Registration for Charitable Organization is a critical legal process that allows nonprofits to obtain official recognition and operate lawfully within a jurisdiction. This process involves submitting necessary documents, such as the organization's mission statement, bylaws, and proof of tax-exempt status, to the relevant government agency. Successfully completing registration for charitable organization enables access to fundraising opportunities and tax benefits.

Registration of Charitable Organization Form

The Registration of Charitable Organization Form is a crucial document required to legally establish a charity. It ensures compliance with government regulations and facilitates the organization's ability to receive tax-exempt status. Completing this form accurately helps streamline the approval process and promotes transparency.

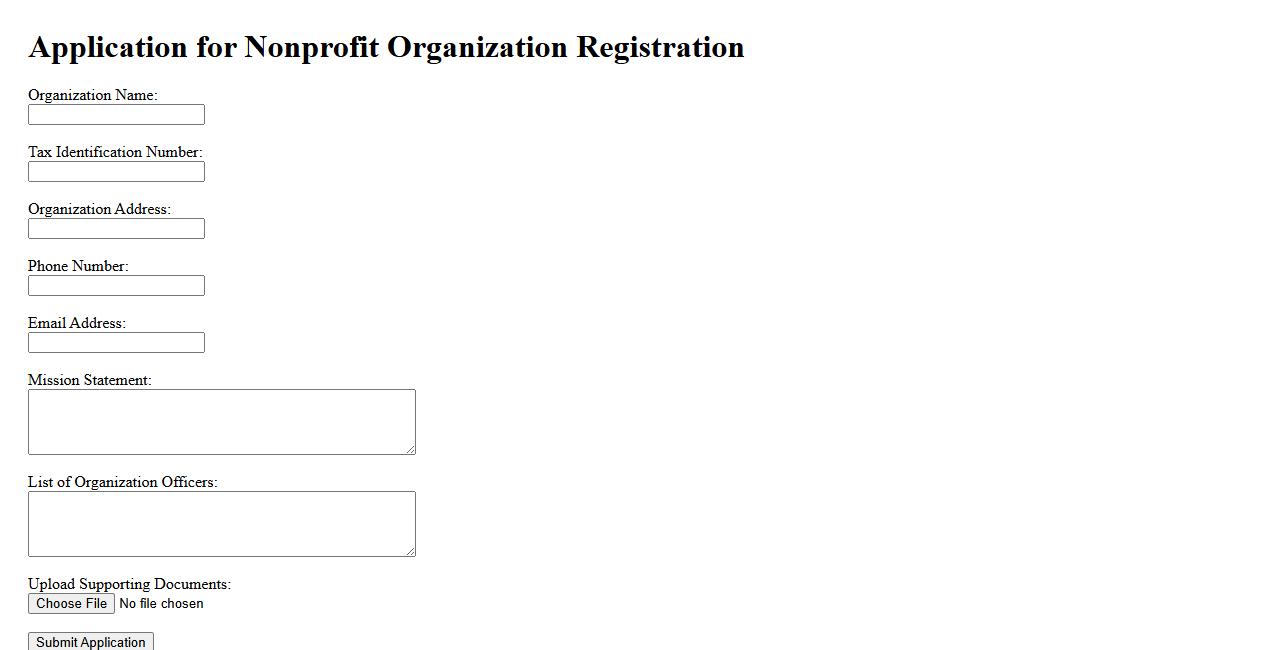

Application for Nonprofit Organization Registration

The application for nonprofit organization registration is a crucial step for establishing a legally recognized nonprofit entity. This process involves submitting specific documentation to government authorities to gain tax-exempt status and operate officially. Proper registration ensures compliance and access to funding opportunities.

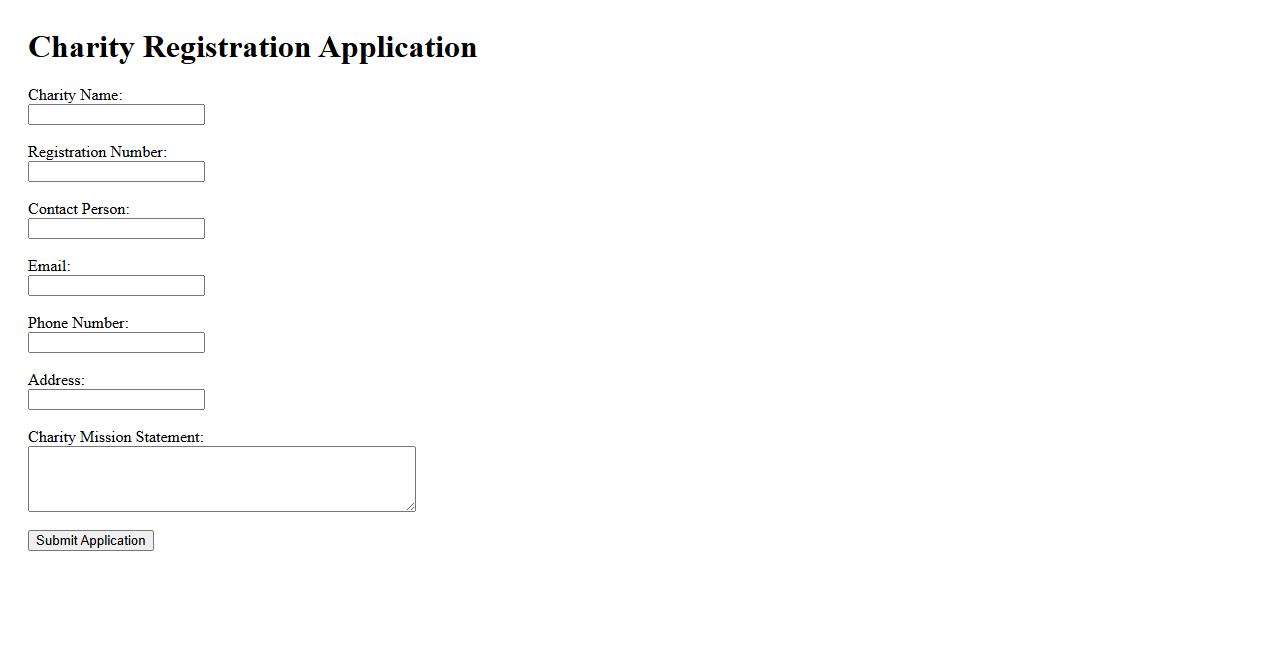

Charity Registration Application

The Charity Registration Application is a streamlined process designed to help organizations officially register as a charity. This application ensures compliance with legal requirements and enables access to benefits such as tax exemptions. Completing the registration accurately is essential for establishing credibility and trust with donors and the public.

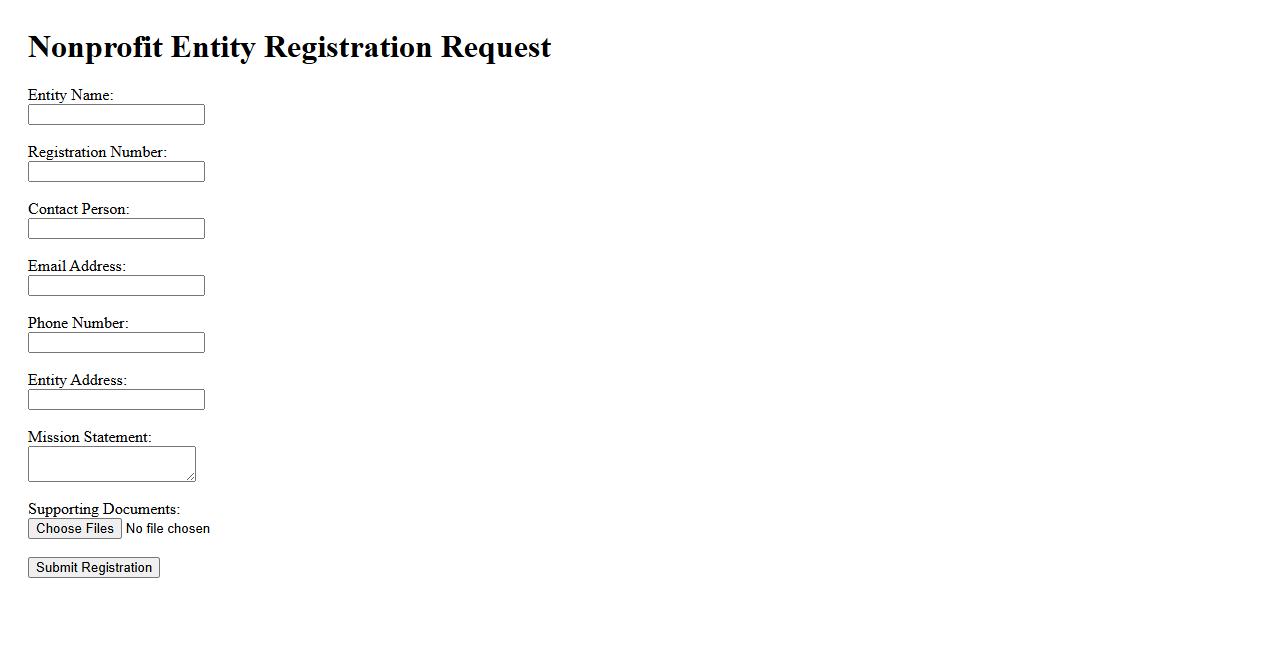

Nonprofit Entity Registration Request

The Nonprofit Entity Registration Request is a formal process required to legally establish a nonprofit organization. This ensures compliance with state regulations and enables the entity to operate with official recognition. Timely registration helps secure tax-exempt status and access to funding opportunities.

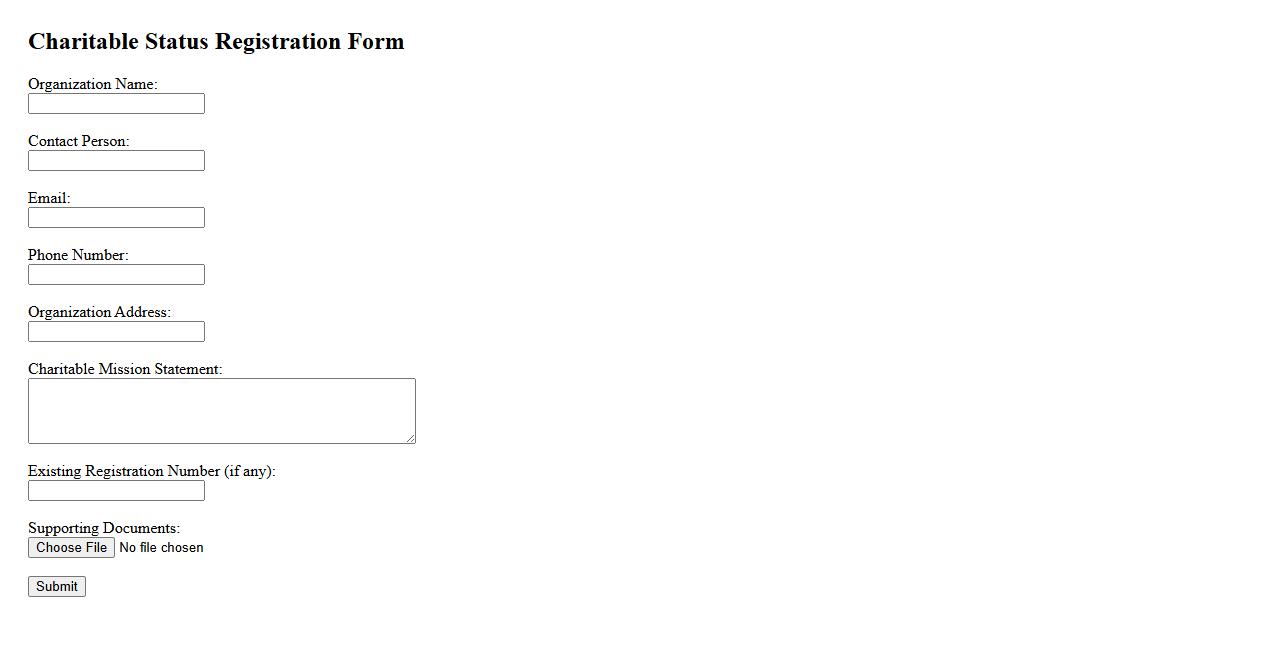

Charitable Status Registration Form

The Charitable Status Registration Form is an essential document used to apply for official recognition as a charity. It ensures that organizations meet legal requirements to receive tax benefits and public trust. Completing this form accurately is crucial for securing charitable status and advancing nonprofit goals.

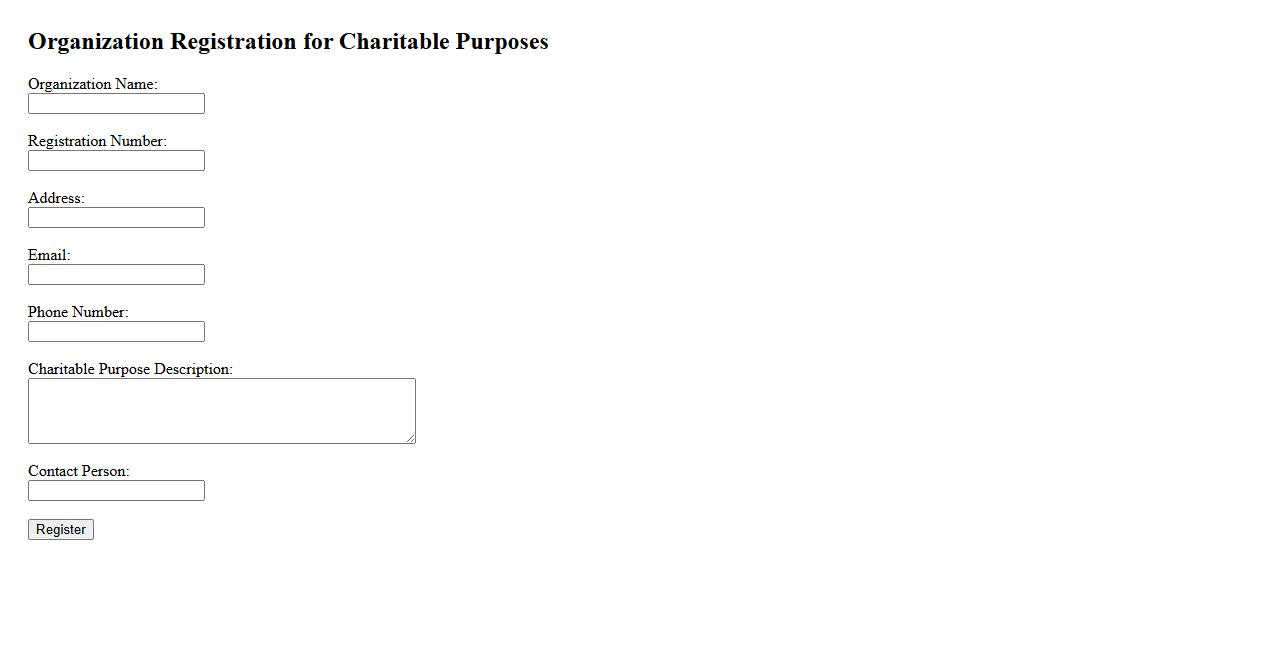

Organization Registration for Charitable Purposes

Registering an organization for charitable purposes is essential to establish legal recognition and access tax benefits. This process ensures compliance with government regulations and enhances credibility with donors and beneficiaries. Proper registration supports transparency and effective management of charitable activities.

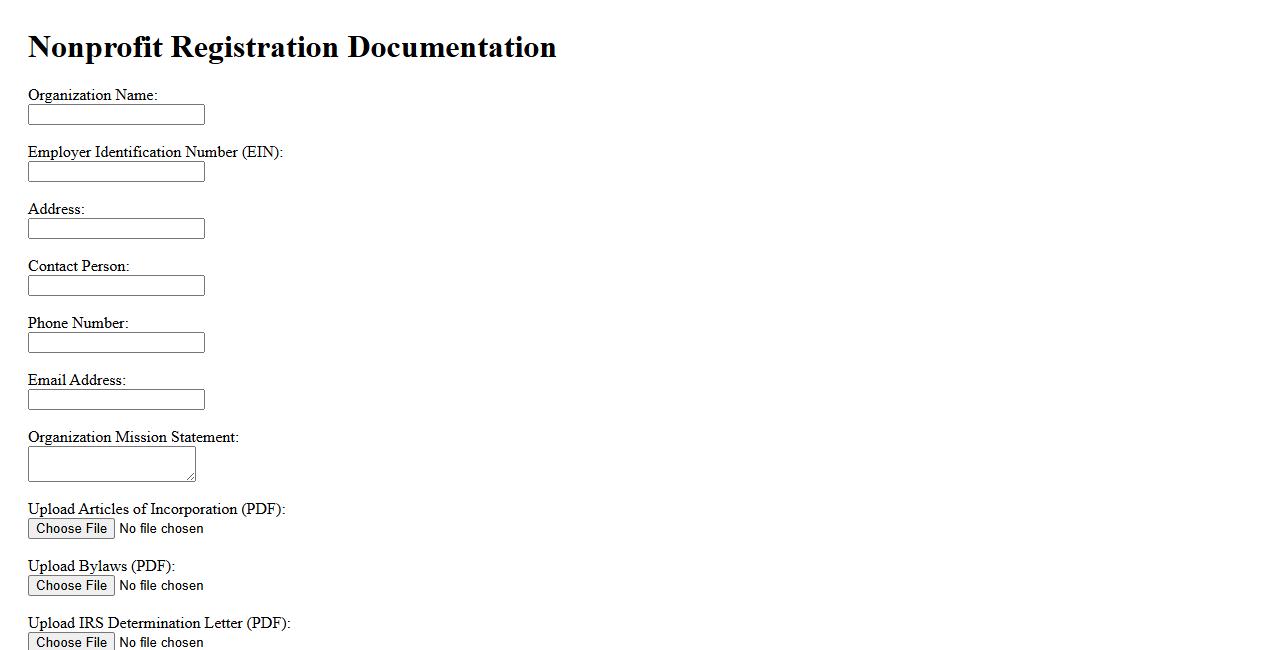

Nonprofit Registration Documentation

The Nonprofit Registration Documentation is essential for establishing a nonprofit organization legally and ensuring compliance with local regulations. This paperwork includes the articles of incorporation, bylaws, and any required state or federal forms. Proper documentation helps secure tax-exempt status and build credibility with donors and stakeholders.

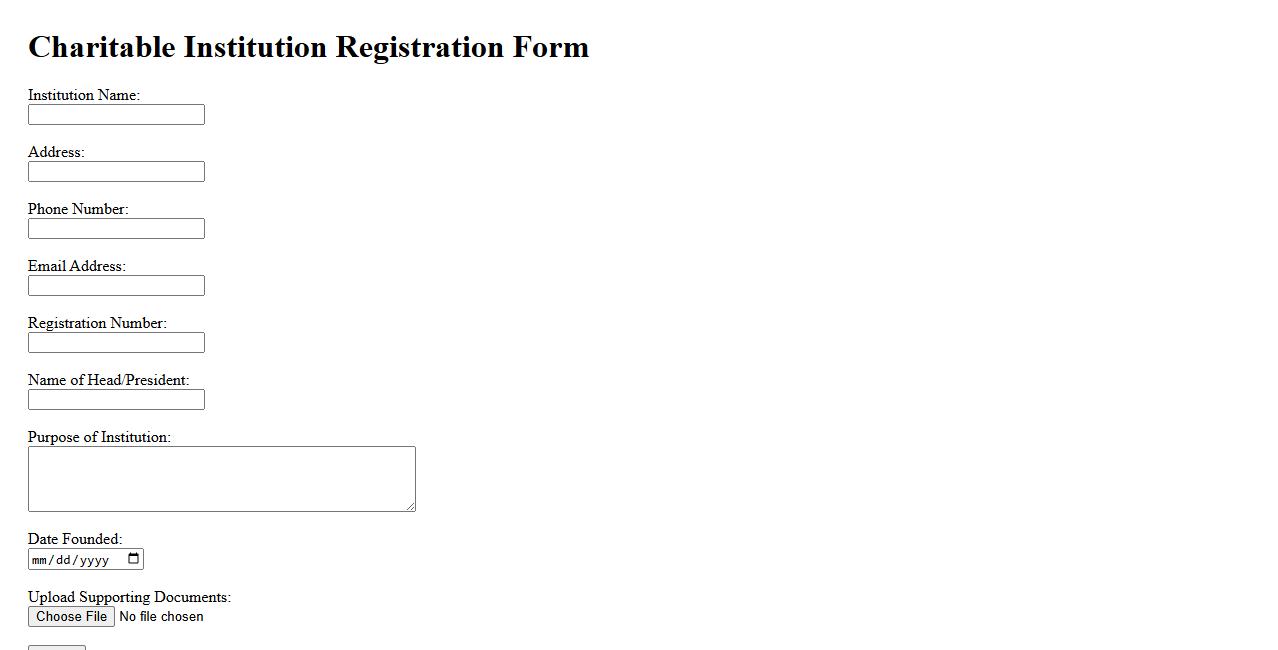

Charitable Institution Registration Form

The Charitable Institution Registration Form is a crucial document used to officially register non-profit organizations. It ensures compliance with legal requirements and grants recognition to the charity. Completing this form accurately facilitates transparency and eligibility for tax benefits and funding.

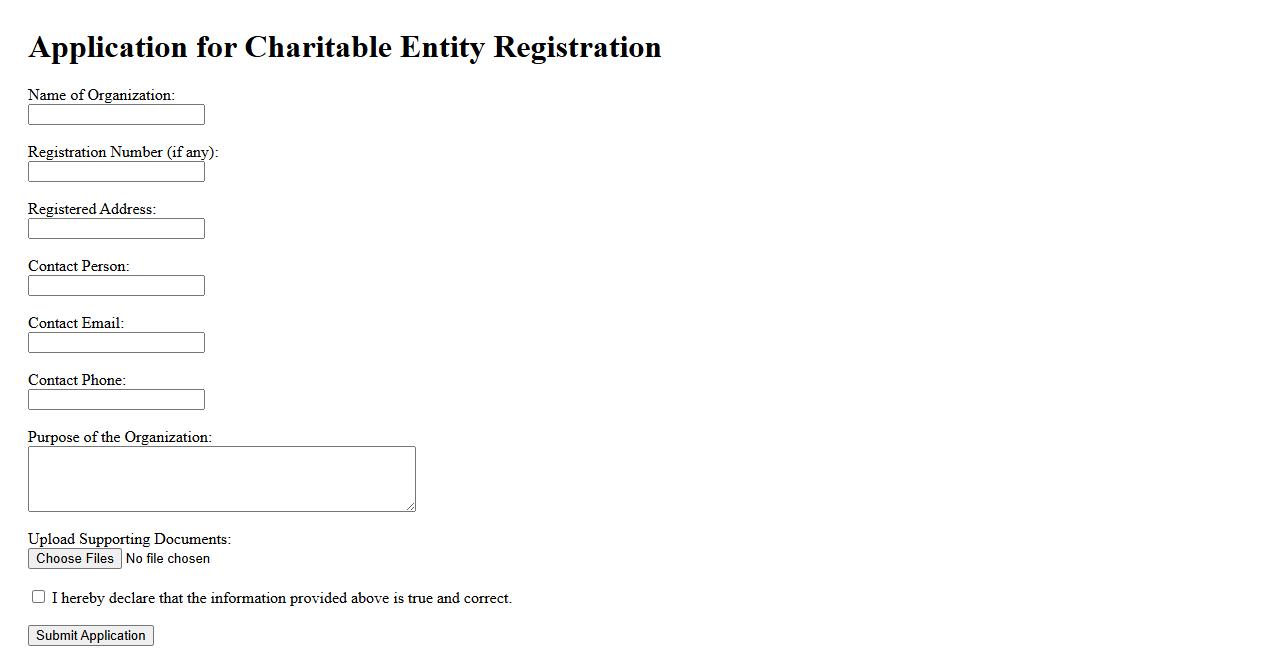

Application for Charitable Entity Registration

Submitting an Application for Charitable Entity Registration is essential for organizations seeking legal recognition and tax benefits. This process ensures compliance with state regulations and allows entities to operate transparently. Proper registration also enhances public trust and eligibility for funding opportunities.

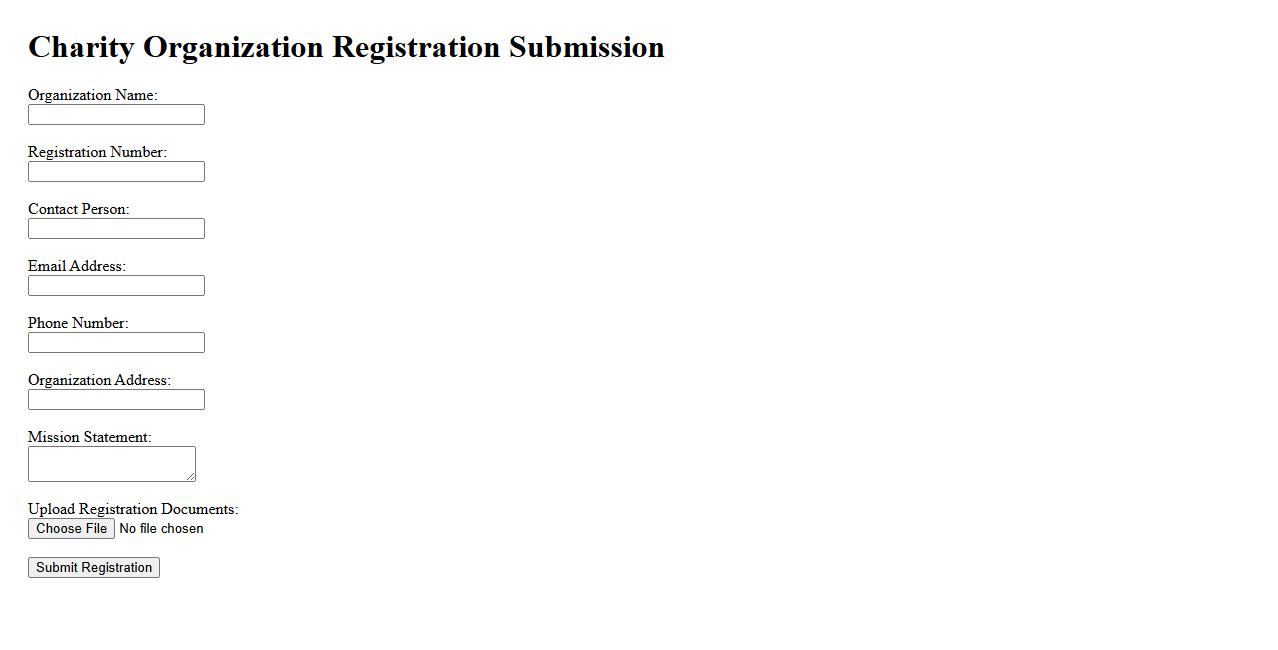

Charity Organization Registration Submission

Submitting a charity organization registration is a crucial step to legally establish and operate a nonprofit entity. This process ensures compliance with government regulations and enables access to tax exemptions and funding opportunities. Proper documentation and accurate information are essential for a successful registration submission.

What legal criteria define a charitable organization for registration purposes?

A charitable organization must operate exclusively for charitable purposes recognized by law, such as relief of poverty, education, or advancement of religion. The organization should have a clear public benefit and cannot primarily benefit private individuals. Additionally, it must be established as a non-profit entity, ensuring funds are used solely for its charitable goals.

Which documents are required to initiate the registration process for a charitable organization?

Key documents include the organization's constitution or bylaws, a statement of purposes, and details of the governing body members. Financial statements or a proposed budget are often needed to demonstrate accountability and transparency. Proof of the organization's address and identification of key officers is also typically required.

What are the steps involved in submitting a registration application for a charitable organization?

The process begins with preparing all necessary documents, including the application form provided by the relevant authority. Next, the organization submits the completed application along with supporting documents, often paying a registration fee. Finally, the authority reviews the application, may request additional information, and then issues a registration certificate if all criteria are met.

How does the registration process differ between local and national charitable organizations?

Local organizations usually register with regional or municipal authorities, while national organizations register with a central government body. National registrations often require more comprehensive documentation and stricter compliance checks due to their broader scope. Additionally, national charities may be subject to extra regulatory oversight and reporting requirements.

What compliance requirements must a registered charitable organization maintain post-registration?

Registered charities must regularly submit financial reports and annual returns to demonstrate ongoing compliance with legal and regulatory standards. They must update the registry with any changes to their governing structure or purposes. Maintaining transparency and adhering to fundraising regulations is essential to retain their registered status.