Registration for GST (Goods and Services Tax) is a mandatory process for businesses whose turnover exceeds the prescribed threshold, ensuring legal compliance and eligibility to collect tax on sales. The registration enables businesses to avail input tax credit and maintain proper tax records, streamlining tax payments to the government. Completing the process online involves submitting relevant documents and obtaining a unique GST identification number.

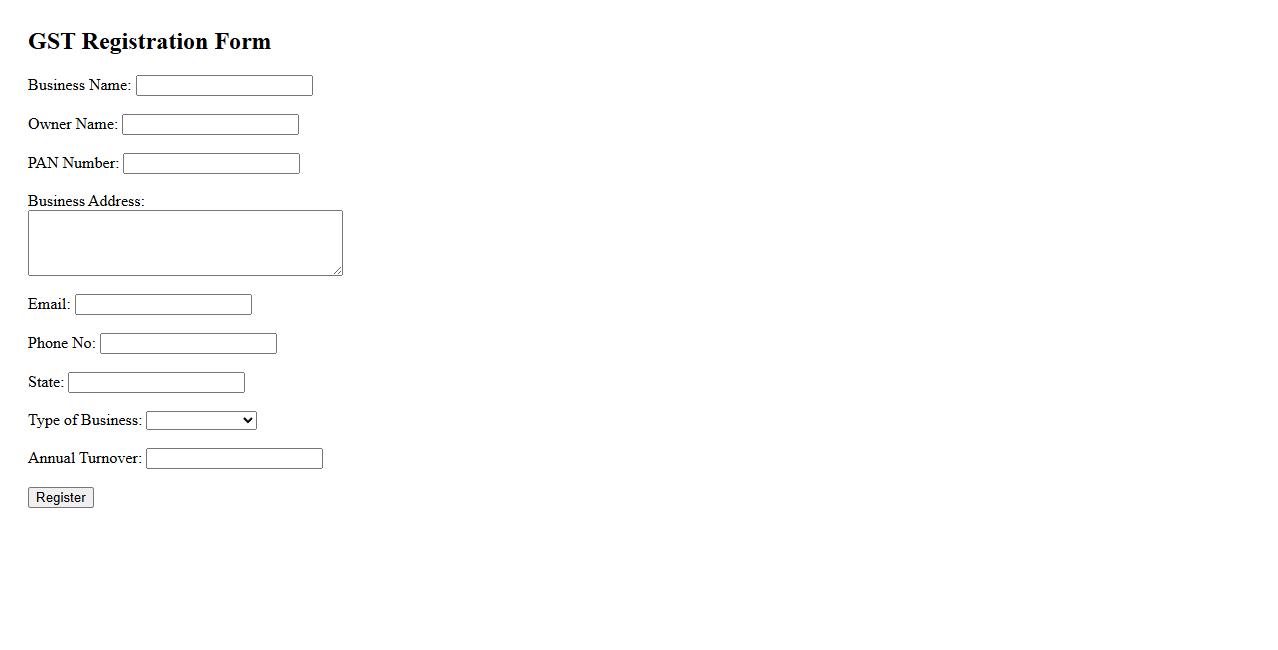

GST Registration Form

The GST Registration Form is a crucial document required for businesses to register under the Goods and Services Tax system. It collects essential information such as business details, PAN number, and address to facilitate compliance. Completing this form accurately ensures seamless tax processing and legal recognition.

Certificate of Incorporation

The Certificate of Incorporation is an official document issued by a government authority that legally establishes a company as a corporation. It includes essential details such as the company's name, registration number, and date of incorporation. This certificate serves as proof that the company is recognized and authorized to operate under corporate law.

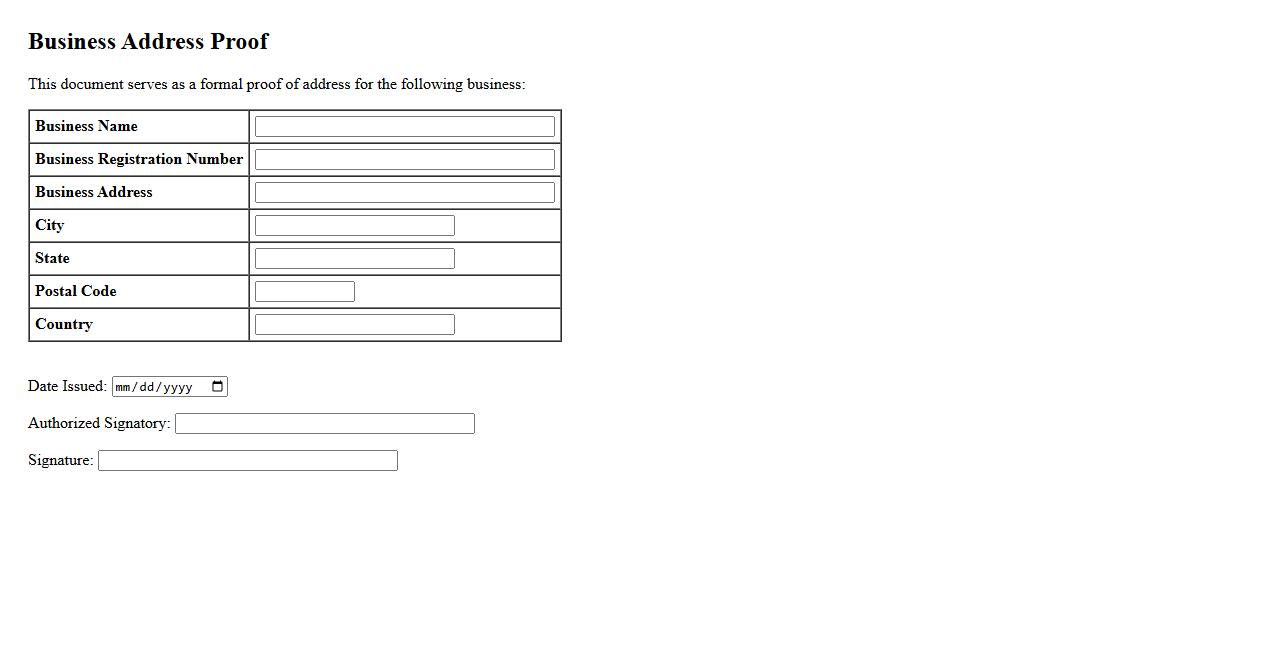

Business Address Proof

Business Address Proof is a crucial document used to verify the official location of a company. It helps establish the legitimacy of a business, facilitating compliance with legal and regulatory requirements. Common forms include utility bills, lease agreements, and government-issued certificates.

PAN Card of Business or Owner

The PAN Card of a business or owner is a crucial identification document issued by the Income Tax Department of India. It uniquely identifies the entity for all financial and tax-related transactions. This card helps ensure transparency and legality in business operations and tax compliance.

Identity Proof of Promoters

Identity Proof of Promoters is a crucial document required to verify the authenticity of individuals backing a business or organization. It typically includes government-issued IDs such as a passport, driver's license, or voter ID, ensuring legal compliance. This proof helps establish trust and transparency in business dealings.

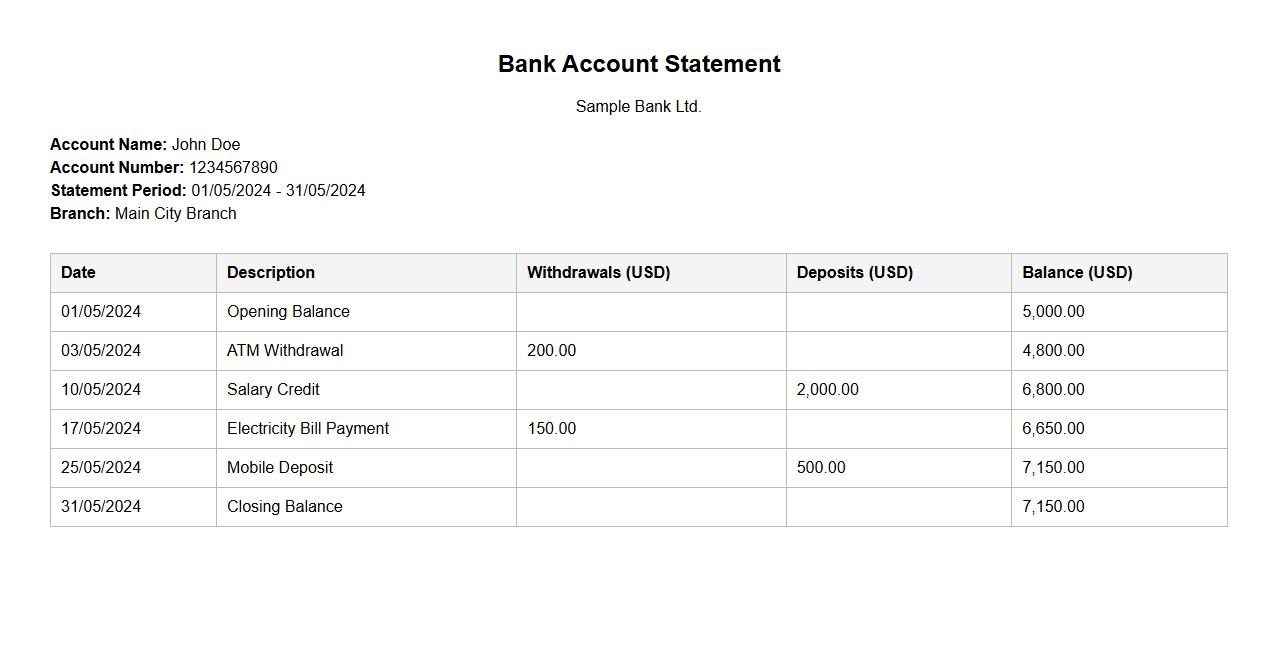

Bank Account Statement

A Bank Account Statement provides a detailed summary of all transactions within a specified period, including deposits, withdrawals, and fees. It helps account holders monitor their financial activities and verify account accuracy. Regularly reviewing statements ensures effective money management and fraud detection.

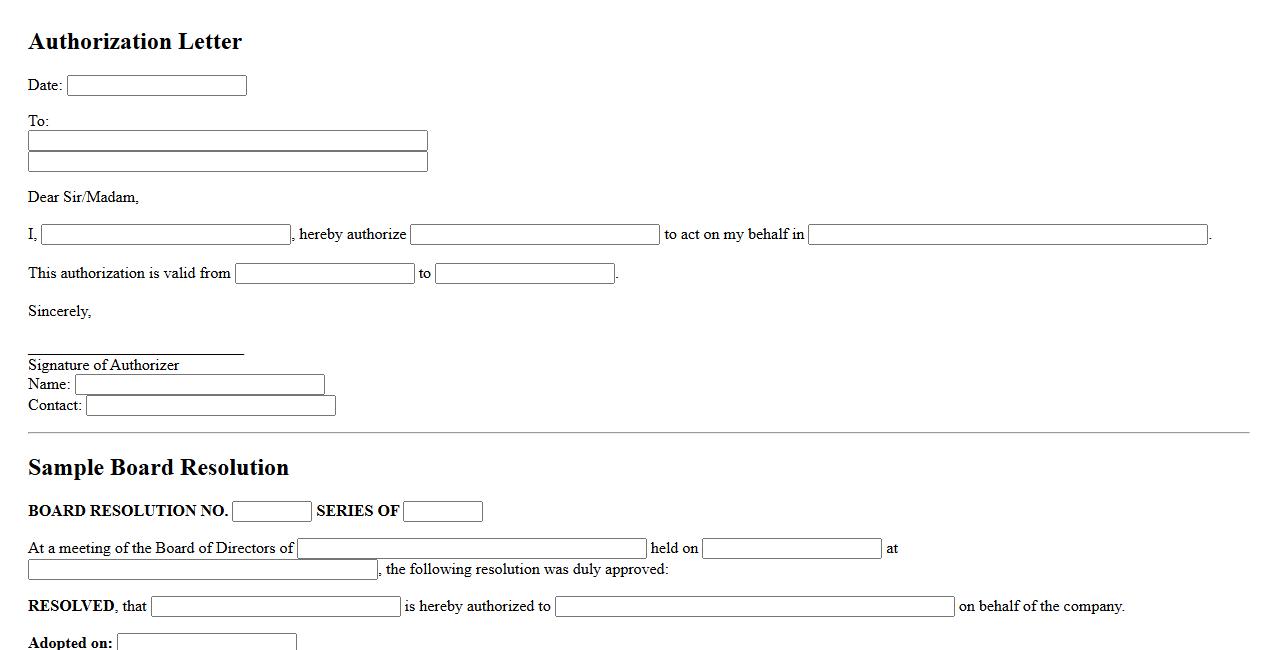

Authorization Letter or Board Resolution

An Authorization Letter or Board Resolution is a formal document that grants permission or authority to an individual or group to act on behalf of an organization. It outlines specific powers or decisions approved by the board or authorized personnel. This document ensures clarity and legality in executing business actions.

Taxpayer Photograph

Taxpayer Photograph is an essential identification image used to verify the identity of an individual in tax-related processes. This photograph helps ensure accuracy and security in taxpayer records and documentation. It is commonly required when registering for tax services or submitting official tax forms.

Trade License or Registration Certificate

The Trade License or Registration Certificate is an official document issued by the local government or authority that authorizes a business to operate legally within a specific jurisdiction. It ensures compliance with regulations and standards, promoting trust and transparency between businesses and customers. Obtaining this certificate is essential for conducting lawful commercial activities.

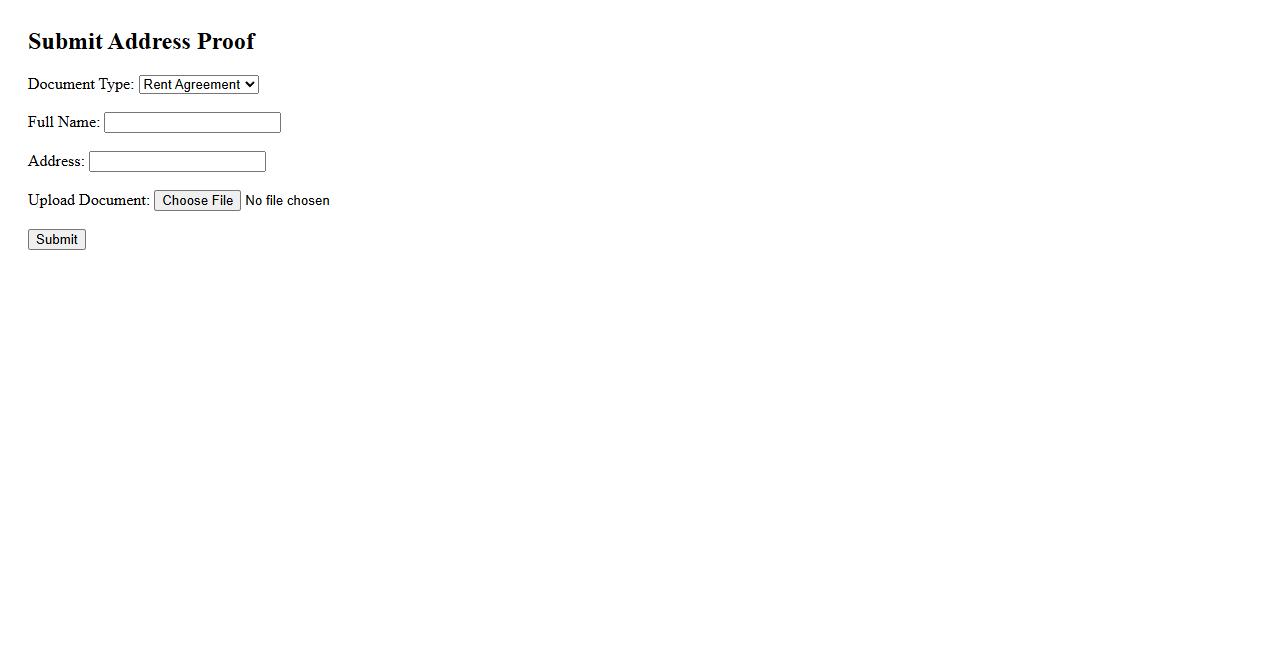

Rent Agreement or Utility Bill as Address Proof

Rent Agreement or utility bill serves as a valid address proof, confirming the occupant's residence. These documents are essential for various legal and administrative purposes, ensuring identity verification and smooth processing. Many institutions accept either as credible evidence of address.

What are the eligibility criteria for mandatory GST registration?

The mandatory GST registration applies to businesses whose aggregate turnover exceeds the prescribed limit in a financial year. This includes individuals engaged in supply of goods or services, casual taxable persons, and those providing online information and database access or retrieval services. Certain special category taxpayers, such as e-commerce operators and input service distributors, are also required to register regardless of turnover.

Which documents are required to complete the GST registration process?

The GST registration process requires submission of key documents including the PAN card of the applicant, proof of business registration or incorporation certificate, and valid address proof of the business premises. Additionally, identity and address proofs of promoters or directors, bank account details, and photographs may also be required. All documents must be uploaded electronically through the GST portal for verification.

How does the threshold limit for GST registration differ for goods and services?

The threshold limits for GST registration vary between goods and services to accommodate sectoral differences. For goods, the limit is generally set at Rs40 lakhs aggregate turnover per annum, whereas for services, it is Rs20 lakhs, with some states having different thresholds under composition schemes. Businesses exceeding these annual turnover thresholds are mandated to register for GST.

What are the consequences of not registering under GST when required?

Failure to register under GST when required leads to several legal and financial consequences. The business may face penalties, interest on tax due, and restriction on input tax credit claims. Additionally, authorities can impose fines and prosecution, which can severely impact normal business operations and credibility.

Can a person voluntarily apply for GST registration before reaching the turnover limit?

Yes, a person can voluntarily apply for GST registration even if their turnover is below the prescribed threshold. This is often done to avail input tax credit benefits and expand business operations. Voluntary registration also allows for compliance benefits and facilitates engagement with other registered businesses.