Registration for Professional Tax is a mandatory process for individuals and entities engaged in professional activities within a specific jurisdiction. This registration ensures compliance with local tax laws and facilitates timely payment of professional tax. Businesses must submit the required application and documents to the appropriate tax authority to obtain their registration certificate.

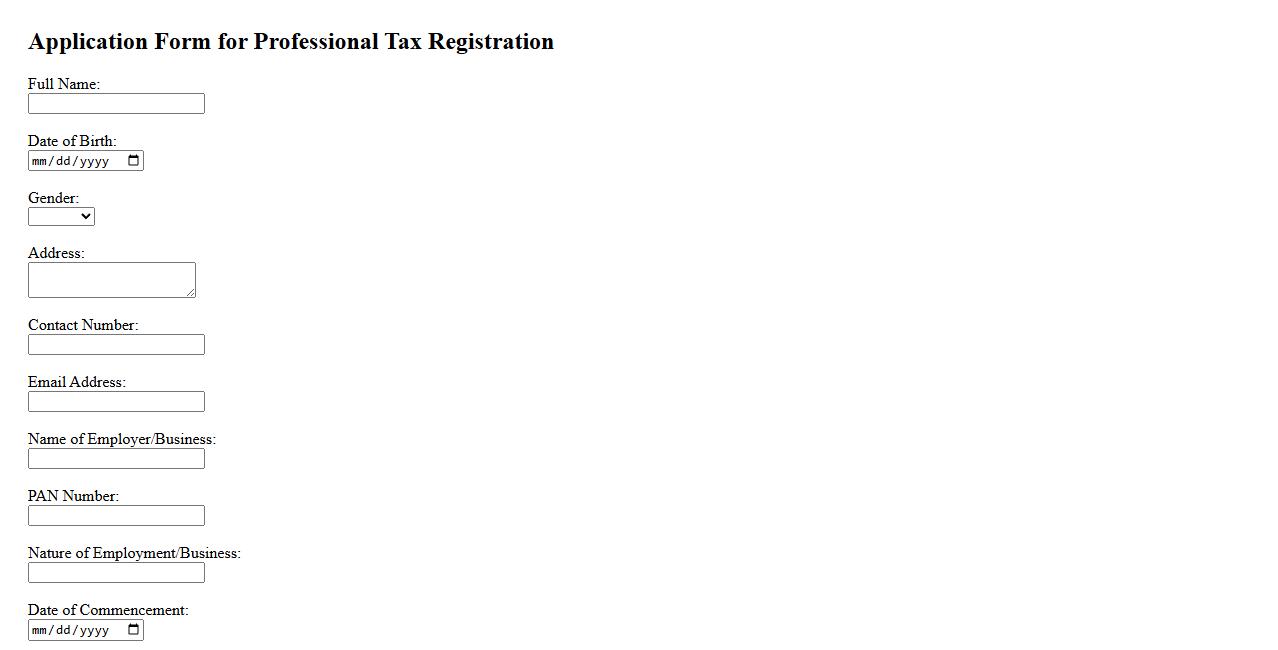

Application form for Professional Tax registration

The Application form for Professional Tax registration is a crucial document for individuals and businesses to comply with tax regulations. It collects essential information for registering and obtaining a professional tax identification number. Timely submission of this form ensures legal compliance and smooth processing of tax obligations.

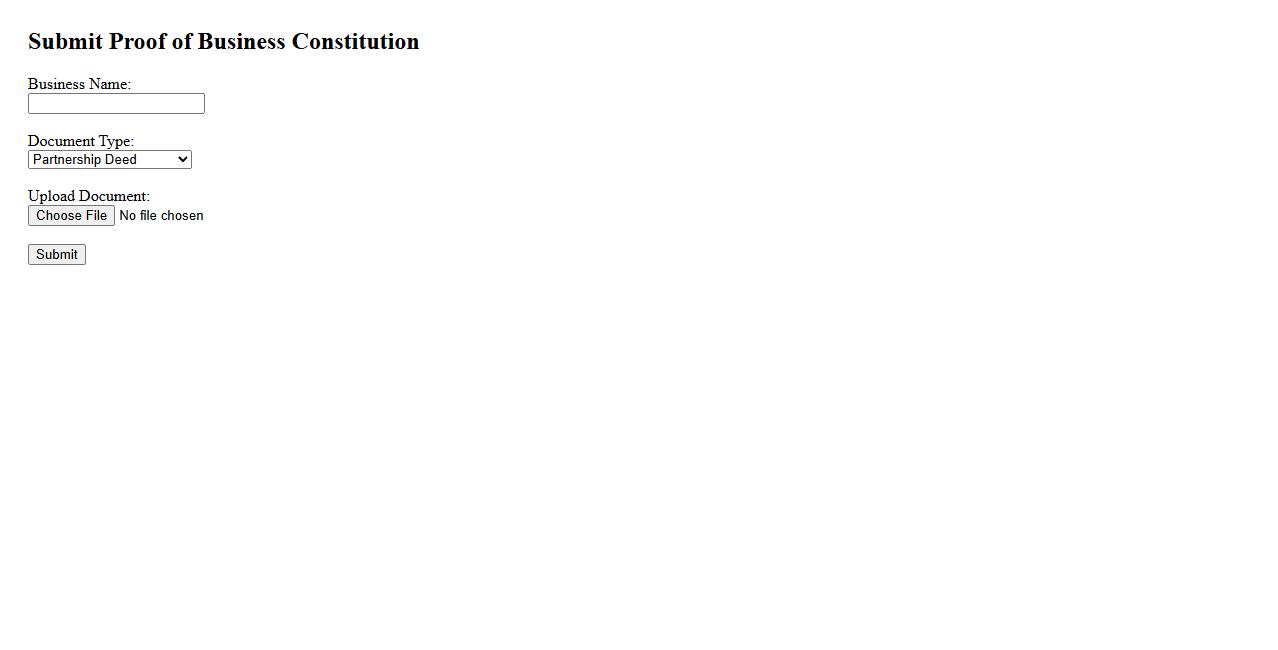

Proof of business constitution (Partnership deed, Incorporation certificate)

Proof of business constitution includes essential documents such as the Partnership Deed and Incorporation Certificate, which establish the legal structure of a business. These documents validate the formation and registration of the enterprise, ensuring compliance with relevant laws. They are crucial for legal recognition, financial transactions, and operational legitimacy.

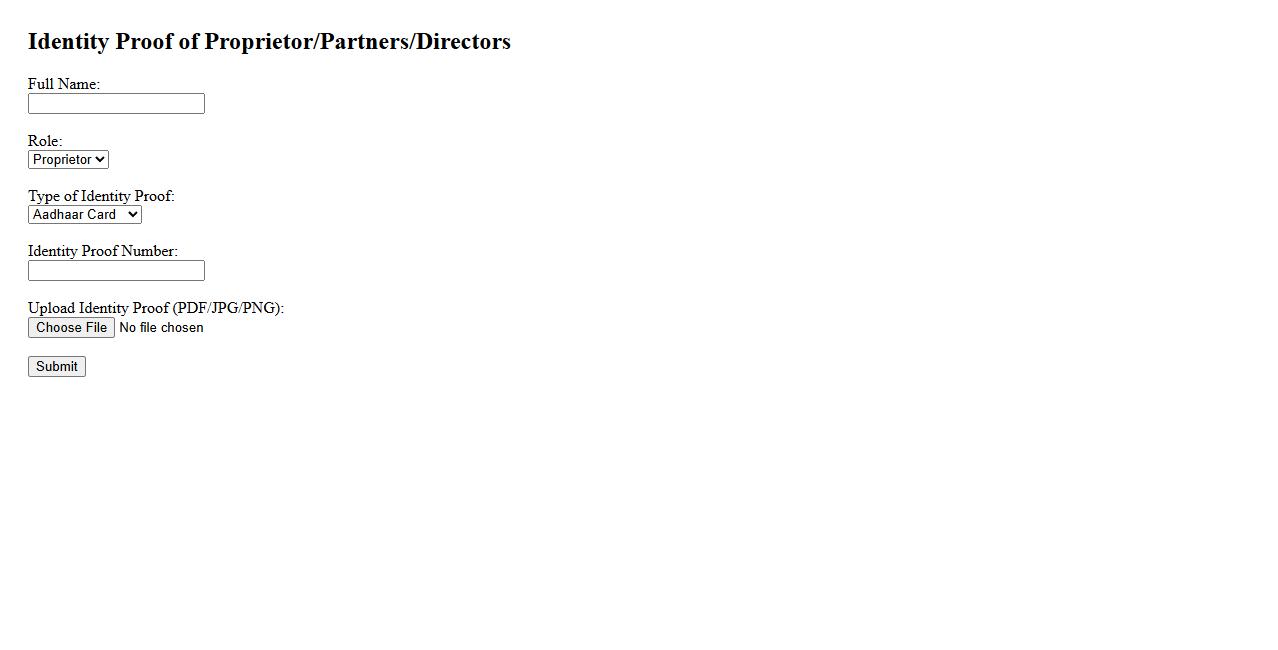

Identity proof of proprietor/partners/directors

Providing identity proof of proprietors, partners, or directors is essential for verification purposes in various legal and financial processes. This documentation typically includes government-issued IDs such as a passport, driver's license, or Aadhaar card. Ensuring accurate identity proof helps maintain transparency and trust in business operations.

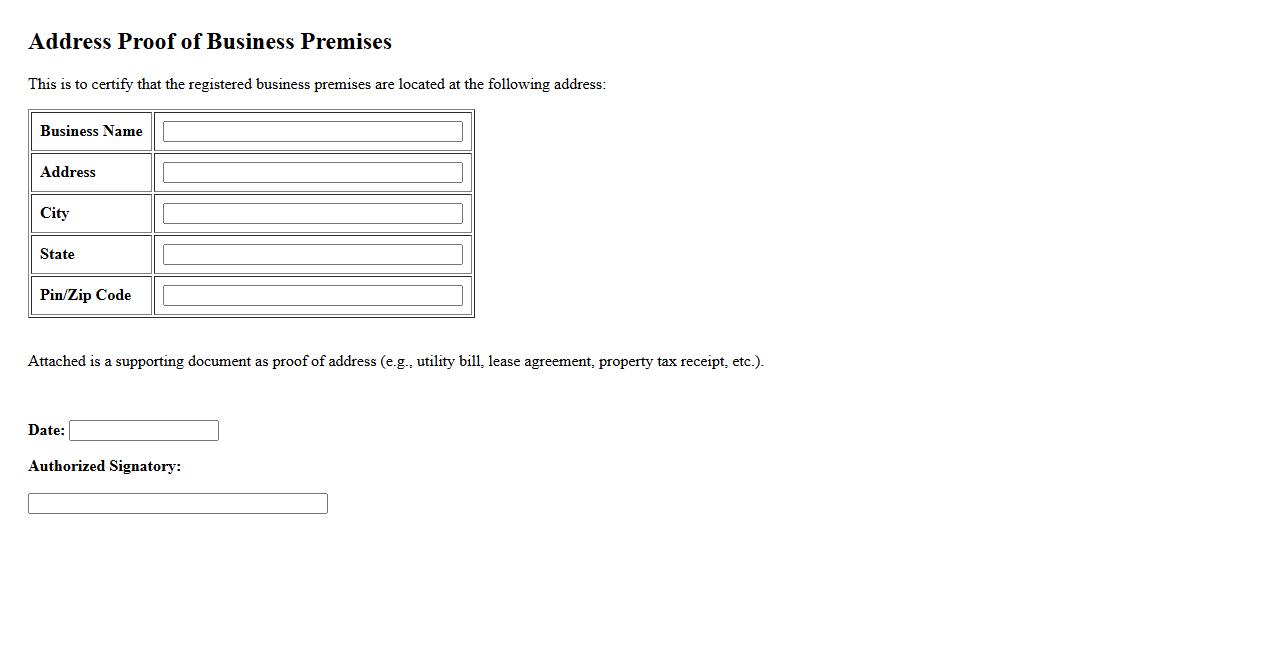

Address proof of business premises

Providing address proof of business premises is essential for verifying the physical location of a company. Common documents include utility bills, lease agreements, or official government letters. This verification helps establish credibility and compliance with legal regulations.

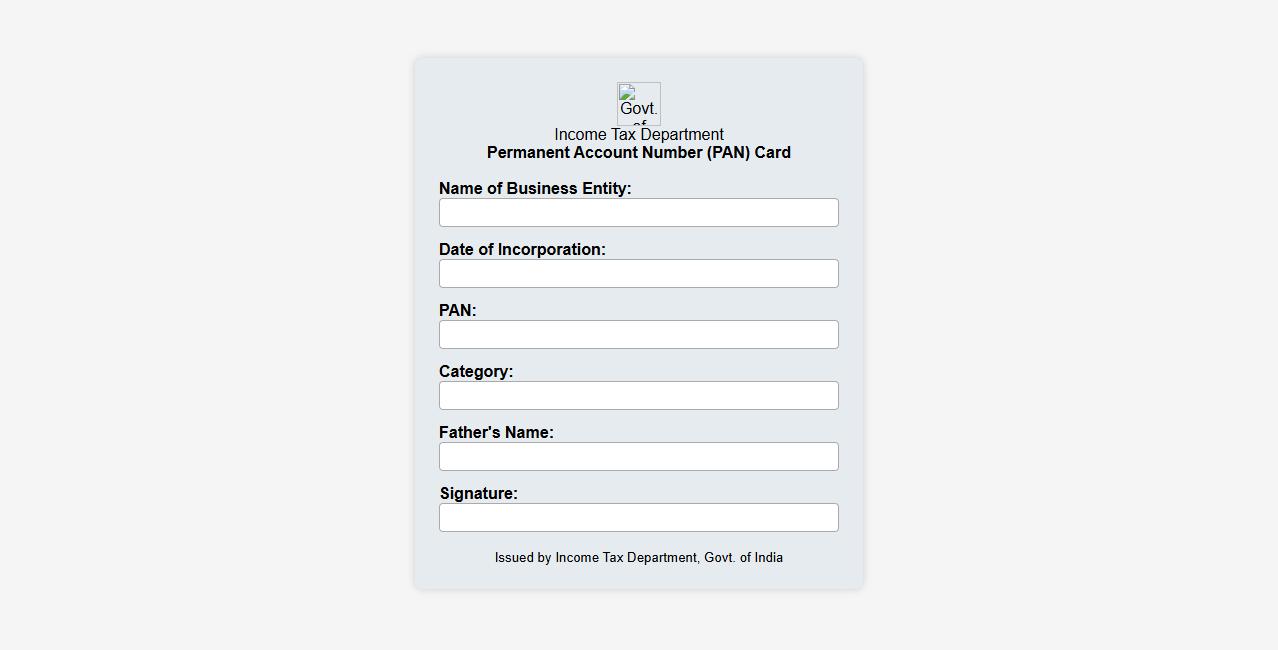

PAN card of business entity

The PAN card of a business entity is a crucial identification document issued by the Income Tax Department in India. It helps in tracking financial transactions and is mandatory for various business-related activities, including filing tax returns and opening bank accounts. This unique identifier ensures compliance and transparency in the business's financial dealings.

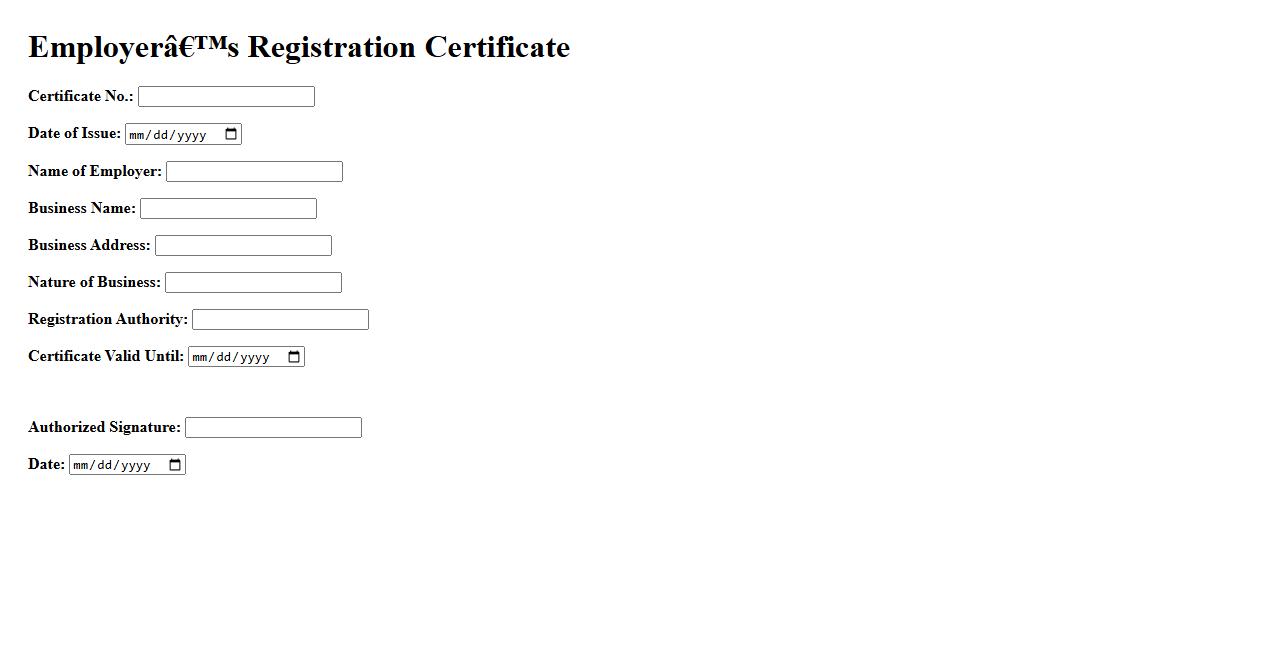

Employer’s registration certificate

An Employer's registration certificate is an official document that confirms a business is legally registered to employ workers. It is essential for compliance with labor laws and tax regulations. This certificate helps ensure transparency and accountability in the hiring process.

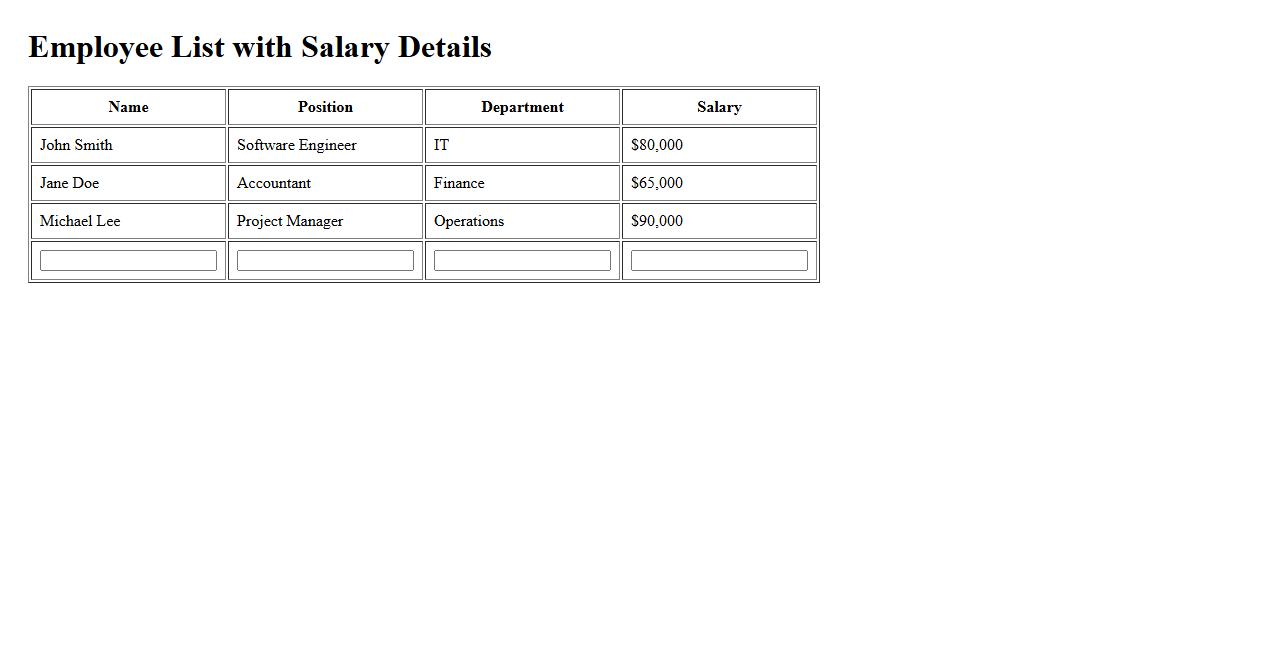

Employee list with salary details

The employee list with salary details provides a comprehensive overview of all staff members along with their respective earnings. This organized record helps in efficient payroll management and financial planning. Accessing this list ensures transparency and accuracy in salary distribution.

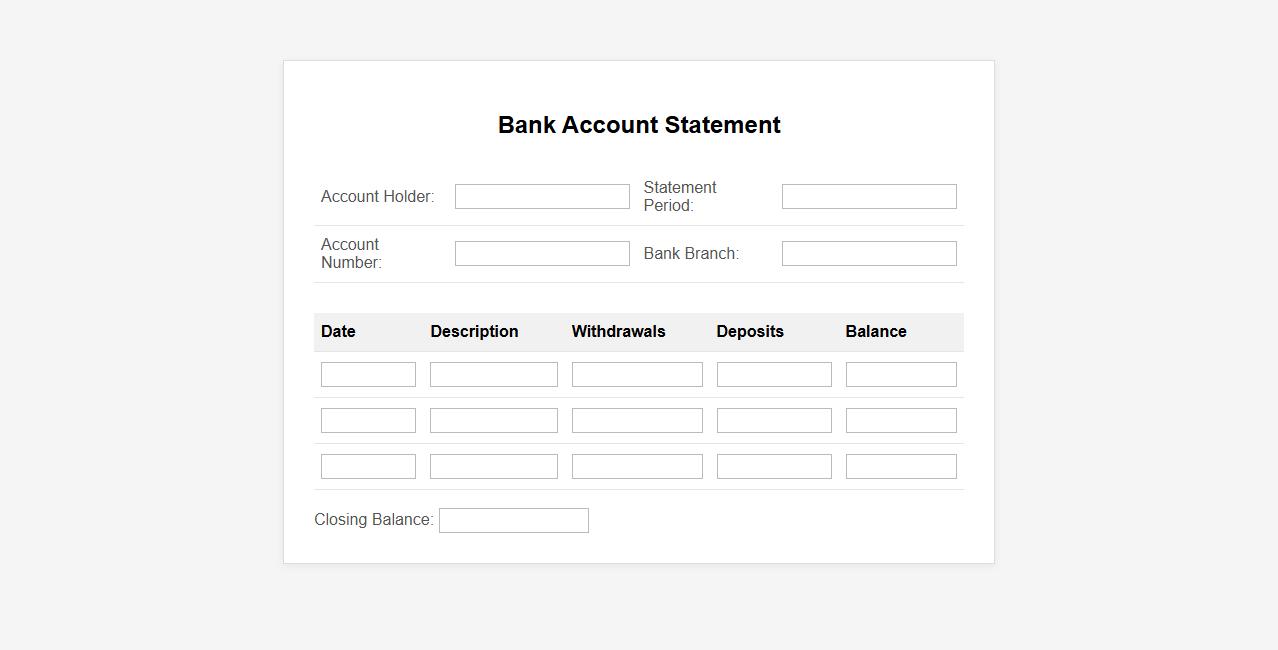

Bank account statement

A bank account statement is a detailed record of all transactions in a bank account over a specific period. It includes deposits, withdrawals, fees, and interest earned, helping account holders track their financial activity. Regularly reviewing the statement ensures accuracy and aids in budgeting effectively.

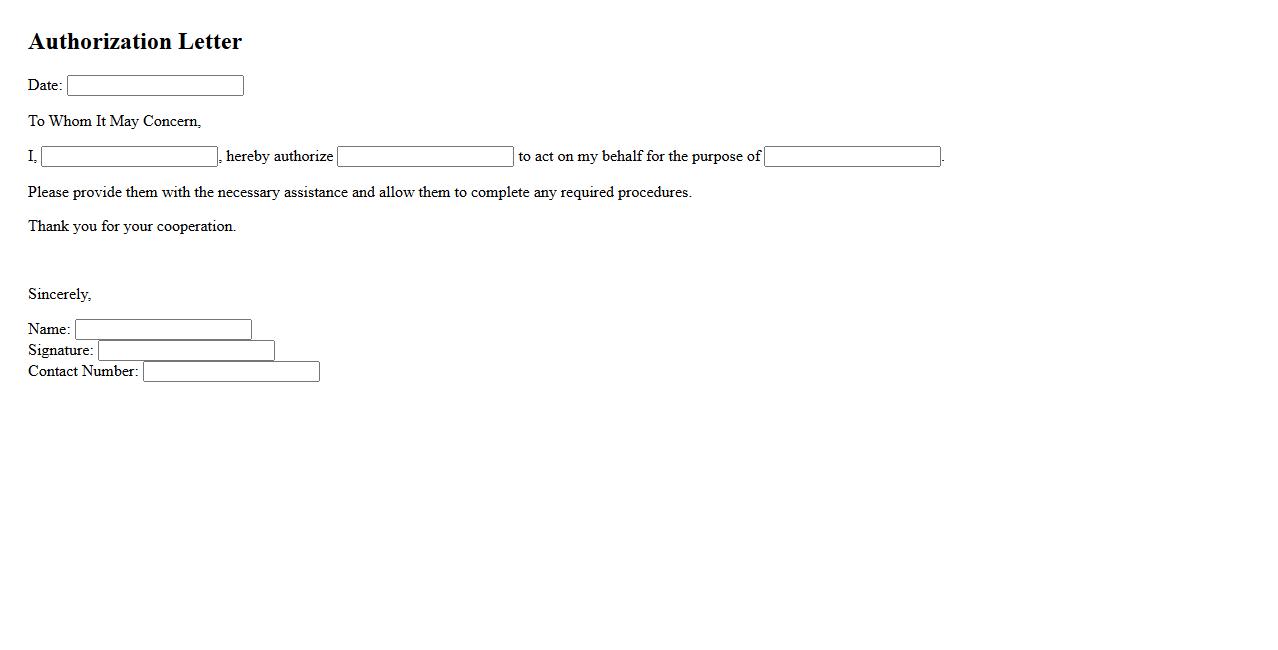

Authorization letter for applicant

An authorization letter for applicant is a formal document that grants permission to a representative to act on behalf of the applicant. This letter ensures that the authorized individual can handle specific tasks or requests with legal consent. It is essential for maintaining transparency and accountability in official processes.

Recent passport-size photographs of authorized persons

Ensure you provide recent passport-size photographs of authorized persons to meet identification requirements. These photos must be clear and comply with official guidelines for accurate verification. Submitting updated images helps streamline processing and enhances security measures.

What documents are required for registration for Professional Tax?

To register for Professional Tax, essential documents include a copy of the PAN card, proof of business address, and the employer's registration certificate. Additionally, recent passport-sized photographs of the employer and employees, along with the company's incorporation certificate, are typically required. These documents help verify identity, address, and the nature of the business for smooth registration.

Who is eligible to apply for Professional Tax registration?

Individuals and entities engaged in a profession, trade, or employment requiring regular earnings are eligible for Professional Tax registration. This includes salaried employees, professionals, and businesses operating within states that impose the tax. Employers are responsible for registering and deducting Professional Tax from eligible employees.

What is the process and timeline for obtaining Professional Tax registration?

The process for Professional Tax registration generally involves submitting the application form along with the required documents to the state tax department. Once submitted, authorities typically process the registration within 7 to 15 working days. Upon approval, a unique Professional Tax Registration Number is issued, enabling compliance under the law.

Are there any exemptions applicable during Professional Tax registration?

Certain categories of individuals and entities may be exempt from Professional Tax, such as government employees, minors, and disabled persons. The exemptions vary by state, so it is important to check specific state rules during registration. Understanding applicable exemptions can reduce compliance burdens and avoid unnecessary tax deductions.

What are the consequences of non-registration for Professional Tax?

Failure to register for Professional Tax can lead to penalties, fines, and legal action by tax authorities. Employers who do not deduct or remit the tax may face prosecution and monetary liabilities. Compliance is essential to avoid disruptions in business operations and maintain legal standing within the jurisdiction.