Requesting an Order Insurance Policy Copy ensures you have a detailed document outlining the terms and coverage of your insurance agreement. This copy serves as a vital reference for claims, renewals, or policy verification. Keeping it accessible safeguards your interests in case of unforeseen events.

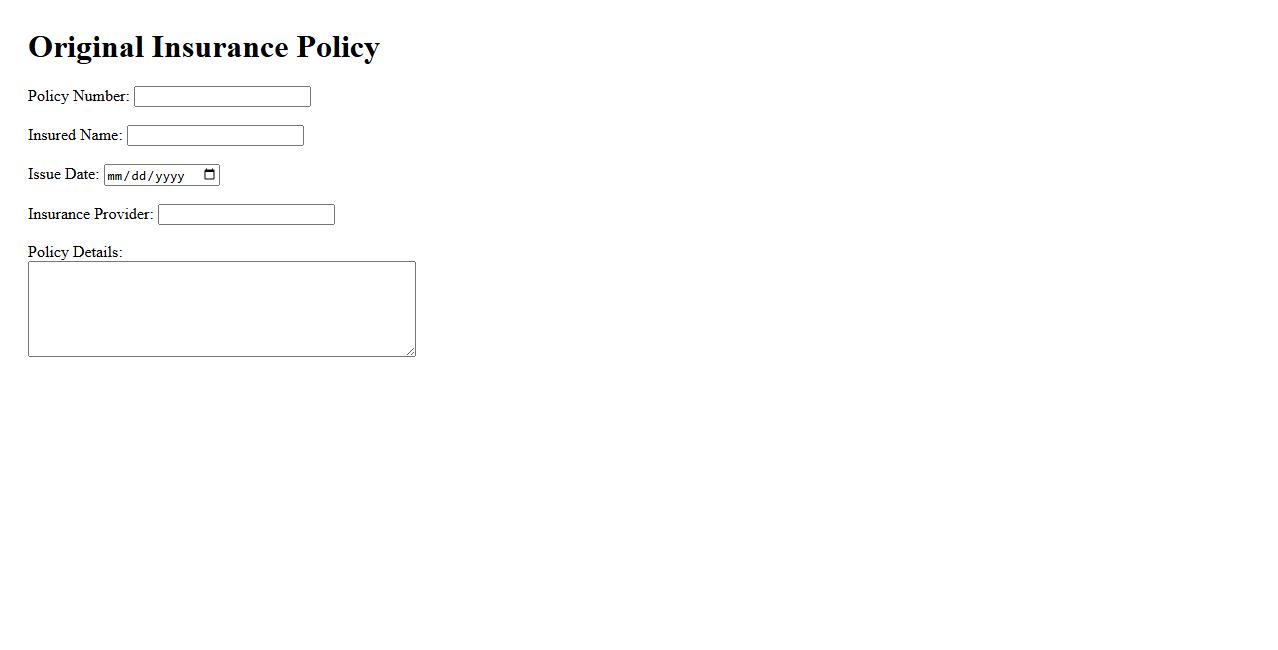

Original Insurance Policy

The Original Insurance Policy is a crucial document that outlines the terms, coverage, and conditions agreed upon between the insurer and the insured. It serves as the official proof of insurance and protects policyholders in case of claims. Keeping this document safe ensures smooth processing of any future insurance requests or disputes.

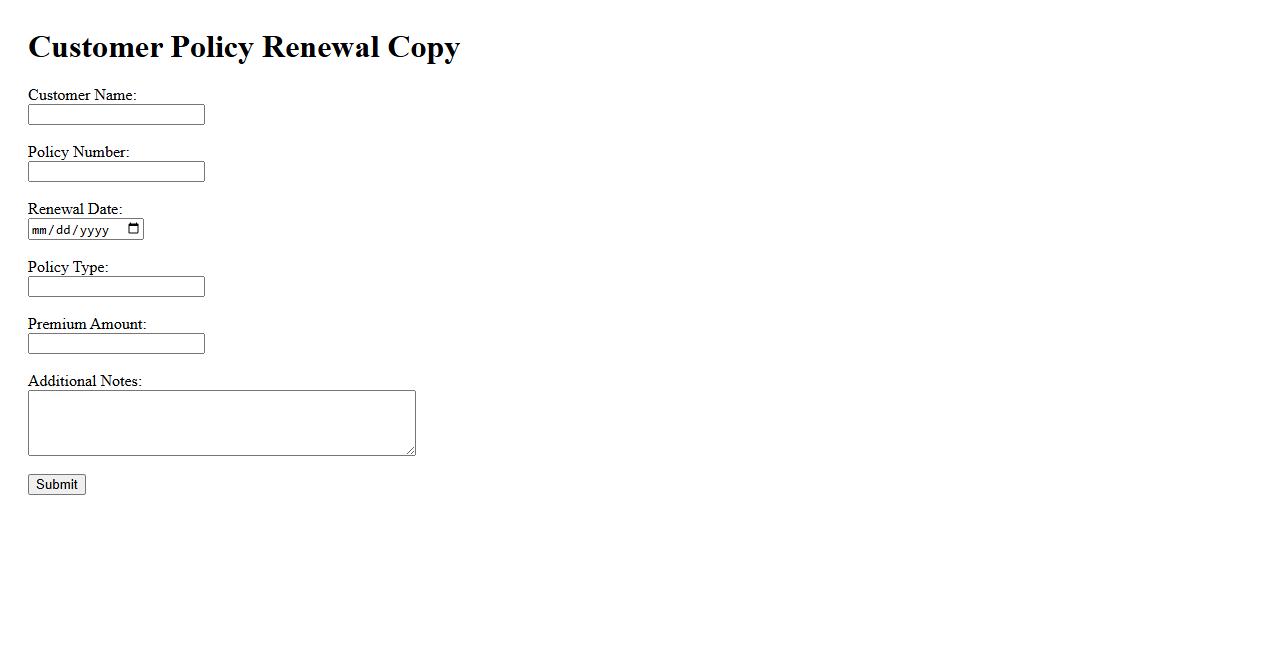

Customer Policy Renewal Copy

Ensure your Customer Policy Renewal Copy is accurate and up-to-date to maintain seamless coverage. This document outlines the terms and conditions of your renewed policy, providing clarity on benefits and obligations. Keep it safe for future reference and quick access during claims or inquiries.

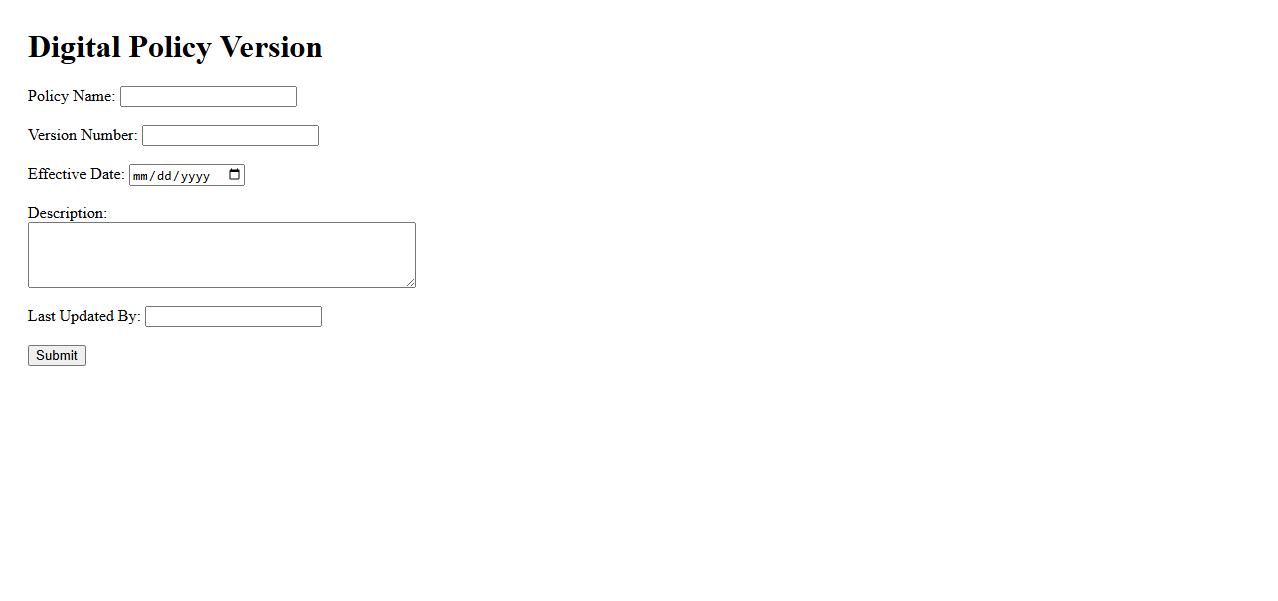

Digital Policy Version

The Digital Policy Version defines the latest guidelines and rules for digital operations within an organization. It ensures compliance with current technological standards and data protection regulations. Regular updates keep the policy aligned with emerging digital trends and security measures.

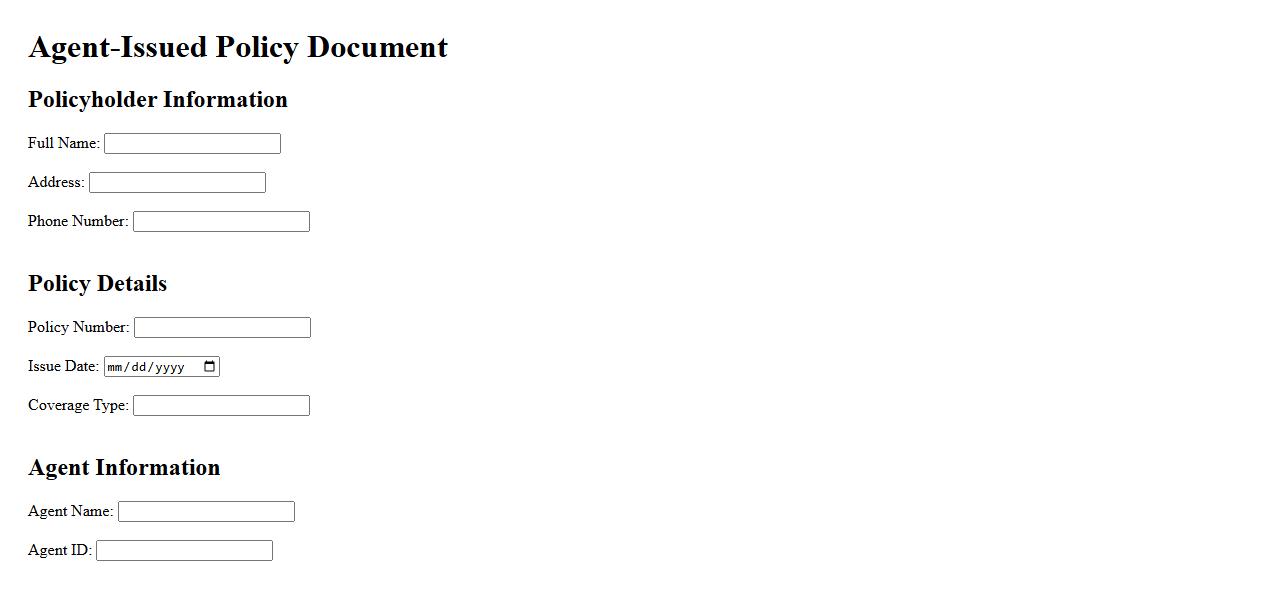

Agent-Issued Policy Document

An Agent-Issued Policy Document serves as an official insurance certificate provided directly by an authorized agent. It outlines the specific coverage details, terms, and conditions agreed upon between the insurer and the policyholder. This document ensures transparent communication and proof of insurance for all parties involved.

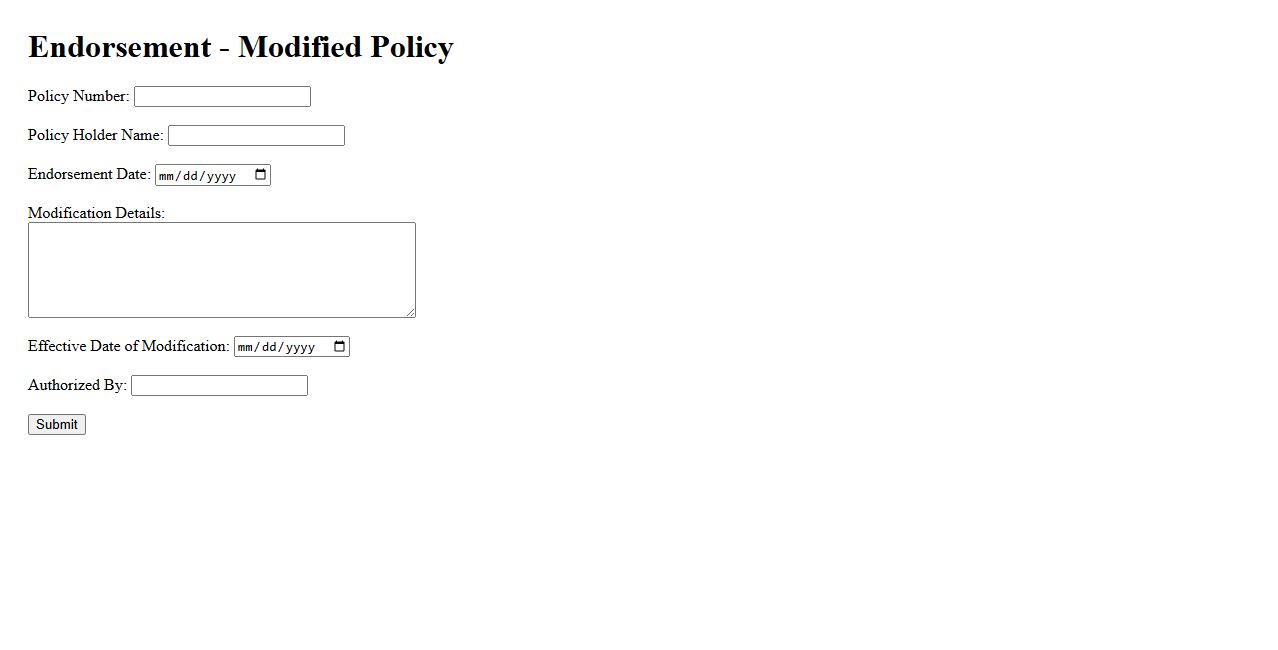

Endorsement-Modified Policy

An Endorsement-Modified Policy is an insurance contract that has been altered by adding an endorsement to change its original terms or coverage. This modification allows policyholders to customize their protection according to specific needs without purchasing a new policy. Endorsements can include additional coverage, exclusions, or changes in policy limits.

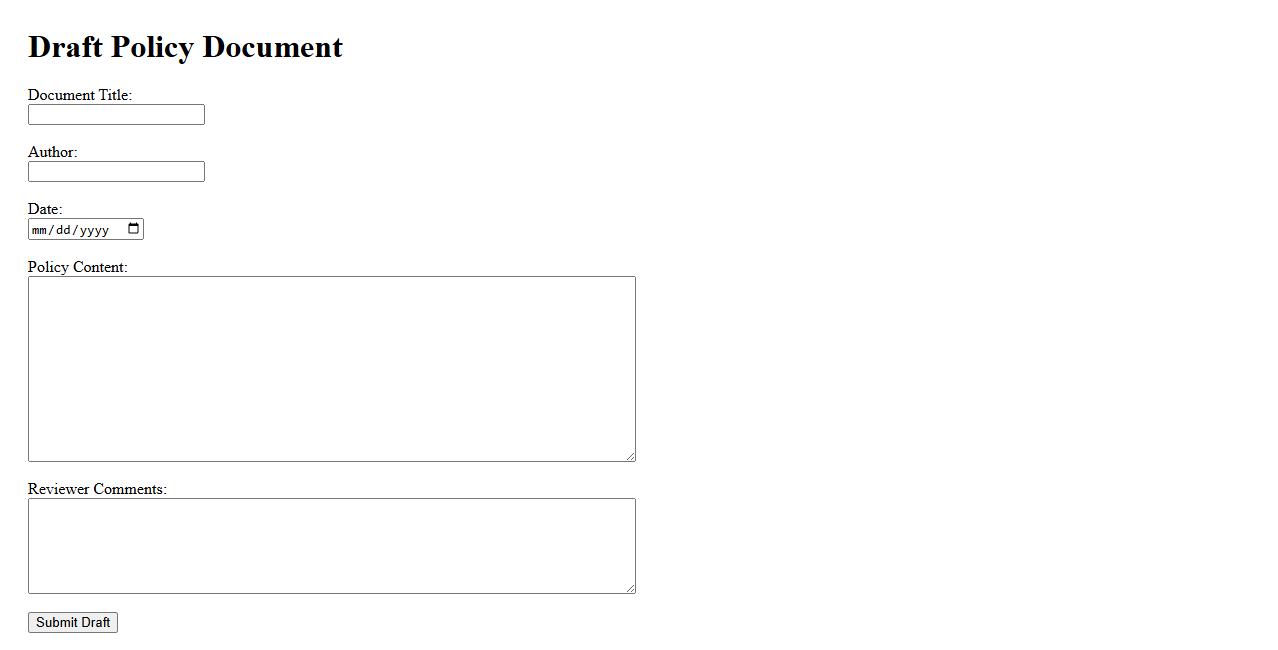

Draft Policy Copy

The Draft Policy Copy serves as a preliminary version of a policy document, outlining key rules and guidelines. It is designed for review and feedback before final approval and implementation. This draft ensures all stakeholders can contribute to refining the policy effectively.

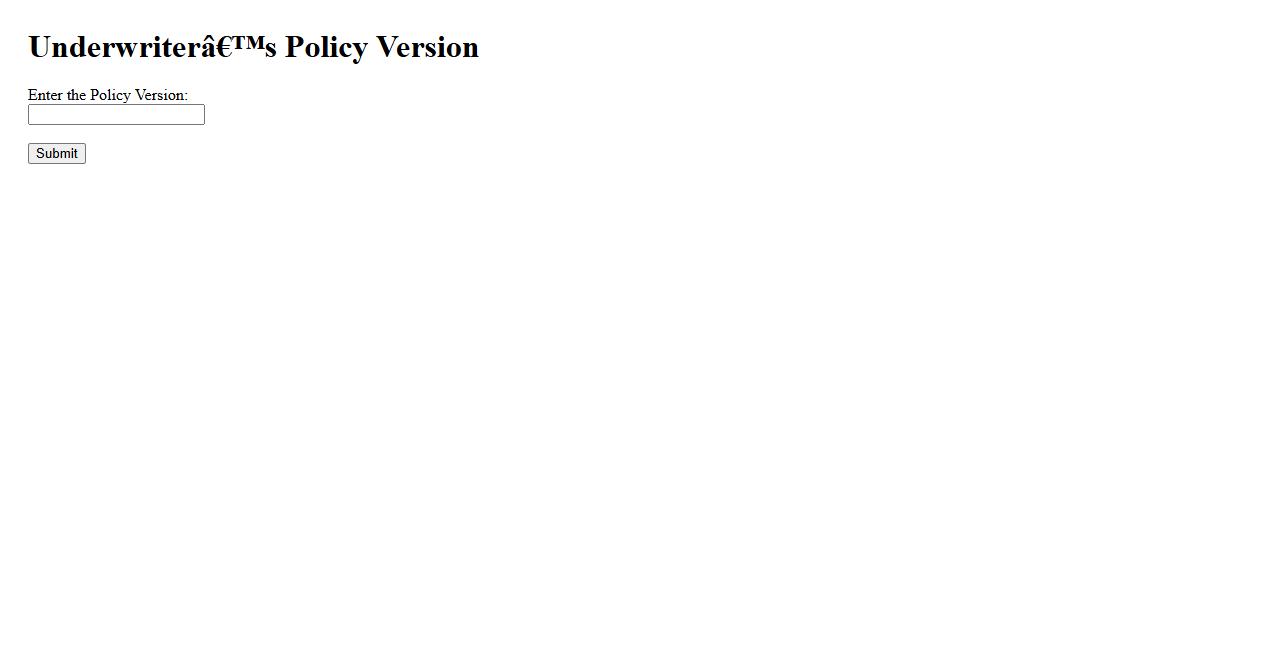

Underwriter’s Policy Version

An Underwriter's Policy Version refers to a specific edition of the insurance policy issued by the underwriter. It outlines the terms, coverage, and conditions applicable at the time of issuance. This version ensures both parties agree on the contractual details governing the insurance agreement.

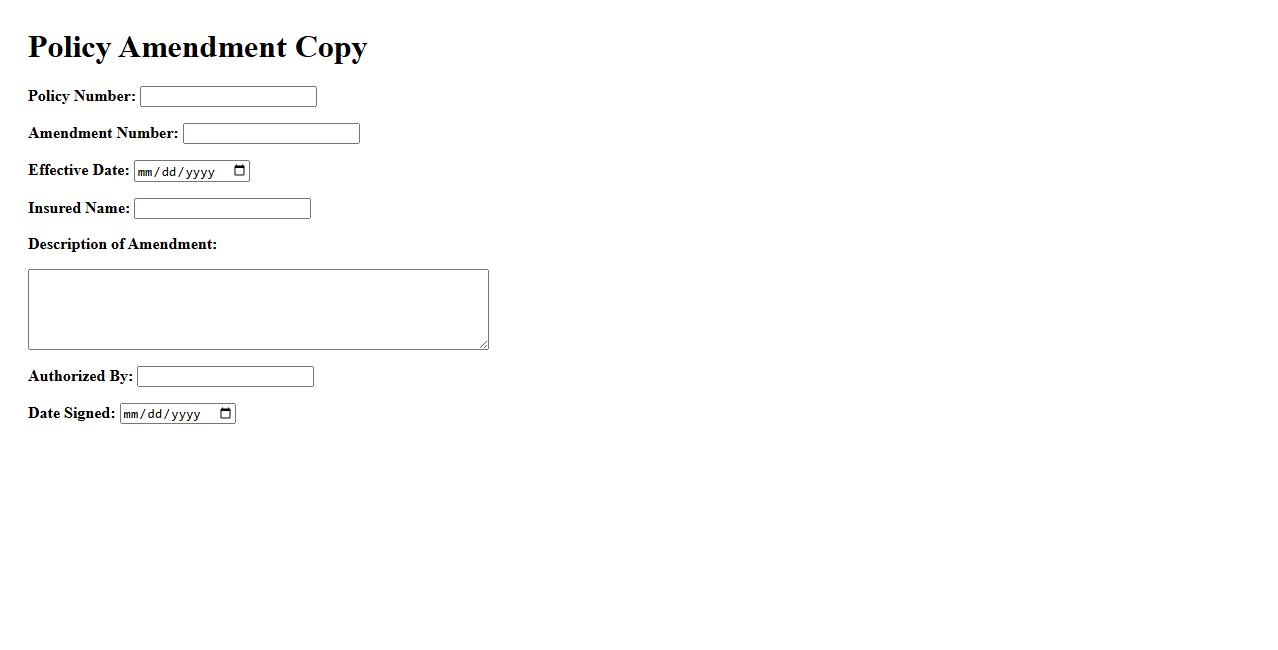

Policy Amendment Copy

A Policy Amendment Copy is a document that outlines changes made to an existing insurance policy. It provides clear details on modifications, updates, or corrections to the original terms and coverage. This ensures both the insurer and policyholder have an accurate and up-to-date record.

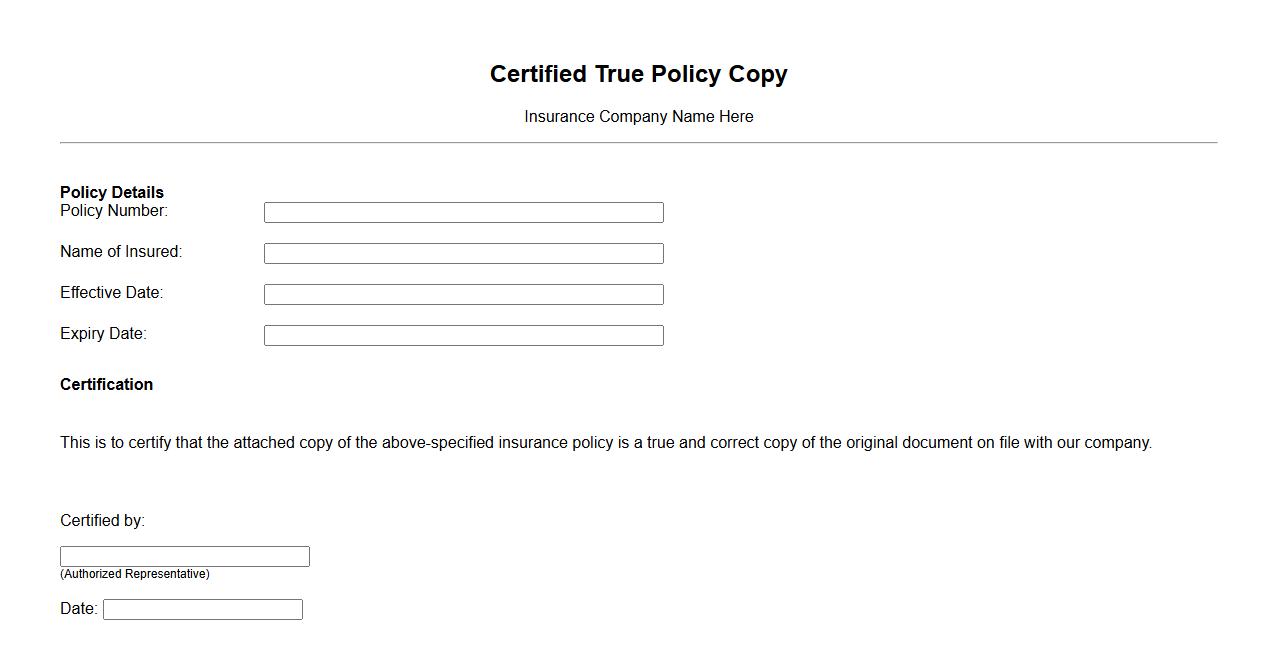

Certified True Policy Copy

A Certified True Policy Copy is an official document that verifies the authenticity of an insurance policy. It serves as a legally recognized reproduction, ensuring that the details match the original policy exactly. This certification is crucial for claims and legal purposes.

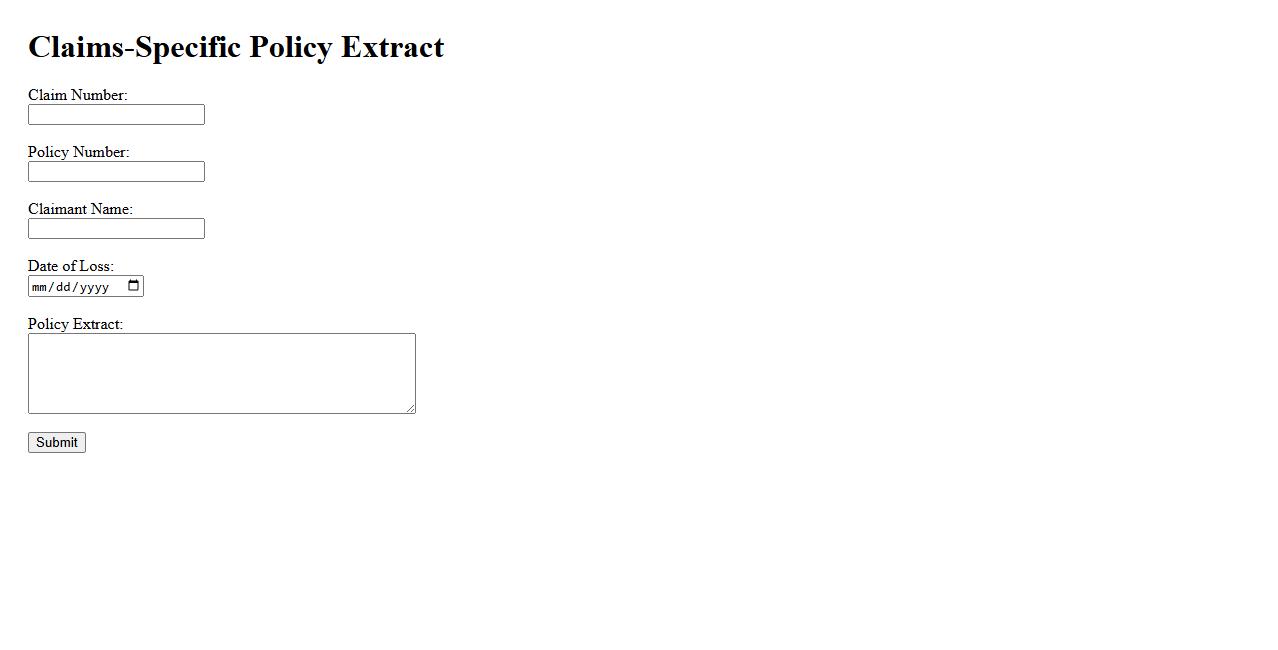

Claims-Specific Policy Extract

The Claims-Specific Policy Extract provides detailed insights into individual insurance claims within a policy. It highlights key information such as claim status, payment history, and coverage details. This extract helps streamline claims management and improve policyholder communication.

What is the process for requesting a copy of an insurance policy document?

The process to request a copy of an insurance policy document typically involves contacting the insurance provider directly. You can do this via phone, email, or through the insurer's official website portal. After submitting your request, the insurer verifies your identity before processing the document copy.

Which identification details are required to order an insurance policy copy?

To order a copy of an insurance policy, you must provide identification details that confirm your identity. This often includes your policy number, full name, date of birth, and sometimes a government-issued ID. The insurer uses this information to ensure the security and privacy of your policy information.

What formats (digital or physical) are available for receiving the policy copy?

Insurance policy copies are usually available in both digital and physical formats. You can receive a PDF version via email or download it from the insurer's online portal. Alternatively, you can request a printed copy to be mailed to your address if preferred.

Are there any fees or charges associated with ordering an insurance policy copy?

Many insurers provide a copy of the policy document free of charge, but some may impose fees or service charges. Charges can vary depending on the insurer's policies and the delivery method chosen. It is advisable to confirm any potential costs before placing your request.

How long does it take to receive the ordered insurance policy copy?

The time frame to receive an insurance policy copy depends on the insurer and delivery format. Digital copies are typically sent within a few hours to a couple of business days. Physical copies may take several days to weeks, depending on postal service and country.