Registration as a Business Entity involves officially recording a business with the relevant government authorities to obtain legal recognition. This process typically requires submitting necessary documents, selecting a business structure, and paying applicable fees. Successfully registering ensures the business can operate legally, access financial services, and protect its brand.

Business Entity Application Form

The Business Entity Application Form is a crucial document used to register and verify the legal structure of a business. It collects essential information such as business name, owner details, and type of entity. This form ensures compliance with regulatory requirements and facilitates smooth operation and recognition of the business.

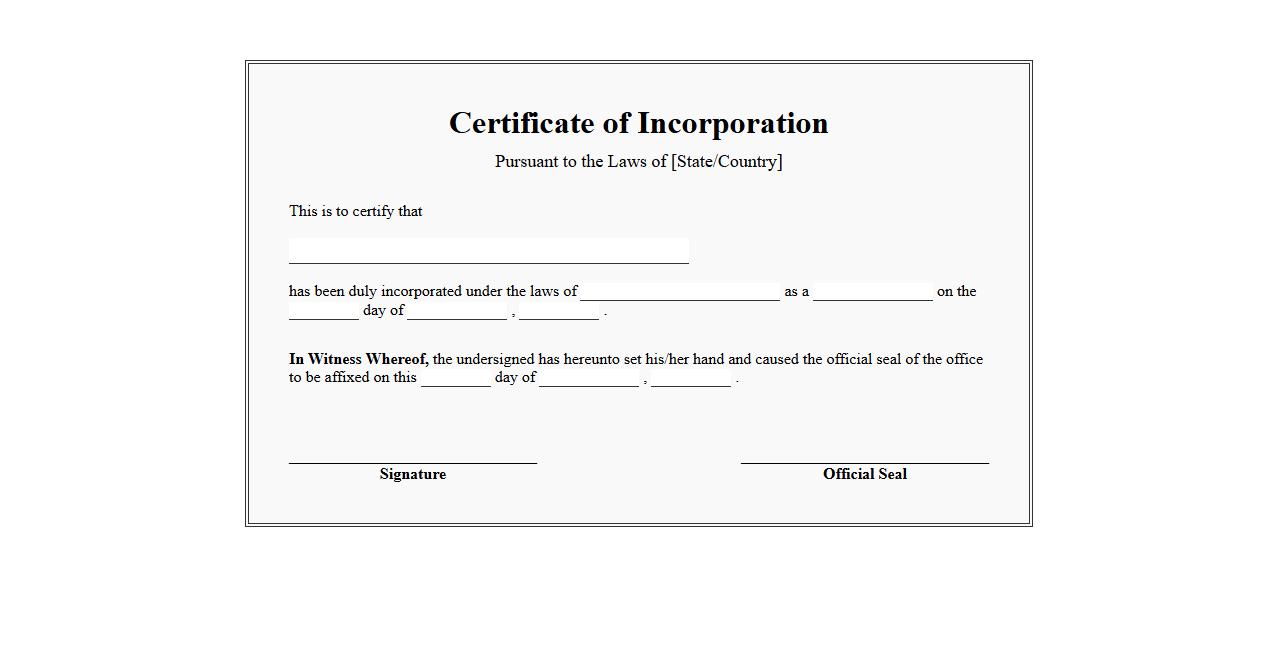

Certificate of Incorporation

The Certificate of Incorporation is an official document issued by a government authority that legally establishes a company as a corporation. It outlines the company's name, purpose, and key details, serving as proof of its existence. This certificate is essential for conducting business and opening corporate bank accounts.

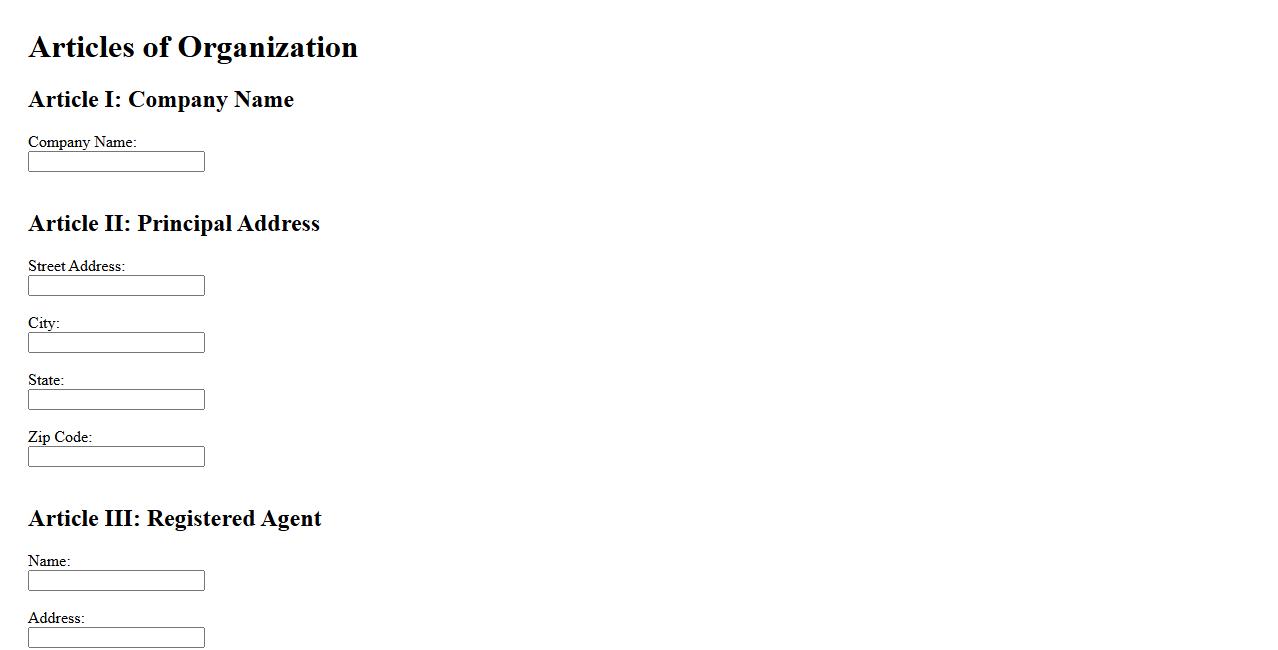

Articles of Organization

The Articles of Organization is a legal document filed with the state to officially form a limited liability company (LLC). It outlines essential information such as the company's name, address, and registered agent. This document serves as the foundation of the LLC's legal status and operating authority.

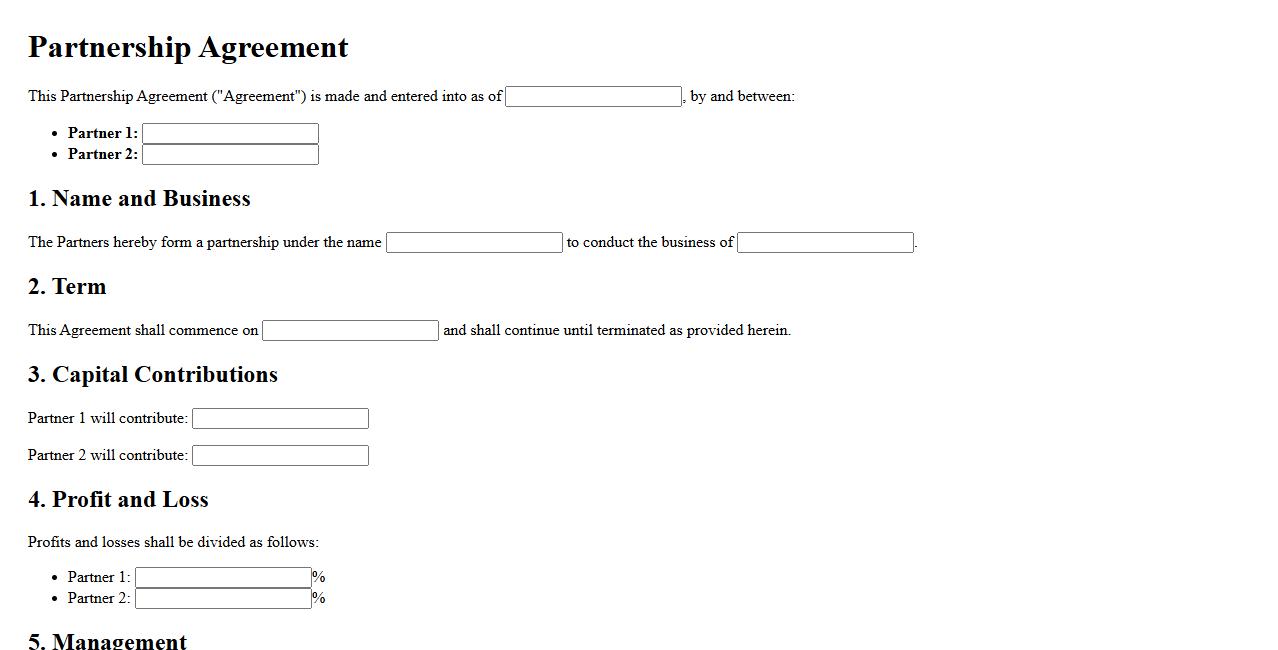

Partnership Agreement

A Partnership Agreement is a legal document that outlines the roles, responsibilities, and profit-sharing arrangements between business partners. It helps prevent conflicts by clearly defining each partner's contributions and decision-making authority. This agreement is essential for establishing a transparent and successful business relationship.

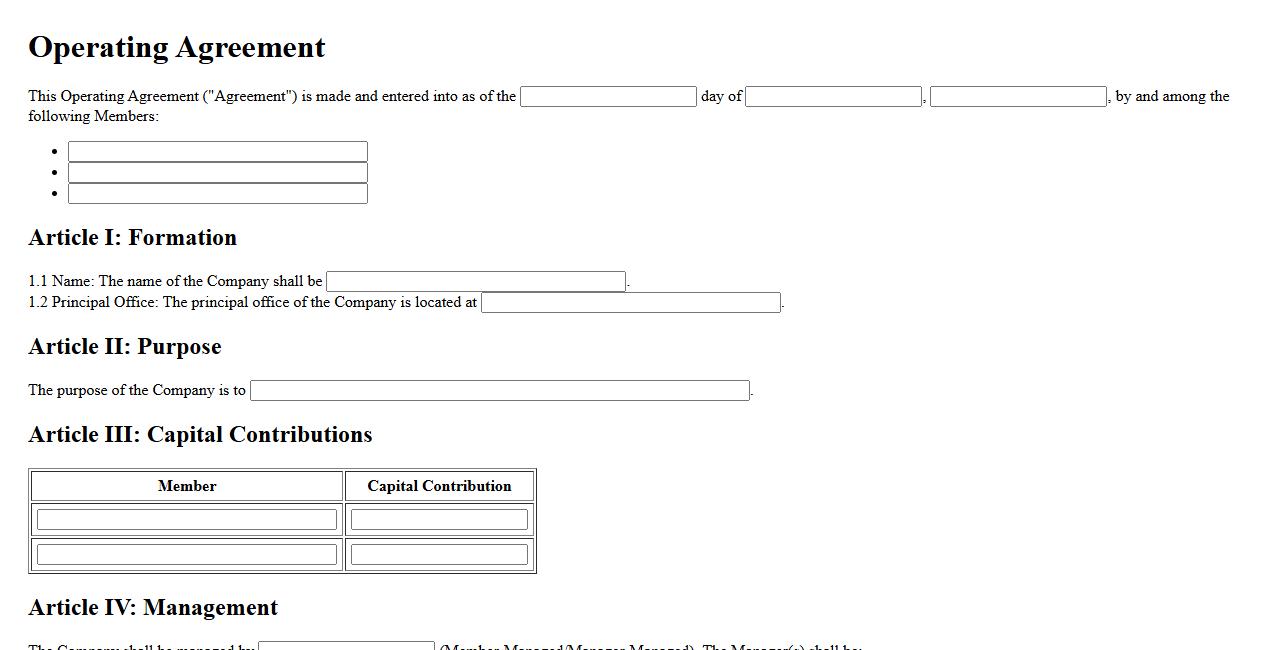

Operating Agreement

An Operating Agreement is a crucial legal document that outlines the ownership structure and operating procedures of a limited liability company (LLC). It defines the roles, responsibilities, and rights of members, ensuring smooth business operations and minimizing conflicts. This agreement provides clarity and protection for all parties involved in the company.

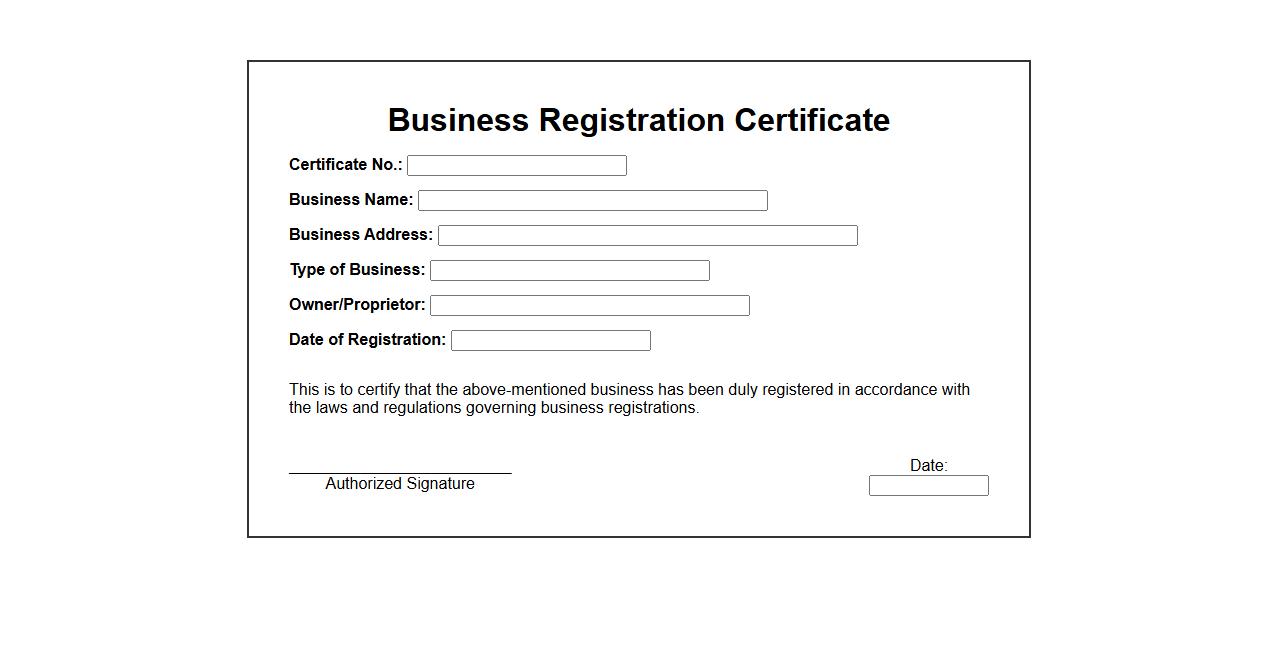

Business Registration Certificate

A Business Registration Certificate is an official document issued by government authorities verifying that a company is legally registered. This certificate serves as proof of a business's existence and compliance with local regulations. It is essential for opening bank accounts, obtaining licenses, and conducting lawful operations.

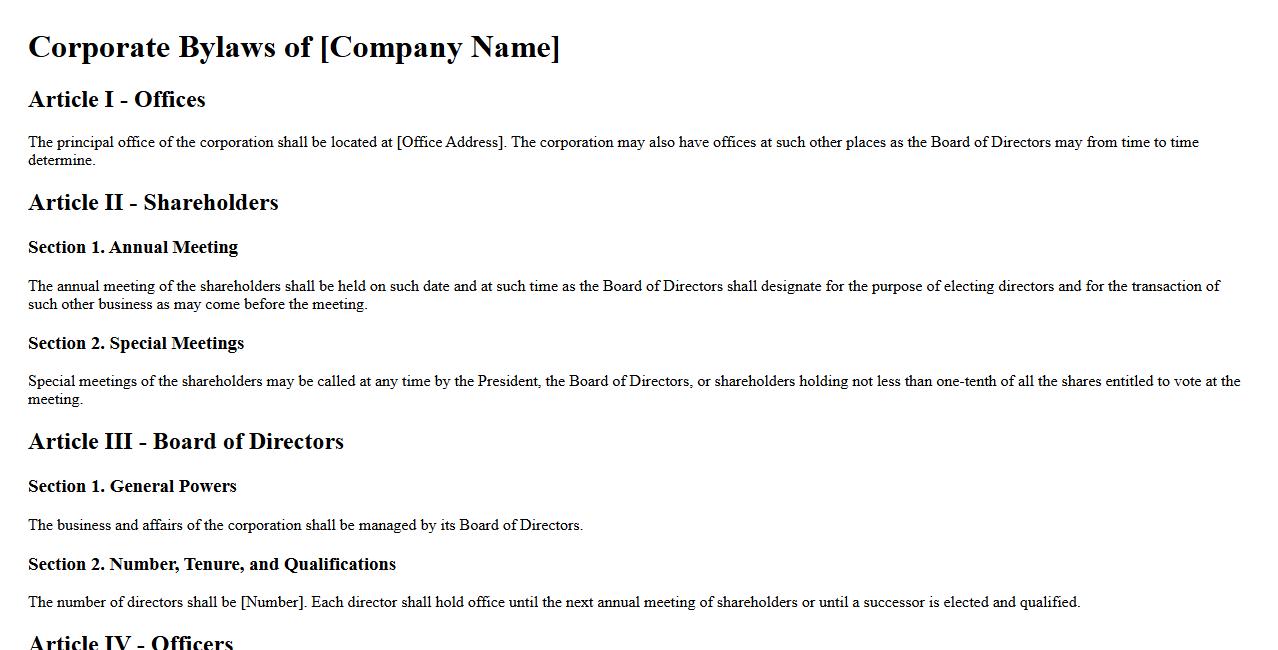

Corporate Bylaws

Corporate bylaws are essential rules that govern the internal management of a corporation. They outline the responsibilities of directors, officers, and shareholders, ensuring smooth organizational operations. Clear corporate bylaws help prevent conflicts and provide a framework for decision-making.

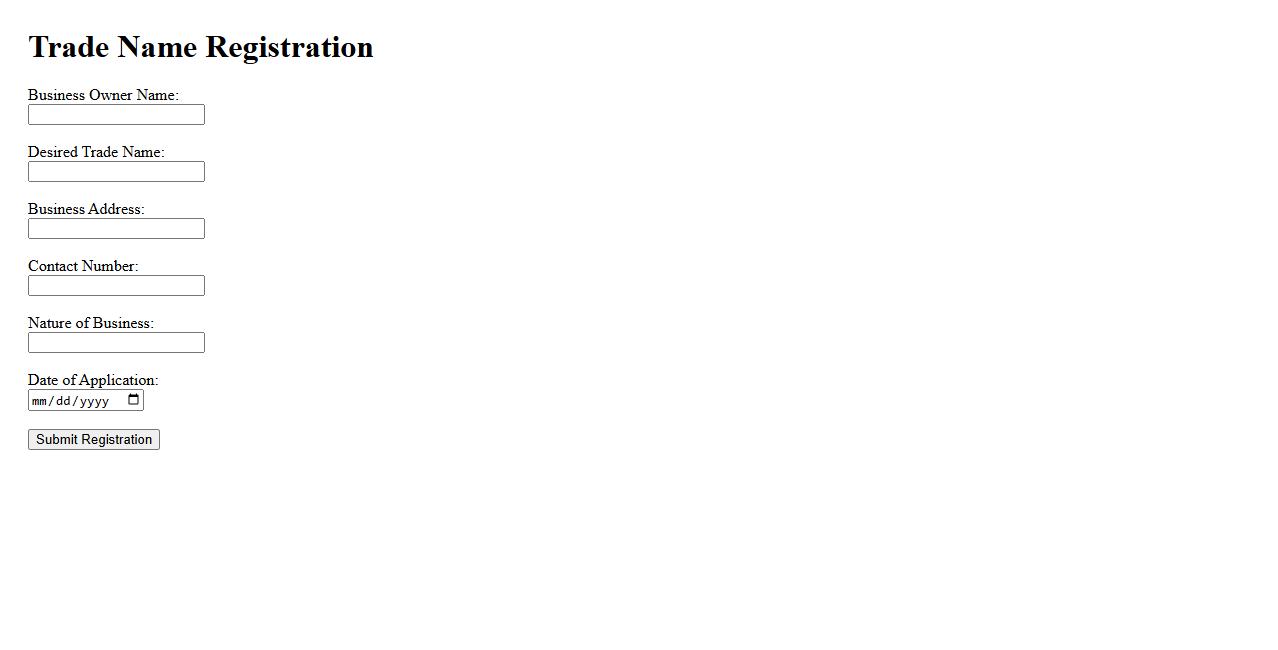

Trade Name Registration

Trade Name Registration is the process of officially recording a business name to protect its unique identity in the marketplace. This registration helps prevent unauthorized use by other entities and establishes legal recognition. It is essential for building brand trust and ensuring compliance with local regulations.

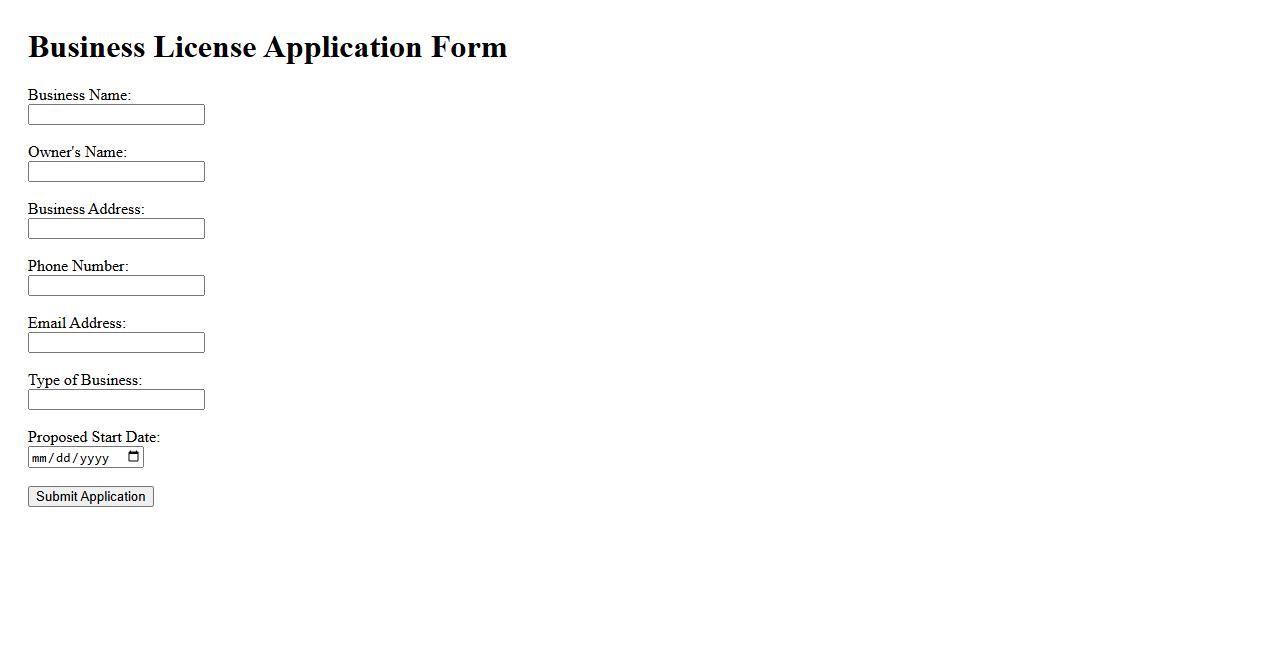

Business License Application

Applying for a Business License is a crucial step for legally operating a company. This process ensures compliance with local regulations and helps protect your business. Timely submission of the application can prevent fines and interruptions.

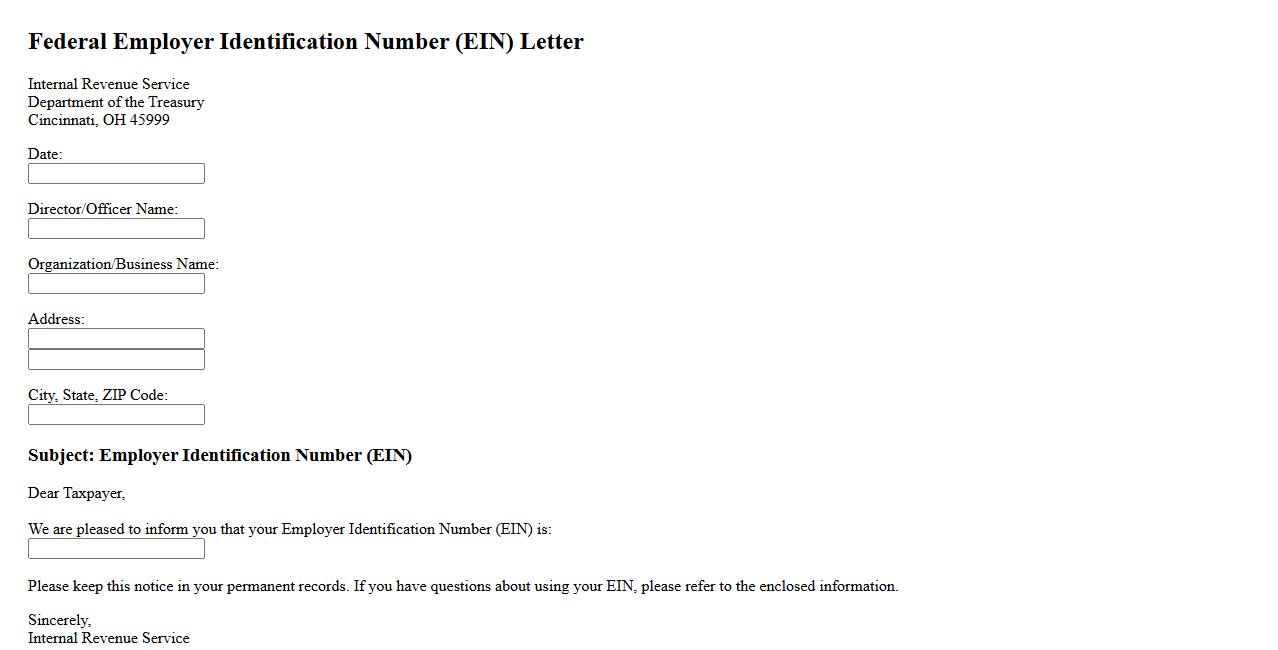

Federal Employer Identification Number (EIN) Letter

The Federal Employer Identification Number (EIN) Letter is an official document issued by the IRS that confirms your business's EIN. It serves as proof of your company's unique tax identification number used for federal tax purposes. This letter is essential for opening bank accounts, applying for licenses, and filing taxes.

What legal structures are available for business entity registration?

There are several legal structures available for business entity registration, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure offers distinct benefits, liabilities, and tax implications suited for different business models. Choosing the right structure is crucial for operational flexibility and legal compliance.

What documents are required for registering a new business entity?

To register a new business entity, various documents are typically required, such as articles of incorporation, partnership agreements, or operating agreements. Additionally, identification documents, proof of address, and registration forms with the relevant government agency are necessary. These documents establish the legal foundation and legitimacy of the business.

What are the legal implications of selecting a specific business entity type?

Selecting a specific business entity type influences the legal responsibilities and liabilities of the owners or shareholders. Different entities provide varying degrees of personal asset protection and compliance obligations. Understanding these implications helps mitigate legal risks and ensures adherence to regulatory requirements.

How does business entity registration affect tax obligations and liabilities?

Business entity registration determines the taxation framework and liability exposure for the business and its owners. For example, corporations may face double taxation, whereas LLCs often benefit from pass-through taxation. Proper registration aligns tax reporting and payment obligations with the appropriate legal structure.

What is the process and timeline for obtaining business registration approval?

The registration process typically involves submitting required documents, paying fees, and undergoing a review by a government agency. Timeline for approval varies by jurisdiction but generally ranges from a few days to several weeks. Expedited services may be available to accelerate the business launch and operational setup.