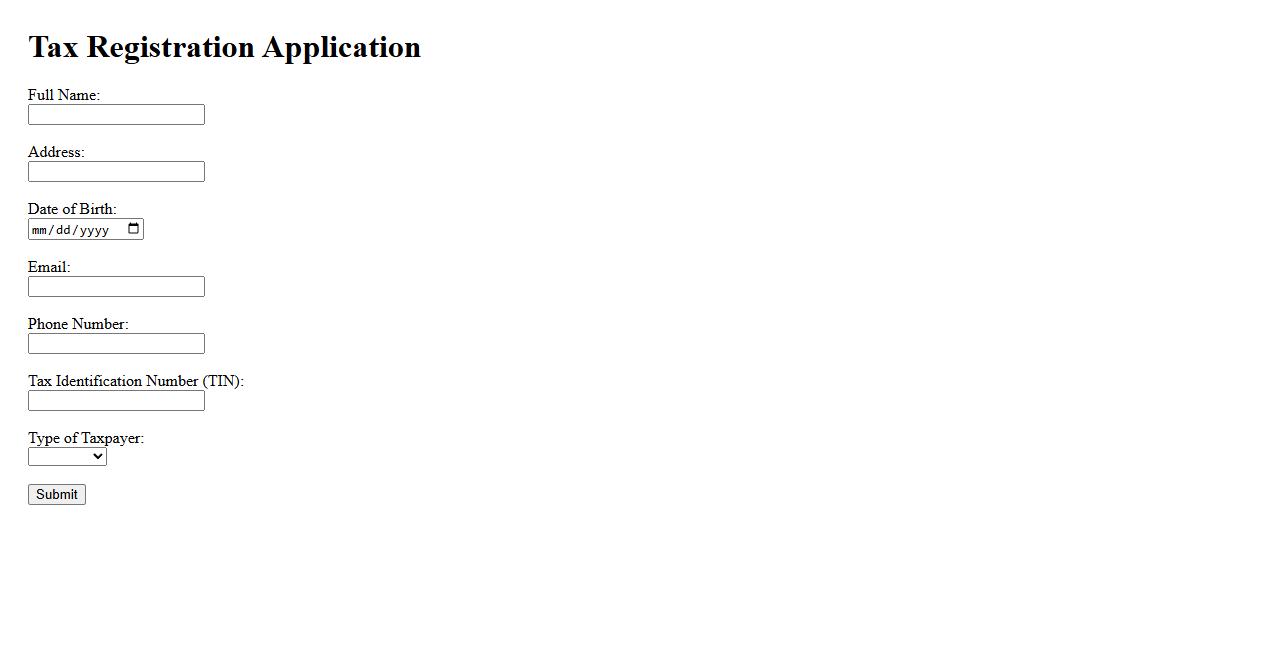

Tax Registration Application

The Tax Registration Application is a formal process used to register individuals or businesses with tax authorities. It ensures compliance with local tax laws and facilitates the issuance of tax identification numbers. Completing this application is essential for lawful tax reporting and payment obligations.

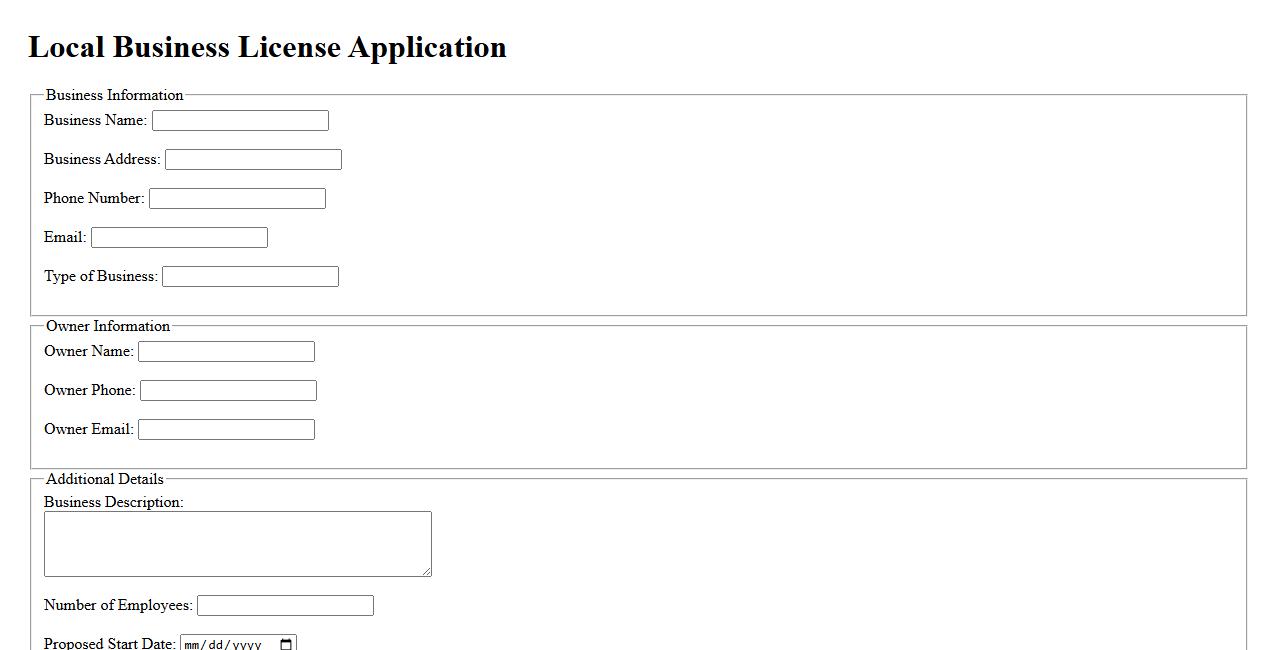

Local Business License Application

Applying for a Local Business License is essential for legally operating a business within a specific municipality. This permit ensures compliance with local regulations and helps maintain community standards. The application process typically involves submitting required documents and paying associated fees.

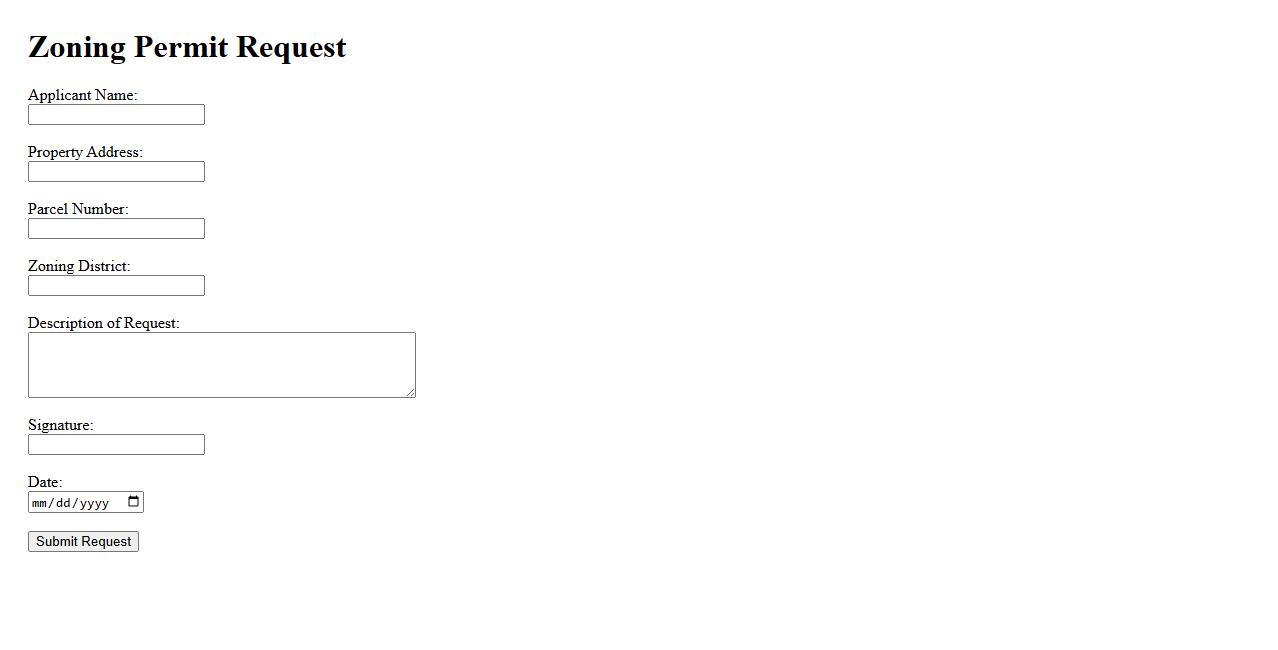

Zoning Permit Request

A Zoning Permit Request is a formal application submitted to local authorities to obtain approval for land use or construction projects. This permit ensures the proposed development complies with zoning laws and regulations. Securing the permit is essential before beginning any construction or land modification.

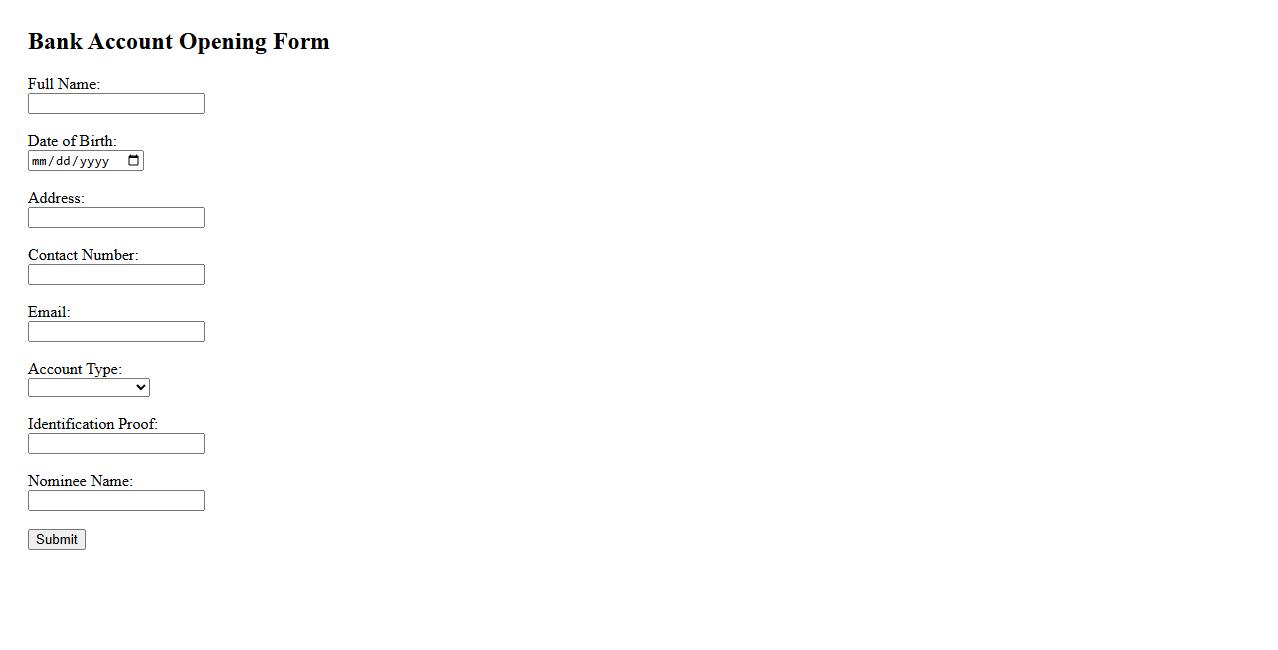

Bank Account Opening Form

The Bank Account Opening Form is essential for initiating a new bank account with all personal and financial details accurately captured. This form ensures compliance with banking regulations and facilitates smooth processing of account setup. Filling it out completely and correctly helps avoid delays and enables quick access to banking services.

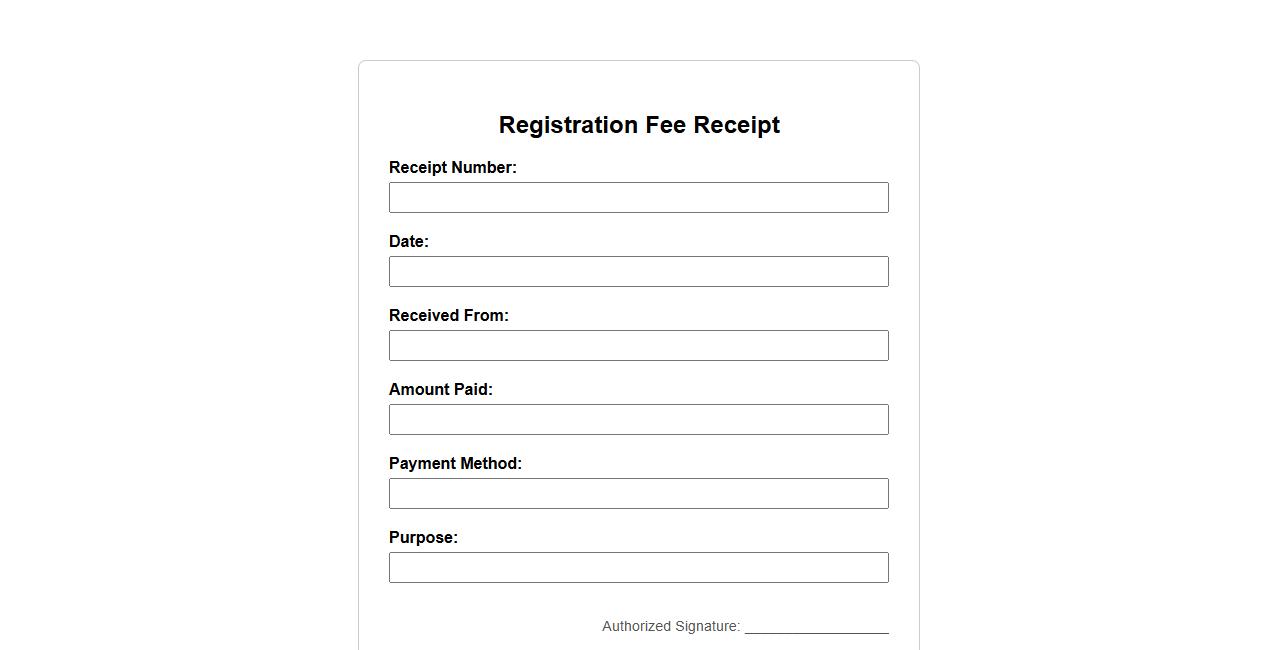

Registration Fee Receipt

The Registration Fee Receipt serves as an official document confirming payment for event or course registration. It details the amount paid, date of transaction, and registrant's information. This receipt is essential for record-keeping and future reference.

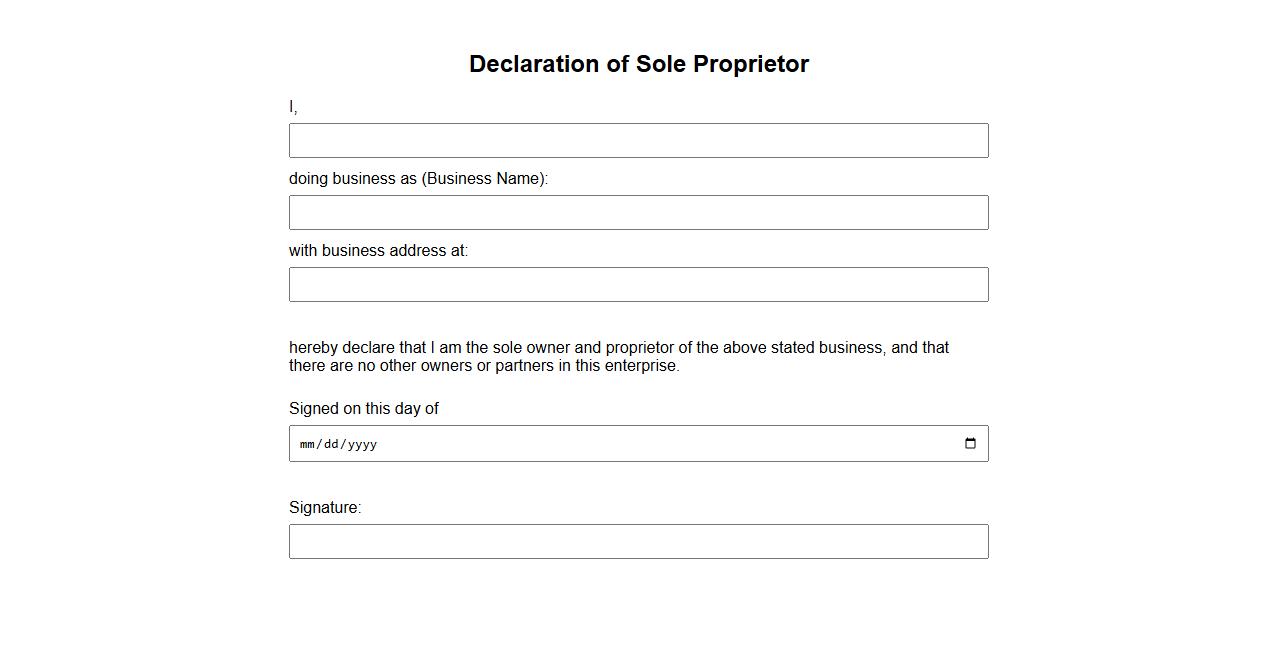

Declaration of Sole Proprietor

The Declaration of Sole Proprietor is a formal document used to establish an individual as the sole owner of a business. It outlines the owner's responsibilities and legal standing, ensuring clarity in business operations. This declaration is essential for registering the business and managing tax obligations.

What are the essential documents required for registration of a sole proprietorship?

The essential documents required for registration of a sole proprietorship typically include proof of identity, address proof, and business name declaration. Additionally, a PAN card and a passport-sized photograph of the proprietor are often necessary. These documents help establish the legitimacy and identity of the sole proprietorship.

Which government authority should a sole proprietorship be registered with?

A sole proprietorship is generally registered with the local Municipal Corporation or the Shops and Establishment Department. The registration process may differ based on the state or region, but local government bodies oversee the formal registration. This ensures the business complies with regional laws and regulations.

What identification proof is necessary for registering a sole proprietorship?

The proprietor must provide valid government-issued identification proof such as an Aadhaar card, passport, or voter ID. This identification is crucial to verify the proprietor's identity during registration. Proper ID proof helps prevent fraudulent registrations and ensures transparency.

Is a trade license mandatory for all sole proprietorship registrations?

A trade license is not mandatory for every sole proprietorship but is required for businesses operating in regulated sectors or specific localities. Depending on the nature of the business, obtaining a trade license from the municipal authority may be compulsory. It serves as official permission to carry out business activities legally.

How does address proof impact the registration process for a sole proprietorship?

Address proof