To obtain a Tax Identification Number, individuals or businesses must complete a registration process with the relevant tax authority. This process typically involves submitting personal or business information and any required documentation to verify identity and eligibility. Once registered, the Tax Identification Number serves as a unique identifier for tax reporting and compliance purposes.

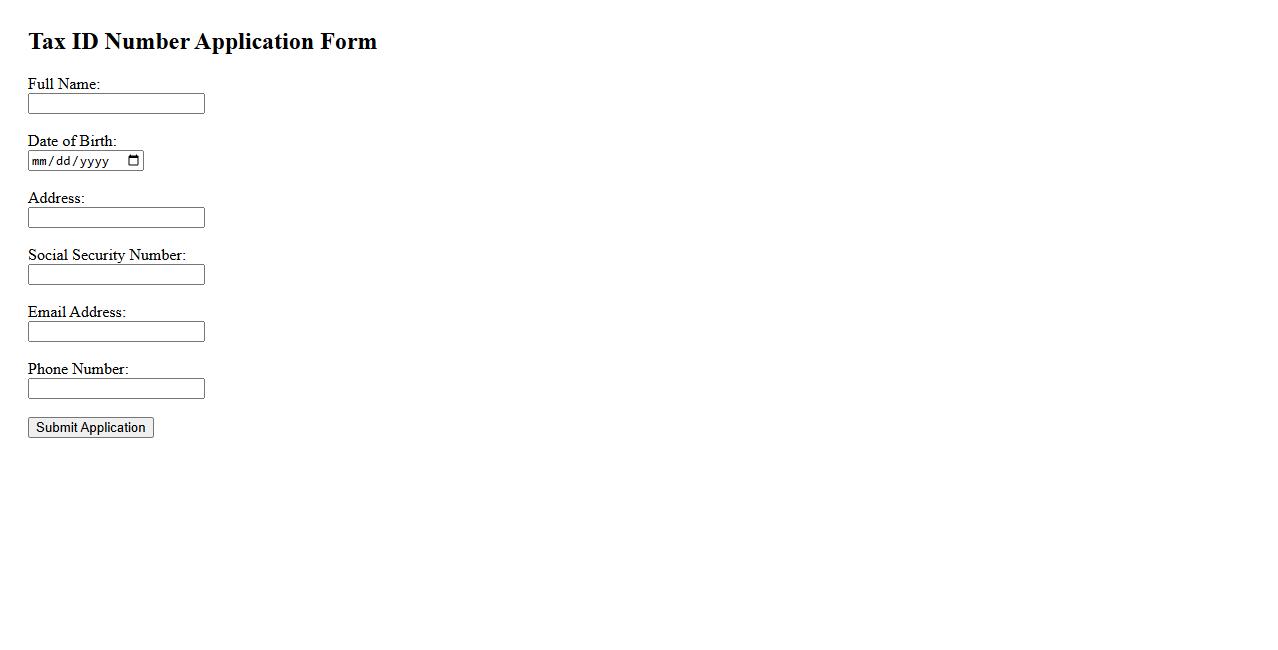

Tax ID Number Application Form

The Tax ID Number Application Form is a crucial document required to obtain a unique identifier for tax purposes. It streamlines the process of tax registration and ensures compliance with government regulations. Filling out this form accurately is essential for individuals and businesses to manage their tax obligations effectively.

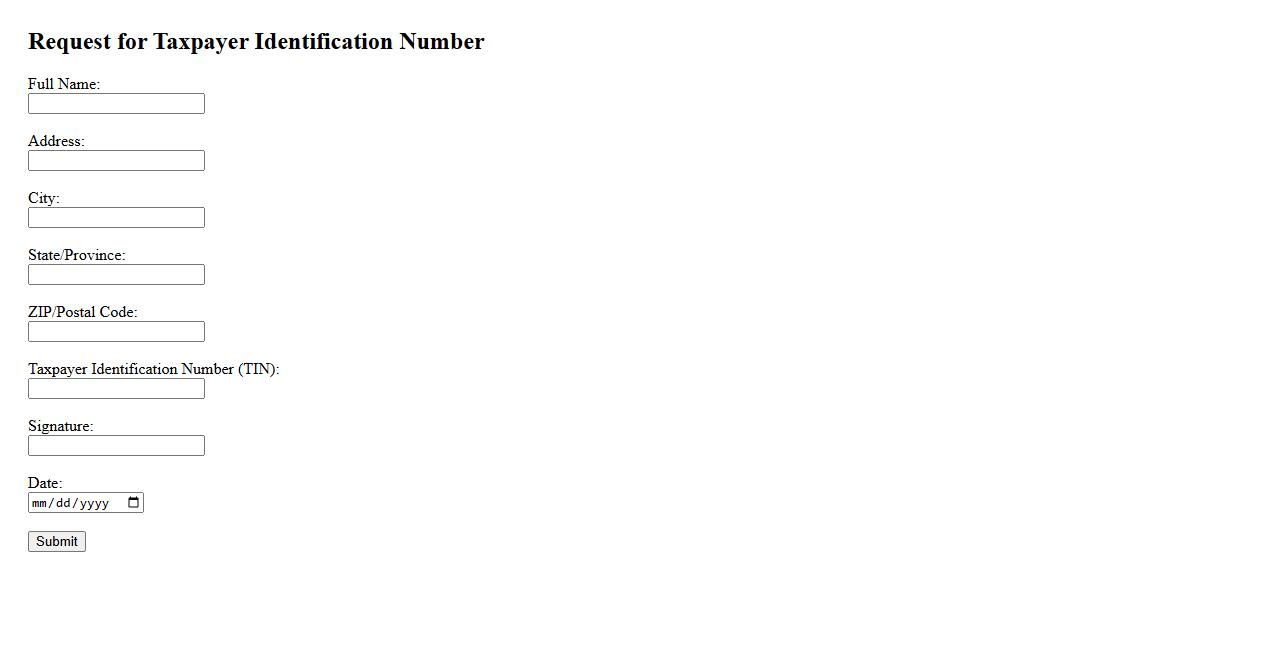

Request for Taxpayer Identification

A Request for Taxpayer Identification is a formal document used to obtain or verify an individual's or entity's tax identification number. This information is essential for tax reporting and compliance with government regulations. Providing accurate taxpayer identification ensures proper processing of tax-related transactions.

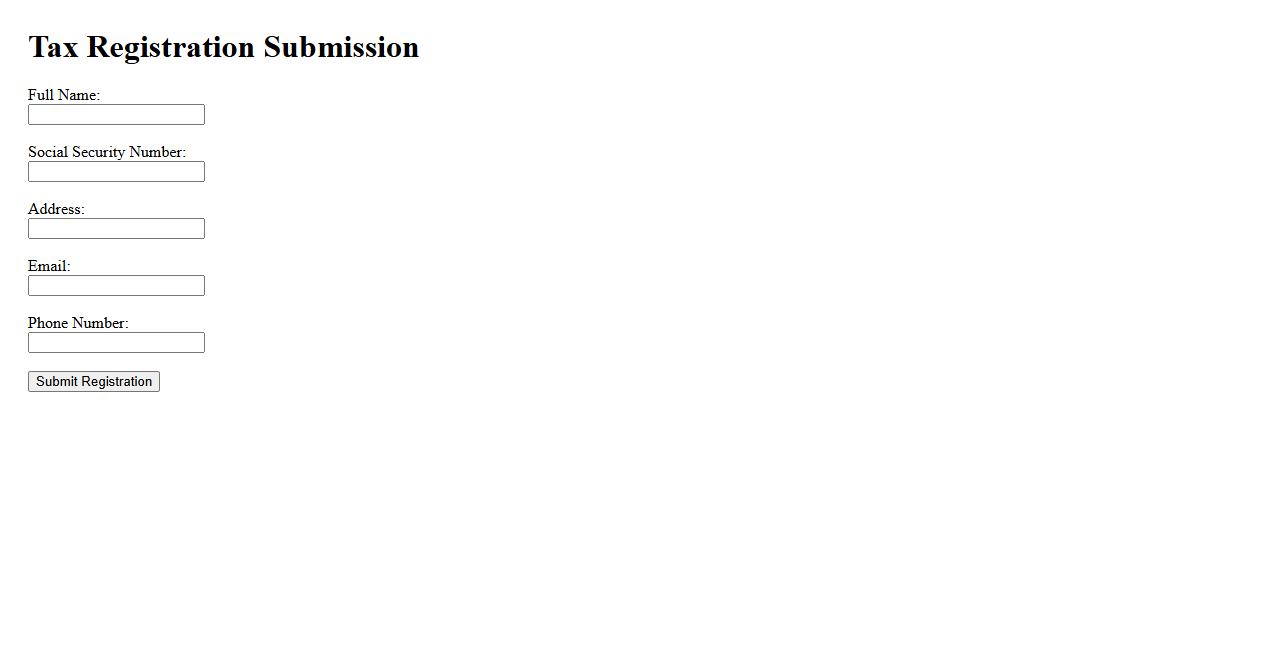

Tax Registration Submission

Efficient Tax Registration Submission ensures your business complies with government regulations from the start. This process involves accurately completing and submitting required tax forms to the relevant authorities. Timely submission helps avoid penalties and facilitates smooth financial operations.

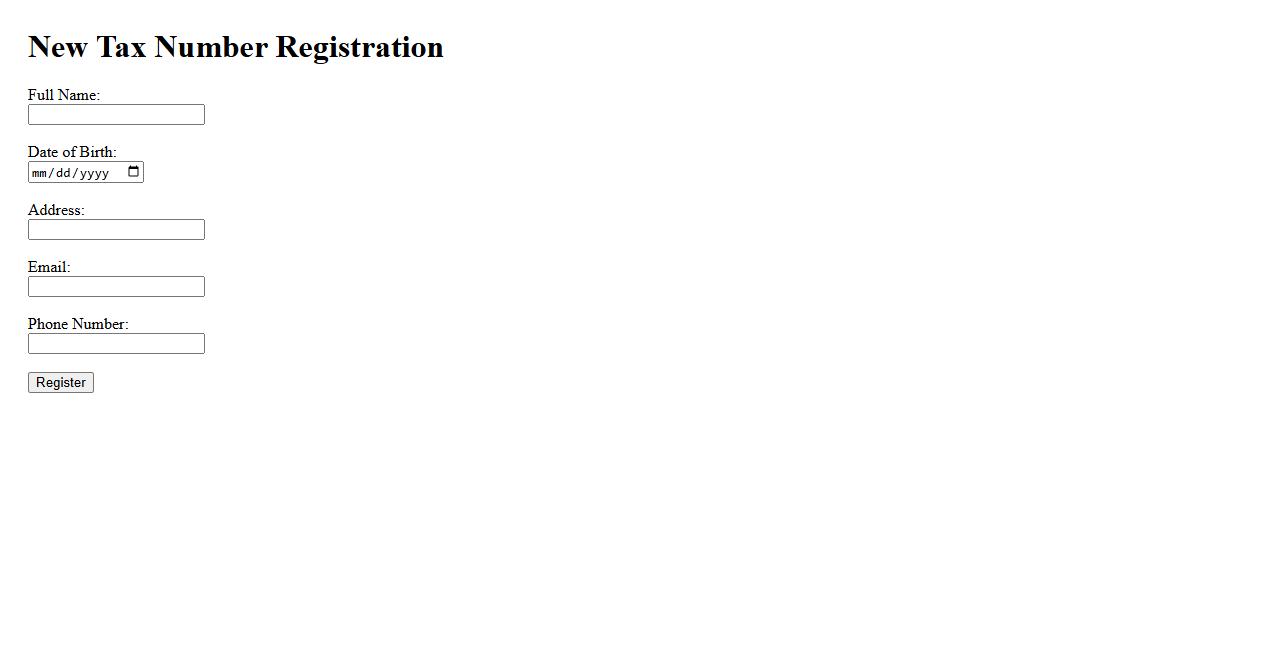

New Tax Number Registration

Registering a New Tax Number is essential for individuals and businesses to comply with legal tax requirements. This process involves submitting the necessary documentation to the relevant tax authority. Obtaining a tax number ensures accurate tax filing and facilitates smooth financial transactions.

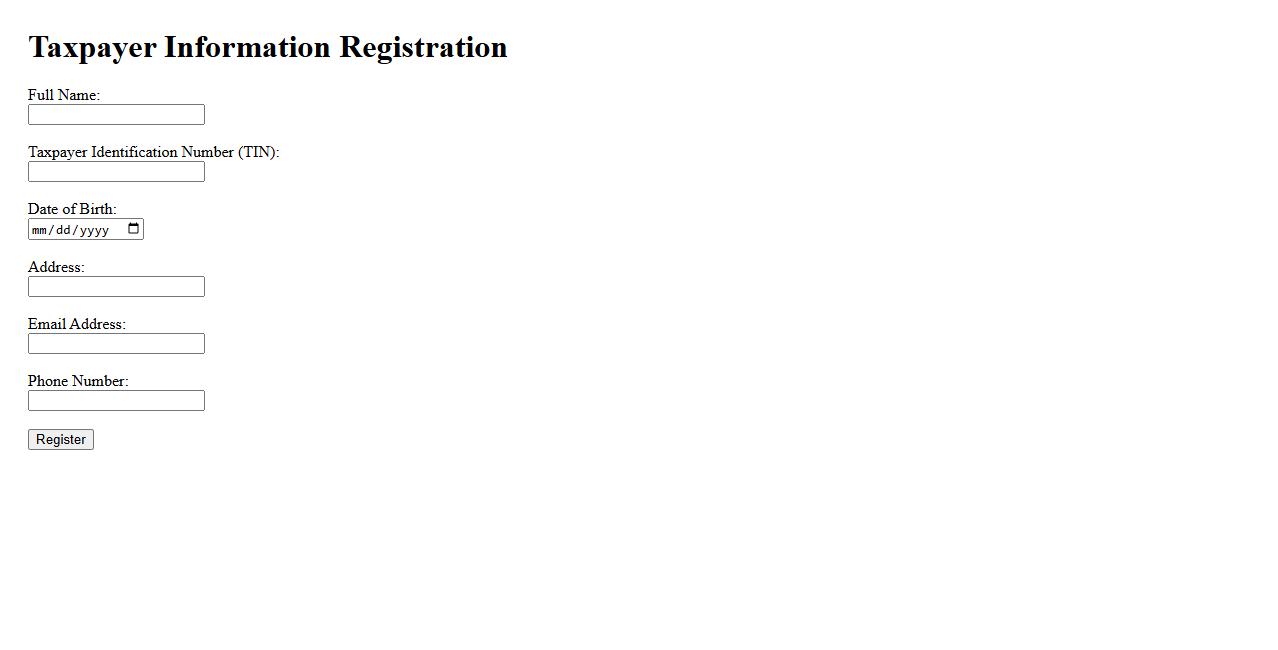

Taxpayer Information Registration

Taxpayer Information Registration is the process of collecting essential details from individuals or businesses to ensure accurate tax identification and compliance. This registration helps government authorities maintain updated records and streamline tax administration. Proper registration enables taxpayers to fulfill their obligations efficiently and avoid penalties.

TIN Enrollment Form

The TIN Enrollment Form is essential for individuals and businesses to register for a Tax Identification Number. This form collects crucial personal and financial information required by tax authorities. Completing it accurately ensures compliance with tax regulations and smooth processing of tax-related transactions.

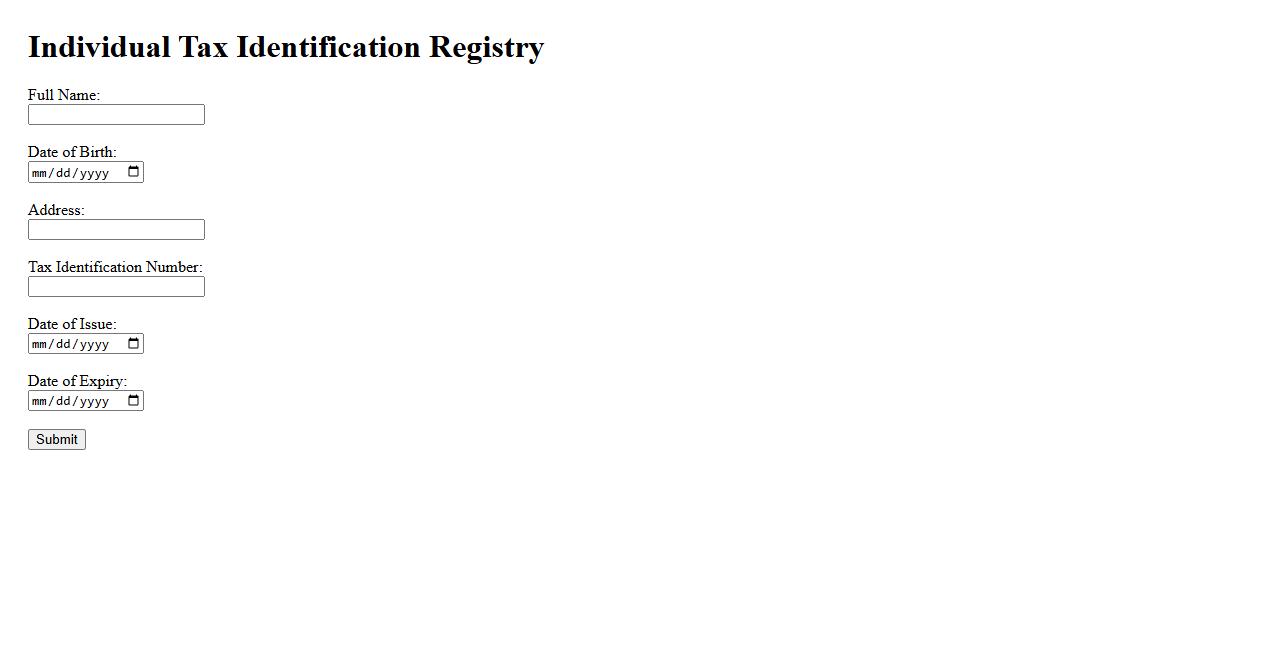

Individual Tax Identification Registry

The Individual Tax Identification Registry is a system designed to keep track of individual taxpayers and their financial activities. It ensures accurate identification for tax reporting and compliance purposes. This registry helps streamline tax processing and supports government revenue collection.

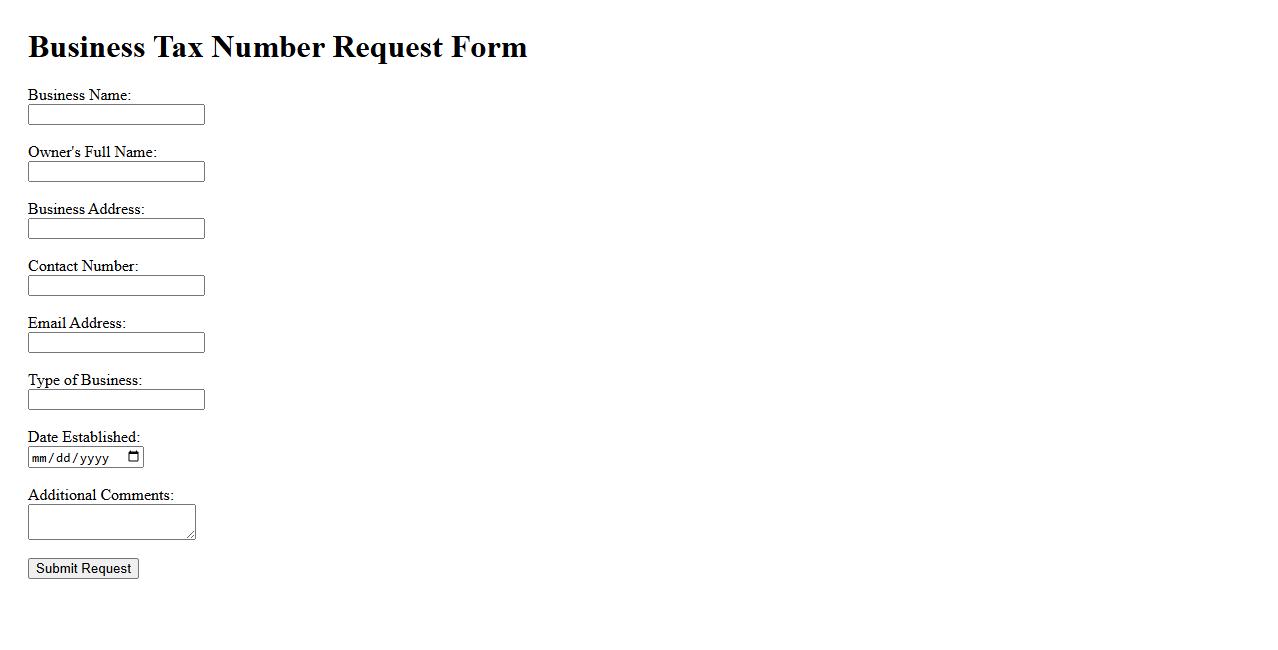

Business Tax Number Request

Requesting a Business Tax Number is an essential step for legally operating a business and fulfilling tax obligations. This unique identifier allows businesses to report income and pay taxes accurately. Obtaining it ensures compliance with government regulations and smooth financial transactions.

Taxpayer Account Setup

Setting up a taxpayer account is essential for managing your tax information efficiently. This account allows you to file returns, track payments, and access personalized tax services. Creating it is a simple process designed to streamline your interactions with tax authorities.

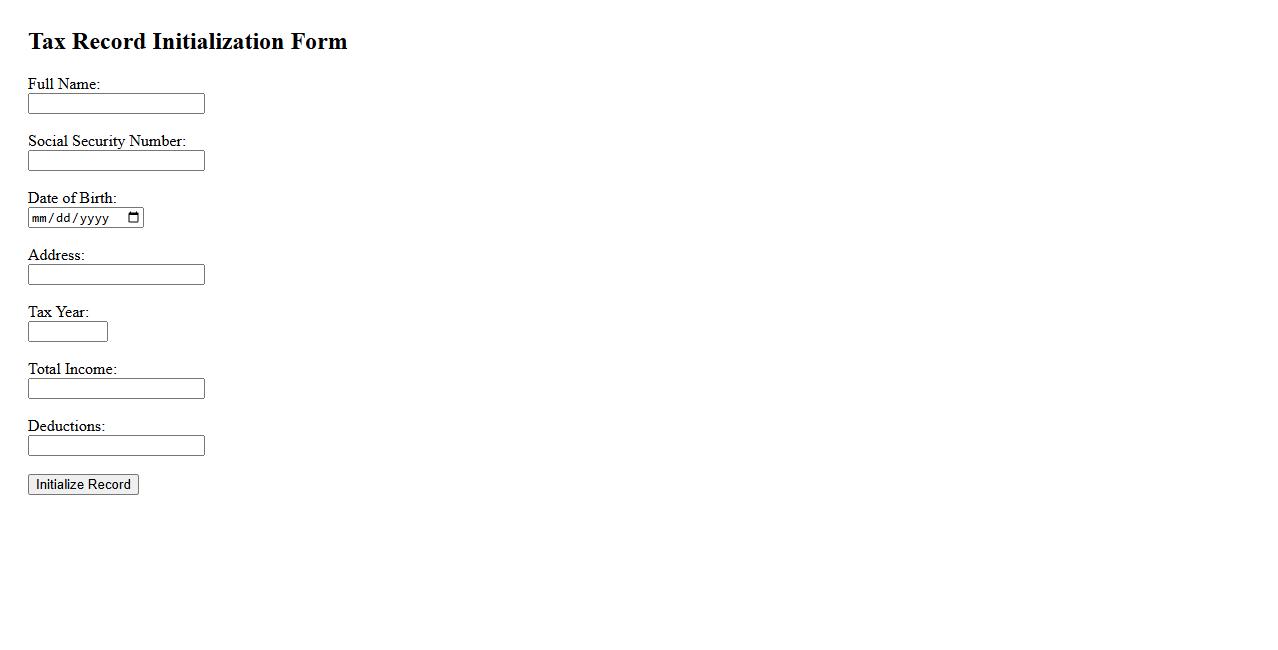

Tax Record Initialization Form

The Tax Record Initialization Form is essential for setting up accurate tax information in financial systems. It ensures all relevant taxpayer details are correctly recorded for compliance and reporting. Proper completion of this form simplifies future tax audits and filings.

What personal or business information is required for Tax Identification Number (TIN) registration?

To register for a Tax Identification Number (TIN), individuals must provide their full name, date of birth, and valid identification details. Businesses need to submit the registered business name, type of business entity, and registration number. Accurate contact information such as address, phone number, and email is also crucial for successful TIN registration.

Which government agency or portal processes the TIN registration application?

The Tax Identification Number (TIN) registration is typically processed by the national tax authority or revenue service of the country. Most countries offer an online portal or a physical office where applicants can submit their forms. It is essential to check the official website to ensure you are using the correct and authorized government agency for registration.

What are the step-by-step procedures for registering for a TIN?

First, gather all required personal or business documents for TIN registration. Next, fill out the registration form online or at the designated government office, providing complete and accurate information. Finally, submit the form along with supporting documents and await confirmation of your Tax Identification Number.

What supporting documents must be submitted during TIN registration?

Applicants must provide government-issued identification such as a passport, national ID, or driver's license for personal TIN registration. Businesses need to submit proof of business registration, articles of incorporation, or any relevant permits. Additional documents like proof of address and contact information may also be required to complete the application process.

How long does it take to receive a TIN after successful registration?

The processing time for a Tax Identification Number (TIN) varies by country and method of application. Generally, it can take from a few hours to several days if applied online, while physical applications may take longer. Most tax agencies provide a confirmation or receipt that includes your TIN once registration is complete.