Registration for VAT is the process businesses must complete to comply with tax regulations by reporting and remitting Value Added Tax to the authorities. It involves submitting necessary documentation, meeting threshold requirements, and obtaining a unique VAT identification number. Proper registration for VAT ensures seamless tax collection, legal compliance, and eligibility to reclaim input VAT on purchases.

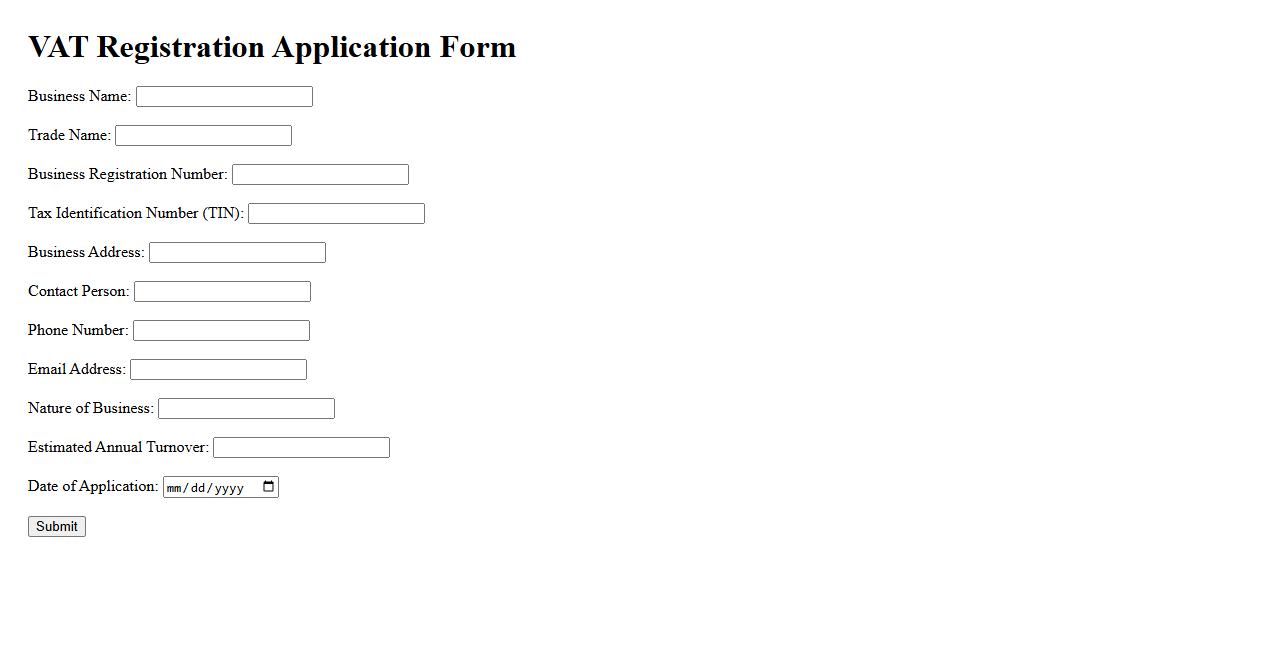

VAT Registration Application

Applying for VAT Registration is a crucial step for businesses exceeding the taxable turnover threshold. This process ensures compliance with tax regulations and allows businesses to reclaim VAT on purchases. Timely registration helps maintain financial transparency and avoid penalties.

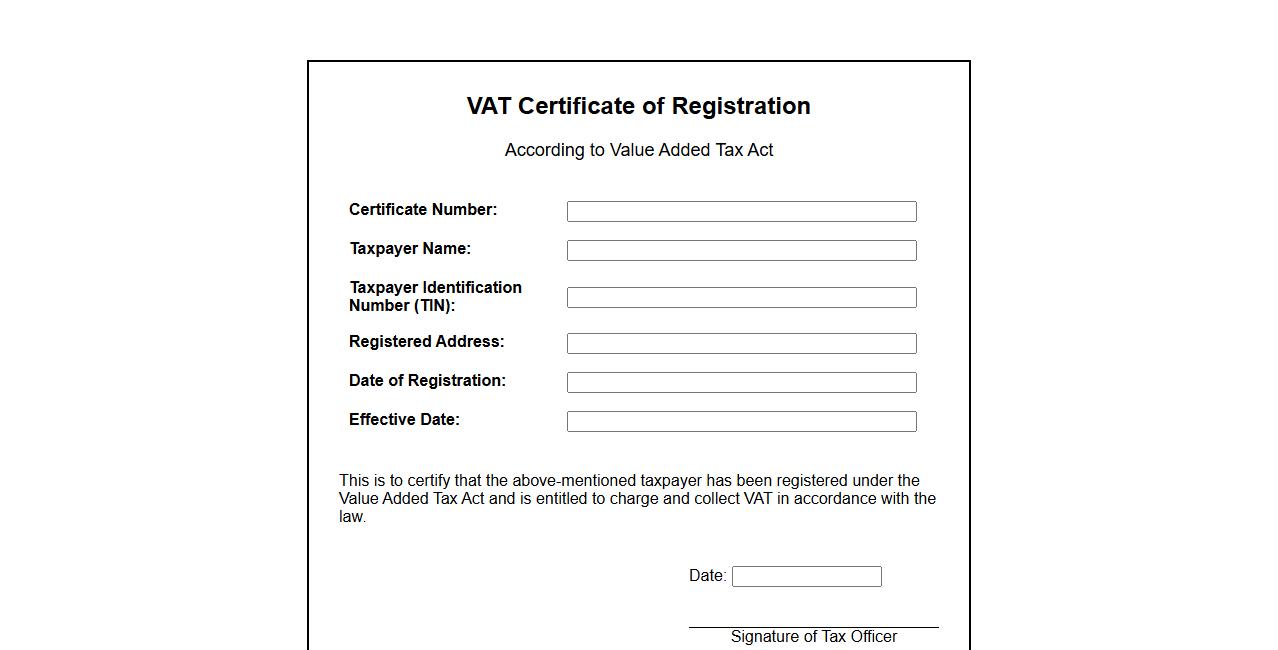

VAT Certificate of Registration

The VAT Certificate of Registration is an official document issued by tax authorities confirming a business's registration under the Value Added Tax system. This certificate enables businesses to legally charge VAT on their goods and services and claim input tax credits. It serves as proof of compliance with tax regulations and is essential for transparent financial operations.

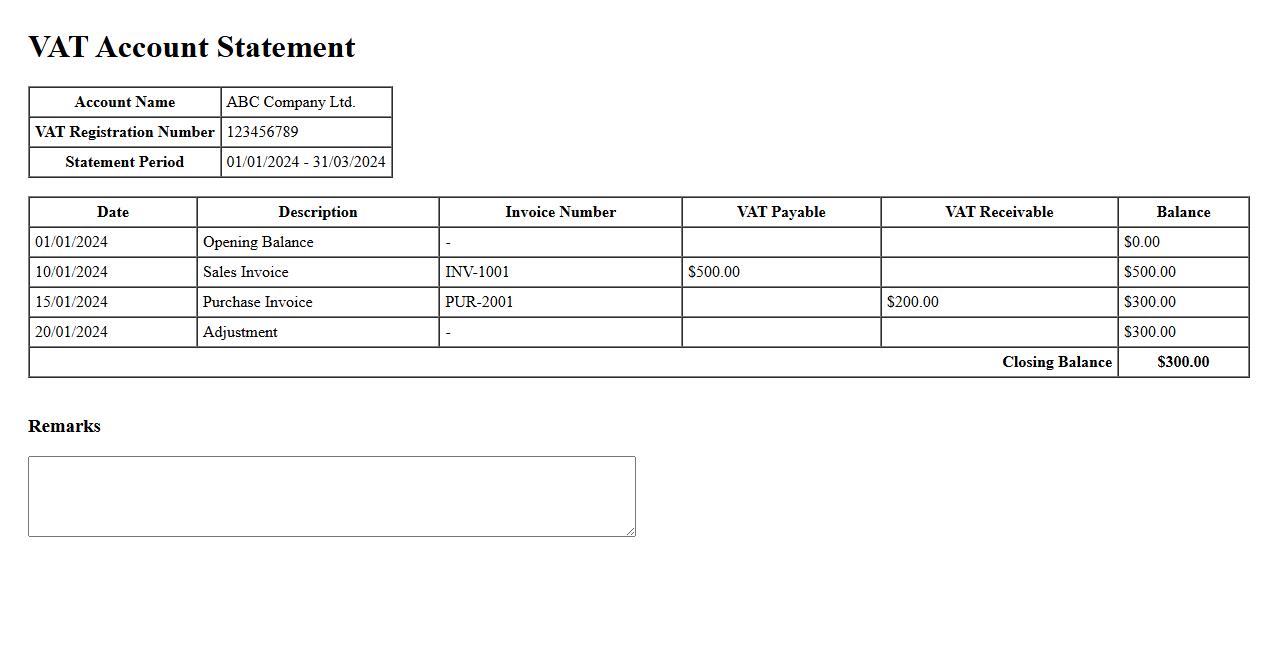

VAT Account Statement

A VAT Account Statement provides a detailed record of all Value Added Tax transactions for a specific period. It helps businesses track VAT payments, credits, and liabilities accurately. This statement is essential for compliance with tax regulations and efficient financial management.

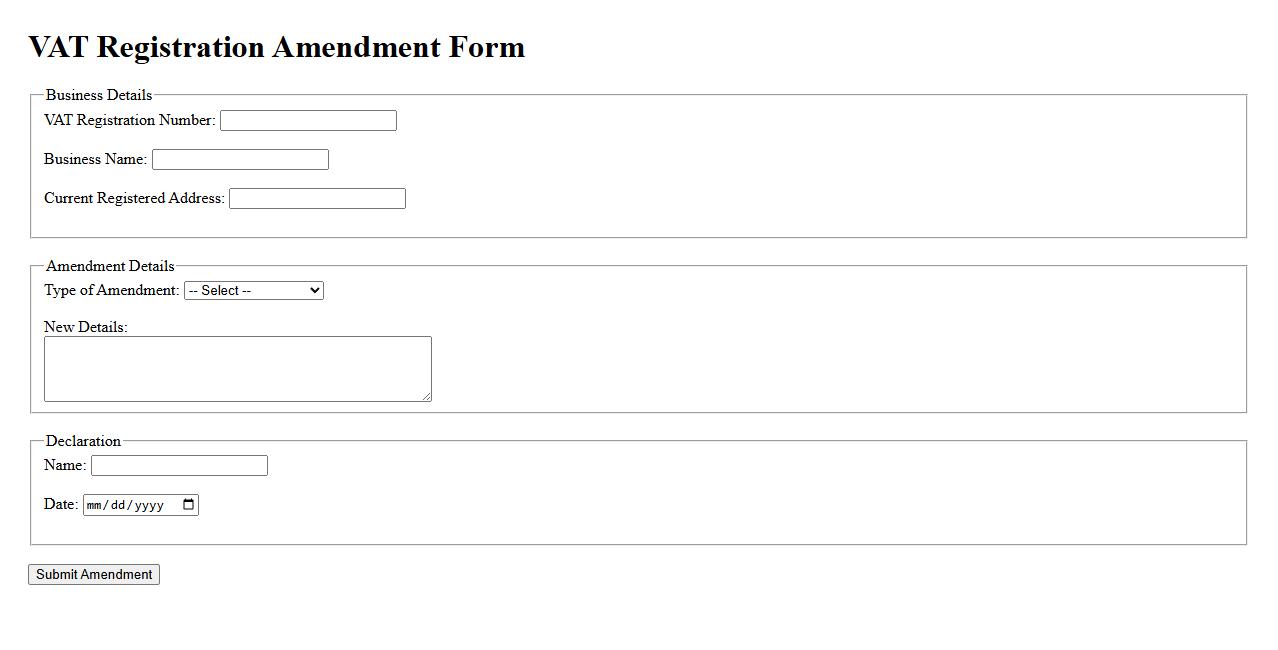

VAT Registration Amendment Form

The VAT Registration Amendment Form is used to update or correct information previously submitted to the tax authorities regarding Value Added Tax registration. This form ensures that all details related to a business's VAT account are accurate and up-to-date. Timely submission of the amendment form helps maintain compliance with tax regulations and avoid penalties.

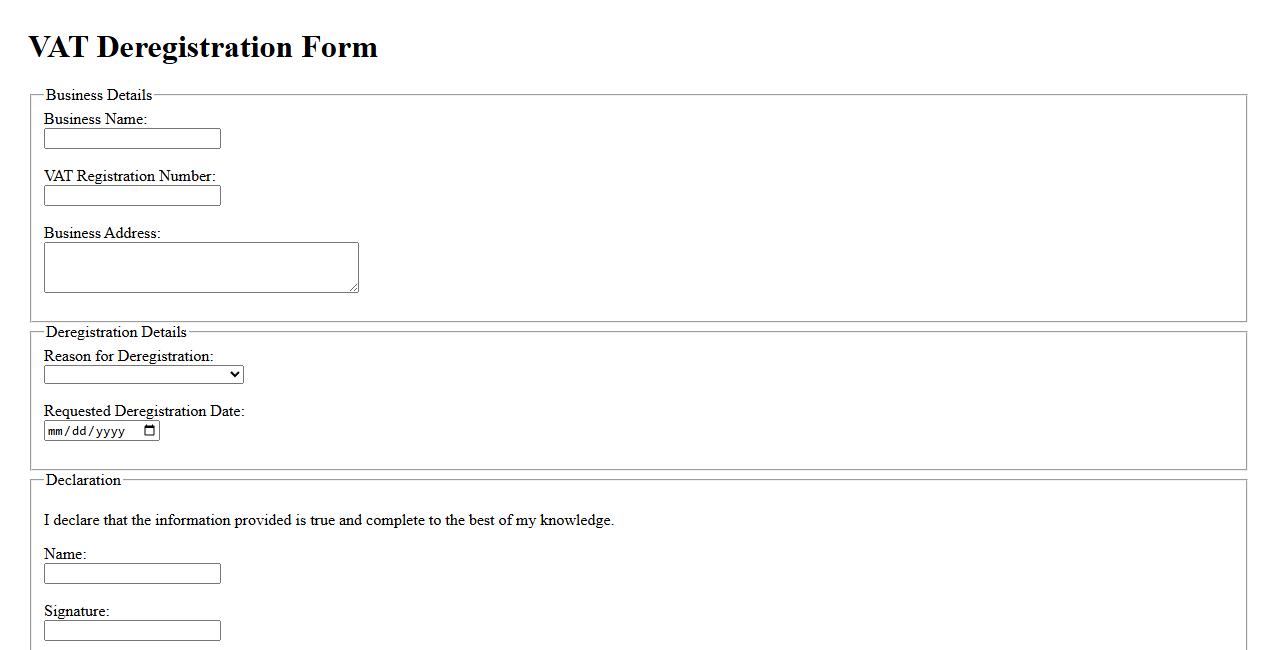

VAT Deregistration Form

The VAT Deregistration Form is used by businesses to officially cancel their VAT registration when they no longer meet the criteria for VAT liability. This form ensures compliance with tax regulations and helps avoid unnecessary VAT payments. Timely submission of the form is essential to prevent legal issues and financial penalties.

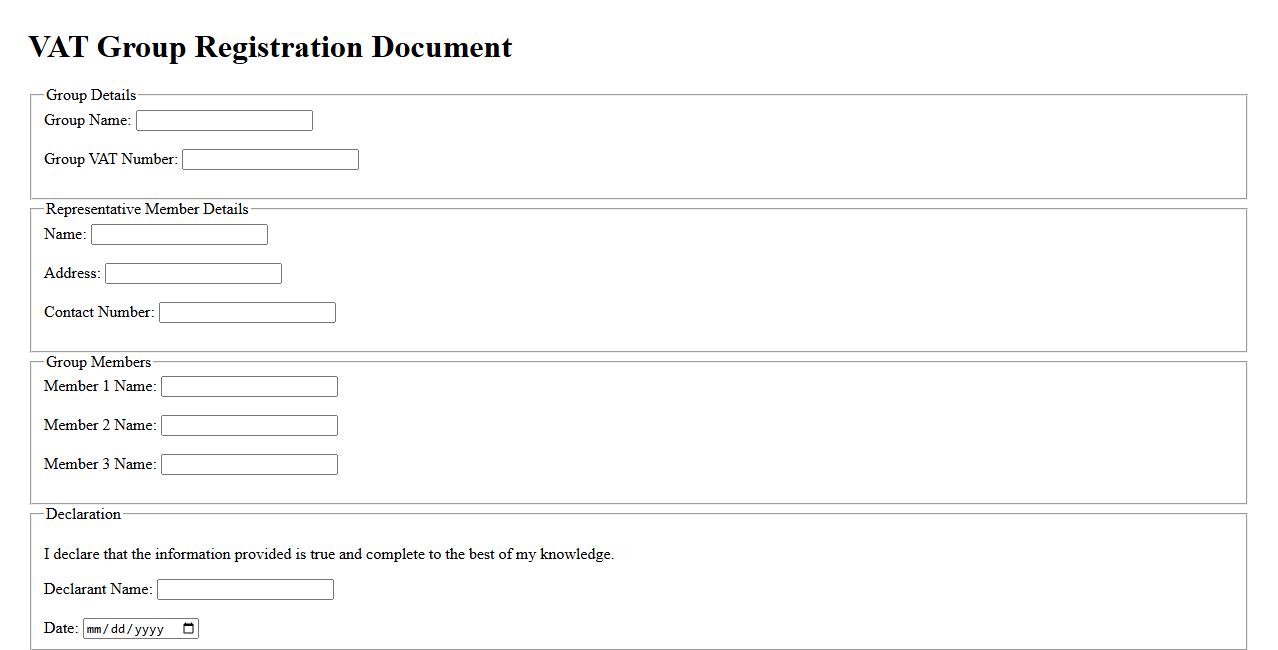

VAT Group Registration Document

The VAT Group Registration Document is an official certificate confirming the registration of multiple related businesses under a single VAT number. This document simplifies VAT reporting by consolidating the tax affairs of the group. It is essential for businesses seeking to streamline their tax processes and ensure compliance with tax authorities.

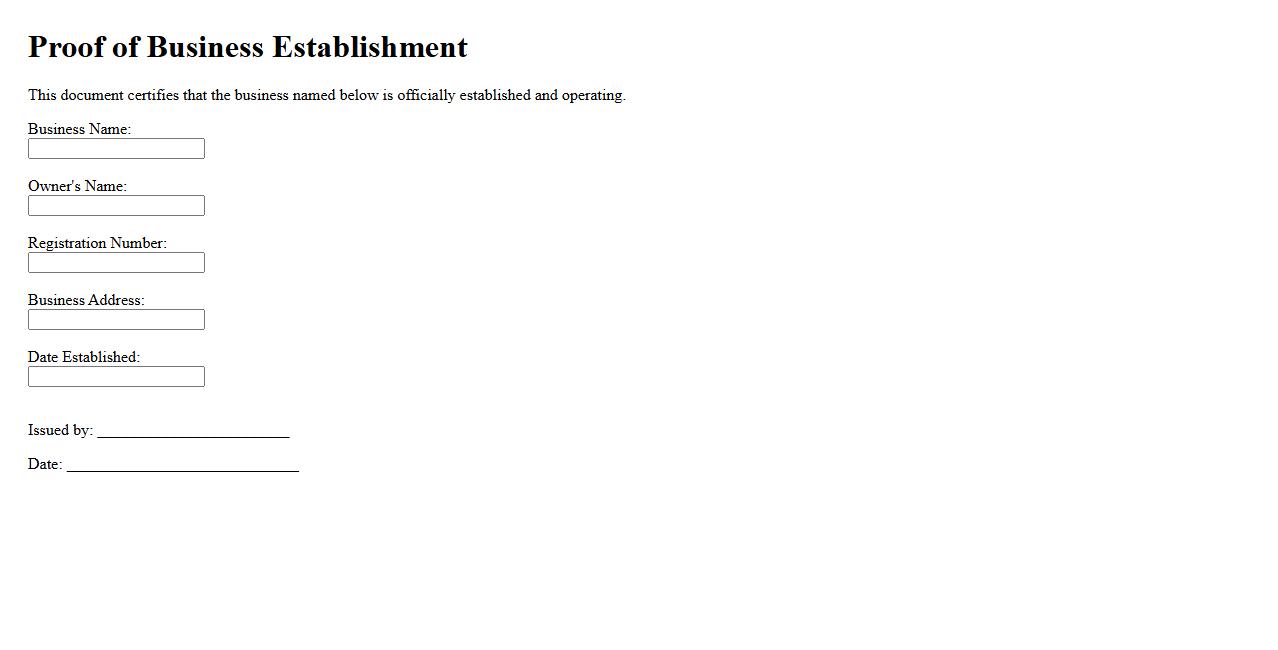

Proof of Business Establishment

Proof of Business Establishment is a critical document that verifies the legal existence and operational status of a company. It is often required by government authorities, financial institutions, and partners to confirm the authenticity of a business. This evidence may include registration certificates, business licenses, or tax identification numbers.

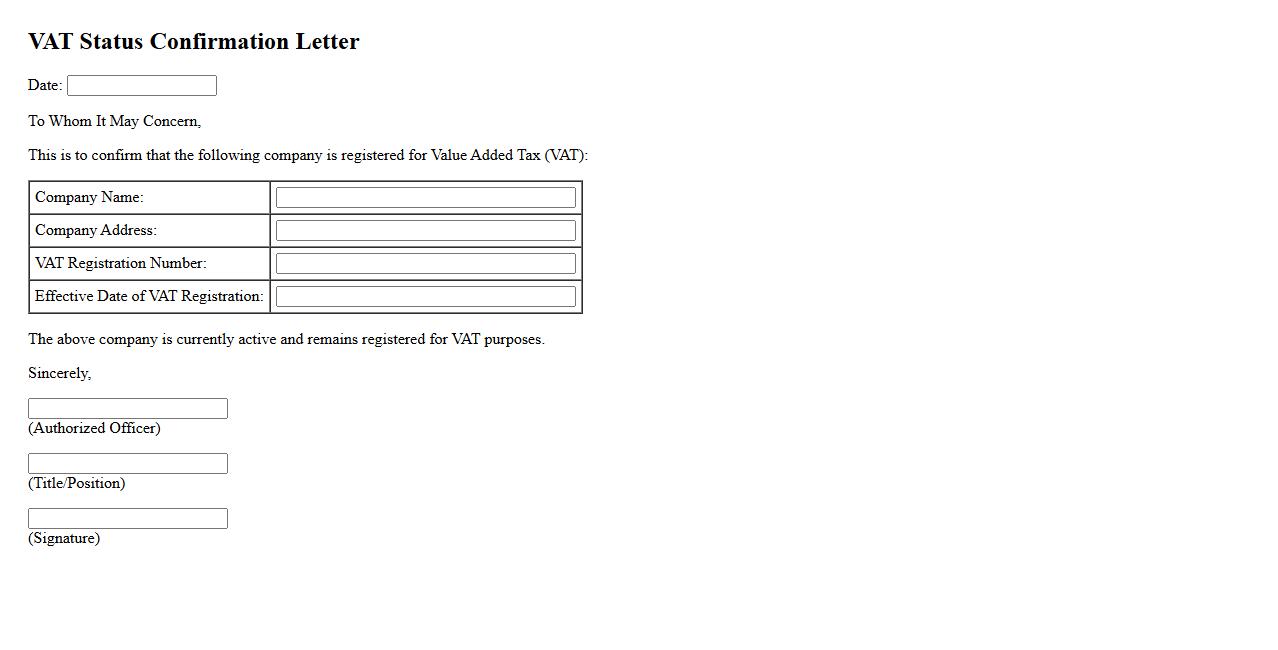

VAT Status Confirmation Letter

A VAT Status Confirmation Letter is an official document issued by tax authorities to verify a business's VAT registration status. It serves as proof that a company is properly registered for VAT and complies with relevant tax regulations. This letter is often required for tax audits, supplier verification, or cross-border transactions.

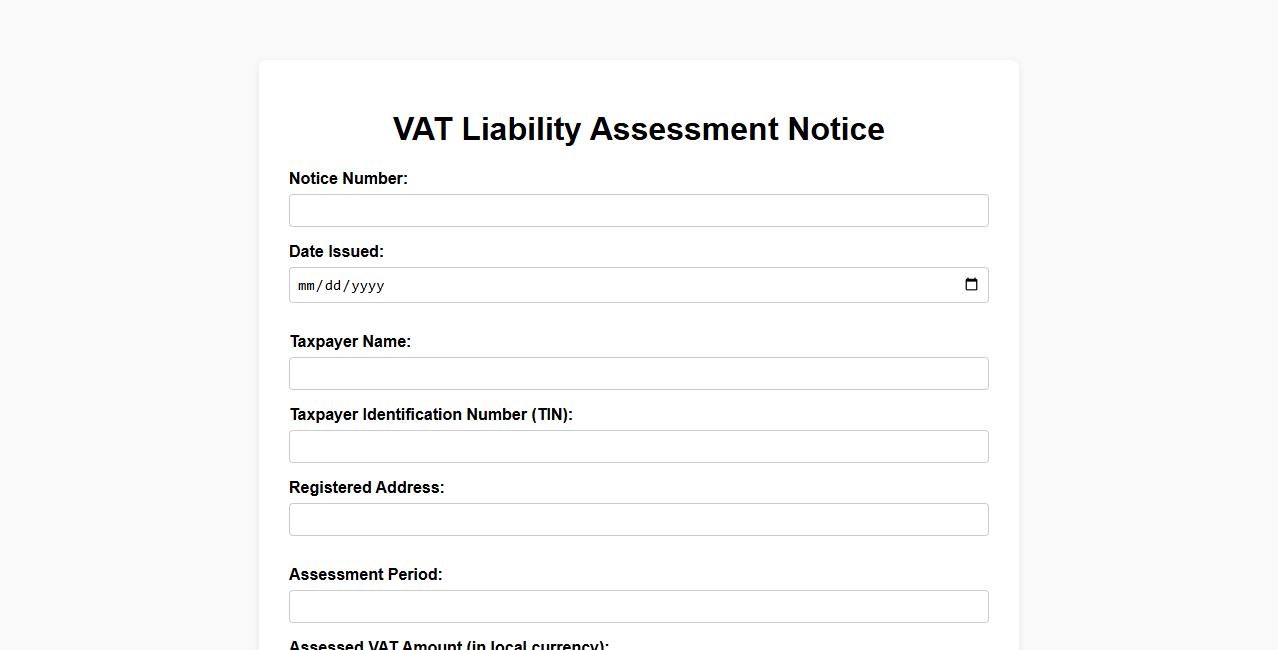

VAT Liability Assessment Notice

The VAT Liability Assessment Notice informs businesses of their value-added tax obligations based on a detailed review of their financial records. It outlines the amount of VAT owed and provides a deadline for payment to ensure compliance with tax regulations. Receiving this notice helps companies avoid penalties by addressing their VAT responsibilities promptly.

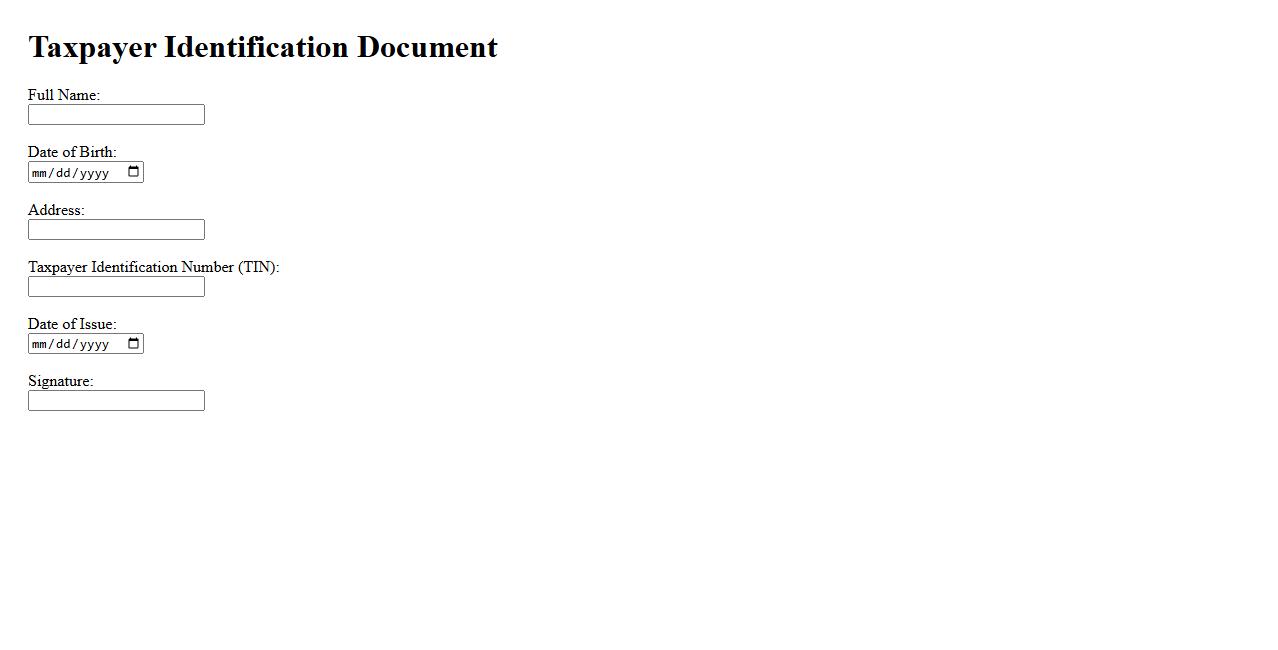

Taxpayer Identification Document

The Taxpayer Identification Document is a crucial official paper used to identify individuals and entities for tax purposes. It ensures accurate processing of tax returns and compliance with government regulations. This document is essential for both personal and business taxation activities.

What are the primary criteria for mandatory VAT registration in a business?

The primary criteria for mandatory VAT registration include exceeding a specific annual turnover threshold set by tax authorities. Businesses must monitor their taxable supplies to ensure compliance with these thresholds. Additionally, certain types of businesses are required to register regardless of turnover due to the nature of their operations.

How does voluntary VAT registration benefit eligible businesses?

Voluntary VAT registration allows businesses below the mandatory threshold to reclaim VAT on purchases, improving cash flow. It also enhances the business's credibility with suppliers and customers by showing compliance with tax regulations. Moreover, registered businesses can expand their market reach by dealing with other VAT-registered entities more efficiently.

Which types of supplies or services require VAT registration according to regulations?

VAT registration is required for businesses providing taxable supplies or services, including goods, digital products, and professional services. Some sectors have specific rules that mandate registration, such as those involving international trade or specific high-risk industries. Exempt supplies might not require registration, but businesses must clearly understand the scope of taxable activities.

What are the consequences of failing to register for VAT on time?

Failure to register for VAT on time can lead to penalties and interest charges from tax authorities, increasing business costs. Businesses may also face reputational damage and scrutiny in further tax audits. Additionally, they lose the ability to reclaim input VAT, negatively impacting financial management.

How does VAT registration impact invoicing and record-keeping requirements?

VAT registration mandates businesses to issue VAT-compliant invoices including specific details like VAT numbers and rate breakdowns. It also requires maintaining detailed records of sales, purchases, and VAT returns for audit purposes. Proper documentation ensures transparency and simplifies tax reporting obligations.