Registration for Employer Withholding is a mandatory process where employers register with tax authorities to withhold income taxes from employees' wages. This ensures compliance with federal and state tax laws by facilitating timely withholding and remittance of payroll taxes. Proper registration helps avoid penalties and supports accurate tax reporting for both employers and employees.

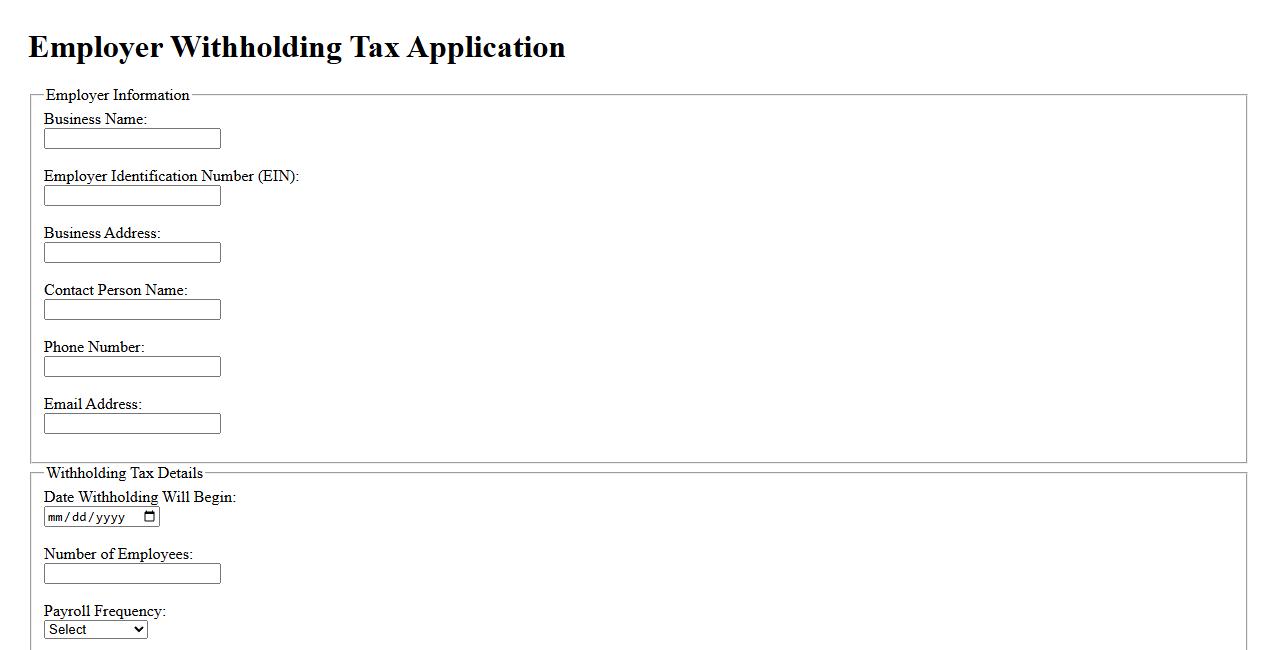

Employer Withholding Tax Application

The Employer Withholding Tax Application is a crucial process for businesses to register and comply with tax withholding obligations. It ensures that employers properly withhold taxes from employee wages and remit them to the tax authorities. Timely application and accurate reporting help avoid penalties and maintain legal compliance.

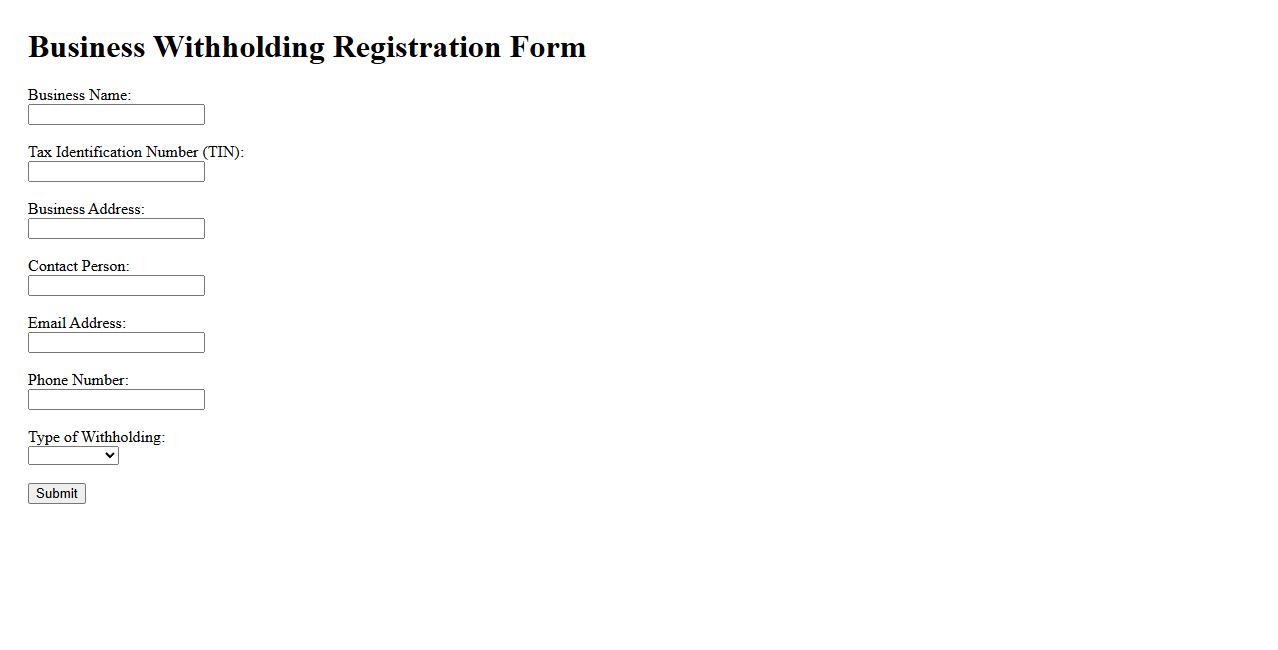

Business Withholding Registration Form

The Business Withholding Registration Form is essential for businesses required to withhold taxes on payments made to employees or contractors. This form ensures compliance with tax regulations by registering the business with the appropriate tax authorities. Timely submission of the form helps avoid penalties and facilitates accurate tax reporting.

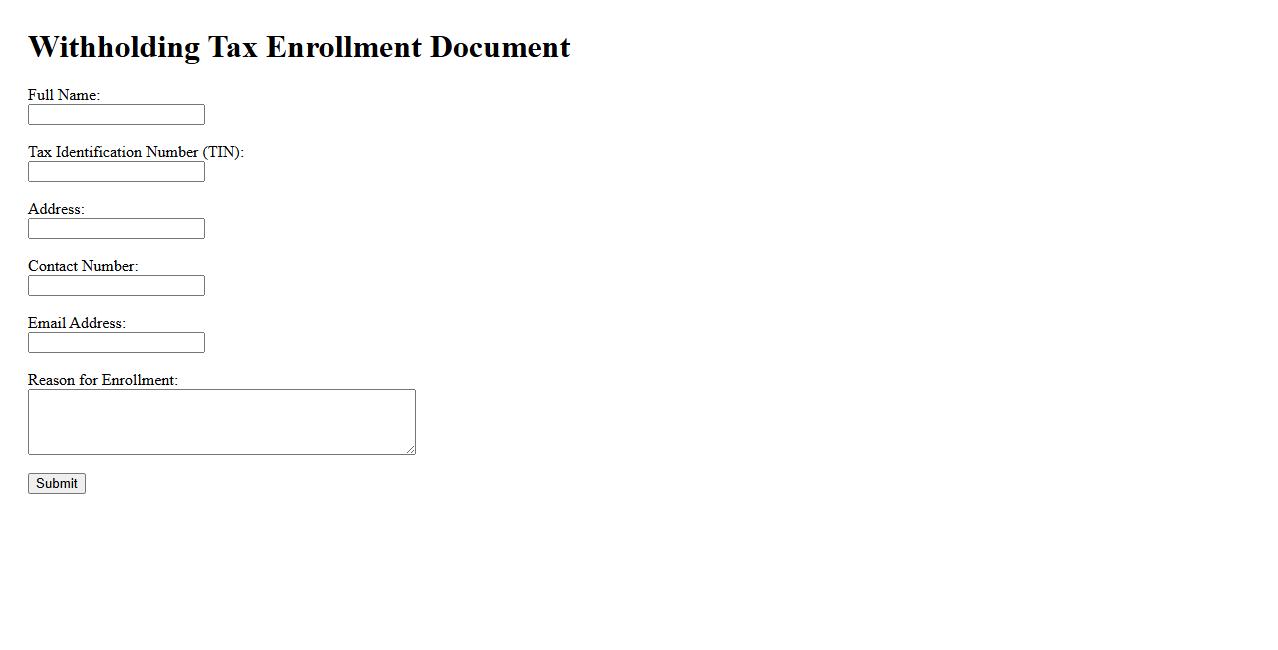

Withholding Tax Enrollment Document

The Withholding Tax Enrollment Document is a crucial form required for registering taxpayers with withholding tax obligations. It ensures proper deduction and remittance of taxes at source by withholding agents. This document facilitates compliance with tax regulations and timely reporting to tax authorities.

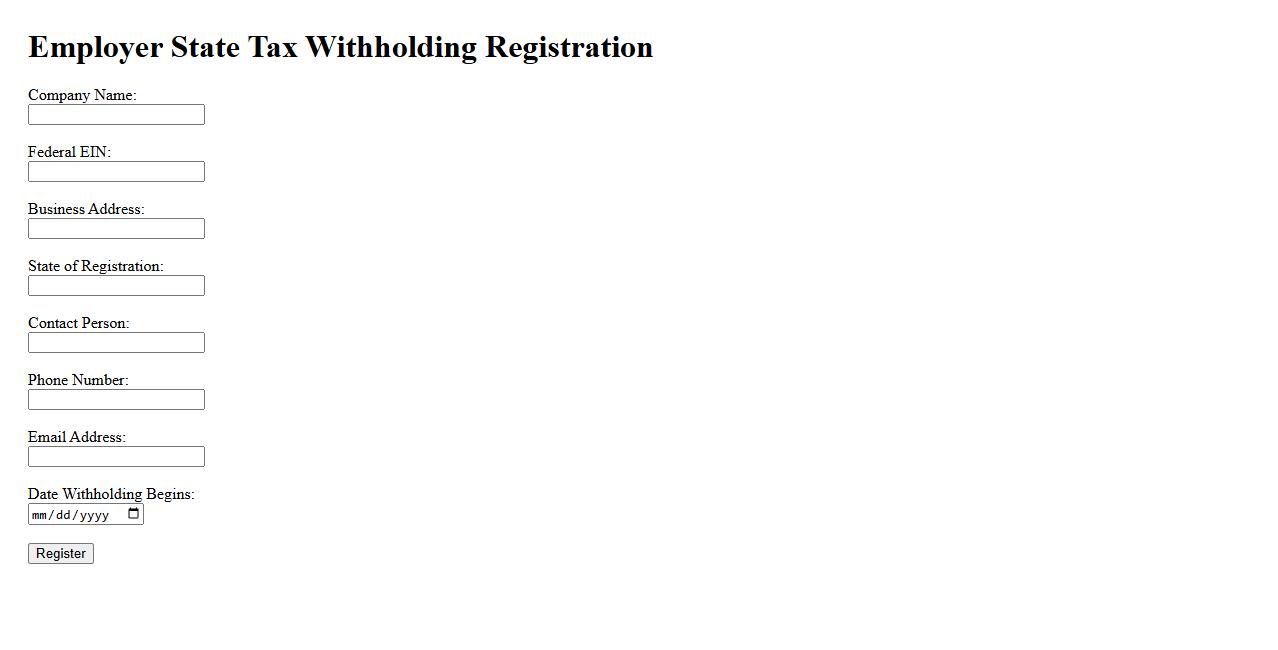

Employer State Tax Withholding Registration

Registering for Employer State Tax Withholding is essential for businesses to comply with state tax laws. This process ensures that employers correctly withhold state income taxes from employees' wages. Proper registration helps avoid penalties and facilitates accurate tax reporting to state authorities.

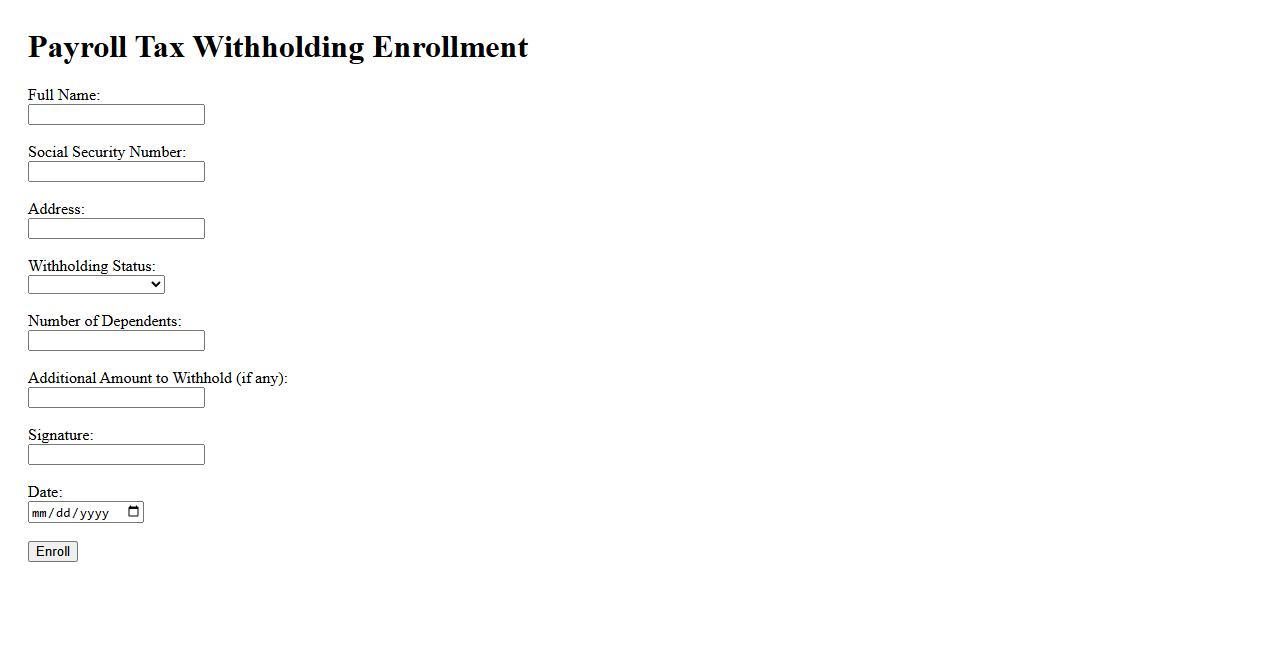

Payroll Tax Withholding Enrollment

Payroll Tax Withholding Enrollment is a crucial process where employees authorize their employer to deduct taxes from their paycheck. This ensures accurate and timely payment of federal, state, and local taxes. Proper enrollment helps avoid tax penalties and simplifies year-end tax filing.

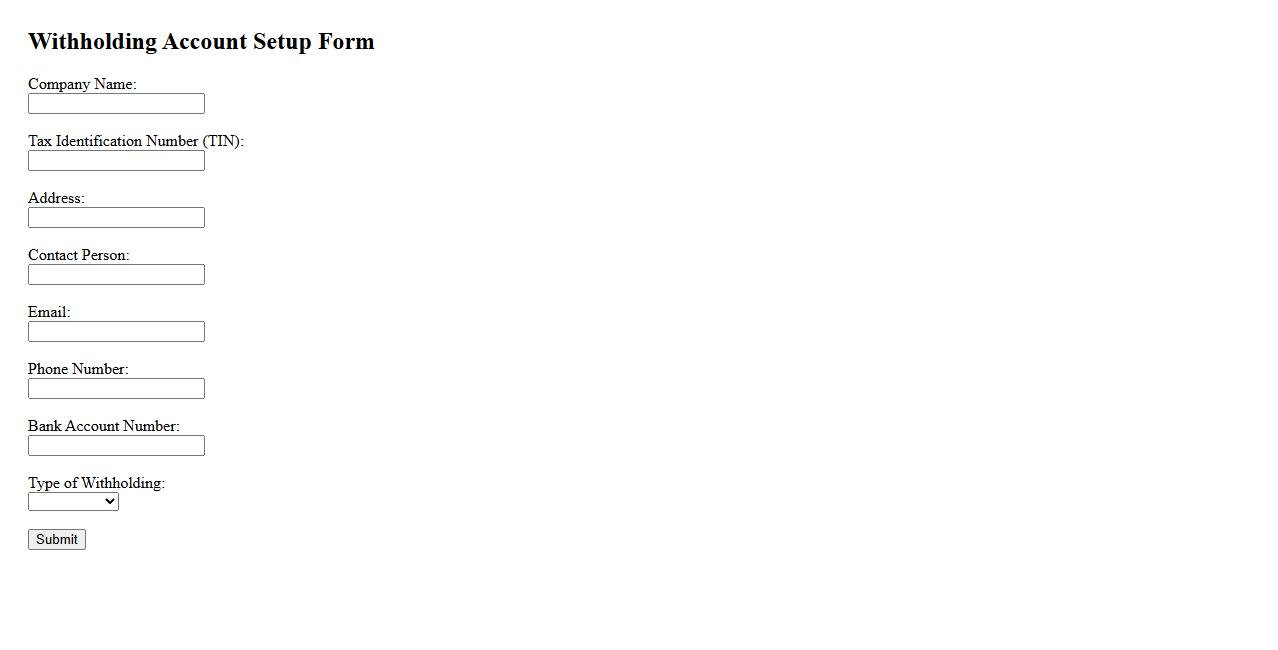

Withholding Account Setup Form

The Withholding Account Setup Form is essential for accurately managing tax deductions at the source. This form ensures proper documentation and compliance with tax regulations. Submitting it timely helps prevent errors in withholding and potential penalties.

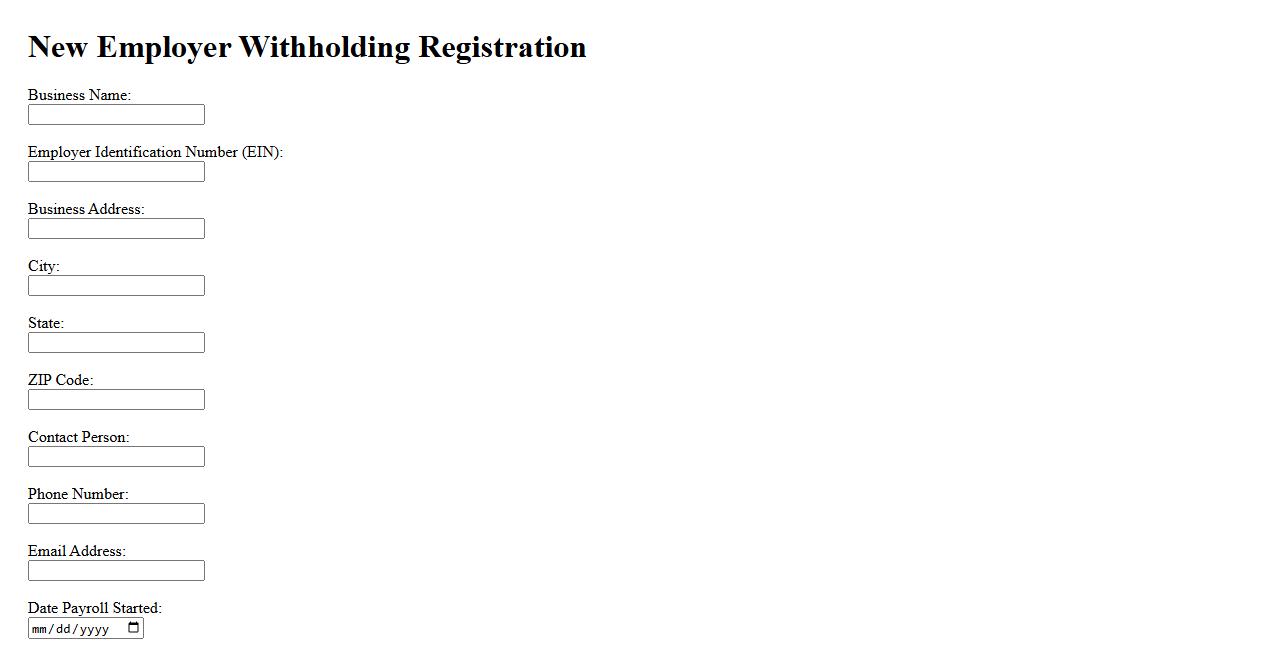

New Employer Withholding Registration

Registering as a New Employer Withholding Registration ensures compliance with tax regulations by withholding the appropriate amount of taxes from employee wages. This process is crucial for accurate payroll management and reporting to government agencies. Employers must complete this registration before hiring staff to avoid penalties.

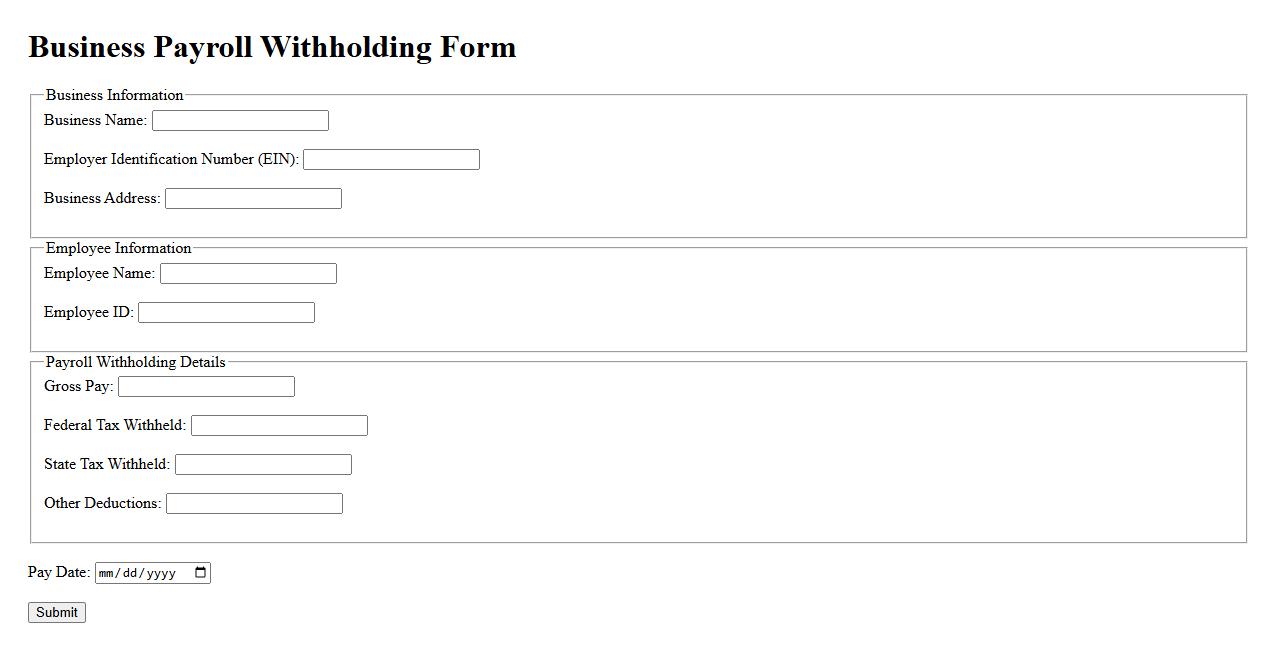

Business Payroll Withholding Form

The Business Payroll Withholding Form is essential for accurately deducting taxes from employee wages. It ensures compliance with state and federal tax regulations by detailing the amounts to be withheld. Proper use of this form helps businesses manage payroll efficiently and avoid penalties.

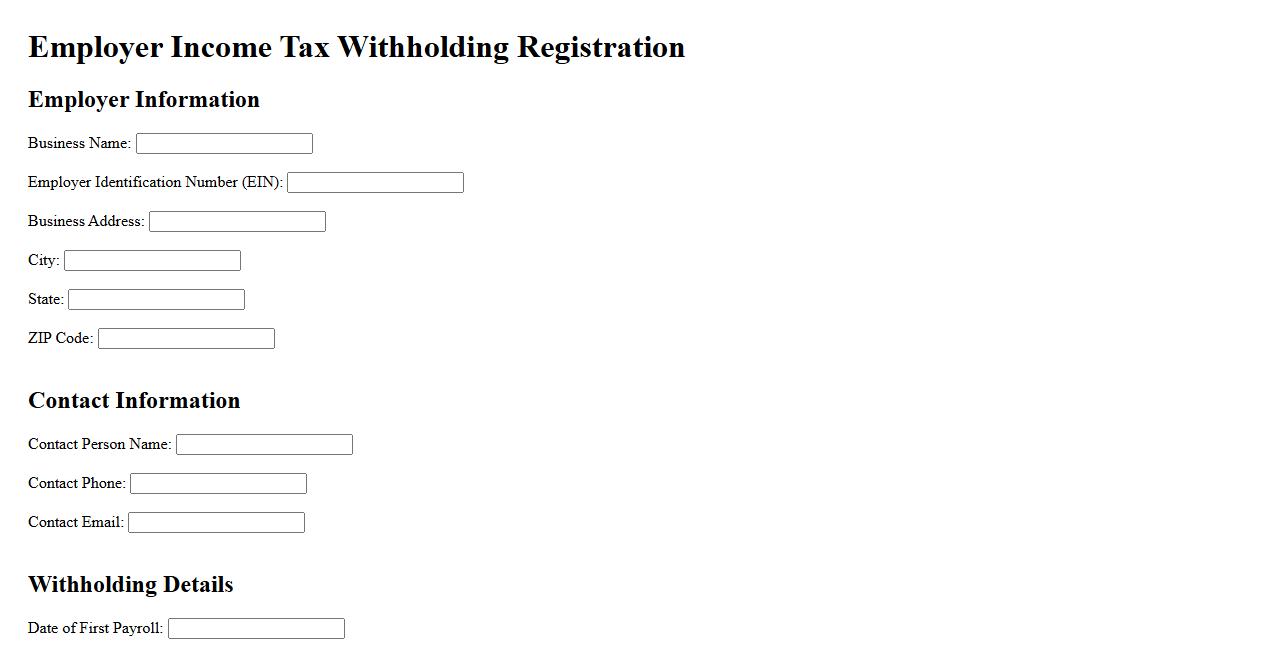

Employer Income Tax Withholding Registration

Employer Income Tax Withholding Registration is the mandatory process businesses must complete to withhold the correct amount of income tax from employee wages. This registration ensures compliance with federal and state tax laws, preventing penalties and facilitating accurate tax reporting. Employers receive a unique identification number to remit withheld taxes and file returns efficiently.

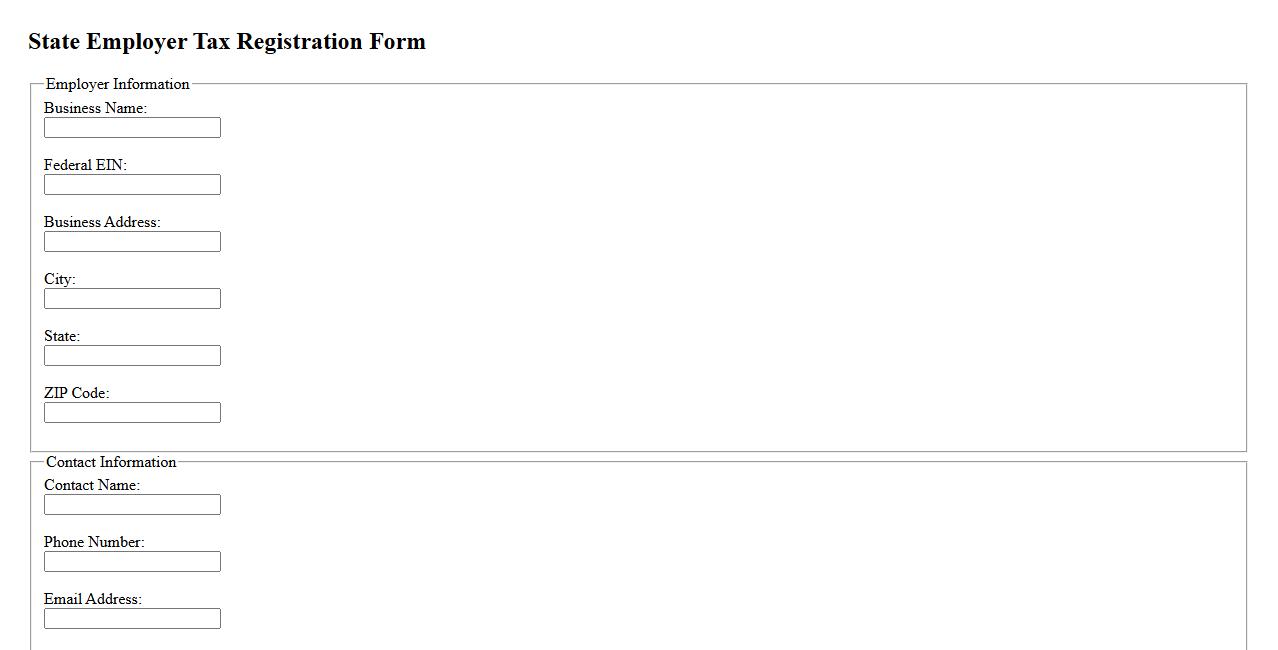

State Employer Tax Registration Form

The State Employer Tax Registration Form is a crucial document required for businesses to register with state tax authorities. It collects essential information needed for payroll tax reporting and compliance. Completing this form ensures your business meets local tax obligations accurately and promptly.

What is the purpose of employer withholding registration for businesses?

The employer withholding registration serves to authorize a business to withhold income taxes from employees' wages. This process ensures compliance with tax regulations and facilitates proper reporting to tax authorities. It helps employers remit withheld taxes accurately and timely on behalf of their employees.

Which types of employers are legally required to complete withholding registration?

All businesses that have employees and pay wages are generally required to register for employer withholding. This includes sole proprietors, corporations, partnerships, and non-profit organizations with payroll. Certain exceptions may apply based on local jurisdiction, but most employers must comply to avoid penalties.

What key information must be provided when registering for employer withholding?

Employers must provide essential details such as their employer identification number (EIN), business name, and address during registration. Additionally, the contact information of the responsible party and the estimated number of employees are often required. Accurate reporting of this information is critical for setting up proper tax withholding accounts.

How does employer withholding registration impact payroll tax compliance?

Registering for employer withholding is fundamental to maintaining payroll tax compliance with federal and state tax laws. It enables employers to collect, report, and remit income taxes withheld from employees properly. This registration also allows tax agencies to track and verify payroll withholding, reducing the risk of audits and penalties.

What are the consequences of failing to register for employer withholding as an employer?

Failure to complete employer withholding registration can result in significant legal and financial penalties. Employers may face fines, interest on unpaid taxes, and even legal action for non-compliance. Additionally, unregistered withholding can cause complications for employees' tax filings and damage the business's reputation.