Registration for Foreign Corporation involves the process of legally authorizing a company incorporated in one state or country to conduct business in another jurisdiction. This procedure typically requires submitting formation documents, appointing a registered agent, and paying applicable fees to the state's Secretary of State office. Compliance with local regulations ensures the corporation can operate lawfully and protects its rights within the new market.

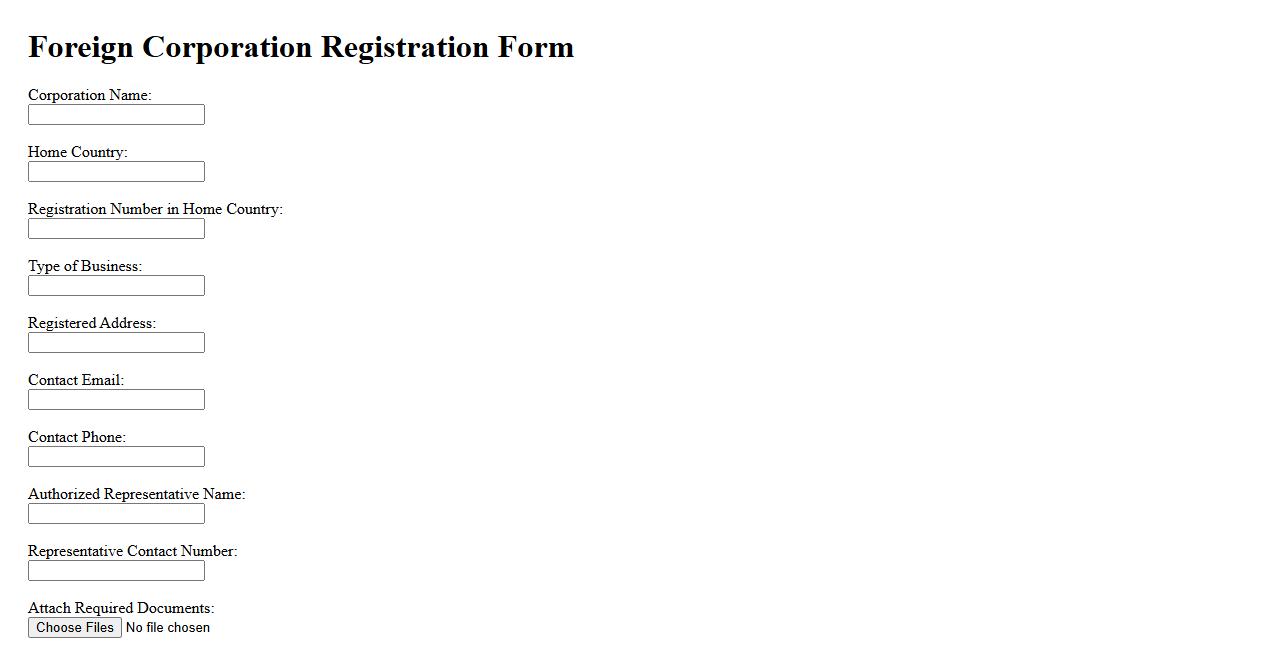

Foreign Corporation Registration Form

The Foreign Corporation Registration Form is essential for businesses incorporated outside a state but seeking to operate within it. This document ensures legal compliance and grants permission to conduct business activities locally. Completing the form accurately aids in seamless market entry and regulatory adherence.

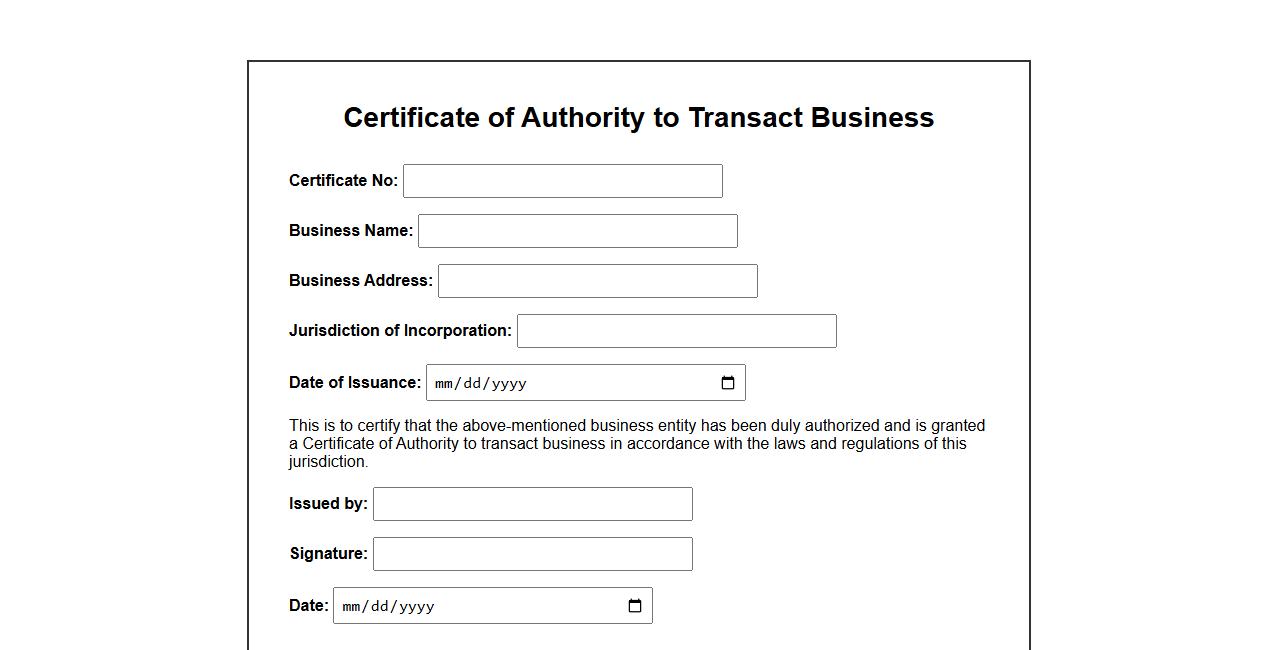

Certificate of Authority to Transact Business

The Certificate of Authority to Transact Business is a legal document that permits a company to operate in a state other than where it was originally incorporated. It ensures compliance with local regulations and authorizes the business to legally conduct transactions. Obtaining this certificate is essential for expanding operations across state lines.

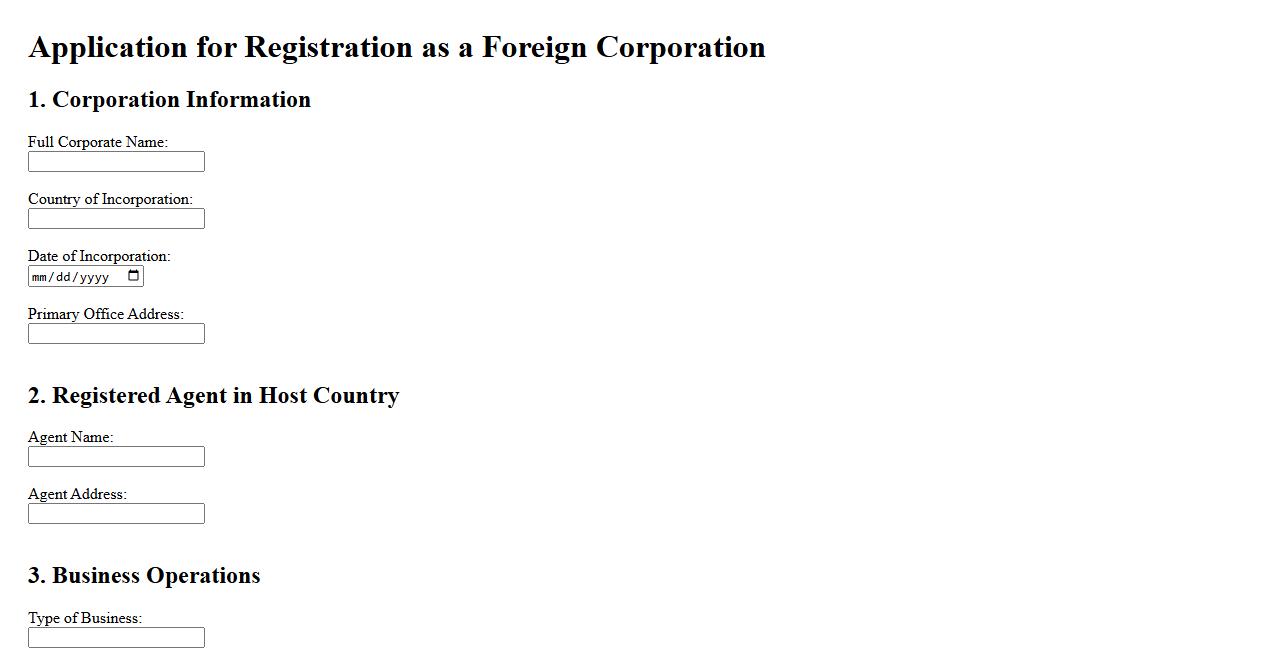

Application for Registration as a Foreign Corporation

The Application for Registration as a Foreign Corporation is a legal document required for businesses incorporated outside a state to legally operate within that state. This application ensures compliance with local regulations and grants the corporation the authority to conduct business activities. Proper registration protects the company's rights and establishes its presence in the new jurisdiction.

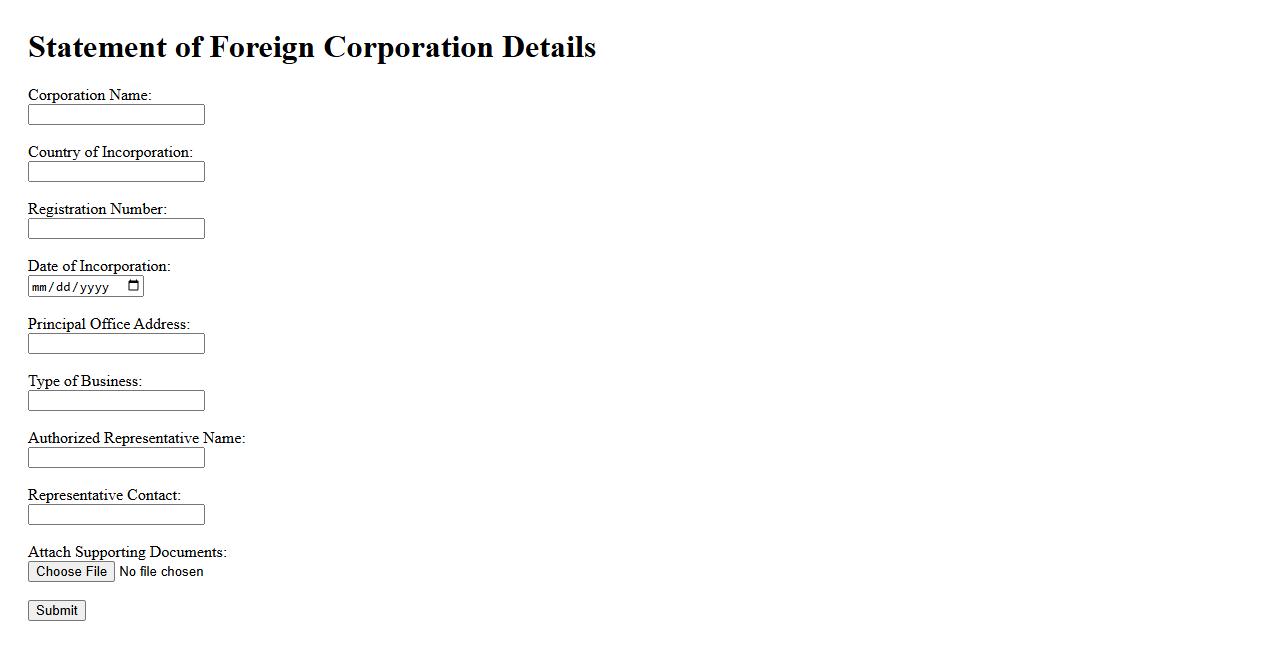

Statement of Foreign Corporation Details

The Statement of Foreign Corporation Details is a legal document required for corporations operating outside their incorporation state. It provides essential information such as the corporation's name, address, and authorized agents. This statement ensures compliance with state regulations and facilitates transparent business operations across borders.

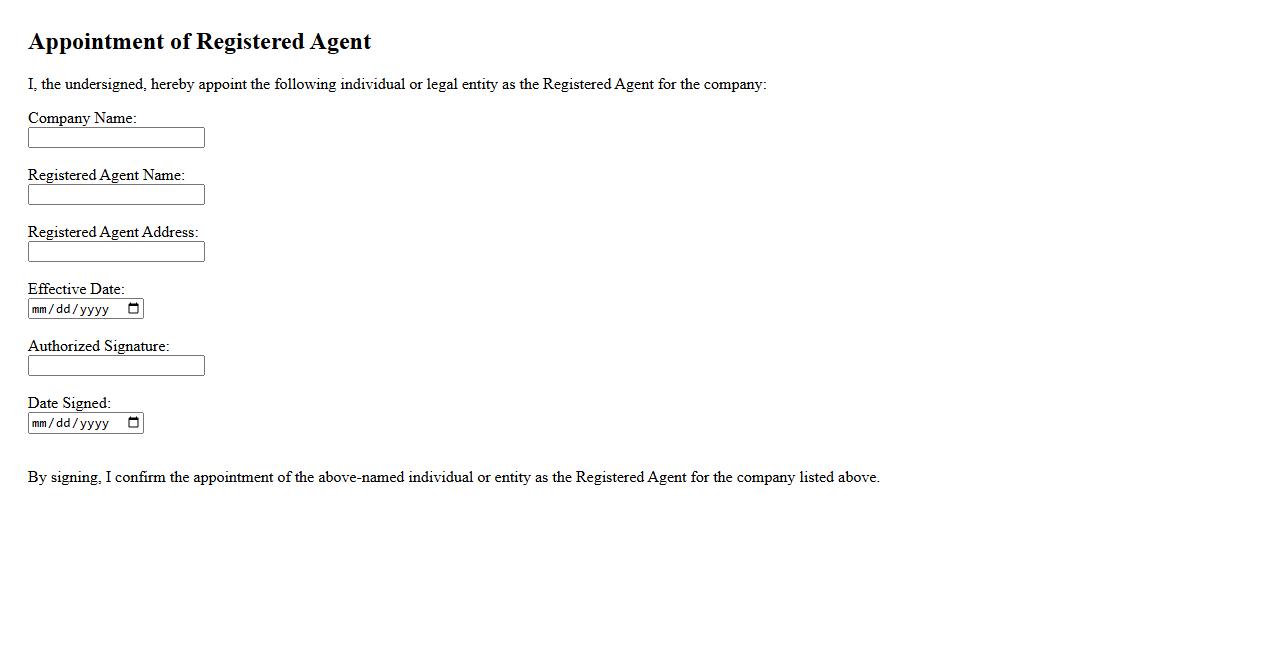

Appointment of Registered Agent

The Appointment of Registered Agent is a crucial step in forming a business entity, ensuring there is an official point of contact for legal and government documents. This agent is responsible for receiving important correspondence on behalf of the company. Choosing a reliable registered agent helps maintain compliance and facilitates seamless communication with state authorities.

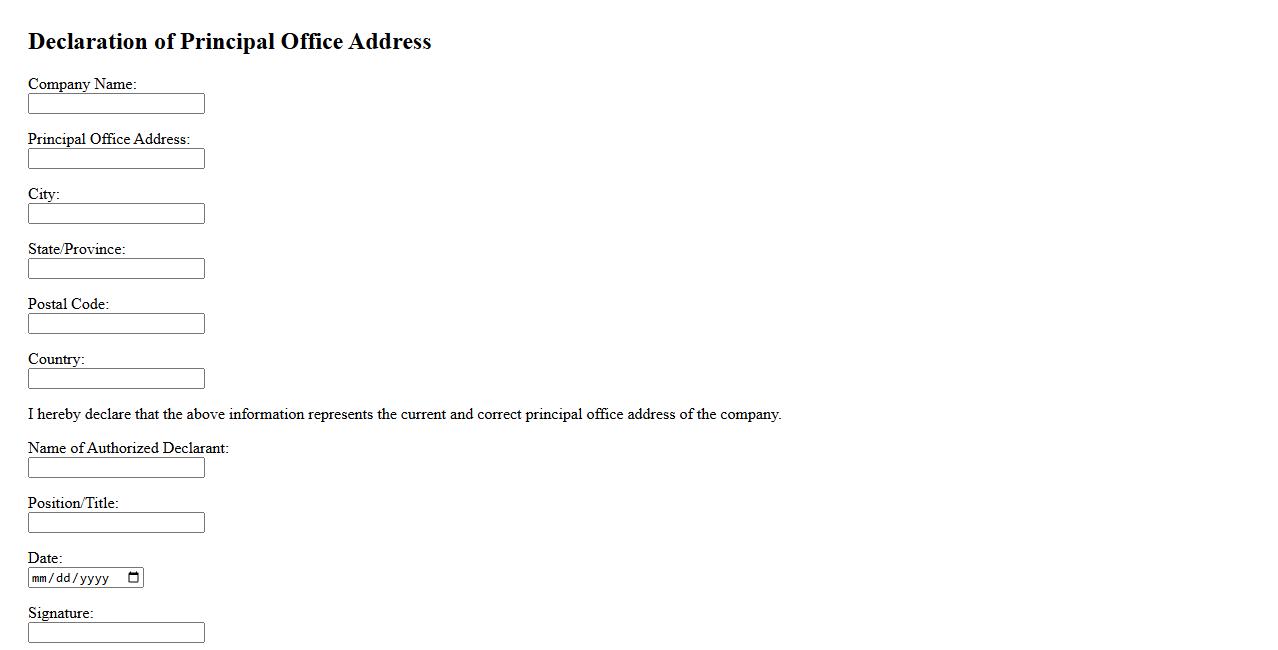

Declaration of Principal Office Address

The Declaration of Principal Office Address is a formal document that specifies the main location where a company's business operations are conducted. It is essential for legal and correspondence purposes, ensuring that official communications are directed to the correct address. Keeping this information up-to-date helps maintain compliance with regulatory requirements.

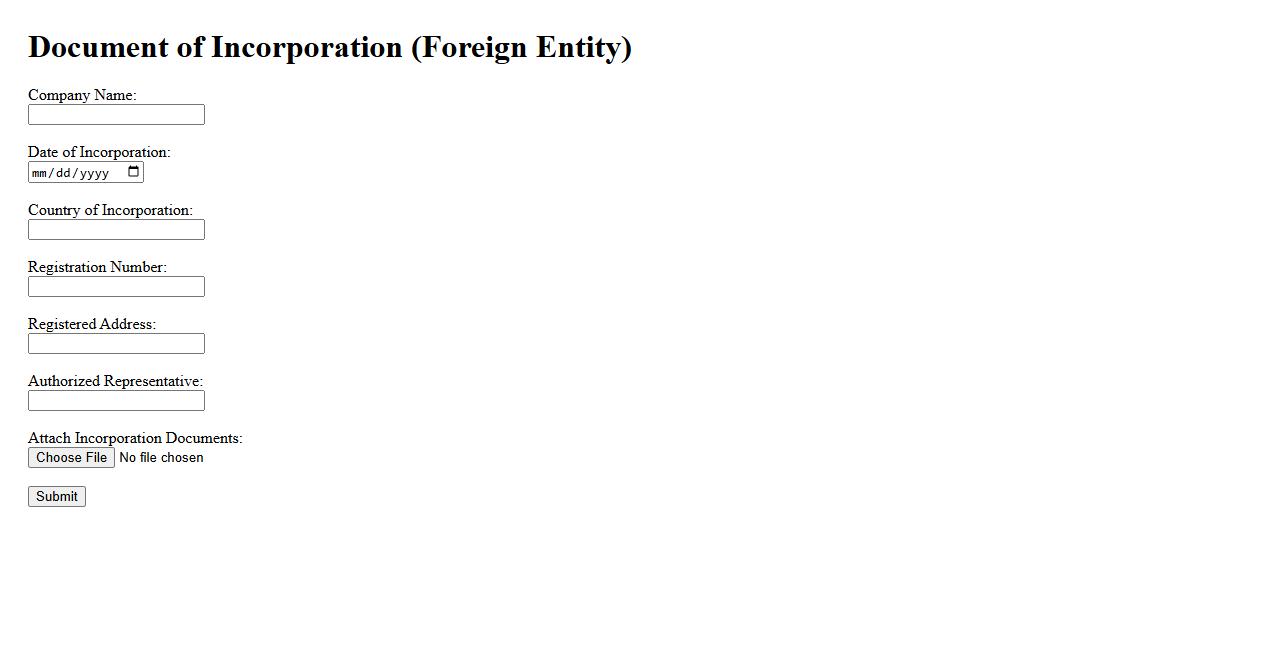

Document of Incorporation (Foreign Entity)

The Document of Incorporation (Foreign Entity) is a legal certificate that allows a company to register and operate in a jurisdiction outside its original formation location. This document ensures compliance with local laws and authorizes the foreign entity to conduct business activities within the new region. It is essential for establishing a valid legal presence and maintaining regulatory standards.

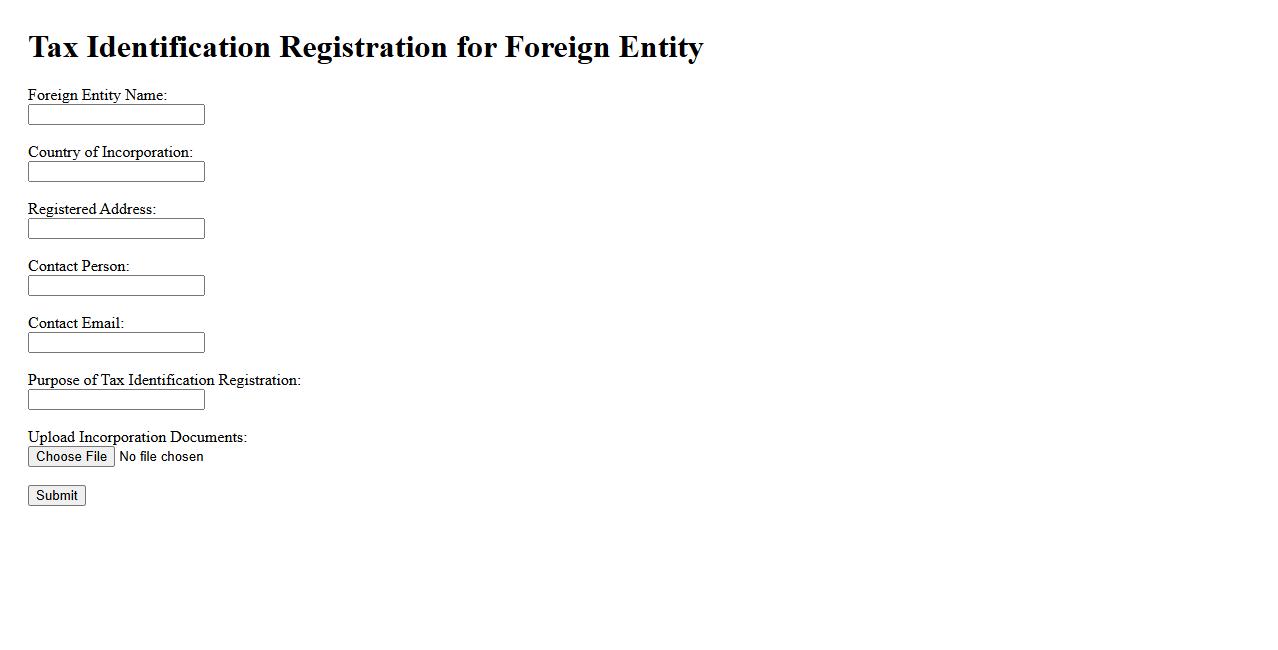

Tax Identification Registration for Foreign Entity

The Tax Identification Registration for Foreign Entity is a crucial process for non-resident businesses operating in a new country. It enables compliance with local tax laws and facilitates legal financial transactions. Completing this registration ensures proper tax reporting and avoids penalties.

Certificate of Good Standing from Home Country

A Certificate of Good Standing from Home Country is an official document that verifies a company's legal existence and compliance with local regulations. This certificate is often required for international business transactions, registration, or expansion purposes. Obtaining this document ensures that the organization is recognized as active and in good legal standing in its home jurisdiction.

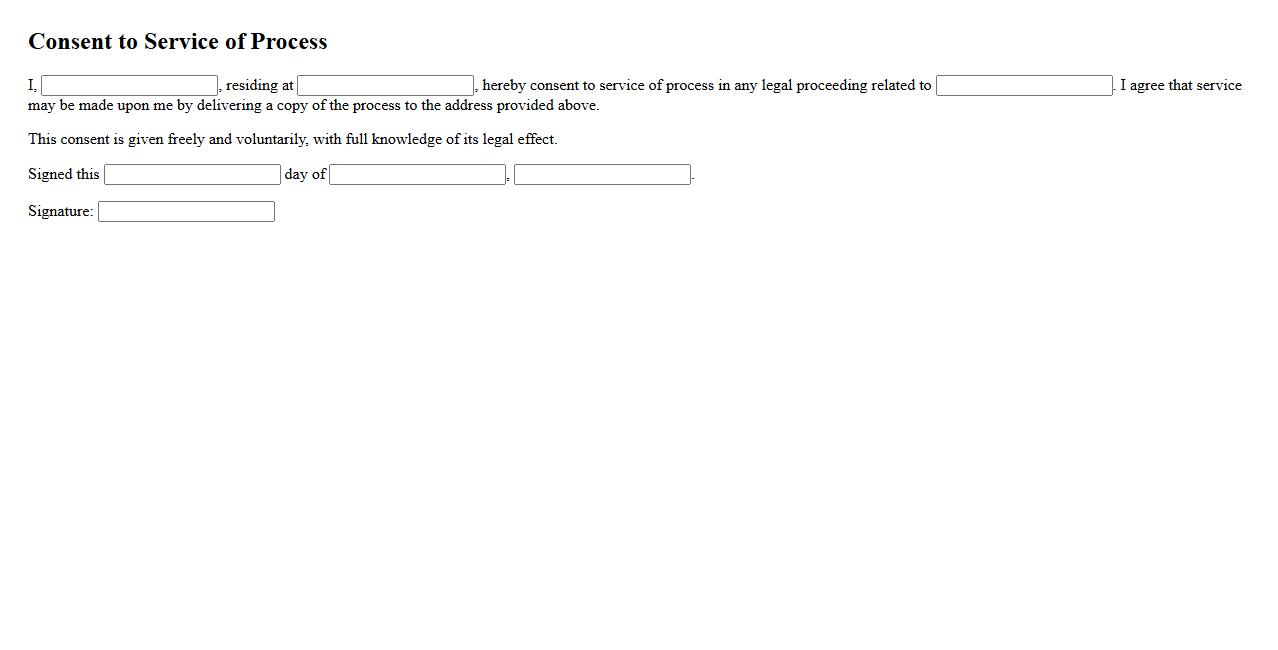

Consent to Service of Process

Consent to Service of Process refers to an agreement allowing legal documents to be served outside the usual methods, often simplifying jurisdictional procedures. This consent ensures that parties acknowledge and accept how and where legal notices are delivered. It is crucial for efficient and clear communication in legal proceedings.

What are the legal prerequisites for a foreign corporation to register in a new jurisdiction?

To register a foreign corporation in a new jurisdiction, it must meet certain legal prerequisites such as obtaining a certificate of good standing from its home country. The corporation typically needs to appoint a registered agent within the host jurisdiction. Additionally, it must comply with local laws, including business licenses and permits.

Which documents must a foreign corporation submit to complete the registration process?

A foreign corporation is required to submit key documents, including a certificate of incorporation or existence, and a certificate of good standing from its home jurisdiction. It also needs to provide a completed application form and details about its directors and officers. Proof of a registered agent and a filing fee are also essential for the registration process.

How does the registration of a foreign corporation affect its tax obligations in the host country?

Once registered, a foreign corporation is subject to the host country's tax obligations, including income and possibly sales taxes. The corporation may be required to withhold taxes on payments to non-resident entities. Registration also triggers the need to file regular tax returns according to local regulations.

What ongoing compliance requirements must a registered foreign corporation fulfill?

Registered foreign corporations must fulfill ongoing compliance requirements such as submitting annual reports and paying periodic fees. They must maintain a registered agent and update their records with any changes in corporate structure. Compliance with local labor, tax, and corporate laws is continuously necessary to retain good standing.

In what instances can a foreign corporation's registration be suspended or revoked?

A foreign corporation's registration can be suspended or revoked due to failure to file required documents or pay owed fees. Non-compliance with local laws or fraudulent activities can also lead to revocation. Persistent violation of regulatory requirements typically results in the loss of the corporation's registration status.