To register for an Employer Identification Number (EIN), you must complete an application through the IRS either online, by mail, or by fax. This unique nine-digit number identifies your business for tax purposes and is required for hiring employees, opening bank accounts, and filing tax returns. The process ensures your business complies with federal regulations and simplifies reporting obligations.

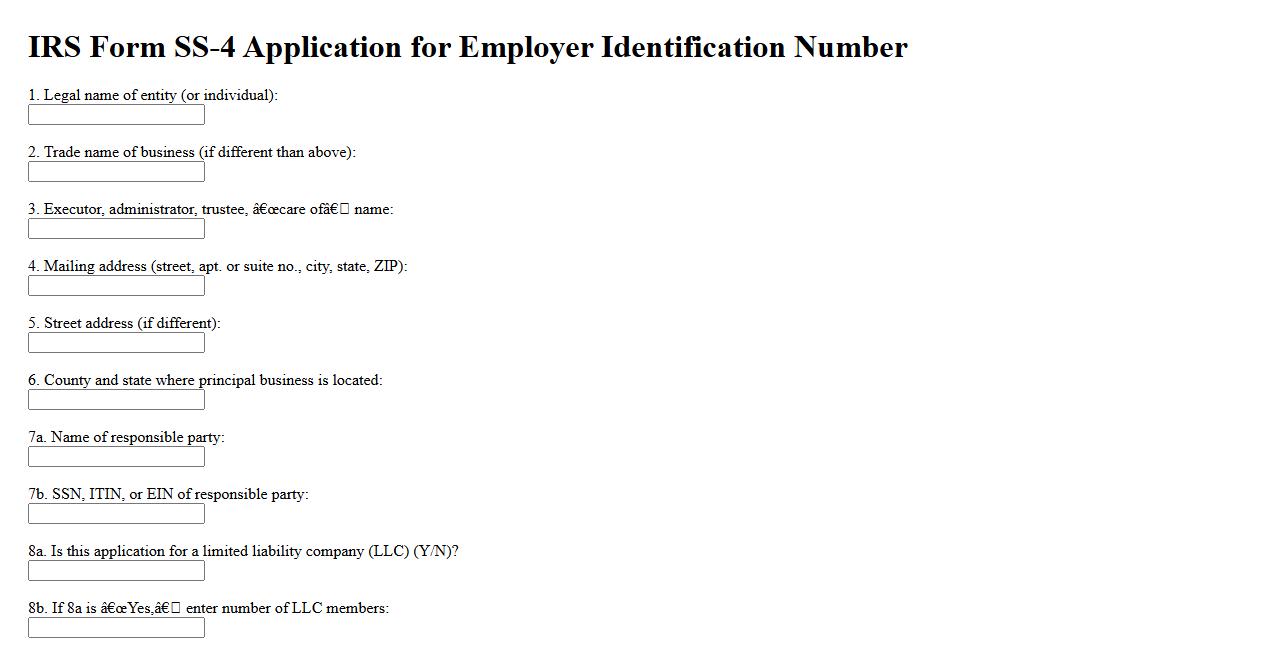

IRS Form SS-4 Application

The IRS Form SS-4 Application is used to apply for an Employer Identification Number (EIN), which is essential for business identification and tax purposes. This form collects important information about the applicant's business entity. Completing and submitting the SS-4 allows businesses to legally open accounts, file taxes, and hire employees.

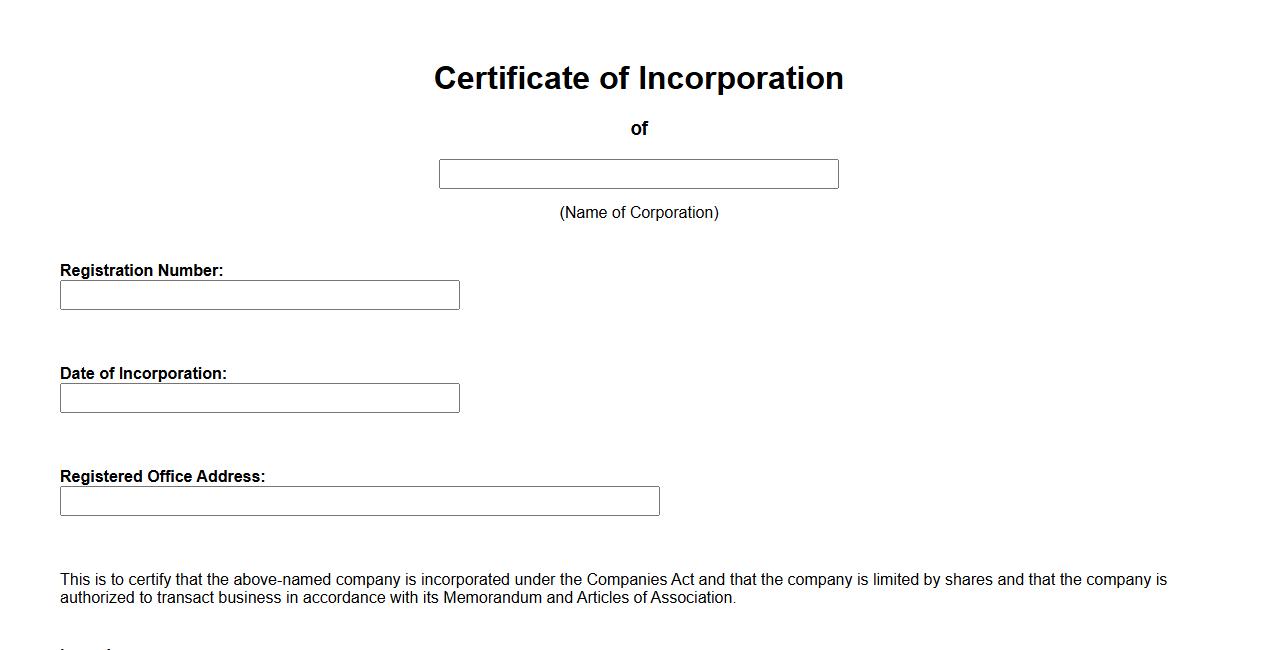

Certificate of Incorporation

The Certificate of Incorporation is an official document issued by a government authority that legally recognizes a company as a corporation. It serves as proof that the business has been registered and complies with statutory requirements. This certificate is essential for establishing the company's legal identity and conducting business operations.

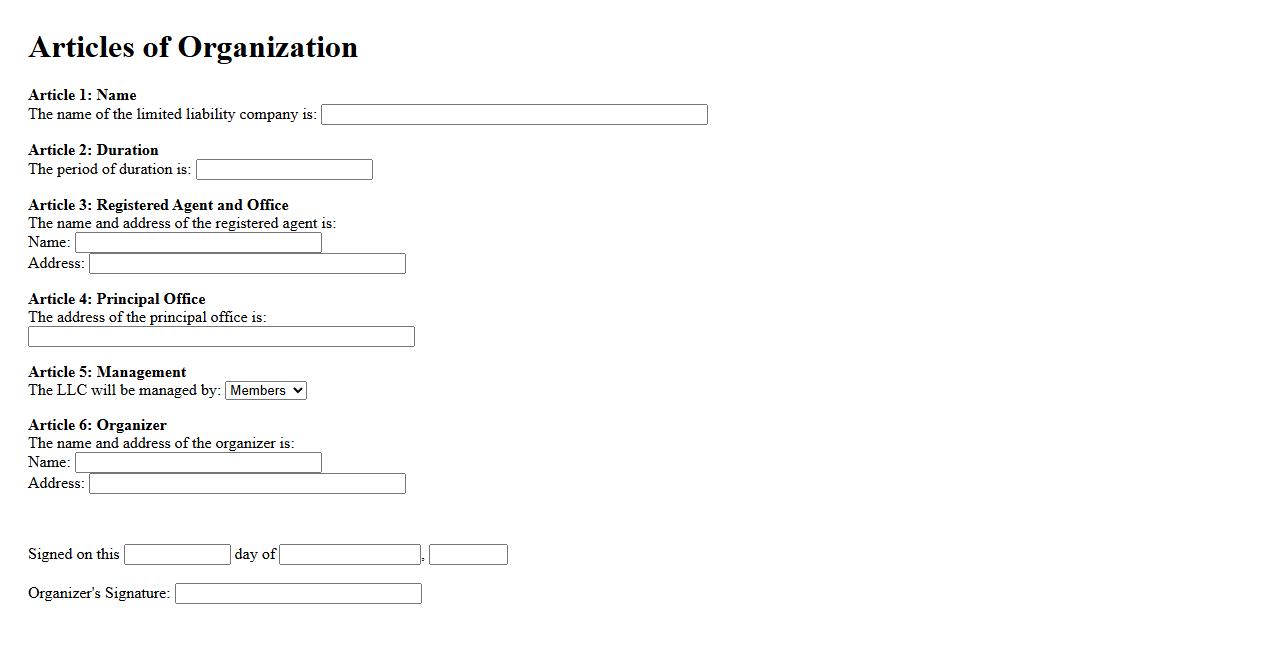

Articles of Organization

The Articles of Organization is a crucial legal document used to establish a limited liability company (LLC). It outlines key information about the business, including its name, address, management structure, and purpose. Filing this document officially registers the LLC with the state, enabling it to operate legally.

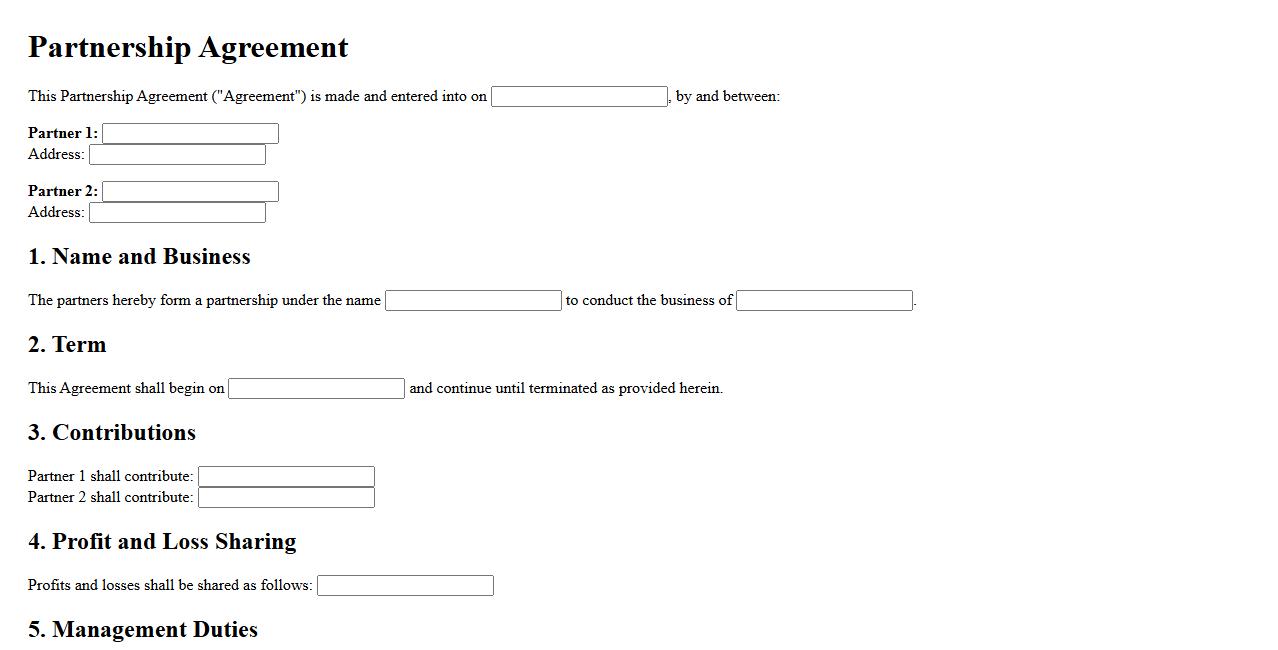

Partnership Agreement

A Partnership Agreement is a legally binding document that outlines the roles, responsibilities, and profit-sharing arrangements between business partners. It helps prevent disputes by clearly defining each partner's contributions and decision-making authority. This agreement is essential for establishing a transparent and successful collaborative business relationship.

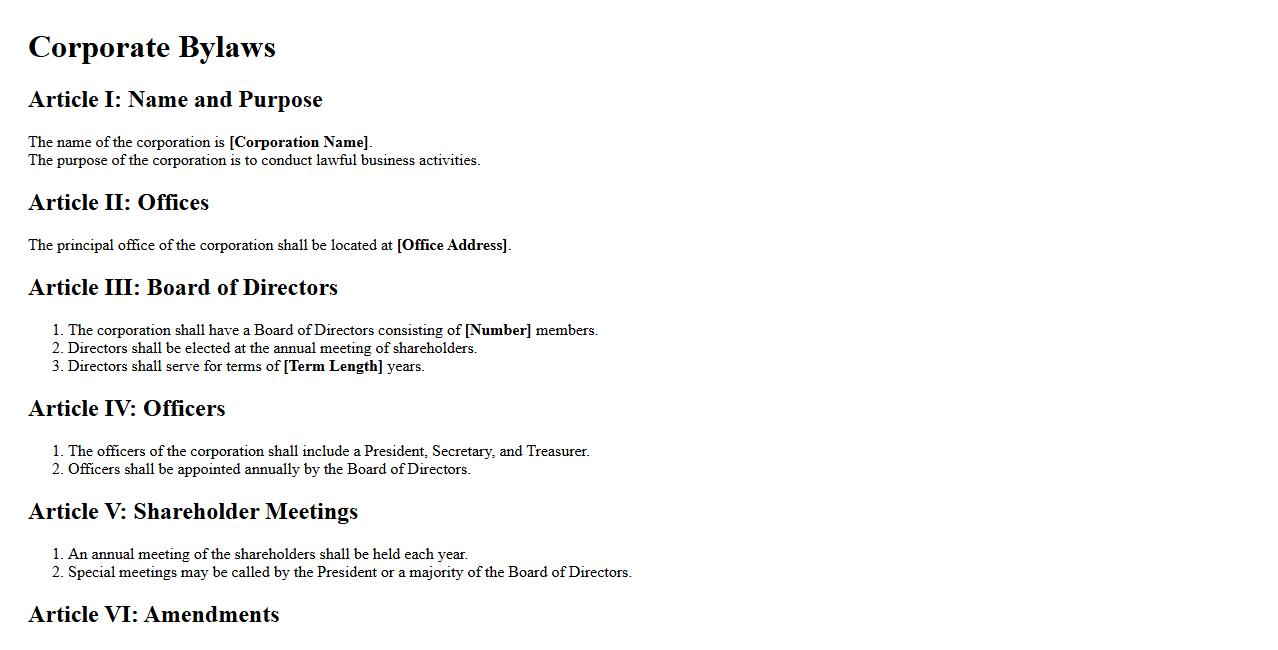

Corporate Bylaws

Corporate Bylaws are essential rules that govern the management and operations of a corporation. They outline the responsibilities of directors, officers, and shareholders, ensuring smooth organizational procedures. These bylaws provide a clear framework for decision-making and conflict resolution within the company.

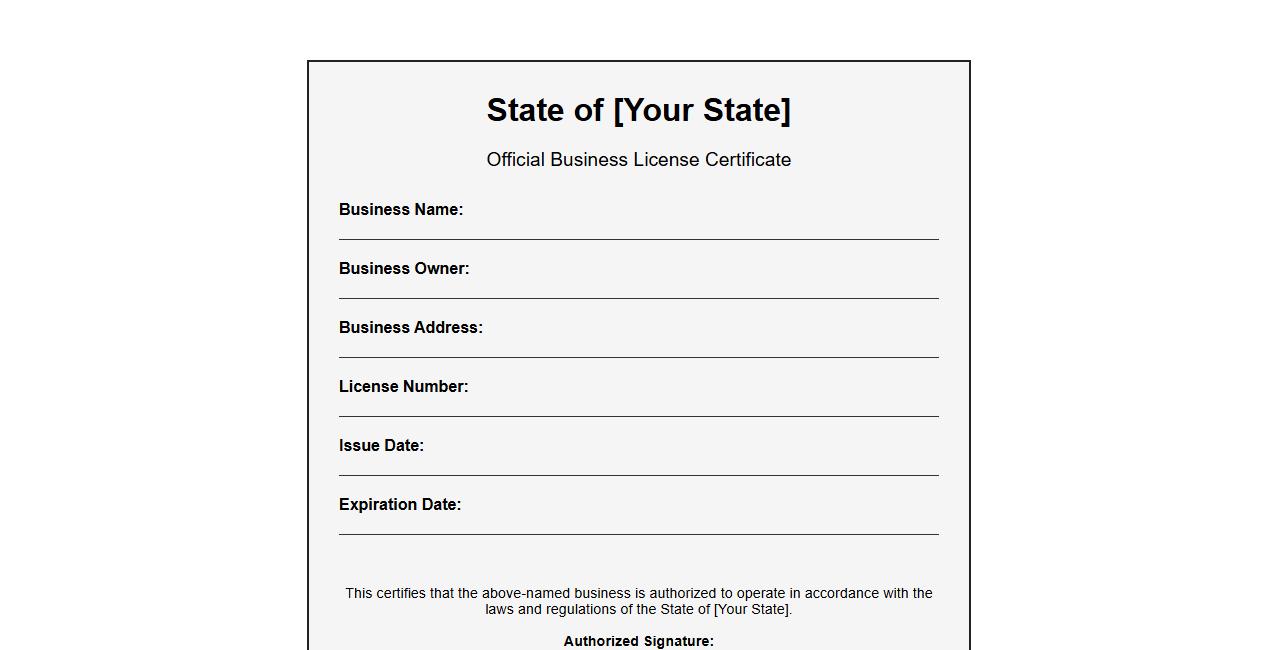

State Business License

Obtaining a State Business License is essential for legally operating a business within a specific state. This license ensures compliance with state regulations and allows businesses to conduct activities without legal interruptions. Most states require this license to monitor and regulate business practices effectively.

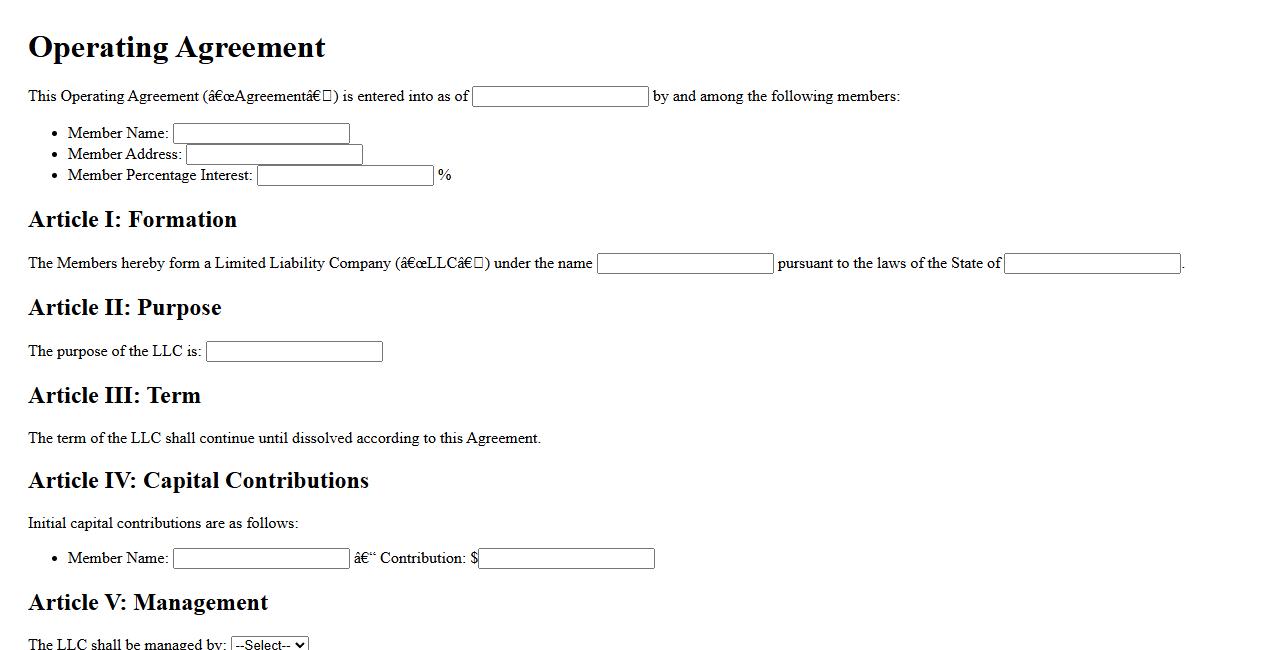

Operating Agreement

An Operating Agreement is a legal document outlining the management structure and operating procedures of a limited liability company (LLC). It defines the roles, responsibilities, and ownership percentages of members to ensure clarity and prevent disputes. This agreement is essential for protecting members' interests and governing internal affairs effectively.

Certificate of Good Standing

A Certificate of Good Standing is an official document issued by a state government, verifying that a business entity has complied with all required state regulations. It confirms that the company is authorized to operate and is up to date with filings and fees. This certificate is often necessary for legal, financial, or business transactions.

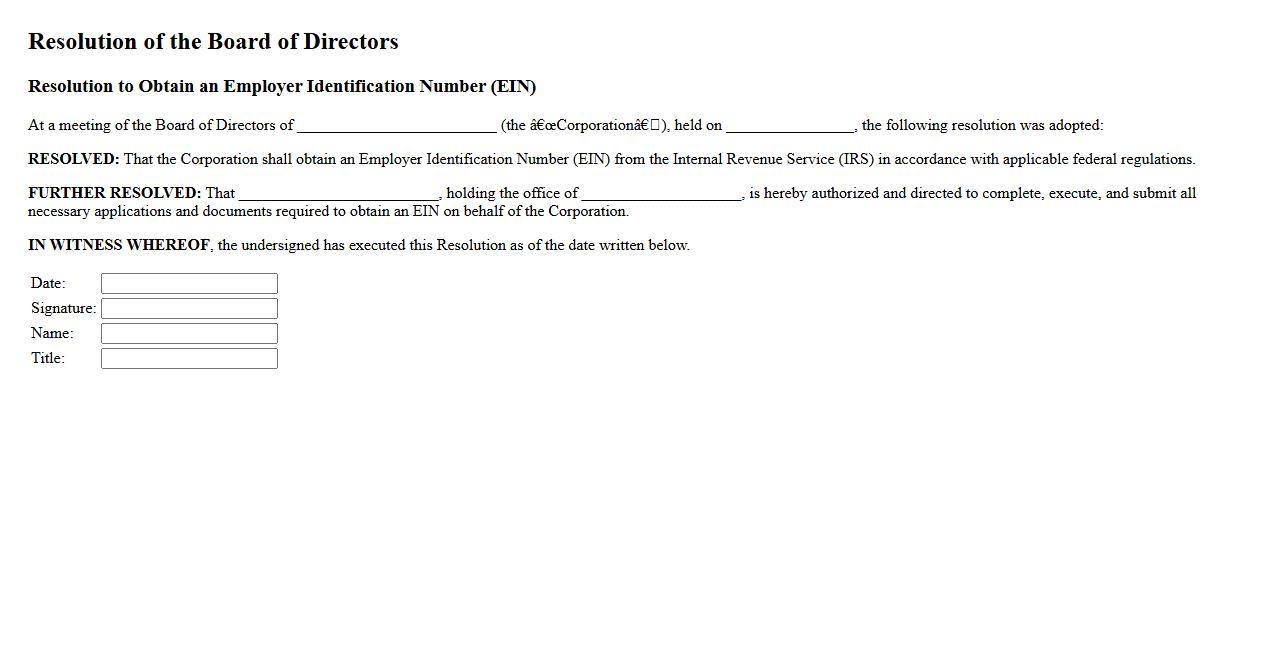

Resolution to Obtain EIN

Applying for a Resolution to Obtain EIN is a crucial step for businesses seeking an Employer Identification Number from the IRS. This official document authorizes a designated individual to act on behalf of the company in obtaining the EIN. Ensuring proper resolution facilitates compliance and smooth processing for tax and legal purposes.

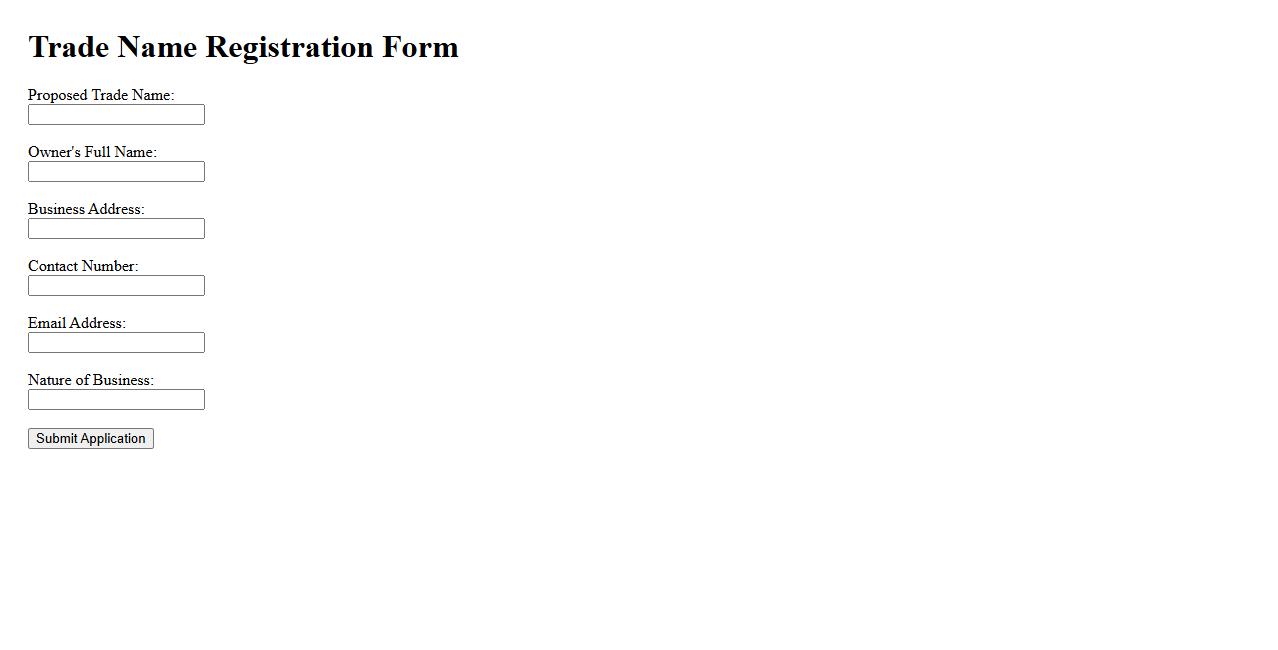

Trade Name Registration

Trade Name Registration is the process of formally recording a business name with the appropriate government authorities to ensure legal protection and exclusive use. This registration helps prevent others from using a similar name that could confuse customers or dilute the brand. It is a crucial step for establishing a recognizable identity in the marketplace.

What information is required to complete the EIN registration document?

To complete the EIN registration document, you must provide the legal name of the entity and its trade name, if applicable. The document also requires the taxpayer identification number of the responsible party and the entity's physical address. Additionally, details such as the type of entity and the reason for applying for an EIN are mandatory.

Who is legally authorized to apply for an Employer Identification Number on behalf of an organization?

The individual legally authorized to apply for an EIN is typically the principal officer, general partner, grantor, owner, or trustor of the organization. This person must have the authority to legally bind the entity in business and tax matters. Authorization ensures that the EIN application is completed by a responsible party with proper oversight.

What is the primary purpose of obtaining an Employer Identification Number (EIN) for a business entity?

The primary purpose of obtaining an EIN is to uniquely identify a business entity for federal tax administration. It is essential for filing tax returns, opening bank accounts, and reporting employment taxes. The EIN serves as a critical identifier for business tax compliance and official communication with the IRS.

How does the EIN registration document address different organizational structures (e.g., sole proprietorship, partnership, corporation)?

The EIN registration document requires applicants to specify their organizational structure by selecting categories like sole proprietorship, partnership, or corporation. This information determines the tax treatment and filing requirements applicable to the entity. Accurate classification ensures the IRS applies the correct tax regulations to the business.

What are the implications stated in the registration document regarding incorrect or false information provided during the EIN application process?

The registration document clearly states that providing incorrect or false information may result in penalties and legal consequences. Misrepresentation can lead to denial of the EIN or revocation of the assigned number. Applicants are legally obligated to submit accurate and truthful information to maintain compliance with federal laws.