Registration for Nonprofit Organization involves submitting necessary documents to the appropriate government agency to obtain legal recognition and tax-exempt status. This process typically requires preparing articles of incorporation, bylaws, and an application for tax exemption. Proper registration ensures compliance with legal requirements and enables eligibility for grants and donations.

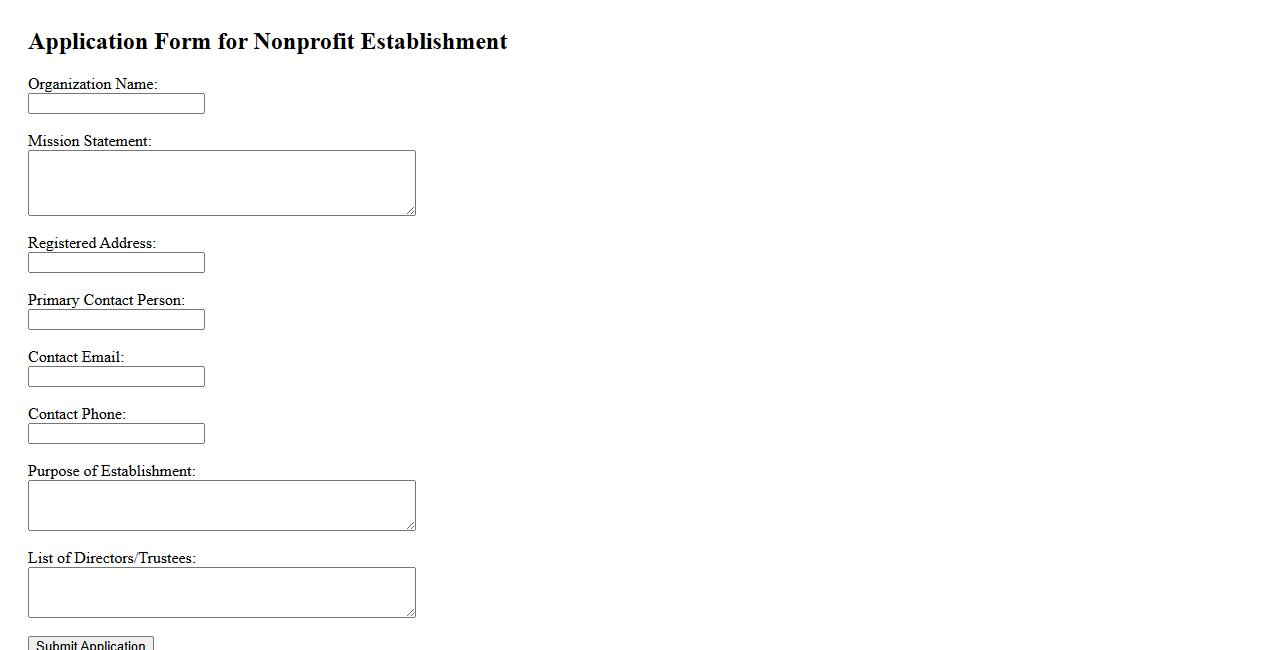

Application Form for Nonprofit Establishment

The Application Form for Nonprofit Establishment is a crucial document required to initiate the legal process of forming a nonprofit organization. It collects essential information about the organization's mission, structure, and leadership. Proper completion of this form ensures compliance with regulatory requirements and facilitates official recognition.

Certificate of Incorporation for Charitable Entities

The Certificate of Incorporation for Charitable Entities is an official document that legally establishes a charity as a recognized organization. It confirms the charity's compliance with government regulations and provides the foundation for its lawful operation. This certificate is essential for securing tax-exempt status and building public trust.

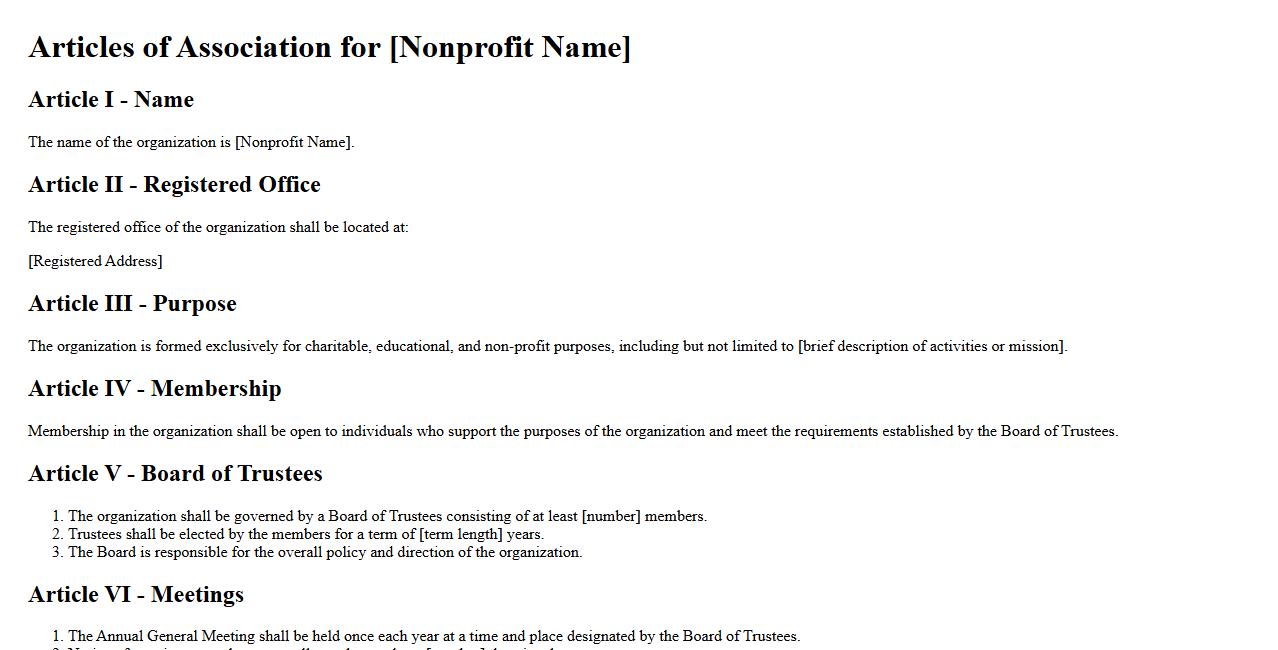

Articles of Association for Nonprofit

The Articles of Association for Nonprofit outline the rules and regulations governing the organization's operations and management. They define the purpose, structure, and responsibilities of members and directors to ensure transparency and accountability. Proper documentation helps nonprofits maintain legal compliance and achieve their mission effectively.

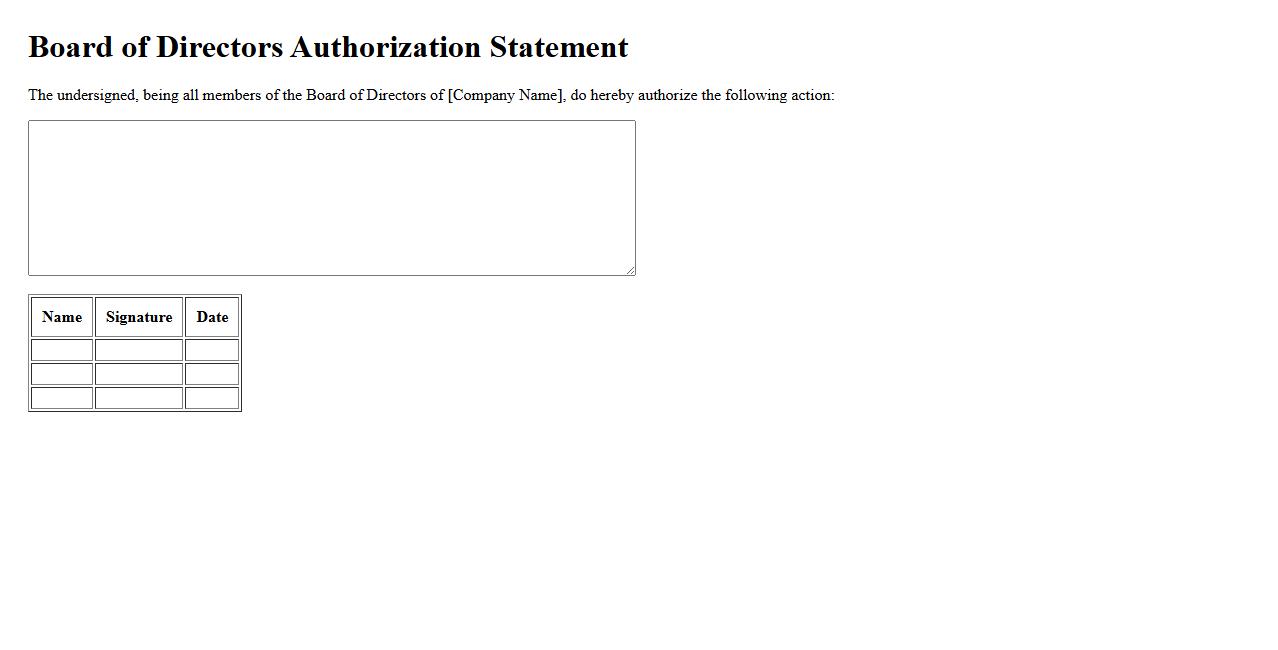

Board of Directors Authorization Statement

The Board of Directors Authorization Statement is an official declaration that validates decisions made by the company's board. It ensures transparency and accountability in corporate governance. This statement confirms the board's approval of key actions and policies.

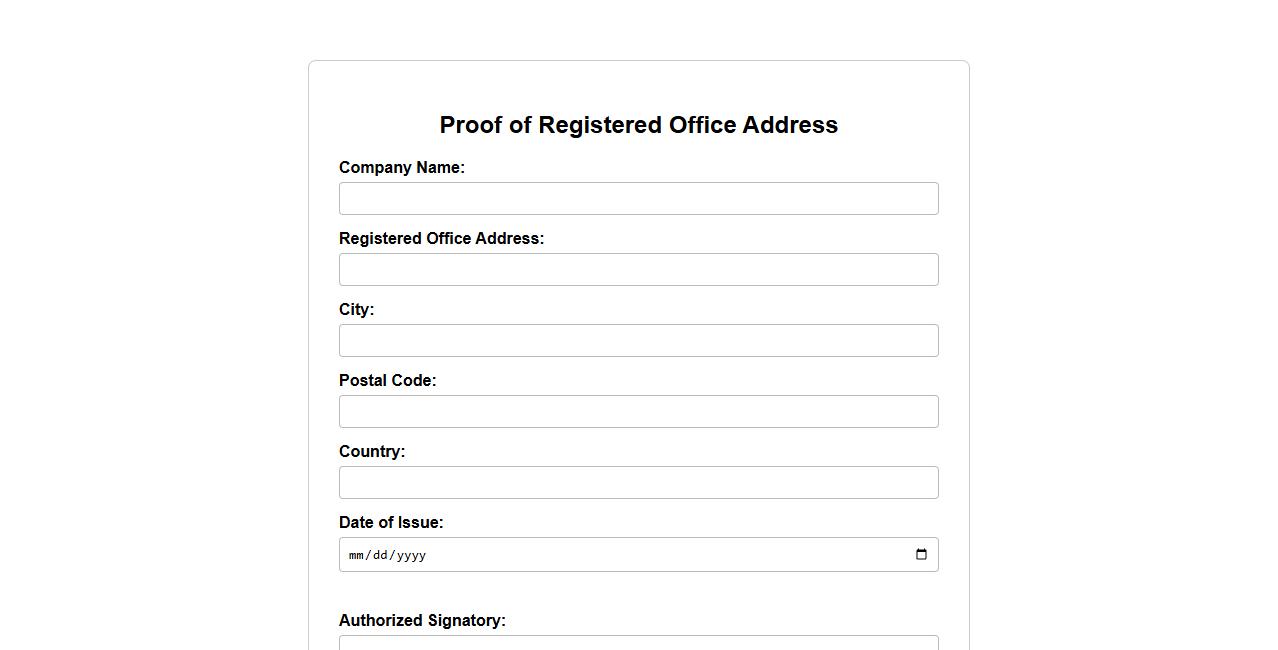

Proof of Registered Office Address

Providing a Proof of Registered Office Address is essential for validating the official location of a business. This document ensures compliance with legal requirements and facilitates communication with authorities. It typically includes utility bills, lease agreements, or government-issued certificates.

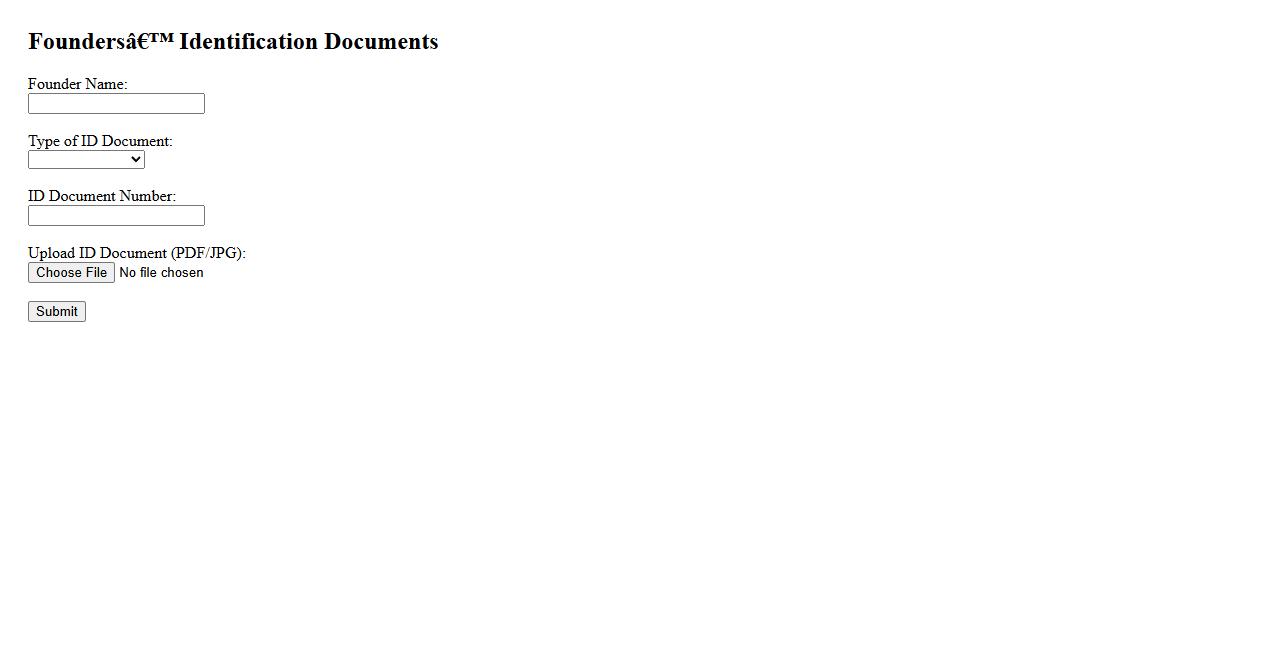

Founders’ Identification Documents

Founders' Identification Documents are essential records that verify the identity of the company's founders. These documents typically include passports, driver's licenses, or other government-issued IDs. Proper identification ensures legal compliance and establishes trustworthiness in business registration processes.

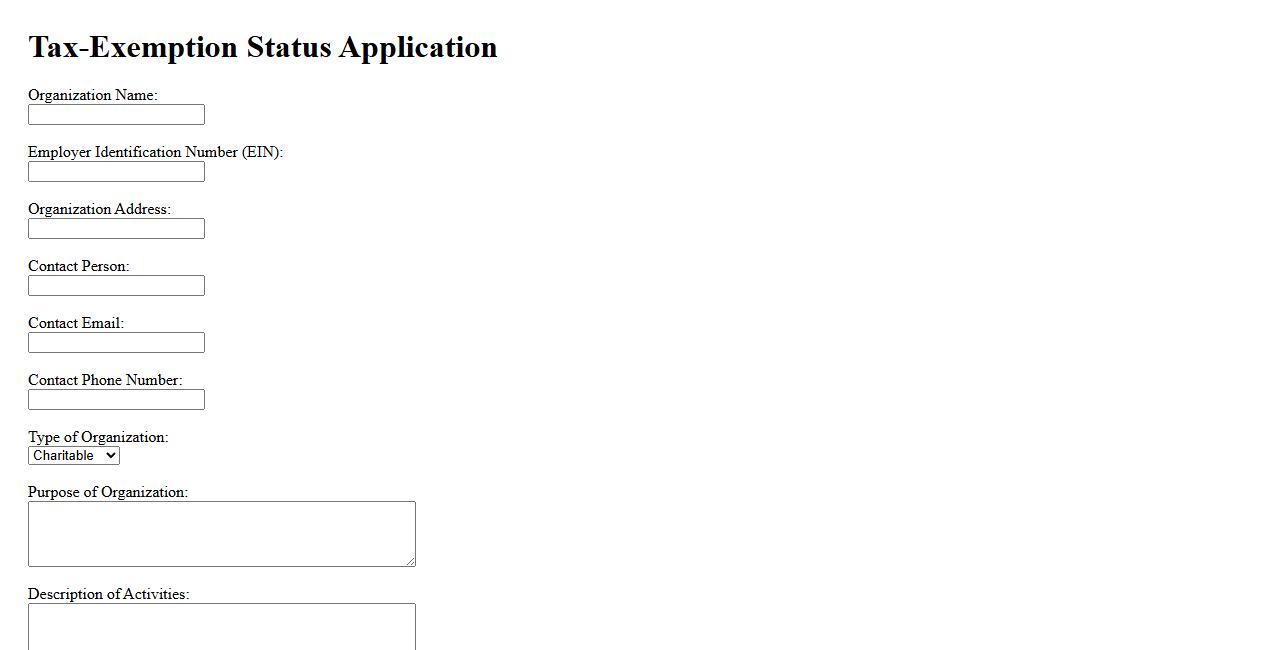

Tax-Exemption Status Application

Applying for tax-exemption status is essential for qualifying organizations to benefit from reduced tax liabilities. This process involves submitting specific documentation to the appropriate tax authority to demonstrate eligibility. Obtaining tax-exempt status can enhance an organization's financial sustainability and credibility.

Annual Report Submission

The Annual Report Submission is a critical process for businesses to provide a comprehensive overview of their financial performance and operations over the past year. This report ensures transparency and compliance with regulatory requirements, helping stakeholders make informed decisions. Timely submission of the annual report reflects a company's commitment to accountability and corporate governance.

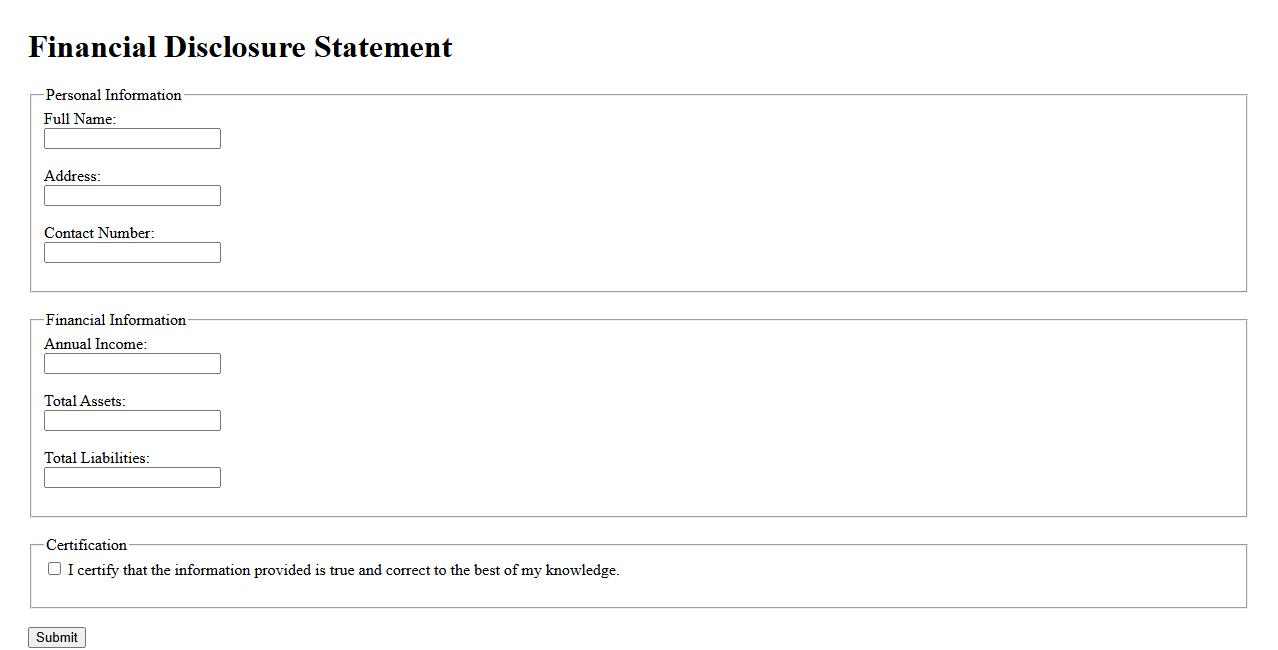

Financial Disclosure Statement

A Financial Disclosure Statement is a document that provides a detailed account of an individual's or organization's financial status. It helps ensure transparency by revealing assets, liabilities, income, and expenses. This statement is often required for legal, tax, or regulatory purposes.

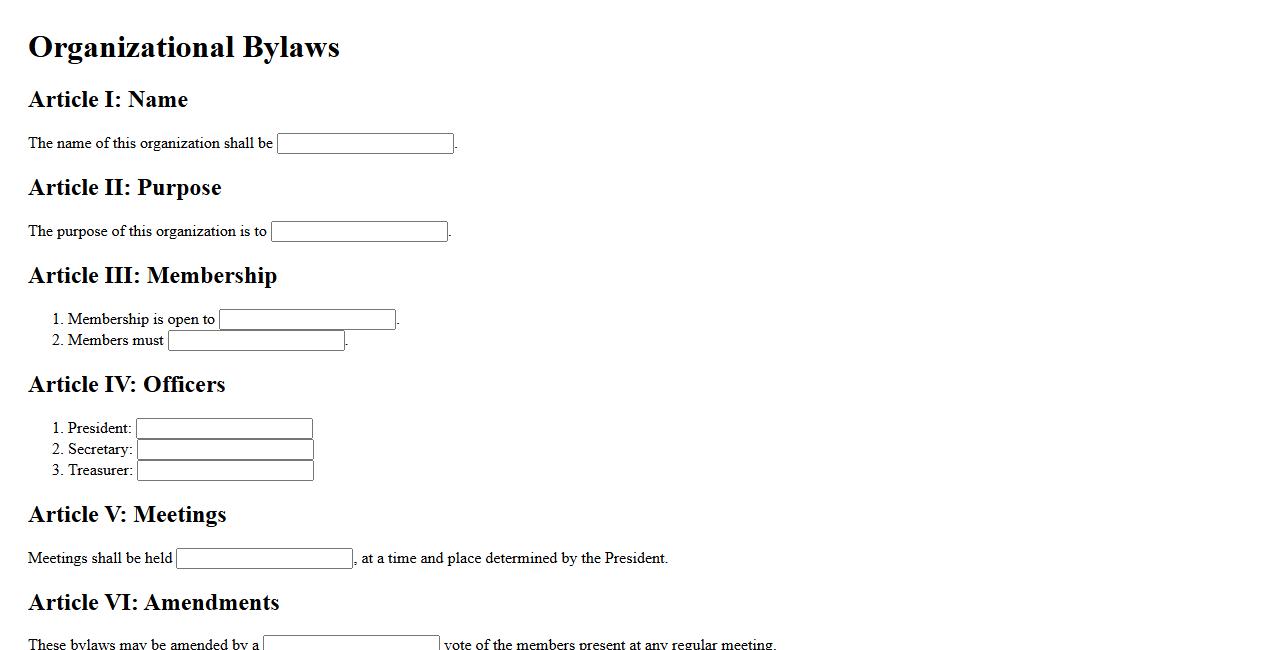

Organizational Bylaws

Organizational Bylaws are essential rules and guidelines that govern the internal management of an organization. They define the roles, responsibilities, and procedures for decision-making within the group. Clear bylaws ensure smooth operations and legal compliance for nonprofits and corporations alike.

What legal documents are required for registering a nonprofit organization?

To register a nonprofit organization, you generally need to prepare and submit the articles of incorporation, bylaws, and an application for tax exemption. These documents establish the legal framework and governance structure of the nonprofit. Additionally, other state-specific forms may be required to complete the registration process.

Which government authority is responsible for nonprofit registration in your jurisdiction?

The primary authority overseeing nonprofit registration is usually the Secretary of State or a similar state-level agency. This entity manages the filing of incorporation documents and maintains records of all registered nonprofits. In some cases, additional oversight might come from the state attorney general's office.

What are the eligibility criteria for establishing a nonprofit organization?

Eligibility criteria for forming a nonprofit typically include having a clear charitable, educational, religious, or social purpose. The organization must operate without profit motives and adhere to state and federal regulations. Founders should also ensure compliance with requirements regarding governance and operational transparency.

What information must be included in the nonprofit organization's articles of incorporation?

The articles of incorporation must include the nonprofit's name, purpose, registered agent details, and information about the incorporators. It should clearly state that the organization will operate on a nonprofit basis. Additionally, provisions about the distribution of assets upon dissolution are often necessary.

Are there any specific compliance documents required post-registration for nonprofits?

After registration, nonprofits must submit annual reports, financial statements, and maintain their tax-exempt status through the IRS. Compliance may also involve state-level filings like charitable solicitation registrations. Ongoing adherence to governance practices and public disclosure rules is essential to remain in good standing.