Registration for State Sales Tax is a mandatory process for businesses selling taxable goods or services within a state. It involves applying for a sales tax permit or license, enabling the business to collect and remit sales tax to the state government. Compliance ensures proper reporting and avoids penalties related to state tax regulations.

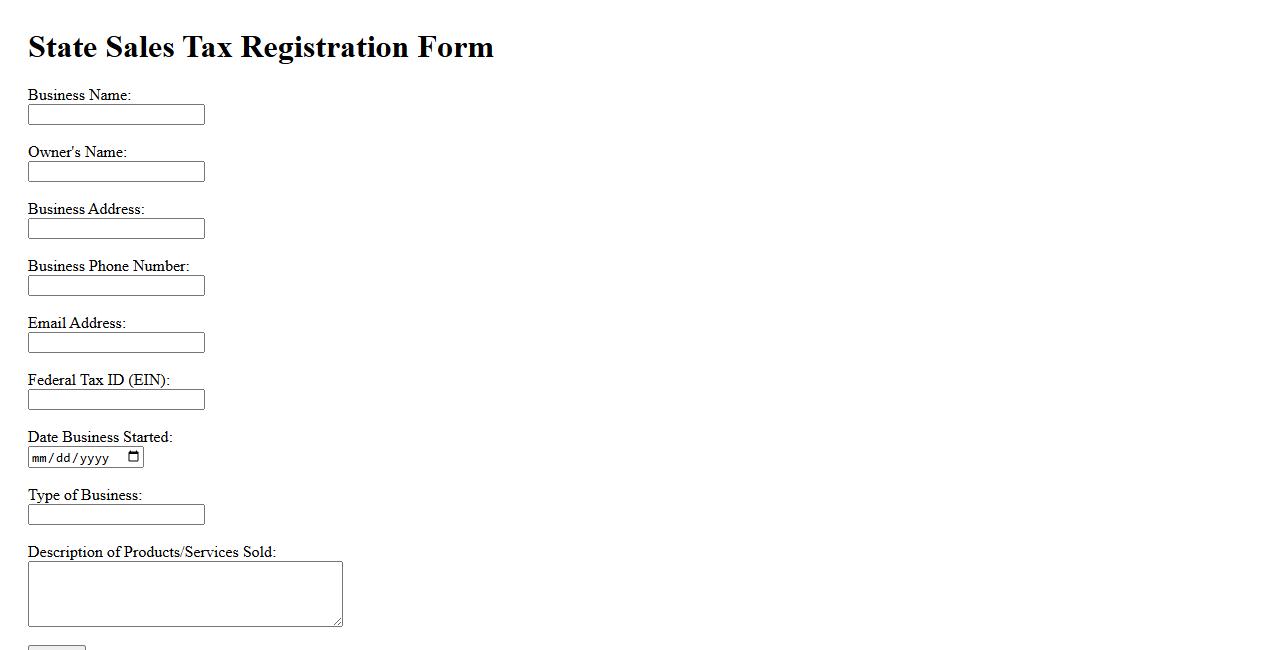

State Sales Tax Registration Form

The State Sales Tax Registration Form is a mandatory document for businesses to legally collect sales tax within a specific state. It ensures compliance with state tax regulations and enables proper tracking of taxable transactions. Completing this form accurately is essential for smooth business operations and avoiding legal penalties.

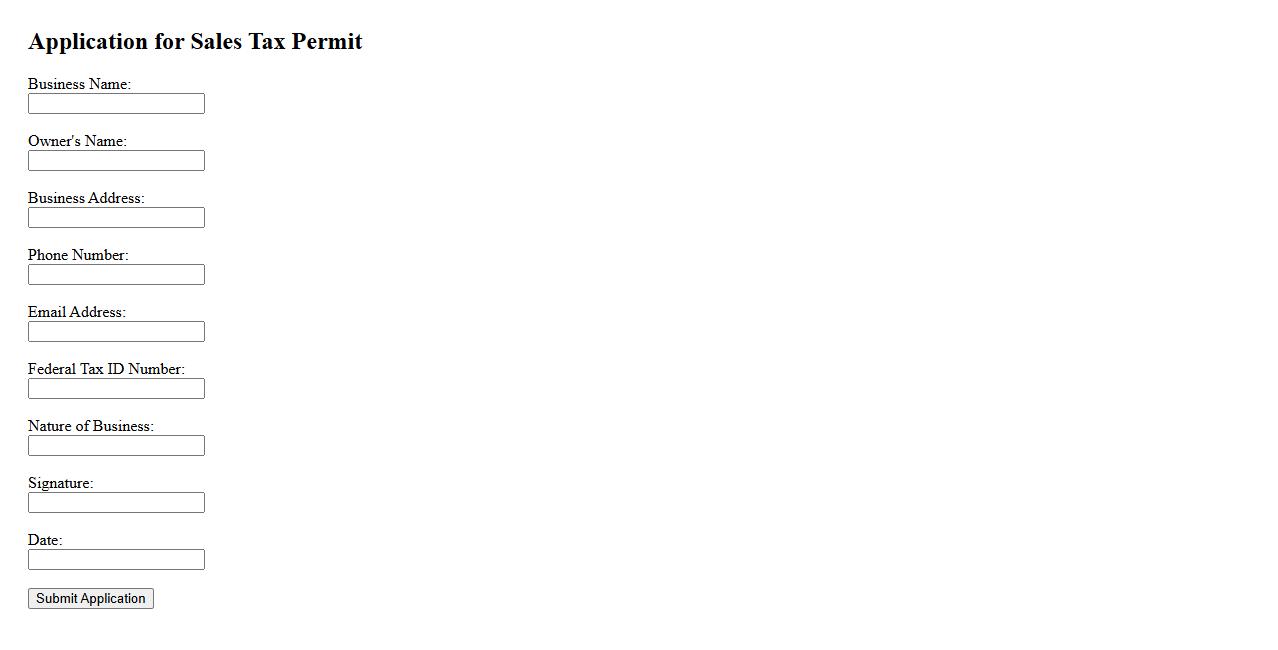

Application for Sales Tax Permit

Applying for a Sales Tax Permit is essential for businesses to legally collect and remit sales tax. This permit allows companies to comply with state tax regulations and avoid penalties. The application process typically involves submitting business information and tax identification details to the appropriate tax authority.

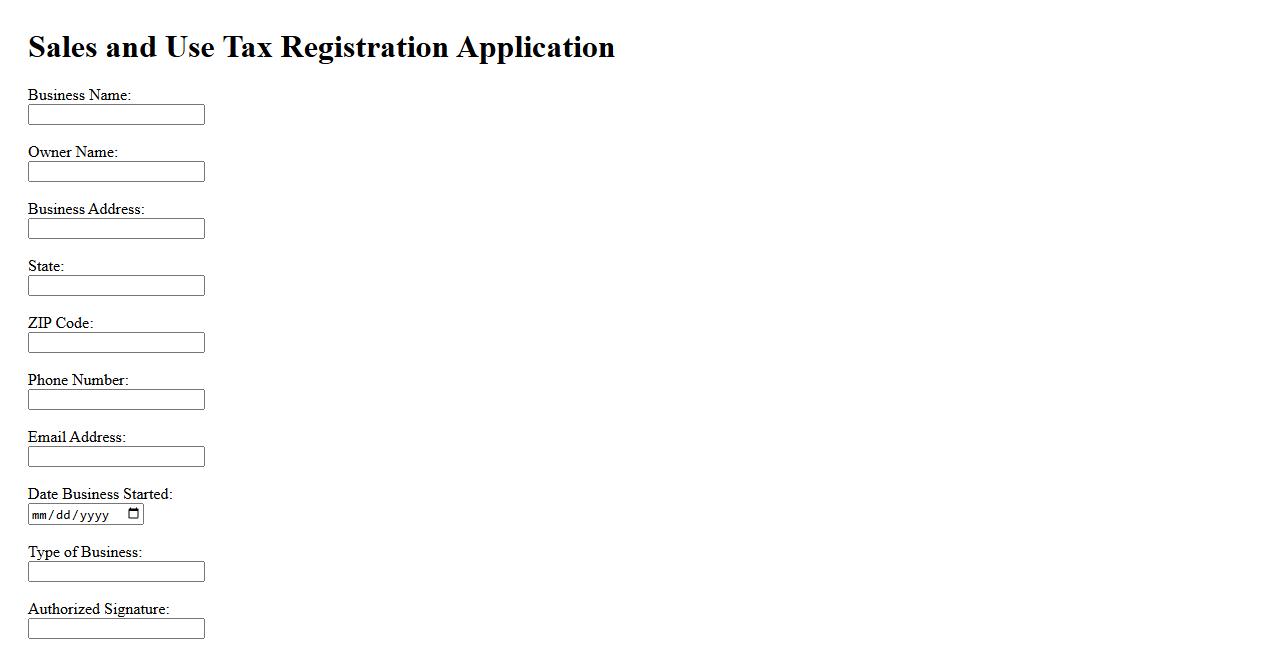

Sales and Use Tax Registration Application

The Sales and Use Tax Registration Application is a necessary form for businesses to legally collect and report sales tax. This application facilitates compliance with state tax regulations by registering your business with the appropriate tax authority. Timely submission ensures proper tax processing and helps avoid penalties.

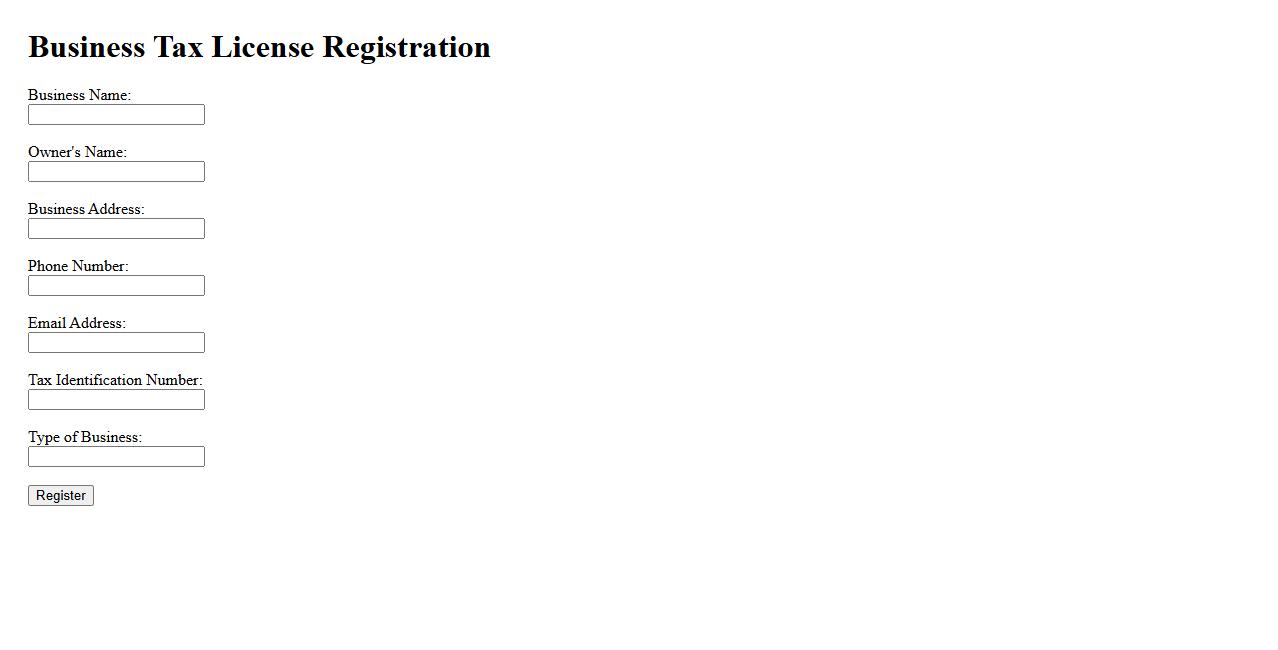

Business Tax License Registration

Obtaining a Business Tax License Registration is essential for legally operating your company within a specific jurisdiction. This registration ensures your business complies with local tax laws and regulations. It also enables you to collect and remit taxes appropriately to avoid penalties.

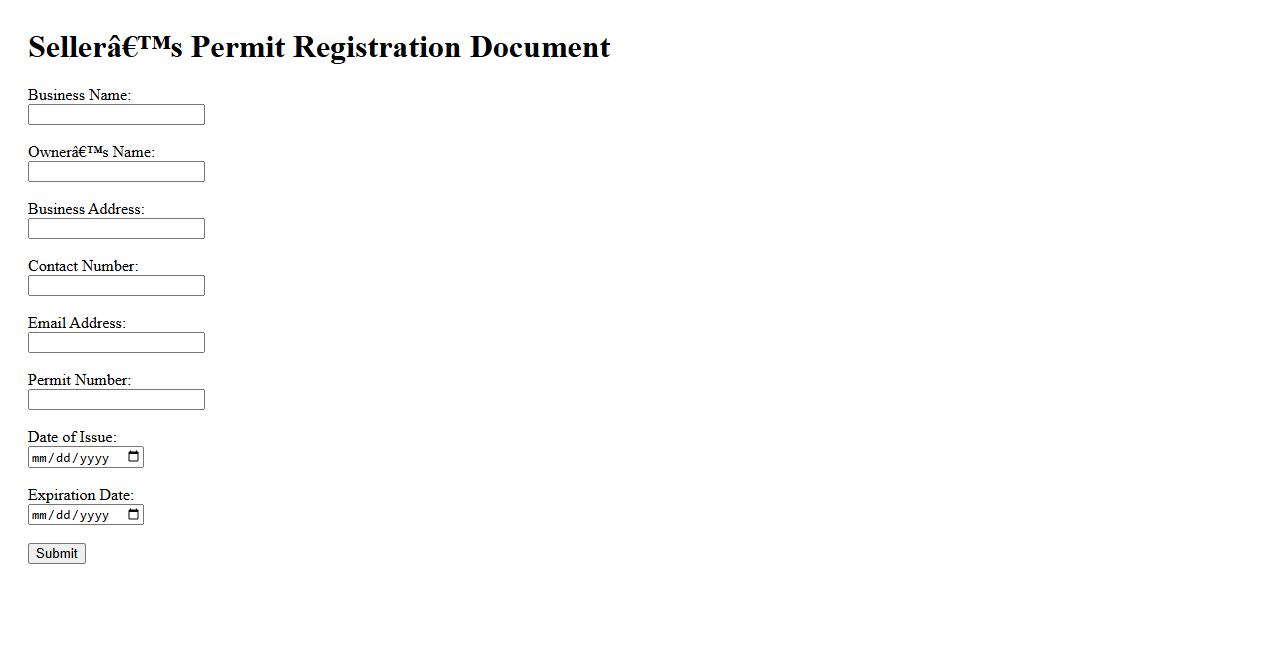

Seller’s Permit Registration Document

The Seller's Permit Registration Document is an essential official form required for businesses to legally sell goods within certain states. It authorizes sellers to collect sales tax from customers, ensuring compliance with tax regulations. Obtaining this document helps businesses operate transparently and avoid legal penalties.

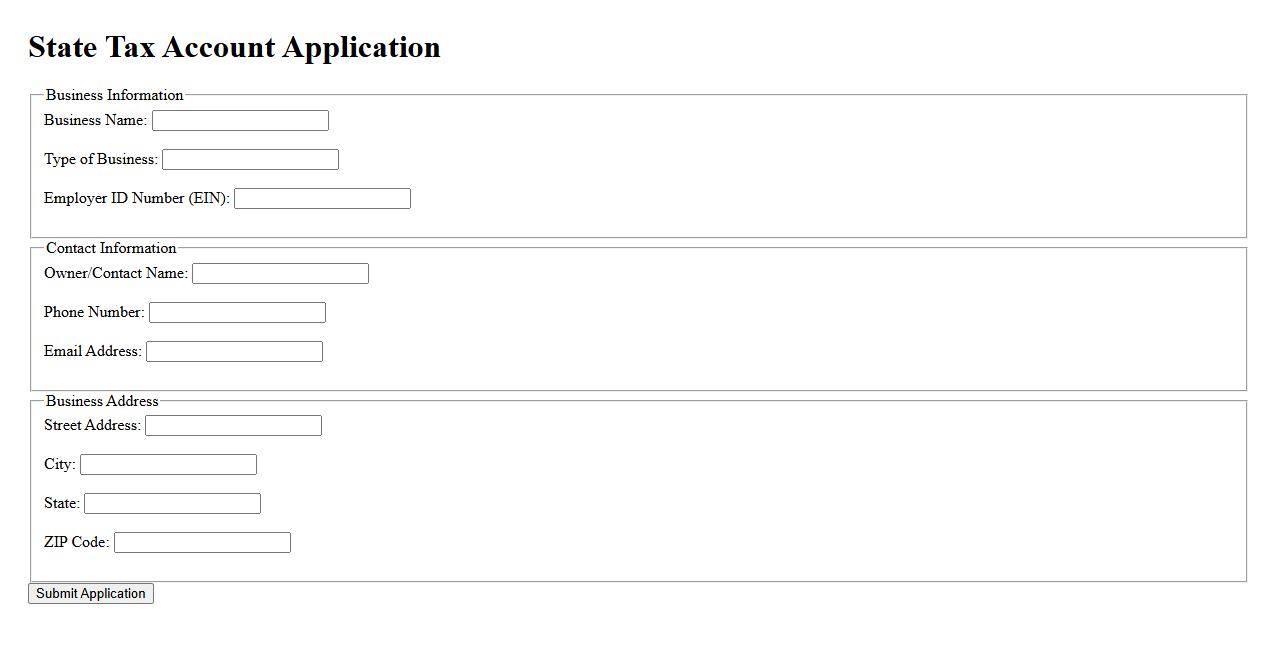

State Tax Account Application

The State Tax Account Application is an essential tool for individuals and businesses to register and manage state tax responsibilities efficiently. It simplifies the filing process by providing a centralized platform for account creation, tax payment, and compliance tracking. Utilizing this application ensures accurate reporting and adherence to state tax regulations.

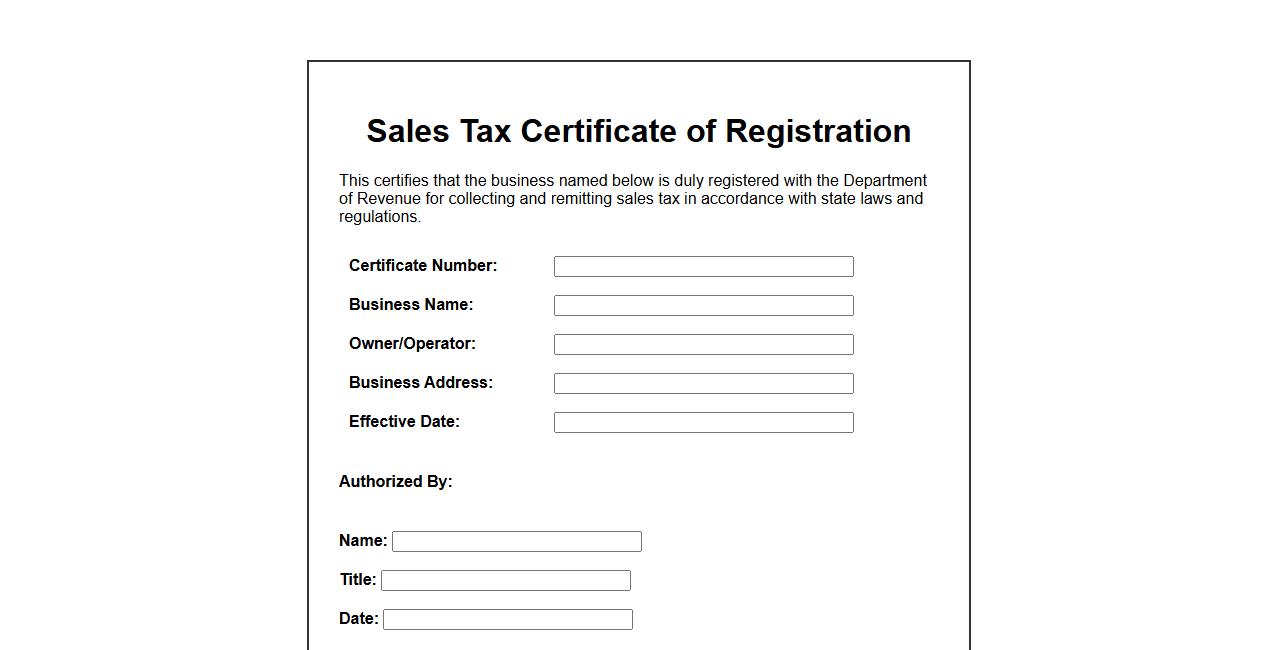

Sales Tax Certificate of Registration

A Sales Tax Certificate of Registration is an official document issued by tax authorities that allows businesses to legally collect and remit sales tax. This certificate verifies that a business is registered to comply with state or local sales tax regulations. Obtaining this certificate is essential for maintaining lawful operations and avoiding penalties.

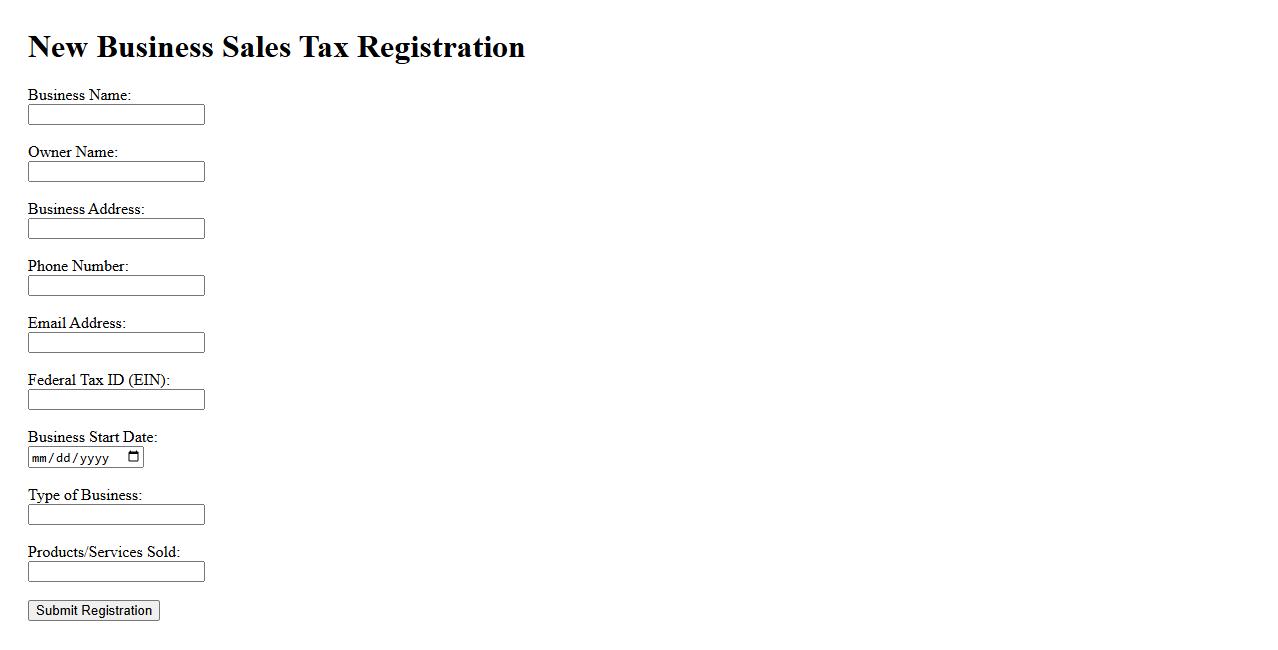

New Business Sales Tax Registration

Registering for New Business Sales Tax is a crucial step for any startup to ensure legal compliance. It involves obtaining a sales tax identification number to correctly collect and remit taxes on sold goods or services. Proper registration helps avoid penalties and streamlines financial operations from the beginning.

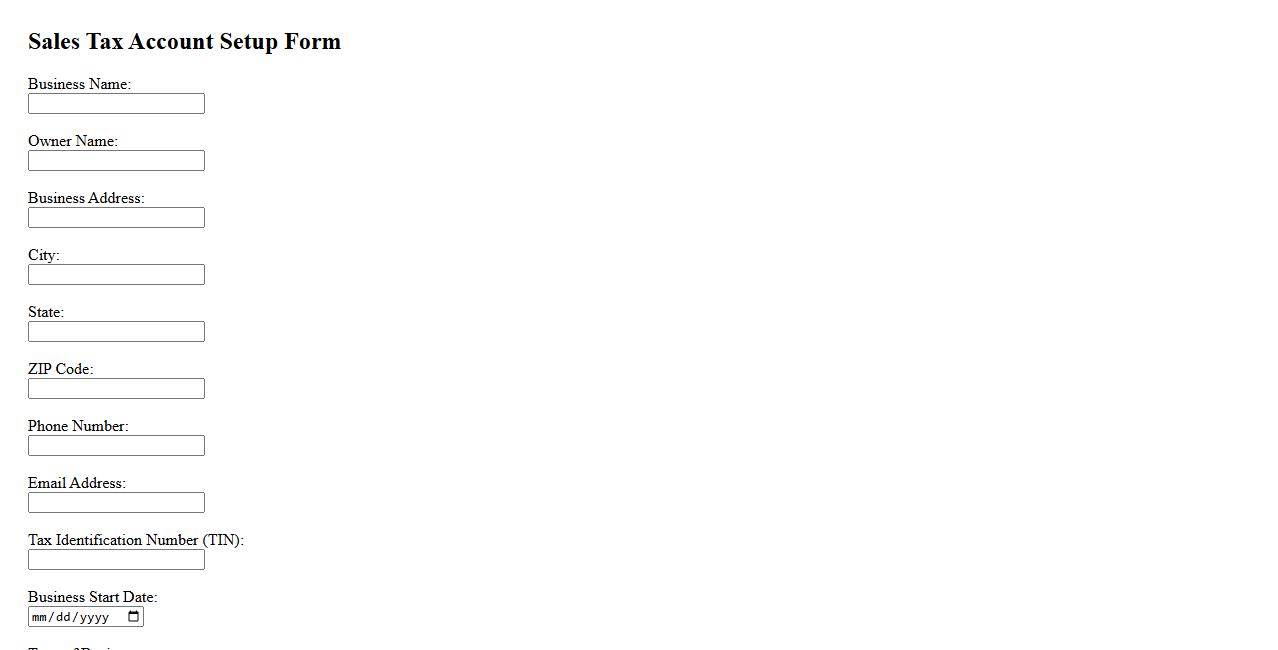

Sales Tax Account Setup Form

The Sales Tax Account Setup Form is essential for businesses to register and manage their sales tax obligations accurately. This form collects critical information needed to create a sales tax account with the appropriate tax authorities. Proper completion ensures compliance with local and state tax regulations.

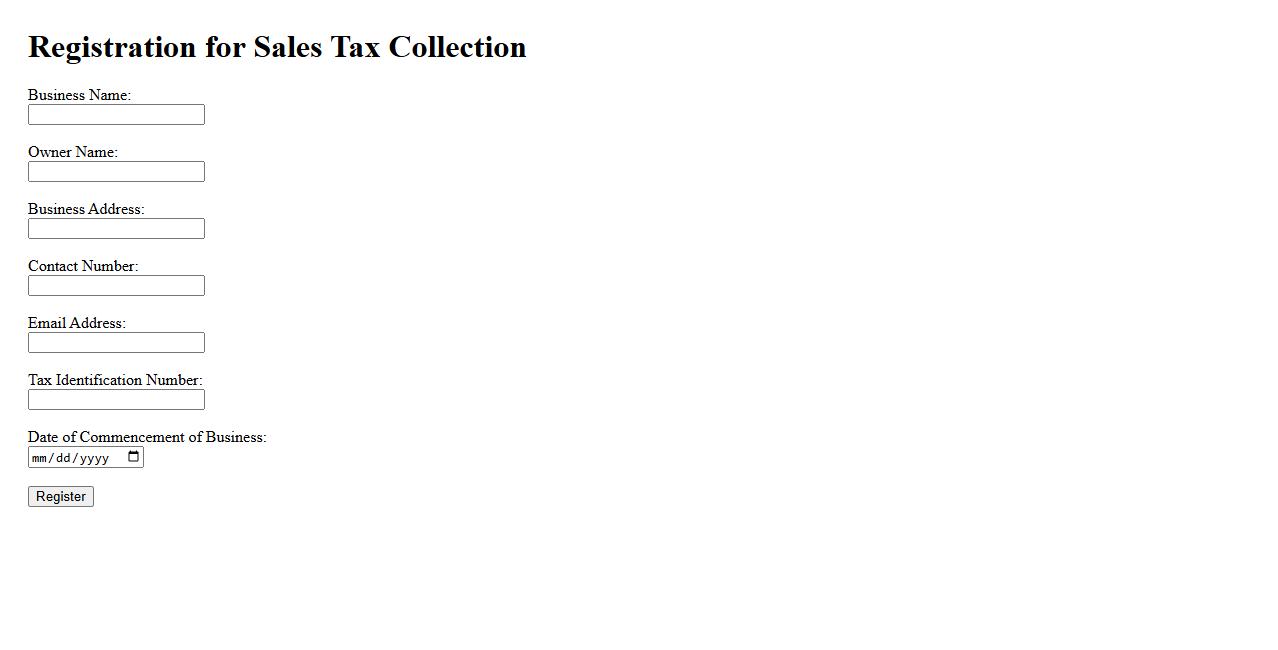

Registration for Sales Tax Collection

Registration for Sales Tax Collection is a crucial process for businesses required to collect sales tax from customers. It involves obtaining a unique tax identification number from the relevant tax authority. Proper registration ensures compliance with tax laws and timely remittance of collected taxes.

What information is required to complete the state sales tax registration document?

To complete the state sales tax registration document, businesses must provide detailed information such as their legal business name, physical address, and Employer Identification Number (EIN). Additionally, the primary business activity and anticipated sales volume are typically requested. Accurate details ensure proper processing and compliance with state tax regulations.

Which types of businesses are obligated to register for state sales tax?

Businesses that engage in the sale, lease, or rental of tangible personal property within a state are generally required to register for state sales tax. This obligation often extends to service providers and e-commerce sellers who meet specific nexus criteria. Registration ensures businesses collect and remit sales tax according to state laws.

What are the steps involved in submitting the sales tax registration form?

Submitting the sales tax registration form typically begins with gathering all required information and completing the application via the state's tax authority website or physical office. After submission, the application is reviewed, and confirmation or a sales tax permit is issued upon approval. Businesses should keep a copy of this permit for their records and future tax reporting.

How does registering for state sales tax impact a business's tax collection and remittance duties?

Once registered for state sales tax, a business is required to collect the appropriate sales tax from customers on taxable transactions. The business must then remit these collected funds to the state at prescribed intervals, maintaining accurate records. Compliance with these duties helps avoid penalties and ensures legal operation within the state.

What supporting documents must be provided with the state sales tax registration application?

Supporting documents for the state sales tax registration application often include proof of business formation, such as articles of incorporation, and tax identification numbers. Additionally, documents verifying the business location and ownership may be required to confirm legitimacy. Providing these ensures the state can validate the application swiftly and accurately.