To obtain a Taxpayer Identification Number, individuals or businesses must complete the required registration process with the relevant tax authority. This process involves submitting necessary identification documents and filling out an application form to verify eligibility. Receiving a Taxpayer Identification Number is essential for filing taxes and conducting financial transactions legally.

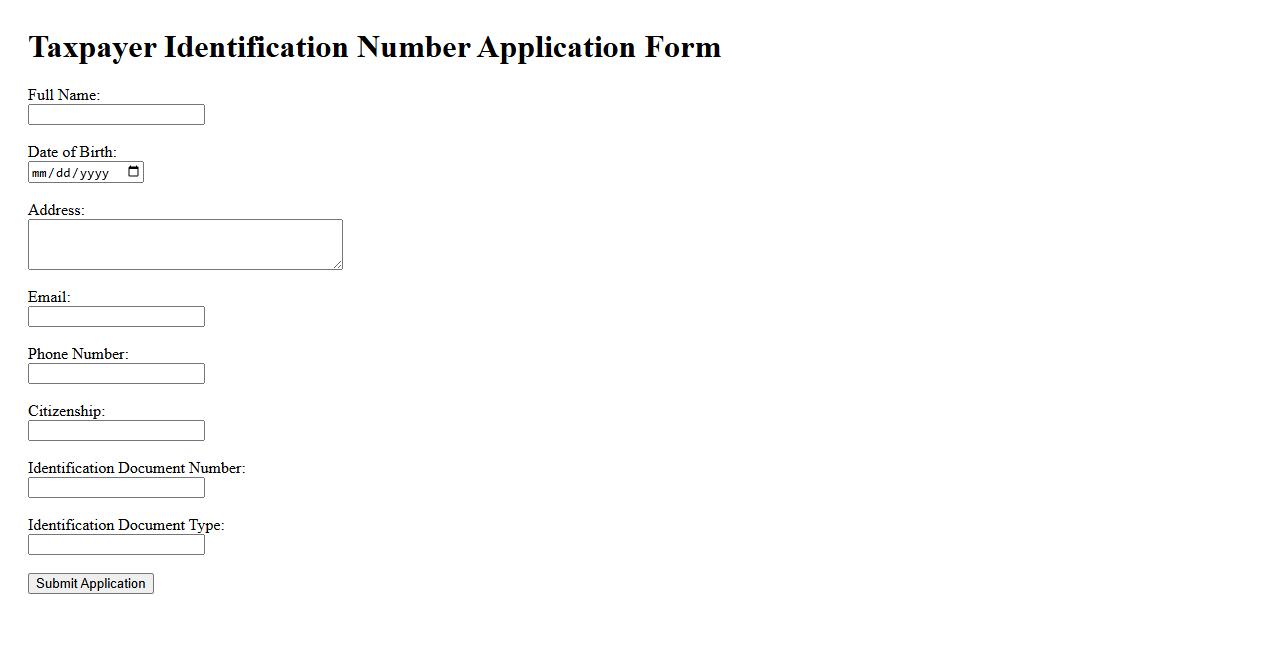

Taxpayer Identification Number Application Form

The Taxpayer Identification Number Application Form is a crucial document used to request a unique identifier for tax purposes. It simplifies tax processing and ensures accurate tracking of individual or business tax obligations. Submitting this form correctly is essential for compliance with government tax regulations.

Request for Taxpayer Identification Code

A Request for Taxpayer Identification Code is a formal process used to obtain a unique identifier assigned by tax authorities. This code is essential for tax reporting, filing, and compliance purposes. Individuals and businesses must submit specific documentation to complete the request successfully.

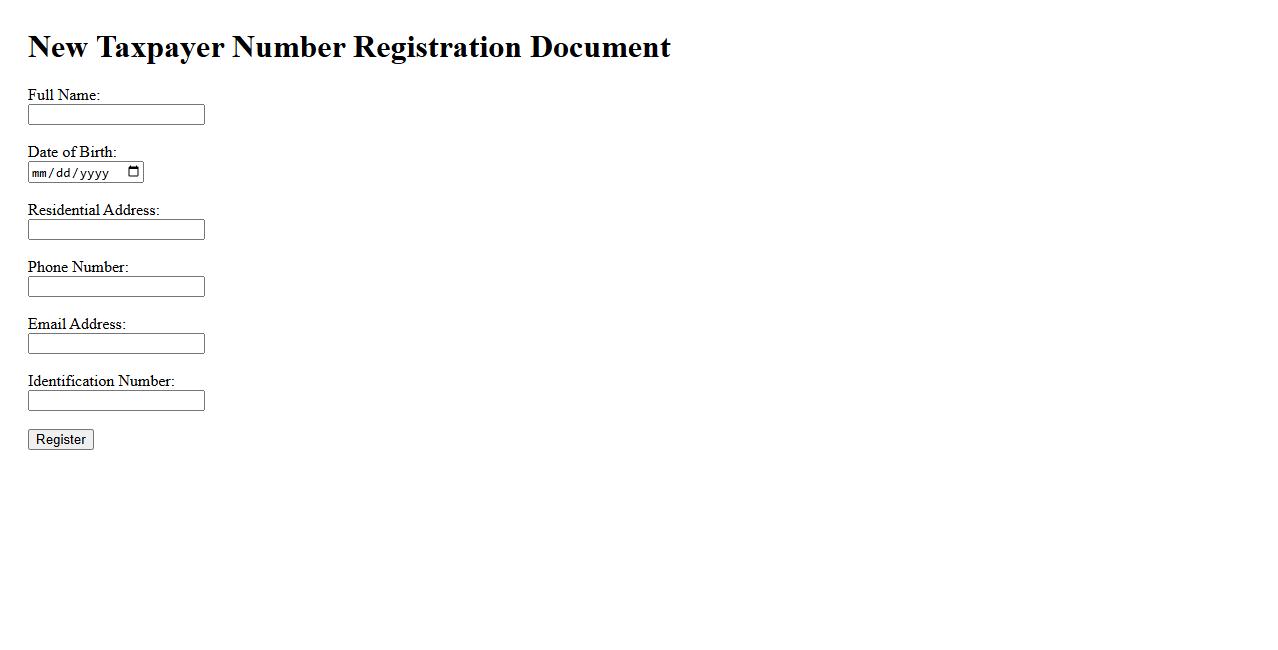

New Taxpayer Number Registration Document

The New Taxpayer Number Registration Document is an essential official form used to register individuals or businesses with the tax authorities. This document ensures proper identification for tax purposes and compliance with government regulations. Accurate submission of this registration is crucial for legal tax filing and record-keeping.

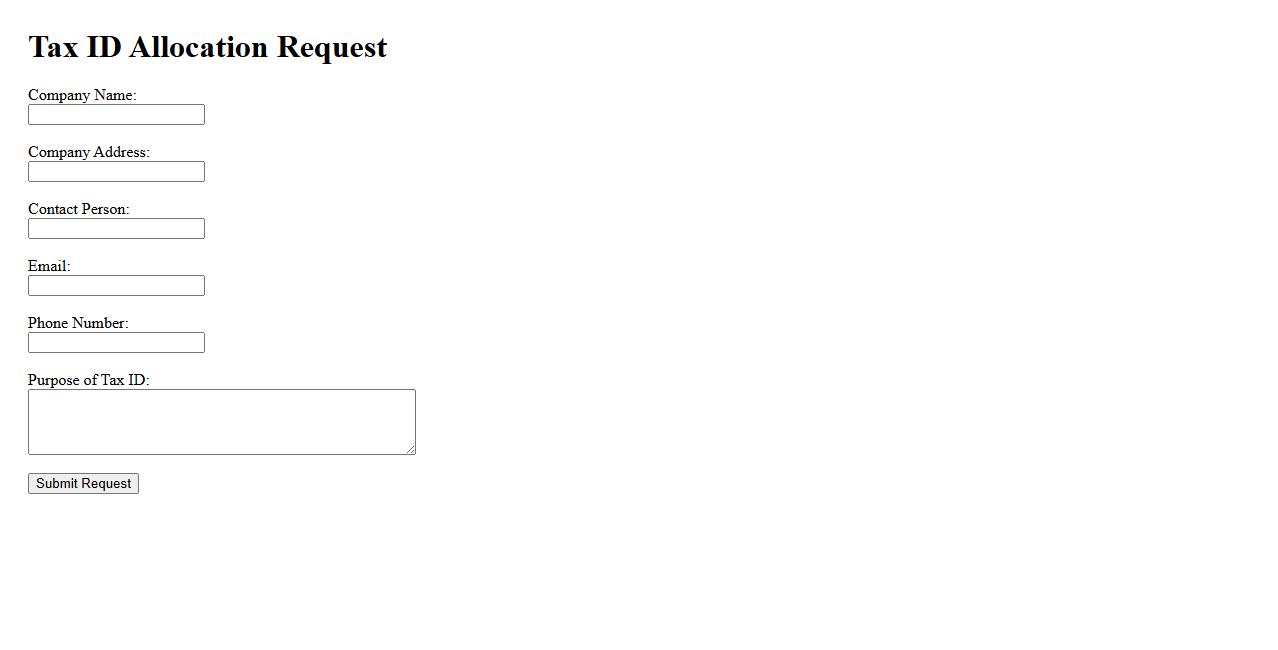

Tax ID Allocation Request

The Tax ID Allocation Request is a formal application submitted to obtain a unique tax identification number. This number is essential for business registration, tax filing, and compliance with government regulations. Timely submission of the request ensures smooth financial and legal operations.

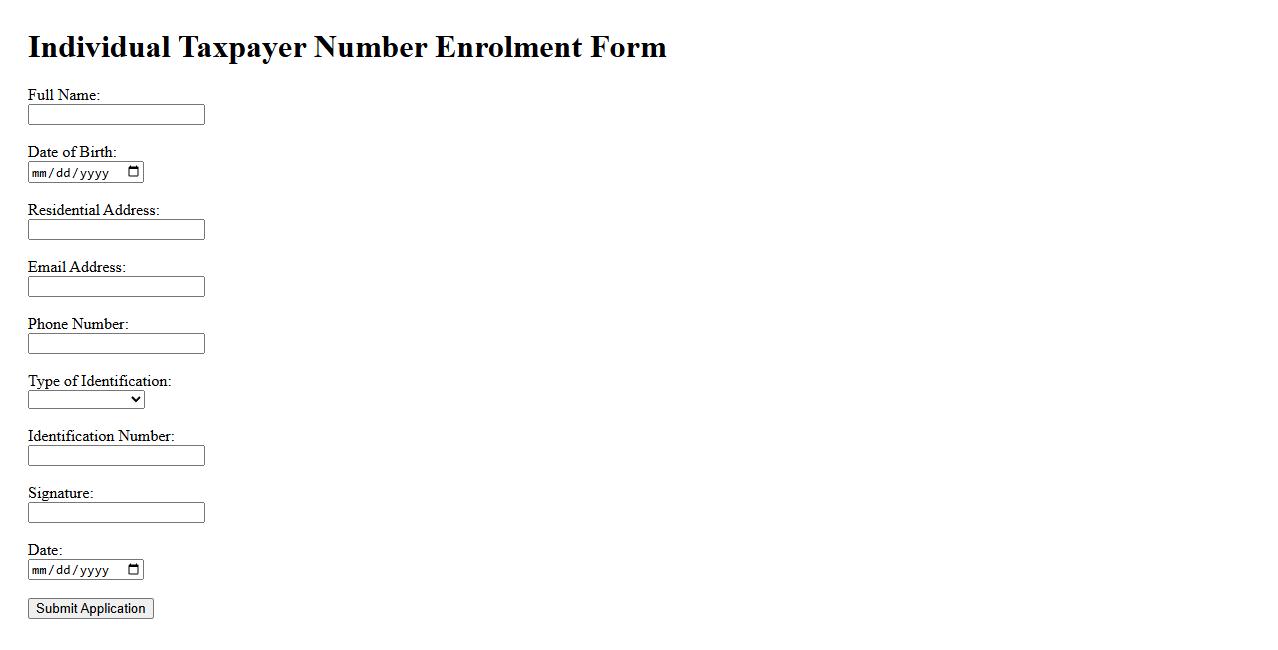

Individual Taxpayer Number Enrolment

The Individual Taxpayer Number Enrolment is a crucial step for residents and non-residents to comply with tax regulations. This process ensures that each taxpayer is uniquely identified for efficient tax administration and reporting. Enrolling for an Individual Taxpayer Number enables easier management of tax obligations and access to government services.

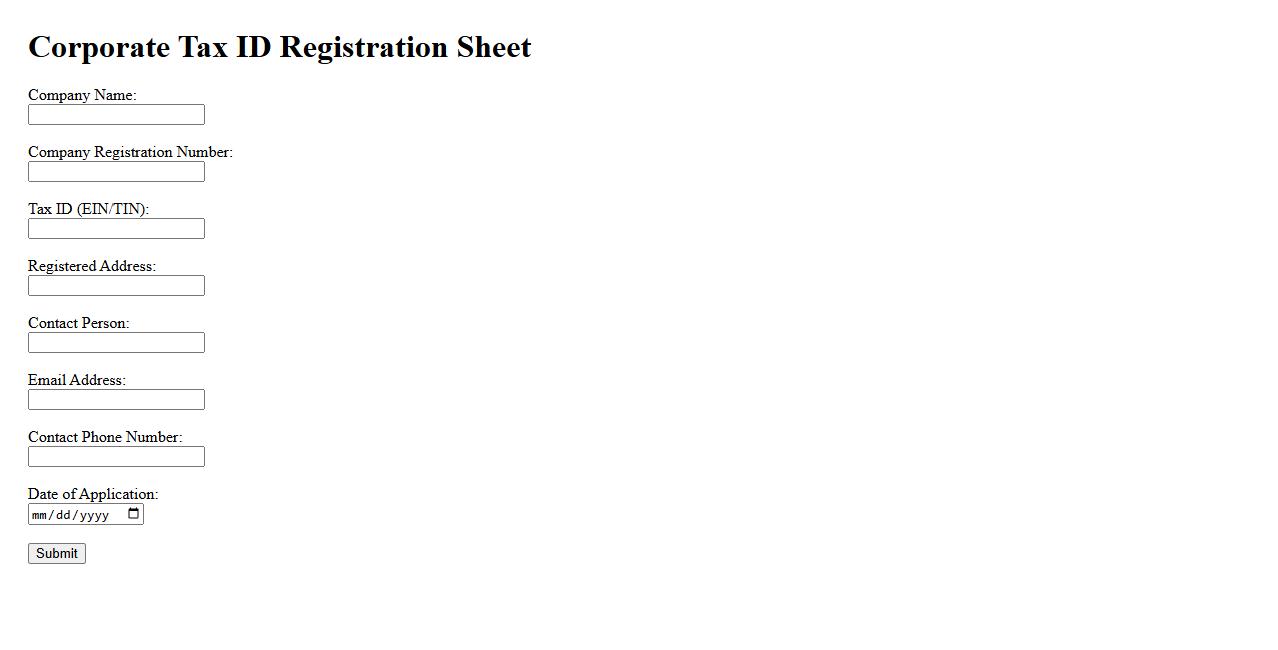

Corporate Tax ID Registration Sheet

The Corporate Tax ID Registration Sheet is an essential document used to register a company's tax identification number with government authorities. It ensures proper tax reporting and compliance for businesses. This sheet streamlines the registration process by collecting all necessary company information in one place.

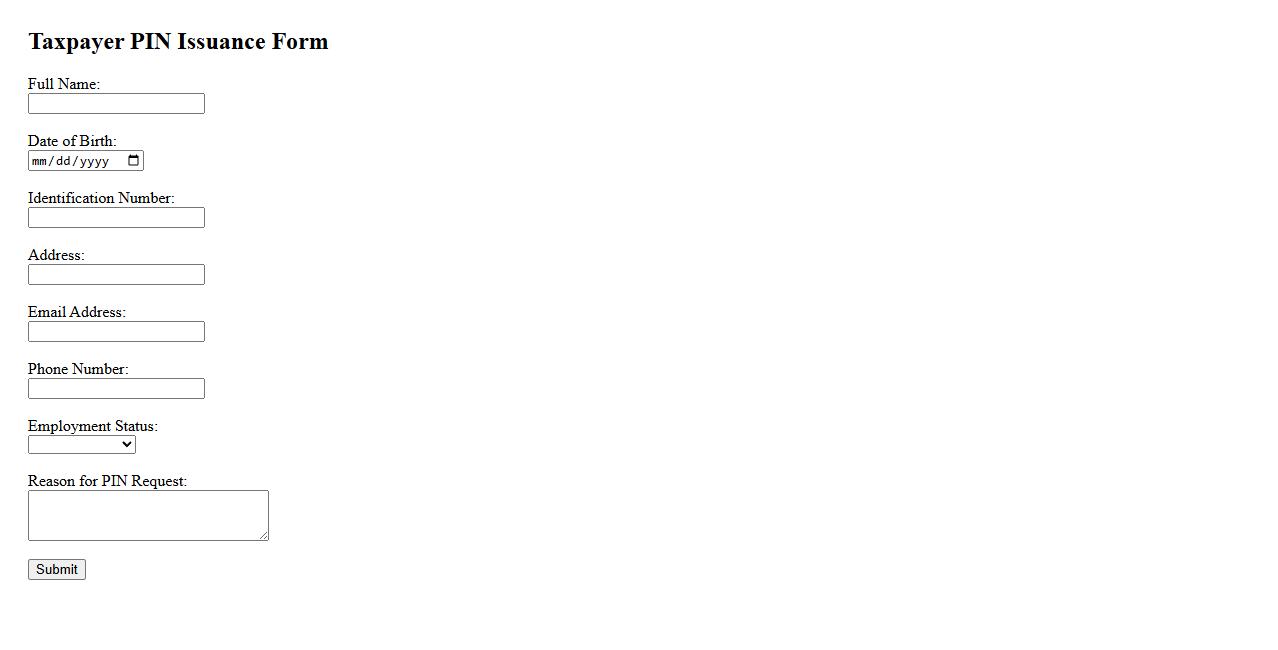

Taxpayer PIN Issuance Form

The Taxpayer PIN Issuance Form is an essential document used to apply for a Personal Identification Number (PIN) for tax purposes. This form collects accurate taxpayer information to facilitate tax registration and compliance. Completing the form ensures proper identification and tracking within the tax system.

Application for Personal Tax ID

An Application for Personal Tax ID is a formal process individuals undergo to obtain a unique identification number for tax purposes. This ID simplifies tax reporting and helps authorities track tax obligations efficiently. Applying ensures compliance with tax regulations and facilitates seamless financial transactions.

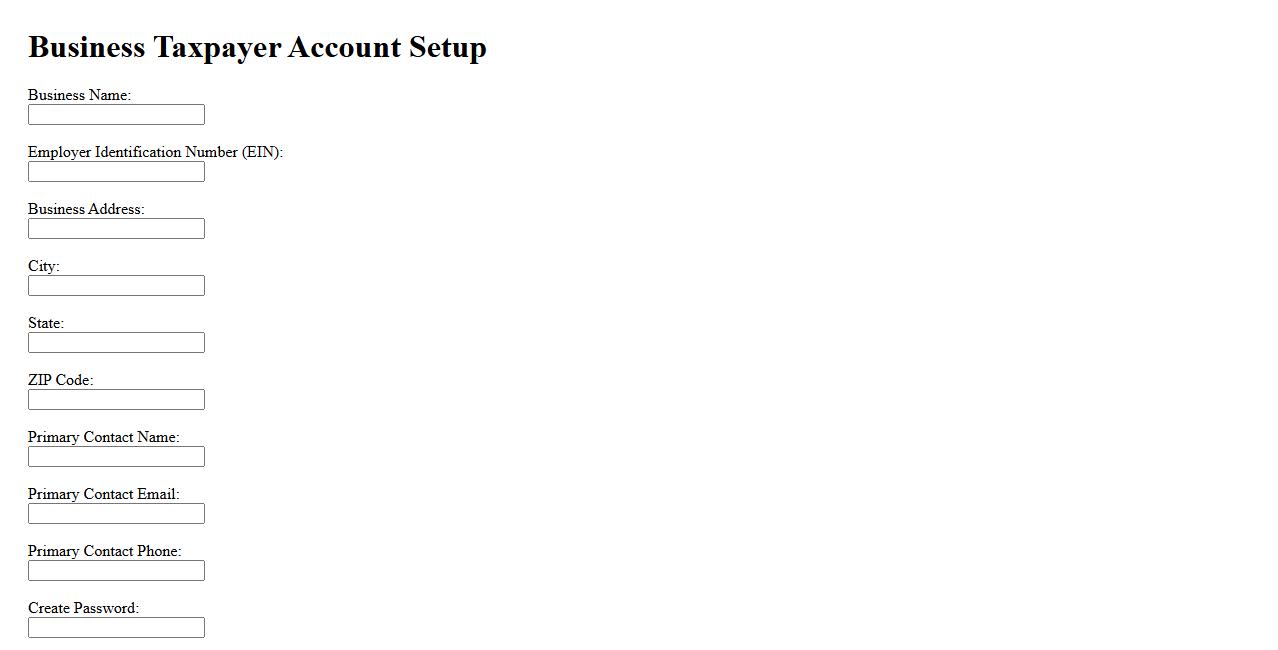

Business Taxpayer Account Setup

Setting up a Business Taxpayer Account is essential for managing tax obligations efficiently. This account allows businesses to file returns, make payments, and access important tax-related information. Proper setup ensures compliance with tax regulations and streamlines financial operations.

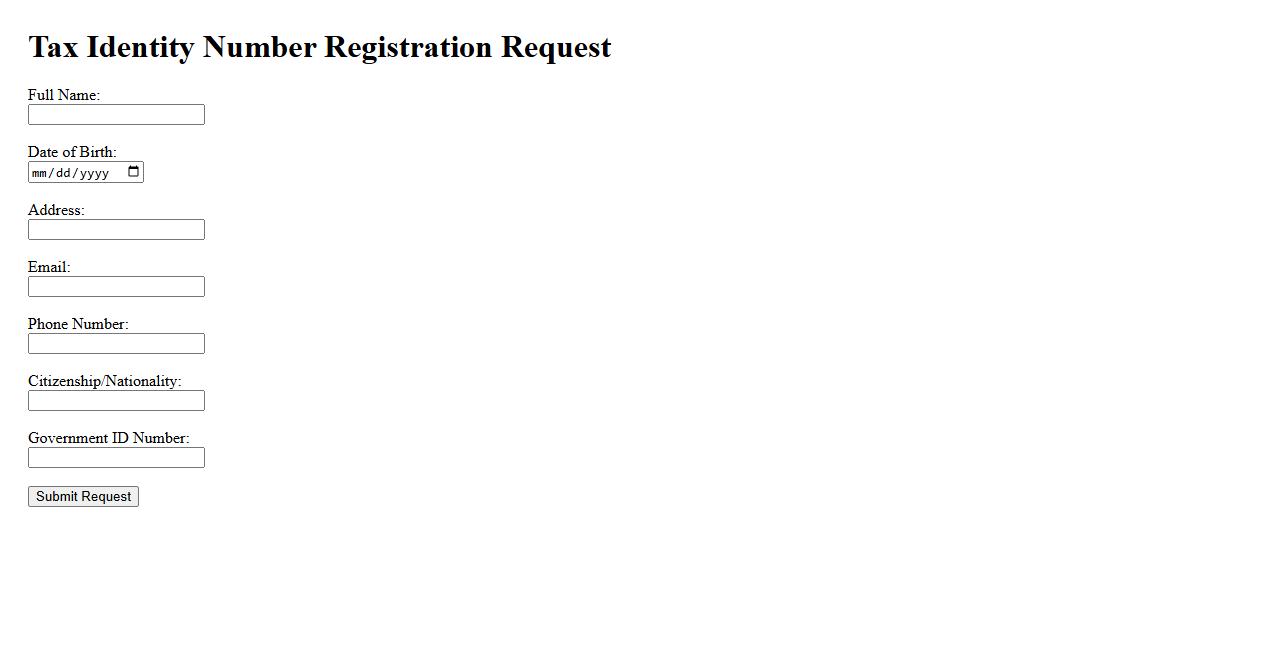

Tax Identity Number Registration Request

Requesting a Tax Identity Number is essential for individuals and businesses to comply with tax regulations. This process ensures proper identification for tax reporting and filing purposes. Timely registration helps avoid penalties and facilitates smooth financial transactions.

What is the primary purpose of obtaining a Taxpayer Identification Number (TIN) in the registration process?

The primary purpose of obtaining a Taxpayer Identification Number (TIN) is to uniquely identify taxpayers within the tax system. This facilitates efficient tracking and management of tax obligations by the relevant authorities. Additionally, the TIN is essential for ensuring correct tax payments and avoiding tax evasion.

Which documents are required to support a Registration for Taxpayer Identification Number?

To register for a Taxpayer Identification Number, applicants must present valid identification documents such as a passport, national ID, or birth certificate. Proof of address and, in some cases, business registration documents may also be required. These documents validate the identity and legitimacy of the applicant for the tax system.

Who is legally mandated to apply for a Taxpayer Identification Number?

Individuals and entities who earn income or conduct business are legally mandated to apply for a Taxpayer Identification Number. This includes employees, self-employed persons, and corporations. The TIN ensures compliance with tax laws and allows authorities to monitor taxable activities effectively.

How does the Registration for Taxpayer Identification Number ensure compliance with tax regulations?

Registration for a Taxpayer Identification Number enforces compliance by creating a formal record of taxpayers. This enables the tax authority to monitor tax filings, payments, and other fiscal responsibilities. Moreover, it aids in identifying non-compliance and applying necessary legal measures.

What information is captured and verified during Taxpayer Identification Number registration?

During TIN registration, personal and business details such as name, address, date of birth, and nature of business activity are captured and verified. The accuracy of this information is crucial for correct tax assessment and communication. Verification helps prevent fraud and ensures that tax records are reliable and up-to-date.