The registration for pension plan involves submitting essential personal and financial information to enroll in a retirement savings program. Applicants must carefully complete the required forms and provide documentation to ensure eligibility and accurate benefit calculation. Timely registration helps secure future financial stability and access to pension benefits upon retirement.

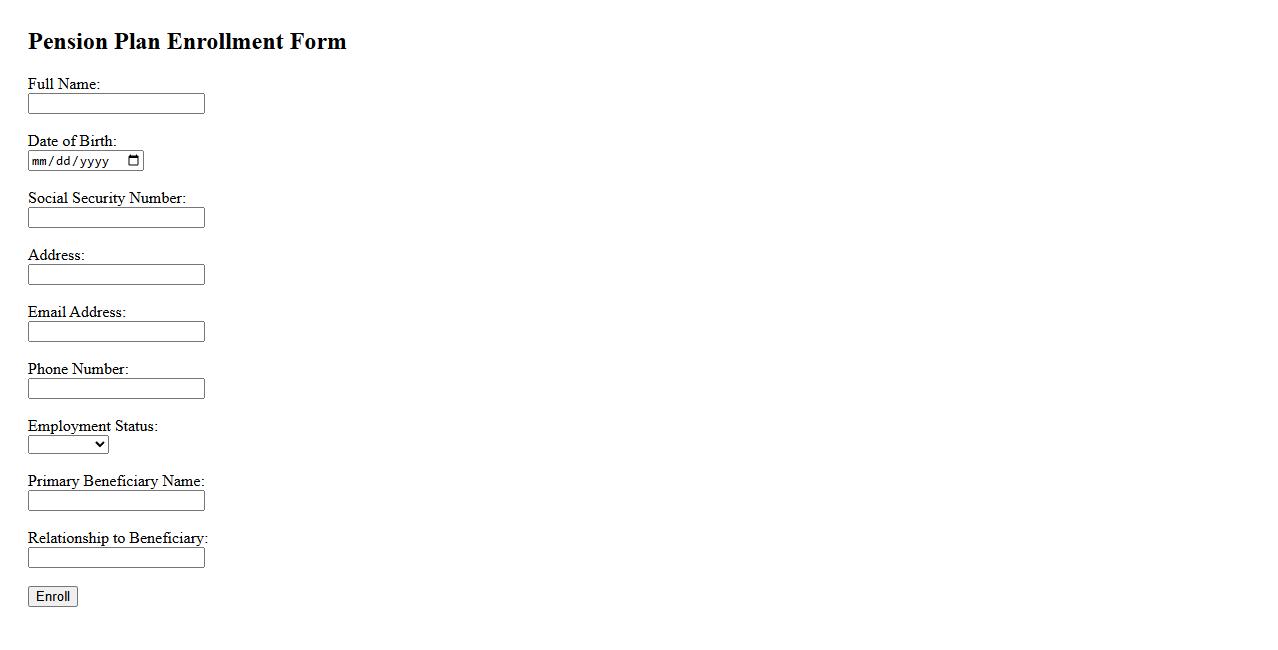

Pension Plan Enrollment Form

The Pension Plan Enrollment Form is a crucial document for employees to initiate their participation in the company's retirement savings program. It collects essential information to ensure proper account setup and future benefit distribution. Timely completion of this form helps secure financial stability after retirement.

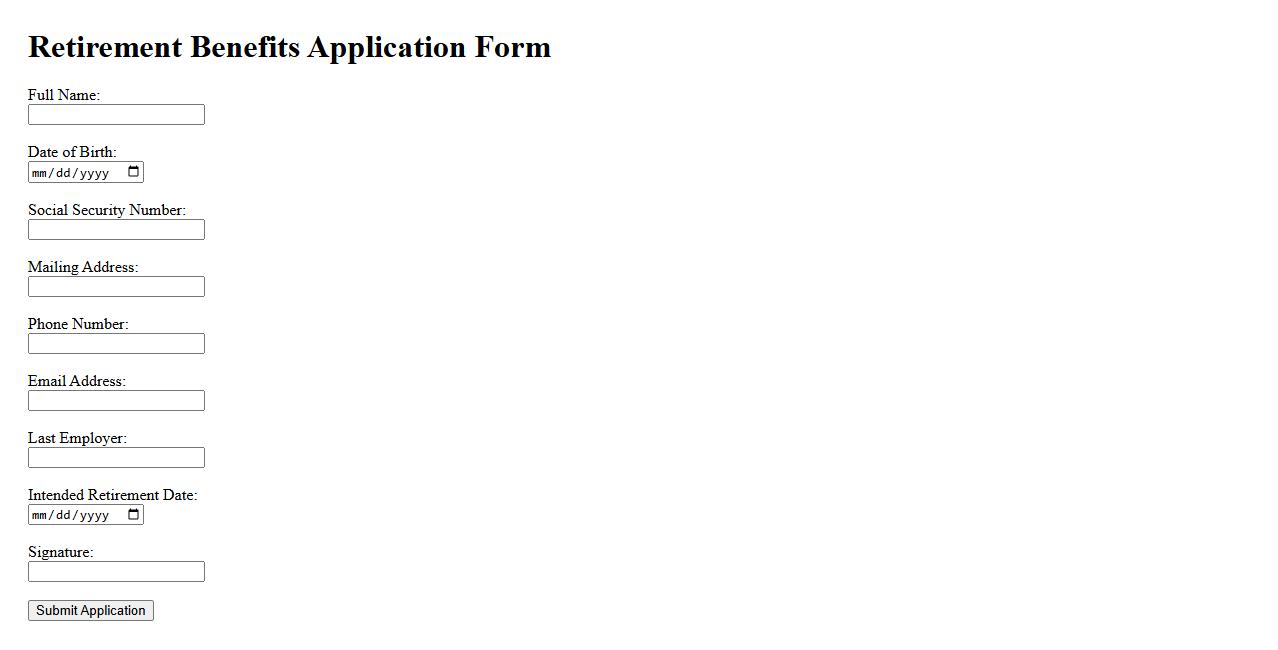

Retirement Benefits Application

The Retirement Benefits Application process allows eligible individuals to claim their entitled benefits upon reaching the required age or service period. It involves submitting necessary documents and completing forms to ensure timely disbursement. Understanding the application steps can help retirees secure their financial stability efficiently.

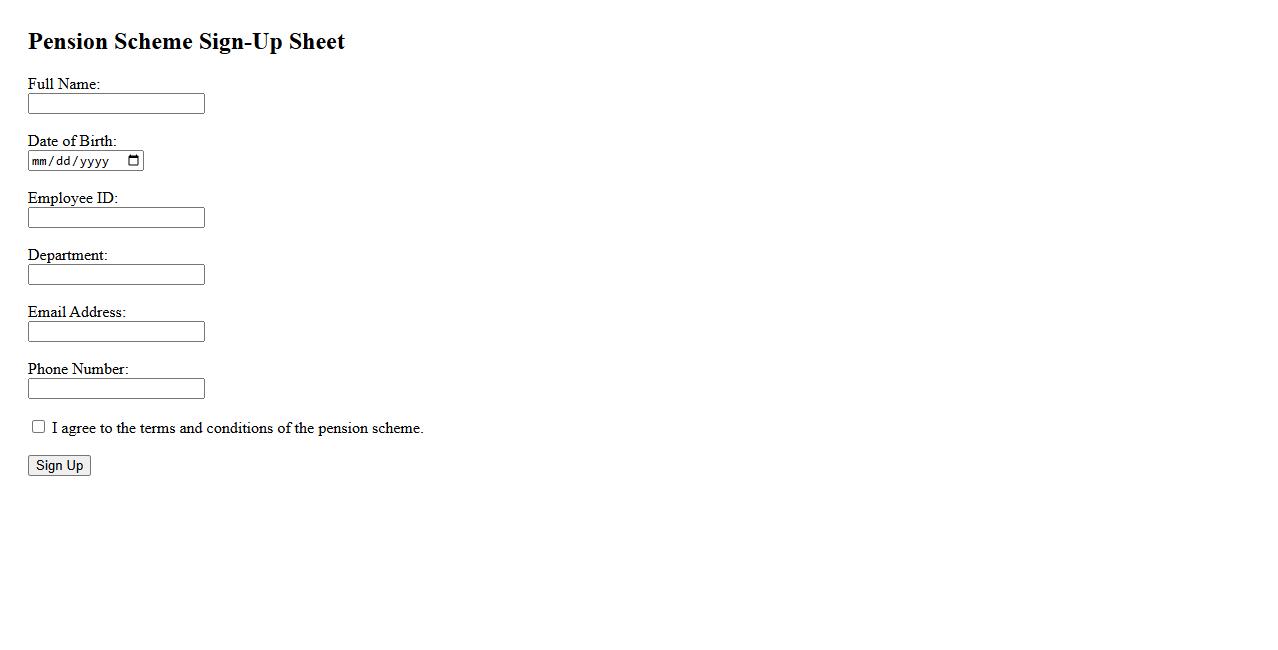

Pension Scheme Sign-Up Sheet

The Pension Scheme Sign-Up Sheet is an essential document for employees to enroll in a company's retirement savings plan. It facilitates the collection of personal and employment details required for pension benefits administration. Using this sheet ensures a streamlined and accurate sign-up process for future financial security.

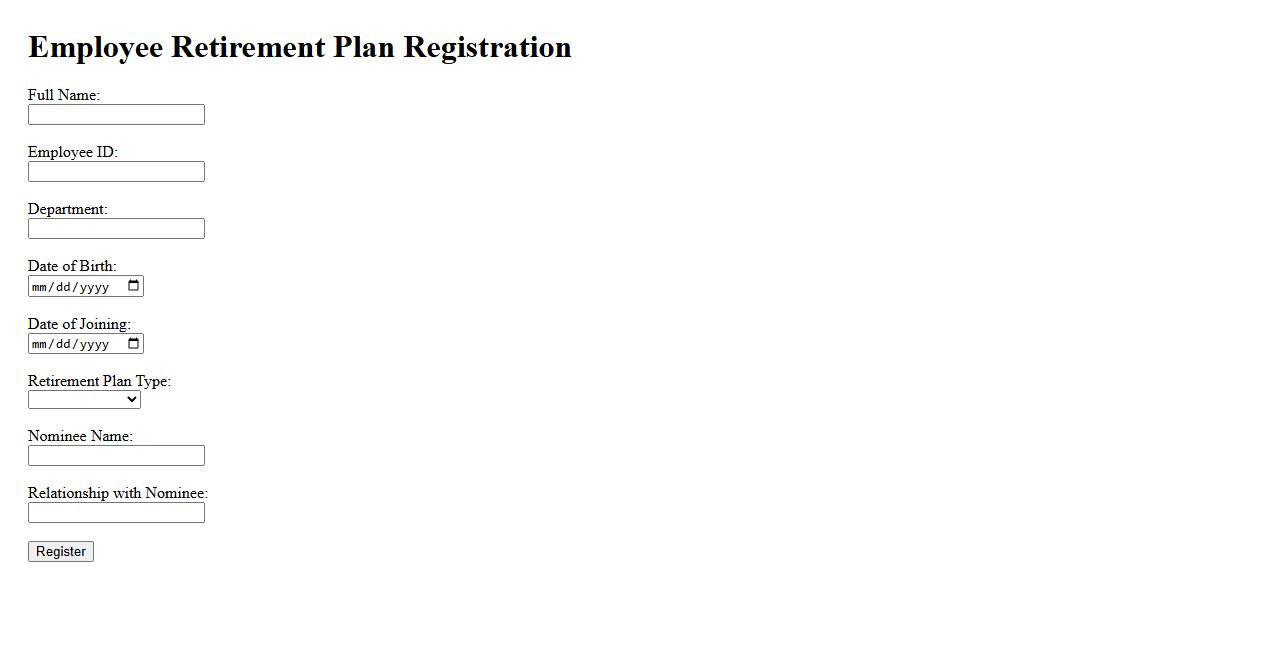

Employee Retirement Plan Registration

Employee Retirement Plan Registration is a crucial process for businesses to provide secure financial futures for their employees. It involves submitting necessary documents to comply with legal requirements and ensure proper plan administration. Timely registration helps employers offer competitive benefits and foster employee loyalty.

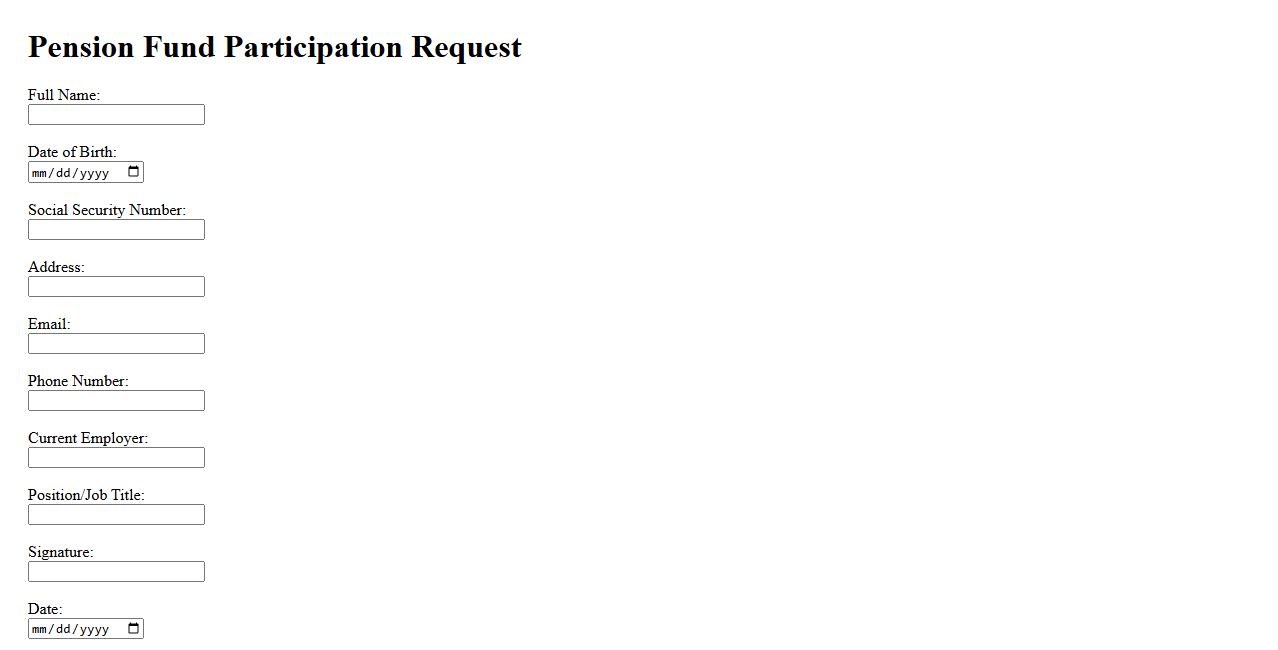

Pension Fund Participation Request

A Pension Fund Participation Request is a formal application submitted by an individual or organization seeking to join a pension fund. This process ensures eligibility verification and compliance with fund regulations. Participation in a pension fund provides long-term financial security for retirement.

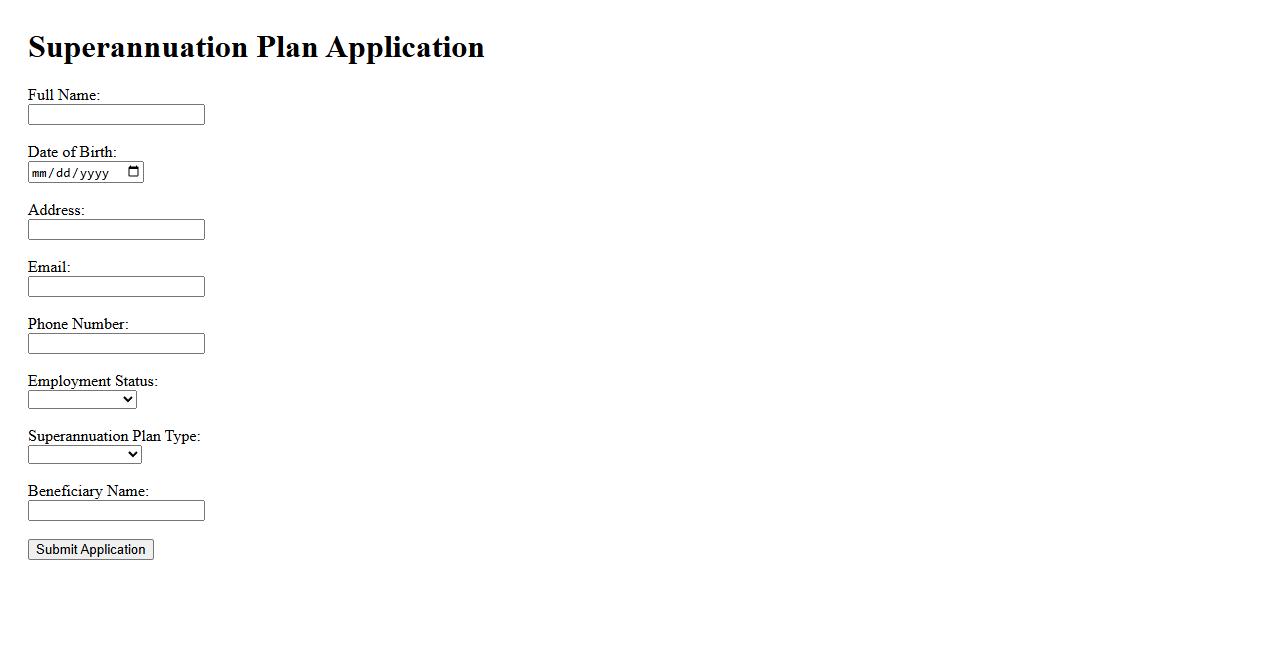

Superannuation Plan Application

The Superannuation Plan Application is a crucial step for individuals seeking to secure their financial future through a structured retirement savings plan. This application process involves providing essential personal and employment details to enroll in the superannuation scheme. Timely submission ensures uninterrupted contributions and benefits accumulation for retirement.

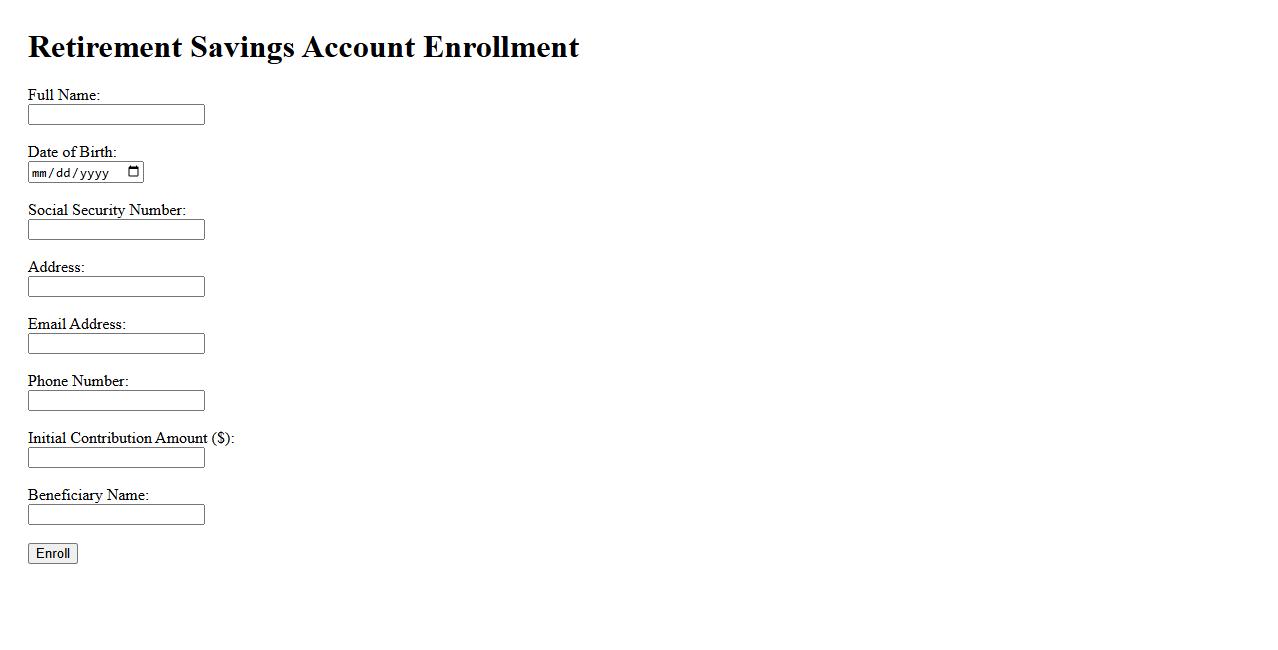

Retirement Savings Account Enrollment

Enrolling in a Retirement Savings Account is a crucial step towards securing your financial future. This account allows you to systematically save and invest funds, providing tax advantages and growth potential over time. Starting early maximizes the benefits of compound interest and helps ensure a comfortable retirement.

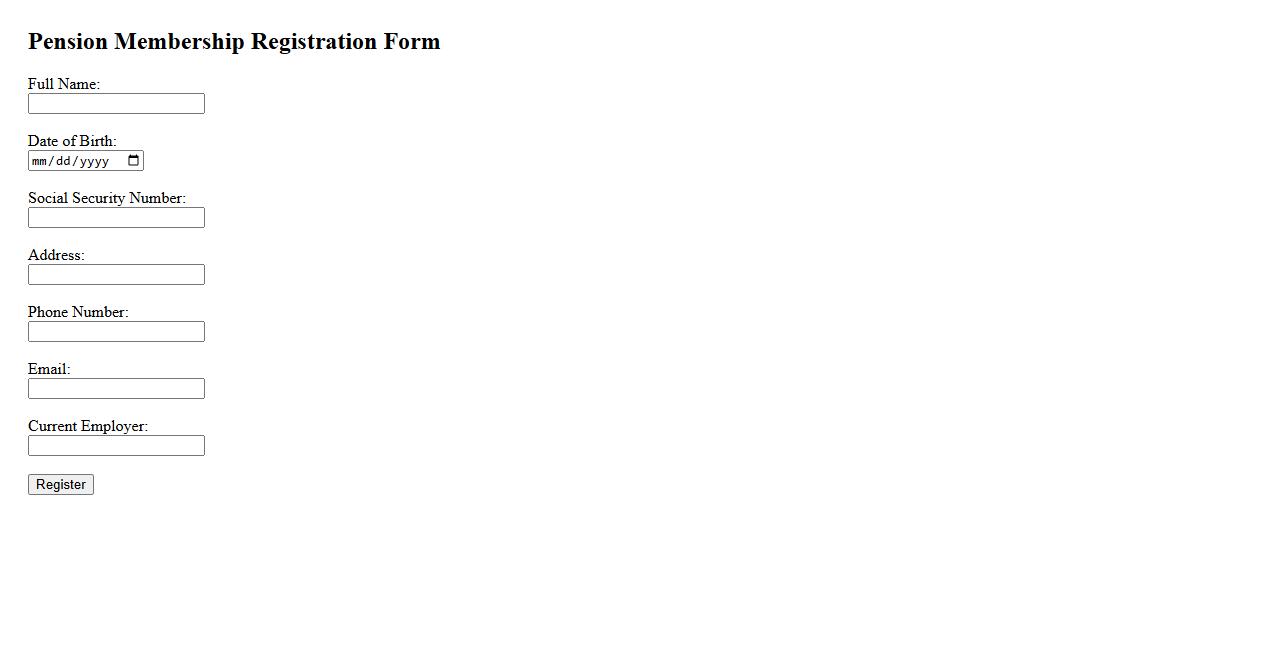

Pension Membership Registration

Registering for pension membership ensures access to valuable retirement benefits and financial security. The process involves submitting necessary personal and employment details to qualify for pension schemes. Early registration helps maximize future pension contributions and benefits.

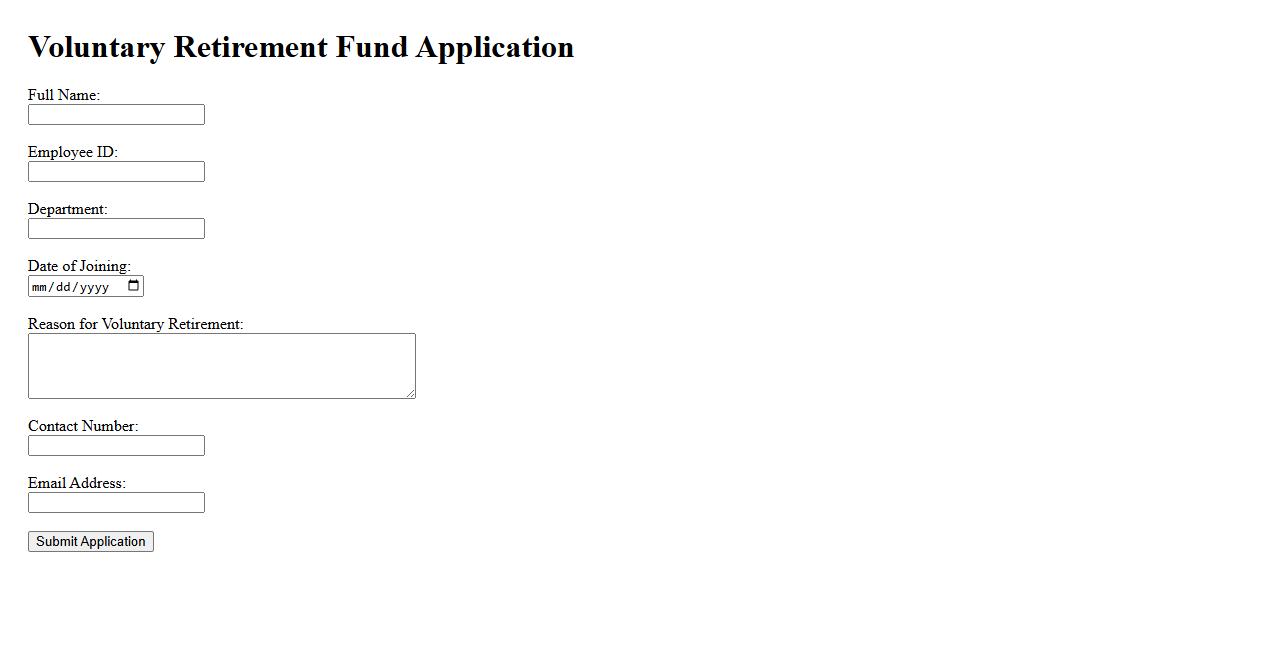

Voluntary Retirement Fund Application

The Voluntary Retirement Fund Application allows individuals to securely apply for retirement savings management. This process ensures users can maximize their financial benefits by contributing voluntarily to their retirement plan. Easy-to-follow steps guide applicants through submitting their information efficiently.

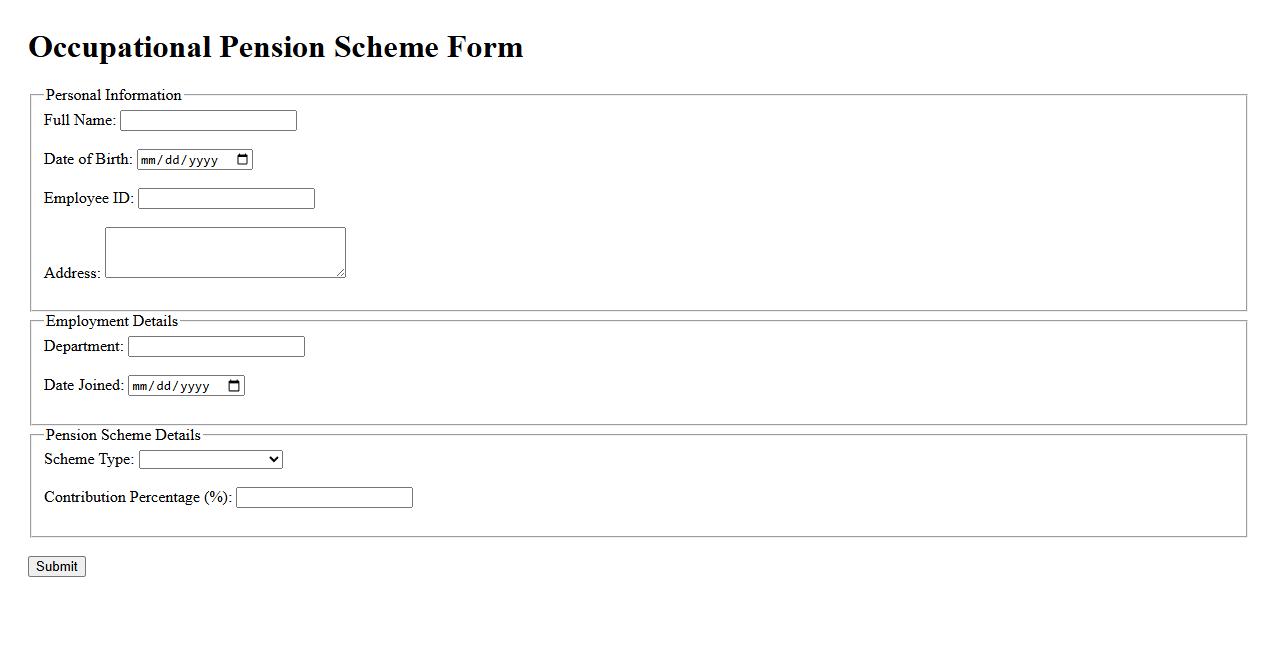

Occupational Pension Scheme Form

The Occupational Pension Scheme Form is a crucial document used to enroll employees in a workplace pension plan. It collects essential details such as personal information, employment status, and contribution preferences. Completing this form ensures proper pension benefits management and compliance with legal requirements.

What personal identification information is required for pension plan registration?

To register for a pension plan, you must provide valid personal identification such as a government-issued ID or passport. Your full name, date of birth, and social security number are essential pieces of information. This data ensures accurate record-keeping and verification during the registration process.

Which eligibility criteria must be met to enroll in the pension plan?

Enrollment requires meeting specific eligibility criteria such as age limits, employment status, and minimum service duration. Typically, employees must be actively employed and have completed a probation period to qualify. Meeting these conditions ensures you are entitled to pension benefits under the plan guidelines.

What documentation is needed to prove age and employment status?

To verify your age, official documents like a birth certificate or passport are necessary. Employment status can be confirmed through employer-provided records or recent pay stubs. Providing these documents is critical to validate eligibility and facilitate a smooth registration process.

How do you select or designate pension plan beneficiaries on the registration form?

Beneficiaries are selected by listing their full names, relationships, and contact details in the designated section of the registration form. You may designate primary and contingent beneficiaries to ensure your benefits are distributed as intended. It is important to review and update beneficiary information regularly.

What are the steps for submitting and confirming successful pension plan registration?

First, complete the registration form with accurate personal and employment details. Next, submit the form along with required documentation either online or in-person to the pension plan administrator. Confirmation of successful registration is usually communicated via email or official notification within a few business days.