Obtaining a Registration for Import Export Code (IEC) is essential for businesses involved in international trade. This unique 10-digit code, issued by the Directorate General of Foreign Trade (DGFT), facilitates smooth customs clearance and compliance with government regulations. The registration process requires submitting basic business documents online, enabling easy tracking and approval within a few days.

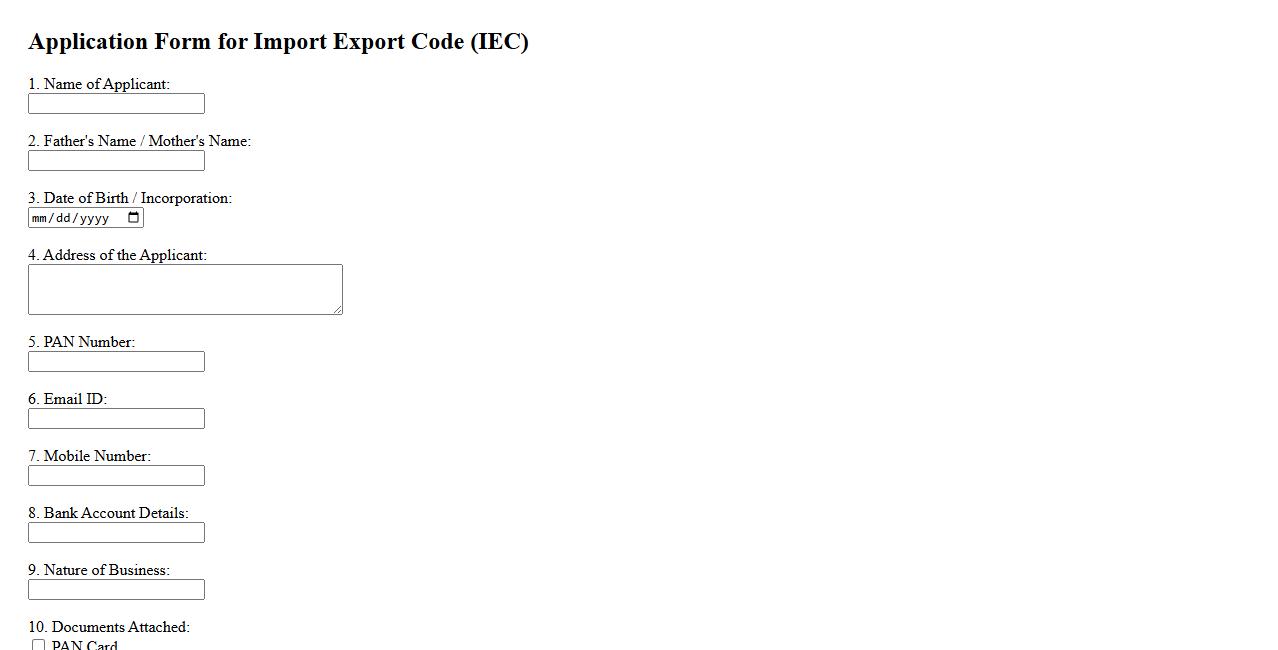

Completed application form for Import Export Code

Submitting a completed application form for Import Export Code is essential for businesses engaging in international trade. This form provides necessary details to the licensing authority for smooth processing. Ensuring accuracy in the application helps in quick approval and start of import-export operations.

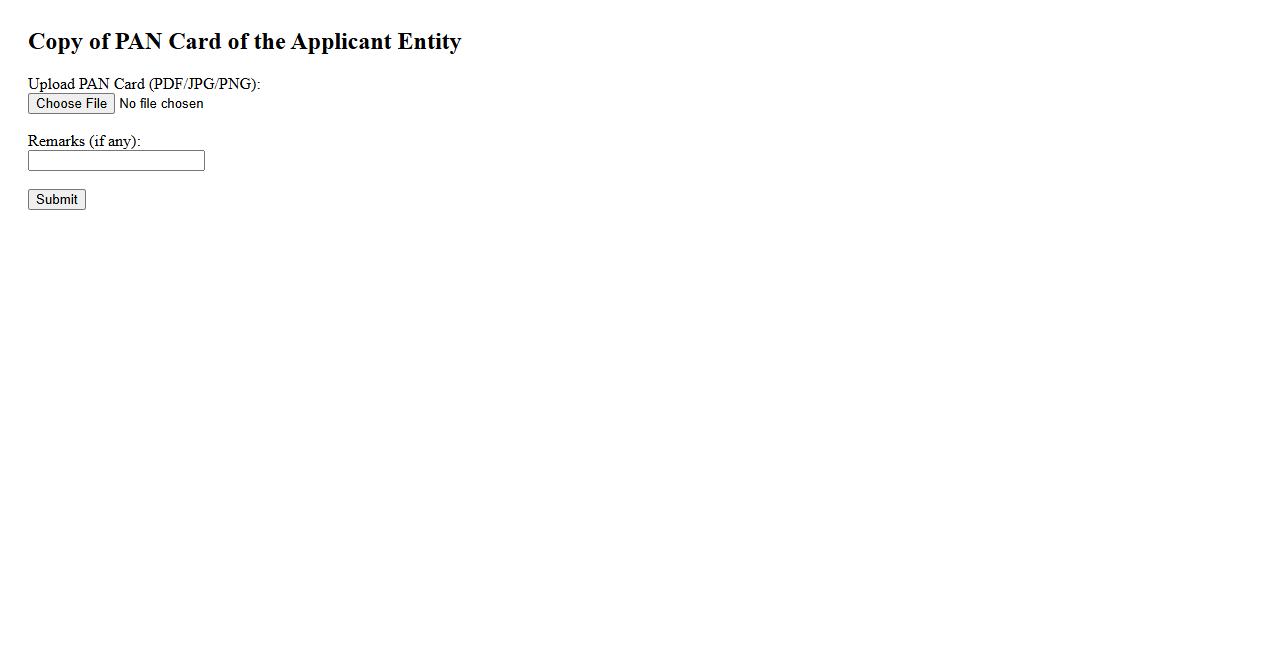

Copy of PAN card of the applicant entity

A copy of PAN card of the applicant entity is essential for identity verification and tax-related purposes. It serves as an official document issued by the Income Tax Department of India. This copy must be clear and legible to ensure accurate processing.

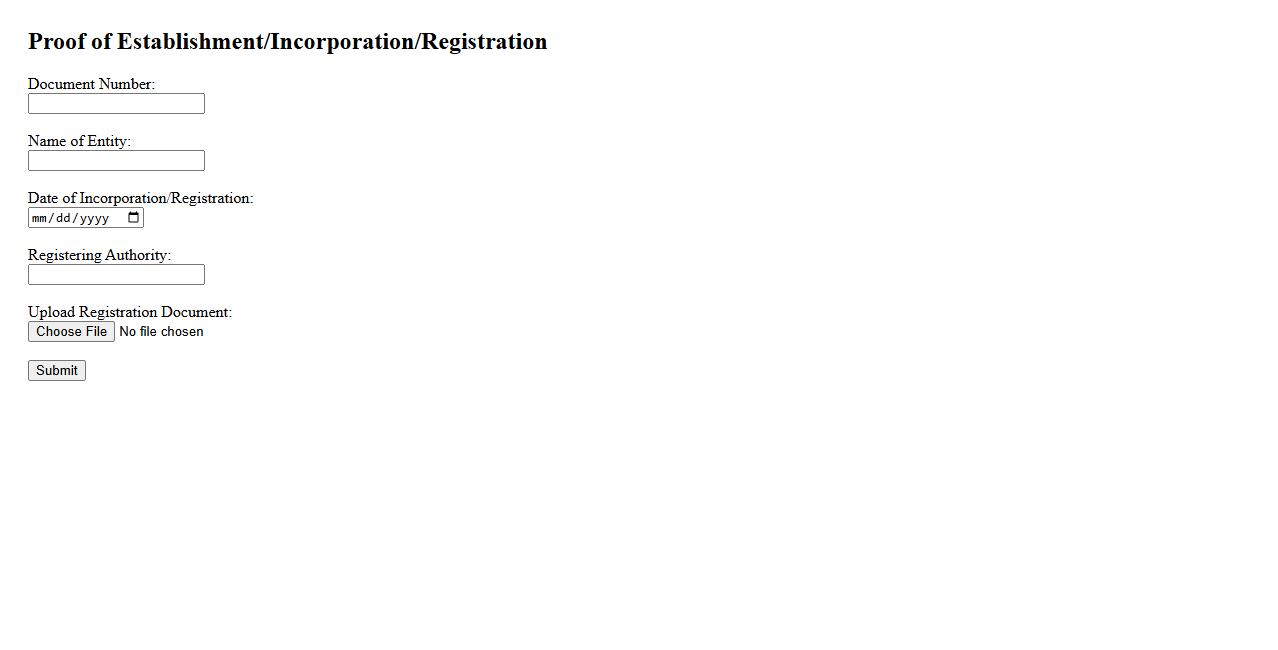

Proof of establishment/incorporation/registration

Proof of establishment or incorporation is a formal document that verifies a company's legal existence and registration with relevant authorities. This document is essential for validating a business's legitimacy and compliance with local regulations. It often includes details such as the company name, registration number, and date of incorporation.

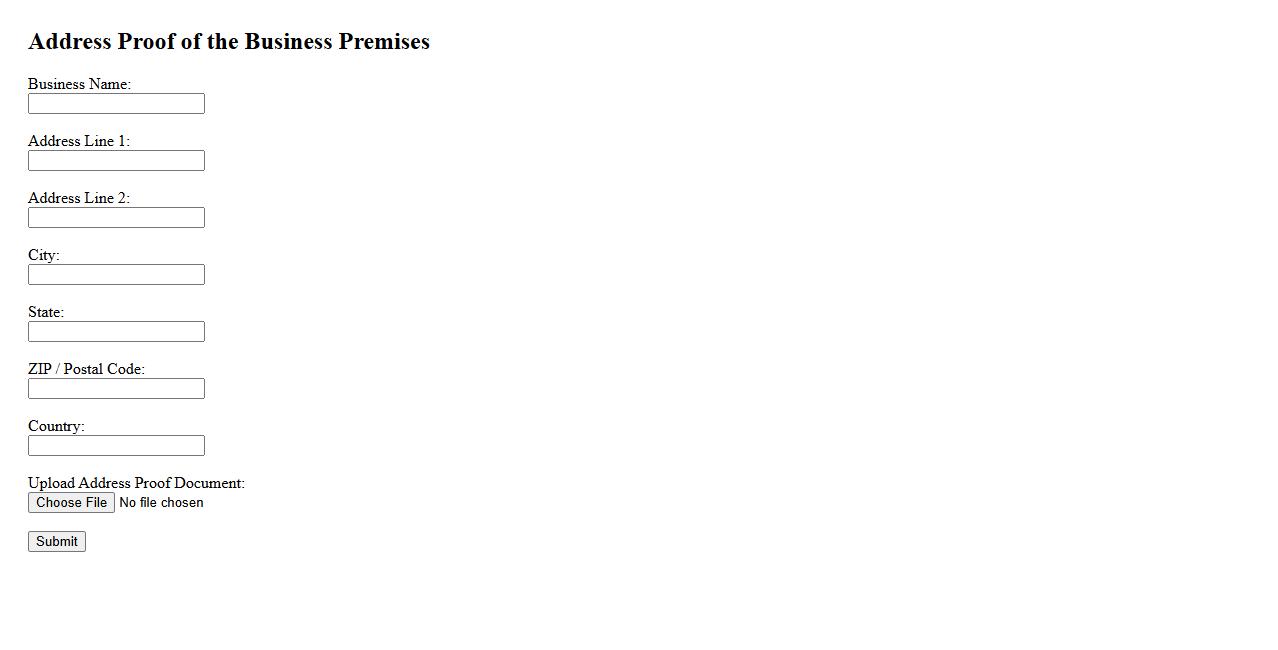

Address proof of the business premises

Address proof of the business premises is a vital document that verifies the physical location of a company. It ensures credibility and compliance with legal requirements for business registration. Common documents used include utility bills, lease agreements, and property tax receipts.

Identity proof of the applicant (Aadhar, Voter ID, Passport, etc.)

Providing identity proof of the applicant is essential for verification purposes. Common documents accepted include Aadhar, Voter ID, and Passport. These documents ensure accurate and secure identification during the application process.

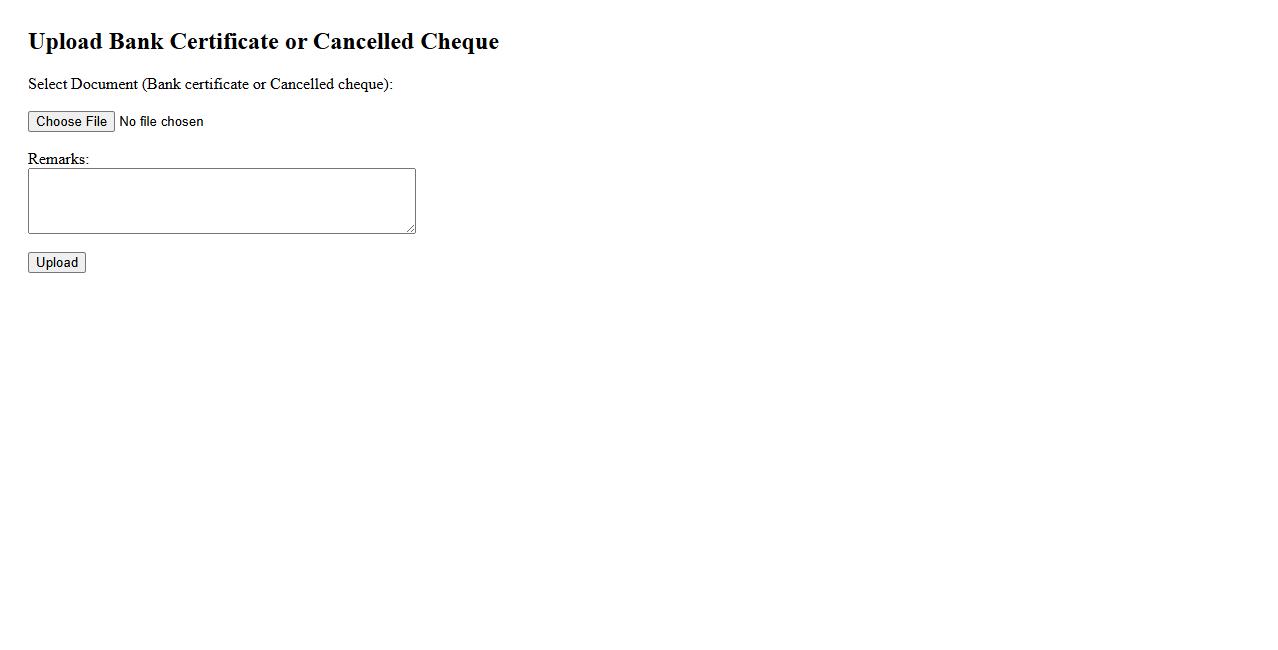

Bank certificate or cancelled cheque of the entity

A bank certificate or cancelled cheque of the entity serves as official proof of the bank account details. It verifies the account holder's information and is often required for financial transactions or compliance purposes. This document ensures accurate and secure processing of payments and receipts.

Digital photograph of the applicant

This digital photograph of the applicant provides a clear and professional image suitable for identification purposes. It captures the applicant's facial features with accurate color and sharpness. The photograph meets all standard requirements for official documents.

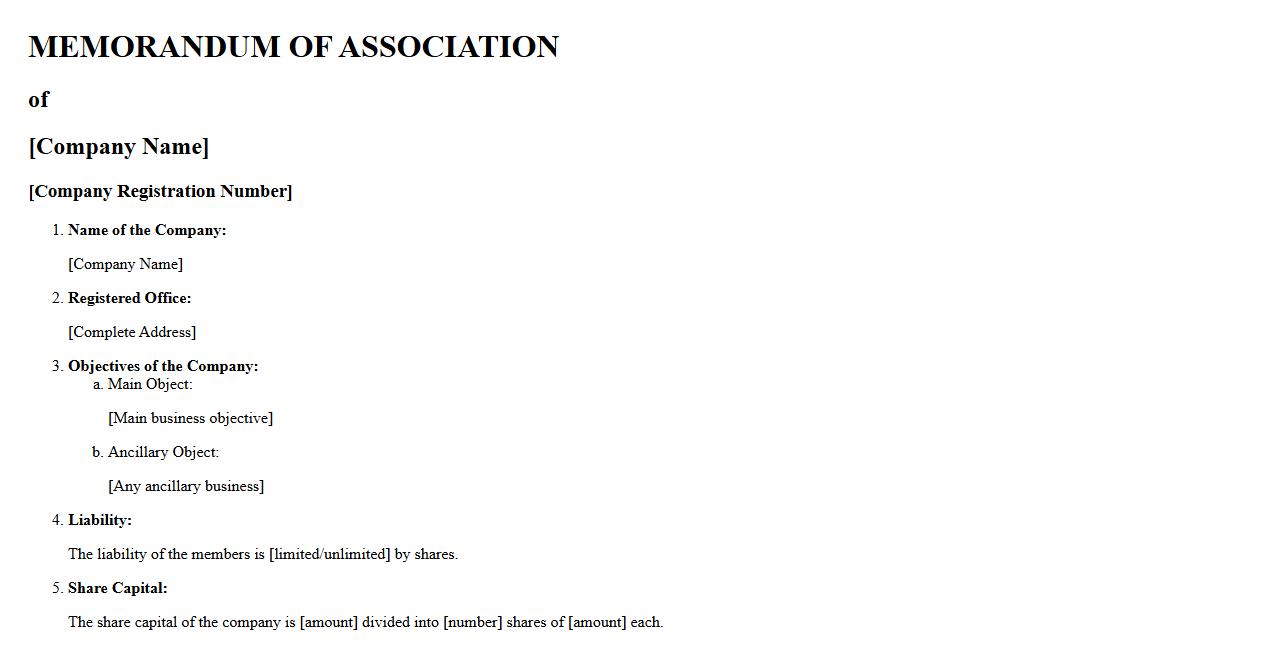

Memorandum of Association (MOA), if applicable

The Memorandum of Association (MOA) is a legal document that defines a company's constitution and scope of power. It outlines the company's objectives, powers, and the relationship with its shareholders. If applicable, it serves as a crucial guide for the company's operations and external dealings.

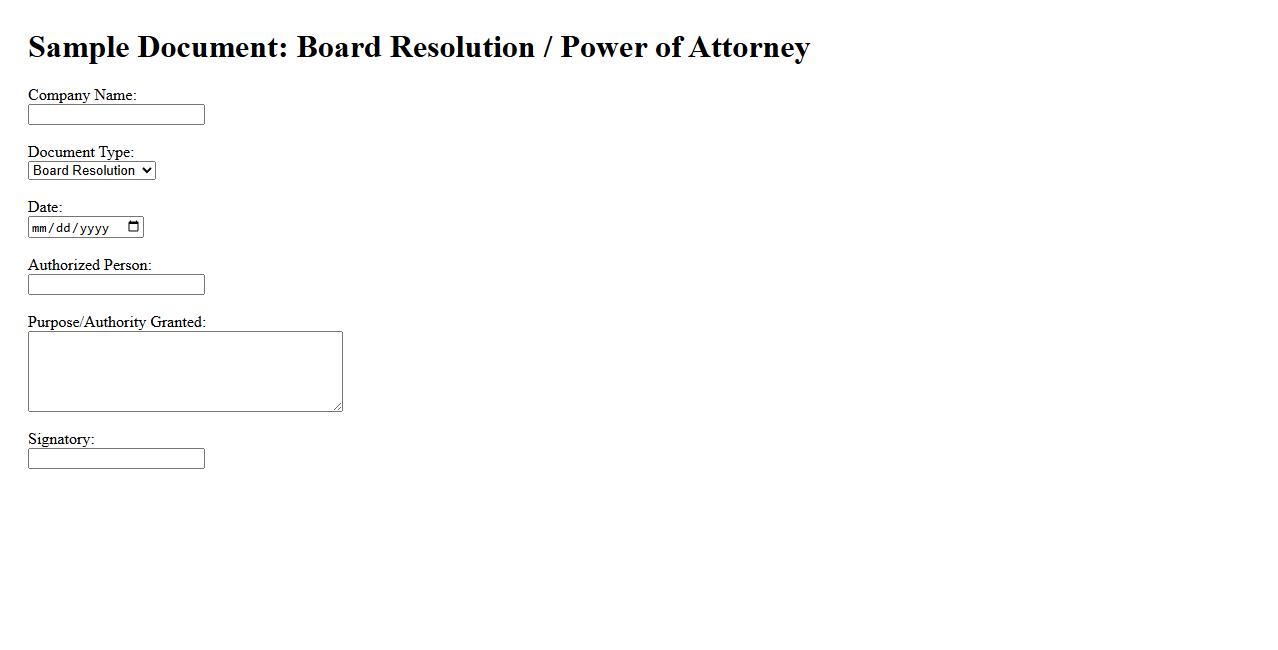

Board resolution or power of attorney, if required

A board resolution or power of attorney may be required to authorize specific actions or decisions on behalf of a company or individual. This legal document ensures clarity and formal approval for important transactions. It provides official consent and empowers designated representatives to act accordingly.

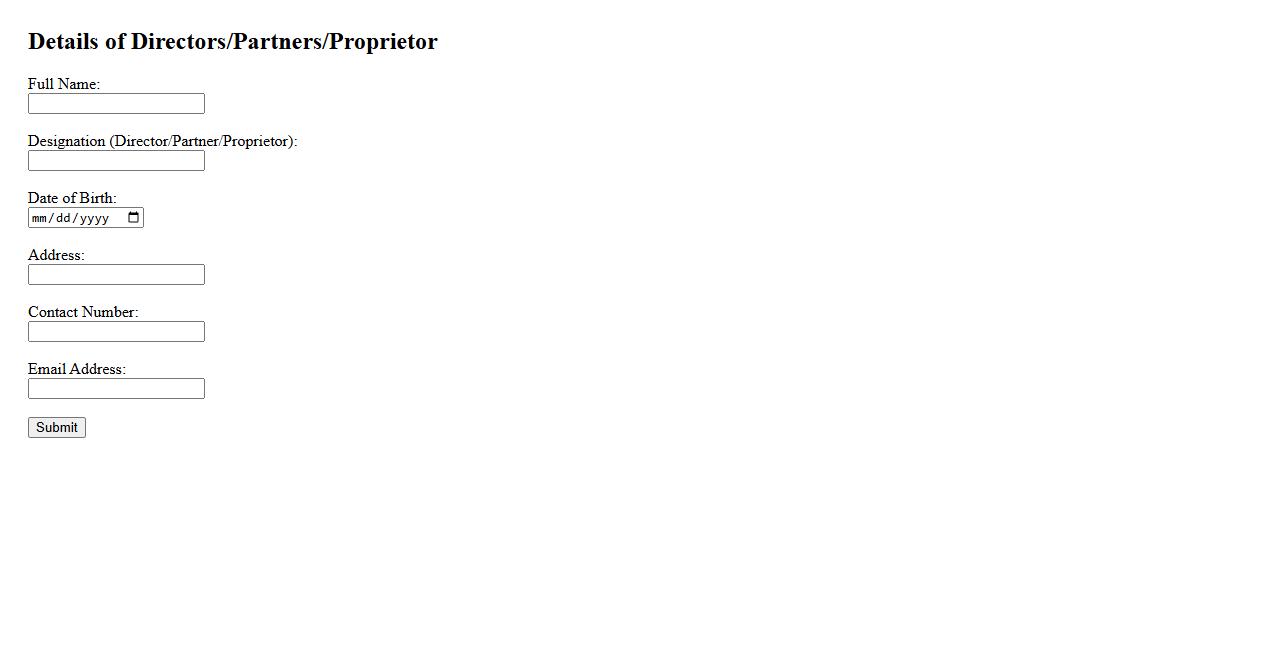

Details of directors/partners/proprietor

The section provides comprehensive details of directors, partners, or proprietors involved in a business or organization. This includes their names, roles, and relevant credentials to establish credibility and accountability. Accurate information ensures transparency and regulatory compliance.

What is the primary purpose of obtaining an Import Export Code (IEC) for a business entity?

The Import Export Code (IEC) serves as a vital registration for businesses engaged in importing and exporting goods and services. Obtaining an IEC is mandatory for legal recognition in foreign trade activities. It enables seamless customs clearance and facilitates government compliance for international transactions.

Which documents are mandatory for successful IEC registration?

Key documents required for IEC registration include the PAN card of the business entity or individual applicant, proof of address, and bank details. Additionally, a passport-sized photograph and a cancelled cheque are often necessary. Ensuring accurate and complete documentation speeds up the IEC approval process.

Who is eligible to apply for an IEC in India?

Any individual, company, partnership firm, or proprietorship engaged in or intending to start import or export activities in India is eligible to apply for an IEC. The applicant must possess a valid PAN card issued by the Indian Income Tax Department. Eligibility extends to all legal entities registered within India, promoting trade inclusivity.

What is the typical validity period of an issued IEC?

The IEC code issued by the Directorate General of Foreign Trade (DGFT) in India has a lifetime validity. Once obtained, there is no need for renewal or periodic updating, simplifying operational continuity. This permanent validity provides a stable foundation for importing and exporting businesses.

Which authorities are responsible for issuing and managing IEC registrations?

The primary authority responsible for issuing and regulating the Import Export Code (IEC) is the Directorate General of Foreign Trade (DGFT), under the Ministry of Commerce and Industry. DGFT ensures that all IEC applications comply with government policies and trade regulations. This centralized management helps maintain standardized foreign trade operations.