The registration for PAN Card involves submitting essential personal and financial details through the official online portal or authorized centers. Applicants must provide documents such as proof of identity, address, and date of birth to complete the process. Once verified, the PAN Card is issued, serving as a unique identifier for financial transactions in India.

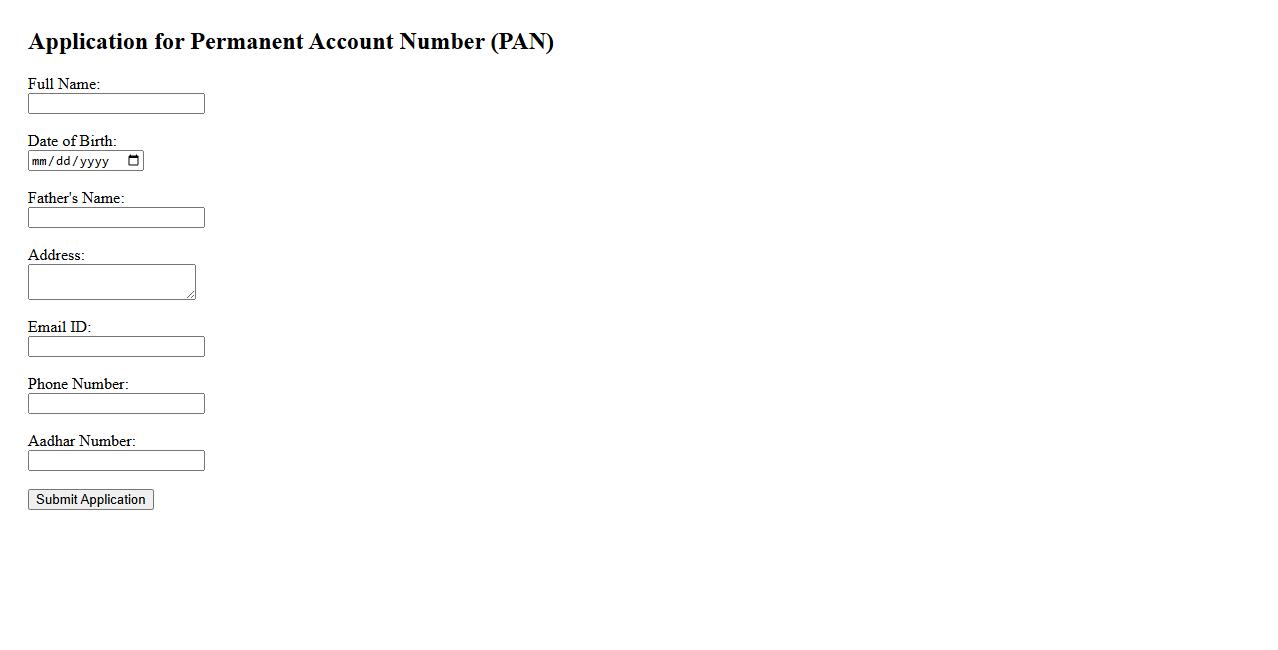

Application for Permanent Account Number (PAN)

The Application for Permanent Account Number (PAN) is a crucial process for individuals and entities in India to obtain a unique identifier for financial transactions. This facilitates tracking of tax payments and helps prevent tax evasion. The application can be submitted online or offline through authorized centers.

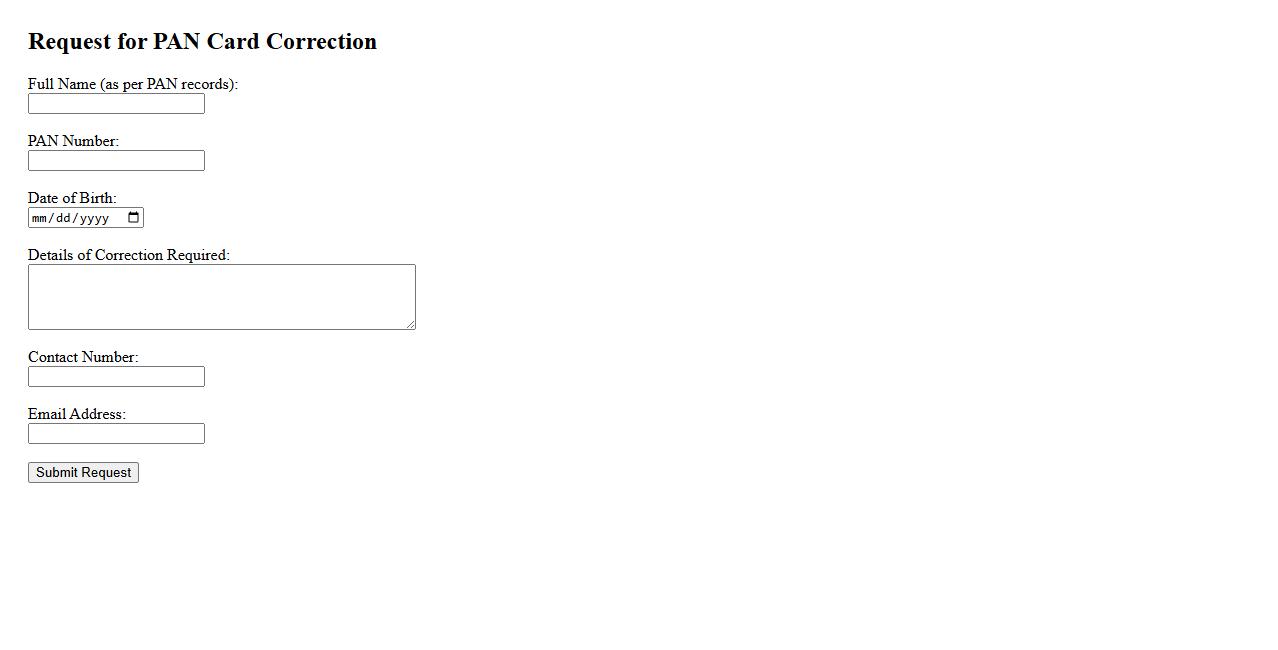

Request for PAN Card Correction

If you notice any errors on your PAN card, you can submit a Request for PAN Card Correction to update the details. This process ensures your personal information is accurate and matches government records. Timely correction helps avoid discrepancies in financial and tax-related activities.

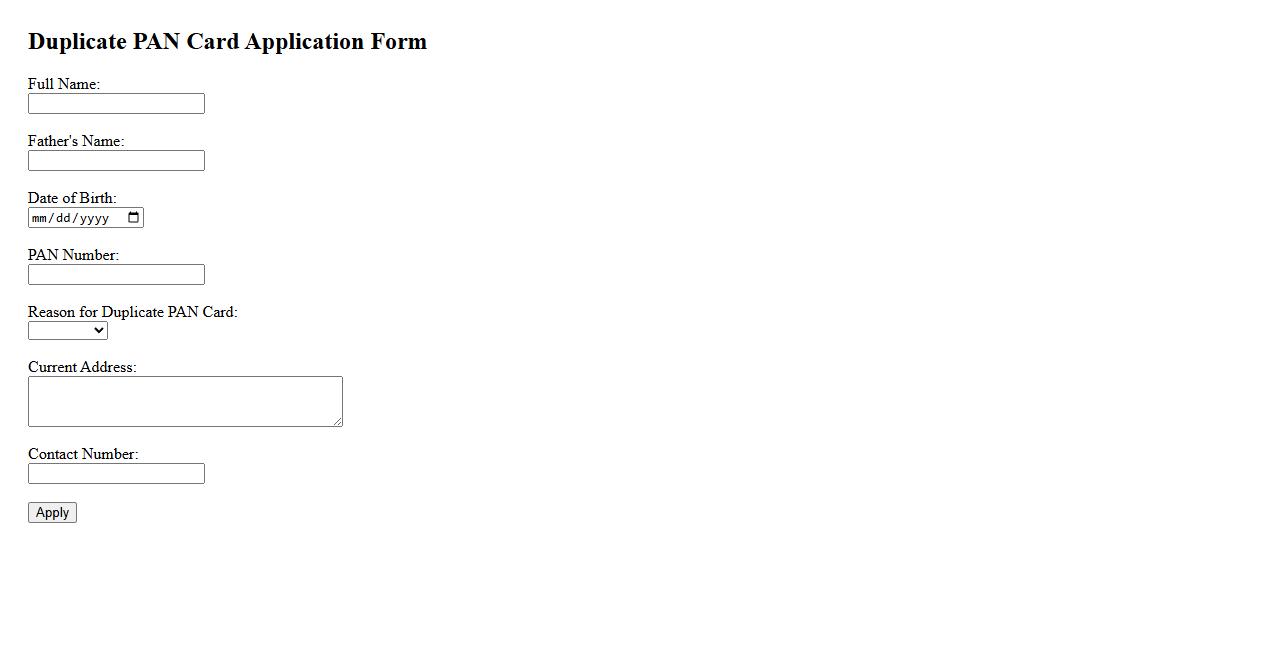

Duplicate PAN Card Application

Applying for a Duplicate PAN Card is essential when the original card is lost, stolen, or damaged. The process involves submitting a request through the official portal with necessary identification documents. Timely application ensures uninterrupted financial transactions and compliance with tax regulations.

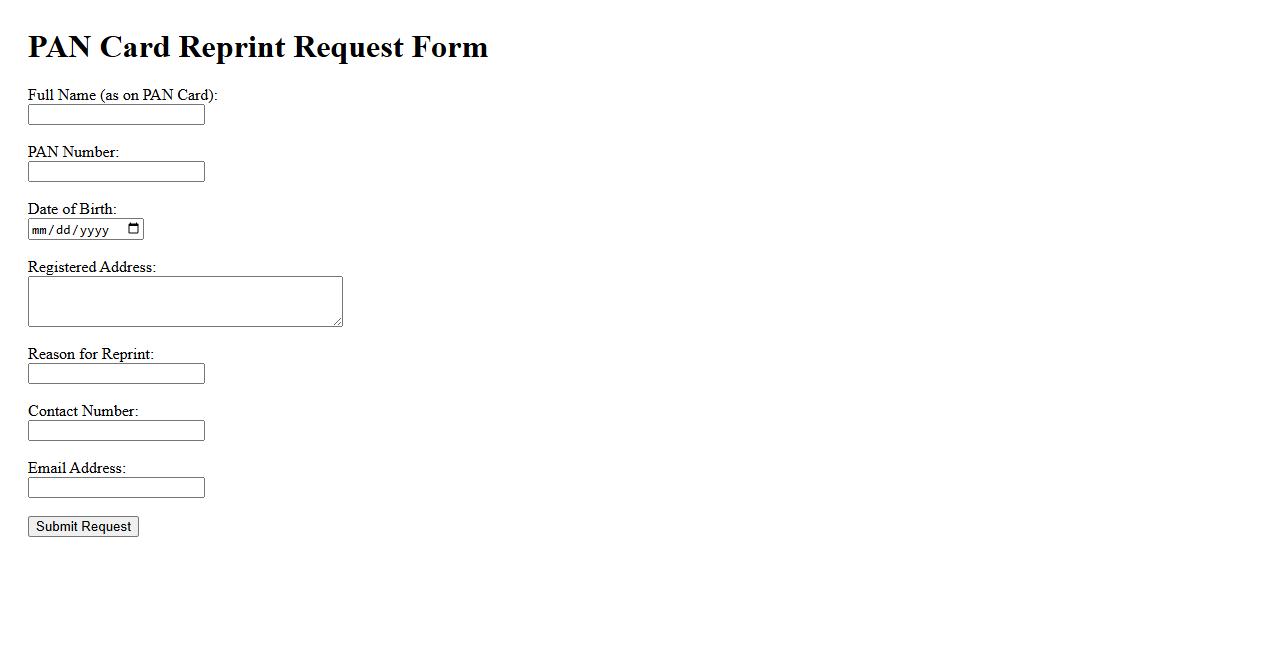

PAN Card Reprint Request

Filing a PAN Card Reprint Request is essential when your PAN card is lost, damaged, or the details need correction. This process allows you to obtain a duplicate card without hassle. It ensures your financial transactions remain uninterrupted with a valid identity proof.

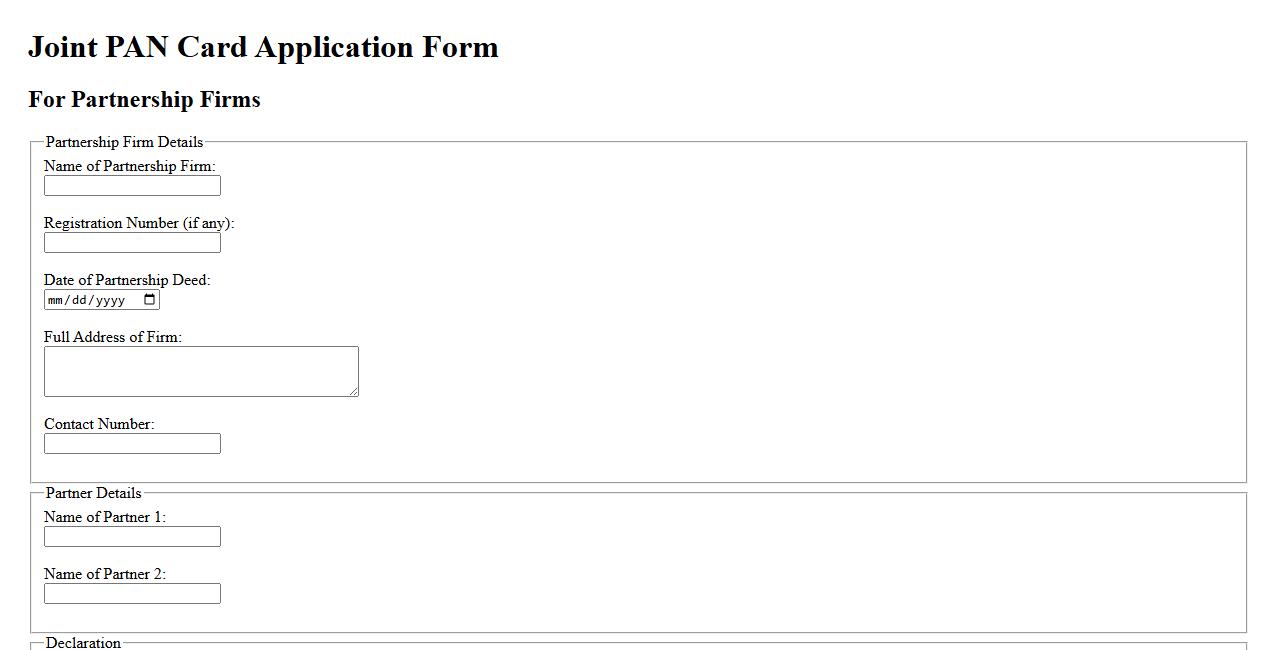

Joint PAN Card Application (for partnership firms)

The Joint PAN Card Application is designed for partnership firms to obtain a Permanent Account Number collectively. This process ensures that the firm is recognized for tax and financial transactions under a single entity. It simplifies compliance and enhances accountability for all partners involved.

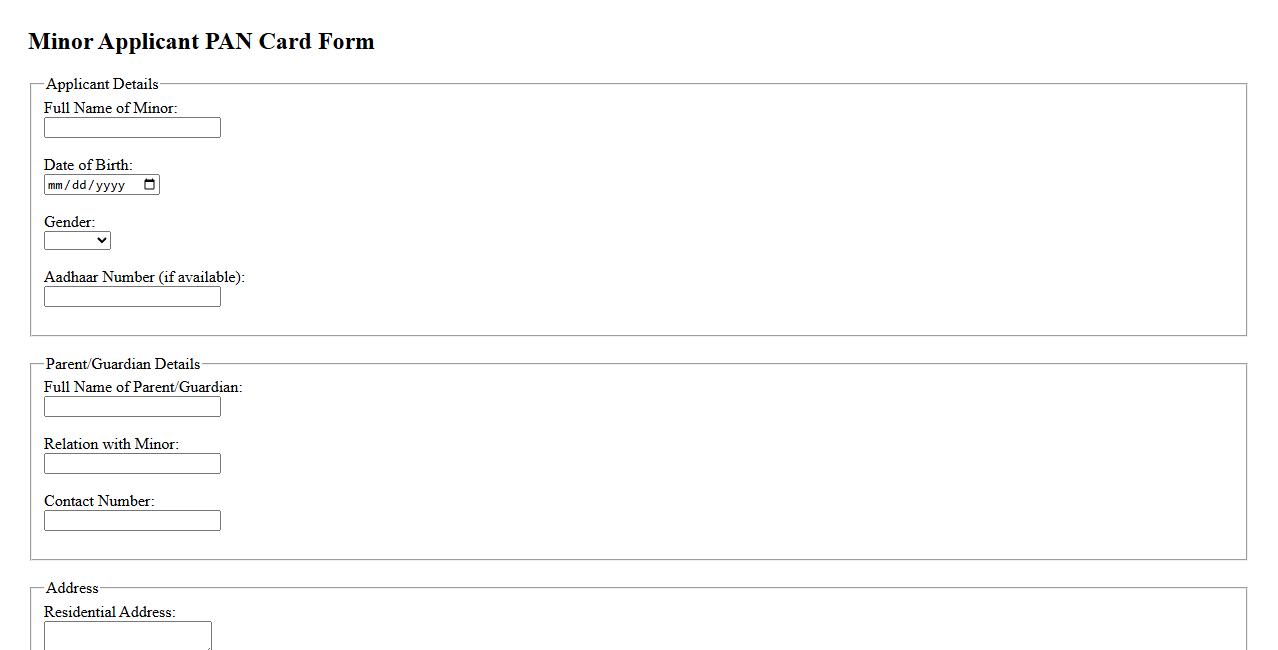

Minor Applicant PAN Card Form

The Minor Applicant PAN Card Form is used to apply for a Permanent Account Number for individuals under the age of 18. This form requires details of the minor as well as the guardian's information for successful submission. It ensures that minors can have a PAN card for financial and tax-related purposes.

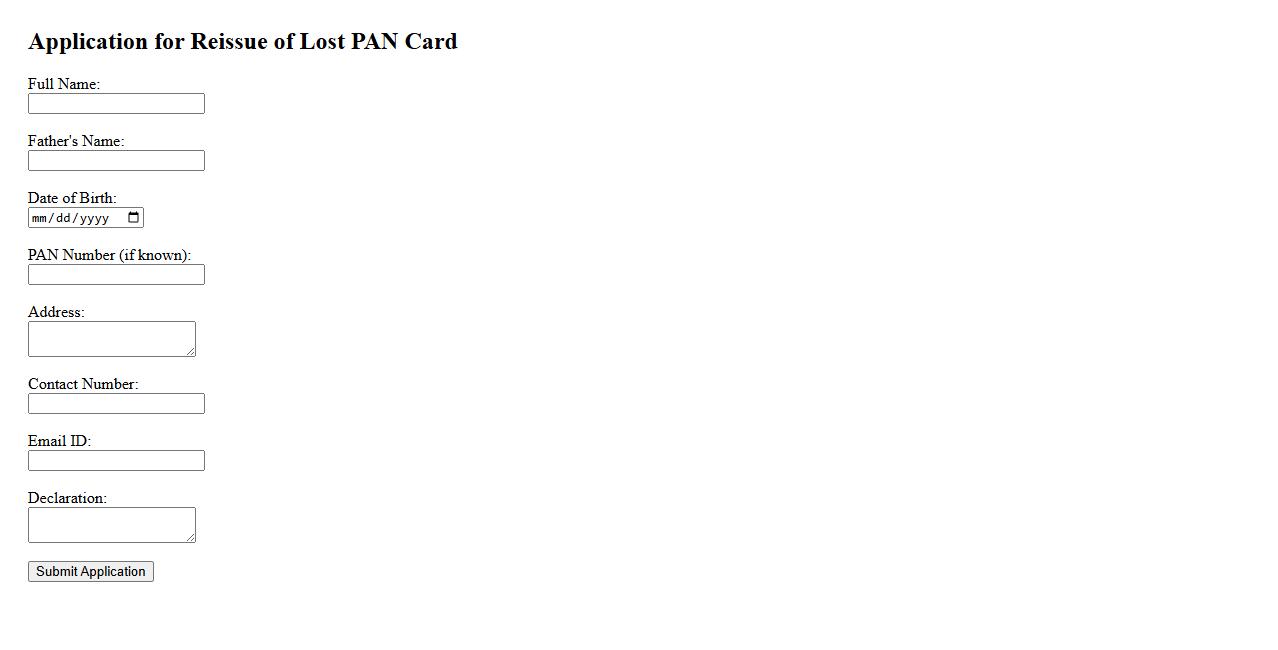

Reissue of Lost PAN Card

The Reissue of Lost PAN Card is a simple and secure process to obtain a duplicate Permanent Account Number card if your original is misplaced. This service helps individuals maintain their financial transactions and tax filings without interruption. Applying online through the official portal ensures quick processing and delivery of the reissued card.

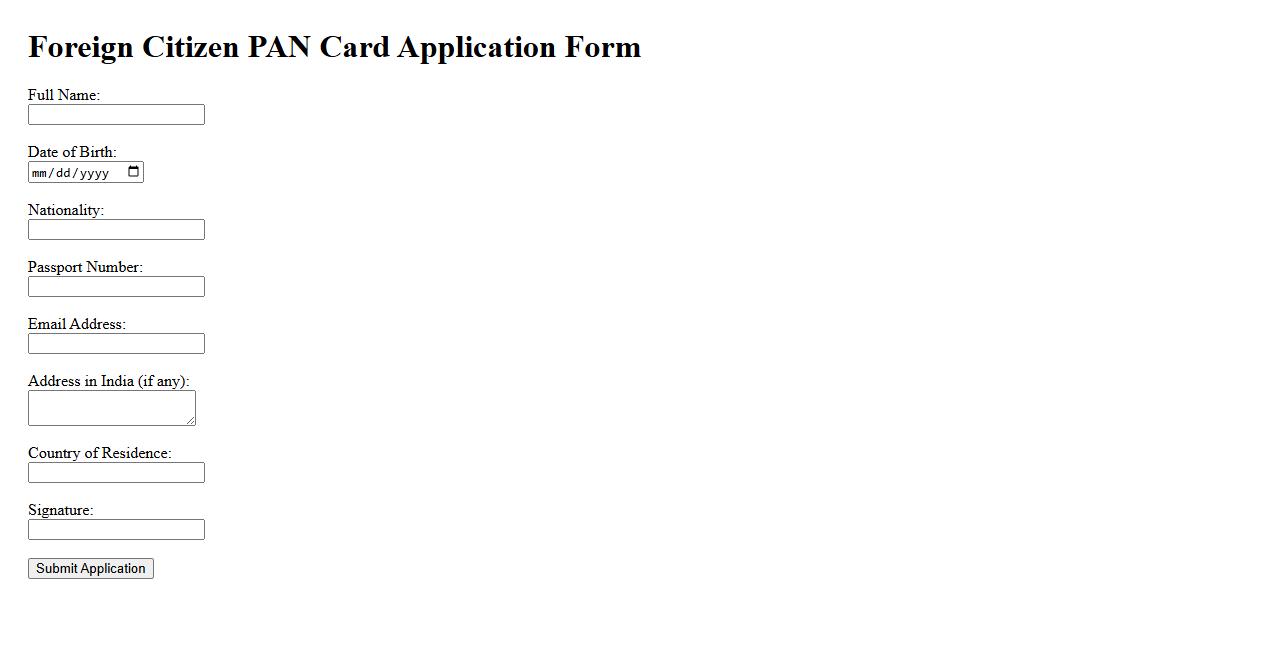

Foreign Citizen PAN Card Application

Applying for a Foreign Citizen PAN Card is essential for non-resident Indians and foreign nationals engaged in financial transactions in India. The process involves submitting required documents such as proof of identity, address, and passport details. Obtaining this card enables smooth tax filing and legal compliance in India.

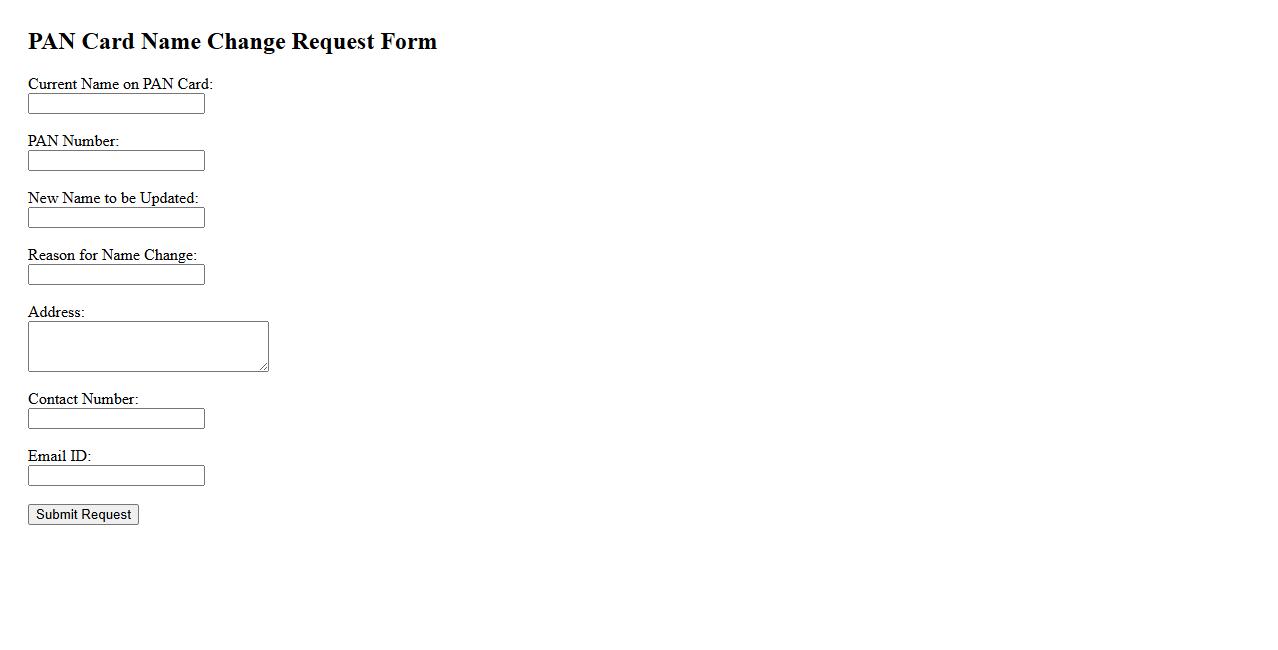

PAN Card Name Change Request

The PAN Card Name Change Request is a process for updating your name on the Permanent Account Number card issued by the Income Tax Department of India. This service is essential for individuals who have undergone a name change due to marriage, legal reasons, or any other valid cause. Submitting the correct documents and following the official procedure ensures your PAN card reflects your current and accurate personal information.

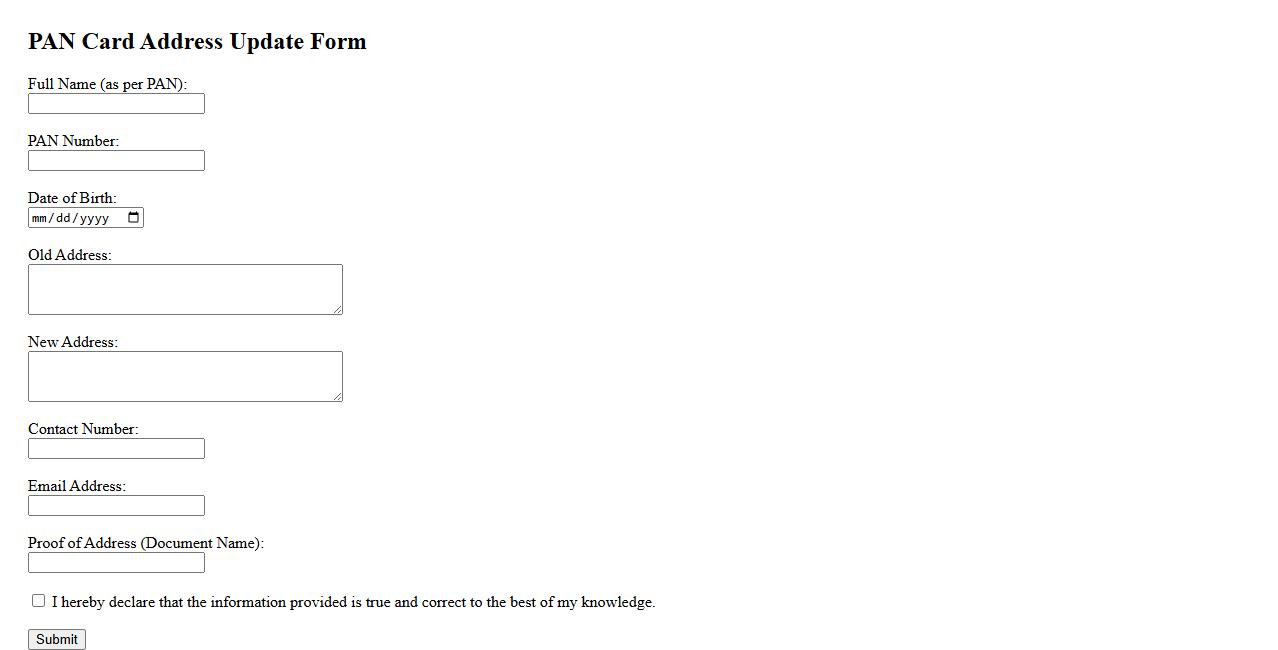

PAN Card Address Update Form

The PAN Card Address Update Form is used to request changes or corrections to the address details on your Permanent Account Number (PAN) card. This form ensures that your updated address is officially recorded with the Income Tax Department. Accurate address information is essential for receiving important correspondence related to your tax filings.

What information is required to complete the PAN Card registration form?

To complete the PAN Card registration form, applicants must provide personal details such as full name, date of birth, and gender. Additionally, contact information including address, email ID, and phone number is required. Income details and proof of identity must also be furnished to ensure accuracy.

Which documents are accepted as valid proof of identity and address for PAN Card registration?

Valid documents for proof of identity include Aadhaar card, passport, voter ID, and driving license. For proof of address, documents like utility bills, bank statements, and rental agreements are accepted. These documents must be current and issued by recognized authorities to be valid.

What are the eligibility criteria for applying for a PAN Card?

Anyone who is an Indian citizen or a foreign national with taxable income in India is eligible to apply for a PAN Card. Entities such as companies, firms, and trusts can also apply for a PAN. The applicant must ensure that the information provided is truthful and verifiable.

What steps are involved in the online PAN Card registration process?

The online PAN Card registration process begins with filling out the application form on the official portal. Next, applicants must upload the required documents and make the payment for processing fees. Lastly, submission verification is conducted before issuing the PAN Card.

How can an applicant track the status of their PAN Card registration?

Applicants can track their PAN Card registration status by visiting the official website and entering their acknowledgment number. Email and SMS alerts are also provided to keep applicants updated. This tracking helps applicants stay informed about the processing stages and delivery.